TIDMCLX

RNS Number : 0561U

Calnex Solutions PLC

21 November 2023

21 November 2023

Calnex Solutions plc

("Calnex", the "Company" or the "Group")

Interim Results

Calnex Solutions plc (AIM: CLX), a leading provider of test and

measurement solutions for the global telecommunications and cloud

computing markets, announces its unaudited results for the six

months ended 30 September 2023 ("H1 FY24" or "the Period").

Financial Highlights

-- Performance impacted by the wider economic environment and

resulting deferral of investment in telecommunications market.

-- Revenue decline of 38% to GBP7.8m (H1 FY23: GBP12.7m).

-- Gross margin maintained at 74%, broadly in line with the prior period (H1 FY23: 76%).

-- Cost controls implemented, while maintaining key product

development and customer engagement to support future growth.

-- Underlying EBITDA(1) loss of GBP0.4m (H1 FY23: profit of GBP3.5m).

-- Loss before tax of GBP0.6m (H1 FY23: profit of GBP3.1m).

-- Basic EPS loss ( pence ) of (0.42)p (H1 FY23: 2.78p).

-- Closing cash position of GBP13.5m (H1 FY23: GBP14.4m,

including fixed term deposits), enabling exploitation of growth

opportunities across key sectors. Cash levels expected to be

maintained for H2.

-- Interim dividend of 0.31 pence per share to be paid in December.

Operational Highlights

-- Sales pipeline remains strong with customers committed to

delivery of pipeline projects once budgets are released.

-- New products performing well, with first orders for SNE-X and

SNE-Ignite and NE-ONE gaining traction in new sectors, such as

defence.

-- Ongoing product development programme to support growth and

meet the evolving needs of customers.

Outlook

-- The Board expects to close the year in line with the current market expectations.

-- Confident in a return to growth in the 12 months to March

2025 ("FY25") through creation of new use cases for existing

products, plus the development of new products and expansion into

growing sectors.

-- Underlying market drivers, including the increase in network

complexity, the build-out of 5G and data centre investment, remain

positive.

Tommy Cook, Chief Executive Officer, and founder of Calnex,

said: "While the results for the first half are disappointing, the

strength of our offering, team, and balance sheet, resulting from

our consistent delivery in recent years, means we are well

positioned to weather the current conditions while continuing to

invest in our product roadmap.

"We have experienced markets such as these before and are adept

at managing the business back to growth.

"We believe the fundamental drivers that underpin the build out

of the mobile network and the expansion of data centres and cloud

computing capacity have not changed, but rather investment put on

pause due to the macro-economic climate. We will continue to focus

on the deployment of our new product programme as a means to

generate additional customer demand and are confident that Calnex

will return to growth in FY25."

(1) EBITDA after charging R&D amortisation.

For more information, please contact:

Calnex Solutions plc Via Alma

Tommy Cook, Chief Executive Officer

Ashleigh Greenan, Chief Financial Officer

+44 (0)131 220

Cavendish Capital Markets Limited - NOMAD 6939

Derrick Lee, Peter Lynch

+ 44(0) 20 3405

Alma 0213

Caroline Forde, Hannah Campbell, Joe Pederzolli

Overview of Calnex

Calnex Solutions designs, produces and markets test and

measurement instrumentation and solutions for the

telecommunications and cloud computing industries. Calnex's

portfolio enables R&D, pre-deployment and in-service testing

for network technologies and networked applications, enabling its

customers to validate the performance of the critical

infrastructure associated with telecommunications and cloud

computing networks and the applications that run on it.

To date, Calnex has secured and delivered orders in 68 countries

across the world. Customers include BT, China Mobile, NTT,

Ericsson, Nokia, Intel, Qualcomm, IBM and Meta.

Founded in 2006, Calnex is headquartered in Linlithgow,

Scotland, with additional locations in Belfast, Northern Ireland,

Stevenage, England and California in the US, supported by sales

teams in China and India. Calnex has a global network of partners,

providing a worldwide distribution capability.

Operational Review

Overview of the Period

Throughout the first half of the financial year, Calnex

continued to operate in a challenging economic environment,

reflecting the ongoing caution in the wider telecommunications

market. Our order inflow remained at the subdued levels we

experienced at the outset of the year. The cautiously improving

outlook reported widely across the sector earlier in H1 failed to

gain the momentum we expected and the typically strong September

trading period that we usually experience, following the seasonally

quiet July and August, did not materialise. As a result of these

factors, the Group achieved HY24 revenue of GBP7.8m (H1 FY23:

GBP12.7m) and a loss before tax of GBP0.6m (H1 FY23: profit of

GBP3.1m), below the Board's expectations set at the start of the

year.

While the extent of the first half decline in revenues and

profits is deeply disappointing for us all, there remain many

reasons for optimism over the longer term. We have multiple

customer orders that have passed through technical and commercial

validation stages and are awaiting budget allocation. Our strong

sales pipeline provides confidence, and customers have confirmed

they remain committed to the delivery of projects once budgets are

released.

Spending within the telecommunications sector is generally led

by the large infrastructure projects of the major

telecommunications operators, which filter down through the wider

ecosystem. These infrastructure projects face macro slowdowns at

times, and we are currently experiencing one that is particularly

prolonged, reflecting both the high interest rate environment and

the increased geopolitical tensions, which have caused network

build-out projects to be slowed or delayed.

