Arcadis Fourth Quarter and Full Year Results 2021

Arcadis reports healthy growth, margin improvement and

strong cash flow

- Growing demand in key areas such as smart mobility, energy

transition and climate adaptation

- Accelerating the transition to a Net Zero world

- Continued progress in implementing our strategy of focus and

scale, creating profitable growth

- Further improved margins, record backlog and a sustained

pipeline of opportunities provide confidence to deliver on

strategic targets

Fourth quarter results:

- Organic net revenue growth of 4.0% to €652 million, 5.3%

excluding Middle East

- Operating EBITA margin of 10.7%

- Strong free cash flow of €129 million

Full year results:

- Organic net revenue growth of 3.5% to €2.6 billion (gross

revenues of €3.4 billion), 4.2% excluding Middle East

- Operating EBITA margin improved to 9.6%

- Excellent free cash flow of €234 million, leading to net debt

of €168 million

- Further improvement of Net Working Capital to 10.7% and DSO

reduced to 63 days

- Dividend proposal of €0.70 per share, special dividend of

€0.60

- Organic backlog growth year-over-year of 5.1%, record backlog

of €2.2 billion

Amsterdam, 17 February

2022 – Arcadis (EURONEXT: ARCAD),

the leading global Design & Consultancy organization for

natural and built assets,

reports organic net

revenue growth for the full year 2021

of 3.5%,

respectively 4.2% excluding

the Middle East, with an improved

operating EBITA margin of 9.6% and

a further strengthened

balance sheet.

Sustained good order intake is resulting in organic

backlog growth of 5.1% year-over-year. Arcadis

proposes a regular dividend

of

€0.70

per share, and

in addition, a

special dividend of

€0.60

per share.

CEO STATEMENTPeter Oosterveer, CEO comments: “I

am delighted to report that 2021 has beena strong and prosperous

year for Arcadis. The company is in an excellent position,

withhealthy organic growth, further improved margins and a solid

balance sheet that will allow us to further invest into 2022. The

past year has not been without challenges. The continued impact of

the COVID-19 pandemic and the emergence of new variants is causing

concern, while the effects of extreme weather events in Europe,

North America and Asia in the summer showed just how fragile our

world has become. As a business that is passionate about improving

quality of life, it is amazing to experience how our people have

responded to these challenges.

Great efforts have gone into the design and planning of our new

operating model, in standardizing our processes and the launch of

our three Global Business Areas (GBA’s) Resilience, Places and

Mobility. The move to this global structure, effective as of

January 1st, 2022, marks an exciting new chapter in how we work at

Arcadis. It will enable us to bring the best of our collective

expertise from all around the world and benefit our clients across

the globe.

Tackling climate change remains the greatest challenge of our

generation and we all need to play our part. At Arcadis, we do see

this as both a commercial opportunity, and a moral obligation, to

develop smarter and greener solutions for our clients. I want

Arcadis to be the leader in our sector; challenging norms,

embracing innovation, collaborating with the best and pushing

boundaries to solve this challenge.

The strong improvement in our results, including an excellent

cash generation over the last couple of years have created our

solid financial position. This will allow us the opportunity to

continue with our investments in people, in sustainable solutions,

and digital capabilities. Additionally, we will embrace

opportunities for bolt-on and medium sized acquisitions to enable

us to increase the return to shareholders. In addition to the

regular dividend of €0.70 per share, we propose a special dividend

of €0.60 per share, both offered in cash, underscoring our

disciplined management of our balance sheet.

