Fiat – Not Crypto – Still The Top Choice For Financial Crimes, US Treasury Says

21 Mars 2022 - 4:29AM

NEWSBTC

Fiat, a government-issued currency, is still the best choice of

financial criminals. Concerns have always centered on the

possibility of crypto assets being used for nefarious reasons,

however the US Treasury department just released something that

dispels these anxieties. Despite widespread fears that

cryptocurrency could be used for criminal purposes, a newly

published report by the US Treasury indicates that the bulk of

financial crimes are still committed using fiat money. The US

Treasury presented a three-year report on money laundering,

proliferation financing, and terrorist financing early this month.

And they were all based on digital assets. And crypto detractors

may believe this is all about digital assets being widely

employed in these sectors. Related Story | Shiba Inu Exodus:

32,000 Holders Lose Interest In The ‘Dogecoin Killer’ It’s Fiat,

Not Crypto Nevertheless, fiat currencies and traditional money are

still more often utilized in this circumstance, thus they are more

likely to come into play. The Treasury’s findings include a

detailed discussion of virtual currencies, stating that both their

user base and market capitalization have expanded dramatically

since the previous risk assessment in 2020. However, these reports

found that criminal flows via fiat currency and established

networks continue to outnumber those involving cryptocurrency.

Crypto total market cap at $1.805 trillion on the daily chart |

Source: TradingView.com The US Treasury disclosed the following:

“The use of crypto assets for money laundering continues to be

significantly less prevalent than the use of fiat cash and other

more traditional means.” Crypto Still A Good Choice For Crime

According to the National Money Laundering Risk Assessment,

“virtual assets” are an ever-evolving domain within money

launderers’ expanding armory for concealing their finances. It

singled out DeFi and “anonymity augmenting technology” as possible

perpetrators. Throughout the pandemic, virtual assets have

apparently been used extensively in phishing assaults and

ransomware scams. Related Article | Bitcoin Breaks Past The $40,000

Barrier Again – Can It Sustain The Momentum? Shady operators may

use pledges of profit from the unpredictable cryptocurrency market

to entice victims into disclosing personal information or infecting

their devices with viruses. The attackers may then demand payment

in crypto following the attack, which is both pseudonymous and

irreversible. In a recent Chainalysis Crypto Crime Report, many

criminals use over-the-counter brokers to launder their

cryptocurrencies. OTC brokers are individuals or businesses that

assist transactions between buyers and sellers who do not wish to

(or are unable to) conduct business on a cryptocurrency exchange. A

Staggering Amount Meanwhile, a United Nations report says that

money laundering costs the global economy between $800 billion and

$2 trillion per year. This equates to between 2% and 5% of gross

domestic output. Today, almost 90% of money laundering remains

undetected. However, technological advancements have led in the

development of more effective tools. Criminals continue to use

these advancements to move dirty money. Simultaneously, government

agencies and fintech firms utilize technology to identify

transaction characteristics and assist in exposing fraud. Featured

image from India Today, chart from TradingView.com

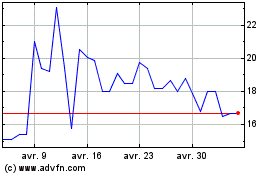

NEO (COIN:NEOUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

NEO (COIN:NEOUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024

Real-Time news about NEO (Cryptomonnaies): 0 recent articles

Plus d'articles sur NEO