BioSenic S.A. : Information on the total number of voting rights and shares

28 Juin 2024 - 7:00AM

BioSenic S.A. : Information on the total number of voting rights

and shares

PRESS RELEASE – REGULATED

INFORMATION

Mont-Saint-Guibert, Belgium, June 28,

2024, 7.00 am CET – BIOSENIC (Euronext

Brussels and Paris: BIOS), the clinical-stage company specializing

in serious autoimmune and inflammatory diseases and cell therapy,

today announces an increase in the total number of voting rights

and shares as a result of the issuance of new shares. The following

information is published in accordance with Article 15 of the

Belgian law of 2 May 2007 on the publication of major shareholdings

in issuers whose shares are admitted to trading on regulated

market.

|

Total amount of share capital on May 31, 2024 |

EUR 36 650 669 |

|

Total number of shares with voting rights on May 31, 2024 |

230 724 583 |

|

Total number of new shares issued between May 31, 2024 and June 28,

2024 |

20 588 234 |

|

Total amount of share capital on June 28, 2024 |

EUR 37 050 669 |

|

Total number of shares with voting rights on June 28, 2024 |

251 312 817 |

|

Total number of voting rights (denominator) on June 28, 2024 |

251 312 817 |

|

Total number of attributed warrants |

161 556 |

|

Total number of convertible bonds outstanding |

169 |

|

Total number of remaining convertible bonds commitments |

0 |

|

Total number of shares with voting rights that can be issued

following the exercise of the attributed warrants, remaining

convertible bonds commitments and the conversion of the convertible

bonds |

787 136 958 (1) |

(1)

- 161 556 shares could be issued in

case all 161 556 attributed warrants were exercised (excluding the

1 000 000 outstanding warrants which are planned to be cancelled in

accordance with the global restructuring plan which was homologated

by the Enterprise Court on 10 June 2024).

- 91 296 689 shares could be issued

in case all 169 convertible bonds outstanding of the convertible

bonds programs with Global Tech Opportunities 15 were exercised and

converted into shares based on the conversion price of EUR

0.0217423 (95% of the Volume-Weighted-Averaged-Price of BioSenic's

shares on 26 June 2024).

- In the event of full conversion of

the new convertible bonds in accordance with the global

restructuring plan which was homologated by the Enterprise Court on

10 June 2024, 695 678 713 shares could be issued in case all of the

EUR 15.5 million worth of convertible bonds are exercised and

converted into shares based on the conversion price of EUR

0.0222804 (95% of 30-days VWAP on 26 June 2024).

About BioSenic

BioSenic is a leading biotech company

specializing in the development of clinical assets issued from its

Medsenic’s arsenic trioxide (ATO) platform. Key target indications

for the autoimmune platform include graft-versus-host-disease

(GvHD), systemic lupus erythematosus (SLE), and now systemic

sclerosis (SSc).Following the merger in October 2022, BioSenic

combined the strategic positionings and strengths of Medsenic and

Bone Therapeutics. The merger specifically enables

Medsenic/Biosenic to develop an entirely new arsenal of various

anti-inflammatory and anti-autoimmune formulations using the

immunomodulatory properties of ATO/oral ATO (OATO).

BioSenic is based in the Louvain-la-Neuve

Science Park in Mont-Saint-Guibert, Belgium. Further information is

available at http://www.biosenic.com.

About the main Medsenic/BioSenic

technology platform

The ATO platform provides

derived active products with immunomodulatory properties and

fundamental effects on the activated cells of the immune system.

One direct application is its use in onco-immunology to treat GvHD

(Graft-versus-Host Disease) in its chronic, established stage.

cGvHD is one of the most common and clinically significant

complications affecting long-term survival of allogeneic

hematopoietic stem cell transplantation (allo-HSCT).

Medsenic has been successful in a phase 2 trial

with its intravenous formulation, Arscimed®, which

has orphan drug designation status by FDA and EMA. The company is

heading towards an international phase 3 confirmatory study, with

its new, IP-protected, OATO formulation. Another selected target is

moderate-to-severe forms of systemic lupus erythematosus (SLE),

using the same oral formulation. ATO has shown good safety and

significant clinical efficacy on several affected organs (skin,

mucosae, and the gastrointestinal tract). Systemic sclerosis is now

full part of the clinical pipeline of Medsenic/BioSenic. This

serious chronic disease badly affects skin, lungs, or

vascularization, and has no current effective treatment.

Preclinical studies on pertinent animal models are positive, giving

good grounds to launch a phase 2 clinical protocol, using new

immunomodulatory formulations of APIs recognized to be active on

the immune system.

The company is currently focusing its present

R&D and clinical activities on a selective, accelerated

development of its autoimmune platform.

Note: The allogeneic cell therapy

platform-originating from the previous listed company Bone

Therapeutics company, may be of renewed interest by using isolated

and purified differentiated bone marrow Mesenchymal Stromal Cells

(MSCs) as a starting material for further isolation of passive or

active biological subcellular elements. Indeed, these cells may

provide new subcellular vesicles potentially able to deliver a

unique and proprietary approach to organ repair. BioSenic is now

involved in determining new patentable approaches in this complex

area of cell therapy.

For further information, please

contact:

BioSenic SAFrançois Rieger, PhD,

CEOTel: +33 (0)671 73 31 59investorrelations@biosenic.com

Certain statements, beliefs and opinions in this

press release are forward-looking, which reflect the company or, as

appropriate, the company directors’ current expectations and

projections about future events. By their nature, forward-looking

statements involve a number of risks, uncertainties and assumptions

that could cause actual results or events to differ materially from

those expressed or implied by the forward-looking statements. These

risks, uncertainties and assumptions could adversely affect the

outcome and financial effects of the plans and events described

herein. A multitude of factors including, but not limited to,

changes in demand, competition and technology, can cause actual

events, performance or results to differ significantly from any

anticipated development. Forward looking statements contained in

this press release regarding past trends or activities should not

be taken as a representation that such trends or activities will

continue in the future. As a result, the company expressly

disclaims any obligation or undertaking to release any update or

revisions to any forward-looking statements in this press release

as a result of any change in expectations or any change in events,

conditions, assumptions or circumstances on which these

forward-looking statements are based. Neither the company nor its

advisers or representatives nor any of its subsidiary undertakings

or any such person’s officers or employees guarantees that the

assumptions underlying such forward-looking statements are free

from errors nor does either accept any responsibility for the

future accuracy of the forward-looking statements contained in this

press release or the actual occurrence of the forecasted

developments. You should not place undue reliance on

forward-looking statements, which speak only as of the date of this

press release.

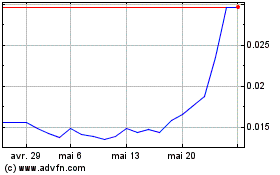

Biosenic (EU:BIOS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Biosenic (EU:BIOS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024