Cabka N.V. Announces 2024 Preliminary Update: resilient portfolio growth and margin expansion in challenging markets

21 Février 2025 - 8:00AM

UK Regulatory

Cabka N.V. Announces 2024 Preliminary Update: resilient portfolio

growth and margin expansion in challenging markets

Amsterdam February 21, 2025 -

Cabka N.V. (together with its subsidiaries “Cabka”, or the

“Company”), a company specialized in transforming hard to recycle

plastic waste into innovative Reusable Transport Packaging (RTP),

listed at Euronext Amsterdam, announced its 2024

preliminary update today.

Cabka expects full year 2024 sales to be around €182 million, in

line with the guided range of €180 - €185 million.

In Europe, our Portfolio business grew by 8% year-over-year,

including intentional price reductions of approx. 4%. The

customized solutions business in Europe remained relatively

resilient to market conditions. Our US Portfolio business grew by

10% in 2024, reflecting our successful commercial strategy and

regaining market share, which was made possible through the

strengthening of our sales force in the region. The ECO business

delivered robust growth of 4% year-over-year.

Full year 2024 sales in the US Customized Solutions segment

declined with €13.5 million, where key customers limited their

capital expenditures. In Contract Manufacturing we faced a decline

of €11.4 million due to weak demand in our customers’ end

markets.

Cabka generated €182 million of sales in 2024, a decline of 8%

compared to 2023 (€197 million). Adjusted for the decline and US

Customized Solutions and Contract Manufacturing, we achieved a

healthy underlying growth of 4.5%.

The company's gross margin significantly improved with 3pp to

51.3%. In the second half of 2024, we improved with a further 2pp

compared to the same period last year. Gross margin improvement

started to stabilize towards the end of the year.

Initiatives to enhance operational efficiencies and boost the

sales organization are ongoing. Full realization of these

improvements was not yet fully visible in our year-end EBITDA

margin. We expect EBITDA to be in the range of 11% to 12%, which is

below the guidance of circa 13%.

Due to the challenging market conditions and financial headwinds

experienced throughout 2024, Cabka has thoroughly reassessed its

capital allocation strategy to ensure long-term business

sustainability and growth. Following a comprehensive evaluation

with the Supervisory Board and consultations with major

shareholders, the company has decided not to pay a dividend for the

financial year 2024. This decision underscores our commitment to

maintaining financial stability, strengthening our balance sheet,

and ensuring sufficient cash generation to support ongoing

operational and strategic initiatives. While we acknowledge the

importance of shareholder returns, the current financial climate

necessitates a prudent approach to capital distribution.

The company will issue a comprehensive update on March 18, 2025,

coinciding with the release of its full-year preliminary results

for 2024.

Financial Reporting Calendar 2025

- March

18 Publication of

Preliminary Results 2024

- April 15 Publication

Annual Report 2024 and Trading Update 2025Q1

- May 29 Annual General

Meeting of Shareholders

- August 12 Half-Year Results and Half-Year

Report 2025

- October 21 Trading Update 2025Q3

For more information, please contact:

Nadia Lubbe, Investor & Press contact

IR@cabka.com

+31 6 21 51 54 52

investors.cabka.com

About Cabka

Cabka is in the business of recycling plastics from

post-consumer and post-industrial waste into innovative reusable

transport packaging (RTP), like pallets- and large container

solutions enhancing logistics chain sustainability. ECO products

are mainly construction and road safety products produced

exclusively out of post-consumer waste.

Cabka is leading the industry in its integrated approach closing

the loop from waste, to recycling, to manufacturing. Backed by its

own innovation center it has the rare industry knowledge,

capability, and capacity of making maximum use bringing recycled

plastics back in the production loop at attractive returns. Cabka

is fully equipped to exploit the full value chain from waste to

end-products.

Cabka is listed at Euronext Amsterdam as of 1 March 2022 under

the CABKA ticker with international securities identification

number NL00150000S7.

Disclaimer

The content of this press release may include statements that

are, or may be deemed to be, ‘’forward-looking statements’’. These

forward-looking statements may be identified by the use of

forward-looking terminology, including the terms ‘’believes’’,

‘’estimates’’, ‘’plans’’, ‘’projects’’, ‘’anticipates’’,

‘’expects’’, ‘’intends’’, ‘’may’’, ‘’will’’ or ‘’should’’ or, in

each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. Forward-looking statements may

and often do differ materially from actual results. Any

forward-looking statements reflect the Company’s current view with

respect to future events and are subject to risks relating to

future events and other risks, uncertainties and assumptions

relating to the Company’s business, results of operations,

financial position, liquidity, prospects, growth, or

strategies.

Readers are cautioned that any forward-looking statements are

not guarantees of future performance. Given these

uncertainties, the reader is advised not to place any undue

reliance on such forward-looking statements. These forward-looking

statements speak only as of the date of publication of this press

release. The Company undertakes no obligation to publicly update or

revise the information in this press release, including any

forward-looking statements, except as may be required by law.

This document contains information that

qualifies as inside information within the meaning of Article 7(1)

of Regulation (EU) No 596/2014 on market abuse.

- 20240217 Cabka 2024 Preliminary update_final

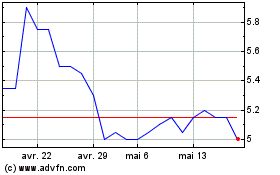

Cabka NV (EU:CABKA)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Cabka NV (EU:CABKA)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025