Hopes For Fed Pause Pull Down U.S. Dollar

06 Juin 2023 - 8:48AM

RTTF2

The U.S. dollar weakened against other major currencies in the

European session on Tuesday, as weak ISM services activity data for

May boosted hopes for a pause in rate hikes at the Fed meeting next

week.

Survey from the Institute for Supply Management showed that U.S.

services PMI index fell to 50.3 in May from 51.9 last month,

missing forecasts of 52.2.

Separate data showed that new orders for manufactured goods rose

by slightly less than expected in April.

Markets are pricing in a 77.1% chance that the Fed will hold

rates steady at its June 13-14 meeting.

U.S. treasury yields dropped, with the benchmark yield on the

10-year note touching 3.66 percent. Yields move inversely to bond

prices.

The greenback fell to 4-day lows of 1.0732 against the euro,

1.2459 against the pound and 139.09 against the yen, from

yesterday's closing quotes of 1.0712, 1.2436 and 139.58,

respectively. The greenback is seen finding support around 1.09

against the euro, 1.27 against the pound and 134.00 against the

yen.

The greenback dropped to a 1-week low of 0.9032 against the

Swiss franc from yesterday's close of 0.9061. The greenback may

face support around the 0.89 region, if it falls again.

The greenback depreciated to a 3-week low of 0.6685 against the

aussie, 4-day low of 0.6100 against the kiwi and near a 4-week low

of 1.3389 against the loonie, from yesterday's closing values of

0.6617, 0.6069 and 1.3445, respectively. The greenback is likely to

challenge support around 0.68 against the aussie, 0.64 against the

kiwi and 1.32 against the loonie.

Looking ahead, Canada building permits for April and Ivey PMI

for May are slated for release in the New York session.

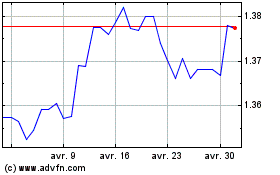

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024