Regulatory News:

NHOA Group (NHOA.PA, formerly Engie EPS) is pleased to release

the Full Year 2023 Results and the Q4 2023 Trading and Operational

Update.

At Group level all targets and expectations have been

achieved:

- Revenues amount to €273 million, up +65% year-on-year

- 2023 EBITDA at Group level, excluding the Atlante perimeter,

reached breakeven and stands at €3.8 million

Guidance and targets have been met also at the business unit

level:

- NHOA Energy:

- Revenues at €205 million, up 33%, despite a 20%+ industry-wide

drop in system prices deriving from a welcome rapid degression in

battery prices

- Positive EBITDA of €7.5 million, +268% compared to FY 2022

- c. 850MWh of Projects online and over 1GWh of projects under

construction, totaling c. 1.9GWh

- Pipeline stable at over €1 billion

- Free2move eSolutions, the joint-venture between NHOA

Group and Stellantis:

- Revenues of c. €65 million, as to say +467% compared to Full

Year 2022

- Over 19,000 residential EV charging devices sold in Europe

- c. 3,000 EV chargers sold in USA, of which c. 2,300 to

Stellantis dealers

- c. $24 million backlog of orders

- Atlante:

- Over 3,600 Points of Charge online and under construction, of

which over 1,800 already online and serving customers on a daily

basis

- Over 4,400 new sites in pipeline

- Utilization Rate, c. 2.2% in 2023 for Italy, France and

Spain

- Occupancy Rate, c. 21.5% in 2023 for Portugal

“NHOA Group achieved record results in this 2023, with over €270

million Revenues and reaching breakeven for the first time with

€3.8 million EBITDA at Group level, excluding the Atlante

perimeter.

NHOA Energy commissioned landmark projects such as over 300MWh

in Taiwan, 200MWh in Western Australia and 100MWh in mainland

China, thus reaching over 800MWh of online capacity with another

1GWh+ under construction.

Free2move eSolutions achieved €65 million Revenues, definitely

sealing its growth potential in the second half of 2023 and marking

a +58% compared to sales at September 30. Wallbox penetration in

Europe reached 13% in the fourth quarter, compared to 3% of the

first half. Around 2,300 fastchargers were delivered in the USA to

Stellantis dealers’ network to support the electrification

path.

Atlante closed 2023 with over 3,600 EV charging points of which

more than 1,800 already online and serving customers, among them c.

90 on French highways and the iconic station in CityLife – Milan”,

commented Carlalberto Guglielminotti, CEO of NHOA Group.

Full Year 2023 Key

Figures

Revenues and Other Income as of 31 December 2023 amount

to €273 million, up 65% compared to FY 2022.

Increase in Revenues and Other Income is mainly driven by the

€205 million realized by NHOA Energy with projects in Taiwan and

Australia, including the 311MWh HePing Big Battery and the 400MWh+

Blyth project representing the main contributors to FY 2023

revenues.

Free2move eSolutions contributes for c. €65 million to the

Group’s consolidated Revenues and other income, of which €54+

million coming from the new US company Free2move eSolutions US.

Atlante closed FY 2023 with Revenues and other income of €3.7

million.

The 20.2% Gross Margin is mainly driven by revenue mix,

where NHOA Energy’s turnkey contracting business model weights

heavier than the e-Mobility (Free2move eSolutions) and EV

Fastcharging Network (Atlante) business units, however, growing

volumes of Free2move eSolutions and Atlante are positively

impacting and progressively improving total Gross margin.

Backlog of NHOA Energy totals €205 million, mainly

related to 800+MWh projects across Australia and EMEA. While this

nominally represents a 32% decrease compared to FY 2022 Backlog,

two important factors should be considered: i) the 20%+

industry-wide decrease in system prices, while beneficial for the

energy storage market, is too recent to generate a material

positive volume impact on Backlog, and so offset the immediate

negative impact via lower unit prices; ii) the different portfolio

mix, where related-party contracts (such as HePing Big Battery),

represented 44% of FY 2022 Backlog, while FY 2023 Backlog is

entirely backed by contracts with third parties (that increased by

22% in twelve months), determining the achievement of complete

commercial non reliance on related-parties business.

The Pipeline of NHOA Energy stands above €1 billion, +6%

year-on-year, across Australia, Asia, North and Latin America,

Europe. NHOA Energy is currently shortlisted in four project

opportunities.

