Blue Solutions: 2019 Results

| 2019

Results |

March 12, 2020 |

Project of a simplified alternative tender offer for Blue

Solutions, followed by mandatory de-listing

The Board of Directors of Blue Solutions, which

met on March 12, 2020, approved the 2019 financial statements.

Blue Solutions' 2019 revenue fell by €12 million

(-31% compared to 2018), due to the loss of a €12.5 million royalty

revenue from Bolloré in respect of a research agreement which came

to an end. The drop in revenue is in line with forecasts pending

the start of new productions. As anticipated, the transformation of

production plants in Canada and Brittany is ramping up to

manufacture the new generation of batteries as of 2020, offering

higher performances and lower production costs.

Adjusted operating income

(EBITA) decreased by €11 million, due primarily to lower

revenue and the discontinuation of the Supercapacitors

business.

Consolidated net income was a

loss of €43 million (vs. a loss of €33 million in 2018).

Net debt amounted to €91

million, including a €34 million return to better fortune clause in

favor of Bolloré.

Simplified alternative tender offer for

Blue Solutions, followed by mandatory de-listing:

- Blue Solutions, which had an initial public offering (IPO) in

2013 at €14.50 was the subject of a simplified tender offer in

2017, because of longer development times, at €17. Bolloré had

committed to making a new tender in 2020 at the same price if the

Blue Solution share price were to remain under 17€;

- Blue Solutions share capital today is split between Bolloré

(77.9%), Bolloré Participations (17.6%)—which had subscribed to the

initial equity at the request of EDF and for the same amount—and

the public (4.5%);

- As part of Blue Solutions’ strategic repositioning in buses and

stationary, and for reasons of economies and simplification (cost

of a listed company, tax consolidation, etc.), today Bolloré has

announced that would like in this tender offer to withdraw Blue

Solutions from trading and offer those shareholders who would like

to remain associated with the Group an alternative in Bolloré

shares in exchange for the tender offer price of €17.00. The

proposed parity would be 4.5 Bolloré shares for one share of Blue

Solutions;

- Based on Blue Solutions' business plan, the recent contracts

signed with Daimler and RTE, in particular, are expected to bring

revenue up from €26 million in 2019 to €70 million in 2020 and to

over €150 million starting in 2021, with an EBITDA that should turn

positive in 2021;

- The first work done by the banks appointed by Bolloré based on

this plan give a valuation of Blue Solutions of €14 per share. The

tender offer at €17 means a premium of over 20%. The planned parity

of 4.5 Bolloré shares for one share of Blue Solutions represents

the average share price of Bolloré over the last six months as of

March 2, 2020. In view of the recent stock markets evolution, this

parity may evolve;

- The Blue Solutions Board of Directors has appointed an

independent expert to examine the financial terms of the offer, on

the basis of Article 261-1, I. 1. and II. of the AMF General

Regulation (Autorité des Marchés Financiers), the firm BM&A,

represented by Mr Pierre Béal (p.beal@bma-groupe.com / +33 1 40 08

99 50). The Bolloré Board of Directors has also appointed an ad hoc

expert charged with examining the financial terms of the

contribution of Bolloré Participations to the exchange option of

the offer;

- In total, this deal would represent a maximum amount of €110

million if all the shareholders chose to be paid in cash and 29

million Bolloré shares (or less than 1% of the Bolloré share

capital) if all opted for payment in shares. Bolloré Participations

wishes to remain associated and has indicated that it will consider

tendering for shares;

- Detailed information on the values and outlook of Blue

Solutions will appear in the documentation of the tender

offer.

