Sidetrade: Resilient operating profitability, at 12%, despite

increased investments in North America

Record bookings

- €5.84 million in new Annual Contract Value: +21%

Robust growth in revenue, up 17%

- Strong increase in Order-to-Cash SaaS subscriptions:

+21%

- Surge in revenue in the United States: +45%

- Increasing demand from multinational corporations:

+46%

Resilient operating profitability, at 12%,

despite €3.8 million investments in North America

Solid financial position

Reinforced commitment to responsible growth

with a full CSR assessment

Sidetrade, the global leader in AI-powered

Order-to-Cash applications, today announces robust revenue

growth in the first half of 2023, up 17%, with a 22% increase in

SaaS subscriptions and double-digit profitability at 12% of revenue

despite increased investment and a reinforced commitment to

responsible growth through an in-depth CSR assessment.

Profitable growth model

|

Sidetrade (€m) |

H1 2023 |

H1 2022 |

Change |

|

Revenue |

20.9 |

17.8 |

+17% |

| of

which 'Order-to-Cash' SaaS subscriptions |

17.4 |

14.3 |

+21% |

|

Gross margin |

16.9 |

14.2 |

+19% |

|

as a % of Revenue |

81% |

80% |

|

|

Operating expenses (OPEX) |

(14.4) |

(11.8) |

+22% |

|

of which North America |

(3.8) |

(2.7) |

+41% |

|

Operating profit |

2.5 |

2.4 |

+2% |

|

as a % of Revenue |

12% |

14% |

|

|

Net profit |

2.2 |

2.3 |

-8% |

2023 information is from consolidated, unaudited data.

Olivier Novasque, CEO of Sidetrade commented:"In

H1 2023, Sidetrade reported an all-time high in bookings, with

nearly €6 million in new Annual Contract Value, representing an

increase of more than 20%. This performance was all the more

remarkable for two reasons. On the one hand, it was achieved in a

market environment of cautious major contractors. On the other, it

followed a demanding base effect with record bookings for Sidetrade

in H1 2022. Our ambitious investment policy is now paying off, with

the goal of 1/ accelerating our development in North

America, 2/ expanding our AI-based product offering

to provide the most comprehensive Order-to-Cash software suite on

the market, and 3/ targeting multinational companies with

revenue over $1 billion. By simultaneously implementing all three

of these strategic decisions, we have increased our credibility,

boosted our appeal to major customers, and ultimately, won multiple

contracts internationally.To date, the United States represents a

robust growth driver, with revenue up 45% for the period. What's

more, our newly launched CashApp solution helped us win tenders the

world over. Lastly, the share of subscriptions with companies

generating $1 billion-plus revenue now accounts for 76% of

Sidetrade's total subscriptions. In the months ahead, we must

continue our efforts while staying focused on our development model

that combines growth with profitability."

Record first half in 2023 with nearly €6

million in bookings in new Annual Contract Value, up 21%

|

Sidetrade (€m) |

H1 2023 |

H1 2022 |

Change |

| New SaaS

subscriptions (New ARR) |

3.30 |

3.04 |

+9% |

|

Services bookings |

2.54 |

1.77 |

+44% |

|

New Annual Contract Value (ACV) |

5.84 |

4.81 |

+21% |

2023 information is from consolidated, unaudited data.

In H1 2023, Sidetrade delivered its

best-ever performance in bookings with new Annual Contract Value

(ACV) of €5.84 million, up 21% versus H1 2022

despite a challenging base effect since the latter period already

set an historic record for the Group with €4.81 million

in ACV.

New SaaS bookings totaled €3.30

million, mainly driven by an exceptional Q2 2023 when Sidetrade

achieved the best quarterly performance in its history with €2.41

million in New Annual Recurring Revenue ("New ARR") signed in one

quarter. Parallel to this, services bookings (with almost

all invoiced within twelve months of their signing) totaled

€2.54 million, up 44% compared to H1 2022. This

performance is largely due to the growing number of deployment

projects signed worldwide.