Due to our long history in the sector, we have experienced

markets such as these before and are adept at managing the business

back to growth, delivering historically, low-teens long-term

revenue CAGR. We are confident that we can capitalise on the

opportunities available to us once market dynamics normalise.

While we are confident that budgets will return in the

telecommunications market as the economic backdrop improves, we are

not simply waiting for the market to re-open. Our new product

programme targeting both telecommunications and

non-telecommunications markets, such as cloud computing, data

centres and the defence sector, which are less affected by the

macroeconomic environment, is more important than ever, as a new

product that serves evolving customer needs provides a more

compelling reason for customers to buy, even in a downturn.

While order levels were suppressed across all product lines and

regions outside of the data centre and cloud and IT markets, we

continued to secure sales for both existing and newly released

products in the Period. Highlights include the first orders for our

newly launched products, SNE-X, SNE-Ignite and NE-ONE, which is

gaining traction in new sectors, such as defence.

The business continues to be supported by a healthy balance

sheet, with cash at the end of September 2023 of GBP13.5 million.

There was significant investment in inventory during the Period to

develop more flexibility in the ability to respond to customer

orders plus an element of inventory build-up from material received

to support previous order expectations. This cash position enables

us to continue to target growth opportunities across our key

sectors and maintain relationships with customers as they plan

future investment in their projects.

Market drivers

The underlying structural growth drivers in the

telecommunications and data centre markets continue to offer

long-term growth opportunities for Calnex. Within the

telecommunications market, these include the increase in network

complexity and the build-out of the mobile infrastructure utilising

5G technology. This will see a long-term transformation of the

telecommunications network, creating the need for test and

measurement equipment to prove that new systems operate effectively

and conform to rigorous international standards. The

telecommunications market is still very much only at the start of

this build out. In a recent interview with Bloomberg, Pekka

Lundmark, Chief Executive Officer, Nokia, is quoted as saying "In

Mobile Networks there is still substantial need for operators to

invest in 5G globally with only approximately 25% of the potential

mid-band 5G base stations so far deployed outside China."

The ongoing investment into data centre capacity and efficiency

to support the growth in cloud computing and adoption of AI is also

providing Calnex with new opportunities in the areas of network

time monitoring (with our recently introduced product 'SyncSense')

and data centre efficiency and effectiveness.

Product development

Innovation is the lifeblood of our business. We have

consistently brought highly engineered, high value and

differentiated products to market, stimulating customer demand and

supporting our growth. Each new platform we develop offers a large

number of features and capabilities. Much of this core capability

can be used in a multitude of testing scenarios in a wide range of

markets, both within telecommunications and non-telecommunications

markets. These core capabilities are then complemented by added

features making the platform appropriate for a specific market in

which we have identified a verified opportunity.

In this way, previous R&D investment is repurposed for new

growth channels, such as the adaptation of our telecommunications

network synchronisation offering, Sentinel, for the data centre

market, re-named Sentry.

We have innovation programmes across all of our product

families, adapting them for new customer needs or markets. These

include SyncSense, a new product to target network time monitoring

in data centres, and SNE-X and SNE-Ignite, targeting high-speed,

and high accuracy Network Emulation opportunities across both

telecommunications and non-telecommunications markets. We

anticipate the launch of these new products will support our growth

in FY25, as well as the demand we are seeing for the newly launched

Sentry and the acquired NE-ONE offering in defence.

Outlook

The Board expects to see a seasonal increase in H2, closing the

year in line with the current market expectations.

During H2, we will remain focused on the deployment of our

existing products as well as our new product programme that targets

both the telecommunications and non-telecommunication markets, to

address unmet customer needs. We are confident that these will

enable Calnex to return to growth in FY25.

We believe the fundamental drivers that underpin the build out

of the mobile network and the expansion of the data centres and

cloud computing capacity have not changed, there is simply a pause

caused by the macro-economic climate. Within the telecommunications

market, the close relationships we hold with our customers and

partners mean we are well positioned to convert the sales pipeline

to orders once spending patterns normalise.

Our healthy balance sheet will enable us to weather these

uncertainties, providing the Board with confidence in the medium-

and long-term future of Calnex and in our ability to deliver for

our shareholders.

Financial Review

While the results for the period are disappointing, importantly

gross margins have remained robust and we continue to benefit from

a healthy cash balance, strong customer relationships and a high

quality and productive R&D team, providing us with confidence

in a return to a stronger financial performance in future

periods.

Broadly, the wider economic concerns and reticence in the market

had an impact on revenue levels across all product lines and

geographies.

Amongst our three territories, Rest of World (EMEA, India, South

East Asia, Australasia) was the least affected by the slow-down,

driven by a resilient performance in EMEA where business is derived

from a wide range of sectors. Within North Asia, China remains

challenging due to the impact of US restrictions and as a result,

an increased focus is being applied to growing business in Taiwan

and Japan. The Americas region was most impacted by the

telecommunications slow down and therefore increased focus is being

applied on Hyperscalers and government opportunities where we see

the best chance to close business.

Looking at our product lines, Lab Sync (Paragon-Neo and

Paragon-X) saw a softened performance in the Period which, given

their dominance in the telecommunications market, is directly

linked to the wider slowdown in the sector. This is also the case

with Sentinel, our telecommunications focused Network Sync product.

