Press Release Biocartis Group NV: Agreement regarding

recapitalization of operating subsidiaries by secured by secured

creditors and wind down of listed holding company

PRESS RELEASE:INSIDE INFORMATION / REGULATED INFORMATION

26 September 2023, 07:00 CEST

AGREEMENT REGARDING RECAPITALIZATION OF

OPERATING SUBSIDIARIES BY SECURED CREDITORS AND WIND DOWN OF LISTED

HOLDING COMPANY

- The Company’s Secured Creditors (being its First Lien Creditors

and Bondholders, as defined below) will take ownership of the

Biocartis operating subsidiaries through enforcement and inject EUR

40 million of new equity capital to fund the business to EBITDA

break-even by the end of 2024

- Under the ownership of the Secured Creditors, the business will

have a right-sized balance sheet with EUR 132 million of

deleveraging from today

- Transaction should be completed by end of 2023 and is not

expected to impact Biocartis's customers, suppliers, partners or

employees

- Shareholders of

Biocartis Group NV will receive no distribution from the security

enforcement and are expected to receive nothing at the time of its

wind down

- Unsecured 4.00% convertible bonds

due 2027 will be written down to zero pursuant to their terms as

part of the enforcement

Mechelen, Belgium, 26 September

2023 – Biocartis Group NV (the “Company”

or “Biocartis”), an innovative molecular

diagnostics company (Euronext Brussels: BCART), announces it has

been informed of an agreement by its Secured Creditors on a

recapitalization of its operating subsidiaries and comprehensive

balance sheet restructuring transaction (the

“Transaction”) that will materially de-lever the

operating business by reducing its debt burden by EUR 132 million

and recapitalizing it with EUR 40 million of new equity capital

under the ownership of the Secured Creditors. This new capital is

expected to fund the business through EBITDA break-even by the end

of 2024 and ensure business continuity of the operating Biocartis

companies, safeguard the interests of customers, suppliers,

partners, and employees of Biocartis, and support execution of the

growth strategy towards profitability. As a result of the

Transaction, there will be a change in ownership through

enforcement of security by the Secured Creditors of substantially

all of the assets of Biocartis to New Biocartis (as defined below);

customers, suppliers, partners, and employees are not expected to

see any impact as a result of this ownership change.

Biocartis's

CEO, Roger Moody, stated: “This announced

recapitalization and balance sheet restructuring plan follows an

extensive process by the Board and Management to address

Biocartis’s leverage and liquidity position. Following that

process, it became evident that the difficult market conditions

combined with the Company’s balance sheet and historic burn rate

made outside funding unattainable. While disappointing to

shareholders and unsecured bondholders, this Transaction is

necessary, and the EUR 40 million of new equity capital to the

operating businesses, combined with the material deleveraging is

expected to provide the Biocartis business with funding to

operational break-even. The core business performance remains

strong, with 22% growth of oncology cartridge revenue, a 40% gross

margin on product sales and a 20% improvement in EBITDA to EUR

-14.5 million in H1 2023. I am convinced that, under the new,

recapitalized holding company and in combination with the

operational reorganization that is now being completed, the

surviving business under new ownership will be able to continue our

path to a financially healthy and sustainable business. The

restructuring and recapitalization allows the Biocartis business to

continue its mission to enable universal access to personalized

medicine for patients around the world by making molecular testing

convenient, fast, and suitable for any lab.”

Main features of the

Transaction: The Transaction will provide for the

following:

- The Company’s

EUR 116 million 4.5% Second Ranking Secured Convertible Bonds due

2026 (ISIN BE6338582206) (the “Bonds”, and the

holders of the Bonds, the “Bondholders”) will be

fully equitized into New Biocartis (as defined below) and the

Bondholders will become the primary owners of Biocartis’s operating

business through their shareholding in New Biocartis. A new entity

will be incorporated (“New Biocartis”), owned by

the Secured Creditors, to which substantially all the Company’s

assets will be transferred upon an anticipated security enforcement

by the Secured Creditors over the Company’s assets that were

pledged to such creditors.

