TIDMAAU

RNS Number : 7026B

Ariana Resources PLC

06 June 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

06 June 2023

AIM: AAU

FINAL AUDITED RESULTS FOR THE YEARED 31 DECEMBER 2022

NOTICE OF ANNUAL GENERAL MEETING ("AGM")

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

mineral exploration and development company with gold mining

interests in Europe, announces its final audited results for the

year ended 31 December 2022.

The Report and Accounts will be posted to shareholders as

applicable and are available on the Company's website .

In accordance with Rule 20 of the AIM Rules, Ariana Resources

confirms that the annual report and accounts for the year ended 31

December 2022 and notice of the Annual General Meeting ("AGM") and

related proxy form will be available to view on the Company's

website on 06 June 2023 and will be posted to shareholders. The AGM

will be held on 29 June 2023, at 10.30 a.m. at East India Club, 16

St James's Square, London, SW1Y 4LH.

Chairman's Statement

In looking forward to the next financial year and beyond, it is

worth highlighting Ariana's transformation over the past 20 years

from a grassroots gold explorer to an international

multi-commodity, multi-region explorer and developer, funded via

successful mining operations. Over this period, and specifically

since achieving profitability in 2016, we have created a

self-sustaining, cash positive, debt free business model, which

allows us to leverage our strengths to grow our business.

This reshaping of our business is occurring against a tipping

point in the world economy. Multiple factors are contributing to a

'perfect storm' in demand for precious and technology metals. The

key factors are the banking crisis, the Ukraine war, the demand for

metals for the de-carbonisation of energy, and the ever increasing

gap between the rate of discovery and demand for mineral resources

in general. Against this backdrop, central bank purchases of gold

are at their highest for 50 years; in 2022 central bank gold

reserves increased by 1,136 tonnes, whilst their foreign reserves

decreased by US$ 950 billion. A clear message can be discerned in

these changes. Unlike fiat currencies created by central bank

printing, gold is a fundamentally different and immutable store of

value, with no counterparty risk and finite supply. Unsurprisingly,

gold spot prices have recently topped US$2,000 per ounce three

times in recent years. At the recent Mining Indaba in Cape Town

several contributors noted that 'animal spirits' have consequently

returned to the precious metals mining industry.

Adding fuel to this situation, international consultancy

McKinsey warned recently that: "We need to double the exploration

effort if we are to avert the looming reserve crisis." McKinsey

also noted that the industry needs to invest in people and to "get

serious about science". These two guiding principles have been

fundamental since our inception and we are confident that our

investors continue to be beneficiaries of our wholehearted emphasis

on our team and the use of cutting-edge technologies. Furthermore,

McKinsey stated that "geology comes first", noting that this

concept had gone somewhat out of fashion, leading to failed

projects and loss of investor confidence. Ariana has always been

driven by geology from the top down; we have always understood that

geological expertise in exploration, resource targeting, definition

and estimation is the difference between success and failure. Given

the looming crisis in the world's mineral reserves, it is vital

that companies like Ariana continue to spearhead the discovery of

precious and technology metals within our framework of technology

leadership, environmentally responsible conduct and robust

governance.

A measure of a successful company is the way in which it meets

such market needs. Hence our clear focus on precious and technology

metals to meet the challenges presented by this financial backdrop,

the energy revolution and the chronic exploration deficit. We also

recognise that investor needs must be addressed in terms of

profitability, opportunity growth, sustainability, robust

governance and risk management. We aim to ensure our exploration

and production costs are industry leading, our project pipeline is

growing, we remain profitable with competent governance, and we

mitigate risks by diversifying across commodities and regions.

Since 2021 we have been able to pay GBP7.74m dividends to

shareholders, which is an extraordinary milestone for any

exploration company.

Shareholder value has been enhanced by sourcing the majority of

our development finance through joint venture partner investment.

Company management has also been enhanced through these

collaborative relationships significantly complementing Ariana's in

house experience. A valuable by-product of being an exploration

company since our inception is that we had to implement effective

remote working from the field and dispersed project offices decades

ago. As this working method was part of our doctrine from the

outset, we were able to thrive for the duration of the recent

pandemic, which proved disruptive to so many other businesses. This

continues to be a valuable approach to growing an accessible pool

of new talent for our industry.

Against a shifting and challenging macroeconomic background, we

believe every crisis is an opportunity. We also believe we have

pivoted Ariana to leverage our competitive advantages over a wider

commodity range and geographical reach. A key differentiator is

that Ariana is a technology-led and data-driven business, enabling

us to achieve industry leading discovery and production costs.

Approaching business decision-making with a doctrine of quality

data at the centre of every investment has ultimately resulted in a

diversified growth path with unique projects in our portfolio.

These significant strategic developments have now positioned us

even more powerfully as an innovative and agile explorer and

developer, able to optimise the opportunities of rising global

demand for precious and technology metals.

Our investments in cutting-edge technologies and processes,

combined with highly skilled staff, are critical to Ariana's

success. Indeed, we have chosen to continue investing further in

these areas and in addition to our own internal competency, we seek

to encourage those of the next generation of industry leaders. Our

strong links with several universities and our sponsorship of

research programmes, notably at the University of Western

Australia, also ensures we remain at the forefront of advanced

geological research. Additionally, we have regularly sponsored

student summer internships, with almost half our geoscientific team

having been derived from such programmes.

Added to these developments it is important to highlight the

progress in many other project areas over the past year. All these

project areas are managed within the framework of our commitment to

socially conscious and environmentally responsible development. We

are focusing our efforts within countries committed to using green

energy and we use solar and geothermal energy systems in our own

offices. Our own carbon emissions are less than half the global

average for our industry. We are involved in extensive

re-forestation programmes in all our operational areas, including

the voluntary planting of new trees and re-wilding programmes

through charitable organisations. We are actively involved with

local communities, especially supporting local educational

institutions.

In western Türkiye at the Kiziltepe gold mine we have seen a

record year, with 50% more gold produced to date than planned in

the Feasibility Study. This mine is operated by Zenit Madencilik, a

partnership in which Ariana has a 23.5% stake with partners Proccea

Construction Co. and Ozaltin Holding A.S. Production at Kiziltepe

has consistently beaten guidance since 2017, with annual production

up to 28,000 ounces of gold per annum and a total revenue of US$235

million to the end of December 2022. Also in western Türkiye, Zenit

Madencilik is currently constructing its second gold mine at Tav

an, which contains a JORC Resource of 307,000 ounces of gold. The

construction is currently being financed by Zenit without the

encumbrance of bank debt. Post-period end construction had been

temporarily suspended owing to a local court ruling, although we

are expecting construction operations to recommence later this

year.

