Strong growth in sales: +28% Operating income

down due to strategic investment Very significant improvement in

free cash flow, up €7.1m vs H1 2022 Solid financial structure to

support future growth Post H1-closing repayment of €15m in EuroPP

debt

Regulatory News:

Xilam Animation (Paris:XIL) has published its interim

financial results for the first six months of 2023 (H1 2023),

approved by the Board of Directors on 27 September 2023, under the

chairmanship of Marc du Pontavice.

Marc du Pontavice, Chairman and CEO of Xilam: "The Xilam

group is firmly committed to continuing on its growth trajectory.

While streaming platforms are experiencing significant turbulence,

particularly in the market for children's programmes, the boom in

orders for programs aimed at adult audiences continues unabated, as

expected by Xilam. To successfully position itself in this market,

Xilam has invested from 2022 onwards, particularly in IT, talent

and management, which partly explains the decline in operating

income in 2023. Over the first six months, servicing accounted for

a high percentage of the sales mix, giving Xilam a virtuous model

in terms of free cash flow generation.”

Income statement (in thousands of

euros)

30.06.2023 (1)

30.06.2022

% change

Sales of new productions and

developments

14,431

9,696

+49%

Catalogue sales

3,716

4,467

-17%

Total sales (2)

18,147

14,163

+28%

Grants (3)

2,351

3,483

-33%

Total sales and grants

20,498

17,646

+16%

Other current operating revenue (including

ATC)(4)

797

1,603

ns

Total operating revenue

21,295

19,249

+11%

Operating expenses

(19,140)

(14,466)

+32.3%

Current operating income

2,155

4,783

-55%

% total sales and grants

10.5%

27.1%

Operating income

2,158

4,684

-54%

% total sales and grants

10.5%

26.6%

Financial income and expenses

(79)

(985)

ns

Group consolidated net income

1,761

2,964

-41%

% total sales and grants

8.6%

16.8%

(1) The limited review of the half-year financial information

has been finalised. (2)Sales only, excluding grants. (3)Total

grants (new productions and catalogue). (4)Audiovisual Tax Credit

(ATC)

Very good performance for new productions and developments in

H1 2023

Sales of new productions and developments amounted to €14.4

million, up sharply (+49%) in the first half of 2023, with a 60%

increase in the scope of Xilam alone, illustrating continued strong

growth in sales to platforms, driven by the new adult segment and

servicing. This growth is mainly driven by an increase in value. As

for the Cube Creative subsidiary, its contribution was down, due to

an order book that is still being rebuilding.

Catalogue sales totalled €3.7 million. Due to an unfavourable

base effect (+78% in H1 2022), they declined 17%, but remained 49%

higher than in H1 2021.

Total sales, excluding grants, rose by 28% to €18.1 million.

International sales amounted to 86%, with streaming platforms

accounting for 76%. This is mainly the result of our young-adult

productions which represented a very high proportion of sales

(40%), reflecting the Group's successful positioning in this

promising segment. As announced, servicing will account for a

particularly high share of sales in 2023 and 2024, spurred by the

signing of new contracts. In the medium term, however, the Group is

aiming for a more balanced split between its proprietary production

and servicing.

Strong production momentum

In the first six months of the year, Xilam had 10 series in

production, including five proprietary productions and five in

servicing.

The production of Twilight of the Gods is a standout example of

Xilam's success with major platforms. The series, directed by the

iconic Zack Snyder, was commissioned by Netflix and is aimed at

young-adult audience. It boasts outstanding production quality and

a per-episode budget that far exceeds the average benchmark. This

series is key to the Group’s future as it gives the American market

a tangible example of Xilam’s production expertise and ambition in

this adult segment.

The trend in the Group's production costs is a good indicator of

business activity, since it will fuel growth over the next few

years. These totalled €20.9 million in H1 2023 (vs €15.7 million in

H1 2022), an increase of 33%. This includes €10.9 million for

servicing and €10 million for proprietary productions (vs €3

million and €12.7 million, respectively, in H1 2022).

Decline in operating income due to strategic

investment

Current operating income stood at €2.2 million in H1 2023, down

€2.6 million vs H1 2022. This was largely due to several key

factors:

- Group’s strategic investments to support future growth,

particularly in the promising young-adult segment. These mainly

involve structural investments such as IT, talents and management

required to boost production capacity and move upmarket. As a

result, fixed costs will have risen by a total of 20% between 2021

and 2023. In an exclusively proprietary growth model (which has

been Xilam's case in recent years), the increase in fixed costs is

partially deferred via capitalisation. But in 2023, in a hybrid

model with a high degree of servicing, most of this increase in

fixed costs is directly recorded in operating expenses and is

therefore weighting on operating income.

- Sluggish proprietary productions for Cube Creative, impacting

the Group's bottom line.

- The reduced share of catalogue sales in overall revenues (20%

vs 31% in H1 2022), whereas it is traditionally the main

contributor to earnings.

- The currency effect, which was positive in H1 2022.

All of this brought the current operating margin to 10.5%.

Financial income was virtually even following a €1m charge in H1

2022 (including a €0.6 million charge linked to currency effects),

reflecting the Group's low level of debt.

Consolidated net income totalled €1.8 million in H1 2023, down

€1.2 million compared with H1 2022. This represents a net margin of

8.6%.

