Bearish Signal? DCG Starts Selling Grayscale Crypto Shares At Almost 50% Discount

08 Février 2023 - 7:00PM

NEWSBTC

The issues at Digital Currency Group (DCG) seem to be coming to a

head as the company has now begun offloading its Grayscale crypto

shares. This move is one that was under speculation for a long time

in the crypto community, as well as what kind of impact such a move

could have on the market. DCG Selling Grayscale Shares For Large

Discount Following Genesis Trading’s filing for bankruptcy last

month, it was brought to light that the platform owed significant

amounts of money to creditors. One of those creditors is the Gemini

crypto exchange whose Earn customers are reportedly owed around

$900 million. This obviously triggered liquidity issues for DCG,

its parent company, which is now selling off Grayscale shares in an

effort to keep afloat. Related Reading: Here’s What Could Stop The

Altcoin Bull Rally Dead In Its Tracks On Tuesday, Financial Times

reported that DCG had filed a document with the US Securities and

Exchange Commission which showed that the company was selling a

significant portion of its holdings in Grayscale, another company

that operates under the DCG umbrella. According to the filing, DCG

has now sold about a quarter of its holdings in the Grayscale

Ethereum fund (ETHE). The company also sold off shares from various

Grayscale crypto funds. These include the Litecoin fund, and the

Ethereum Classic Fund, among others. Interestingly, the company

reportedly sold the shares for around 50% of what they are actually

worth. The ETH fund shares were sold for approximately $8 each when

their value compared to Ether is actually over $16. DCG CEO

Barry Silbert defended the sale of the shares saying that they were

“simply part of our ongoing portfolio rebalancing.” The sale is the

company’s first sale in over a year since it last sold some of its

Ether fund shares back in 2021. ETHE share price at $7.64 | Source:

Grayscale Ethereum Trust on TradingView.com Will DCG’s Dump Affect

The Crypto Market? So far, DCG’s sale of its Grayscale shares has

not had any impact on the movement of the broader crypto market.

This could be because the company seems to be avoiding selling off

any of its Grayscale Bitcoin Trust (GBTC) shares. The GBTC is the

largest Bitcoin trust in the world and with over $14 billion under

management, the trust accounts for around 3% of the total BTC

supply. As of January 2023, DCG reportedly holds around 67 million

GBTC shares, a number that could definitely have an impact on the

market if the company were to dump them. However, DCG is still

holding on to its shares, which is good news for the asset, at

least for now. Related Reading: Will Bitcoin Price Return To

$20,000? Here’s What Investors Expect Nevertheless, both the GBTC

and the ETHE are still trading at significant discounts to net

asset value (NAV). This is because investors are unable to redeem

the shares they hold for the digital assets held in the trust.

Grayscale is currently locked in a legal battle with the SEC to

turn the trust into a spot bitcoin ETF, which it believes would

help close the massive discount. As of the time of writing, the

GBTC is trading at a 42.53% discount to NAV, while the ETHE is

trading at a 51.11% discount to NAV. ETHE discount to nav remains

above 50% | Source: YCharts Follow Best Owie on Twitter for market

insights, updates, and the occasional funny tweet… Featured image

from Forbes, chart from TradingView.com

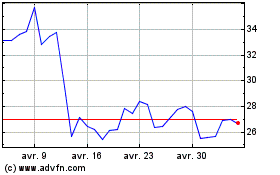

Ethereum Classic (COIN:ETCUSD)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ethereum Classic (COIN:ETCUSD)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024