Regulatory News:

NHOA Group (NHOA.PA, formerly Engie EPS) is pleased to release

its First Half 2024 Results and the Q2 2024 Trading and Operational

Update.

At Group level:

- First Half Revenues amount to €124 million, up +7%

year-on-year

- H1 2024 EBITDA at Group level, excluding the Atlante perimeter,

stands at €4.8 million, +26% higher than the EBITDA generated in

the whole FY 2023

- Gross Margin up to 25%, compared to 15% in H1 2023

At the business unit level positive results were achieved:

- NHOA Energy:

- Revenues at €90 million, an 11% decrease versus H1 2023,

entirely attributable to the industry-wide drop in system prices

deriving from a welcome rapid degression in battery prices

- EBITDA of €4.4 million and Net income positive

- Over 1GWh of Projects online, +344% year-on-year, and

additional 1GWh of projects under construction

- Almost €2 billion Pipeline, as a result of major acceleration

in origination activities in the face of extremely challenging

market conditions

- Free2move eSolutions, the joint-venture between NHOA

Group and Stellantis:

- Revenues of €32 million, as to say more than two times the

revenues registered in H1 2023

- Over 30,000 residential EV charging devices sold in Europe

- Launched the residential EV charging also in North America,

with 2,000 devices sold

- EBITDA of €3.7 million

- Atlante:

- Over 2,300 Points of Charge online in Southern Europe

- Utilization Rate, 1.8% for Italy, France and Spain

- Occupancy Rate, 28.3% for Portugal, the first country of the

Atlante network turning EBITDA positive

“After closing 2023 with over €270 million Revenues and all

financial and EBITDA targets reached, first half 2024 continues on

the positive path, despite the increasingly challenging market

conditions, with revenues growing to €124 million and EBITDA,

excluding the Atlante perimeter, up +26% to €4.8 million.

NHOA Energy commissioned projects in Asia, United States and

Latin America, counting now over 1GWh of capacity online, +344%

year-on-year, and 1GWh under construction, with over €4 million

EBITDA and positive Net Income for the first time ever.

Free2move eSolutions closed a remarkable first half with €32

million revenues, more than two times year-on-year, and €3.7

million EBITDA, launching a full suite of residential charging

devices also in North America and closing the semester with over

30,000 wallbox in Europe and 2,000 in the US.

Atlante, which now counts over 2,300 points of charge online in

Southern Europe, in the first half inaugurated key sites on French

highways, and was awarded iconic locations, like Turin Airport and

Italian highways with the first public tender from Autostrade per

l’Italia. While slowdown in EV sales in Europe caused a downward

revision of the 2025 targets, Portugal is the first country of the

Atlante network turning EBITDA positive, thus confirming the

ability to generate positive cashflows when the EV sales reach

market expectations”, commented Carlalberto Guglielminotti, CEO

of NHOA Group.

First Half 2024 Key

Figures

Revenues and Other Income as of 30 June 2024 amount to

€124 million, +7% compared to H1 2023.

Revenues and Other Income are mainly driven by the €90 million

realized by NHOA Energy mostly from flagship projects in Australia

and UK. The nominal figure (11% lower than in H1 2023) is affected

by the major welcome drop in battery prices, that is being

transferred to clients. Furthermore, H1 2024 revenues only benefit

from a 1% contribution from related-party sales, versus 82% in H1

2023, witnessing NHOA Energy’s path towards full commercial

independence.

Important increase has been registered by Free2move eSolutions,

reaching €32 million revenues, more than two times the ones of H1

2023.

Atlante in H1 2024 reported Revenues and other income for €2.6

million, with a 29% increase compared to the same period of

2023.

The 25.3% Gross Margin is mainly driven by an increase of

Gross Margin across all the Business Units. NHOA Energy registered

an increase in gross margin thanks to the mix of projects in

execution. Free2move eSolutions improved both the gross margin and

its contribution in volumes to the Group figures. Atlante increased

both gross margin and volumes, confirming its positive trend but it

still represents a marginal impact on Group figures.

Backlog of NHOA Energy totals €141 million, mainly

related to 1.0GWh of projects across Australia and EMEA. This

represents a 33% decrease compared to H1 2023 Backlog, due to the

oversupply of batteries which has led to a precipitous

industry-wide decrease in system prices. Furthermore, increased

counterparty risk on the battery supplier side has brought NHOA

Energy to take a more selective contracting approach.

To counter this market situation, origination activities have

been accelerated. Accordingly, the Pipeline of NHOA Energy

stands at almost €2 billion, almost doubling year-on-year, across

Australia, Asia, North and Latin America and Europe. NHOA Energy is

currently shortlisted in 6 project opportunities.

