2023: Strategy on track, driving improved profitability

PRESS RELEASE

Online investor presentation and Q&A

at 10.30 CET on 20 March 2024

via:https://channel.royalcast.com/cabka/#!/cabka/20240320_1

2023: Strategy on track, driving

improved profitability

- Sales of € 197 million

(2022: € 209 million)

- Operational EBITDA 8%

higher at € 24.2 million (2022: € 22.5 million)

- Net Income from operations

€ 2.5 million (2022: € 1.6 million)

- Cash flow from operating

activities significantly improved to € 27.1 million (2022: € 5.3

million)

- Recycled raw material

inflow at 89% (2022: 86%)

- Successfully secured debt

refinancing of € 80 million at improved terms

- Proposed cash distribution

of € 0.15 per share

Amsterdam 19 March 2024.

Cabka N.V. (together with its subsidiaries “Cabka”, or the

“Company”), a company specialized in transforming hard to recycle

plastic waste into innovative Reusable Transport Packaging (RTP),

listed at Euronext Amsterdam, announces its preliminary non-audited

2023 full year results.

Cabka CEO Tim Litjens,

commented:

“In 2023 we’ve made solid progress with the

execution of our strategy. Investments in product innovation have

led to the launch of various new Reusable Transport Packaging (RTP)

products based on recycled plastics, particularly in the strategic

segments of large foldable containers and customized solutions. We

launched these new products based on longer-term commercial

partnerships with leading industry players such as Continental,

BMW, CHEP, IFCO, and Red Bull. These partnerships form the

foundation for future growth and further margin enhancement. In our

operations we completed the consolidation and expansion of our ECO

business in Europe, leading to immediate sales growth, reopened and

expanded our production plant in the US, and completed the

divestment of our PVC business.

2023 is characterized by challenging general

market circumstances with increasing interest rates leading to

significant destocking and restricted capital investments from

customers in most of Cabka’s end markets. This was especially

notable in the US, where key customers deliberately chose to

restrict their CAPEX spending. It resulted in overall lower market

demand and pricing pressure across the industry especially in the

second half of the year. Going into 2024 we expect to see a

recovery by Q2.

In the context of these challenging market circumstances, Cabka

posted full year sales in 2023 of €197 million, 6% lower compared

to the record sales achieved in 2022 of €209 million. The decline

in sales was driven by the divestment of the PVC business, and

declining sales in the non-strategic contract manufacturing

segment. The continued focus on product innovations enabled Cabka

to mitigate market headwinds and deliver stable sales across its

strategic segments, while the reopening of our operations in the US

allows us to recover the market share lost due to the flooding.

Although sales declined, our operational EBITDA

has increased by 8% from €22.5 million in 2022 to €24.2 million in

2023, representing an improvement of our operational EBITDA over

Sales from 10.8% to 12.3%. Contributing factors are the continued

recovery of our gross margins due to lower variable costs, and a

gradual shift towards higher value-add products. On top strict cost

discipline resulted in a limited increase of fixed costs against a

background of high inflation.

Despite slow sales at the start of the year, the

current recovery of order intake and pipeline of new product

launches underpins our expectations of delivering mid-single digit

sales growth for the full year, and an EBITDA margin within the

13-15% range.”

Financial Highlights

- Total sales for the full year of

2023 amounted to €197 million, 6% lower compared to the record

sales achieved in 2022 of €209 million. Sales in strategic segments

remained stable at € 187 million. Decline driven by a € 11 million

lower sales in the divested PVC business and non-strategic Contract

Manufacturing.

- Consolidation of Cabka’s strong

European position in RTP Portfolio, sales up 2%.

- Customized Solutions growth of 20%,

driven by new product launches in Europe and sales to Target in the

US.

- ECO sales growth of 8%, following

the completion of its capacity expansion in Q1 2023

- Operational gross profit at € 99.8

million (2022: € 92.6 million), bringing the gross margin to 51%

(2022: 44%).

