XRP Retreats To $0.55, On-Chain Metrics Expose Investor Pain

01 Septembre 2024 - 8:30AM

NEWSBTC

XRP is now trading at $0.55, following weeks of speculation and

excitement from investors who expected a sharp price rise. However,

fear and uncertainty drive the market, with Bitcoin and most

altcoins trading at lower levels. This downturn has impacted

investor sentiment across the board. Related Reading: XRP

Remains Strong Despite Market Pullback: Analyst Forecasts $500 By

2025 Crucial data from Santiment shows a noticeable change in the

outlook of XRP holders. The optimism that once drove confidence is

now fading, as most investors are sitting on unrealized losses.

This shift in sentiment underscores the growing concerns

surrounding XRP’s future, particularly in the context of broader

market challenges. With the market under pressure, XRP’s prospects

appear increasingly uncertain. XRP Holders Facing Unrealized Losses

XRP has demonstrated relative strength compared to other altcoins,

dropping 13% from its August 24 high of $0.631. However, this

decline has created considerable distress among investors,

mirroring the broader market’s uncertainty. Crucial data from

Santiment sheds light on the situation, revealing that both the

30-day and 7-day Market Value to Realized Value (MVRV) ratios for

XRP have turned negative. A negative MVRV ratio indicates that XRP

is currently undervalued, meaning that, on average, if all coins

were sold at the current price, most traders would incur a loss.

This shift in MVRV ratios is significant, as it suggests that the

majority of XRP holders are now at risk of realizing negative

returns on their investments. The data reflects a broader trend of

investor caution, particularly in light of the ongoing market

volatility. While XRP’s performance has been relatively better than

many other altcoins, the negative MVRV ratios highlight the growing

concerns within the investor community. Related Reading: Ethereum

(ETH) Struggles To Break Past $2,600: What’s Driving ETH Down? The

declining MVRV ratios serve as a crucial indicator of market

sentiment, suggesting that the optimism surrounding XRP may be

waning. Investors are increasingly wary of the potential for

further declines, which could exacerbate losses. While XRP has

shown resilience, the current market conditions and negative MVRV

ratios suggest that caution is warranted. The coming days will be

critical for XRP holders as they navigate this challenging market

environment, weighing the potential risks and rewards of holding or

selling their assets. $0.55 Key Support Must Hold For Consolidation

XRP is currently trading at $0.559, holding just above a critical

support level, the daily 200 moving average (MA), which sits at

$0.5509. This level is crucial for maintaining bullish momentum, as

it has acted as a strong support, giving hope to investors

expecting a price recovery. If the price can sustain above this MA,

it may signal a potential continuation of the uptrend, reassuring

bulls. However, if the price drops below this key indicator, it

could trigger a further decline, pushing the price toward lower

demand levels. Related Reading: Solana (SOL) Funding Rate Signals A

Decline: Investors Expect $130 The next significant support to

watch would be around $0.48, a critical level for bulls to defend.

Holding above the 200 MA is essential for maintaining a positive

outlook, while a break below could indicate increased selling

pressure. As XRP navigates through this pivotal phase, traders and

investors are closely monitoring these levels to assess the

market’s next direction. Featured image from Dall-E, chart from

TradingView

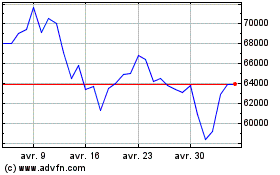

Bitcoin (COIN:BTCUSD)

Graphique Historique de l'Action

De Août 2024 à Sept 2024

Bitcoin (COIN:BTCUSD)

Graphique Historique de l'Action

De Sept 2023 à Sept 2024