Personnel costs reached €46.4 million, increasing more

than 51% compared to FY 2022, mainly due to the increase in

headcount. As of 31 December 2023, NHOA Group can count on 542

people compared to 451 in FY 2022. The strengthening of the

workforce is mainly due to the consolidation of Atlante in four

countries and to NHOA Energy’s global growth and is in line with

NHOA Group’s roadmap and Masterplan10x.

Capital investments increased to €100.5 million, largely

comprised of investments in the roll-out of the Atlante

network.

R&D investments amounted to €11.3 million,

representing approximately 4% of the consolidated Revenues.

Other Operating Expenses increased by c. 33%, amounting

to €23.2 million, compared to €17.4 million in FY 2022, expressing

an organic growth of every Business Unit of the Group.

EBITDA at Group level, excluding Atlante, turned

positive, standing at €3.8 million. Free2move eSolutions exceeded

the breakeven point, posting a positive EBITDA of c. €5.1 million

with strong contribution coming from the US Market. NHOA Energy

more than tripled its EBITDA to €7.5 million, falling perfectly in

the middle of the guidance range. At Group level, including

Atlante, EBITDA stands at -€14.4 million in FY 2023, highlighting a

significant improvement compared to -€32.9 million of FY 2022.

Non recurring expenses and Incentive Plan account for

€4.5 million and €3.7 million, respectively; the first one is

mainly due to expenses related to the European Commission grant

under the Connecting Europe Facility (CEF) program application

support, the opening of the new legal entities in new countries and

extraordinary and M&A activities, while the second is mainly

related to the accrual as per IFRS 2 of the cost of the Long Term

Incentive Plan approved by the Board of Directors in 2022.

EBIT and Net Result as of 31 December 2023 stand,

respectively, at -€35.4 million and -€46.1 million, compared to

-€50.4 million and -€52.2 million of the previous year.

Net Financial Position significantly increased to €100.6

million as at 31 December 2023 compared to €4.2 million as at 31

December 2022, mainly due to the successful completion of the

equity capital increase through the Fall 2023 rights issue

offering. The cash position as of 31 December 2023, represented by

liquid assets, amounted to €238.9 million compared to €47.4 million

at the end of the previous year.

Full Year 2023 Results by Business

Unit

ACTUAL

Information by operating

segment

(amounts in k Euro)

Energy

Storage

e-Mobility

Atlante

Corporate

Total

Revenues

204.492

64.454

3.234

0

272.180

Other Income including non recurring

443

226

492

6

1.166

TOTAL REVENUES AND OTHER INCOME

204.935

64.679

3.726

6

273.346

Cost of goods sold

(174.915)

(41.266)

(1.966)

4

(218.143)

GROSS MARGIN FROM SALES

30.020

23.413

1.760

10

55.203

% on Revenues and other income

14,6%

36,2%

47,2%

170,7%

20,2%

Personnel costs

(17.363)

(12.028)

(11.968)

(5.046)

(46.404)

Other operating expenses

(5.177)

(6.314)

(7.991)

(3.669)

(23.151)

EBITDA

7.481

5.070

(18.199)

(8.705)

(14.352)

Amortization and depreciation

(4.817)

(2.889)

(2.913)

(521)

(11.141)

Impairment and write down

(426)

(1.283)

0

0

(1.710)

Management Fees

(1.555)

(66)

(1.122)

2.743

(0)

Stock options and Incentive plans

(2.099)

0

(531)

(1.079)

(3.709)

EBIT excluding non-recurring items

(1.418)

832

(22.765)

(7.561)

(30.913)

Non recurring expenses and Integration

costs

(279)

(573)

(3.036)

(601)

(4.489)

EBIT

(1.697)

258

(25.802)

(8.162)

(35.402)

Net financial income and expenses

(2.718)

(1.925)

(2.244)

864

(6.023)

Income Taxes

117

(4.859)

98

(4)

(4.647)

NET INCOME (LOSS)

(4.297)

(6.525)

(27.947)

(7.302)

(46.071)

NHOA Energy

NHOA Energy, NHOA Group’s business unit dedicated to energy

storage, tripled its EBITDA, with €7.5 million of EBITDA realized

over €205 million of revenues and other income, despite the

continuous expansion of its headcount (+36% in 2023) in order to

enhance the global origination and execution in line with its

ambitions.