- Operational EBITDA increased to €

24.2 million (2022: € 22.5 million), reflecting a margin

improvement of 1.5pp to 12.3% (2022: 10.8%).

- Net Income from operations improved

50% to € 2.5 million (2022: € 1.6 million).

- Net IFRS Income improved to € -0.7

million (2022: € -29.8 million, mainly as a result of non-cash

listing expenses).

- Net Working Capital at € 27.1

million or 13.7% of sales (2022: € 38.3 million, respectively

18.3%), leading to a strong improvement in cash flow from

operations to € 27.1 million (€ 5.3 million).

- Net debt € 56.8 million including

lease obligations (2022: € 44.6 million),

- Total CAPEX of € 30.9 million

(2022: €24.6 million), including maintenance & replacement

investments of € 7.4 million, 3.8% of sales.

- An agreement was reached with a

consortium of banks on a new initial debt facility of € 80 million

for four years at improved terms.

- Dividend: the company proposes a

cash distribution of € 0.15 per Ordinary Share, subject to AGM

approval.

Strategic & Market

Highlights

- New co-development products

launched with our customers include:

- the CabFold hybrid for BMW,

- the CabFold Prime for CHEP,

- the Red Bull BigBag pallet,

- the IFCO Hybrid pallet,

- the Xella Nestable pallet and

- the Continental tire pallet.

- A two-year framework agreement with

Tesla was signed, coming into effect in 2024

- Recycled raw material inflow at 89%

(2022: 86%) of total compared to a European recycling average1 of

14%

- Cabka North America’s plant in St.

Louis (MO) fully up and running since July 2023 after 2022

flooding.

- Consolidation and expansion of our

ECO business completed in Q1 2023.

- Divestment of non-strategic PVC

business completed in Q4 2023.

Condensed bridge from operational to

IFRS consolidated statement of profit and loss, 2023 preliminary

unaudited 2

|

in € million |

2023 |

2022 |

Change |

|

|

|

|

Revenues |

196.9 |

208.9 |

-6% |

|

|

|

|

|

|

|

|

Other operating income items |

3.4 |

11.9 |

-72% |

|

|

Total Operating Income |

200.3 |

220.8 |

-9% |

|

|

|

|

|

|

|

|

Expenses for materials, energy and purchased services |

(100.5) |

(128.2) |

-22% |

|

|

Gross Profit |

99.8 |

92.6 |

8% |

|

|

|

|

|

|

|

|

Operating expenses |

(75.6) |

(70.0) |

8% |

|

|

Operational EBITDA |

24.2 |

22.5 |

7% |

|

|

|

|

|

|

|

|

Depreciation, amortization and impairment of intangible and

tangible fixed assets |

(16.9) |

(18.0) |

-6% |

|

|

EBIT /Operating Income |

7.3 |

4.5 |

60% |

|

|

|

|

|

|

|

|

Financial results |

(4.0) |

(2.4) |

69% |

|

|

Earnings before taxes |

3.3 |

2.2 |

51% |

|

|

|

|

|

|

|

|

Taxes |

(0.8) |

(0.5) |

52% |

|

|

Net income from operations |

2.5 |

1.6 |

50% |

|

|

|

|

|

|

|

|

Non-operational items |

|

|

|

|

|

IPO listing expenses3 |

- |

(26.8) |

|

|

|

IPO other related costs |

(1.1) |

(3.2) |

|

|

|

ECO restructuring |

- |

(0.6) |

|

|

|

St. Louis Flooding4 |

(3.2) |

(6.9) |

|

|

|

|

|

|

|

|

|

Tax on non-operational items |

1.0 |

6.0 |

|

|

|

Non-controlling interest |

- |

0.1 |

|

|

|

|

|

|

|

|

|

Net result reported IFRS |

(0.7) |

(29.7) |

|

|

DistributionProposed cash

distribution of € 0.15 per ordinary share, subject to AGM

approval.

