TIDMDWF

RNS Number : 4119K

DWF Group PLC

25 August 2023

DWF Group PLC

("DWF" or "the company" or "Group)

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon publication of this

announcement, this inside information is now considered to be in

the public domain.

25 August 2023

Full year results for the year ended 30 April 2023

DWF, the global provider of integrated legal and business

services, today announces its full-year results for the year ended

30 April 2023. The Board is pleased with the Group's performance

considering the challenging backdrop for the broader economy and

the legal sector.

GROUP FINANCIAL SUMMARY

GBPm (unless otherwise stated) FY2022/23 FY2021/22 Change

Revenue 451.6 416.1 8.6 %

----------- ----------- --------------

Net revenue (1) 380.1 350.2 8.5 %

----------- ----------- --------------

Gross profit 191.7 180.9 6.0 %

----------- ----------- --------------

Gross profit margin (2) 50.4% 51.7% (1.3) ppts

----------- ----------- --------------

Cost to income ratio (1) 37.2% 38.4% (1.2) ppts

----------- ----------- --------------

Adjusted EBITDA (1) 69.6 66.7 4.3 %

----------- ----------- --------------

Operating profit 24.2 27.7 (12.4)%

----------- ----------- --------------

Adjusted profit before tax

('Adjusted PBT') (1) 43.3 41.4 4.7 %

----------- ----------- --------------

Profit before tax ('PBT') 17.2 22.3 (23.1)%

----------- ----------- --------------

Adjusted diluted EPS (pence)

(1) 10.2 10.7 (4.7)%

----------- ----------- --------------

Diluted EPS (pence) 3.8 6.5 (41.5)%

----------- ----------- --------------

Gross lock-up days (1) 196 days 179 days 17 days

----------- ----------- --------------

Free cash flow (1) 12.9 12.9 (0.5) %

----------- ----------- --------------

Net debt (1) 101.7 71.8 29.9

----------- ----------- --------------

Leverage (1) 1.46x 1.08x 0.38x

----------- ----------- --------------

FY2022/23 HIGHLIGHTS

-- Group net revenue growth of 8.5% (5% like-for-like (3) ) to

GBP380.1m. Reported revenue growth of 8.6% to GBP451.6m.

-- Gross profit margin reduced by 1.3ppts to 50.4% (FY22 51.7%)

reflecting direct cost pressure from salary increases.

-- Cost to income ratio improved by 1.2ppts versus FY22 to

37.2%, helping to offset margin pressures.

-- Adjusted PBT up 4.7% to GBP43.3m, with direct cost and interest rate pressures weighing on profitability.

-- Adjusted PBT margin (4) of 11.4%, a reduction of 0.4

percentage points on FY22 reflecting cost pressures.

-- Reported PBT of GBP17.2m (FY22 GBP22.3m), which differs to

Adjusted PBT due to adjusting items of GBP26.2m (FY22

GBP19.1m).

-- Adjusted diluted EPS of 10.2p (FY22 10.7p) a 4.7% decrease on

prior year due to the non-recurring tax benefit in the prior year

which related to deductions for historical restructuring costs.

-- Lock-up days of 196 versus prior year of 179, representing a

17 day stretch (14 excluding acquisitions) due to sector wide trend

towards extended billing and payment terms

-- GBP12.9m free cash flow generated (FY22 GBP12.9m), flat on PY due to lock-up stretch.

-- Net debt of GBP101.7m, GBP29.9m higher than FY22 due to

initial consideration payments of GBP10m for the acquisition of

Acumension and Whitelaw Twining in the year, combined with the

impact of the 17 day lock-up stretch versus the prior year.

-- Leverage has increased to 1.46x EBITDA (FY22 1.08x).

STRATEGIC HIGHLIGHTS

-- Two strategic acquisitions made in the year with Acumension and Whitelaw Twining.

-- Cost efficiency programme has continued with target savings

of GBP15.0m offsetting salary pressures and interest rate

increases.

-- New divisional structure from 1(st) May 2023 further

integrates the delivery of client service by combining legal and

business services which are aligned with the needs of the Group's

clients, whilst maximising the opportunity for future profitable

revenue growth.