Revenues and Other Income grew by +33% year-on-year, with

eight projects commissioned in 2023, bringing capacity in operation

to over 800MWh. Among such projects are world-class undertaking

like the HePing Big Battery project (311MWh) in Taiwan, the Yingde

project (107MWh) in mainland China and the Kwinana project (200MWh)

in Western Australia.

Backlog for NHOA Energy totalizes €205 million. While

this nominally represents a 32% decrease compared to FY 2022

Backlog, two important factors should be considered: i) the 20%+

industry-wide decrease in system prices, beneficial for prospective

volumes but too recent to offset the impact on unit prices on the

Backlog figure; ii) the different portfolio mix, where

related-party contracts (such as HePing Big Battery), represented

44% of FY 2022 Backlog, while FY 2023 Backlog is entirely backed by

contracts with third parties such as Neoen and EKU Energy (a 22%

increase in twelve months), determining the achievement of complete

commercial non reliance on related-parties business.

Pipeline for NHOA Energy remains stable at over €1

billion, despite the above-mentioned industry-wide decrease in

system prices. The company is currently shortlisted in 4 project

tenders.

Gross Margin stands at 14.6%, representing a

relatively substantial increase compared to 9.1% of the FY

2022.

NHOA Energy confirms EBITDA positive, at €7.5 million in

2023, while continuing its geographical expansion and talent

acquisition investments. NHOA Energy has focused on expanding its

footprint in its key regions and has established three new

subsidiary companies in Taiwan, the UK, and Spain. This move aims

to enhance its engagement with the local markets, as evidenced by

its latest contracts in the UK and Europe.

EBIT stands at -€1.7 million, improving from -€3.7

million of FY 2022. Net Result equals -€4.3 million.

Free2move eSolutions

Free2move eSolutions, NHOA Group’s business unit dedicated to

e-mobility products and services in joint venture with Stellantis,

had a very positive 2023.

Free2move eSolutions Revenues and Other Income, indeed,

reached €64.7 million, up +467% compared to the end of 2022, mainly

due to the successful electrification of Stellantis dealers in

North America.

In Europe the acceleration of EV domestic chargers penetration

rate within the Stellantis portfolio of electric vehicles increased

from 3% in H1 to 13% in Q4, whereas in the United States Free2move

eSolutions successfully provided comprehensive support to

Stellantis dealers in the deployment of Fast Charging solutions,

totaling c. 2,300 units in 2023.

Gross Margin of the period stands at 36,2%, with a

favorable mix from Free2move eSolutions US.

EBITDA exceeded €5 million thanks to the strong

performance especially in the US market. EBIT reached

breakeven as well, with a positive value of €0.3 million, while

Net Result is at -€6.5 million, mainly due to financing

costs and US income taxes.

Atlante

Atlante, NHOA Group’s business unit dedicated to EV fast and

ultra-fast charging network, is making significant progress toward

its 2025 targets. Currently, it has 3,651 points of charge

(“PoC”) online and under construction, as to say over 600

points of charge more than the released guidance, and a pipeline of

4,400 additional sites. In 2023 Atlante has been selected once more

by the European Union under CEF 2 Transport, after the €23 million

award of 2022, with the award of a €49.9 million grant for the

deployment of over 1,800 fast and ultra-fast points of charge.

Atlante will also benefit from the financial support of France’s

Groupe Caisse des Dépôts, which will provide additional funding for

approximately €20 million.

Atlante in 2023 inaugurated its landmark station at CityLife,

Milan, co-branded with BMW and MINI and in partnership with

Mastercard, to offer in this station and many others easy and

straightforward ways of payment to EV drivers, and inaugurated its

largest station to date, the e-mobility hub at To Dream, the new

innovative urban district in Turin, with more than 130 fast and

ultra-fast points of charge. Atlante was also awarded with 52 PoC

to be deployed in Ancona, and 87 fastcharging points to be

installed on French highways for Vinci Autoroutes. The latter were

installed on four service areas and opened up just before the end

of the year, in time to serve customers over the busy winter

holiday season. In 2023 was also signed the partnerships with

Groupe Duval in France for the installation of more than 180 fast

and ultra-fast charging points across the country and the one with

Avanza Food in Spain. In Portugal, after closing the announced

acquisition of a majority stake in Kilometer Low Cost S.A.

(“KLC”), Atlante fully integrated the existing business and

then proceeded to install and bring online 188 fastchargers, the

largest number to be installed in 2023 in the country by any

Charging Point Operator.