Medium-term guidance updateIn

light of the inflationary pressure impacting industries across the

board, Cabka reviewed its medium-term guidance for the period

2021-2026. Cabka reiterates its guidance on high single digit sales

growth, maintenance and replacement CAPEX (~4%), Net Working

Capital at approximately 20% of sales and pay-out ratio of net

profit (~30-35%). Given the continued and increasing impact of

inflation on margins we now expect to grow EBITDA margin towards

17% by 2026.

OutlookAfter a slow start of

2024, full year mid-single digit sales growth expected, and EBITDA

margin within the 13-15% range.

COMPREHENSIVE OVERVIEW 2023

Sales

performance Sales

in 2023 are to be considered in the context of challenging general

market circumstances, with increasing interest rates leading to

significant destocking and restricted capital investments from

customers in most of Cabka’s end markets. This resulted in overall

lower market demand and pricing pressure across the industry.

In 2023, Cabka realized € 196.9 million in sales, 6% lower

compared to the record sales of € 208.9 million in 2022. Lower

total sales were driven by the divestment of the PVC business, and

declining sales in the non-strategic contract manufacturing

segment. The continued focus on product innovations enabled Cabka

to mitigate market headwinds, resulting in stable sales across

strategic segments.

Aligned with our strategy, Cabka continued its

focus on product innovations throughout 2023. Sales from Customized

Solutions demonstrated strong growth in 2023 increasing with 20.3%

to € 53.0 million (2022: € 44.0 million). The increase was

predominately driven by new products launched in close partnership

with CHEP, Continental, and BMW and sales to Target in the US.

Given challenging market circumstances, with

rising interest rates and the destocking effect noted in the end

markets of Cabka, our RTP portfolio business was robust, increasing

with 1.9% to €68.1 million in 2023 (2022: €66.8 million).

The consolidation and expansion of our ECO business was

concluded by the end of the first quarter in 2023. This strategic

decision already proved positive results, delivering 7.6% sales

growth in 2023 to realize a total revenue of €24.5 million (2022:

€22.8 million).

Cost developmentsRaw material

costs prices and the energy prices reduced significantly in 2023,

after the steep increases in 2022. We noted stabilizing prices in

the second half of 2023, also resulting from our stringent energy

hedging policy. Together with an active diversification of our

energy sources, it significantly helped to control our variable

costs.

The reopening of the US plant in the second half

of 2023 allowed us to avoid further expensive tolling costs. With

our own in-house production and recycling lines back on track we

expect our margins to further strengthen. Consequently, our

operational gross margin improved to 50.7% (2022: 44.3%)

Operating expenses increased 8%, predominantly

driven by the impact of inflation on personnel costs, but also on

all other operating expenses, such as insourced services,

insurances, audit fees and repairs & maintenance costs. Also,

certain key vacancies in sales were successfully filled.

Depreciation and amortization decreased by 6.3%

to € 16.9 million, due to lower depreciation of fixed assets in the

US whilst production was not yet operational.

EBITDAIn 2023, Cabka achieved

an operational EBITDA of € 24.2 million, which is a 7.5% increase

compared to 2022 of € 22.5 million, representing 1.5 pp improvement

in operational EBITDA over Sales from 10.8% to 12.3%. Operational

EBITDA improved as a result of lower variable costs leading to

continued recovery in gross margin, a gradual shift towards higher

value-add products and strict cost control limiting the impact of

high inflation on fixed costs.

Debt Facility RenewalIn

December 2023, Cabka reached an agreement with a consortium of

banks on a new initial debt facility of € 80 million for four

years, which includes extension options for up to two years. The

new initial facility is agreed at improved terms and conditions for

Cabka. It consists of two parts: namely a € 30 million term

facility and € 50 million revolving credit facility, replacing the

€ 27 million outstanding debt facility and the € 30 million initial

revolving credit facility. The facility will be used to enhance

Cabka’s growth and innovation capabilities and organizational

flexibility.