The provisional timetable is as

follows:

- By May 2020: filing of the tender offer by Bolloré

- Sometime in May 2020: the conclusion reached by the Blue

Solutions Board of Directors about the offer based on report of the

firm BM&A, the independent expert

- End of May 2020: compliance ruling by the AMF

- May 27, 2020: Bolloré General Shareholders' Meeting authorizing

the share capital increase as remuneration for the exchange option

in the offer

- June 2020: Execution of the offer and mandatory de-listing of

Blue Solutions

On the basis of the valuation work carried out

by Thierry Bergeras, an expert appointed by the Paris Commercial

Court, the Board of Directors meeting on March 12, 2020, on the

recommendation of the Chief Executive Officer, decided

[unanimously] not to exercise any of the seven call options

regarding the assets of the Bolloré Group, of which Blue Solutions

was the beneficiary.

This decision follows most notably the

termination of the Autolib' service, which raised a strategic

thought process on the production activities of electric cars

(Bluecar) and car-sharing operations (Bluecarsharing). As a result

of these considerations, the Group has ceased the production of

electric cars (the management lease contract for the Bairo plant

concluded with Pininfarina having expired December 31, 2019) and

has also announced the cessation of certain car-sharing activities,

with various new directions now being considered for the remaining

car-sharing activities.

Blue Solutions will focus on the commercial

development and production of batteries dedicated to electric bus

markets and energy storage solutions.

A new industrial strategy to ensure its

business development in markets with high growth

potential:

§ Blue Solutions is becoming an

industrial pure player specialized in the design and production of

“completely solid” cells and batteries.

This new strategy has already made it possible

to roll out partnerships with major international groups which have

chosen to integrate the only technology able to ensure that

batteries meet safety (no thermal runaway), robustness

(insensitivity to temperature) and environmental footprint

(phosphate without nickel or cobalt) requirements.

A pioneer in solid state batteries, Blue

Solutions is now the only player able to roll out this proven

technology on a large scale thanks to its feedback dating back

almost 10 years.

- Blue Solutions continues to focus its investments on boosting

its production capacities and R&D:

- Considerable investments in production capacities in Brittany

and Quebec will support the expected growth in coming years;

- Sustained R&D efforts give it a major competitive edge in

the future generation of “completely solid” batteries. Blue

Solutions favors three major focus areas for its technology

roadmap: lower operating temperature, higher energy density and

recycling of materials indispensable to ensure respect for the

environment.

- By developing its expertise in LMP® batteries, Blue Solutions

is positioned on high-growth markets.

- Developing environmental-friendly urban public

transport networks is a priority for public policies and

conurbations worldwide.

Therefore, Blue Solutions, by constantly

evolving its LMP® technology, has considerable resources to become

a major player in this transformation. The partnerships forged in

2019 with leading international companies confirm the superiority

of the “completely solid” LMP® technology such as:

- RATP, global urban mobility leader: the buses manufactured by

Bluebus run on the first fully electric bus lanes in Paris. Blue

Solutions has supported RATP's transition to carbon neutrality

since 2017;

- EVOBUS (DAIMLER), The Evobus GmbH part of the DAIMLER Group

expressed its interest in an exclusive right at the European level

to integrate the LMP® batteries in its eCitaro buses. The first

eCitaro buses equipped with LMP® batteries will be delivered in

2020, confirming the relevance of this strategic choice;

- GAUSSIN, designer of innovative industrial vehicles in

transportation and logistics, selected LMP® technology for its

electric terminal tractors sold globally with initial success in

New Zealand and Qatar;

- ACTIA, integrator of solutions and applications: this

longstanding partner of Blue Solutions acquired expertise in the

integration of LMP® batteries in the mobility field. It will be one

of the first integrators to offer LMP® technology to its

international customers in 16 countries.

- Energy storage has become essential for the management

and intelligent regulation of electricity flows and the injection

of renewable energy into the network. Local and

international policies promote the development of renewables.

- RTE, global leader in managing electricity networks: In 2019,

Blue Storage signed a framework contract with RTE for the provision

of a battery-based storage system on the Ventavon site, as part of

the RINGO project. With over 30 MWh installed, this 28-month

project will result in one of the largest storage systems in France

and in Europe.