In eastern Türkiye at our Salinbas/Ardala project we are highly

encouraged by the progress of our recent extensive drilling

programme. The 1.5Moz gold Salinbas/Ardala system is a porphyry and

epithermal deposit containing gold, silver, copper and molybdenum.

This project is situated in the highly prospective Artvin

Goldfield, containing the 4Moz Hot Maden project 16 km to the

south. Last year we separately initiated Project Leopard across

eastern Türkiye. The project aims to expand our reach into new

search spaces across three under-explored yet highly prospective

volcanic arcs in a region estimated to contain 40Moz gold. For this

project Ariana has deployed its Project Generation Division, with

our in-house specialists in remote sensing, geophysics and

geochemistry. This gives us high quality, rapid and cost-effective

results, as none of these processes are outsourced to consultants.

Our ability to deploy these expert in-house teams allows us to

deliver results faster, better and cheaper than many of our peers;

our US$11 per ounce discovery cost is proof of this excellence. We

have great expectations for this team which was responsible for

identifying the potential of the Gulluce licence area.

In Cyprus, Ariana is working with Venus Minerals to develop near

term and advanced copper-gold projects. Ariana has a 58%* stake in

Venus Minerals and we are working with our partners Semarang

Enterprises on an IPO for Venus. Our Magellan Project contains some

17 million tonnes at 0.45-1.10% copper with associated gold. Our

investment in Venus is significant given the scale of the impending

world copper supply deficit against rising demand for copper used

in alternative energy production. Elsewhere in south-eastern

Europe, we have entered into a five-year exploration partnership

with Newmont Corporation targeting Tier 1 copper-gold resources. We

established Western Tethyan Resources (WTR) which is 75% held by

Ariana, with the remainder held by an expert board with regional

specialisation. Newmont invested US$2.5 million in Ariana to

develop the WTR initiative and provided joint-ownership of the

Eastern Europe Newmont exploration database.

On a broader geographic scale Ariana's wholly-owned subsidiary,

Asgard Metals is focused on investments in discovery-stage

opportunities. We use our well-defined selection process to

identify high prospectivity projects in low cost/risk

jurisdictions, where there are sound environmental policies. This

approach has worked successfully for Ariana, as it has delivered a

100 times value increase in some of our prior investments. Our

current work with Panther Metals Ltd is an example of the way

Asgard is operating. Working in parallel with the Panther team we

have supported the discovery of a major nickel-cobalt project at

Coglia in Western Australia. These developments highlight our focus

on what we consider to be the sweet spot for Ariana's growth. This

is the inflexion point between greenfield discovery and

development, where we can act as a project catalyst by bringing to

bear our geological expertise and cutting-edge technologies.

Ariana has travelled a long way from its foundation over 20

years ago. The team has put in the hard yards to win the respect of

its major shareholders, industry partners, academic institutions,

technology suppliers, government organisations and local

communities. Alongside our geological expertise, each one of these

relationships has been critical to Ariana's success. From the

springboard of our technologies and our team we are confident we

are now ready to drive further and faster towards the discovery of

significant Tier 1 resources across an international stage.

The Board looks forward to welcoming shareholders at our next

Annual General Meeting where we will conduct the formal business of

the meeting outlined in the Notice of Meeting. I would like to

encourage shareholders to exercise their proxy votes in favour of

these resolutions even if you are planning to attend the

meeting.

Last but not least, I would like to sign off by thanking our

excellent team and stakeholders and in particular those new to the

Ariana family, all of whom have contributed to the Ariana success

story.

* Post-period end.

Michael de Villiers

Chairman

05 June 2023

Financial Review

The Consolidated Statement of Comprehensive Income sets out our

very satisfactory results for the year, reflecting the success of

the group on a number of fronts. Overall the Group has recorded a

profit before tax for the year to December 2022 of GBP5.0m. This

was GBP2.7m less than 2021, albeit that year benefited from the

profit of GBP6.4m on the part disposal of our Turkish interests.

Administrative costs increased only marginally on the prior year,

though as explained in note 4a, we have benefited from an exchange

gain of GBP2.8m arising on our US dollar cash balances this year,

resulting in a reduction to GBP0.6m as reported in the Statement.

Otherwise the principal driver of our performance has been the

increase in our net share of the profit and losses of our

Associated investments, which increased by GBP1.5m over the prior

year. Once again the decline in value of the Turkish Lira has meant

that we are showing an accounting loss through Other Comprehensive

Income primarily on the translation of our opening balances of our

overseas subsidiaries at closing rates of exchange. These losses

are not realised unless we divest ourselves of such assets.

The Consolidated Statement of Financial Position reflects the

increase in the value of our share of our Associates, up from

GBP11.4m to GBP15.3m in 2022, as set out in note 6. The main change

was in the value of Zenit, in part reflecting the fact there was no

dividend received this year, as funds were directed at developing

Tav an. Another major change this year is the decline in cash

balances from GBP16.4m to GBP9.4m, comprising dividends paid by the

Company to shareholders amounting to GBP4m during the year as part

of the special dividend arising on last year's part disposal of our

interests, and also an increase in tax payable in Turkey of GBP1.9m

due to corporation tax changing to becoming payable in advance

there. A final point worthy of note is the transfer of GBP7.2m from

the Capital Reduction Reserve to boost Retained Earnings, and

facilitate dividend payments in future years.

Overall the Group has made great progress and the financial

results reflect that performance, and our strong financial position

gives us the platform to continue our development at pace.

Outlook

2022 marked the 20(th) anniversary of the foundation of the

Company. We enjoyed the opportunity to celebrate this significant

event with our long-term and supportive shareholders, advisors,

friends and relatives in London in July. Subsequently, in Türkiye,

we were also able to formally open our own dedicated Head Office in

Ankara, surrounded by our fantastic team.