Personnel costs reached €26.5 million, increasing more

than 13% compared to H1 2023, mainly due to the increase in

headcount. As of 30 June 2024, NHOA Group can count on 588 people

compared to 522 in H1 2023. The strengthening of the workforce is

mainly due to the consolidation of Atlante in four countries and to

NHOA Energy’s global growth.

Capital investments reached €50 million, largely

comprised of investments in the roll-out of the Atlante

network.

R&D, Software and Digital investments amounted to

€7.8 million, representing approximately 6.3% of the consolidated

Revenues.

Other Operating Expenses increased by 14.4%, amounting to

€11.8 million, compared to €10.4 million in H1 2023, expressing an

organic growth of every business unit of the Group.

EBITDA at Group level, excluding Atlante, is positive,

standing at €4.8 million. Free2move eSolutions exceeded the

breakeven point, posting a positive EBITDA of €3.7 million. NHOA

Energy has an EBITDA of €4.4 million. At Group level, including

Atlante, EBITDA stands at -€6.8 million in H1 2024, highlighting a

significant improvement compared to -€16.6 million of H1 2023.

Non recurring expenses and Incentive Plan account for

€0.7 million and €0.9 million, respectively related to

non-recurring financial and restructuring activities and related to

short term and long term incentive plans to employees.

EBIT and Net Result as of 30 June 2024 stand,

respectively, at -€17.4 million and -€21.9 million, compared to

-€24.6 million and -€26.7 million of the previous year. Remarkably,

NHOA Energy reached Net Income breakeven in H1 2024.

Net Financial Position stands at €54.9 million as of 30

June 2024 compared to €100.6 million as at 31 December 2023, mostly

as the effect of Atlante’s rollout and financial debt repayment,

improved respect to -€75.8 million as at 30 June 2023, mainly due

to the successful completion of the equity capital increase through

the Fall 2023 rights issue offering. The cash position as of 30

June 2024, represented by liquid assets, amounted to €118.9 million

compared to €55.6 million at H1 2023.

Guidance update

As announced on 5 July 2024 with a dedicated press release, the

recent unfavorable developments in both the electric vehicles and

energy storage markets have undermined the underlying assumptions

of the guidance reflected in the 2023 Universal Registration

Document, resulting in the revised consolidated guidance released

on the same day.

While Free2move eSolutions remains in line with the previous

guidance and NHOA Energy forecasted a delay in the achievement of

its medium-term financial targets driven by a more cautious

short-term outlook, the impact on Atlante is very significant. The

lower-than-expected growth in sales of electric vehicles lowered

the cash flows expectations, driving the impossibility to implement

the originally planned funding strategy. As a result, the revised

guidance announced on July 5 only assumes existing funding for

Atlante’s development, targeting therefore to reach 3,000 charging

points online by 2025. To meet this target and without additional

funding, for which NHOA has no visibility at present, Atlante would

need to put on hold the development part of the points of charge

currently under construction (which amount to 4,977 in the table

below).

First Half 2024 Results by Business

Unit

ACTUAL

Information by operating

segment (amounts in k Euro)

Energy Storage

e-Mobility

Atlante

Corporate

Total

Revenues

90.081

31.445

2.445

0

123.971

Other Income including non

recurring

97

84

157

19

357

TOTAL REVENUES AND OTHER

INCOME

90.178

31.530

2.602

19

124.329

Cost of goods sold

(71.639)

(20.293)

(891)

(0)

(92.823)

GROSS MARGIN FROM

SALES

18.538

11.237

1.711

19

31.506

% on Revenues and other

income

20,6%

35,6%

65,8%

100,0%

25,3%

Personnel costs

(10.734)

(5.823)

(8.284)

(1.671)

(26.512)

Other operating expenses

(3.410)

(1.763)

(5.032)

(1.638)

(11.843)

EBITDA

4.395

3.652

(11.605)

(3.291)

(6.849)

Management Fees

(295)

0

(247)

542

0

Amortization and depreciation

(2.592)

(1.777)

(3.127)

(207)

(7.702)

Impairment and write down

(507)

(84)

(706)

0

(1.297)

Stock options and Incentive

plans

104

0

(695)

(264)

(854)

EBIT excluding non-recurring

items

1.105

1.791

(16.381)

(3.219)

(16.703)

Non recurring expenses and

Integration costs

(300)

0

(206)

(147)

(653)

EBIT

805

1.791

(16.587)

(3.366)

(17.357)

Net financial income and

expenses

(816)

(1.283)

(1.740)

(49)

(3.888)

Income Taxes

73

(791)

54

(24)

(689)

NET INCOME (LOSS)

63

(284)

(18.274)

(3.440)

(21.934)

NHOA Energy

NHOA Energy, NHOA Group’s business unit dedicated to energy

storage, confirmed EBITDA positive in H1 2024, with €4.4 million of

EBITDA realized over €90 million of revenues and other income,

despite the continuous expansion of its structure in order to

enhance the global origination and execution capabilities in line

with its ambitions.