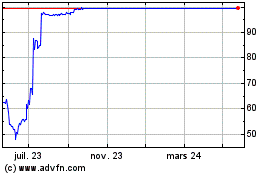

-- On 21 July 2023, we were pleased to announce the Board's

unanimous recommendation of an all cash offer for DWF Group plc

from Aquila Bidco Limited, a newly incorporated wholly-owned

subsidiary of funds advised by Inflexion ("Offer").

OUTLOOK AND CURRENT TRADING

-- The first three months of trading for FY24 have been in line

with management expectations from a revenue and income perspective,

however lock-up stretch has had a balance sheet and cash

impact.

-- Management are considering the achievability of the lock-up

target of 170 days given economic headwinds which are driving

longer billing and payment cycles.

-- With the current trends not expected to abate, the Board is

not expecting to undertake any material M&A in the short term

on a stand-alone basis as it seeks to address the ongoing

challenges presented by lock-up stretch, increasing interest costs

and the balance sheet leverage.

ACQUISITION BY INFLEXION

-- The acquisition by Inflexion is expected to complete during

the final quarter of this calendar year.

-- As part of the Offer from Inflexion, shareholders will be

entitled to receive a special dividend of 3 pence per share. The

special dividend, payment of which will be funded by Inflexion, is

conditional upon, and only payable if, the Offer becomes effective.

Absent the Offer, in light of the broader challenges in the sector

and for DWF, the Board would need to consider the appropriate level

of dividend for the 6 month period ending Apr-23, if any, and also

its medium term capital management framework including sustainable

dividend distributions.

-- With respect to the recommended cash acquisition of DWF Group

plc by Inflexion Private Equity Partners LLP the shareholder Court

Meetings and a General Meeting are to be held on 12(th) September

2023 to consider the scheme of arrangement.

-- The DWF Directors recommend unanimously that DWF Shareholders

vote in favour (or procure votes in favour) of the Scheme at the

applicable Court Meetings and vote in favour (or procure votes in

favour) of the Resolution at the General Meeting as the DWF

Directors who hold DWF Shares as at the date of the Scheme Document

have irrevocably undertaken to do (or procure to be done) in

respect of their own beneficial holdings, amounting to 9,655,772

DWF Shares in aggregate, representing approximately 2.8 per cent.

of the ordinary share capital of DWF as at 11 August 2023.

-- Bidco has also received irrevocable undertakings to vote (or,

where applicable, procure voting) in favour of the Court Meetings

and the General Meeting from 107 DWF Partners and Senior Employees

who hold DWF Shares totalling 132,370,677 DWF Shares representing

approximately 38.7 per cent. of the existing issued ordinary share

capital of DWF as at 11 August 2023.

Sir Nigel Knowles, Chief Executive Officer, commented:

"We have once again grown the business profitably in what

continues to be a very challenging economic environment. Like other

legal businesses, we have seen salary and inflationary pressures,

the impact of interest rate increases and variable demand

particularly in transactional areas. Despite these challenges, we

have seen our organic growth strategy and integrated propositions

continue to resonate with clients, and have also added quality

businesses to the Group via our acquisitions of Acumension and

Whitelaw Twining"

Paul Rimmer, CEO of Commercial Services, commented:

"The Senior Partners and leaders and I wanted to take this

opportunity, on behalf of ourselves and the broader DWF partners

and employees, to say thank you to our institutional shareholders

for their support since DWF's IPO. The business has made

substantial progress over the last 4.5 years in an evolving market

and we are now excited about delivering the next stage of our

strategy under private ownership. The quantum of irrevocable

undertakings obtained from the senior partners and leaders

demonstrates our collective strong belief in the rationale for the

proposed acquisition, especially access to additional capital, more

flexibility on investment spend and the ability to maintain

additional leverage capacity in the business as we invest to

counter macro headwinds. This is an essential opportunity to ensure

DWF has a firm footing for growth over the medium term and we all

look forward to supporting our clients under Inflexion's

ownership."

The person responsible for making this announcement on behalf of

the Company is Chris Stefani, Group Chief Financial Officer.