Blue Solutions has positioned itself as a

favored partner for carbon-free storage and transportation players.

Ongoing sales agreements mentioned above back up this new strategic

approach. Being the only player to manage the completely

solid LMP® battery technology will guarantee its growth.

********

|

Blue Solutions consolidated results |

|

(in millions of euros) |

12/31/2019 |

12/31/2018 |

Change |

|

Revenue |

26 |

38 |

-31% |

|

EBITDA (1) |

(24) |

(14) |

NA |

|

Adjusted operating income (EBITA) (1) |

(42) |

(30) |

NA |

| Financial

income |

(1) |

(2) |

NA |

| Net

income |

(43) |

(33) |

NA |

|

Net income, Group share |

(43) |

(33) |

NA |

|

|

12/31/2019 |

12/31/2018 |

Change

(€ m) |

|

Shareholders’ equity, Group share |

44 |

88 |

(43) |

| net

debt |

91 |

46 |

44 |

|

Gearing (%) (2) |

204% |

53% |

|

- See Glossary.

- Gearing = net financial debt/equity ratio ‐ see Glossary.

The audit of the 2019 consolidated financial

statements has been completed, and the certification report will be

issued after review of the management report.

Glossary

- Organic growth: at constant scope and exchange

rate

- Adjusted operating income

(EBITA): corresponds to operating income

before amortization of intangible assets related to business

combinations (PPA, Purchase Price Allocation), goodwill impairment

and other intangible assets related to business combinations.

- EBITDA: earnings before interest, taxes,

depreciation, and amortization.

- Net financial debt / Net cash

position: sum of borrowings at amortized cost,

less cash and cash equivalents, cash management financial assets

and net derivative financial instruments (assets or liabilities)

with an underlying net financial indebtedness, as well as cash

deposits backed by borrowings.

The non‐GAAP measures defined above should be

considered in addition to, and not as a substitute for other GAAP

measures of operating and financial performance, and Blue Solutions

considers these to be relevant indicators of the Group's

operational and financial performance. Furthermore, it should be

noted that other companies may define and calculate these

indicators differently. It is therefore possible that the

indicators used by Blue Solutions cannot be directly compared with

those of other companies.

The percentages changes indicated in this

document are calculated in relation to the same period of the

preceding fiscal year, unless otherwise stated. Due to rounding in

this presentation, the sum of some data may not correspond exactly

to the calculated total and the percentage may not correspond to

the calculated variation.

DISCLAIMER

This press release is for information purposes

only. It does not constitute a sales offer, or a

solicitation/invitation to purchase or subscribe for securities,

nor is it a solicitation of any vote in connection with the

transaction or any other matter in any jurisdiction.

The supporting documents attached to the tender

offer, which will include, once it is filed, the terms and

conditions governing the tender offer, will be submitted to the

French Autorité des marchés financiers (AMF) for approval.

Investors and shareholders are strongly encouraged to read said

documents as soon as they become available, as well as any

amendment or additions thereto, it being specified that these

documents will include material information on Bolloré, Blue

Solutions and the envisaged transaction.

This press release must not be published,

released or distributed, directly or indirectly, in any country in

which the release of such information is subject to legal

restrictions.

The release or distribution of this press

release in certain countries may be subject to legal or regulatory

restrictions. Accordingly, people located in countries where this

press release is published, released or distributed should inform

themselves about, and observe, such restrictions. Bolloré accepts

no responsibility with regard to any potential violation of these

restrictions by any person whatsoever.

- 2020 03 12_CP Blue Solutions FY 2019-UK

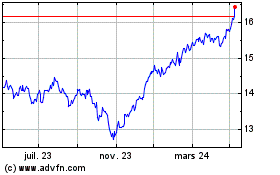

BNP Paribas Easy ECPI Gl... (EU:BLUE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

BNP Paribas Easy ECPI Gl... (EU:BLUE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024