Operationally with Zenit, the Company had its most successful

year to date, achieving record gold production and revenue from its

Turkish mine, coupled with the most drilling ever completed across

three simultaneous campaigns at Kiziltepe, Tav an and Salinbas. The

year also marked the commencement of construction at the Tav an

mine site in July, which will lead to the development of Zenit's

second gold mining operation in Türkiye.

Following the strategic investment of US$2.5 million into the

Company by Newmont Mining Corporation in March, we were pleased to

see the grant of the first four exploration licences in Kosovo,

coupled post-period end with the grant of the first Project Leopard

exploration licences in Eastern Türkiye. These events mark the

commencement of new grassroots exploration for major copper-gold

systems across the Tethyan Metallogenic Belt, in poorly explored

areas known to host multi-million ounce gold deposits. This

represents one of the core strands of our strategy; to pick up good

ground cost-effectively and to build value incrementally and

organically within the Company over time.

In Australia, our nascent discovery fund, Asgard Metals,

achieved a number of milestones of its own. In addition to

completing three substantial investments, it also established a

trading account through which it may participate in corporate

offers or trade securities on the ASX market. Meanwhile, our

technical team has contributed to the exploration programmes of our

investee companies across a variety of jurisdictions, but perhaps

most notably in Western Australia, where a substantial

nickel-cobalt JORC Resource Estimate of 70.6Mt at 0.7% Ni + 460ppm

Co was established for Panther Metals Limited.

Of course, not everything can go our way or in the manner

originally intended. Notably our intention to list Venus Minerals

on AIM did not happen as planned during the year. While we had made

arrangements for an IPO in June, the markets took a turn for the

worse and we decided to postpone the launch. Poor market conditions

have unfortunately prevailed for the remainder of the year and have

only continued to deteriorate during 2023. However, this did not

phase us, as it enabled the opportunity to increase our holding in

Venus, making it a subsidiary, and we look forward to continuing to

incubate and advance its Cypriot copper-gold portfolio

accordingly.

Lastly, we were very pleased to pay the last tranche of our

Special Dividend to shareholders in October, thus completing on a

process which we had initiated in late 2019. Accordingly, we have

come to view this moment as the closure of the first chapter in the

life of Ariana, having successfully brought our most advanced

projects in Türkiye to the point of providing very meaningful

returns to our shareholders. We are now on the hunt for new

projects on the international stage which may be developed in

similar ways, to ensure that further returns may continue to be

paid well in the future.

We are resolutely focused on upscaling the Company by pursuing

bold objectives. In particular we are keen to advance on larger

projects capable of supporting the Company on its journey towards

becoming a mid-tier mine developer. As part of this process, we are

going to pursue support from investors from further afield and will

be marketing the Company accordingly. In parallel with this we are

undertaking several project and jurisdictional reviews with the aim

of securing a significant new flagship asset around which the

future of the Company may continue to be built.

Over the years we have developed a unique skill-set, rarely seen

in a company of our size. We have the capacity to undertake

exploration and development projects from the grassroots stage all

the way through to mine development and production. Our in-house

team comprises individuals with backgrounds in every geoscientific

discipline relevant to mineral exploration and mine development,

with the expertise to take projects through to Feasibility Study

level. We recognise this as being where the true value of the

Company lies. We will be drawing on these skills to draw the

maximum value out of the opportunities already available to us but

also to create new opportunities capable of catapulting the Company

into the next decade and towards a higher level of market

recognition.

We invite shareholders to join us on the next chapter of our

journey and welcome their ongoing support.

Dr Kerim Sener

Managing Director

05 June 2023

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2022

Continuing operations Note 2022 2021

GBP'000 GBP'000

--------------------------------------------- ----- --------- ---------

Administrative costs (net of exchange

gains) 4a (555) (2,917)

General exploration expenditure (181) (67)

--------------------------------------------- ----- --------- ---------

Operating loss 4b (736) (2,984)

--------------------------------------------- ----- --------- ---------

Profit on restructuring of group activities 5 - 6,423

Share of profit of associate accounted

for using the equity method 6c 6,010 4,260

Share of loss of associate accounted

for using the equity method 6b (551) (213)

Other income 159 -

Investment income 135 202

--------------------------------------------- ----- --------- ---------

Profit before tax 5,017 7,688

--------------------------------------------- ----- --------- ---------

Taxation 8 (987) (3,832)

--------------------------------------------- ----- --------- ---------

Profit for the year from continuing

operations 4,030 3,856

--------------------------------------------- ----- --------- ---------

Earnings per share (pence) attributable

to equity holders of the company

Basic and diluted 10 0.36 0.36

Other comprehensive income

Items that are or may be reclassified

subsequently to profit or loss:

Exchange differences on translating

foreign operations (3,504) (2,948)

Other comprehensive loss for the year

net of income tax (3,504) (2,948)

--------------------------------------------- ----- --------- ---------

Total comprehensive profit for the

year 526 908

--------------------------------------------- ----- --------- ---------

The accompanying notes form part of these financial

statements.

Consolidated Statement of Financial Position

For the year ended 31 December 2022

Note 2022 2021

GBP'000 GBP'000

---------------------------------------- ----- --------- ---------

Assets

Non-current assets

Trade and other receivables 16 414 815

Financial assets at fair value through

profit or loss 13 639 461

Intangible assets 11 130 149

Land, property, plant and equipment 12 461 238

Investment in associates accounted for

using the equity method 6 15,317 11,402

Exploration expenditure 14a 199 -

Earn-In advances 14b 87 -

---------------------------------------- ----- --------- ---------

Total non-current assets 17,247 13,065

---------------------------------------- ----- --------- ---------

Current assets

---------------------------------------- ----- --------- ---------

Trade and other receivables 17 1,280 1,136

Cash and cash equivalents 9,375 16,389

Total current assets 10,655 17,525

---------------------------------------- ----- --------- ---------

Total assets 27,902 30,590

---------------------------------------- ----- --------- ---------

Equity

Called up share capital 19 1,147 1,097

Share premium 19 2,207 305

Capital reduction reserve 19 - 7,222

Other reserves 720 720

Share based payments 19 - 173

Translation reserve (11,682) (8,178)

Retained earnings 34,666 27,160

---------------------------------------- ----- --------- ---------

Total equity attributable to equity

holders of the parent 27,058 28,499

---------------------------------------- ----- --------- ---------

Non-controlling interest 30 30

---------------------------------------- ----- --------- ---------

Total equity 27,088 28,529

---------------------------------------- ----- --------- ---------

Liabilities

Current liabilities

Trade and other payables 18 814 2,061

Total current liabilities 814 2,061

---------------------------------------- ----- --------- ---------

Total equity and liabilities 27,902 30,590

---------------------------------------- ----- --------- ---------

The financial statements were approved by the Board of Directors

and authorised for issue on 5 June 2023.