With our new organizational structure now in place and

benefitting from a sustained pipeline of opportunities with clients

in both the public and private sector, I am confident in our

ability to deliver on our strategic targets”.

| in €

millions |

FULL YEAR |

|

FOURTH QUARTER |

|

Period ended December 31 |

2021 |

2020 |

change |

|

2021 |

2020 |

change |

|

Gross revenues |

3,378 |

3,303 |

2% |

|

890 |

820 |

9% |

|

Organic growth |

3.3% |

-3.3% |

|

|

4.7% |

-7.0% |

|

|

Net revenues |

2,565 |

2,494 |

3% |

|

652 |

603 |

8% |

|

Organic growth |

3.5% |

-1.5% |

|

|

4.0% |

-3.3% |

|

|

EBITDA1) |

338 |

337 |

0% |

|

91 |

91 |

0% |

|

EBITDA margin |

13.2% |

13.5% |

|

13.9% |

15.1% |

|

|

EBITA1) |

237 |

221 |

8% |

|

66 |

65 |

1% |

|

EBITA margin |

9.3% |

8.9% |

|

|

10.1% |

10.8% |

|

|

Operating EBITA1,2) |

246 |

226 |

9% |

|

70 |

63 |

11% |

|

Operating EBITA margin |

9.6% |

9.1% |

|

|

10.7% |

10.4% |

|

|

Net Income1) |

168 |

19 |

790% |

|

|

|

|

|

Net Income from Operations (NIfO)1) |

175 |

130 |

35% |

|

|

|

|

|

NIfO per share (in €) |

1.96 |

1.46 |

36% |

|

|

|

|

|

Dividend (proposal) per share |

0.70 |

0.60 |

17% |

|

|

|

|

|

Avg. number of shares (millions) |

89.4 |

89.6 |

0% |

|

|

|

|

|

Net Working Capital % |

10.7% |

12.6% |

|

|

|

|

|

|

Days sales outstanding |

63 |

66 |

-5% |

|

|

|

|

|

Free Cash Flow3) |

234 |

324 |

-28% |

|

129 |

124 |

4% |

|

Net Debt |

168 |

330 |

|

|

|

|

|

|

Net Cash (excl. IFRS 16) |

87 |

-48 |

|

|

|

|

|

|

Backlog net revenues (billions) |

2.2 |

2.0 |

|

|

|

|

|

|

Backlog organic growth (YTD) |

5.1% |

5.1% |

|

|

|

|

|

|

Voluntary employee turnover |

14.9% |

8.7% |

|

|

|

|

|

1) Figures restated in accordance with IAS8, for comparability

purposes2) Excluding restructuring, acquisition & divestment

costs

REVIEW BY SEGMENT Americas(34% of net revenues)

| in €

millions |

YEAR-TO-DATE |

|

FOURTH QUARTER |

|

Period ended December 31 |

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Gross revenues |

1,372 |

1,370 |

0% |

|

364 |

335 |

9% |

|

Net revenues |

884 |

876 |

1% |

|

229 |

205 |

12% |

|

Organic growth |

5.2% |

|

|

|

8.1% |

|

|

|

EBITA |

96 |

106 |

-9% |

|

|

|

|

|

Operating EBITA1) |

97 |

102 |

-5% |

|

|

|

|

|

Operating EBITA margin |

11.0% |

11.7% |

|

|

|

|

|

1) Excluding acquisition, restructuring and integration-related

costs

Strong market conditions across the private sector are offering

significant client opportunities in multiple segments, despite some

delayed economic recovery in manufacturing associated with supply

chain challenges. The equally opportunity rich federal market is

providing significant bidding opportunities, new project awards,

and expanded funding on existing contracts. Capitalizing on strong

economic conditions while managing the ever-changing restrictions

from the COVID-19 pandemic, North America delivered year-over-year

organic growth in all business lines.

In Q4, Arcadis announced that it will support the US Army Corps

of Engineers with environmental remediation services to enable safe

water and land use, in addition we will continue to support New

York’s Economic Development Corporation with the masterplan to

transform Lower Manhattan’s waterfront. The transformative project

has prioritized natural and nature-based features to manage

stormwater, local energy generation and sustainable material usage

throughout the design.

In Latin America, net organic growth was excellent led by large

infrastructure projects and environmental assignments in

Brazil.

The operating EBITA margin for the segment was good at 11.0%,

albeit slightly lower than in 2020, which included some cost

benefits caused by the pandemic, which didn’t materialize in

2021.

