false

0000839470

0000839470

2024-02-04

2024-02-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 4, 2024

WESTWATER RESOURCES, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-33404 |

|

75-2212772 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

6950 S. Potomac Street, Suite 300

Centennial, Colorado |

|

80112 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (303) 531-0516

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| Common Stock, $0.001 par value |

|

WWR |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

On February 4, 2024, Westwater Resources, Inc. (the “Company”)

and SK On Co., Ltd. (“SK On”) entered into a Products Procurement Agreement (the “Procurement Agreement”).

Pursuant to the terms of the Procurement Agreement, SK On will purchase

CSPG-10 natural graphite anode products (the “Product”) from the Company. Under the terms of the Procurement Agreement, SK

On will be obligated to purchase, on an annual basis, a quantity of Product equal to a percentage of the forecasted volume required by

SK On (the “Minimum Purchase Amount”), provided that the Minimum Purchase Amount may be increased from time to time by the

mutual agreement of the parties. The forecasted volumes required by SK On are set forth on Schedule 2 of the Procurement Agreement

and the forecasted volume in the final year of the Procurement Agreement is 10,000 mt of Product.

The foregoing description of the Procurement Agreement is qualified

in its entirety by reference to the full text of the Procurement Agreement which is filed with this Current Report on Form 8-K as

Exhibit 10.1.

| Item 7.01 | Regulation FD Disclosure. |

On February 5, 2024, the Company issued a press release announcing

entry into the Procurement Agreement.

A copy of the press release is furnished as Exhibit 99.1 to this

Current Report on Form 8-K and is incorporated herein by reference. The information contained in this Item 7.01, including Exhibit 99.1,

is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in

any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 5,

2024

| |

WESTWATER RESOURCES, INC. |

| |

|

|

| |

By: |

/s/ Steven M. Cates |

| |

Name: |

Steven M. Cates |

| |

Title: |

Senior Vice President–Finance and Chief Financial Officer |

Exhibit 10.1

Portions of this document have been redacted

pursuant to Item 601(b)(10)(iv) of Regulation S-K because it is both not material and would likely cause competitive harm to the

registrant if publicly disclosed. Redacted portions are indicated with the notation “[***]”.

PRODUCTS PROCUREMENT AGREEMENT

| 1. | Agreement and Applicability |

This Products Procurement Agreement (“Agreement”) for the

sale of Products, as defined in Section 4 below, between the Seller and the Buyer, as identified in Section 2 below, shall become

effective on the Effective Date, as identified in Section 3 below.

The Seller and the Buyer agree that the sale of the Product (as defined

in Section 4 below) in the quality, at the quantity, and for the prices (as addressed in Section 5 below) satisfy the requirements

found in Section 4 of that certain Joint Development Agreement (“JDA”) executed by the Seller and the Buyer on 14 November 2022,

and the Seller and the Buyer also agree that this Agreement is the “Products Procurement Agreement” reference therein. The

Seller and Buyer further agree that the JDA shall continue in effect.

Seller and Buyer (each a party and together the Parties) are identified

as follows:

| SELLER: | The Seller under this Agreement shall be Westwater Resources, Inc. (“WWR” or “Westwater”), which is a

publicly traded company organized and existing under the laws of the State of Delaware in the United States of America, with its head

office located at 6950 South Potomac Street, Suite #300, Centennial, Colorado, 80112. |

| BUYER: | The Buyer under this Agreement shall be SK On Co., Ltd. (“SKO” or “Buyer”), a company incorporated under

the laws of the Republic of Korea, having its principal place of business at 51 Jong-ro, Jongno-gu, Seoul 03161, Republic of Korea. |

Buyer

and Seller are executing and delivering this Agreement as of the later of the date of their signatures set forth on the signature page hereto

(the “Signing Date”) but acknowledge and agree that the effective date of this Agreement (“Effective Date”) shall

be [***]. Notwithstanding the foregoing, this Agreement shall only take in effect when: (i) Seller completes Phase 1 before eighteen

(18) months prior to the Effective Date (“Longstop Date”) and; (ii) Buyer executes and signs a certain nomination or

supply agreement with a third party purchaser that is potentially expected to use the Product (“Third-party OEM Purchaser”)

herein before the Effective Date and provides written notification of such event to Seller (the “Notice”).

This

Agreement shall commence on the Effective Date and shall continue until [***] (the “Term”), unless terminated earlier

by mutual written agreement of the parties. Parties may extend the term when the initial Term is expired by mutual written agreement.