Revenues and Other Income in the first semester of 2024

saw a decrease of 11% year-on-year, due to drop in system prices

deriving from a welcome rapid degression in battery prices. In H1

2024 three projects have been commissioned in Asia, Latin America

and the US, bringing the capacity in operation to over 1GWh. Among

such projects are world-class undertakings like the SuAo project

(120MWh+) in Taiwan, that takes NHOA Energy to have over 550MWh

online in Asia.

Backlog for NHOA Energy totalizes €141 million. In the

first semester of 2024 NHOA Energy was awarded with its third

project in the UK, namely a 113MWh battery storage system in

Coylton, Scotland from Statkraft. While this nominally represents a

33% decrease compared to H1 2023 Backlog, the current situation of

the energy storage market must be taken into account, which saw an

abrupt oversupply of batteries which has led to an industry-wide

decrease in system prices, while rising counterparty risk with

battery suppliers advises a more selective commercial strategy.

Pipeline for NHOA Energy amounts to almost €2 billion,

reflective of a drastic acceleration in origination activities to

counter market conditions. The company is currently shortlisted in

6 project tenders.

Gross Margin stands at 20.6%, representing a

substantial increase compared to 11.7% of the H1 2023.

NHOA Energy confirmed EBITDA positive, at €4.4 million in

H1 2024, while continuing its geographical expansion and talent

acquisition investments.

EBIT stands at €0,8 million, improving from -€2.1 million

of H1 2023. Net Result reaches break-even point, at €0.1

million.

Free2move eSolutions

Free2move eSolutions, NHOA Group’s business unit dedicated to

e-mobility products and services in joint venture with Stellantis,

had a positive first semester 2024.

Free2move eSolutions Revenues and Other Income, indeed,

reached €32 million, up +141% compared to H1 2024.

In Europe the acceleration of EV domestic chargers penetration

rate within the Stellantis portfolio of electric vehicles increased

from 3% in H1 2023 to 18% in H1 2024, with over 30,000 EV charging

devices sold. Whereas in North America, Free2move eSolutions

launched residential home charging, with 2,000 devices sold.

Gross Margin of the period stands at 35.6%, with a

favorable mix from Free2move eSolutions US.

EBITDA stands at 12% (€3.7 million) vs -40% H1 2023

(-€5.3 million).

EBIT reached breakeven, with a positive amount of €1.8

million (vs -€7.4 million in H1 2023), while Net Result is

at -€0.3 million, mainly due to financing costs and US income

taxes.

Atlante

Atlante, NHOA Group’s business unit dedicated to EV fast and

ultra-fast charging network, can currently count on over 2,300

points of charge online.

In the first semester of 2024 Atlante has achieved important

results across Southern Europe. In Italy, notably Atlante was

awarded with the first public tender by Autostrade per l’Italia to

position over 90 fastcharging points along Italian highways.

Furthermore, during H1 2024 Atlante won a tender to take

fastcharging for electric vehicles to Torino Airport. In France, at

the same time, Atlante inaugurated its fastcharging stations

positioned across Vinci highway network together with other

important stations in shopping malls and commercial areas. The

partnership with Groupe Duval in France saw the expansion of the

agreement to additional 130 sites, as did the agreement with

ToDream shopping district in Turin where the number of PoC

increased from 130 to 230, making it the largest charging hub in

Italy and one of the largest in Europe. In Portugal, Atlante

completed the acquisition of the remaining 40% of Kilometer Low

Cost S.A. (“KLC”) and also inaugurated the first station

co-funded by the European Union under CEF program. Soon after the

closing of H1, Atlante announced the signing of an agreement with

ALDI in Spain, a key strategic partnership matured during H1

2024.

Revenues and Other Income for H1 2024 amount to €2.6

million.

EBITDA of -€11.6 million still reflects the start-up

phase of the company and its investments in terms of people,

technology and tools required to build up the development platform,

coherent with Atlante’s ambitious targets. Portugal is the first

country of the Atlante network turning EBITDA positive with €0,16

million and, at the same time, the sole country in the Atlante

network where EV sales matched the expectations underlying the

targets announced with the 2023 Capital Markets Day.

EBIT stands at -€16.6 million and Net Result

stands respectively at -€18.3 million.