Europe & Middle East (47% of net revenues)

| in €

millions |

YEAR-TO-DATE |

|

FOURTH QUARTER |

|

Period ended December 31 |

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Gross revenues |

1,448 |

1,339 |

8% |

|

381 |

346 |

10% |

|

Net revenues |

1,201 |

1,119 |

7% |

|

301 |

282 |

7% |

|

Organic growth |

5.6% |

|

|

|

2.7% |

|

|

|

EBITA |

117 |

83 |

42% |

|

|

|

|

|

Operating EBITA1) |

121 |

88 |

38% |

|

|

|

|

|

Operating EBITA margin |

10.1% |

7.9% |

|

|

|

|

|

1) Excluding acquisition, restructuring and integration-related

costs

Strong public investment continued throughout Europe and the UK

enabled by government supported recovery programs. Sustainable

infrastructure development, cleaner and greener mobility solutions,

and further investment in energy transition -partly driven by the

recommendations from UN COP26 summit and national governments net

zero targets- are key growth areas for the business.

Organic net revenue growth in EME was driven by significant

growth in the UK and several countries in Continental Europe,

compensating for a planned decline in the Middle East as a result

of our decision to reduce our footprint in this region.

In Q4, Arcadis helped to launch the largest integrated transport

program in the UK to date. This ‘Mobility as a Service’ project in

the Scottish Highlands and Islands will help to rebalance how

people travel, by increasing access to integrated transport

options, ultimately helping to reduce the number of vehicles on the

road, cut congestion and limit harmful emissions.

In December, Arcadis, in collaboration with partners, was

awarded five framework contracts for policy consultancy and

engineering services to support the Dutch Ministry of

Infrastructure and Water Management to help adapt and plan for

changing climatic conditions in the Netherlands.

The operating EBITA margin for the segment improved to 10.1%

(2020: 7.9%), due to excellent performance in the UK and the

Netherlands, and further improvements in Belgium, while France and

Germany delivered consistent and steady performance.

Asia Pacific (13% of net revenues)

| in €

millions |

YEAR-TO-DATE |

|

FOURTH QUARTER |

|

Period ended December 31 |

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Gross revenues |

362 |

358 |

1% |

|

93 |

88 |

6% |

|

Net revenues |

334 |

323 |

3% |

|

87 |

79 |

10% |

|

Organic growth |

2.0% |

|

|

|

7.0% |

|

|

|

EBITA |

26 |

33 |

-20% |

|

|

|

|

|

Operating EBITA1) |

27 |

34 |

-21% |

|

|

|

|

|

Operating EBITA margin |

8.0% |

10.5% |

|

|

|

|

|

1) Excluding acquisition, restructuring and integration-related

costs

China experienced good growth in cost and

commercial management as well as program management for technology

clients who are expanding in logistics hubs and data centers.

Additionally, we are utilizing our global capabilities to grow our

presence in the Chinese environmental and water markets. The rest

of Asia continued to be impacted by COVID-19, with prolonged

lockdowns resulting in reduced activity and lower margins on

projects.

In Australia, infrastructure demand was high

driven by government stimulus programs and demand for logistics and

data center infrastructure. The growing need for renewable energy

transition solutions s offers significant opportunity to further

grow Arcadis’ footprint in the region. The fourth quarter created

good order intake, allowing the business to start the year with a

strong and replenished backlog.

Revenues increased in China, Hong Kong and Australia. The

operating EBITA margin for the segment decreased to 8.0% due to the

prolonged impact of COVID-19 in the rest of Asia.

CallisonRTKL (6% of net revenues)

| in €

millions |

YEAR-TO-DATE |

|

FOURTH QUARTER |

|

Period ended December 31 |

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Gross revenues |

196 |

236 |

-17% |

|

52 |

51 |

2% |

|

Net revenues |

146 |

176 |

-17% |

|

36 |

38 |

-5% |

|

Organic growth |

-15.2% |

|

|

|

-14.6% |

|

|

|

EBITA |

-2 |

0 |

n/a |

|

|

|

|

|

Operating EBITA) |

1 |

1 |

-12% |

|

|

|

|

|

Operating EBITA margin |

0.8% |

0.8% |

|

|

|

|

|

1) Excluding acquisition, restructuring and integration-related

costs

The significant impact of COVID-19 on the global economy,

especially the design space, continued to affect CallisonRTKL. The

focus in the year has therefore been on business turnaround,

foundational repositioning, and creating deeper alignment with the

existing MEPC+ and Risk Management programs. CallisonRTKL

implemented a more rigorous project review process and focused on

reducing indirect costs, including restructuring in the U.S. and

Asia and a reduction of the real estate footprint. The total amount

of the turnaround and restructuring cost in 2021 was approximately

€10 million.