During 2023 Atlante unveiled the exclusive design of Atlante’s

charging station design, in partnership with Bertone Design (New

Crazy Colors), one of the world’s most renowned design,

architectural planning and all-around creativity companies. The

team also continued the development of its proprietary energy

management system, leveraging on the 15 years of know-how developed

by NHOA.

Revenues and Other Income for 2023 amount to €3.7

million.

EBITDA of -€18.2 still reflects the start-up phase of the

company and its investments in terms of people, technology and

tools required to build up the development platform, coherent with

Atlante’s ambitious targets.

EBIT stands at -€25.8 million and Net Result

stands respectively at -€27.9 million.

Q4 2023 Trading and Operational

Update

2022

2023

Q4 2023 TRADING AND

OPERATIONAL UPDATE

Notes

Data in

FY 2022

Q3 2023

as of 30

Sept

FY 2023

Q4

3-month

period

Var%

vs

FY

2022

Var% vs

30 Sept 2023

Consolidated Sales[1]

€m

165,7

194,5

273,3

78,8

+65%

+41%

Cash and Deposits

€m

286,4

238,8

of which delta Net Working

Capital

(1)

€m

(34,5)

Cash Collateralized

€m

60,5

44,7

Indebtedness

€m

(149,0)

(149,1)

Net Cash

(2)

€m

197,9

134,4

Consolidated Cash and Credit Lines

available

(3)

€m

74,7

433,0

397,1[2]

-8%

of which cash and credit lines

available for drawdown

€m

309,7

251,7

of which guarantees’ dedicated

credit lines

€m

123,2

145,4

Grants and Financing Awarded

(4)

€m

80,9

80,9

Oustanding Bonds and Guarantees

(5)

€m

149,0

152,2[3]

BY

BUSINESS

UNIT

Notes

Data in

FY 2022

Q3 2023

as of 30

Sept

FY 2023

Q4

3-month

period

Var%

vs

FY

2022

Var% vs

30 Sept 2023

Sales[1]

€m

153,6

151,1

204,9

53,8

+33%

+36%

Backlog

(6)

€m

301

160

205

-32%

+28%

12-month Order Intake

(7)

€m

244

243

131

-46%

-46%

Online Capacity[4]

MWh

126

535

846

+572%

+58%

Projects Under Construction

(8)

MWh

1.384

1.145

1.073

-22%

-6%

Pipeline

(9)

€m

1.043

1.110

1.110

+6%

In Line

Projects in which NHOA is shortlisted

#

3

7

4

Notes

Data in

FY 2022

Q3 2023

as of 30

Sept

FY 2023

Q4

3-month

period

Var%

vs

FY

2022

Var% vs

30 Sept 2023

Sales[1]

€m

11,4

40,9

64,7

23,8

+467%

+58%

Manufacturing Capacity

# PoC

2.750/week

2.750/week

2.750/week

Notes

Data in

FY 2022

Q3 2023

as of 30

Sept

FY 2023

Q4

3-month

period

Var%

vs

FY

2022

Var% vs

30 Sept 2023

Sales[1]

(10)

€m

0,6

2,5

3,7

1,3

+474%

+51%

Utilization Rate[5]

(11)

%

N/A

2,3%

2,2%

1,9%

Occupancy Rate

(12)

%

N/A

20,3%

21,5%

25,2%

Sites Online and Under Construction

[6]

(13)

#

554

1.132

1.147

15

+107%

+1%

PoC Online and Under Construction [6]

(14)(15)

#

2.088

3.506

3.651

145

+75%

+4%

- Italy

%

N/A

45%

42%

- France

%

N/A

23%

22%

- Spain

%

N/A

11%

10%

- Portugal

%

N/A

22%

26%

of which PoC online [6]

#

N/A

1.475

1.830

+24%

of which PoC already built and

waiting for grid connection [6]

#

N/A

217

264

+22%

of which PoC Secured & Under

Construction [6]

#

N/A

1.814

1.557

-14%

Sites Under Assessment

(16)

#

2.165

2.641

2.891

+34%

+9%

Sites Under Development

(17)

#

569

1.409

1.517

+167%

+8%

[1] Sales refers to Revenues

& Other Income. FY2023 Sales refers to audited Revenues &

Other Income as at 31 Dec 2023.