Sales of Sentry, our Network Sync product aimed at data centres,

are continuing as planned.

Our Cloud & IT (infrastructure) product, SNE, endured a

challenging H1 given its exposure to the US market, but performance

is expected to pick up in H2 from the growing sales pipeline for

the newly launched SNE-X & SNE-Ignite products. Across Cloud

& IT (Applications), NE-ONE, we are on track to achieve our

original FY revenue target, with the growth being driven by channel

expansion and a strong performance in defence and satellite

communications sectors.

Key performance indicators

GBP000 H1 FY24 H1 FY23 FY23

Unaudited Unaudited Audited

Revenue 7,847 12,728 27,449

Gross Profit 5,836 9,617 20,472

Gross Margin 74% 76% 75%

Underlying EBITDA (1) (411) 3,466 7,980

Underlying EBITDA % -5% 27% 29%

Profit before tax (599) 3,086 7,208

Profit before tax % -8% 24% 26%

Closing cash including fixed

term deposits (2) 13,478 14,436 19,098

Capitalised R&D 2,554 2,247 4,523

Basic EPS (pence) (0.42) 2.78 6.75

Diluted EPS (pence) (0.42) 2.67 6.42

(1) EBITDA after charging R&D amortisation.

(2) The Group places surplus cash balances not required for

working capital into notice and fixed term deposit accounts. Under

IAS 7 Statement of Cash Flows, cash held on long-term deposits

(being deposits with maturity of greater than 95 days, and no more

than twelve months) that cannot readily be converted into cash is

classified as a fixed term investment.

A reconciliation between the statutory reported income statement

and the adjusted income statement is shown in note 22 to the

financial statements.

Revenue

Revenue recognised in the first half of the year was GBP7.8m, a

38% decline on H1 FY23 revenue of GBP12.7m, driven by the subdued

level of order volumes experienced through the Period.

Gross Margin

Gross margin in the Period was 74%, in line with the FY23 margin

of 75%. (H1 FY23: 76%). This gross margin is net of commissions

payable to our channel partners and can fluctuate by 1-2% through

the year depending on the mix and timing of the hardware and

software bundles shipped.

The Group increased pricing in the prior period to negate

inflationary direct materials cost increases, which has contributed

to the protection of the product margins throughout the Period.

Underlying EBITDA

Underlying EBITDA is stated after charging R&D

amortisation.

Underlying EBITDA was a GBP0.4m loss in the Period (H1 FY23:

GBP3.5m), driven by the reduction in revenue volumes. Underlying

EBITDA margin was -5% (H1 FY23: 27%).

Administration costs excluding depreciation and amortisation

were GBP4.5m in H1 FY23 (H1 FY22: GBP4.7m). The Group paused on any

further recruitment at the start of the year as a consequence of

the slowdown in trading and, as a result, excluding graduate hires,

there were no new headcount increases in the Period.

The reduced order levels have resulted in lower commission costs

compared to the prior period together with lower recruitment costs

and legal fees (non-recurring deal fees for the iTrinegy

acquisition were included in administration costs in the prior

period). Staff and management profit share accruals have also been

reduced compared to the prior year. These cost savings were offset

partially by adverse foreign exchange impacts on overseas salary

costs and increased share-based payment charges.

GBP0.1m has been charged to the income statement in the Period

to account for the Earn-out Payment in relation to the iTrinegy

acquisition, with a further GBP0.1m to be charged in H2. If revenue

growth targets from the NE-ONE product line are met, the Earn-Out

Payment will be paid as a combination of cash and new shares issued

in Calnex Solutions plc in early FY25.

Whilst cost controls have been implemented across all cost lines

and departments, the Group has not implemented any investment

reduction programmes as maintaining investment in product

development and customer engagement at this point is fundamental to

support future growth.

Amortisation of R&D costs in H1 FY23 was GBP1.8m (H1 FY23:

GBP1.6m). The increase on the prior period is due to the impact of

the 5 year amortisation profile and growth in capital spend in

prior years. Excluding graduate hires (of which there were 5 new

hires in the Period), there have been no headcount increases in the

R&D team in the Period.

Profit before tax

Loss before tax was GBP0.6m in the Period (H1 FY23: GBP3.1m

profit), with the reduction in trading volumes and predominantly

fixed cost base causing a negative operational leverage effect on

profit.

Tax

The Group's loss-making position resulted in a tax credit of

GBP0.2m for the Period (H1 FY23: charge of GBP0.7m), driven

predominantly by the proportion of R&D SME enhanced tax credit

relief.

The weighted average applicable tax rate for FY24 is 25% (FY23:

19%). The difference between the applicable rate of tax and the

effective rate of 37% (H1 FY23: 21%) is largely due to the

following:

-- Availability of R&D SME enhanced deduction at 86% (increasing effective rate by 24%); and

-- A combination of such as prior year adjustments, timing

differences, and overseas tax (decreasing effective rate by

12%).

We expect the effective tax rate to revert back in line with the

weighted average applicable tax rate once the Group returns to

profitability in future periods.

