Political Turmoil In South Korea Impacts Bitcoin Prices As Market Eyes Trump’s Policies

04 Décembre 2024 - 7:00AM

NEWSBTC

Despite a notable pause in its upward trend, Bitcoin (BTC) is

approaching the landmark $100,000 mark, fueled by expectations of

supportive policies for the sector from US President-elect Donald

Trump. On Tuesday, the largest digital asset traded above the key

$95,000 mark, acting as support for the past 24 hours. This

reflects a remarkable surge of over 40% since Trump’s election

victory on November 5. Could A National BTC Reserve Become

Reality? Trump’s administration is expected to reverse the

Biden administration’s stringent regulations on digital assets,

which could significantly alter the landscape for cryptocurrencies

in the US. The Republican party is already positioning

crypto-friendly candidates to lead key regulatory bodies, including

the Securities and Exchange Commission (SEC) and the Commodity

Futures Trading Commission (CFTC). Related Reading: XRP Q3

Overview: Key Metrics Suggest A Bright Future For The Third Biggest

Crypto Additionally, discussions within Trump’s transition team

have included the potential creation of a dedicated White House

position focused on digital-asset policy. President-elect Trump has

voiced ambitions to establish the US as the global hub for

cryptocurrency, even proposing the concept of a national Bitcoin

reserve. However, analysts express skepticism about the

practicality of this idea. Jaret Seiberg from TD Cowen noted

that while Trump may advocate for a Bitcoin reserve in public

forums, it would require significant political capital to

implement, especially given his firm stance on maintaining the US

dollar’s status as the world’s primary currency. Crypto advocate

Paul Atkins is considered a strong candidate to replace outgoing

SEC chairman Gary Gensler. The current chair officially announced

his resignation last week, effective January 20, the day of Trump’s

inauguration. Gensler has played a key role in enforcing compliance

in the digital asset space, especially after a tumultuous 2022 that

saw a significant market downturn and significant financial losses

for investors following the implosion of the once Sam Bankman-led

FTX exchange. Political Instability In South Korea Drives Bitcoin

Prices Below $72,000 Bitcoin and other cryptocurrencies, such as

XRP and Dogecoin (DOGE), have experienced notable price

discrepancies in South Korea due to local political

instability. Following the imposition and subsequent

rescinding of martial law by President Yoon Suk Yeol, Bitcoin’s

price on South Korean exchanges dipped below $72,000 at one point,

reflecting heightened risk aversion among investors. Related

Reading: CryptoQuant CEO Warns Not To Short XRP Due To Insider

Whale Activity However, the overall cryptocurrency market has seen

a staggering increase since Trump was declared president-elect,

with total market capitalization rising by approximately $1.3

trillion, according to data from CoinGecko. At the time of

writing, BTC is trading at $95,840, posting slight losses of 0.2%,

but halting the upward trend seen over the past few months. Over

the past 8 hours, attention has shifted to altcoins such as BNB,

which hit a new record high, and XRP, which is trading just 20%

below its all-time high. Featured image from DALL-E, chart

from TradingView.com

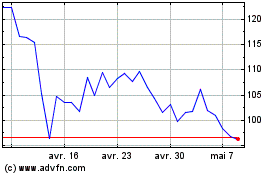

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024