Substantial improvement in cash-flow generation

In the first six months of 2023, Xilam achieved €2.2 million in

free cash flow, compared with negative cash flow of -€4.9 million

in H1 2022. This represents a substantial improvement of €7.1

million, mainly resulting from a working capital requirement

reduction and the preponderance of servicing in H1 revenues.

A solid balance sheet

Gross cash stood at €13.9 million as of 30 June 2023. Net

financial debt totalled €15.6 million, with non‑self-liquidating

financial debt at €3.7 million.

Xilam took advantage of this strong financial structure to repay

the €15 million debt provided by the 2017 Euro PP bond maturing in

July this year.

To substitute this debt where necessary, Xilam has opened two

new self-liquidating credit lines (in addition to the one available

with Natixis-Coficiné) with Palatine (€12 million) and BNP Paribas

(€6 million), reflecting the banking partners' faith in the Group's

financial robustness.

As of 30 June 2023, shareholders' equity stood at €71.1 million,

compared with €69.5 million on 31 December 2022.

Six-point improvement in EthiFinance ESG ratings score to

68/100

In the first six months of 2023, Xilam classified more than

15,000 pieces of financial data, logged all of its consumption and

conducted an initial employee survey with a view to publishing its

first Carbon Footprint Assessment by the end of the year, based on

2022 data. These initiatives covered all of the Group's studios (in

Paris, Lyon, Angoulême and Vietnam), providing Xilam with a

detailed assessment of its greenhouse gas emissions to help draw up

and implement an effective low-carbon strategy.

Alongside this in-depth assessment, Xilam also made significant

strides to curb its greenhouse gas emissions in the first half of

the year. This included greening its IT infrastructure through the

purchase of new, less energy-intensive servers, migrating its data

to a zero-carbon data centre, and cutting back its overall data

storage. The Group also began work to improve energy efficiency at

its main site.

Xilam is a committed company that has taken tangible steps to

make sustainable development and social responsibility an integral

part of its business over the years. This commitment was once again

reflected in the 2023 EthiFinance ESG Ratings, which revealed a

third consecutive year of progress, with Xilam scoring 68 out of

100, an improvement of six points vs 2021 and 9 points vs 2020.1 In

particular, its Corporate Governance and Social scores improved by

nine points (69/100) and six points (76/100) vs 2021,

respectively.

In the Media & Entertainment sector, Xilam came third out of

78 companies listed, ahead of TF1 and Vivendi.

Outlook

Xilam plans to invest around €40m in 2023 (equally between

proprietary productions and servicing) in expenditure on new

productions, up significantly on 2022 (€36.3m).

In 2023, the Group is paving the way for the future by investing

in its structure and diversifying its offering to provide

programmes for all kinds of viewers (including preschool, families

and young adults) spanning a full range genres (such as comedy,

horror and action-adventure), ensuring it is perfectly positioned

to fully harness the development potential in the global animation

industry.

This business growth, coupled with the stabilization of fixed

costs, should contribute to a significant improvement in the

Group's operating profitability in the years ahead. All the more so

as from the second half of 2023, financing in the form of a grant

under the French government’s France 2030 programme will contribute

to financing the Group’s growth investments.

Building on this momentum, Xilam will continue to execute its

Ambition 2026 plan, which aims to boost revenues to €80

million.

About Xilam As a major player in the animation industry,

Xilam is an integrated studio founded in 1999 that creates,

produces and distributes original programmes in more than 190

countries for children and adults, broadcast on television, and on

SVoD (Netflix, Disney+, Amazon) and AVoD (YouTube, Facebook)

platforms. With a global reputation for creativity and innovation,

coupled with cutting-edge editorial and commercial expertise, the

company has cemented its position as a key player in a fast-growing

market. Every year, Xilam builds on soaring successes and

capitalises on flagship franchises (Oggy and the Cockroaches, Zig

& Sharko, Chicky) as well as new brands (Oggy Oggy, Mr. Magoo,

Karate Sheep), which are strengthening and expanding a substantial

catalogue of more than 2,800 episodes and three feature films,

including the Oscar-nominated I Lost My Body. Xilam has unique CGI

skills and employs more than 600 people, including 400 artists,

across its studios in Paris, Lyon and Angoulême in France and Ho

Chi Minh City in Vietnam. Xilam was ranked France's leading

animation studio for the 2018-2022 period in a report by the French

national centre for cinema and animation (CNC). Xilam is listed on

Euronext Paris Compartment B - PEA - SRD long Eligibility. ISIN:

FR0004034072, Mnemo: XIL

1Rating based on 2022 data

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230928732488/en/

Marc du Pontavice – Chairman and CEO Cécile Haimet - CFO Phone:

+33 (0)1 40 18 72 00

Image Sept Agency xilam@image7.fr Karine Allouis (Media

Relations) – Phone +33 (0)1 53 70 74 81 Laurent Poinsot (Investor

Relations) +33 (0)1 53 70 74 77

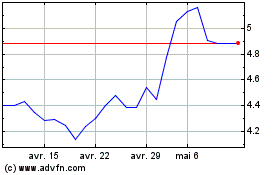

Xilam Animation (EU:XIL)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Xilam Animation (EU:XIL)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024