Earnings per share

Basic earnings per share was a loss of 0.42p in the Period (H1

FY23: 2.78p) and diluted earnings per share was also a loss of

0.42p (H1 FY23: 2.67p), with the movement compared to the prior

period attributed to reduced trading volumes.

Cashflows

The Group experienced a cash outflow of GBP5.6m in the period,

reflecting the loss made in the Period and increases in working

capital.

Working capital in the period increased by GBP3.3m (H1 FY23:

GBP1.3m) driven predominantly by increased levels of product to

increase responsiveness to order intake, plus inventory increases

as a result of the tail end effects of supply chain issues coupled

with investment in inventory to support the previous order

expectations. The inventory will be sufficient to support the

remainder of the year and positions the company well to deliver

faster turnaround of orders to revenue in H2.

The Group paid GBP0.8m in tax in the period based on the profit

generated in the prior year. Given the Group's current expectations

for profit for FY24, this cash is potentially refundable in FY25

after submission of the FY24 year-end tax return.

Cash used in investing activities is principally cash spent on

R&D activities which is capitalised and amortised over five

years. Investment in R&D in the Period was GBP2.6m (H1 FY22:

GBP2.5m), reflecting inflationary salary increases and graduate

headcount increases.

The Group places surplus cash balances not required for working

capital into notice and fixed term deposit accounts. Under IFRS,

cash held on long-term deposits (being deposits with maturity of

greater than 95 days, and no more than twelve months) that cannot

readily be converted into cash is classified as a fixed term

investment. This is shown separately on the balance sheet and

classed as a cash outflow within investing activities in the

consolidated cashflow statement in prior periods. As at 30

September 2023, the Group held surplus cash in notice accounts, but

did not hold any on long term deposit.

Closing cash at 30 September 2023 was GBP13.5m (30 September

2022: GBP14.4m including fixed term deposits; 31 March 2022:

GBP19.1m including fixed term deposits). Subject to any effects of

supply chain issues, we expect this cash balance to be maintained

throughout H2.

Dividend

The Board retain full confidence in future growth and

accordingly has resolved to pay an interim dividend of 0.31 pence

per ordinary share (FY23 Interim dividend 0.31p) on 15 December

2023 to those shareholders on the register as at 1 December 2023,

the record date. The ex-dividend date is 30 November 2023.

Calnex Solutions plc

Consolidated Statement of Comprehensive Income

For the period ended 30 September 2023

6 months 6 months Year ended

to to

30 Sep 30 Sep 31 Mar

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Revenue 5 7,847 12,728 27,449

Cost of sales (2,011) (3,111) (6,977)

------------ ------------ -----------

Gross profit 5,836 9,617 20,472

Other income 111 150 751

Administrative expenses (6,705) (6,669) (13,989)

------------ ------------ -----------

Operating (loss)/profit (758) 3,098 7,234

Presented as:

EBITDA 1,405 5,076 11,295

Depreciation and amortisation of non-R&D

assets (347) (368) (746)

Amortisation of R&D asset (1,816) (1,610) (3,315)

Operating (loss)profit (758) 3,098 7,234

============ ============ ===========

Finance costs 6 (11) (12) (26)

Interest received 170 - -

(Loss)/profit before taxation (599) 3,086 7,208

Taxation 7 223 (656) (1,297)

------------ ------------ -----------

(Loss)/profit and total comprehensive

income for the year (376) 2,430 5,911

============ ============ ===========

Earnings per share (pence)

Basic (loss)/earnings per share 8 (0.42) 2.78 6.75

Diluted (loss)/earnings per share 8 (0.42) 2.67 6.42

Calnex Solutions plc

Consolidated statement of financial position

For the period ended 30 September 2023

6 months 6 months Year ended

to to

30 Sep 30 Sep 31 Mar

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 9 11,168 10,181 10,565

Goodwill 10,11 2,000 1,646 2,000

Plant and equipment 12 434 297 404

Right of use assets 13 409 660 533

Deferred tax asset 14 691 304 272

------------ ------------ -----------

14,702 13,088 13,774

Current assets

Inventory 15 3,837 1,532 2,748

Trade and other receivables 16 4,676 6,035 3,130

Corporation tax receivable 42 - -

Cash and cash equivalents 17 13,478 12,936 17,583

Short term investments 17 - 1,500 1,515

------------ ------------ -----------

22,033 22,003 24,976

Total assets 36,735 35,091 38,750

------------ ------------ -----------

Current liabilities

Trade and other payables 18 5,515 6,059 5,988

Corporation tax payable - - 843

Lease liability payable within

one year 13 271 192 260

5,786 6,251 7,091

Non-current liabilities

Trade and other payables 18 1,096 1,965 1,396

Lease liabilities payable later

than one year 13 280 566 431

Deferred tax liability 14 2,663 2,253 2,457

Provisions 19 15 15 15

------------ ------------ -----------

4,054 4,799 4,299

Total liabilities 9,840 11,050 11,390

------------ ------------ -----------

Net assets 26,895 24,041 27,360

============ ============ ===========

Equity

Share capital 109 109 109

Share premium 7,495 7,495 7,495

Share option reserve 1,327 764 873

Retained earnings 17,964 15,673 18,883

Total equity 26,895 24,041 27,360

============ ============ ===========

Calnex Solutions plc

Consolidated statement of cashflows

For the period ended 30 September 2023

6 months 6 months Year ended

to to

30 Sep 30 Sep 31 Mar

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cashflow from operating activities

