Hyloris Pharmaceuticals Reports 2023 Half-Year Results and provides

Business Outlook

- Total

revenue and other income nearly doubled (€2,4 million, +95%)

- R&D

progress across the board, including initiation of the 4-arm Phase

2 clinical trial for AlenuraTM, targeting IC/BPS, a condition

affecting at least 6 million U.S. patients

- PDUFA

goal date for Maxigesic® IV set for 17 October 2023 by the U.S.

FDA1

-

Evaluating external product candidates & advancing internal

projects to reach 30 key assets before 2025

- Multiple

NDA2 submissions expected within the next 18 months

-

Analyzing different go-to-market strategies for commercial launch

of a range of cardiovascular product candidates in the U.S.

healthcare market

- Net cash

position of €39,2 million, sufficiently capitalized for all

expected R&D expenditures related to the current product

candidates3

Webcast 7

September at 3PM CET

/ 2PM GMT / 10AM EST

(register here)

Liège, Belgium

– 6 September

2023 - 10PM CET – Regulated

information - Hyloris Pharmaceuticals SA (Euronext

Brussels: HYL), a specialty biopharma company committed to

addressing unmet medical needs through reinventing existing

medications, today reported its condensed consolidated financial

results for the six-month period ending 30 June 2023, along with

recent achievements and a business outlook.

Stijn Van Rompay, Chief Executive Officer of Hyloris,

commented: “Progress on all fronts is what we have

demonstrated during the first half of the year, and what we will

continue to pursue in the future.”

Our unwavering ambition to offer innovative and improved

treatment outcomes starting from existing medicines resulted in

progress for the existing portfolio. R&D progress was marked by

the enrolment of the first patients in a 4-arm Phase 2 clinical

trial of AlenuraTM, a product candidate targeting acute

interstitial cystitis/bladder pain syndrome (IC/BPS). This huge

unmet medical need affects at least 6 million people in the U.S.

alone.”

“Another major expected milestone, only weeks away, is the

potential approval for Maxigesic® IV by the US Food & Drug

Administration. Such an NDA approval would be a rare occurrence for

a Belgian company, and would demonstrate the strength of our

R&D capabilities. Maxigesic® IV, our valueable non-opioid

intravenous pain treatment for use post-operatively in hospitals

has the potential to offer pain relief and reduce the use of

opioids in the U.S. The U.S. is the world’s largest healthcare

market, where Maxigesic® IV can contribute to improving patient’s

lives.”

“Financially, our rigorous focus on costs and cash management

resulted in a healthy balance sheet with no financial debt and a

cash position of close to €40 million. This is a significant

advantage in today’s buyer’s market as we are in advanced

discussions on multiple product candidates, driving innovation for

better patient outcomes.”

COMMERCIAL VALUE DRIVERS

Maxigesic® IV is a novel,

unique combination, intravenous formulation for the treatment of

post-operative pain and is currently licensed to partners covering

over 100 countries across the globe.

The number of countries in which Maxigesic® IV has been approved

has increased to more than 40. So far, launches have occurred in

around 20 countries.

A potential approval date for the US market was set for 17

October 2023 by the U.S. Food & Drug Administration. The U.S.

regulatory body confirmed that it had received a complete response

in relation to the additional data on E&L (extractables and

leachables) it had requested in July 2022.

Maxigesic® IV aims to provide an alternative, non-opioid

treatment option for post-operative pain. In the United States,

chronic opioid usage in patients following surgery averages around

9%, ranging from 4% to 24% among various specialties4. Drug

overdoses involving opioids resulted in over 80.000 deaths in the

U.S. in 20215. Patients who experienced an opioid overdose

accounted for nearly $2 billion in annual hospital costs6.

On the condition of FDA approval, sales of Maxigesic® IV could

start soon, with an exclusive license and distribution agreement

already signed between Hyloris’ partner AFT Pharmaceuticals and

Hikma Pharmaceuticals, a leading supplier of complex, injectable

hospital products in the U.S.

