Russia Keeps Key Interest Rate Unchanged At Record High 21%

14 Février 2025 - 8:35AM

RTTF2

The Bank of Russia retained its interest rate at a record high

for the second consecutive meeting on Friday and kept the door open

for further rate hike as inflationary pressures remain high.

The board of directors, governed by Elvira Nabiullina,

maintained the key interest rate at a record 21.00 percent.

The Russian central bank has raised the key interest rate by

1,350 basis points since July 2023.

Policymakers observed that the current inflationary pressures

remain high. The bank said it will assess the need for a key rate

increase at its upcoming meeting, taking into consideration the

speed and sustainability of the inflation slowdown.

"The baseline scenario provides that returning inflation to the

target will require a longer period of maintaining tight monetary

conditions in the economy than it was forecast in October," the

bank said.

The bank raised its inflation forecast for this year to 7.0-8.0

percent from 4.5-5.0 percent. Price growth is expected to return to

4.0 percent in 2026 and stay at the target further on.

Regarding economic growth, the bank said the Russian economy

expanded 4.1 percent in 2024, which was slightly stronger than

previously estimated due to higher domestic demand growth.

Capital Economics' economist Nicholas Farr said inflation is

likely to rise further over the coming months as the war continues

to push the economy up against capacity constraints.

Despite recent calls among businesses and politicians for

monetary loosening, a pivot to interest rate cuts is unlikely until

at least the second half of the year, the economist noted. The

policy rate is set to end this year at 18.00 percent.

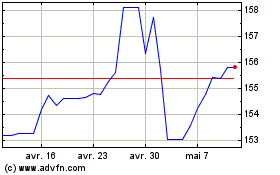

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Jan 2025 à Fév 2025

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Fév 2024 à Fév 2025