Net Working Capital Net Working

Capital position was € 27.1 million or 13.7% of sales as per 31

December 2023 which is well within our medium-term guidance.

Compared to the 31 December position of € 38.3 million, the net

working capital position decreased by 29.3%.

The movement in Net Working Capital for the year

was € 11.2 million5. The positive movement in Net Working Capital

is the result of a € 9.7 million decrease in inventory, followed by

a decrease in trade receivables and other current assets of € 4.2

million. This was partially offset by a decrease in trade payables

and other current liabilities of € 2.7 million.

The decline in inventory value was the result of

active inventory management, stabilizing raw material and energy

costs, and delivery of moulds to our customers in 2023 versus 2022.

Active reduction of our raw materials inventory led to a decrease

in trade payables. Diligent management of trade receivables

resulted in a healthy position by year end.

Cash flows and cash

positionCash flows from operating activities amounted to €

27.1 million (2022: € 5.3 million). This comprised of an inflow of

€ 20.7 million from operating activities (2022: € 15.9 million) and

€ 6.4 million positive movement in our working capital (2022: €

-10.7 million), resulting from active working capital

management.

Cash flows used in investing activities amounted

to € 30.0 million (2022: € 23.1 million) of which € 30.4 million

was related to capital investments in tangible assets (2022: € 24.2

million) and € 0.5 million in intangible assets (2022: € 0.4

million). Cabka disposed of certain assets contributing € 0.7

million of cash, in addition, interest earned on short term

deposits amounted to € 0.2 million.

Cash flows used in financing activities amounted

to € -11.1 million (2022: € 29.7 million, of which € 41.7 million

cash flow from IPO proceeds). Main cash out flow resulted from the

repayment of debt facilities and interest totaling € -7.2 million

(2022: € -6.8 million), followed by the settlement of lease

facilities in 2023 amounting to € -2.7 million (2022: € -5.1

million).

The total cash balance at 31 December 2023 was €

7.3 million (31 December 2022: € 21.0 million).

CAPEX Total CAPEX for 2023 came

at € 30.9 million (2022: € 24.6 million). Total investments in

maintenance & replacement were € 16.2 million, of which € 7.4

million was excluding the investments made in the US, or 3.8% of

total sales. Total investment in 2023 for our St. Louis plant to

reopen and expand, amounted to € 12.1 million. In our ECO business

we invested € 2.3 million (2022: € 3.7 million).

ESGCabka is committed to making

a positive impact with its operations and ultimately with the

product it supplies to the market. We are the circularity leader in

the RTP industry, with approximately 89% of our products made from

recycled materials during 2023, 100% was reusable with take-back

clauses for recycling and supporting the collection of additional

plastics for recycling. The average for Europe in 2023 is still at

14% recycled plastics targeting to get to 33% by 2030.6

In 2023, Cabka achieved “gold” status in the

EcoVadis assessment. The Gold rating from EcoVadis is a testament

to Cabka’s commitment and excellence across the various

sustainability categories and demonstrates the significant progress

that has been made in one year, moving Cabka from the top 25% to

the top 6% rated companies, placing us amongst the best in the

industry.

Cabka participated for the first time in the

assessment with the Carbon Disclosure Program (CDP), a non-profit

organization that runs a global disclosure system for companies on

climate impacts. In its first assessment (2023/2024), Cabka scored

B on a scale from A to D-, with A being best practice. The B score

reflects the importance Cabka gives to climate issues and proves

that we are well on track with other European businesses on the

topic. From an industry perspective, Cabka scores better that the

plastic manufacturing sector on average.

In 2023, Cabka continued to work on the

governance structure for ESG and will publish its second ESG report

integrated in the 2023 Annual Report. In addition, the company is

currently focusing on its CSRD readiness to ensure compliance for

its annual report to be published over the 2024 financial year.