Going forward, CallisonRTKL and the Places

Global Business Area will focus on areas for collaboration and

synergy, and to deliver better solutions for our clients. As of

2022, CallisonRTKL will be reported as part of the Places Global

Business Area.

REVIEW OF PERFORMANCE 2021Net revenues totaled €2,565 million

and increased organically by 3.5%, with a currency impact of -1%.

Revenues increased in all segments, partly offset by COVID-19

related decline in CallisonRTKL and the Middle East, driven by our

decision to further reduce our footprint in that region. Excluding

the Middle East, the organic revenue growth was 4.2%

Operating EBITA increased by 9% to €246 million (2020: €226

million) and the operating EBITA margin increased to 9.6% (2020:

9.1%). This increase was mainly driven by a

improvement in EME.

Non-operating costs were €9 million (2020: €5 million); mostly

relating to restructuring at Middle East and CallisonRTKL.

The underlying income tax rate was 25.1% (2020: 33.2%) and was

impacted by, amongst other things, non-deductible expenses, updates

to tax positions from previous years, and unrecognized losses.

Net finance expenses decreased to €19 million (2020: €27

million). The interest expense on loans and borrowings of €11

million (2020: €18 million) reduced due to lower average gross debt

and lower interest rates.

Income from associates increased to €11 million (2020: €1

million) due to a favorable outcome of a commercial

arbitration.

Net income from operations increased by 35% to €175 million

(2020: €130 million) or €1.96 per share (2020: €1.46).

REVIEW OF PERFORMANCE FOR THE FOURTH QUARTERNet revenues were

€652 million, with an organic growth of 4.0%, with a foreign

exchange impact of -4.1%, mainly related to the weakening of the

U.S. Dollar.

Operating EBITA was €70 million (Q4 2020: €63 million). The

operating EBITA margin of 10.7% increased (Q4 2020: 10.4%) mainly

due to improved performance in EME.

CASH FLOW, WORKING CAPITAL AND BALANCE SHEETFree cash flow in

the fourth quarter was €129 million, leading to a full year free

cash flow of €234 million (2020: €324 million). In 2020, the full

year free cash flow was exceptionally strong due to the cash

program undertaken and a significant improvement in the invoicing

process in the U.S. following the Oracle implementation.

Net working capital as a percentage of annualized gross

revenues further improved to 10.7% (2020: 12.6%) and Days

Sales Outstanding improved to 63 days (2020: 66

days), both well within the strategic targets set for 2023.

The balance sheet was further strengthened resulting in a net

debt position of €168 million (2020: €330 million), mainly due to

an excellent cash collection. The net debt / EBITDA ratio further

improved to 0.8x (2020: 1.3x). Excluding lease liabilities (IFRS

16) the net cash position was €87 million (2020: net debt of €48

million).

BACKLOGOrder intake in the year was €2.7

billion leading to a book-to-bill of 1.04.

The book-to-bill ratio was greater than 1 in all regions,

except for the Middle East, driven by our decision to reduce

our footprint, and for CallisonRTKL. Exceptionally strong was

the order intake in Australia due to some significant project

wins. Organic backlog increased by 5.1% to a record

amount of €2.2 billion. There were no material project

cancellations in the quarter.

DIVIDEND PROPOSALThe Board will propose a dividend of €0.70 per

share (2020: €0.60) to the Shareholders, a 17% increase year on

year. On top of the regular dividend, the Board will also propose a

special cash dividend of €0.60 per share. Both the regular dividend

as well as the special dividend will be paid in cash.