(Loss)/profit before tax from

continuing operations (599) 3,086 7,208

Adjusted for:

Finance costs 11 12 26

Interest received (170) - (160)

Government grant income (111) (96) (201)

R&D tax credit income - - (390)

Movement in provisions - (141) -

Share based payment transactions 450 286 574

Depreciation 211 368 371

Amortisation 1,952 1,610 3,690

Movement in inventories (1,234) (569) (1,554)

Movement in obsolescence provision 145 109 (122)

Movement in trade and other receivables (1,546) (1,054) 1,619

Movement in trade and other payables (649) 239 (329)

Cash (outflow)/inflow generated

from operations (1,540) 3,850 10,732

Movement in provision (overseas

tax) - - (140)

Corporation and foreign tax payments (843) - (70)

Corporation tax receivable (42) - -

R&D tax credit cash refunds received - 393 589

------------ ------------ -----------

Net cash (outflow)/inflow from

operating activities (2,425) 4,243 11,111

------------ ------------ -----------

Investing activities

Purchase of intangible assets (2,554) (2,247) (4,523)

Purchase of plant and equipment (117) (64) (181)

Purchase of subsidiary: net of

cash acquired - (2,263) (2,263)

Short term investment: fixed term

deposit 1,515 - (15)

Interest received 170 - 160

Net cash outflow from investing

activities (986) (4,574) (6,822)

------------ ------------ -----------

Financing activities

Payment of lease obligations (151) (111) (245)

Dividends paid (543) (490) (761)

Share options proceeds - 11 11

Government grant income - - 432

Net cash outflow from financing

activities (694) (590) (563)

------------ ------------ -----------

Net (decrease)/increase in cash

and cash equivalents (4,105) (921) 3,726

Cash and cash equivalents at the beginning

of the period 17,583 13,857 13,857

Cash and cash equivalents at

the end of the period 13,478 12,936 17,583

============ ============ ===========

Calnex Solutions plc

Consolidated statement of changes in equity

For the period ended 30 September 2023

Share

Share Share option Retained Total

capital premium reserve earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 30 September

2022 109 7,495 764 15,673 24,041

Transactions with owner in their capacity as owners

Share options - - 109 - 109

Interim dividend - - - (271) (271)

--------- --------- --------- ---------- --------

- - 109 (271) (162)

Profit for period ended 31 March

2023 - - - 3,481 3,481

Balance as at 31 March 2023 109 7,495 873 18,883 27,360

--------- --------- --------- ---------- --------

Transactions with owner in

their capacity as owners

Share options - - 454 - 454

Final dividend - - - (543) (543)

--------- --------- --------- ---------- --------

- - 454 (543) (89)

Loss for period ended 30 September

2023 - - - (376) (376)

Balance at 30 September 2023 109 7,495 1,327 17,964 26,895

--------- --------- --------- ---------- --------

Calnex Solutions plc

Notes to the interim consolidated financial statements

For the period ended 30 September 2023

1. General information

The interim consolidated financial statements cover the

consolidated entity Calnex Solutions plc and the entities it

controlled at the end of, or during, the interim period to 30

September 2023 ("the Group").

Calnex Solutions plc ("the Company") is a public limited company

and is domiciled and incorporated in Scotland.

The registered office is:

Oracle Campus

Linlithgow

West Lothian

EH49 7LR

The principal activity of the Group is the design, production

and marketing of test instrumentation and solutions for network

synchronisation and network emulation enabling its customers to

validate the performance of critical infrastructure associated with

telecommunications networks, enterprise networks and data

centres.

The interim consolidated financial statements for the period

ended 30 September 2023 are unaudited, and do not constitute

statutory accounts as defined in section 434 of the Companies Act

2006. They do not therefore include all the information and

disclosures required in annual statutory financial statements and

should be read in conjunction with the Group annual report and

accounts for the year ended 31 March 2023.

The Group annual report and accounts for the year ended 31 March

2023 were approved by the Board of Directors on 22 May 2023 and

have been delivered to the Registrar of Companies. The auditor's

report on those accounts was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement made

under Section 498(2) or (3) of the Companies Act 2006.

The interim consolidated financial statements for the period

ended 30 September 2023 were approved by the Board of Directors on

20 November 2023.

2. Basis of preparation

The interim consolidated financial statements for the period

ended 30 September 2023 have been prepared in accordance with IAS

34 'Interim Financial Reporting' as issued by the International

Accounting Standards Board, endorsed by, and adopted for use in,

the United Kingdom.

The accounting policies and methods of computation adopted are

consistent with those applied in the Group's consolidated financial

statements for the year ended 31 March 2023 and have been applied

consistently to all periods presented.

There have been no new standards or amendments to existing

standards effective from 1 April 2023 that are applicable to the

Group or that has had any material impact on the financial

statements and related notes as at 30 September 2023.

The Directors do not anticipate that the adoption of any of the

new standards and interpretations issued by the IASB and IFRIC with

an effective date for the Group after the date of these interim

financial statements will have a material impact on the Group's

interim financial statements in the period of initial

application.

3. Going concern

The interim consolidated financial statements have been prepared

on the basis that the Group will continue as a going concern.