[2] 151 million are represented

by credit lines that benefit from the support of the major

shareholder, Taiwan Cement Corporation.

[3] 94.1 million of the

outstanding bonds and guarantees benefit from the support of the

major shareholder, Taiwan Cement Corporation.

[4] Starting from Q2 2023, the

Online Capacity KPI is expressed in MWh and not in MW.

[5] Q4 2023 as of 31 Dec

Utilization Rate is computed weighting past periods and quarterly

utilization rates.

[6] This performance indicator

includes AC PoC, mainly coming from the KLC and Ressolar acquired

networks.

Notes to the Q4 2023 Trading and

Operational Update

(1) Delta Net Working Capital indicator has been added in

Q4 2023 and at each Quarter is calculated as (A) delta in

short-term commercial liabilities over the three-month period less

(B) delta in short-term commercial assets over the three-month

period.

(2) Net Cash indicator has been introduced in Q3 2023 and

it represents the sum of the amount of (i) the bank accounts

balances and readily available cash investments of the NHOA Group

(Cash and Deposits), (ii) the amount of cash deposited with banks

as collateral (and thus excluded from (i)) for the guarantees they

issue for the NHOA Group’s projects (Cash Collateralized), after

deduction of (iii) amounts drawn under credit facilities and other

financial indebtedness, plus accrued interest.

(3) the Consolidated Cash and Credit Lines

available indicator has been amended in Q3 2023 and it

represents the bank accounts balances and readily available cash

investments of the NHOA Group (Cash and Deposits) plus amounts

available for draw down as of the relevant reporting date under

approved credit lines and banks guarantees that can be issued.

(4) Grants and Financing Awarded indicator has

been introduced in Q3 2023 and it represents the total amount of

grants and financing approved and available for drawdown on agreed

future dates.

(5) Outstanding Bonds and Guarantees indicator has been

introduced in Q3 2023 and it represents the amount of bank

guarantee securities (i.e. advance payment bonds, performance

bonds, warranty bonds and other guarantees) issued as financial

security for the fulfillment of NHOA’s obligations in accordance

with the terms of the agreed project and commercial contracts.

(6) Backlog means the estimated revenues and other income

attributable to (i) purchase orders received, contracts signed and

projects awarded (representing 100% of Backlog as of the date

hereof), and (ii) Project Development contracts associated with a

Power Purchase Agreement, where the agreed value is a price per kWh

of electricity and an amount of MW to be installed (nil at the date

hereof). When any contract or project has started its execution,

the amount recognized as Backlog is computed as (A) the transaction

price of the relevant purchase order, contract or project under (i)

and (ii) above, less (B) the amount of revenues recognized, as of

the relevant reporting date, in accordance with IFRS 15

(representing the amount of transaction price allocated to the

performance obligations carried out at the reporting date).

(7) 12-month order intake represents the cumulated value

of new purchase orders received, contracts signed and projects

awarded in the 12 months preceding the relevant reporting date.

(8) Projects Under Construction is an indicator

representing the capacity equivalent of Backlog, in terms of signed

turnkey supply or EPC contracts and therefore excluding Project

Development contracts associated with a Power Purchase Agreement,

(please see Note (5) above).

(9) Pipeline means the estimate, as of the release date,

of the amount of potential projects, tenders and requests for

proposal for which NHOA Energy has decided to participate or

respond.

(10) Sales include the data coming from the recent

acquisition of the e-mobility business unit of Ressolar S.r.l.

(“Ressolar”) and the recent acquisition of the majority

stake in Kilometer Low Cost S.A. (“KLC”).

(11) Utilization Rate indicator first published in Q2

2023, applies to Italy, France and Spain only and is calculated

first at station level as the ratio of (a) kWh sold divided (b) the

maximum available power (i.e. the available grid connection)

multiplied by 18 hours (being the assumed daily maximum charging

hours) per number of days in the relevant period. The ratios are

then aggregated, weighted by the stations' available power. Note

that stations' utilization data is only included in the calculation

after a phase-in period of six months and for sites with at least

one DC fastcharging EVSE.

(12) Occupancy Rate indicator applies to Portugal only

where, due to the different local market regulations, as Charge

Point Operator (CPO) Atlante is remunerated for the usage of its

infrastructure "by minute". Occupancy rate is therefore calculated

on a 24-hour basis, at a charger level considering 1 PoC per EVSE

as the ratio of (a) minutes of charging sessions sold divided (b)

total number of minutes in the relevant period. The ratios are then

aggregated, weighted by the stations' available power. Note that

stations' occupancy data is only included in the calculation after

a phase-in period of six months.