They were signed on its behalf by:

M J de Villiers

Chairman

A.K.Sener

Managing Director

Registered number: 05403426

The accompanying notes form part of these financial

statements.

Company Statement of Financial Position

For the year ended 31 December 2022

Note 2022 2021

GBP'000 GBP'000

--------------------------------------- ----- --------- ---------

Assets

Non-current assets

Trade and other receivables 16 3,850 5,942

Investments in group undertakings 15 377 377

Investment in associate accounted for

using the equity method 6 2,612 2,612

Total non-current assets 6,839 8,931

--------------------------------------- ----- --------- ---------

Current assets

Trade and other receivables 17 540 132

Cash and cash equivalents - -

--------------------------------------- ----- --------- ---------

Total current assets 540 132

--------------------------------------- ----- --------- ---------

Total assets 7,379 9,063

--------------------------------------- ----- --------- ---------

Equity

Called up share capital 19 1,147 1,097

Share premium 19 2,207 305

Capital reduction reserve 19 - 7,222

Share based payments reserve 19 - 173

Retained earnings 3,886 34

--------------------------------------- ----- --------- ---------

Total equity 7,240 8,831

--------------------------------------- ----- --------- ---------

Liabilities

Current liabilities

Trade and other payables 18 139 232

--------------------------------------- ----- --------- ---------

Total current liabilities 139 232

--------------------------------------- ----- --------- ---------

Total equity and liabilities 7,379 9,063

--------------------------------------- ----- --------- ---------

The financial statements were approved by the Board of Directors

and authorised for issue on 5 June 2023.

They were signed on its behalf by:

M J de Villiers

Chairman

A.K.Sener

Managing Director

Registered number: 05403426

The accompanying notes form part of these financial

statements.

Consolidated Statement of Changes in Equity

For the year ended 31 December 2022

Share Share Other Share Capital Translation Retained Total Non- Total

capital premium reserves based reduction reserve earnings attributable controlling GBP'000

GBP'000 GBP'000 GBP'000 payments reserve GBP'000 GBP'000 to equity interest

reserve GBP'000 holders GBP'000

GBP'000 of parent

GBP'000

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Changes in

equity to

31 December

2021

Balance at

1 January

2021 6.070 12,053 720 307 - (9,617) 17,164 26,697 - 26,697

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Profit for

the year - - - - - - 3,856 3,856 - 3,856

Other

comprehensive

income - - - - - (2,948) - (2,948) - (2,948)

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Total

comprehensive

income - - - - - (2,948) 3,856 908 - 908

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Issue of

ordinary

shares 22 305 - - - - - 327 - 327

Court order

-

reduction

in capital (4,995) (12,053) - - 7,222 - 9,826 - - -

Dividend paid

to

shareholders - - - - - - (3,820) (3,820) - (3,820)

Recycle of

translation

losses - - - - - 4,387 - 4,387 - 4,387

Transactions

between

shareholders - - - - - - - - 30 30

Transfer

between

reserves - - - (134) - - 134 - - -

Transactions

with owners (4,973) (11,748) - (134) 7,222 4,387 6,140 894 30 924

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Balance at

31 December

2021 1,097 305 720 173 7,222 (8,178) 27,160 28,499 30 28,529

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Changes in

equity to

31 December

2022

Profit for

the year - - - - - - 4,030 4,030 - 4,030

Other

comprehensive

income - - - - - (3,504) - (3,504) - (3,504)

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Total

comprehensive

income - - - - - (3,504) 4,030 526 - 526

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Issue of

ordinary

shares 50 1,902 - - - - - 1,952 - 1,952

Dividend paid

to

shareholders - - - - - - (3,919) (3,919) - (3,919)

Transfer

between

reserves - - - (173) (7,222) - 7,395 - - -

Transactions

with owners 50 1,902 - (173) (7,222) - 3,476 (1,967) - (1,967)

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

Balance at

31 December

2022 1,147 2,207 720 - - (11,682) 34,666 27,058 30 27,088

-------------- ------- -------- -------- -------- --------- ----------- -------- ------------ ----------- -------

The accompanying notes form part of these financial

statements

Company Statement of Changes in Equity

For the year ended 31 December 2022

Share Share Capital Share Retained Total

capital premium reduction based earnings GBP'000

GBP'000 GBP'000 Reserve payments GBP'000

GBP'000 reserve

GBP'000

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Changes in equity to

31 December 2021

Balance at 1 January 2021 6,070 12,053 - 307 (9,826) 8,604

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Profit for the year - - - - 3,720 3,720

Other comprehensive income - - - - - -

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Total comprehensive income - - - - 3.720 3,720

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Issue of ordinary shares 22 305 - - - 327

Court order - reduction in capital (4,995) (12,053) 7,222 - 9,826 -

Dividend paid to shareholders - - - - (3,820) (3,820)

Transfer between reserves - - - (134) 134 -

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Transactions with owners (4,973) (11,748) 7,222 (134) 6,140 (3,493)

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Balance at 31 December 2021 1,097 305 7,222 173 34 8,831

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Changes in equity to

31 December 2022

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Profit for the year - - - - 376 376

Other comprehensive income - - - - - -

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Total comprehensive income - - - - 376 376

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Issue of ordinary shares 50 1,902 - - - 1,952

Dividend paid to shareholders - - - - (3,919) (3,919)

Transfer between reserves - - (7,222) (173) 7,395 -

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Transactions with owners 50 1,902 (7,222) (173) 3,476 (1,967)

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

Balance at 31 December 2022 1,147 2,207 - - 3,886 7,240

------------------------------------ --------- --------- ----------- ---------- ---------- ----------

The accompanying notes form part of these financial

statements.