In adopting the going concern basis, the Directors have

considered the principal risks and uncertainties of the group,

which remain unchanged from those reported in the Group annual

report for the year ended 31 March 2023, a copy of which is

available on the Company's website at:

https://investors.calnexsol.com. The uncertainties arising from the

macro-economic backdrop and inflationary pressures are covered by

existing risks, and these continue to be closely monitored.

The Board has reviewed cashflow forecasts and availability of

cashflow to fund the ongoing operations of the Group. Based on this

review, along with regular oversight of the Group's risk management

framework, the Board has concluded the going concern basis to

remain appropriate.

4. Operating segments

Operating segments are based on the internal reports that are

reviewed and used by the Board of Directors (who are identified as

the Chief Operating Decision Makers) in assessing performance and

determining the allocation of resources. As the Group has a central

cost structure and a central pool of assets and liabilities, the

Board of Directors do not consider segmentation in their review of

costs or the balance sheet. The only operating segment information

reviewed, and therefore disclosed, are the revenues derived from

different geographies.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Americas 1,893 4,538 9,644

North Asia 1,527 3,168 6,475

Rest of world 4,427 5,022 11,330

Total revenue 7,847 12,728 27,449

========= ========= ===========

5. Revenue

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Sale of goods 5,981 11,665 24,579

Rendering of services 1,866 1,063 2,870

Total revenue 7,847 12,728 27,449

========= ========= ===========

6. Finance costs

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Interest expense on lease liabilities 11 12 26

Total finance costs 11 12 26

========= ========= ===========

7. Taxation

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Current taxation

UK corporation tax on profits for

the period - 413 1,143

Foreign current tax expense 46 8 149

Adjustments relating to prior years (42) - (4)

Deferred taxation

Origination and reversal of temporary

differences (233) 235 (46)

Adjustments relating to prior years 6 - -

Effects of changes in tax rate - - 55

Taxation charge (223) 656 1,297

========= ========= ===========

(Loss)/profit before tax for the year (599) 3,086 7,208

Effective tax rate 37% 21% 18%

The weighted average applicable tax rate for the period ended 30

September 2023 is forecast at 37% (2022: 21%), being the current

period tax charge as a percentage of profit/(loss) before tax.

The current underlying corporation tax rate is 25% and the

movement to the effective tax rate of 37% has been affected by the

following factors:

-- UK corporation tax rate: 25%

-- Timing differences/deferred tax movement/ disallowable expenses (12%)

-- Enhanced R&D relief 24%

8. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of Ordinary Shares in issue during the year.

Diluted earnings per share is calculated by dividing the

earnings attributable to ordinary shareholders by the total of the

weighted average number of Ordinary Shares in issue during the year

and adjusting for the dilutive potential Ordinary Shares relating

to share options.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

(Loss)/profit after tax attributable

to shareholders (376) 2,430 5,911

Weighted average number of shares

used in calculation:

Basic earnings per share 87,524 87,508 87,520

Diluted earnings per share 92,430 91,493 92,070

(Loss)/earnings per share - basic

(pence) (0.42) 2.78 6.75

(Loss)/earnings per share - diluted

(pence) (0.42) 2.67 6.42

9. Intangible Assets

Included within intangible assets are the following significant

items:

-- Intellectual property representing the cost of patent

applications and on-going patent maintenance fees.

-- Acquired intellectual property from business combinations.

-- Capitalised development costs representing expenditure

relating to technological advancements on the core product base of

the Group. These costs meet the requirement of IAS 38 (Intangible

Assets) and will be amortised over the future commercial life of

the related product. Amortisation is charged to administrative

expenses.

Intellectual Development

property Costs Total

GBP'000 GBP'000 GBP'000

Cost

At 1 April 2023 3,526 30,395 33,921

Additions - 2,554 2,554

Disposals - - -

------------- ------------ --------

At 30 September 2023 3,526 32,949 36,475

------------- ------------ --------

Amortisation

Balance at 1 April 2023 2,482 20,874 23,356

Charge for the period 136 1,816 1,952

Eliminated on disposal - - -

------------- ------------ --------

At 30 September 2023 2,618 22,690 25,308

------------- ------------ --------

Net book value

31 March 2023 1,044 9,522 10,565

============= ============ ========

30 September 2023 908 10,260 11,168

============= ============ ========

10. Business combinations

In the prior financial period, on 12 April 2022, Calnex

Solutions plc acquired 100 per cent of the issued share capital of

iTrinegy Ltd, a leading developer of Software Defined Test Networks

technology for the software application and digital transformation

testing market. This acquisition was made on a cash free, debt free

basis, for an initial cash consideration of GBP2.5 million, fully

funded from Group free cash. An additional GBP0.5 million was also

paid to the vendors in exchange for them leaving all available cash

(GBP0.7m at acquisition date) within the acquired business. Up to a

further GBP1 million consideration is potentially payable subject

to the achievement of revenue growth from the NE-ONE product line

in the year ended 31 March 2024 (the 'Earn-Out Payment'). This

Earn-Out Payment will be realised as a combination of cash and new

ordinary shares issued in Calnex Solutions plc. The maximum number

of new ordinary shares that may be issued as a result of the

Earn-Out Payment targets being met in full is 322,579.