For further information:

H/Advisors Maitland (public relations advisers to DWF)

Sam Turvey or Sam Cartwright

+44(0)20 7379 5151

DWF Group plc

James Igoe

+44(0)7971 783533

Head of Communications & IR

About DWF Group

DWF is a global provider of integrated legal and business

services. It has approximately 4,000 people and with offices and

associations located across the globe. For more information visit:

dwfgroup.com

Forward looking statements

This announcement contains certain forward--looking statements

with respect to the Company's current targets, expectations and

projections about future performance, anticipated events or trends

and other matters that are not historical facts. These

forward--looking statements, which sometimes use words such as

"aim", "anticipate", "believe", "intend", "plan" "estimate",

"expect" and words of similar meaning, include all matters that are

not historical facts and reflect the directors' beliefs and

expectations and involve a number of risks, uncertainties and

assumptions that could cause actual results and performance to

differ materially from any expected future results or performance

expressed or implied by the forward--looking statement.

LEI: 213800O9QREOHTOGQ266

(1) Described in the glossary to the financial statements

(2) Gross profit margin is defined as gross profit divided by

net revenue

(3) Like-for-like ('L4L') net revenue growth removes the impact

of acquisitions

(4) Adjusted PBT margin is defined as Adjusted PBT divided by

net revenue

Chair's Statement

Dear Shareholder,

I am delighted to introduce our Annual Report and Accounts for

the year ended 30 April 2023. The past year has been marked by

continued macroeconomic volatility with considerable inflationary

pressures across food, energy and other essential consumer

categories. These pressures have led, in many countries, to a cost

of living crisis and rising interest rates, which in turn, has

fuelled further uncertainty about economic growth rates.

Despite these challenging conditions, our differentiated

integrated legal and business services offering and our focus on

delivering positive outcomes has enabled us to continue to perform

well relative to some challenging sentiments in the legal

sector.

I would like to offer my thanks, and the thanks of the whole

Board, to all of our colleagues across the Group for their

continued commitment, dedication and high-quality delivery

throughout the year.

Group performance

We are focused on driving shareholder value through the delivery

of sustainable attractive growth. That is what we have achieved

again this year.

The Board is pleased with the Group's performance on revenue

growth, profitability and cost control. Net revenue is up by more

than 8% to GBP380m, with a like-for-like growth rate of 5%.

Pleasingly we have seen this rate of growth improve in the second

half of the financial year although this was against a challenging

H2 in FY22.

Adjusted profit before tax increased by 4.7% to GBP43.3m,

supported by our cost programme which now anticipates savings of

GBP15m, helping to in part offset the well-publicised upward salary

cost pressures affecting the sector. Reported profit before tax was

GBP17.2m which represents a GBP5m or 23% reduction on prior year

owing to an increase in adjusting items of GBP7m in the year as

well as rising interest costs.

This performance reflects the impact of the Group's Integrated

Legal Management strategy and ongoing key client focus, delivering

integrated solutions to more Group clients.

Culture

We are a people business where developing a positive and

inclusive culture, underpinned by our values and behaviours, is

critical to our success.

Over the past year, I have enjoyed spending more time in our

offices meeting with partners and colleagues, hearing first-hand

about their experiences of working for DWF and perspectives on the

culture within our organisation.

We have been able to organise more colleague engagement

activities in-person and in different locations. This allowed the

Board to hold informal meetings with a cross-section of DWF

colleagues, at every career level and from all parts of the

business. We have all found these very valuable.

I would like to express my thanks to all attendees at these

meetings in providing their thoughts and opinions in an open and

constructive manner.

The feedback received at these meetings is echoed through our

well established engagement survey, where our engagement score has

remained stable at 76. In the context of macroeconomic volatility,

we are pleased with this strong performance in this key

indicator.

Our role in society

ESG is core to our business model and long-term strategy and it

remains a priority focus area for the Board. FY22/23 marked the

first full year since publication of our ESG Strategy and I am

pleased to report that we have made meaningful progress in a number

of areas.

This includes reductions of our Scope 1 and Scope 2 CO2

emissions of 20% and 41% respectively, compared with FY21/22. We

have continued to enhance our office space, with Pune, India and

the new Edinburgh office both powered entirely by renewable

energy.

On our diversity & inclusion agenda, we increased overall

ethnic minority representation to 14%, against a target of 13% by

2025 and we invested in a range of new and improved family friendly

policies, significantly enhancing our maternity, paternity and

adoption leave schemes.