Share priceOn 31 December 2023

the Cabka shares closed at € 6.04.

|

Cabka share capital per 31 December 2023 |

Shares |

ISIN |

|

Ordinary Shares issued |

24,710,600 |

CABKA / NL00150000S7 |

|

Ordinary Shares in treasury |

15,994,378 |

DSC2S / NL00150002R5 |

|

|

|

|

|

Total Ordinary Shares |

40,704,978 |

|

|

Special Shares |

97,778 |

|

|

|

|

|

|

Total shares |

40,802,756 |

|

Tax positionsDeferred tax

assets are recognized for unused tax losses to the extent that it

is probable that taxable profit will be available against which the

losses can be utilized. Management’s assessment is required to

determine the amount of deferred tax assets that can be recognized,

based upon the likely timing and the level of future taxable

profits. At the moment of publication of this preliminary unaudited

financial results report, the assessment of current and deferred

tax positions has not been fully finalized and might be revised

ahead of the publication of the Annual Report 2023.

Relevant events after 31 December

2023

- As of 1 January 2024, the Executive

Committee has been streamlined, consisting of Tim Litjens CEO,

Frank Roerink CFO, Naiara Loroño CCO, Geert de Wilde COO, Javier

Fernandez CTIO and Irina Mengert CPO.

- As of 19 February 2024, Niek Hoek

has been appointed as Chairman of the Supervisory Board. The

appointment was supported by the full Board, as part of a rotation

following the mid-term internal review. Mr. Manuel Beja will

continue as vice chairperson of the Supervisory Board.

Financial Calendar 2024

- 20 March Webcast Preliminary Results

2023

- 18 April Publication Annual Report

2023 and Trading Update 2024Q1

- 30 May Annual General Meeting

of Shareholders

- 13 August Half-Year Results and Half-Year

Report 2024

- 21 October Trading Update 2024Q3

For more information, please

contact:Nadia Lubbe, Investor & Press

contactIR@cabka.com, or n.lubbe@cabka.com;+49 152 243 254

79www.investors.cabka.comCommercial contact: info@cabka.com

www.cabka.com

About CabkaCabka is in the

business of recycling plastics from post-consumer and

post-industrial waste into innovative reusable transport packaging

(RTP), like pallets- and large container solutions enhancing

logistics chain sustainability. ECO product are mainly construction

and road safety products produced exclusively out of post-consumer

waste.

Cabka is leading the industry in its integrated

approach closing the loop from waste, to recycling, to

manufacturing. Backed by its own innovation center it has the rare

industry knowledge, capability, and capacity of making maximum use

bringing recycled plastics back in the production loop at

attractive returns. Cabka is fully equipped to exploit the full

value chain from waste to end-products.

Cabka is listed at Euronext Amsterdam as of 1

March 2022 under the CABKA ticker with international securities

identification number NL00150000S7.

DisclaimerAll results in the

press release are based on regular operations excluding

extraordinary items, unless mentioned otherwise. The qualification

extraordinary item is a management accounting term to indicate this

is not part of regular operations. The financial statements in the

appendix are based on IFRS and do not distinguish between

operational or extraordinary items. See appendix I. for definitions

of operational items by management.

The content of this press release may include

statements that are, or may be deemed to be, ‘’forward-looking

statements’’. These forward-looking statements may be identified by

the use of forward-looking terminology, including the terms

‘’believes’’, ‘’estimates’’, ‘’plans’’, ‘’projects’’,

‘’anticipates’’, ‘’expects’’, ‘’intends’’, ‘’may’’, ‘’will’’ or

‘’should’’ or, in each case, their negative or other variations or

comparable terminology, or by discussions of strategy, plans,

objectives, goals, future events or intentions. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements reflect the Company’s current view

with respect to future events and are subject to risks relating to

future events and other risks, uncertainties and assumptions

relating to the Company’s business, results of operations,

financial position, liquidity, prospects, growth, or

strategies.