Consolidated Statement of Cash Flows

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

---------------------------------------------------- --------- ---------

Cash flows from operating activities

Profit for the year 4,030 3,856

Adjustments for:

Profit on restructuring of group activities - (6,423)

Depreciation of non-current assets 93 44

Share of profit in equity accounted associate (6,010) (4,260)

Share of loss in equity accounted associate 551 213

Investment income (135) (202)

Income tax expense 987 3,832

---------------------------------------------------- --------- ---------

(484) (2,940)

Movement in working capital

(increase)/decrease in trade and other receivables (361) 62

(Decrease)/increase in trade and other payables 46 (271)

---------------------------------------------------- --------- ---------

Cash (outflow)/inflow from operating activities (799) (3,149)

Taxation paid (1,882) (2,923)

---------------------------------------------------- --------- ---------

Net cash (used in)/generated from operating

activities (2,681) (6,072)

---------------------------------------------------- --------- ---------

Cash flows from investing activities

Earn-In Advances (87) (1,406)

Purchase of land, property, plant and equipment (333) (241)

Payments for intangible and exploration assets (199) -

Proceeds from restructuring of group activities - 28,951

Purchase of associate investment - (4,139)

Purchase of financial assets at fair value

through profit or loss (155) (461)

Loan granted to associate (500) -

Dividends from associate - 705

Investment income 135 202

---------------------------------------------------- --------- ---------

Net cash generated from/ (used in) investing

activities (1,139) 23,611

---------------------------------------------------- --------- ---------

Cash flows from financing activities

Issue of share capital 1,952 326

Proceeds from non-controlling interest - 30

Payment of shareholder dividend (excluding

uncashed) (4,022) (3,689)

---------------------------------------------------- --------- ---------

Net cash (used in)/generated from financing

activities (2,070) (3,333)

---------------------------------------------------- --------- ---------

Net (decrease)/increase in cash and cash

equivalents (5,890) 14,206

Cash and cash equivalents at beginning of

year 16,389 2,978

Exchange adjustment on cash and cash equivalents (1,124) (795)

---------------------------------------------------- --------- ---------

Cash and cash equivalents at end of year 9,375 16,389

---------------------------------------------------- --------- ---------

The accompanying notes form part of these financial

statements.

Selected Notes to the Consolidated Financial Statements for the

year ended 31 December 2022

1. General Information

Ariana Resources PLC (the "Company") is a public limited company

incorporated, domiciled and registered in the UK. The registered

number is 05403426 and the registered address is 2nd Floor, Regis

House, 45 King William Street, London, EC4R 9AN.

The Company's shares are listed on the Alternative Investment

Market of the London Stock Exchange. The principal activities of

the Company and its subsidiaries (together the "Group") are related

to the exploration for and development of gold and

technology-metals, principally in south-eastern Europe.

The consolidated financial statements are presented in Pounds

Sterling (GBP), which is the parent company's functional and

presentation currency, and all values are rounded to the nearest

thousand except where otherwise indicated. The financial

information has been prepared on the historical cost basis modified

to include revaluation to fair value of certain financial

instruments and the recognition of net assets acquired including

contingent liabilities assumed through business combinations at

their fair value on the acquisition date modified by the

revaluation of certain items, as stated in the accounting

policies.

Basis of Preparation

The Group financial statements have been prepared and approved

by the Directors in accordance with UK-adopted International

Accounting Standards and effective for the Group's reporting for

the year ended 31 December 2022.

The separate financial statements of the Company are presented

as required by the Companies Act 2006. As permitted by that Act,

the separate financial statements have been prepared in accordance

with UK-adopted International Accounting Standards. These financial

statements have been prepared under the historical cost convention

(except for financial assets at FVOCI) and the accounting policies

have been applied consistently throughout the period.

Going Concern

These financial statements have been prepared on the going

concern basis.

The Directors are mindful that there is an ongoing need to

monitor overheads and costs associated with delivering on its

strategy and certain exploration programmes being undertaken across

its portfolio. The Group is not expecting to raise additional

capital at this time, but may do so to support its strategy and

specific activities on occasion. The Group has no bank facilities

and has been meeting its working capital requirements from cash

resources. At the year end the Group had cash and cash equivalents

amounting to GBP9.375 million (2021: GBP16.389 million).

The Directors have prepared cash flow forecasts for the Group

for the period to 30 September 2024 based on their assessment of

the prospects of the Group's operations. The cash flow forecasts

include expected future cash flows from our equity accounted

associates along with the normal operating costs for the Group over

the period together with the discretionary and non-discretionary

exploration and development expenditure.

The forecasts indicate that on the basis of existing cash and

other resources, and expected future dividend payments from Zenit,

the Group will have adequate resources to meet all its expected

obligations in delivering its work programme for the forthcoming

year.

In preparing these financial statements the Directors have given

consideration to the above matters and on this basis they believe

that it remains appropriate to prepare the financial statements on

a going concern basis.

4. Administrative costs & Operating loss

4a. Administrative costs amounting to GBP555,000 are stated

after exceptional exchange gains amounting to GBP2.8m, these

primarily arising in the group's wholly owned subsidiary Galata

Mineral Madencilik San. ve Tic. A.S. ("Galata"), mainly due to the

strengthening of the US dollar against the Turkish Lira. On

retranslation into Galata's functional currency, US dollar

denominated assets held by Galata, including bank and trade

receivables, resulted in an uplift to those Lira asset valuations

and a corresponding exchange gain for the year to 31 December

2022.

4b . The operating loss is stated after

charging/(crediting):

2022 2021

GBP'000 GBP'000

----------------------------------------------------- --------- ---------

Depreciation and amortisation - owned assets 93 44

Office lease rentals 8 12

Exceptional exchange (gain) in Türkiye (2,821) -

Net foreign exchange losses/(gains) 156 (75)

Fees payable to the Company's auditor for the

audit of the Group's and Company's annual accounts 50 50

Fees payable to the Company's auditor for other

services:

- The audit of the Company's subsidiaries 25 25

----------------------------------------------------- --------- ---------

5. Profit on restructuring of group activities

During the prior year, the Group concluded its restructuring

programme. This comprised the part-disposal of its interest in

Zenit Madencilik San. ve Tic. A.S. ("Zenit") and Pontid Madencilik

San. ve Tic. A.S. ("Pontid") to Ozaltin Insaat, Ticaret and Sanayi

A.S. ("Ozaltin") and Proccea Construction Co ("Proccea") for a

total consideration of US$35.75m. Under the terms of the Pontid

sale agreement and during the year, Ozaltin completed its equity

commitment to invest a further US$8m in the development of the

Salinba project. A further US$2m is to be paid in instalments to

the Group by Zenit following the transfer of the three remaining

satellite projects held by the Group's wholly owned subsidiary,

Galata Mineral Madencilik San. ve Tic. A.S.