- The Bondholders

will recapitalize New Biocartis (and its operating subsidiaries)

with EUR 40 million of equity capital, backstopped by a group of

supporting Bondholders (the “Equity

Injection”).

- Lenders under

the Company’s first lien convertible term loan facility (the

“First Lien Creditors”) have agreed to roll over

their first lien debt into New Biocartis (or its wholly owned

subsidiaries) and release claims against Biocartis Group NV. KBC

have agreed to extend their financing to Biocartis NV and Biocartis

US Inc.

- Shareholders of

Biocartis Group NV will receive no distribution from the security

enforcement and are expected to receive nothing at the time of its

wind down.

- The interests

and claims of the EUR 16 million unsecured 4.00% convertible bonds

due 2027 (ISIN BE0002651322) (the "Unsecured 2027

Bonds") will be written down to zero pursuant to their

terms as part of the enforcement.

- Following the

full equitization of EUR 116 million of Bonds, the write down of

EUR 16 million of Unsecured 2027 Bonds, and the closing of the

Equity Injection, New Biocartis will have less than EUR 45 million

of gross debt and net debt of approximately zero, allowing it to

continue the operations of the Biocartis group.

The Transaction is pursuant to the consent of

all First Lien Creditors and more than 75% of Bondholders. To date,

100% of the First Lien Creditors and more than 90% of the

Bondholders have delivered support letters with respect to the

Transaction.

Trade creditors of Biocartis NV and Biocartis US

Inc. are not expected to be impacted by the change in the parent

entity.

The Transaction is expected to be completed by

the end of the year, subject to receipt of certain regulatory

approvals.

Following enforcement, Biocartis Group NV is

expected to be wound down in an orderly fashion.

Shareholders of Biocartis Group NV will receive

no distribution from the security enforcement and are expected to

receive nothing at the time of its winding down.

Security Enforcement Steps by the

Secured Creditors: The Transaction will be implemented

through a security enforcement by the Secured Creditors, pursuant

to which the Secured Creditors will incorporate the New Biocartis

entity to be the new, unlisted holding company for Biocartis’s

operating subsidiaries. New Biocartis will become the owner of all

of the material assets of the current Biocartis group through a

security enforcement over substantially all assets of the Company

secured by liens (being, primarily, the shares of Biocartis NV and

Biocartis US Inc. and cash and other working capital assets). Any

remaining non-collateral assets of Biocartis Group NV may be

disposed of post-enforcement, although these are not expected to be

material.

Bondholders consent: More than 90% of the

Bondholders have already provided binding support letters, which is

sufficient to effect the Transaction by way of a written resolution

pursuant to the terms of the Bonds. Those supporting Bondholders

will receive a consent fee of 250bps (paid 50bps in cash and 200bps

in equity in New Biocartis, together the "Consent

Fee") and an “early bird” fee from New Biocartis at

completion of the Transaction. Any Bondholders who have not yet

consented will have until 25 October 2023 to provide their consent

and be eligible for the Consent Fee from New Biocartis at the

closing of the Transaction. Any such Bondholders should contact

their brokers or the Company if they have not received the relevant

documentation in the coming days.

First Lien Creditors: First lien obligations

under the Company’s first lien convertible term loan facility (the

“Existing First Lien Facility”) will be rolled

over (on a cashless basis) into a new 3-year non-convertible term

loan extended to New Biocartis at par (the “New First Lien

Facility”) at completion of the Transaction. In connection

with their consent to the Transaction, the First Lien Creditors

will receive, at completion of the Transaction, certain fees from

New Biocartis payable in kind, in equity of New Biocartis and

equity warrants in New Biocartis. The interest rate of the New

First Lien Facility will remain unchanged. The New First Lien

Facility is callable at 103/101/par in years 1, 2, and 3,

respectively. All other terms and conditions (including the scope

of security) will be substantially the same as in the Existing

First Lien Facility, including the EUR 10 million minimum liquidity

financial covenant.