Under the terms of the development collaboration agreement

between Hyloris and AFT, Hyloris is eligible to receive a share on

any product-related revenues, such as license fees, royalties,

milestone payments, received by AFT.

Subject to market approval by the FDA and the first U.S. sales,

Hyloris will be be entitled to to a milestone of approximately $2

million as revenue.

Sotalol IV is a novel, patented, intravenous

formulation of Sotalol for the treatment of atrial fibrillation,

and life-threatening ventricular arrhythmias developed for the US.

Sotalol IV allows to significantly reduce the length of hospital

stay and potentially the overall cost of care potentially improving

patient outcomes.

Hyloris is taking further steps to capture more of the growth

potential in the future. In addition, Hyloris will capture a larger

share of the product sales in the second half of the year as the

royalty percentages are attributed to the Company on a step-up

basis.

COMMERCIAL ROLL-OUT PREPARATION

Out-licensing agreements were signed for Tranexamic Acid RTU in

early 2023, covering an important European country and a major

Southeast Asian country, with a combined population of over 60

million people. Earlier agreements have been signed in 2021 for

Australia, New-Zealand and Canada. Regulatory submissions in the

partnered territories are in progress, and additional out-licensing

agreements are expected going forward.

For product candidates which Hyloris intends to out-license, the

strategic goal is to capture a substantial part of the net product

margin realized by our commercial partners. The Company aims to

achieve this by partnering these assets close to regulatory

submission, except in countries where additional local clinical

trials are required. In general, we will prioritize in-market

product sales or profit-based participation over (upfront)

milestone payments.

Cardiovascular portfolio

Hyloris is actively analyzing different go-to-market strategies

to bring its range of cardiovascular product candidates to the U.S

healthcare market in the most efficient way.

The strategic grouping of submission dates targeted by Hyloris

makes 2025 a pivotal year for the Company, with several launches

anticipated or in in preparation for the U.S. market by that year.

These product candidates will be promoted primarily to

electrophysiologists, and a subset of cardiologists in

hospitals.

Other value-added

product candidates

With a growing portfolio and multiple product candidates

progressing towards commercialization, the Company intends to sign

partnerships with leading companies in their respective

territories.

PIPELINE EXPANSION

The business development team applies its knowledge of

established products and real-world data in the search for

solutions to underserved medical needs. Inhouse knowhow is

supplemented by leveraging dialogues with healthcare professionals,

patient groups, payors and partners as well as our extensive

sourcing network and R&D capabilities. We aim to create value

by expanding our portfolio to 30 assets before 2025, and expect to

accelerate pipeline expansion in the coming months.

In January 2023, Hyloris in-licensed HY-088, a

product candidate targeting hypophosphatemia, a serious condition

causing patients to have low level of phosphate in the blood. While

mild hypophosphatemia is common and many patients are asymptomatic,

severe hypophosphatemia can be life-threatening and requires

medical treatment. Treatment protocols for patients deficient in

phosphate are well-established and have proven useful in other

situations of bone mineral imbalance, but in most countries no

approved oral drugs exist.

By definition, the compounded drugs currently administered to

patients have not been submitted for regulatory scrutiny regarding

safety, efficacy and quality. Hyloris intends to achieve market

access with an approved treatment in European countries.

R&D UPDATE &

OUTLOOK

Swift & steady progress was made in the first half of 2023

to bring 14 repurposed and reformulated product candidates closer

to patients in need, as well as 3 high barrier generics.

Our new and improved R&D lab is now operational at Légiapark

in Liège (Belgium), the life sciences hub where Hyloris moved its

head office at the end of 2022. Expanded R&D facilities and

expertise will allow the Company to perform drug formulation and

analytical activities in-house for its growing pipeline, further

streamlining processes and more effectively deploying internal

resources.

A non-exhaustive list of R&D achievements as well as

selected milestones can be found below.

Cardiovascular portfolio

Progress has been made on all cardiovascular assets in the first

half of 2023.

- For Dofetilide

IV, the results of the pivotal clinical study,

allowing regulatory submission, are expected by the summer of 2024.

Additional U.S. patent applications have been submitted.