Q2 2024 Trading and Operational

Update

H1 2024 TRADING AND OPERATIONAL

UPDATE

Notes

Data in

H1 2023

FY 2023

Q1 2024

H1 2024

Q2 3-months period

Var% vs H1 2023

Var% vs Q1 2024

NHOA

Sales[1]

€m

116,0

273,3

58,2

124,3

66,1

+7%

Cash and Deposits

€m

238,8

199,1

118,9

(80,3)

of which delta Net Working

Capital

(1)

€m

(5,1)

Cash Collateralized

€m

44,7

44,8

26,5

(18,3)

Indebtedness

€m

(149,1)

(133,1)

(75,0)

58,0

Net Cash

(2)

€m

134,4

110,9

70,3

(40,5)

Cash and Credit Lines available

(3)

€m

82,0

397,1

334,1

274,5[2]

(59,6)

235%

-18%

of which cash and credit lines

available for drawdown

251,7

212,5

125,9

(86,6)

of which guarantees dedicated

credit lines

145,4

121,7

148,6

26,9

EU Grants and Financing to be received

(4)

€m

80,9

98,1

98,1

-

Outstanding Bonds and Guarantees

(5)

€m

152,2

181,1

156,1[3]

(25,1)

*Consolidated figures at Group level

BY BUSINESS UNIT

Notes

Data in

H1 2023

FY 2023

Q1 2024

H1 2024

Q2 3-months period

Var% vs H1 2023

Var% vs Q1 2024

NHOA Energy

Sales[1]

€m

100,8

204,9

39,8

90,2

50,4

-11%

Backlog

(6)

€m

211

205

189

141

-33%

-25%

12-month Order Intake

(7)

€m

250

131

147

120

-52%

-19%

Online Capacity[4]

MWh

228

846

975

1.010

+344%

+4%

Projects Under Construction

(8)

MWh

1.413

1.073

1.058

1.023

-28%

-3%

Pipeline

(9)

€m

1.035

1.110

1.596

1.962

+90%

+23%

Projects in which NHOA Energy is

shortlisted

#

6

4

6

6

Notes

Data in

H1 2023

FY 2023

Q1 2024

H1 2024

Q2 3-months period

Var% vs H1 2023

Var% vs Q1 2024

Free2move eSolutions

Sales[1]

€m

13,1

64,7

17,3

31,5

14,2

+141%

Manufacturing Capacity

# PoC

2.750/week

2.750/week

2.750/week

2.750/week

Notes

Data in

H1 2023

FY 2023

Q1 2024

H1 2024

Q2 3-months period

Var% vs H1 2023

Var% vs Q1 2024

Atlante

Sales[1]

(10)

€m

2,0

3,7

1,1

2,6

1,5

29%

Utilization Rate[5]

(11)

%

2,4%

2,2%

2,0%

1,8%

1,8%

Occupancy Rate

(12)

19,7%

21,5%

26,3%

26,3%

28,3%

Sites Online and Under Construction

[6]

(13)

#

1.062

1.147

1.213

1.277

64

+20%

+5%

PoC Online and Under Construction

[6][7]

(14)(15)

#

3.215

3.651

4.111

4.977

866

+55%

+21%

- Italy

%

43%

42%

48%

40%

- France

%

23%

22%

19%

25%

- Spain

%

11%

10%

9%

15%

- Portugal

%

23%

26%

24%

20%

of which PoC online [6]

#

1.263

1.830

2.067

2.367

300

+15%

of which PoC already built and

waiting for grid connection [6]

#

306

264

377

536

159

+42%

of which PoC Secured & Under

Construction [6]

#

1.646

1.557

1.667

2.074

407

+24%

Sites Under Assessment

(16)

#

2.493

2.891

2.810

2.810

In Line

+13%

In Line

Sites Under Development

(17)

#

1.229

1.517

1.455

809

-646

-34%

-44%

[1] Sales refers to Revenues & Other

Income. H1 2024 Sales refers to Revenues & Other Income as at

30 June 2024.

[2] 149.5 million are represented by

credit lines that benefit from the support of the major

shareholder, TCC Group Holdings.

[3] 120.9 million of the outstanding bonds

and guarantees benefit from the support of the major shareholder,

TCC Group Holdings.

[4] Starting from Q2 2023, the Online

Capacity KPI is expressed in MWh and not in MW.

[5] H1 2024 as of 30 June Utilization Rate

is computed weighting past periods and quarterly utilization

rates.

[6] This performance indicator includes AC

PoC, mainly coming from the KLC and Ressolar acquired networks

[7] In light of the revised guidance

announced on July 5, 2024 (a target of 3,000 charging points online

by 2025), the development of part or all of the PoCs in the Secured

category will be put on hold.

Notes to the Q2 2024 Trading and

Operational Update

(1) Delta Net Working Capital indicator has been added in

Q4 2023 and at each Quarter is calculated as (A) delta in

short-term commercial liabilities over the three-month period less

(B) delta in short-term commercial assets over the three-month

period.