Readers are cautioned that any forward-looking

statements are not guarantees of future performance. Given

these uncertainties, the reader is advised not to place any undue

reliance on such forward-looking statements. These forward-looking

statements speak only as of the date of publication of this press

release. The Company undertakes no obligation to publicly update or

revise the information in this press release, including any

forward-looking statements, except as may be required by law.

This document contains information that

qualifies as inside information within the meaning of Article 7(1)

of Regulation (EU) No 596/2014 on market abuse.

FINANCIAL OVERVIEW APPENDIX

I. Definitions of operational

items by management

- Gross MarginGross Profit divided by

Revenue

- Gross ProfitProfit as Revenue for the period

plus changes in inventory and other operating income for the

period, minus raw material costs, energy costs and purchased

services

- Maintenance and Replacement Capital

ExpendituresThe expenses incurred by the company that are

related to the maintenance and replacements of assets like plants,

machinery and buildings

- Maintenance and Replacement Capital Expenditures as a

percentage of revenue: Maintenance and Replacement Capital

Expenditures divided by Revenue

- Net Working CapitalTrade accounts receivables

plus inventories net of trade accounts payables

- Net Working Capital as percentage of

revenueNet Working Capital divided by Revenue.

- Net Income from operationsNet Income reported

for the period, being adjusted for non-operational activities.

- Non-operational Indicates that this is not

part of regular operational activities.