Seller

shall complete the Kellyton Plant by Longstop Date and shall provide written evidence of such completion to the Buyer. In the event that

Kellyton Plant is not completed by the Longstop Date for any reason, the Buyer’s obligation set forth in this Agreement shall not

be applicable. For the avoidance of doubt, the completion the Seller’s Kellyton advance graphite processing plant located in Kellyton,

Alabama (the “Kellyton Plant”) occurs when the Kellyton Plant becomes capable of producing sufficient volume of Product

agreed in Schedule 2 below (“Phase 1”).

The following amounts of CSPG-10 natural graphite anode products (“Product”)

to be sold under the Agreement shall comply with the specifications attached as Schedule 1 (the “Specifications”) and shall

be delivered in accordance with the terms and conditions set forth hereunder this section.

| a. | The Seller shall make available to the Buyer, DDP (Delivered Duty Paid) Incoterms at the Buyer’s plant in Georgia, JV plant

in Kentucky, or JV Plant in Tennessee which will be designated in each order by Buyer. In case of other destinations other than three

above locations, Parties shall discuss in good faith the costs related to the shipping again. : |

| i. | Beginning on [***], and ending on [***], Buyers intends to order with shipments starting in [***], and with the parties willing to

develop a rolling forecast to ensure volumes will be available. See Schedule 2 for forecast. |

| ii. | Buyer may elect to move contract forward to a start date of [***] with such an election by the Buyer to be provided to Seller in writing

no later than [***]. |

| iii. | The Buyer shall purchase, on an annual basis, a minimum

quantity of Product equal to [***]% of the forecast set forth in the Schedule 2 each year; provided, the minimum purchase quantity

of Product can be increased from time to time by negotiations between the Parties. |

| iv. | Prior to [***], the parties agree to negotiate in good faith for the annual quantities specified in (a) above to be increased,

beginning on [***]. |

| b. | In case of the Force Majeure event set forth in Section 7 arises, parties shall discuss and renegotiate the volume and price

of the annual minimum purchase quantity of the Buyer. |

| c. | The quantities purchased per month shown above shall be specified by the Buyer to the Seller in writing at least 90 days in advance

of the commencement of each quarter during the Term, but such quantities shall be within the ranges specified above. |

| d. | With each Product sold to Buyer, Seller shall provide a dated Bill of Lading (BOL), which includes an invoice for the same using the

Price determined in accordance with Section 5 below. |

| e. | Seller shall inform Buyer in case of any changes of raw materials and any components of the Product at least six (6) months prior

to such changes and obtain Buyer’s prior written approval. |

| /s/ FB | Page 2 of 8 | /s/ JJP |

| WWR | | SKO |

| f. | Seller shall conduct due diligence its sub-suppliers and will keep Buyer informed regularly on i) their activities and compliances

with sanctions, export controls, and other applicable regulations and laws and ii) Buyer’s code of conduct and related policy from

time to time published by Buyer and provided to Seller which as of the Effective Date. |

As of December 11, 2023, Seller’s expected

available CSPG-10 capacity is as follows.

| CAPACITY |

20[***] |

20[***] |

20[***] |

20[***] |

20[***] |

20[***] |

20[***] |

| Metric tons |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

Capacity is subject to change in the event that Seller executes

an off-take agreement with another company prior to completing and signing final Agreement with Buyer.

| a. | The amount to be charged for the Product is set out in the

table and notes shown below (“Price”). |

| PRICE* |

20[***] |

20[***] |

20[***] |

20[***] |

20[***] |

| $USD/kg |

$[***] |

$[***] |

$[***] |

$[***] |

$[***] |

* Price NTE (not to exceed)

| i. | For the avoidance of doubt, parties can discuss and renegotiate the Price from time to time but newly adjusted price shall not exceed

the Price set forth in this Agreement. |

| ii. | Price is inclusive of any transportation and insurance costs, taxes, fees, duties, and levies, however designated or imposed, which

are incurred by the Seller as addressed in Section 8 below. |

| b. | Notwithstanding the foregoing, Seller hereby agrees that it will sell the Products to Buyer [***]. |

| c. | If during the Term, Buyer believes that the Seller or the Products are not competitive in price, Buyer may send written notice to

the Seller describing the non-competitiveness with all available details (“Non-Competitive Notice”) and the parties shall

meet to discuss in good faith to renegotiate the price based on the market conditions. |

| /s/ FB | Page 3 of 8 | /s/ JJP |

| WWR | | SKO |

The

Seller warrants that the Product shall be in accordance with the Specifications set out in Schedule 1. The Seller and Buyer agree that