As at 30 September 2022, the reported business combination

financial impact was provisional on release of the interim

financials. In line with the 12 month measurement period afforded

within IFRS 3 Business Combinations, the accounting work was

finalised ahead of the year end, 31 March 2023. A reconciliation of

adjustments processed following the interim reporting period ended

30 September 2022 is detailed below:

Goodwill

GBP'000

Goodwill reported as at 30 September

2022 1,646

Adjustments reducing net identifiable assets

of acquired entity :

Recognition of deferred tax liability arising from IP

fair value adjustment 311

'Other payables' acquisition accounts

finalisation adjustment 43

---------

Total adjustments 354

Goodwill reported as at 31 March

2023 2,000

---------

All values identified in relation to the acquisition of iTrinegy

Ltd were final as at 31 March 2023.

11. Goodwill

The goodwill arising in a business combination is allocated, at

acquisition, to the cash generating units that are expected to

benefit from the business combination. The Board considers the

Group to consist of a single cash generating unit, reflective of

not only the manner in which the Board (who operate as the Chief

Operating Decision Makers) assesses and reviews performance and

resource allocation of the group, but also the centralised cost

structure and pooled assets and liabilities which are critical to

revenue generation across all platforms. The determination of a

single cash generating unit within the Group therefore reflects

accurately the way the Group manages its operations and with which

goodwill would naturally be associated.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Cost 2,000 1,646 2,000

--------- --------- -----------

The Group tests goodwill for impairment annually, or more

frequently if there are indications that the goodwill has been

impaired. The Group has an annual impairment testing date of 31

March. As at 30 September 2023, management has reviewed goodwill

for indicators of impairment, and has considered the Group's

trading performance, the Group's principal risks and uncertainties,

and the other assumptions utilised in the value in use calculation.

Management has performed sensitivity analyses on the key

assumptions both with other variables held constant and with the

other variables simultaneously changed. Management has concluded

that there are no reasonable changes in the key assumptions that

would cause the carrying amount of goodwill to exceed the value in

use for the cash generating unit.

No evidence of impairment was found at balance sheet date.

12. Plant & equipment

Plant

and

equipment

GBP'000

Cost

At 1 April 2023 570

Additions 117

Disposals -

-----------

At 30 September 2023 687

-----------

Amortisation

Balance at 1 April 2023 166

Charge for the period 87

Eliminated on disposal -

-----------

At 30 September 2023 253

-----------

Net book value

31 March 2023 404

===========

30 September 2023 434

===========

13. Leases

The Group has recognised a right-of use asset and a lease

liability for the lease of land and buildings for its head office

in Linlithgow, Scotland.

The Group leases IT equipment with contract terms ranging

between 1 to 2 years. The Group has recognised right-of use assets

and lease liabilities for these leases.

The Group also leases land and buildings in Belfast and one

motor vehicle. These leases are low-value, so have been expensed as

incurred. The Group has elected not to recognise right -- of -- use

assets and lease liabilities for these leases.

Information about the right of use assets and leases for which

the Group is a lessee is presented below:

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Right of use assets

NBV brought forward in the period 533 791 791

Additions to right of use assets

for the period - - -

Depreciation charge for the period (124) (131) (258)

NBV carried forward for the period 409 660 533

========= ========= ===========

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Lease liabilities

Balance brought forward in the period 691 857 857

Lease additions for the period - - 53

Payment of lease expense (151) (111) (245)

Interest on lease expense 11 12 26

--------- ---------

Balance carried forward for the period 551 758 691

========= ========= ===========

Represented as:

Due within 1 year 271 192 260

Due in more than 1 year 280 566 431

--------- --------- -----------

Total amounts due 551 758 691

========= ========= ===========

14. Deferred tax

Deferred tax asset 6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Opening balance 272 304 304

Recognised in statement of comprehensive

income 405 - (192)

Recognised in equity 14 - 160

--------- --------- -----------

Closing balance 691 304 272

--------- --------- -----------

Deferred tax assets arise as follows:

Unused losses 321 - -

Share based remuneration 348 265 250

Other timing differences 22 39 22

--------- --------- -----------

Total deferred tax asset 691 304 272

--------- --------- -----------

Deferred tax liability 6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Opening balance 2,457 2,017 2,017

Recognised in statement of comprehensive

income 206 236 440

Closing balance 2,663 2,253 2,457

--------- --------- -----------

Deferred tax liabilities arise as

follows:

Deferred tax on acquisition 226 19 260

Timing differences on development

costs 2,333 2,151 2,108

Accelerated capital allowances 104 83 89

--------- --------- -----------

Total deferred tax liability 2,663 2,253 2,457

--------- --------- -----------

15. Inventory

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Finished goods 4,314 2,071 3,055

Provision for obsolescence (478) (539) (307)

3,837 1,532 2,748

========= ========= ===========

16. Trade and other receivables

Trade receivables are consistent with trading levels across the

Group and are also affected by exchange rate fluctuations.

No interest is charged on the trade receivables.

The Group has reviewed for estimated irrecoverable amounts in

accordance with its accounting policy, and at the balance sheet

date, there are no amounts outstanding beyond agreed credit

terms.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Trade receivables 2,675 5,237 2,605

Other receivables 180 468 213

Prepayments and accrued income 1,821 330 312

4,676 6,035 3,130

========= ========= ===========

The Directors consider that the carrying amount of trade and

other receivables approximates their fair value.

