Ethereum Whales Load Up: Bullish Sign Or Bear Trap?

17 Décembre 2024 - 5:00AM

NEWSBTC

Ethereum is on the verge of reclaiming the $4,000 level as it

inches closer to its all-time highs. The second-largest

cryptocurrency by market cap has faced skepticism throughout this

cycle, with some analysts predicting it would underperform compared

to its previous bull runs. However, Ethereum has surprised

doubters, steadily climbing in recent weeks despite market

uncertainty. Related Reading: ONDO Exchange Inflows Grow –

Volatility Ahead? Key on-chain metrics from Glassnode reveal an

important trend that could fuel further price gains: Ethereum

whales have been accumulating aggressively since late November.

This signals growing confidence among major holders, who are

positioning themselves for potential upside. Historically, whale

accumulation has often preceded significant price moves, hinting at

the possibility of a breakout in the near term. While the market

remains divided on Ethereum’s trajectory, its ability to sustain

upward momentum near the $4,000 mark will likely define its

performance in the weeks ahead. Breaking above this critical

resistance could open the door to new highs and further solidify

ETH’s role as a leader in the ongoing bull cycle. Ethereum

Mega-Whale Balances Grow Ethereum has experienced a steady, albeit

modest, rally since November 5, but it seems the real fireworks for

ETH are yet to ignite. As Bitcoin soars into price discovery and

several altcoins outperform expectations, Ethereum investors are

searching for clear signals of an impending bull run for the

second-largest cryptocurrency. Key on-chain data shared by top

analyst Ali Martinez on X provides intriguing insights into

Ethereum’s current state. Martinez highlights that Ethereum

whales—entities holding significant amounts of ETH—have been

accumulating aggressively since the price broke above the $3,330

level. This accumulation trend suggests that smart money is

positioning itself for what could be a massive upward move in the

months ahead. Historically, whale accumulation has often been a

precursor to strong price rallies, as these large investors tend to

anticipate major market shifts before retail traders. However, the

narrative isn’t entirely bullish. While whale accumulation may

signal confidence, it also raises concerns about a potential bull

trap. These large holders could quickly pivot, offloading their ETH

for other assets if market conditions shift or if Bitcoin’s

dominance suppresses altcoin growth. Such a move could catch

smaller investors off guard, leading to sharp corrections. Related

Reading: AAVE Dominates DeFi Lending – Metrics Reveal 45% Market

Share For Ethereum, holding above critical levels like $3,800 while

breaking key resistances could be the catalyst needed to spark a

true bull run. Until then, ETH remains a watchlist favorite,

balancing potential and uncertainty. Price Testing Crucial

Resistance Ethereum (ETH) is trading at $3,950, struggling to break

above the crucial $4,000 resistance level for several days. Despite

this, the price remains resilient, signaling strong market support.

Clearing this level is essential to confirm the continuation of the

uptrend, as $4,000 represents a psychological barrier and a key

resistance zone for the asset. If Ethereum fails to breach the

$4,000 mark, a retrace toward lower demand zones around $3,500

could be expected. This level has served as strong support in

recent weeks, providing a cushion during periods of increased

selling pressure. A pullback to this area could allow for renewed

buying momentum, setting the stage for another attempt to break

higher. Related Reading: Dogecoin Will See New ATH Soon – Top

Trader Sets $2 Target However, recent market dynamics suggest

Ethereum may be poised for a significant move upward. Bitcoin’s

surge into price discovery and growing optimism around altcoins

have created a bullish environment. With whales continuing to

accumulate ETH, as highlighted by on-chain data, market

participants are increasingly confident in Ethereum’s ability to

retest and surpass its all-time highs. Featured image from Dall-E,

chart from TradingView

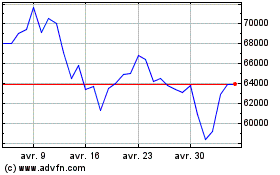

Bitcoin (COIN:BTCUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Bitcoin (COIN:BTCUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024