(2) Net Cash indicator has been introduced in Q3 2023 and

it represents the sum of the amount of (i) the bank accounts

balances and readily available cash investments of the NHOA Group

(Cash and Deposits), (ii) the amount of cash deposited with banks

as collateral (and thus excluded from (i)) for the guarantees they

issue for NHOA Group’s projects (Cash Collateralized), after

deduction of (iii) amounts drawn under credit facilities and other

financial indebtedness, plus accrued interest.

(3) the Cash and Credit Lines available indicator

has been amended in Q3 2023 and it represents the bank accounts

balances and readily available cash investments of the NHOA Group

(Cash and Deposits) plus amounts available for draw down as of the

relevant reporting date under approved credit lines and banks

guarantees that can be issued.

(4) EU Grants and Financing to be received

indicator has been introduced in Q3 2023 and it represents the

total amount of grants and financing approved and available for

drawdown on agreed future dates.

(5) Outstanding Bonds and Guarantees indicator has been

introduced in Q3 2023 and it represents the amount of bank

guarantee securities (i.e. advance payment bonds, performance

bonds, warranty bonds and other guarantees) issued as financial

security for the fulfillment of the NHOA Group’s obligations in

accordance with the terms of the agreed project and commercial

contracts.

(6) Backlog means the estimated revenues and other income

attributable to (i) purchase orders received, contracts signed and

projects awarded (representing 100% of Backlog as of the date

hereof), and (ii) Project Development contracts associated with a

Power Purchase Agreement, where the agreed value is a price per kWh

of electricity and an amount of MW to be installed (nil at the date

hereof). When any contract or project has started its execution,

the amount recognized as Backlog is computed as (A) the transaction

price of the relevant purchase order, contract or project under (i)

and (ii) above, less (B) the amount of revenues recognized, as of

the relevant reporting date, in accordance with IFRS 15

(representing the amount of transaction price allocated to the

performance obligations carried out at the reporting date).

(7) 12-month order intake represents the cumulated value

of new purchase orders received, contracts signed and projects

awarded in the 12 months preceding the relevant reporting date.

(8) Projects Under Construction is an indicator

representing the capacity equivalent of Backlog, in terms of signed

turnkey supply or EPC contracts and therefore excluding Project

Development contracts associated with a Power Purchase Agreement,

(please see Note (5) above).

(9) Pipeline means the estimate, as of the release date,

of the amount of potential projects, tenders and requests for

proposal for which NHOA Energy has decided to participate or

respond.

(10) Sales include the data coming from the recent

acquisition of the e-mobility business unit of Ressolar S.r.l.

(“Ressolar”) and the recent acquisition of the majority

stake in Kilometer Low Cost S.A. (“KLC”).

(11) Utilization Rate indicator first published in Q2

2023, applies to Italy, France and Spain only and is calculated

first at station level as the ratio of (a) kWh sold divided to (b)

the maximum available power (i.e. the available grid connection)

multiplied by 18 hours (being the assumed daily maximum charging

hours) per number of days in the relevant period. The ratios are

then aggregated, weighted by the stations' available power. Note

that stations' utilization data is only included in the calculation

after a phase-in period of six months and for sites with at least

one DC fastcharging EVSE.

(12) Occupancy Rate indicator applies to Portugal only

where, due to the different local market regulations, as Charge

Point Operator (CPO) Atlante is remunerated for the usage of its

infrastructure "by minute". Occupancy rate is therefore calculated

on a 24-hour basis, at a charger level considering 1 PoC per EVSE

as the ratio of (a) minutes of charging sessions sold divided to

(b) total number of minutes in the relevant period. The ratios are

then aggregated, weighted by the stations' available power. Note

that stations' occupancy data is only included in the calculation

after a phase-in period of six months.

(13) Sites Online and Under Construction, includes, as of

the relevant reporting date, the number of sites already

operational, already installed but waiting for grid connection,

secured and under construction. Please note that this performance

indicator includes sites with AC points of charge, mainly coming

from the KLC and Ressolar acquired networks.

(14) PoC Online and Under Construction, includes the

points of charge already operational, as of the relevant reporting

date, already installed but waiting for grid connection, secured

and under construction. Please note that this performance indicator

includes AC points of charge, mainly coming from the KLC and

Ressolar acquired networks.

(15) Of the PoC Online and Under Construction performance

indicator the geographical and construction phase split are

provided, including the AC points of charge, mainly coming from the

KLC and Ressolar acquired networks.

(16) Sites Under Assessment includes the total number of

sites, as of the relevant reporting date, which are actively

pursued after prospecting activity and following a first internal

screening for high level feasibility. At this point, the full

contractual documentation remains to be finalized and signed, all

the required permits have not yet been awarded and construction has

not started.

(17) Sites Under Development, includes sites for which a

more detailed feasibility activity commences, including detailed

discussions with site owners and exchange of documentation. For the

sites included in the “under development” performance indicator

there would be a reasonable degree of confidence that they can be

converted into stations within the next six months (subject to

interconnection and timely delivery of hardware).