Dofetilide IV aims to reduce hospitalization stays and related

risks and costs. Currently, Dofetilide is only available as an oral

capsule, and Dofetilide formulated as an IV could be used as an

initial loading dose with subsequent oral Dofetilide dosing to

reduce the time to reach steady state and hospital discharge.

- Metolazone IV: The

process of manufacturing the final registration batches is

currently in progress, with stability testing expected to be

initiated as soon as October 2023. The pivotal clinical trial is

currently in preparation and an additional U.S. patent application

has been submitted.

Metolazone tablets are used in patients with congestive heart

failure, the most rapidly growing cardiovascular condition globally

and the leading cause of hospitalization. The potential benefits of

Metolazone IV include accelerating onset of action, allowing

simultaneous administration with furosemide IV (the most frequently

used intravenous hospital diuretic), and improving drug absorption

for patients with concomitant gastrointestinal oedema. The

intravenous formulation will also allow drug administration in

patients who are too ill to receive oral medications or who are

unconscious.

- Aspirin IV: The

transfer to a new contract manufacturing organization (CMO),

required following a strategic review, has been successfully

concluded. Discussions with the FDA on the drug development program

are ongoing.

Aspirin IV is an intravenous formulation of acetylsalicylic acid

(aspirin) targeting Acute Coronary Syndrome (ACS). When ACS occurs,

fast diagnosis and treatment is crucial and potentially

lifesaving.

- HY-074: Regulatory

submission for the U.S. market is expected shortly after

submissions related to the other cardiovascular assets mentioned in

this list. For HY-074, Hyloris is exploring additional indications

outside of the cardiovascular space.

HY-074 is an IV formulation of a current standard of care

treatment significantly reducing risk of death in ACS patients.

HY-074 aims to offer faster onset of action, more convenient

administration (more notable in patients who are nauseated or

unconscious) and dosage control.

Other value-added product

candidates

Notable points of progress for our these product candidates are

described below. Other product candidates have advanced in line

with the timelines previously indicated.

- AlenuraTM : At the

start of the summer, the first patients entered a 4-arm study which

is part of an ambitious adaptive phase 2 program. The 4-arm trial

is currently targeting to enroll 120 patients across multiple sites

in the U.S. Each subject will receive a single blinded dose of

Alenura™, placebo, lidocaine, or heparin by random assignment.

AlenuraTM is being developed as a ready-to-use

instillation to be administered intra-vesicularly. The product

candidate targets acute pain flares in patients with IC/BPS, which

affects at least 6 million people in the US alone.

- HY-083: A Phase 1

study was conducted demonstrating no systemic exposure could be

detected following intranasal administration of the molecule using

a nasal spray.

HY-083 targets idiopathic rhinitis, a medical disorder

characterized by a collection of nasal symptoms that resemble nasal

allergies and hay fever (allergic rhinitis) but are not caused by a

known cause like allergens or infectious triggers.

- Tranexamic Acid Oral

Suspension: FDA agreement to proceed with the Phase 3

study was obtained, with the enrolment of the first patient

expected in September 2023.

TXA oral mouth rinse aims to reduce oral bleeding in patients

undergoing dental procedures.

-

Miconazole-Domiphen

Bromide: A full read-out of the Phase 2

dose-finding study can be expected shortly, with the results

guiding the company for the design of the next clinical trial.

Miconazole-DB is a topical synergistic combination treatment for

vulvovaginal candidiasis .

- HY-029: Subject to

a successful outcome of the planned pivotal clinical study,

regulatory filing to the U.S. FDA can be expected by mid-2024.

HY-029 is a liquid formulation of an existing non-disclosed

antiviral drug that is currently only available in oral solid form.

Hyloris aims to improve ease of administration and dosage control,

and thus potentially improving clinical outcome.

The total headcount of the Company grew to slightly over 40

people, with several key recruitments occurring over the summer. To

enhance the development activities, only limited additional hiring

is required.