In H1 2023, the initial contract period for

new customers (excluding renewals) rose to 44.8 months

versus 43.2 months a year earlier, demonstrating new

customers' confidence in Sidetrade. This extended contract period

increases the economic model's strong predictability. Attrition

remained extremely low for the industry (generally around 10%) with

a churn rate of 2.51% at the end of the first half.

Sidetrade's winning strategy: Ramp-up in new

global contracts

The commercial successes in recent months

validate Sidetrade's strategic decision to target companies

generating revenue in excess of $1 billion. As such, this

first-half performance is largely attributable to the ramp-up in

new global contracts with multinationals including Bayer AG, BIC,

NIELSENIQ and Dassault Systèmes. Sidetrade benefits from 1/

a technological edge in artificial intelligence,

2/ increased credibility with a significant

foothold on both sides of the Atlantic to implement and support

international contracts, and 3/ an effective

salesforce that fosters collaboration between teams in Europe

and North America.Sidetrade also cemented its market position

following Gartner's recognition for the second year in a row as one

of the global Leaders for Integrated Invoice-to-Cash

applications.

Expansion of Sidetrade's offering: a complete

suite for Order-to-Cash cycle and the success of CashApp

Another crucial factor behind this first-half

performance is the expanded AI offering which aims to transform

Sidetrade's platform into the most comprehensive Order-to-Cash

software suite on the market. It includes paperless order

processing, real time credit risk management, electronic invoicing,

dunning and dispute resolution as well as reconciliation of

payments. With respect to the latter, Sidetrade secured its first

contracts thanks to its all-new CashApp solution which automates

the reconciliation of customers' banked payments with open invoices

by leveraging the capabilities of machine learning and deep

learning algorithms. CashApp was a resounding success among major

customers such as Bayer AG and BIC who both opted to deploy the

application worldwide.

In H1 2023, bookings by new customers ("New

Business") accounted for 62% of the total new bookings

while Cross-selling represented 13% of total new

bookings, with the remaining 25% of bookings driven by

Upselling of additional modules to existing customers.

Robust growth in revenue, up 17%, with SaaS

subscriptions up 21%In H1 2023, revenue for 'Order-to-Cash'

SaaS subscriptions continued its brisk growth, up

21%.

Sidetrade's revenue topped the €20 million mark

for the first time in a half year, totaling €20.9 million, an

increase of 17% compared to the same period in the previous fiscal

year. This growth is attributable to two factors:

- Expansion in the United States

In H1 2023, the United States was a growth

driver for Sidetrade, posting revenues up 45%. As a result of this

successful expansion, international markets now represent

57% of the Company's total revenue, including 27% in

North America. Going forward, the United States will continue

to be pivotal for Sidetrade's growth.

- Increasing demand from multinational corporations

Analysis of customer profiles for

'Order-to-Cash' activities is underpinned by impressive growth

of 46% in subscriptions with multinational corporations on

annual contracts in excess of €250,000. These subscriptions now

account for 42% of Sidetrade's total subscriptions and are

expected to remain an important growth driver in the months

ahead.

In H1 2023, the impact of exchange rates on

Sidetrade was not material.

Strong results in a context of accelerating

investment

Record gross margin at 81% of revenue

Sidetrade achieved a record gross margin

in H1 2023, representing 81% of total revenue, with an

impressive rate of 93% in SaaS subscriptions. This

remarkable performance results from Sidetrade's strategy to promote

its technological edge, coupled with strict cost control in an

inflationary environment.Sidetrade continues to illustrate the

robustness of its SaaS model, which generates significant

incremental gross margin, year after year.

Double-digit profitability at 12%, despite

investment of €3.8 million in North America

Operating profit for H1 2023 totaled €2.5

million (vs. €2.4 million in H1 2022), representing 12% of

revenue. Profitability slightly increased, remaining in double

digits under the combined impact of vigorous revenue growth, an

excellent gross margin and efficient cost control.

Bolstered by its robust economic model,

Sidetrade stepped up investment in North America, which amounted to

€3.8 million in H1 2023, up €1.1 million compared to the same

period in the previous fiscal year. This investment mainly focused

on building a regional team of more than 50 colleagues.