* * *

Readers are reminded that, on June 13, 2024 TCC

Group Holdings Co., Ltd, NHOA’s indirect majority shareholder, has

declared its intention to file a simplified tender offer (to be

followed by a squeeze out if the legal conditions are met) on the

shares of the Company. The H1 2024 and Q2 Trading and Operational

Update will therefore not be illustrated in a dedicated investor

call.

* * *

NHOA Group

NHOA S.A. (formerly Engie EPS), global player in energy storage,

e-mobility and EV fast and ultra-fast charging network, develops

technologies enabling the transition towards clean energy and

sustainable mobility, shaping the future of a next generation

living in harmony with our planet.

Listed on Euronext Paris regulated market (NHOA.PA), NHOA Group

forms part of the CAC® Mid & Small and CAC® All-Tradable

financial indices.

NHOA Group, with offices in France, Spain, Portugal, United

Kingdom, United States, Taiwan and Australia, maintains entirely in

Italy research, development and production of its technologies.

For further information, go to www.nhoagroup.com

Follow us on LinkedIn

Follow us on Instagram

Forward looking statement

This release may contain forward-looking statements. These

statements are not undertakings as to the future performance of

NHOA. Although NHOA considers that such statements are based on

reasonable expectations and assumptions at the date of publication

of this release, they are by their nature subject to risks and

uncertainties which could cause actual performance to differ from

those indicated or implied in such statements. These risks and

uncertainties include without limitation those explained or

identified in the public documents filed by NHOA with the French

Financial Markets Authority (AMF), including those listed in the

“Risk Factors” section of the NHOA 2023 Universal Registration

Document, filed with the AMF on April 12, 2024 (under number

D.24-0279). Investors and NHOA shareholders should note that if

some or all of these risks are realized they may have a significant

unfavorable impact on NHOA.

These forward looking statements can be identified by the use of

forward looking terminology, including the verbs or terms

“anticipates”, “believes”, “estimates”, “expects”, “intends”,

“may”, “plans”, “build- up”, “under discussion” or “potential

customer”, “should” or “will”, “projects”, “backlog” or “pipeline”

or, in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts and

that are to different degrees, uncertain, such as statements about

the impacts of the war in Ukraine and the current economic

situation pandemic on NHOA’s business operations, financial results

and financial position and on the world economy. They appear

throughout this announcement and include, but are not limited to,

statements regarding NHOA’s intentions, beliefs or current

expectations concerning, among other things, NHOA’s results of

business development, operations, financial position, prospects,

financing strategies, expectations for product design and

development, regulatory applications and approvals, reimbursement

arrangements, costs of sales and market penetration. Important

factors that could affect performance and cause results to differ

materially from management’s expectations or could affect NHOA’s

ability to achieve its strategic goals, include the uncertainties

relating to the impact of war in Ukraine and the current economic

situation on NHOA’s business, operations and employees. In

addition, even if the NHOA’s results of operations, financial

position and growth, and the development of the markets and the

industry in which NHOA operates, are consistent with the

forward-looking statements contained in this announcement, those

results or developments may not be indicative of results or

developments in subsequent periods. The forward-looking statements

herein speak only at the date of this announcement. NHOA does not

have the obligation and undertakes no obligation to update or

revise any of the forward-looking statements.

CONSOLIDATED FINANCIAL STATEMENTS

The following statements have been examined by the Board of

Directors of 25th July 2024.

1.1 Consolidated Income Statement

CONSOLIDATED INCOME STATEMENT

(amounts in K Euro)

NOTES

30/06/2024

31/12/2023

30/06/2023

Revenues

123.971

272.180

115.666

Other Income including non

recurring

357

1.166

304

TOTAL REVENUES AND OTHER INCOME

(including non recurring income)

5.1

124.329

273.346

115.970

Cost of goods sold

5.2

(92.823)

(218.143)

(98.811)

GROSS MARGIN FROM SALES

(including non recurring income)

31.506

55.203

17.159

% on Revenues and other

income

25.3%

20.2%

14.8%

Personnel costs

5.3

(26.512)

(46.404)

(23.399)

Other operating expenses

5.4

(11.843)

(23.151)

(10.350)

EBITDA excluding Stock Option

and Incentive Plans expenses, including non recurring income

(1)

5.5

(6.849)

(14.352)

(16.590)

Amortization and depreciation

5.6

(7.702)

(11.141)

(4.318)

Impairment and write down

5.7

(1.297)

(1.710)

(793)

Non recurring expenses and

Integration costs

5.8

(653)

(4.489)

(962)

Stock options and Incentive

plans

5.9

(854)

(3.709)

(1.933)

EBIT

5.1

(17.356)

(35.401)

(24.596)