With a net cash position of €39,2 million and assuming continued

strategic out-licensing, commercial success for Maxigesic® IV and

Sotalol IV, additional non-dilutive funding and milestone payments,

the Company believes it is sufficiently capitalized to fund all

expected R&D expenditures of the current product candidates (14

product candidates & 3 generics)

FINANCIAL HIGHLIGHTS AND

RESULTS OF OPERATIONS

| |

Period ended 30 June |

|

|

(in € thousands) |

2023 |

2022 |

Variance |

|

Total revenue and other income |

2,391 |

1,229 |

95% |

|

Revenues |

1,160 |

1,033 |

12% |

|

Other income |

1,231 |

196 |

528% |

|

Cost of sales |

(46) |

(61) |

(25%) |

|

Operating expenses |

(9,361) |

(5,986) |

56% |

|

Research and development expenses |

(6,871) |

(4,712) |

46% |

|

General and administration expenses |

(2,490) |

(1,274) |

95% |

|

Operating result |

(7,100) |

(4,876) |

46% |

|

Net financial result |

466 |

(66) |

(806%) |

|

Net result |

(6,634) |

(4,942) |

34% |

|

Net operating cashflow |

(4,129) |

(6,401) |

-35% |

|

Cash and cash equivalents |

39,159 |

57,687 |

-32% |

Total Revenue and Other

Income

During the first six months of 2023, total

revenue and other income increased to €2,391 thousand compared to

€1,229 thousand in the first half year of 2022, which is

approximately 95% higher compared to last year. The strong growth

is mainly driven by increase of royalties, out-licensing income for

Maxigesic IV and non-dilutive funding which we received from a US

State Government and the Walloon region in Belgium.

Results The Company

realized a net loss of €6,634 thousand for the six-month period

ending 30 June 2023, compared to a net loss of €4,942 thousand for

the first half year of 2022. In the first half of this year,

the net loss is mainly resulting from the increase in R&D

expenditure and G&A expenses R&D expenditure during

the first six months of 2023 amounted to €6,871 thousand, compared

to €4,712 thousand for the same period of 2022. The increase was

mainly driven by intensified activities to progress product

candidates through the drug development stages.

General and administrative expenses increased to

€2,490 thousand in the first half-year of 2023 versus €1,274

thousand in 2022, primarily driven by the enlargement of the

Group’s structure, additional recruitments, increased IP costs and

higher legal costs compared to last year.

The net financial income in the first six months

of 2023 was €466 thousand compared to a net financial loss of €66

thousand in the same period of 2022. The positive evolution of the

financial result is mainly due to the impact of an active cash

management strategy in a context of high short term interest rates

both in EURO and USD.

As a result, net losses in the first-half year

of 2023 increased to €6,634 thousand versus €4,942 thousand in the

same period of 2022.

Balance Sheet

Compared to the end of 2022, the Group is free

of debt. The increase in right-of-use assets and borrowings is due

to the start of the lease agreement related to the new inhouse

R&D lab. The Company received an advance payment related to a

government grant from the Walloon region, supporting the drug

development of the product candidate HY-083. €43 thousand of this

advance is a financial liability and €37 thousand is part of Trade

and other liabilities.

