This Bitcoin Indicator Has Hit Levels That Often Lead To Corrections

08 Mars 2024 - 2:00AM

NEWSBTC

On-chain data shows a Bitcoin metric has recently hit levels that

have historically led to corrections in the cryptocurrency’s price.

Bitcoin Is Currently 40% Above The Cost Basis Of Short-Term Holders

CryptoQuant Netherlands community manager Maartunn explained in a

post on X that the BTC price is currently 40% above the cost basis

of the short-term holders. The indicator of interest here is the

“Market Value to Realized Value (MVRV) ratio,” which is an

indicator that keeps track of the ratio between the Bitcoin market

cap and the realized cap. The “realized cap” refers to a

capitalization model for the asset that assumes that the real value

of any coin in circulation isn’t equal to the current spot price

but rather the price when it was last transacted on the blockchain.

Related Reading: Dogecoin Accumulation: DOGE Millionaires Have Shot

Up By 76% The previous transfer of any coin was likely the last

point at which it changed hands, so the price at that time would

act as its current cost basis. As such, the realized cap is

essentially the sum of the cost basis of the entire supply.

Therefore, the metric’s value can measure the total capital the

holders have put into the asset. And since the market cap is the

value they are currently carrying, its comparison against the

realized cap in the MVRV ratio can tell us about the amount of

profits or losses the investors hold. In the current discussion,

the MVRV ratio of the entire market isn’t of interest but rather of

a particular segment of it: the “short-term holders” (STHs). The

STH cohort includes all investors who bought their coins within the

past 155 days. The below chart shows the trend in the Bitcoin MVRV

ratio specifically for these investors over the history of the

cryptocurrency: Looks like the value of the metric has been rising

in recent days | Source: @JA_Maartun on X As displayed in the above

graph, the Bitcoin STH MVRV has been greater than 1 for a while now

as the STHs have been carrying net profits, but with the latest

rally in the asset, the indicator has shot up to especially high

levels. The BTC spot price has recently been 40% over this cohort’s

average cost basis. The chart shows that this same level has led to

asset corrections a few times in the past. Related Reading: Bitcoin

Short-Term Holders Panic Capitulate $2.6 Billion In BTC Crash

Naturally, this doesn’t mean that the coin would necessarily see a

correction here, but given the historical pattern, there is a

chance one would occur. The likely reason behind this pattern is

that Bitcoin investors are more likely to give in to the allure of

profit-taking the larger their profits grow. BTC Price Bitcoin has

gone through some significant volatility since setting its brand

new all-time high above the $69,000 level, with its price now

trading around $67,700. BTC has seen a rollercoaster over the past

few days | Source: BTCUSD on TradingView Featured image from André

François McKenzie on Unsplash.com, CryptoQuant.com, chart from

TradingView.com

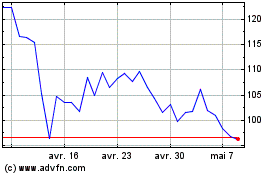

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024