Net financial income and

expenses

5.11

(3.889)

(6.023)

(2.401)

Income Taxes

5.12

(689)

(4.647)

307

NET INCOME (LOSS)

5.13

(21.934)

(46.071)

(26.689)

Attributable to:

Equity holders of the parent

company

(21.758)

(42.463)

(22.497)

Non-controlling interests

(176)

(3.607)

(4.192)

Basic earnings per share

(0.08)

(0.39)

(0.88)

Weighted average number of

ordinary shares outstanding

275.197

108.755

25.534

Diluted earnings per share

(0.08)

(0.39)

(0.88)

(1) EBITDA excluding stock option expenses and profit-sharing

plans, including non-recurring items, is not defined by IFRS. It is

defined in note 5.5 of the Consolidated Financial Statements.

1.2 Consolidated Statement of Other Comprehensive

Income

OTHER COMPREHENSIVE INCOME

(amounts in K Euro)

30/06/2024

31/12/2023

30/06/2023

NET INCOME (LOSS)

(21.758)

(42.463)

(22.497)

Other comprehensive income to be

reclassified to profit or loss in subsequent periods (net of

tax)

(473)

-

Exchange differences on

translation of foreign operations and other differences

581

(1.468)

(988)

Other comprehensive income not to

be reclassified to profit or loss in subsequent periods (net of

tax)

-

12

47

Actuarial gain and (losses) on

employee benefits

(91)

(130)

(103)

Other comprehensive income (loss)

for the year, net of tax

17

(1.586)

(1.044)

Total comprehensive income for

the year, net of tax

(21.741)

(44.049)

(23.541)

Attributable to Equity holders

of the parent company

(21.741)

(44.049)

(23.541)

1.3 Consolidated Balance Sheet

ASSETS (amounts in K

Euro)

NOTES

30/06/2024

31/12/2023

30/06/2023

Property, plant and equipment

5.14

159.307

121.912

76.310

Intangible assets

5.15

39.296

34.708

33.109

Other non current financial

assets

5.16

13.708

16.753

13.307

Other non current assets

979

47

47

TOTAL NON CURRENT ASSETS

213.290

173.420

122.773

Trade and other receivables

5.17

40.374

51.393

74.723

Contract assets

5.18

23.365

6.512

5.069

Inventories

5.19

17.488

18.642

20.349

Other current assets

5.20

47.892

47.599

68.405

Current financial assets

5.20

14.061

29.603

44.959

Cash and cash equivalent

5.21

118.860

238.901

55.550

TOTAL CURRENT ASSETS

262.040

392.650

269.057

TOTAL ASSETS

475.330

566.070

391.830

EQUITY AND LIABILITIES

(amounts in K Euro)

NOTES

30/06/2024

31/12/2023

30/06/2023

Issued capital

5.22

55.039

55.039

5.107

Share premium

5.22

376.994

376.994

180.589

Other Reserves

5.22

4.886

7.590

6.298

Retained Earnings

5.22

(175.759)

(133.876)

(133.361)

Profit (Loss) for the period

5.22

(21.758)

(42.463)

(22.497)

TOTAL GROUP EQUITY

239.403

263.284

36.136

TOTAL GROUP EQUITY

239.403

263.284

36.136

Minorities interest

5.22

2.781

2.142

1.557

TOTAL EQUITY

5.22

242.184

265.426

37.693

Severance indemnity reserve and

Employees' benefits

5.23

2.550

2.218

2.038

Non current financial

liabilities

5.27

5.762

6.123

5.954

Other non current liabilities

5.26

29.494

29.057

15.833

Non current deferred tax

liabilities

5.24

866

921

24

TOTAL NON CURRENT LIABILITIES

38.672

38.319

23.848

Trade payables

5.25

72.724

54.562

48.174

Other current liabilities

5.26

52.762

59.678

141.197

Current financial liabilities

5.27

68.988

148.085

140.918

TOTAL CURRENT LIABILITIES

194.474

262.326

330.289

TOTAL EQUITY AND

LIABILITIES

475.330

566.070

391.830

1.4 Consolidated Statement of Changes in Equity

CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY (amounts in K Euro)

NOTES

Share Capital

Premium Reserve

Stock Option and Warrants plan

reserve

Other Reserves

Retained Earnings

(Losses)

Profit (Loss) for the

period

Total Group Equity

Minority interests

TOTAL EQUITY

Net Equity as of 31 December

2022

4.24

5.107

180.589

4.969

104

(93.843)

(38.577)

58.349

5.749

64.098

Previous year result

allocation

(38.577)

38.577

(5.749)

(5.749)

Other movements

-

-

-

1.327

-

-

1.327

-

1.327

Non controlling interests

-

-

-

-

-

-

-

5.749

5.749

Loss for the period

-

-

-

-

-

(22.497)