Cash Position and cash

flow The Company maintains its strong cash position,

with current cash and cash equivalents totaling €39,159 thousand on

30 June 2023, compared to €43,457 thousand on 31 December 2022.

Net cash outflow generated from operating

activities was €4,158 thousand during the first six months of 2023,

compared to a net operating cash outflow of €6,401 thousand in the

same period of 2022. The decrease of 35% in the operating cash

outflow is the result of revenue growth and good working capital

management.CONSOLIDATED STATEMENT OF FINANCIAL POSITION FOR

THE FIRST HALF-YEAR OF 2023

|

ASSETS (in €

thousands) |

30-Jun-23 |

31-Dec-22 |

|

| |

|

Non-current assets |

12,258 |

11,063 |

|

|

Intangible assets |

3,785 |

3,607 |

|

|

Property, plant and equipment |

275 |

176 |

|

|

Right-of-use assets |

1,667 |

885 |

|

|

Equity accounted investments |

3,863 |

3,948 |

|

|

Other investment, including derivatives |

1,000 |

1,000 |

|

|

Trade and other receivables |

1,667 |

1,447 |

|

|

Current assets |

45,015 |

50,801 |

|

|

Trade and other receivables (current) |

4,541 |

5,127 |

|

|

Other investment, including derivatives (Current) |

489 |

469 |

|

|

Prepayments |

826 |

1,748 |

|

|

Cash and cash equivalents |

39,159 |

43,457 |

|

|

TOTAL ASSETS |

57,273 |

61,863 |

|

| |

|

|

|

|

EQUITY AND LIABILITIES (in €

thousands) |

30-Jun-23 |

31-Dec-22 |

|

| |

|

|

|

|

|

|

Equity attributable to owners of the

parent |

48,723 |

55,045 |

|

|

Share capital |

140 |

140 |

|

|

Share premium |

121,513 |

121,513 |

|

|

Retained earnings |

(64,246) |

(53,476) |

|

|

Result of the period |

(6,634) |

(10,770) |

|

|

Share based payment |

1,934 |

1,622 |

|

|

Cost of Capital |

(4,460) |

(4,460) |

|

|

Other reserves |

476 |

476 |

|

|

Total equity |

48,723 |

55,045 |

|

|

Non-current liabilities |

1,822 |

1,047 |

|

|

Borrowings |

1,478 |

747 |

|

|

Other financial liabilities |

344 |

300 |

|

| Current

liabilities |

6,728 |

5,772 |

|

|

Borrowings (current) |

195 |

138 |

|

|

Other financial liabilities (current) |

3,200 |

3,212 |

|

|

Trade and other liabilities |

3,332 |

2,422 |

|

| Total

liabilities |

8,550 |

6,819 |

|

|

TOTAL EQUITY AND LIABILITIES |

57,273 |

61,863 |

|

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

AND OTHER COMPREHENSIVE INCOME FOR THE FIRST HALF-YEAR OF

2023

|

in € thousands |

30-Jun-23 |

30-Jun-22 |

|

Revenue |

1,160 |

1,033 |

|

Cost of sales |

(46) |

(61) |

|

Gross profit |

1,114 |

973 |

|

Research and development expenses |

(6,871) |

(4,712) |

|

Selling, general and administrative expenses |

(2,490) |

(1,274) |

|

Share of result of equity-accounted investees |

(85) |

(58) |

|

Other operating income |

1,231 |

196 |

|

Operating profit/(loss) (EBIT) |

(7,100) |

(4,876) |

|

Financial income |

566 |

55 |

|

Financial expenses |

(100) |

(621) |

|

Profit/(loss) before taxes |

(6,634) |

(4,942) |

|

PROFIT/(LOSS) FOR THE PERIOD |

(6,634) |

(11.579) |

Detailed financial statements as well as the financial

notes can be found on the Company website.

AUDIT REPORT

The statutory auditor, KPMG Bedrijfsrevisoren -

Réviseurs d’Entreprises, represented by Olivier Declercq, has

confirmed that the audit procedures, which have been substantially

completed, have not revealed any material misstatement in the

accounting information included in the Company’s annual

announcement.

WEBCAST DETAILS

The Company will host a webcast conducted in English to present

its 2023 Half-Year results and Business Outlook, followed by a live

Q&A session. The webcast will start on September 7th at 3PM CET

/ 2PM GMT / 10 AM EST. To join the webcast, please register at

Hyloris.com/webcast

EXPECTED FINANCIAL CALENDAR

|

14 March 2024 |

Annual Results

2023 |

|

25 April 2024 |

Annual Report 2023 |

|

4 June 2024 |

Annual General Meeting of Shareholders |

UPCOMING EVENTS

Hyloris regularly takes part in events to interact with

investors, partners and other stakeholders. We look forward to

meeting you on one of the following occasions, and will be adding

new events to our website under events &

presentations.