NEW GLOBAL STRUCTURE TO BETTER SERVE THE NEEDS OF CLIENTSAs

announced on February 10, 2022, Arcadis has changed its operating

structure to reflect the changing needs of the market and clients.

This is in line with the 2021 - 2023 business strategy to provide

focus, global scale and strengthen the business’ sustainable and

digital offering to clients. As announced during the Capital

Markets Day in November 2020, Arcadis has now transitioned from a

country-led operating model, to collaborate across borders in three

new global business areas.

The changes, which were effective from January 1, 2022, see the

creation of three new business areas – Resilience, Places and

Mobility. Each business area consists of globally diverse

organizations that collaborate to bring focus and the very best of

Arcadis’ collective expertise from around the world to help serve

the changing needs of clients, regardless of where they are

located.

The Company’s reporting of its first quarter 2022 results will

reflect these three new reportable segments. To assist in the

analysis and understanding of the new reportable segment structure,

Arcadis has restated the four quarters and full year of 2021 for

the new reportable operating segments and this information is

included in the appendix of this release. These changes have no

impact on the Company’s previously reported consolidated balance

sheet, statement of income, or cash flows.

CHANGES TO THE SUPERVISORY BOARDArcadis today announces that

Michiel Lap will succeed Niek Hoek as Chair of its Supervisory

Board per the annual General Meeting of 12 May 2022. Mr. Hoek will

complete his third term as a member of the Supervisory Board of

Arcadis, which term runs until the annual General Meeting of

2023.

If re-appointed by the shareholders of Arcadis on 12 May 2022,

Michael Putnam, member of the Supervisory Board is appointed to

succeed Mr. Lap as Vice-Chair of the Board. Deanna Goodwin, member

of the Supervisory Board is appointed to succeed Mr. Lap as Chair

of the Audit and Risk Committee

CHANGE IN ACCOUNTING POLICYNew guidance has recently been issued

by the IASB relating to the treatment of configuration and

customization costs in cloud computing arrangements. Arcadis

assessed in the second half of 2021 its treatment of configuration

and customization costs in cloud computing arrangements, such as

Oracle Cloud implemented as part of the Arcadis Way. It concluded

on a change in the accounting treatment, resulting in the

configuration and customization costs of cloud computing

arrangements be expensed as incurred. This leads to an increase in

the personnel costs and consultancy costs and a reversal of the

depreciation and amortization costs. The retrospective application

of the change in accounting treatment resulted in restatements in

accordance with IAS8.

As a result of the restatements, the operating income in 2020

decreased by €3.3 million and the basic earnings per share for the

2020 financial year decreased from €0.24 (reported) to €0.21

(restated).

FINANCIAL CALENDAR 2022

| 4 May 2022 |

Trading update

Q1 |

| 12 May 2022 |

Annual General

Meeting of Shareholders |

| 28 July 2022 |

First half year

results |

| 27 October

2022 |

Trading update

Q3 |

FOR FURTHER INFORMATION PLEASE CONTACT:

ARCADIS INVESTOR RELATIONSChristine DischMobile: +31 6

15376020E-mail: christine.disch@arcadis.com

ARCADIS CORPORATE COMMUNICATIONS

Chris Wiggan Mobile: +44 7881 845741E-mail:

chris.wiggan@arcadis.com

ABOUT ARCADISArcadis is the leading global

design & consultancy organization for natural and built assets.

We maximize impact for our clients and the communities they serve

by providing effective solutions through sustainable outcomes,

focus and scale, and digitalization. We are 29,000 people, active

in more than 70 countries that generate €3.4 billion in revenues.

We support UN-Habitat with knowledge and expertise to improve the

quality of life in rapidly growing cities around the world.

www.arcadis.com

- Arcadis Q4 and FY 2021 results press release

- Arcadis Q4 and FY 2021 results presentation

- Arcadis Q4 and FY 2021 financial tables

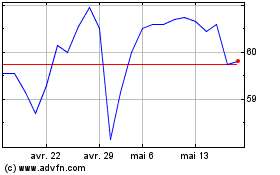

Arcadis NV (EU:ARCAD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Arcadis NV (EU:ARCAD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025