(22.497)

(4.192)

(26.689)

Total comprehensive income

-

-

-

(103)

(941)

-

(1.044)

-

(1.044)

Net Equity as of 30 June

2023

4.24

5.107

180.589

4.969

1.328

(133.361)

(22.497)

36.135

1.557

37.694

Previous year result

allocation

22.497

22.497

(1.557)

20.940

Shareholder's capital

increase

49.933

196.405

-

-

-

-

246.337

-

246.337

Other movements

-

-

-

1.319

-

-

1.319

-

1.319

Non controlling interests

-

-

-

-

-

-

-

5.749

5.749

Loss for the period

-

-

-

-

-

(42.463)

(42.463)

(3.607)

(46.071)

Total comprehensive income

-

-

-

(27)

(516)

-

(542)

-

(542)

Net Equity as of 31 December

2023

4.24

55.039

376.994

4.969

2.621

(133.876)

(42.463)

263.284

2.142

265.426

Previous year result

allocation

(42.463)

42.463

-

(2.142)

(2.142)

Other movements

-

-

-

(2.140)

-

-

(2.140)

-

(2.140)

Non controlling interests

-

-

-

-

-

-

-

2.957

2.957

Loss for the period

-

-

-

-

-

(21.758)

(21.758)

(176)

(21.934)

Total comprehensive income

-

-

-

(564)

581

-

17

-

17

Net Equity as of 30 June

2024

4.24

55.039

376.994

4.969

(83)

(175.756)

(19.684)

239.403

2.781

242.184

1.5 Consolidated Statement of Cash Flows

CASH FLOW STATEMENT (amounts

in K Euro)

NOTES

30/06/2024

31/12/2023

30/06/2023

Net Income or Loss

5.13

(21.934)

(46.071)

(26.689)

Income Taxes

5.12

-

-

(307)

Amortisation and depreciation

5.6

7.702

11.141

4.318

Impairment and write down

5.7

1.297

1.444

793

Stock option and incentive plans

impact

5.9

(1.814)

3.709

1.933

Defined Benefit Plan

5.23

332

(417)

(598)

Non-cash variation in equity

opening

-

(154)

1.224

Non-cash variation in bank

accounts

(35)

15

(552)

Working capital adjustments

Decrease (increase) in tax

assets

5.20

-

(344)

-

Decrease (increase) in trade and

other receivables and prepayments

5.17,5.18

(6.126)

(32.077)

(73.980)

Decrease (increase) in

inventories

5.19

1.154

(543)

(2.251)

Increase (decrease) in trade and

other payables

5.25

11.190

20.099

94.332

Increase (decrease) in non

current assets and liabilities

5.16,5.26

(5.871)

15.717

(526)

Net cash flows from operating

activities

(14.105)

(27.481)

(2.303)

Investments

Net Decrease (Increase) in

intangible assets

5.15

(7.953)

(14.446)

(6.583)

Net Decrease (Increase) in

tangible assets

5.14

(33.921)

(66.395)

(20.213)

Net Decrease (Increase) due to

IFRS 16 FTA

5.14

(8.517)

(4.169)

(985)

Changes in consolidation

perimeter

-

(15.528)

(14.520)

Net cash flows from investments

activities

(50.391)

(100.538)

(42.301)

Financing

-

Increase (decrease) in financial

debts

5.29

(79.457)

87.041

79.705

Shareholders cash injection

-

246.337

-

Minorities cash injection

-

4.700

4.700

Decrease (increase) in current

financial assets

5.20

15.542

(15.163)

(30.520)

Decrease (increase) in

non-current financial assets

3.045

(3.609)

(163)

Translation differences

5.22

581

(1.468)

(988)

Lease liabilities

4.744

1.696

33

Net cash flows from financing

activities

(55.545)

319.534

52.768

Net cash and cash equivalent at

the beginning of the period

238.901

47.386

47.386

NET CASH FLOW FOR THE PERIOD

(120.041)

191.515

8.164

NET CASH AND CASH EQUIVALENTS

AT THE END OF THE PERIOD

118.860

238.901

55.550

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725975900/en/

Press Office: Claudia Caracausi and Davide Bruzzese,

Image Building, +39 02 89011300, nhoa@imagebuilding.it Financial

Communication and Institutional Relations: Chiara Cerri, +39

337 1484534, ir@nhoagroup.com

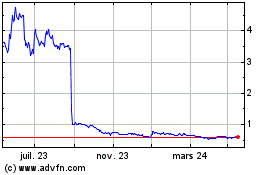

NHOA (EU:NHOA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

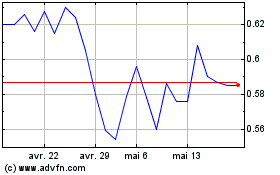

NHOA (EU:NHOA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025