|

Date |

Location |

Event |

|

27-29 September 2023 |

Munich, Germany |

Biotech On Tap 2023 |

|

5 October 2023 |

Paris, France |

Investor Day |

|

9 October 2023 |

Antwerp, Belgium |

De Belegger On Tour |

|

24-25 October 2023 |

Barcelona, Spain |

CPHI |

|

6-8 November 2023 |

Munich, Germany |

BIO-Europe |

|

14-16 November 2023 |

London, U.K. |

Jefferies Healthcare Conference |

|

23 November 2023 |

Paris, France |

Belgian Day in Paris (Degroof Petercam) |

|

8-11 January 2024 |

San Francisco, U.S. |

JP Morgan Healthcare Conference |

About HylorisHyloris is a specialty biopharma

company focused on innovating, reinventing, and optimizing existing

medications to address important healthcare needs and deliver

relevant improvements for patients, healthcare professionals and

payors. Hyloris has built a broad, patented portfolio of 16

reformulated and repurposed value-added medicines that have the

potential to offer significant advantages over available

alternatives. Outside of its core strategic focus, the Company also

has 3 high barrier generic products in development. Two products

are currently in initial phases of commercialization with partners:

Sotalol IV for the treatment of atrial fibrillation, and

Maxigesic®® IV, a non-opioid post-operative pain treatment. The

Company’s development strategy primarily focuses on the FDA’s

505(b)2 regulatory pathway, which is specifically designed for

pharmaceuticals for which safety and efficacy of the molecule have

already been established. This pathway can reduce the clinical

burden required to bring a product to market, and significantly

shorten the development timelines and reduce costs and risks.

Hyloris is based in Liège, Belgium. For more information,

visit www.hyloris.com and follow-us on LinkedIn.

For more information, contact

Hyloris:Stijn Van Rompay,

CEOstijn.vanrompay@hyloris.com+32 (0)4 346 02 07Jean-Luc

Vandebroek, CFOjean-luc.vandebroek@hyloris.com+32 (0)478 27 68

42Sven Watthy, Investor Relations & Communications

managersven.watthy@hyloris.com+32 (0)499 71 15 29Disclaimer

and forward-looking statementsHyloris means “high yield,

lower risk”, which relates to the 505(b)(2) regulatory pathway for

product approval on which the Company focuses, but in no way

relates or applies to an investment in the Shares. Certain

statements in this press release are “forward-looking statements.”

These forward-looking statements can be identified using

forward-looking terminology, including the words "believes",

"estimates," "anticipates", "expects", "intends", "may", "will",

"plans", "continue", "ongoing", "potential", "predict", "project",

"target", "seek" or "should", and include statements the Company

makes concerning the intended results of its strategy. These

statements relate to future events or the Company’s future

financial performance and involve known and unknown risks,

uncertainties, and other factors, many of which are beyond the

Company’s control, that may cause the actual results, levels of

activity, performance or achievements of the Company or its

industry to be materially different from those expressed or implied

by any forward-looking statements. The Company undertakes no

obligation to publicly update or revise forward-looking statements,

except as may be required by law.

1 The Prescription Drug User Fee Act (PDUFA) date is the date by

which the U.S. FDA expects to complete the review process for 90%

of submitted drug applications. It is a potential approval date

after which a drug product candidate could be commercialized in the

U.S. healthcare market.2 NDA: New Drug Application3 Assuming

continued strategic out-licensing, commercial success for

Maxigesic® IV and Sotalol IV, additional non-dilutive funding and

milestone payments.4 https://pubmed.ncbi.nlm.nih.gov/27163960/5

Data Overview | Opioids | CDC6 Premier | Opioid Overdoses Costing

U.S. Hospitals an Estimated $11… (premierinc.com)

- PR H1 2023 results FINAL ENG

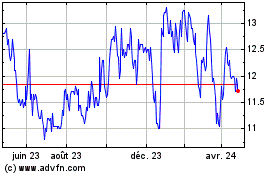

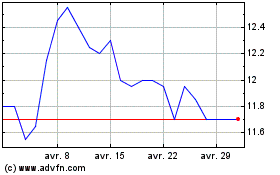

Hyloris Pharmaceuticals (EU:HYL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Hyloris Pharmaceuticals (EU:HYL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024