(13) Sites Online and Under Construction, includes, as of

the relevant reporting date, the number of sites already

operational, already installed but waiting for grid connection,

secured and under construction. Please note that this performance

indicator includes sites with AC points of charge, mainly coming

from the KLC and Ressolar acquired networks.

(14) PoC Online and Under Construction, includes the

points of charge already operational, as of the relevant reporting

date, already installed but waiting for grid connection, secured

and under construction. Please note that this performance indicator

includes AC points of charge, mainly coming from the KLC and

Ressolar acquired networks.

(15) Of the PoC Online and Under Construction performance

indicator the geographical and construction phase split are

provided, including the AC points of charge, mainly coming from the

KLC and Ressolar acquired networks.

(16) Sites Under Assessment includes the total number of

sites, as of the relevant reporting date, which are actively

pursued after prospecting activity and following a first internal

screening for high level feasibility. At this point, the full

contractual documentation remains to be finalized and signed, all

the required permits have not yet been awarded and construction has

not started.

(17) Sites Under Development, includes sites for which a

more detailed feasibility activity commences, including detailed

discussions with site owners and exchange of documentation. For the

sites included in the “under development” performance indicator

there would be a reasonable degree of confidence that they can be

converted into stations within the next six months (subject to

interconnection and timely delivery of hardware).

* * *

The FY 2023 and Q4 Trading and Operational

Update will be illustrated in the investor conference call

scheduled on 23 February at 9:00am CET. Dial-in details and

presentation will be available on the corporate website

nhoagroup.com

* * *

NHOA Group

NHOA S.A. (formerly Engie EPS), global player in energy storage,

e-mobility and EV fast and ultra-fast charging network, develops

technologies enabling the transition towards clean energy and

sustainable mobility, shaping the future of a next generation

living in harmony with our planet.

Listed on Euronext Paris regulated market (NHOA.PA), NHOA Group

forms part of the CAC® Mid & Small and CAC® All-Tradable

financial indices.

NHOA Group, with offices in France, Spain, UK, United States,

Taiwan and Australia, maintains entirely in Italy research,

development and production of its technologies.

For further information, go to www.nhoagroup.com

follow us on LinkedIn

follow us on Instagram

Forward looking statement

This release may contain forward-looking statements. These

statements are not undertakings as to the future performance of

NHOA. Although NHOA considers that such statements are based on

reasonable expectations and assumptions at the date of publication

of this release, they are by their nature subject to risks and

uncertainties which could cause actual performance to differ from

those indicated or implied in such statements. These risks and

uncertainties include without limitation those explained or

identified in the public documents filed by NHOA with the French

Financial Markets Authority (AMF), including those listed in the

“Risk Factors” section of the NHOA 2022 Universal Registration

Document. Investors and NHOA shareholders should note that if some

or all of these risks are realized they may have a significant

unfavorable impact on NHOA. These forward looking statements can be

identified by the use of forward looking terminology, including the

verbs or terms “anticipates”, “believes”, “estimates”, “expects”,

“intends”, “may”, “plans”, “build- up”, “under discussion” or

“potential customer”, “should” or “will”, “projects”, “backlog” or

“pipeline” or, in each case, their negative or other variations or

comparable terminology, or by discussions of strategy, plans,

objectives, goals, future events or intentions. These

forward-looking statements include all matters that are not

historical facts and that are to different degrees, uncertain, such

as statements about the impacts of the war in Ukraine and the

current economic situation pandemic on NHOA’s business operations,

financial results and financial position and on the world economy.

They appear throughout this announcement and include, but are not

limited to, statements regarding NHOA’s intentions, beliefs or

current expectations concerning, among other things, NHOA’s results

of business development, operations, financial position, prospects,

financing strategies, expectations for product design and

development, regulatory applications and approvals, reimbursement

arrangements, costs of sales and market penetration. Important

factors that could affect performance and cause results to differ

materially from management’s expectations or could affect NHOA’s

ability to achieve its strategic goals, include the uncertainties

relating to the impact of war in Ukraine and the current economic

situation on NHOA’s business, operations and employees. In

addition, even if the NHOA’s results of operations, financial

position and growth, and the development of the markets and the

industry in which NHOA operates, are consistent with the

forward-looking statements contained in this announcement, those

results or developments may not be indicative of results or

developments in subsequent periods. The forward-looking statements

herein speak only at the date of this announcement. NHOA does not

have the obligation and undertakes no obligation to update or

revise any of the forwardlooking statements.