Operating profit for H1 2023 includes a French

Research Tax Credit of €1.3 million, equivalent to that of H1 2022,

as well as activation of €0.2 million in marginal R&D costs. It

should be noted that H1 2022 included an innovation subsidy

(EuroFirmo project) of €0.5 million. Restated for this exceptional

item, operating profit would have increased by €0.6 million, up

25%.

Corporate income tax for H1 2023 totaled €0.3

million, versus €0.2 million a year earlier.

All told, Sidetrade's net profit for H1 2023

was almost stable at €2.2 million, demonstrating that continued

growth and profitability are achievable while strategically

investing.

Note that the acquisition of CreditPoint

Software on June 30, 2023, will be consolidated into the Group's

financial statements from July 1, 2023.

Solid financial positionOn June 30, 2023,

Sidetrade reported €24.2 million in gross cash (vs. €20.4

million on December 31, 2022). As of June 30, 2023, the Company

also holds 86,000 of its own shares with a value of

€12.1 million.

Sidetrade's financial debt stands at €11.4

million (fixed rate at 1.1%), giving the Group significant

investment capacity to accelerate its expansion.

Reinforced commitment to responsible growth

with a full CSR assessmentIn addition to its robust financial

results, Sidetrade is committed to a CSR (Corporate Social

Responsibility) approach. The latter centers on integrating ESG

(Environmental, Social, Governance) challenges into its company

strategy.

While Sidetrade is not yet bound by regulatory

requirements, as an industry-recognized leader, the Company

understands the significant role it has in shaping a more

responsible and sustainable future. Against this background,

Sidetrade has already performed a comprehensive Carbon

Assessment (scopes 1, 2 and 3) for FY 2022, which applies to

activities and regions across the board. This assessment helped the

Group to pinpoint the main greenhouse gas emission sources and

identify concrete actions to regulate them.

On top of this, Sidetrade published its

first-ever CSR report (in compliance with the European Union's new

Corporate Sustainability Reporting Directive – CSRD), showcasing

its commitment towards corporate sustainability (see press release

of July 26, 2023). Through this approach, the Company is convinced

that it will further cement its industry-leading position.

Next financial

announcementThird Quarter Revenue for 2023: October 17, 2023,

after the stock market closes.

Investor

relationsChristelle Dhrif

00 33 6 10 46 72

00

cdhrif@sidetrade.com

Media

relationsBecca

Parlby

00 44 7824 5055

84

bparlby@sidetrade.com

About Sidetrade

(www.sidetrade.com)Sidetrade (Euronext Growth:

ALBFR.PA) provides a SaaS platform dedicated to securing and

accelerating cash flow. Sidetrade’s next-generation AI, nicknamed

Aimie, analyzes $4.6 trillion worth of B2B payment transactions

daily in the Sidetrade Cloud to predict customer payment behavior

and the attrition risk of more than 21 million companies worldwide.

Aimie recommends the best cash collection strategies, intelligently

automates actions on the Order-to-Cash process, and dematerializes

customer transactions to enhance productivity, performance, and

working capital management. Sidetrade has a global reach, with 300

talented employees based in Paris, London, Birmingham, Dublin,

Houston, Calgary, and Tulsa serving global businesses in more than

85 countries. Amongst them: Tech Data, KPMG, Nespresso, Hearst,

Expedia, Criteo, Manpower, Securitas, Randstad, Engie, Veolia,

Inmarsat, and Bidfood.Sidetrade is a participant of the United

Nations Global Compact and adheres to its principles-based approach

to responsible business.

For further

information, visit us at www.sidetrade.com and follow us on Twitter

@Sidetrade.

In the event of any

discrepancy between the French and English versions of this press

release, only the French version is to be taken into account.

- Sidetrade: A double-digit profitability at 12% of revenue

despite increased North America investment

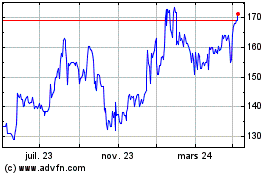

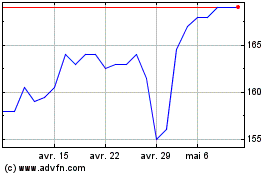

SideTrade (EU:ALBFR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

SideTrade (EU:ALBFR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024