17. Cash and cash equivalents

Cash and cash equivalent amounts included in the Consolidated

Statement of Cashflows comprise the following:

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Cash at bank 8,222 6,370 12,439

Cash on short term deposit 5,256 6,566 5,144

Total cash and cash equivalents 13,478 12,936 17,583

========= ========= ===========

Short term investment: Fixed term

deposit - 1,500 1,515

========= ========= ===========

Short term cash deposits of GBP5,255,881 are callable on a

notice of 95 days.

Cash held on long-term deposits (being deposits with maturity of

greater than 95 days) that cannot be readily converted into cash

have been classified as short term investments in prior

periods.

The Directors consider that the carrying value of cash and cash

equivalents and short term investments approximates their fair

value.

18. Trade and other payables

Trade and other payables are consistent with trading levels

across the Group but are also affected by exchange rate

fluctuations. Trade payables and accruals principally comprise

amounts outstanding for trade purchases and ongoing costs. The

Group has financial risk management policies in place to ensure all

payables are paid within the agreed credit terms.

Deferred income relates to fees received for ongoing services to

be recognised over the life of the service rendered.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Trade payables 2,038 2,204 1,770

Other taxes and social security 217 183 197

Other payables 84 76 75

Accruals 783 1,818 1.275

Deferred income 2,393 1,778 2,671

5,515 6,059 5,988

Amounts due in more than one year

Deferred income 1,096 1,748 1,166

Other payables - 217 230

--------- --------- -----------

1,096 1,965 1,396

Total amounts due 6,611 8,024 7,384

========= ========= ===========

The Directors consider that the carrying amount of trade and

other payables approximates their fair value.

19. Provisions

Current provisions are recognised in respect of dilapidations on

leased assets. No discount is recorded on recognition of the

provisions or unwound due to the short-term nature of the expected

outflow and the low value and estimable nature of the non-current

element.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-current provisions

Dilapidations 15 15 15

========= ========= ===========

20. Dividends paid and proposed

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Proposed but not yet recognised

Interim dividend 2024: 0.31 per share 271 - -

Declared and paid

Final dividend 2022: 0.56p per share - 490 490

Interim dividend 2023: 0.31p per

share - - 271

Final dividend 2023: 0.62p per share 543 - -

An interim dividend of 0.31 pence per Ordinary Share (FY23

interim dividend:0.31 pence per Ordinary Share) was declared by the

board on 21 November 2023, and will be paid to ordinary

shareholders on 15 December 2023. The dividend is payable to all

shareholders on the Register of Members at the close of business on

the 1 December 2023.

All dividends are determined and paid in Sterling.

21. Events after the reporting date

On 5 October 2023, the Company submitted an application to

Companies House to strike off iTrinegy Ltd, a 100% owned subsidiary

of Calnex Solutions plc. This will finalise the post-acquisition

hive up of the iTrinegy entity, with all trade and operations

having been transferred to Calnex Solutions plc in the prior

financial year.

The first Gazette notice was issued on the 17(th) October 2023,

and expectation is the strike off will complete in the current

financial year.

22. Alternative performance measures ('APMs')

The performance of the Group is assessed using a variety of

performance measures, including APMs which are presented to provide

users with additional financial information that is regularly

reviewed by the Board of Directors. These APMs are not defined

under IFRS and therefore may not be directly comparable with

similarly identified measures used by other companies.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Underlying EBITDA (411) 3,466 7,980

Underlying EBITDA % (5%) 27% 29%

Capitalised R&D spend 2,554 2,247 4,523

-- Underlying EBITDA: EBITDA including R&D amortisation.

Reconciliation of statutory figures to alternative performance

measures - Income Statement

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBP'000 GBP'000 GBP'000

Revenue 7,847 12,728 27,449

Cost of sales (2,011) (3,111) (6,977)

Gross profit 5,836 9,617 20,472

Other income 111 150 751

Administrative expenses (excl depreciation

and amortisation) (4,542) (4,691) (9,928)

-------------------------------------------- --------- --------- -----------

EBITDA 1,405 5,076 11,295

Amortisation of development costs (1,816) (1,610) (3,315)

-------------------------------------------- --------- --------- -----------

Underlying EBITDA (411) 3,466 7,980

Other depreciation and amortisation (347) (368) (746)

-------------------------------------------- --------- --------- -----------

Operating (loss)/ profit (758) 3,098 7,234

Finance costs (11) (12) (26)

Interest received 170 - -

(Loss)/profit before tax (599) 3,086 7,208

Tax 223 (656) (1,297)

-------------------------------------------- --------- --------- -----------

(Loss)/profit for the year (376) 2,430 5,911

23. Availability of Interim Report

The Company's Interim Report for the six months ended 30

September 2023 will be available to view on the Company's website

https://investors.calnexsol.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FBLLLXFLFFBK

(END) Dow Jones Newswires

November 21, 2023 02:00 ET (07:00 GMT)

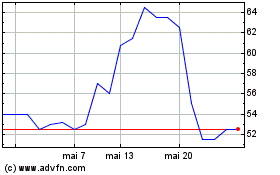

Calnex Solutions (LSE:CLX)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Calnex Solutions (LSE:CLX)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024