- Operational EBITDANet Result reported for the

period, adjusted for non-operational activities, before

depreciation and amortization, interest expenses and income, taxes

and share option plan accruals

II. Condensed bridge

from operational to IFRS consolidated statement of profit and loss,

2023 preliminary unaudited

|

Condensed income statement bridge operational to

IFRS7 |

|

|

|

|

|

in € million |

2023 |

2022 |

Change |

|

|

|

|

|

|

|

|

|

|

Revenues |

196.9 |

208.9 |

-6% |

|

|

|

|

|

|

|

|

Other operating income items |

3.4 |

11.9 |

-72% |

|

|

Total Operating Income |

200.3 |

220.8 |

-9% |

|

|

|

|

|

|

|

|

Expenses for materials, energy and purchased services |

(100.5) |

(128.2) |

-22% |

|

|

Gross Profit |

99.8 |

92.6 |

8% |

|

|

|

|

|

|

|

|

Operating expenses |

(75.6) |

(70.0) |

8% |

|

|

Operational EBITDA |

24.2 |

22.5 |

7% |

|

|

|

|

|

|

|

|

Depreciation, amortization and impairment of intangible and

tangible fixed assets |

(16.9) |

(18.0) |

-6% |

|

|

EBIT /Operating Income |

7.3 |

4.5 |

60% |

|

|

|

|

|

|

|

|

Financial results |

(4.0) |

(2.4) |

69% |

|

|

Earnings before taxes |

3.3 |

2.2 |

51% |

|

|

|

|

|

|

|

|

Taxes |

(0.8) |

(0.5) |

52% |

|

|

Net income from operations |

2.5 |

1.6 |

50% |

|

|

|

|

|

|

|

|

Non-operational items |

|

|

|

|

|

IPO listing expenses8 |

- |

(26.8) |

|

|

|

IPO other related costs |

(1.1) |

(3.2) |

|

|

|

ECO restructuring |

- |

(0.6) |

|

|

|

St. Louis Flooding9 |

(3.2) |

(6.9) |

|

|

|

|

|

|

|

|

|

Tax on non-operational items |

1.0 |

6.0 |

|

|

|

Non-controlling interest |

- |

0.1 |

|

|

|

|

|

|

|

|

|

Net result reported IFRS |

(0.7) |

(29.7) |

|

|

III. Condensed

consolidated statement of profit and loss 2023 preliminary

unaudited

|

Condensed statement of profit and loss |

|

|

|

in € million |

2023 |

2022 |

|

|

|

|

|

Revenues |

196.9 |

208.9 |

|

|

|

|

|

Change in inventories of finished goods and work in progress |

(6.0) |

4.2 |

|

Other operating income items10 |

9.3 |

13.7 |

|

Total Operating income |

200.3 |

226.8 |

|

|

|

|

|

Material expenses / expenses for purchased services |

(103.6) |

(131.5) |

|

Personnel expenses |

(42.6) |

(40.4) |

|

Depreciation, amortization and impairments of intangible and

tangible fixed assets |

(16.9) |

(18.0) |

|

IPO listing expenses11 |

- |

(26.8) |

|

Other operating expenses |

(34.3) |

(43.6) |

|

Total Operating expenses |

(197.3) |

(260.3) |

|

|

|

|

|

Interest income and similar income |

0.3 |

1.6 |

|

Interest expenses and similar charges |

(4.2) |

(2.4) |

|

Financial Result |

(3.9) |

(0.8) |

|

|

|

|

|

Result before taxes |

(1.0) |

(34.3) |

|

|

|

|

|

Income tax expense |

0.2 |

4.5 |

|

Net Result |

(0.7) |

(29.8) |

|

Attributable to non-controlling interest |

- |

(0.1) |

|

Attributable to Owners of the Company |

(0.7) |

(29.7) |

IV. Consolidated Balance

Sheet 2023 preliminary unaudited

|

Consolidated Balance Sheet |

|

|

|

|

in € million |

|

31.12.2023 |

31.12.2022 |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

Other intangible assets |

|

2.8 |

0.7 |

|

Property, plant and equipment |

|

90.7 |

77.6 |

|

Long-term financial assets |

|

0.1 |

0.1 |

|

Other long-term assets |

|

- |

0.1 |

|

Deferred taxes |

|

8.9 |

7.3 |

|

|

|

102.5 |

85.8 |

|

|

|

|

|

|

Current Assets |

|

|

|

|

Inventories |

|

32.1 |

41.7 |

|

Trade receivables |

|

27.6 |

31.8 |

|

Short-term financial assets |

|

- |

- |

|

Other short-term assets |

|

12.6 |

8.8 |

|

Cash and cash equivalents |

|

7.3 |

21.0 |

|

|

|

79.5 |

103.3 |

|

|

|

182.0 |

189.1 |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

Share capital |

|

0.4 |

0.4 |

|

Treasury shares |

|

(0.2) |

(0.2) |

|

Capital reserve |

|

77.2 |

75.1 |

|

Warrants reserve |

|

7.8 |

11.0 |

|

Retained earnings |

|

(12.6) |

(12.1) |

|

Foreign currency translation reserve |

|

(1.6) |

(1.5) |

|

Non-controlling interests |

|

- |

- |

|

|

|

71.0 |

72.7 |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

Long-term financial liabilities |

|

43.3 |

38.5 |

|

Other long-term liabilities |

|

- |

- |

|

Deferred taxes |

|

0.5 |

0.5 |

|

|

|

43.7 |

39.0 |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

Short-term financial liabilities |

|

20.8 |

27.3 |

|

Provisions |

|

0.8 |

0.7 |

|

Contract liabilities |

|

4.4 |

6.8 |

|

Trade payables |

|

32.6 |

35.2 |

|

Income tax liabilities |

|

- |

- |

|

Other short-term liabilities |

|

8.7 |

7.4 |

|

|

|

67.3 |

77.4 |

|

|

|

182.0 |

189.1 |

V.