the Specifications contained in Schedule 1 can be changed once the Buyer identifies the specific cell program for which the Product

will be used. If the eventual Specification required by the Buyer materially differs from the Specification shown in Schedule 1, and there

is an associated change in cost in the future, the parties agree to negotiate in good faith to determine a new price. Notwithstanding

the foregoing, at the Buyer’s sole discretion, if the Product fails to conform the Specifications, the Buyer’s obligation

to buy up to the required minimum volume set forth herein is not applicable and Buyer may suspend its purchase until Supplier cures the

non-conformity with respect to the Specification. For the avoidance of doubt, if the Product fails to pass the Buyer’s internal

assessment process for the conformity of Product, the Buyer may terminate this Agreement with non-conformity notice.

The foregoing warranty by the Seller extends only to the Buyer and

is in lieu of and excludes all other warranties not expressly stated in this Agreement, whether express or implied by operation of law

or otherwise, including but not limited to any implied warranties of merchantability or fitness for any particular purpose.

Each

party shall not be liable to the other party nor be found in breach or default of its obligations under the Agreement to the extent each

party’s performance of such obligations is delayed, hindered or prevented, in whole or in part, directly or indirectly, due to causes

beyond its reasonable control, whether foreseeable or unforeseeable, such as: acts of God; actions taken by a governmental authority

(whether valid or invalid); embargoes; fires; floods, earthquakes, explosions; natural disasters; riots; wars; sabotage; or court injunction

or order. Upon occurrence of a force majeure or other excusable delay, each party’s performance or delivery date shall be extended

for a period equal to the duration of the force majeure or time lost by reason of delay, plus such additional time as may be reasonably

necessary to overcome the effect of the delay. If the delay is due to any acts or omissions of Buyer, Seller shall be entitled to both

an equitable performance and price adjustment. If the delay is due to any acts or omissions of Seller, Buyer shall be entitled to both

an equitable performance and price adjustment.

| 8. | Incoterms Delivery Basis |

The Price set forth in Section 5 above are DDP (Delivered Duty

Paid) Incoterms to the Buyer’s plant in Georgia, JV plant in Kentucky, or JV Plant in Tennessee which will be designated in each

order by Buyer. In case of other destinations other than three above locations, Parties shall discuss in good faith the costs related

to the shipping again. The Seller is responsible for any and all transportation and insurance costs, taxes, fees, duties, and levies,

however designated or imposed, which are incurred by Seller to sell the Products DDP.

Buyer shall make payment to the Seller for the Product in the amount

invoiced by telegraphic transfer net 60 days after BOL date against a copy of the scanned shipping documents.

| /s/ FB | Page 4 of 8 | /s/ JJP |

| WWR | | SKO |

Seller to arrange and pay for insurance against loss of the Product

during shipment per DDP (Delivered Duty Paid) Incoterms.

If

requested on or before [***], the Buyer can elect to move the contract forward to a start date of [***] as addressed in Section 4(a)(ii),

and this Agreement shall continue in effect.

Buyer acknowledges that Seller and its affiliates are the owners or

licensors of brands, trademarks, designs, patents, copyrights and other intellectual property related to Seller’s Products, and

that no right or license is conveyed by Seller to Buyer to manufacture, have manufactured, modify, impact or copy such Products.

Seller agrees to indemnify, defend and hold harmless Buyer and its

related parent, subsidiary and affiliate companies, and each of their respective directors, officers and employees, from and against any

and all claims, losses, damages, costs and expenses (including reasonable attorney’s fees) that may be suffered or incurred by any

of them as a result of any claim, demand, suit, proceeding or cause of action arising in any manner from (i) the insolvency, bankruptcy

or any other similar proceedings in any jurisdiction of the Seller, (ii) the use of the Products provided by Seller to Buyer, or

(iii) breach or failure of express or implied warranty, breach of this Agreement, misrepresentation, negligence, strict liability

in tort, or otherwise.

In

no event shall the aggregate liability of Seller in any action or proceeding exceed the higher amount between the [***]% of the

total amount actually paid to Seller during the certain period agreed between the parties and $[***] USD. For clarity, the aggregate liability

of Seller in any action or proceeding shall not exceed $[***] USD in any case.