KBC debt: Other debt owed to KBC (approximately

EUR 13.4 million) will be extended at the level of Biocartis NV and

Biocartis US Inc. at completion of the Transaction. The maturity of

the EUR 7.5 million straight loan will be extended by 21 months to

September 2025, subject to certain partial prepayments being made

at the time of the completion of the Transaction. The maturity of

the guarantee facility (which is not part of the aggregate amount

of debt owed to KBC stated above) will be extended to December

2025. The existing security package in favor of KBC will remain

unchanged.

Unsecured creditors and shareholders: Following

enforcement, Biocartis Group NV is expected to be wound down in an

orderly fashion. Shareholders and holders of the Unsecured 2027

Bonds will receive no distribution from the security

enforcement.

Equity Injection through New

Biocartis: Immediately following the security enforcement

and equitization of the Bonds into shares of New Biocartis, the

shareholders of New Biocartis (the current Bondholders) will make

the Equity Injection of not less than EUR 40 million of equity

capital, which will be made available to New Biocartis and its

operating subsidiaries to fund working capital, capital

expenditures and investments, and to pay the costs and expenses of

the Transaction. Consenting Bondholders may be eligible to

participate in the Equity Injection on a pro rata basis.

Backstop and Commitments: The Equity Injection

is fully backstopped by a group of supporting Bondholders to ensure

certainty of funding New Biocartis going forward. The backstopping

parties will receive a fee from New Biocartis, payable in equity of

New Biocartis, for their backstop commitment, as will other

bondholders who have already committed to participate in the Equity

Injection.

New Biocartis: New Biocartis

will have approximately EUR 44.5 million of debt, comprising

approximately EUR 32.7 million of debt under the New First Lien

Facility, approximately EUR 11.8 million of debt with KBC. For the

First Lien Facility, the main borrower is expected to be New

Biocartis with upstream guarantees from the operating subsidiaries,

while for KBC the main borrowers will be the operating subsidiaries

with a downstream guarantee from New Biocartis. New Biocartis will

provide share security and a guarantee of the KBC debt and the New

First Lien Facility. Post-closing of the Transaction, it is

expected that the Bondholders participating in the Equity Injection

will own a majority of the shares of New Biocartis, while the

equitized Bonds will represent a small fraction (approximately 14%,

pro forma equity allocation calculated on the basis of EUR 40

million Equity Injection) of the shares after dilution from fees

and the Equity Injection. KBC will have no equity stake in New

Biocartis. New Biocartis will be managed by a board of directors

made up of a majority of industry experts.

New Biocartis is forecast to reach operational

breakeven on an EBITDA-basis by end of 2024. New Biocartis is

expected to achieve (i) total revenue CAGR of approximately 20%

over the 2022-2028 period (mostly driven by increases in both

cartridge sales volume and average selling price in the US), (ii)

industry-standard gross margins of 60%+ over the 2024-2028 period,

and (iii) an industry-standard EBITDA margin of 20%+ by 2028.

Advisers: DC Advisory and Baker

McKenzie are respectively serving as financial and legal advisors

to the Company.

Further implementation: The

Transaction is subject to finalizing additional contractual

agreements and the receipt of certain regulatory approvals. The

Company intends to reach out to remaining Bondholders who have not

yet consented to the Transaction. In the event that the Transaction

does not complete in full and/or on time, the Biocartis group may

not be able to continue operating and may not be recapitalized, and

the Company would need to consider alternative arrangements, which

may not be available on time or at all.

--- END ---

More information:

Corporate Communications & Investor Relations

Biocartise-mail ir@biocartis.com

tel +32

15 631 729 @Biocartis_ www.linkedin.com/Biocartis

About Biocartis

With its revolutionary and proprietary Idylla™

platform, Biocartis (Euronext Brussels: BCART) aspires to enable

personalized medicine for patients around the world through

universal access to molecular testing, by making molecular testing

actionable, convenient, fast and suitable for any lab. The Idylla™

platform is a fully automated sample-to-result, real-time PCR

(Polymerase Chain Reaction) based system designed to offer in-house

access to accurate molecular information in a minimum amount of

time for faster, informed treatment decisions. Idylla™'s

continuously expanding menu of molecular diagnostic tests address

key unmet clinical needs, with a focus in oncology. This is the

fastest growing segment of the molecular diagnostics market

worldwide. Today, Biocartis offers tests supporting melanoma,

colorectal, lung and liver cancer, as well as for sepsis. More

information: www.biocartis.com. Follow us on Twitter:

@Biocartis_.