Condensed

consolidated statement of cash flow 2023 preliminary

unaudited

|

Consolidated statement of cash flow |

|

|

|

in € million |

2023 |

2022 |

|

|

|

|

|

Cash flows from operating activities |

|

|

|

Net loss / income for the period |

(0.7) |

(29.8) |

|

|

|

|

|

Adjustments for: |

|

|

|

Depreciation, amortization and impairments of intangible and

tangible fixed assets |

16.9 |

18.0 |

|

Listing expenses (non-cash transaction) |

- |

26.8 |

|

Other non-cash transactions |

5.8 |

3.2 |

|

Taxes |

(1.2) |

(2.2) |

|

Cash flow |

20.7 |

15.9 |

|

|

|

|

|

Changes in working capital: |

|

|

|

Increase (-) / decrease (+) of inventories |

9.7 |

(10.9) |

|

Increase (-) / decrease (+) trade receivables and

other current assets |

0.4 |

(6.6) |

|

Increase (+) / decrease (-) of trade payables and other current

liabilities |

(3.6) |

6.9 |

|

Cash flow (used in)/from operating activities |

27.1 |

5.3 |

|

|

|

|

|

Cash flow from investing activities |

|

|

|

Cash outflow for investment in property, plant and equipment and

intangible assets |

(30.9) |

(24.6) |

|

Cash inflow from sale of property, plant and equipment and

intangible assets |

0.7 |

1.4 |

|

Interest received on cash and cash equivalents |

0.2 |

- |

|

Net cash from/(used in) investing activities |

(30.0) |

(23.1) |

|

|

|

|

|

Cashflow from financing activities |

|

|

|

Proceeds form issue of share capital |

- |

108.5 |

|

Cash outflow from buy out of Cabka minority shareholders |

- |

(66.8) |

|

Cash inflow from Sale of treasury shares |

0.1 |

- |

|

Cash outflow from dividend payments |

(1.2) |

- |

|

Cash inflow (+) / outflow (-) for other financial liabilities |

(0.1) |

(0.1) |

|

Cash outflow for the repayment of liabilities to banks |

(3.3) |

(4.4) |

|

Cash outflow for repayment of lease liabilities |

(2.5) |

(2.2) |

|

Cash outflow for rental purchase liabilities |

(0.2) |

(2.9) |

|

Interest paid |

(3.9) |

(2.4) |

|

Net cash from/(used in) financing activities |

(11.1) |

29.7 |

|

|

|

|

|

Changes in cash and cash equivalents |

(13.9) |

11.9 |

|

Cash and cash equivalents at the beginning of the

period |

21.0 |

10.0 |

|

Net foreign exchange difference |

0.2 |

(0.8) |

|

Cash and cash equivalents at the end of the

period |

7.3 |

21.0 |

1 Systemiq April 2022 report Reshaping plastics. Pathway to a

circular climate neutral plastics system in Europe 2 The condensed

income statement provides operational and non-operational result

items for insight on underlying operational performance. The

attached statements II to V provide integral IFRS statements

without this distinction. 3 This represents a purely non-cash

accounting-only loss with no impact on the IFRS Equity, Balance

Sheet total, or Cash Flow. Please see AR2022 page 5 under ‘listing’

for more details.4 In 2023 this relates to higher costs resulting

from temporarily outsourcing production to tollers. 5 Net working

capital movement excludes other working capital movements of € -4.7

million.6 Systemiq April 2022 report Reshaping plastics. Pathway to

a circular climate neutral plastics system in Europe 7 The

condensed income statement provides operational and non-operational

result items for insight on underlying operational performance. The

attached statements II to V provide integral IFRS statements

without this distinction. 8 This represents a purely non-cash

accounting-only loss with no impact on the IFRS Equity, Balance

Sheet total, or Cash Flow. Please see AR2022 page 5 under ‘listing’

for more details.9 In 2023 this relates to higher costs resulting

from temporarily outsourcing production to tollers. 10 Includes

income from Insurance St. Louis flooding 11 This represents a

purely non-cash accounting-only loss with no impact on the IFRS

Equity, Balance Sheet total, or Cash Flow.

- 20240319_Cabka 2023FY preliminary results PR

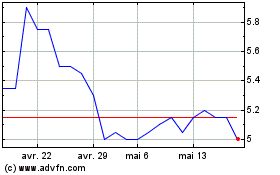

Cabka NV (EU:CABKA)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Cabka NV (EU:CABKA)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025