In

case of Buyer, in no event shall the aggregate liability of Buyer in any action or proceeding exceed [***].

| 13. | Confidentiality and Publicity |

| a. | The parties agree that all of the information included within the Agreement is business proprietary and, therefore, neither party

shall be permitted to disclose any of the information included within the Agreement and the Agreement itself to any third party other

than its own representatives or affiliates or publicly without the express, written, prior approval of the other party. |

| b. | Each party agrees that if it is required by legal process or otherwise required by law to disclose the Agreement or any portion of

the Agreement or any of the information included within the Agreement, then to the extent permitted by law that party shall, prior to

disclosing the same, inform the other party promptly in writing of such required disclosure. In such circumstances, the parties

shall reasonably cooperate to contest such disclosure, or to obtain a protective order regarding such disclosure, or to otherwise reasonably

limit such disclosure to only that legally required to be disclosed. |

| /s/ FB | Page 5 of 8 | /s/ JJP |

| WWR | | SKO |

| c. | The parties agree that each party may publicly disclose that it has entered into this Agreement, the parties to this Agreement, and

the general nature of this Agreement; provided that, any such public disclosure shall be subject to prior review and approval by the other

party with such approval not unreasonably withheld. |

| 14. | Governing Law and Venue |

This Agreement shall be governed by and construed according to the

laws of Singapore. Any dispute between the parties relative to this Agreement shall be resolved by arbitration in Singapore in English

in accordance with the Arbitration Rules of the Singapore International Arbitration Center. The United Nations Convention on Contracts

for the International Sale of Goods does not apply to this Agreement and any transaction between the parties related thereto, and it is

hereby expressly disclaimed by the parties.

Executed as an AGREEMENT:

|

Signed by an authorized representative for Westwater

Resources, Inc.

|

Signed

by an authorized representative for SK On, Inc.

|

|

Signature

/s/ Frank Bakker |

Signature

/s/ Jong Jin Park |

|

Name (print)

Frank Bakker

President & CEO |

Name (print)

Jong Jin Park

Executive VP Strategic Sourcing

|

| Date: February 4, 2024 |

Date: February 2, 2024 |

| /s/

FB | Page 6 of 8 | /s/

JJP |

| WWR | | SKO |

SCHEDULE 1 – SPECIFICATIONS

| 1. | ULTRA-CSPG 10 natural graphite anode material |

| 2. | Delivered in 1 metric ton bags (nominal) |

| 3. | Sourced from Westwater’s Kellyton, Alabama facility, which is owned and operated by Westwater’s wholly-owned subsidiary

Alabama Graphite Products, LLC. |

| No |

Item |

Unit |

CSPG10 |

| 1 |

Particle Size |

[***] |

㎛ |

[***] |

| [***] |

㎛ |

[***] |

| [***] |

㎛ |

[***] |

| 2 |

LOI |

% |

[***] |

| 3 |

Ash |

% |

[***] |

| 4 |

Tap Density |

g/㎤ |

[***] |

| 5 |

SSA |

㎡/g |

[***] |

| 6 |

Reversible Capacity |

mAh/g |

[***] |

| 7 |

Irreversible Loss-ICL |

% |

[***] |

| 8 |

Trace elements |

[***] |

ppm |

[***] |

| [***] |

ppm |

[***] |

| [***] |

ppm |

[***] |

| [***] |

ppm |

[***] |

| [***] |

ppm |

[***] |

| [***] |

ppm |

[***] |

| 9 |

Trace element Magnetic impurity

([***]) |

ppm |

<0.1 |

| /s/

FB | Page 7 of 8 | /s/

JJP |

| WWR | | SKO |

SCHEDULE 2 – SK ON VOLUME FORECAST

| |

20[***] |

20[***] |

20[***] |

20[***] |

20[***] |

| SK on Volume Forecast (mt) |

[***]K |

[***]K |

[***]K |

[***]K |

10K |

| /s/ FB | Page 8 of 8 | /s/ JJP |

| WWR | | SKO |

Exhibit 99.1

Westwater Resources Announces First Off-Take

Agreement

for Sale of Graphite from its Kellyton Plant

| · | Westwater contracts to supply natural purified graphite anode material to SK On, a leading manufacturer of EV batteries, at its

plants in the U.S. |

| · | Off-Take Agreement a critical element to obtaining financing for construction of Kellyton Phase I |

Centennial, CO – February 5, 2024:

Westwater Resources, Inc. (NYSE: American: WWR), an energy technology and battery-grade natural graphite company (“Westwater

Resources” or “Westwater”), today announced the execution of its first off-take agreement with SK On Co., Ltd.

(“SK On” and such agreement, the “Off-Take Agreement”), a leading electric vehicle (“EV”) battery

manufacturer, supplying electric vehicle batteries to Ford, Hyundai, Volkswagen and others.