Biocartis and Idylla™ are registered trademarks

in Europe, the United States and other countries. The Biocartis and

Idylla™ trademark and logo are used trademarks owned by Biocartis.

Please refer to the product labeling for applicable intended uses

for each individual Biocartis product.

This press release is not for distribution,

directly or indirectly, in any jurisdiction where to do so would be

unlawful. Any persons reading this press release should inform

themselves of and observe any such restrictions. Biocartis takes no

responsibility for any violation of any such restrictions by any

person. This press release does not constitute an offer to sell or

buy, nor the solicitation of an offer to sell or buy, any

securities referred to herein in any jurisdiction. Any solicitation

or offer will only be made pursuant to a confidential offering

memorandum and only to such persons and in such jurisdictions as is

permitted under applicable law.

No securities of Biocartis may be offered or

sold in the United States of America absent registration with the

United States Securities and Exchange Commission or an exemption

from registration under the U.S. Securities Act of 1933, as amended

(the “Securities Act”). Any new securities to be issued by New

Biocartis pursuant to the Transaction will not be registered under

the Securities Act or any U.S. state securities laws. Therefore,

such new securities may not be offered or sold in the United States

absent registration or an applicable exemption from the

registration requirements of the Securities Act and any applicable

U.S. state securities laws.

Forward-looking statements

Certain statements, beliefs and opinions in this

press release are forward-looking, which reflect the Company's or,

as appropriate, the Company directors' or managements' current

expectations and projections concerning future events such as the

Company's results of operations, financial condition, liquidity,

performance, prospects, growth, strategies, the industry in which

the Company operates, the timing and effect of the Transaction, and

the satisfaction of the conditions to the Transaction. By their

nature, forward-looking statements involve a number of risks,

uncertainties, assumptions and other factors that could cause

actual results or events to differ materially from those expressed

or implied by the forward-looking statements. These risks,

uncertainties, assumptions and factors could adversely affect the

outcome and financial effects of the plans and events described

herein. A multitude of factors including, but not limited to,

changes in demand, competition and technology, can cause actual

events, performance or results to differ significantly from any

anticipated development. Forward-looking statements contained in

this press release regarding past trends or activities are not

guarantees of future performance and should not be taken as a

representation that such trends or activities will continue in the

future. In addition, even if actual results or developments are

consistent with the forward-looking statements contained in this

press release, those results or developments may not be indicative

of results or developments in future periods. No representations

and warranties are made as to the accuracy or fairness of such

forward-looking statements. As a result, the Company expressly

disclaims any obligation or undertaking to release any updates or

revisions to any forward-looking statements in this press release

as a result of any change in expectations or any change in events,

conditions, assumptions or circumstances on which these

forward-looking statements are based, except if specifically

required to do so by law or regulation. Neither the Company nor its

advisers or representatives nor any of its subsidiary undertakings

or any such person's officers or employees guarantees that the

assumptions underlying such forward-looking statements are free

from errors nor does either accept any responsibility for the

future accuracy of the forward-looking statements contained in this

press release or the actual occurrence of the forecasted

developments. You should not place undue reliance on

forward-looking statements, which speak only as of the date of this

press release.

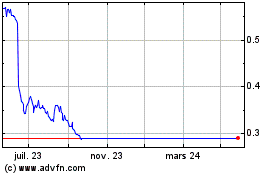

Biocartis Group NV (EU:BCART)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

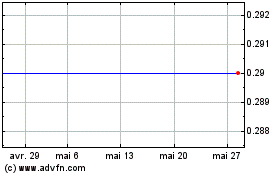

Biocartis Group NV (EU:BCART)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025