2022 2021

GBP'000 GBP'000

------------------------------------------------ ---------- ---------

Disposal proceeds receivable (net of group

transactions)

Less:- - 26,976

Cost of Investment and other incidental costs

incurred on disposal - (4,684)

Reversal of fair value transactions associated

with the Salinba acquisition - (9,466)

Increase in valuation of associate following

acquisition - 2,197

Reduction in valuation of JV following part

disposal (excluding translation losses) - (4,234)

Recycled translation losses - (4,386)

------------------------------------------------ ---------- ---------

Profit on restructuring of Group's activities - 6,423

------------------------------------------------ ---------- ---------

6. Equity accounted Investments

The Group and Company's investments comprise the following:

-

Associates and joint ventures Note Group Company Group Company

companies 2022 2022 2021 2021

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ----- --------- --------- --------- ---------

Associate Interest in

Pontid Madencilik San.

ve Tic. A.S. ("Pontid") 6a 4,139 - 4,139 -

Associate Interest in

Venus Minerals Ltd ("Venus") 6b 1,848 2,612 2,399 2,612

Associate Interest in

Zenit Madencilik San.

ve Tic. A.S. ("Zenit") 6c 9,330 - 4,864 -

Carrying amount of investment

at 31 December 15,317 2,612 11,402 2,612

------------------------------- ----- --------- --------- --------- ---------

6a Associate Interest in Pontid.

Following the disposal in the prior year by Greater Pontides

Exploration B.V. (holding company) of its entire interest in Pontid

Madencilik San. ve Tic. A.S. ("Pontid") to Ozaltin Holding A.S and

Proccea Construction Co., the Group reinvested US$5.75m for a 23.5%

shareholding in Pontid. This investment is currently valued at

GBP4.139m and represents the Group's share of Pontid's net assets

and goodwill paid on acquisition. Since the date of acquisition,

Pontid continues to benefit from new capital funding into its

Salinba project.

Financial information based on Pontid's translated financial

statements, and reconciliations with the carrying amount of the

investment in the consolidated financial statements are set out

below

Statement of financial position 2022 2021

As at 31 December 2022 GBP'000 GBP'000

----------------------------------------------- --------- ---------

Assets

Non-current assets

Other receivables 14 10

Intangible exploration assets 2,006 1,120

Land, property, plant and machinery 69 96

----------------------------------------------- --------- ---------

Total non-current assets 2,089 1,226

----------------------------------------------- --------- ---------

Current assets

Trade and other receivables 337 86

Cash and cash equivalents 4,377 5,230

----------------------------------------------- --------- ---------

Total current assets 4.714 5,316

----------------------------------------------- --------- ---------

Total assets 6,803 6,542

----------------------------------------------- --------- ---------

Current liabilities

Other payables 131 229

----------------------------------------------- --------- ---------

Total current liabilities 131 229

----------------------------------------------- --------- ---------

Equity 6,672 6,313

Proportion of the Group's ownership 23.5% 23.5%

Share of net assets per above analysis 1,568 1,483

Goodwill on acquisition and share of interest

post acquisition 2,571 2,656

----------------------------------------------- --------- ---------

Carrying amount of investment in Pontid 4,139 4,139

----------------------------------------------- --------- ---------

6b Share of loss of associate interest in Venus Minerals Ltd

The Company and group acquired 50% of Venus Minerals Ltd through

an earn-in agreement on 5 November 2021.

The Group accounts for its associate interest in Venus Minerals

Ltd using the equity method in accordance with IAS 28 (revised).

The results set out below includes the Group`s share of loss for

the year to 31 December 2022.

Group Company Group Company

2022 2022 2021 2021

GBP'000 GBP'000 GBP`000 GBP`000

--------------------------------- ----------- ----------- ----------- -----------

Equity Equity Equity Equity

accounted accounted accounted accounted

Associate Associate Associate Associate

interest interest interest interest

--------------------------------- ----------- ----------- ----------- -----------

At 1 January 2022 2,399 2,612 2,612 2,612

Share of loss since significant

influence recognised by

Group (551) - (213) -

--------------------------------- ----------- ----------- ----------- -----------

At 31 December 2022 1,848 2,612 2,399 2,612

--------------------------------- ----------- ----------- ----------- -----------

6c Share of profit of associate interest in Zenit

The Group accounts for its associate interest in Zenit using the

equity method in accordance with IAS 28 (revised). In prior years

Zenit was also accounted for using the equity method of accounting,

albeit the company was then classified as a joint venture, until

part disposal by the Group in February 2021. At 31 December 2022

the Group has a 23.5% interest in Zenit, and profits from Zenit are

shared in the ratio of 23.5% the Group, 23.5% Proccea and the

remaining 53% interest to Ozaltin Holding A.S.

Zenit was incorporated in, and has its principal place of

business in Ankara, Türkiye.

Financial information based on Zenit's translated financial

statements, and reconciliations with the carrying amount of the

investment in the consolidated financial statements are set out

below:

Statement of Comprehensive Income 2022 2021

For the year ended 31 December 2022 GBP'000 GBP'000

------------------------------------------------- --------- ---------

Revenue 47,489 32,784

Cost of sales (26,244) (14,586)

------------------------------------------------- --------- ---------

Gross Profit 21,245 18,198

Administrative expenses (555) (2,344)

------------------------------------------------- --------- ---------

Operating profit 20,690 15,854

------------------------------------------------- --------- ---------

Other income - 124

Finance expenses including foreign exchange

losses (1,102) (1,171)

Finance income including foreign exchange gains 4,728 5,213

------------------------------------------------- --------- ---------

Profit before tax 24,316 20,020

Taxation (credit) / charge 1,259 (1,890)