1.1 Consolidated Income Statement

CONSOLIDATED INCOME STATEMENT

(amounts in K Euro)

31/12/2023

31/12/2022

Revenues

272.180

164.220

Other Income including non recurring

1.166

1.466

TOTAL REVENUES AND OTHER INCOME (including

non recurring income)

273.346

165.686

Cost of goods sold

(218.143)

(150.627)

GROSS MARGIN FROM SALES (including non

recurring income)

55.203

15.059

% on Revenues and other income

20,2%

9,1%

Personnel costs

(46.404)

(30.617)

Other operating expenses

(23.151)

(17.383)

EBITDA excluding Stock Option and

Incentive Plans expenses, including non recurring income

(1)

(14.352)

(32.941)

Amortization and depreciation

(11.141)

(7.022)

Impairment and write down

(1.710)

(5.977)

Non recurring expenses and Integration

costs

(4.489)

(2.829)

Stock options and Incentive plans

(3.709)

(1.596)

EBIT

(35.401)

(50.364)

Net financial income and expenses

(6.023)

(3.851)

Income Taxes

(4.647)

1.971

NET INCOME (LOSS)

(46.071)

(52.244)

Attributable to:

Equity holders of the parent company

(42.463)

(38.577)

Non-controlling interests

(3.607)

(13.668)

Basic earnings per share

(0,39)

(1,51)

Weighted average number of ordinary shares

outstanding

108.755

25.534

Diluted earnings per share

(0,39)

(1,51)

(1) EBITDA excluding Stock Option and

Incentive Plans expenses is not defined by IFRS. It is defined in

notes 5.5 of the Consolidated Financial Statements

1.2 Consolidated Statement of Other Comprehensive

Income

OTHER COMPREHENSIVE INCOME

(amounts in K Euro)

31/12/2023

31/12/2022

NET INCOME (LOSS)

(42.463)

(38.577)

Exchange differences on translation of

foreign operations and other differences

(1.468)

511

Other comprehensive income not to be

reclassified to profit or loss in subsequent periods (net of

tax)

12

(40)

Actuarial gain and (losses) on employee

benefits

(130)

439

Other comprehensive income (loss) for the

year, net of tax

(1.586)

910

Total comprehensive income for the year,

net of tax

(44.049)

(37.667)

Attributable to Equity holders of the

parent company

(44.049)

(37.667)

1.3 Consolidated Balance Sheet

ASSETS

(amounts in K Euro)

31/12/2023

31/12/2022

Property, plant and equipment

121.912

52.068

Intangible assets

34.708

15.418

Other non current financial assets

16.753

13.144

Other non current assets

47

60

TOTAL NON CURRENT ASSETS

173.420

80.690

Trade and other receivables

51.393

28.487

Contract assets

6.512

16.770

Inventories

18.642

18.099

Other current assets

47.599

29.753

Current financial assets

29.603

18.495

Cash and cash equivalent

238.901

47.386

TOTAL CURRENT ASSETS

392.650

158.990

TOTAL ASSETS

566.070

239.681

EQUITY AND LIABILITIES

(amounts in K Euro)

31/12/2023

31/12/2022

Issued capital

55.039

5.107

Share premium

376.994

180.589

Other Reserves

7.590

5.073

Retained Earnings

(133.876)

(93.843)

Profit (Loss) for the period

(42.463)

(38.577)

TOTAL GROUP EQUITY

263.284

58.349

Minorities interest

2.142

5.749

TOTAL EQUITY

265.426

64.098

Severance indemnity reserve and Employees'

benefits

2.218

2.636

Non current financial liabilities

6.123

3.922

Other non current liabilities

29.057

15.867

Non current deferred tax liabilities

921

16

TOTAL NON CURRENT LIABILITIES

38.319

22.441

Trade payables

54.562

61.920

Other current liabilities

59.678

33.126

Current financial liabilities

148.085

58.096

TOTAL CURRENT LIABILITIES

262.326

153.141

TOTAL EQUITY AND LIABILITIES

566.070

239.681

1.4 Consolidated Statement of Changes in Equity

CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY

(amounts in K Euro)

