Creightons PLC Update on Emma Hardie, Trading in own shares & TVR (7140A)

27 Septembre 2022 - 8:01AM

UK Regulatory

TIDMCRL

RNS Number : 7140A

Creightons PLC

27 September 2022

27 September 2022

CREIGHTONS plc ("Creightons" or the "Company")

Update on acquisition of Emma Hardie Limited

Trading in own shares and TVR

Creightons plc (LSE: CRL), manufacturers of personal care,

beauty, and fragrance products, announces that further to the sale

and purchase agreement ("SPA") relating to the acquisition of the

entire share capital of Emma Hardie Limited as announced on 28 July

2021, the Company's subsidiary Potter and Moore Limited (P&M")

has now made the final payment due to be made under the SPA to the

sellers, and the Company and P&M has also entered into a

settlement and share buyback agreement (the "Agreement") with the

sellers in respect of certain matters related to the

acquisition.

Final Payments to the Sellers under the SPA

The consideration for the transaction was approximately GBP6.36

million, comprising GBP5 million in cash and the issue of 1,600,000

ordinary shares of 1p each in the Company at the volume weighted

average middle market CRL quoted price for the preceding 5 Business

Days of 84.78p per share ("Consideration Shares"). Under the SPA,

if on the date of twelve months from completion the volume weighted

average middle market quoted price of an Ordinary Share for the

last 5 Business days prior to that date (as derived from the Daily

Official List of London Stock Exchange Plc) were to be less than

GBP1.25, then an additional amount would be payable to the sellers

in cash equal to such difference in price multiplied by the number

of Consideration Shares issued. Having calculated the amounts due

in accordance with the provisions of the SPA, the Company and each

of the two sellers have now agreed the due amounts to be GBP666,832

per seller, being a total due amount of GBP1,333,664. P&M has

made this payment to those sellers on 26 September 2022.

The additional payments due under the SPA comprising the

adjustment payment and the deferred payment amounting in aggregate

to GBP90,336 have also now been made to the sellers and no further

amount is due to be paid by the Company or by P&M under the

SPA.

Separate Share Buy Back of the Consideration Shares

Separately, it has been agreed with the two sellers that the

Company buy back 800,000 Consideration Shares from each of them for

a consideration of GBP288,000, being an aggregate consideration

ofGBP576,000 (together the "Buyback"). The consideration is based

on the price of 36p per ordinary share being the on-market price at

the time of the transaction. The Buyback took place on 26 September

2022.

The Company intends the total of 1,600,000 re-purchased shares

to be held as treasury shares.

Accordingly, following the Buyback the Company's issued share

capital now consists of 68,417,983 ordinary shares with voting

rights (excluding treasury shares), with 1,600,000 ordinary shares

held in treasury.

The above figure of 68,417,983 may be used by shareholders (and

others with notification obligations) as the denominator for the

calculation by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Mr Bernard Johnson Managing Director of the Company

commented:

'We are pleased to announce the finalisation of the

consideration for the acquisition of Emma Hardie Limited including

the share buyback. Emma Hardie represents our first premium

skincare brand and we remain confident that it will deliver

significant return to shareholders in the years ahead.'

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English law by virtue of the European (Withdrawal)

Act 2018, as amended. On publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

Enquiries - Analysts and Investors:

Nicholas O'Shea, Director, Creightons Plc 01733 281000

Roland Cornish / Felicity Geidt, Beaumont Cornish Limited 0207

628 3396

Press Nigel Szembel, Anagallis Communications Limited 07802

362088

nigelszembel@anagallis.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSAALIRFIF

(END) Dow Jones Newswires

September 27, 2022 02:01 ET (06:01 GMT)

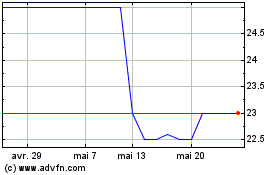

Creightons (LSE:CRL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Creightons (LSE:CRL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025