------------------------------------------------- --------- ---------

Profit for the year 25,575 18,130

Proportion of the Group's profit share 23.5% 23.5%

------------------------------------------------- --------- ---------

Group's share of profit for the year 6,010 4,260

------------------------------------------------- --------- ---------

6c Share of profit of interest in associate in Zenit

Statement of financial position 2022 2021

As at 31 December 2022 GBP'000 GBP'000

------------------------------------------------------ --------- ---------

Assets

Non-current assets

Other receivables and deferred tax asset 6,287 295

Intangible exploration assets 50 70

Kiziltepe Gold Mine (including capitalised

mining costs, land, property, plant, and equipment) 12,889 15,804

Tav an construction in progress 4,709 -

------------------------------------------------------ --------- ---------

Total non-current assets 23,935 16,169

------------------------------------------------------ --------- ---------

Current assets

Trade and other receivables 281 650

Inventories 3,424 2,033

Other receivables, VAT and prepayments 5,345 2,521

Cash and cash equivalents 15,420 6,680

------------------------------------------------------- -------- ---------

Total current assets 24,470 11,884

------------------------------------------------------- -------- ---------

Total assets 48,405 28,053

------------------------------------------------------- -------- ---------

Liabilities

Non-current liabilities

Borrowings - 412

Deferred tax - 367

Asset retirement obligation 582 616

------------------------------------------------------- -------- ---------

Total non-current liabilities 582 1,395

------------------------------------------------------- -------- ---------

Current liabilities

Borrowings 361 884

Trade payables 3,345 1,406

Other payables 4,415 3,671

------------------------------------------------------- -------- ---------

Total current liabilities 8,121 5,961

------------------------------------------------------- -------- ---------

Total liabilities 8,703 7,356

------------------------------------------------------- -------- ---------

Equity 39,702 20,697

Proportion of the Group's ownership 23.5% 23.5%

------------------------------------------------------- -------- ---------

Carrying amount of investment in associate 9,330 4,864

------------------------------------------------------- -------- ---------

Movement in Equity - our share

Opening balance 4,864 11,213

Profit for the year 6,010 4,260

Part disposal of Interest - (5,943)

Translation and other reserves (1,544) (3,613)

Dividend receivable - (1,053)

------------------------------------------------------- -------- ---------

Closing balance 9,330 4,864

------------------------------------------------------- -------- ---------

9. Profit and distributable reserves of parent Company

(a) Profit of parent company

As permitted by Section 408 of the Companies Act 2006, the

statement of comprehensive income of the parent Company is not

presented as part of these financial statements. The parent

Company's Profit for the financial year was GBP376,000 (2021:

GBP3,720,000).

(b) Distributable reserves of parent company

The Company paid its first shareholder inaugural special

dividend on 24 September 2021 amounting to GBP3,820,873. To

facilitate this distribution the Company gained shareholder

approval during February 2021 and applied to the High Court of

Justice of England and Wales to reduce its share capital. This

application was granted by the High Court during July 2021 and the

share capital reduction scheme resulted in generating distributable

reserves of GBP7.22m, as set out in the Company's Statement of

Changes in Equity and note 19.

(c) Dividends

A second interim and third final part of the inaugural special

dividend distribution was paid out of distributable reserves. The

second interim payment on the 11(th) March 2022 of 0.175 pence per

ordinary share amounted to GBP1,919,186; the third and final

payment on the 21(st) September 2022 of 0.175 pence per ordinary

share amounted to GBP2,000,010.

10. Earnings per share on continuing operations

The calculation of basic profit per share is based on the profit

attributable to ordinary shareholders of GBP4,030,000 (2021:

GBP3,856,000) divided by the weighted average number of shares in

issue during the year being shares 1,133,043,081 (2021:

1,085,894,966). There is no material effect on the basic earnings

per share for the dilution provided by the share options.

13. Financial assets at fair value through profit or loss

Group and Company Group

2022

GBP'000

--------------------- ---------

At 1 January 2022 461

Addition 155

Exchange movement 23

--------------------- ---------

At 31 December 2022 639

--------------------- ---------

Carrying value

At 31 December 2021 461

--------------------- ---------

At 31 December 2022 639

--------------------- ---------

During the year, the Group's wholly owned subsidiary, Asgard

Metals Pty. Ltd., continued with its investment strategy, and

further investments during the year amounted to GBP155,000. The

market valuation of listed securities at the balance sheet date

amounted to GBP202,000, compared to a carrying valuation of

GBP217,000 (level 1 hierarchy). This immaterial fall in valuation

amounting to GBP15,000 has not been reflected in the statement of

comprehensive income.

Unlisted securities, where fair value cannot be reliably

measured, continue to be valued at cost and amounted to GBP422,000

(level 3 hierarchy) at the balance sheet date.

16. Non-current other receivables

Group Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------- ---------- --------- ----------

Amounts owed by Group undertakings - - 3,850 5,942

------------------------------------ --------- ---------- --------- ----------

Amounts owed by associate

interest 414 815 - -

------------------------------------ --------- ---------- --------- ----------

414 815 3,850 5,942

------------------------------------ --------- ---------- --------- ----------

The amount owed to the Group relate to an instalment based

interest free loan agreed upon following the disposal by Galata of

its three remaining satellite projects to Zenit at a rate of

US$50,000 per calendar month. The directors have assessed that the

future fair value return on settlement of this debt is not

materially different from the carrying value shown above.

17. Trade and other receivables

Group Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- ---------- --------- ----------

Other receivables 155 219 29 132

Amounts owed by associate

interest 497 792 - -

Loan to associate interest 500 - 511 -

Prepayments 128 125 - -

---------------------------- --------- ---------- --------- ----------

1,280 1,136 540 132

---------------------------- --------- ---------- --------- ----------

The carrying values of other receivables and amounts owed by

associate interest approximate their fair values as these balances

are expected to be cash settled in the near future.

During September 2022, a convertible loan agreement was entered

into with Venus Minerals Limited amounting to GBP500,000.

Post-period end a further convertible loan agreement was completed

with Venus for GBP200,000.

18. Trade and other payables

Group Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- --------- ---------

Trade and other payables 189 203 102 94

Social security and other

taxes 355 1,380 - -

Other creditors and advances 137 343 29 132

Accruals and deferred income 133 135 8 6

------------------------------ --------- --------- --------- ---------

814 2,061 139 232

------------------------------ --------- --------- --------- ---------

The above listed payables are all unsecured. Due to the

short-term nature of current payables, their carrying values

approximate their fair value.