Share

Capital

Premium

Reserve

Stock

Option and

Warrants

plan reserve

Other

Reserves

Retained

Earnings

(Losses)

Profit

(Loss) for

the period

Total

Group

Equity

Minority

interests

TOTAL

EQUITY

Net Equity as of 31 December

2021

5.107

180.589

4.969

(961)

(67.066)

(27.213)

95.425

19.291

114.716

Previous year result allocation

-

-

-

35

(27.248)

27.213

-

(19.291)

(19.291)

Change in consolidation perimeter

-

-

-

(576)

-

-

(576)

-

(576)

Other movements

-

-

-

1.166

-

-

1.166

-

1.166

Non controlling interests

-

-

-

-

-

-

-

19.417

19.417

Loss for the period

-

-

-

-

-

(38.577)

(38.577)

(13.668)

(52.244)

Total comprehensive income

-

-

-

439

471

-

910

-

910

Net Equity as of 31 December

2022

5.107

180.589

4.969

104

(93.843)

(38.577)

58.349

5.749

64.098

Previous year result allocation

-

-

-

-

(38.577)

38.577

(5.749)

(5.749)

Shareholder's capital increase

49.933

196.405

-

-

-

-

246.337

-

246.337

Other movements

-

-

-

2.646

-

-

2.646

-

2.646

Non controlling interests

-

-

-

-

-

-

-

5.749

5.749

Loss for the period

-

-

-

-

-

(42.463)

(42.463)

(3.607)

(46.071)

Total comprehensive income

-

-

-

(130)

(1.456)

-

(1.586)

-

(1.586)

Net Equity as of 31 December

2023

55.039

376.994

4.969

2.621

(133.876)

(42.463)

263.284

2.142

265.426

1.5 Consolidated Statement of Cash Flows

CASH FLOW STATEMENT

(amounts in K Euro)

31/12/2023

31/12/2022

Net Income or Loss

(46.071)

(52.244)

Income Taxes

-

(1.971)

Amortisation and depreciation

11.141

7.022

Impairment and write down

1.444

5.977

Stock option and incentive plans

impact

3.709

1.596

Defined Benefit Plan

(417)

428

Non-cash variation in equity opening

(154)

1.065

Non-cash variation in bank accounts

15

151

Working capital adjustments

Decrease (increase) in tax assets

(344)

100

Decrease (increase) in trade and other

receivables and prepayments

(32.077)

(35.889)

Decrease (increase) in inventories

(543)

(14.616)

Increase (decrease) in trade and other

payables

20.099

47.580

Increase (decrease) in non current assets

and liabilities

15.717

461

Net cash flows from operating

activities

(27.481)

(40.341)

Investments

Net Decrease (Increase) in intangible

assets

(14.446)

(8.097)

Net Decrease (Increase) in tangible

assets

(70.564)

(34.437)

Changes in consolidation perimeter

(15.528)

-

Net cash flows from investments

activities

(100.538)

(42.535)

Financing

Increase (decrease) in financial debts

87.041

729

Shareholders cash injection

246.337

-

Minorities cash injection

4.700

7.600

Decrease (increase) in current financial

assets

(15.163)

(5.908)

Decrease (increase) in non-current

financial assets

(3.609)

(940)

Translation differences

(1.468)

511

Lease liabilities

1.696

5.459

Net cash flows from financing

activities

319.534

7.452

Net cash and cash equivalent at the

beginning of the period

47.386

122.811

NET CASH FLOW FOR THE PERIOD

191.515

(75.424)

NET CASH AND CASH EQUIVALENTS AT THE

END OF THE PERIOD

238.901

47.386

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240222411781/en/

Press Office: Claudia Caracausi and Davide Bruzzese,

Image Building, +39 02 89011300, nhoa@imagebuilding.it Financial

Communication and Institutional Relations: Chiara Cerri, +39

337 1484534, ir@nhoagroup.com

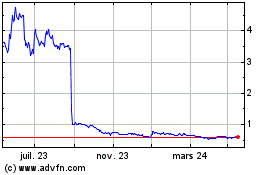

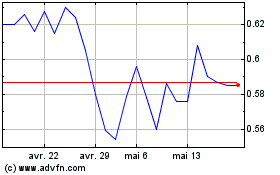

NHOA (EU:NHOA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

NHOA (EU:NHOA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024