Pursuant to the terms of the Off-Take

Agreement, Westwater will supply CSPG-10 natural graphite anode products (the “Product”) from its Kellyton Graphite

Plant located near Kellyton, Alabama to SK On battery plants located within the U.S. Under the terms of the Procurement Agreement,

SK On will be obligated to purchase, on an annual basis, a quantity of Product equal to a percentage of the forecasted volume

required by SK On (the “Minimum Purchase Amount”), provided that the Minimum Purchase Amount may be increased from time

to time by the mutual agreement of the parties. The forecasted volume required by SK On in the final year of the Off-Take Agreement is 10,000 mt of Product.

“The contract with SK On is another important

step in advancing Westwater’s graphite business. We are excited to partner with a leading global manufacturer of EV batteries and

assist SK On to further establish its U.S.-based supply chain. This agreement is also a critically important step to securing the additional

financing needed to complete construction of Phase I of our Kellyton Graphite Plant,” said Terence Cryan, Westwater’s Executive

Chairman.

Frank Bakker, Westwater’s President &

CEO, added, “This is the first off-take agreement for Westwater, and the Company is actively negotiating additional off-take agreements

with other customers. We believe the contract with SK On is also the first agreement for the supply of CSPG between a South Korean EV

battery manufacturer and a U.S. natural purified graphite producer. Our technical and commercial teams have worked very hard to complete

the necessary steps to achieve this important milestone. We believe that Westwater is well positioned as one of the first U.S.-based suppliers

of natural purified graphite for companies seeking an IRA-compliant source by 2025.”

About Westwater Resources, Inc.

Westwater Resources is an energy technology company

that is focused on developing battery-grade natural graphite. Westwater Resources’ primary project is the Kellyton Graphite Processing

Plant that is under construction in east-central Alabama. In addition, Westwater Resource’s Coosa Graphite Deposit is the most

advanced natural flake graphite deposit in the contiguous United States — and is located across 41,965 acres (~17,000 hectares)

in Coosa County, Alabama. For more information, visit westwaterresources.net.

About SK On

SK On is a global leading electric vehicle battery

developer, manufacturer, and solutions provider whose mission is to make our world a cleaner and more convenient place as an electrification

linchpin. SK On was launched as an independent company in October 2021 after SK Innovation, South Korea’s largest energy company,

decided to split off its battery business unit. SK On aims to become a world leader in the clean energy industry by leveraging its global

production base and R&D capabilities, as well as its production and quality management know-how. SK On is a 50/50 joint venture partner

together with Ford Motor Company in BlueOval SK.

Headquartered in Seoul, South Korea, SK On has

a worldwide presence with battery plants currently operating or in construction across the United States, Europe, and Asia.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks, uncertainties

and assumptions and are identified by words such as “will,” “can be,” “expected,” and other similar

words. Forward-looking statements in this release include, among other things, statements concerning Westwater’s future sales of

CSPG products to SK On, including the amounts, timing, and types of products included within those sales, and Westwater’s expectations

with respect to the Off-Take Agreement. Westwater cautions that there are certain factors that could cause actual results to differ materially

from the forward-looking information that has been provided. The reader is cautioned not to put undue reliance on this forward-looking

information, which is not a guarantee of future performance and is subject to a number of uncertainties and other factors, many of which

are outside the control of Westwater; accordingly, there can be no assurance that such suggested results will be realized. Additional

risks facing Westwater‘s future prospects are discussed in the Westwater Resources, Inc. Annual Report on Form 10-K for

the year ended December 31, 2022, and subsequent securities filings.

Contacts

Westwater Resources, Inc.

Email: Info@WestwaterResources.net

Investor Relations

Email: Investorrelations@westwaterresources.net

####

v3.24.0.1

Cover

|

Feb. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 04, 2024

|

| Entity File Number |

001-33404

|

| Entity Registrant Name |

WESTWATER RESOURCES, INC.

|

| Entity Central Index Key |

0000839470

|

| Entity Tax Identification Number |

75-2212772

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

6950 S. Potomac Street

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Centennial

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80112

|

| City Area Code |

303

|

| Local Phone Number |

531-0516

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

WWR

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

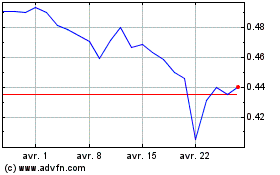

Westwater Resources (AMEX:WWR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Westwater Resources (AMEX:WWR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024