19. Called up share capital, share premium and capital reduction

reserve

Allotted, issued and fully Number Ordinary Share Capital

paid ordinary 0.1p shares Shares Premium reduction

GBP'000 GBP'000 reserve

GBP'000

-------------------------------- -------------- --------- --------- -----------

In issue at 1 January

2022 1,096,677,943 1,097 305 7,222

Issue of ordinary shares 46,185,387 46 1,843 -

Share options exercised 3,500,000 4 59 -

Transfer to retained earnings - - - (7,222)

-------------------------------- -------------- --------- --------- -----------

In issue at 31 December

2022 1,146,363,330 1,147 2,207 -

-------------------------------- -------------- --------- --------- -----------

During the prior year, the Company was granted permission by the

High Court of Justice in England and Wales to reduce its share

capital by the cancellation of its share premium and its

sub-divided deferred shares. This allowed the Company to extinguish

retained losses bought forward from prior years amounting to

GBP9,826,000 and resulted in the establishment of a capital

reduction reserve. This distributable reserve was subsequently

transferred to retained earnings during 2022.

22. Contingent liabilities

Following the restructuring of the Group and the part disposal

by Galata Mineral Madencilik San. ve Tic. A.S. of 26.5% of its

interest in Zenit Madencilik San. ve Tic. A.S., 75% of the

resulting gain on disposal is exempt from Turkish corporation tax

provided the gain is retained under equity by Galata for a period

of 5 years. This potentially exempt taxable gain, including the

previously reported gain during 2019 on Çamyol Gayrimenkul,

Madencilik, Turizm, Tarim ve Hayvancilik Ltd ("Camyol") is as

follows:

Contracting Shareholding Taxable gain Contingent Contingent Liability

parties in Lira liability in in GBP

Lira

------------- ------------- ------------- -------------- ---------------------

Galata 26.5% 127,766,456 31,941,614 1,414,761

Çamyol 99% 4,529,343 996,455 44,135

------------- ------------- ------------- -------------- ---------------------

24. Post year end events

In April 2023 the loan of GBP500,000 outstanding at the year end

from Venus Minerals Limited was capitalised, along with an

additional loan of GBP200,000 increasing the Group's shareholding

in that company to 58%. The assessment of the fair values of the

assets and liabilities acquired is currently ongoing, and will be

reported in the Group's next available financial statements.

Note to the announcement

The financial information set out above does not constitute the

Company's statutory accounts for the year ended 31 December 2022 or

year ended 31 December 2021, but is derived from those accounts.

Statutory accounts for 2021 have been delivered to the Registrar of

Companies and those for 2022 on which the auditors have provided an

unqualified report will be delivered following the AGM.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 3476 2080

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited (Nominated Tel: +44 (0) 20 7628 3396

Adviser)

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886 2500

(Joint Broker)

John Prior / Hugh Rich / Atholl

Tweedie

WHIreland Limited (Joint Broker) Tel: +44 (0) 207 2201666

Harry Ansell / Katy Mitchell

/ George Krokos

Yellow Jersey PR Limited (Financial arianaresources@yellowjerseypr.com

PR) Tel: +44 (0) 7983 521 488

Dom Barretto / Shivantha Thambirajah

/

Bessie Elliot

Editors' Note:

The information in this announcement that relates to exploration

results is based on information compiled by Dr. Kerim Sener BSc

(Hons), MSc, PhD, Managing Director of Ariana Resources plc. Dr.

Sener is a Fellow of The Geological Society of London and a Member

of The Institute of Materials, Minerals and Mining and has

sufficient experience relevant to the styles of mineralisation and

type of deposit under consideration and to the activity that has

been undertaken to qualify as a Competent Person as defined by the

2012 edition of the Australasian Code for the Reporting of

Exploration Results, Mineral Resources and Ore Reserves (JORC Code)

and under the AIM Rules - Note for Mining and Oil & Gas

Companies. Dr. Sener consents to the inclusion in the report of the

matters based on his information in the form and context in which

it appears.

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at February 2022).

The joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 222,000 ounces gold and 3.8 million ounces silver (as at

February 2022). The mine has been in pro table production since

2017 and is expected to produce at a rate of c.20,000 ounces of

gold per annum to at least the mid-2020s. A Net Smelter Return

("NSR") royalty of 2.5% on production is being paid to

Franco-Nevada Corporation.

The Tavsan Gold Mine is located in western Turkey and contains a

JORC Measured, Indicated and Inferred Resource of 307,000 ounces

gold and 1.1 million million ounces silver (as at November 2022).

Following the approval of its Environmental Impact Assessment and

associated permitting, Tavsan is being developed as the second gold

mining operation in Turkey. Construction progress is temporarily

suspended pending the outcome of a local court decision pertaining

to the EIA. A NSR royalty of up to 2% on future production is

payable to Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Gold eld, which contains the "Hot Gold

Corridor" comprising several signi cant gold- copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana owns 100% of Australia-registered Asgard Metals Fund

("Asgard"), as part of the Company's proprietary Project Catalyst

Strategy. The Fund is focused on investments in high-value

potential, discovery-stage mineral exploration companies located

across the Eastern Hemisphere and within easy reach of Ariana's

operational hubs in Australia, Turkey and the UK.

Ariana owns 75% of UK-registered Western Tethyan Resources Ltd

("WTR"), which operates across south-eastern Europe and is based in

Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition. WTR is being funded through a

ve-year Alliance Agreement with Newmont Corporation (

www.newmont.com ) and is separately earning-in to 85% of the

Slivova Gold Project.

Ariana owns 58% of UK-registered Venus Minerals Ltd ("Venus")

which is focused on the exploration and development of copper-gold

assets in Cyprus which contain a combined JORC Indicated and

Inferred Resource of 17Mt @ 0.45% to 1.10% copper (excluding

additional gold, silver and zinc.

Panmure Gordon (UK) Limited and WH Ireland Limited are brokers

to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana, you are invited to visit the

Company's website at www.arianaresources.com .

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EASKSELDDEFA

(END) Dow Jones Newswires

June 06, 2023 02:00 ET (06:00 GMT)

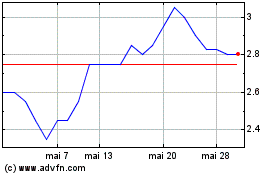

Ariana (AQSE:AAU.GB)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ariana (AQSE:AAU.GB)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025