We are also proud that in the last financial year the DWF

Foundation, an independent charity established by DWF in 2015,

exceeded the GBP1 million mark for grants distributed. Funded in

large part by the fundraising activities of DWF colleagues, the

Foundation is an excellent example of the positive outcomes

achieved through colleagues living our values. A point reinforced

by the nearly 9,000 hours of volunteering time delivered by

colleagues through the last financial year.

I talk more about our purpose, values and culture in the

Governance introduction. You can read more detail on our priorities

and actions in the ESG section of our Annual Report and

Accounts.

Annual General Meeting 2023

The Annual General Meeting will be held on 20 October 2023.

Looking ahead

On 21 July 2023, we were pleased to announce the Board's

unanimous recommendation of an all cash offer for DWF Group plc

from Aquila Bidco Limited, a newly incorporated wholly-owned

subsidiary of funds advised by Inflexion. This transaction is

highly attractive not only for our internal and external

shareholders, but also for our clients, employees and other

stakeholders. The DWF board of directors recognises the

opportunities that could be delivered under private ownership with

Inflexion, which includes access to significant capital to invest

in people and technology, accelerated lateral hiring and

transformative acquisitions across jurisdictions. Inflexion has a

clear ambition to support the management team to execute its

strategy to create a global professional services business

emanating from the legal sector and this will enhance the already

exceptional and differentiated services that we deliver for our

clients.

Shareholders will already have received a copy of the Scheme

Document which was published on 15 August 2023. The shareholder

Court Meetings and a General Meeting to approve the scheme of

arrangement have been scheduled for 12 September 2023.

Subject to shareholder approval and the satisfaction (or, where

applicable, waiver) of the Conditions and further terms set out in

Part 3 of the Scheme Document, the Acquisition is expected to

become effective during Q2 FY2024.

I would like to thank all of our Board members for their time

and focus throughout this year.

Jonathan Bloomer

Chair

24 August 2023

Chief Executive Officer's Review

How did the Group perform this year?

We have once again grown the business profitably in what has

been a very challenging economic environment. Like other legal

businesses, we have seen salary and inflationary pressures, the

impact of interest rate increases and variable demand particularly

in transactional areas. Despite these challenges, we have seen our

organic growth strategy and integrated propositions continue to

resonate with clients, and have also added quality businesses to

the Group via our acquisitions of Acumension and Whitelaw

Twining.

You have further extended your capabilities in North America

through the transaction with Whitelaw Twining in Canada. How is

this integration progressing and what next for this region?

We were pleased to complete this transaction with Whitelaw

Twining, one of Canada's top legal businesses which we knew would

always represent a high quality opportunity for our clients. Good

progress has been made since they became part of the DWF Group in

December.

We have already expanded into the Toronto legal services market

with the hire of three partners, four additional lawyers, one

paralegal and two support staff. We are also seeing great

collaboration - between our legal and business services colleagues

within Canada and between our Canadian team and colleagues

globally.

This move marked the next step in DWF's North American strategy

and has given us an integrated legal and business services offering

in Canada which also aligns to the Group's existing claims and

legal operations offering in Chicago.

In a highly-competitive talent market, what have you done this

year to strengthen your colleague proposition?

Attracting and retaining the very best talent remains a top

priority. That is why in the past year we have taken steps to

continue strengthening our colleague proposition. I would highlight

two areas where we have made particular progress, through

significantly enhanced family friendly policies and improvements

made to a number of our office locations through our future

workplace strategy.

Our enhanced family friendly policies including aligning our

maternity leave provision for all colleagues and partners to offer

26 weeks at full salary, with this same 26-week provision available

to colleagues and partners taking adoption leave. We have doubled

our paternity leave entitlement from two weeks to a four-week

benefit and increased our Shared Parental Leave benefit from two

weeks with full pay, to eight weeks. These investments carry a

cost, but the improvements benefit our colleagues and support our

drive to create an inclusive culture.

Our future workplace strategy includes a commitment to reducing

the amount of overall office space and improving the quality,

contributing to our ESG commitments through our use of materials

and improving colleague wellbeing with smart and functional work

areas. The actions taken this year include a relocation in

Edinburgh, where we selected a building which has been designed

with a clear focus on sustainability, creating an exceptional

working environment and having a positive impact on the local

community.

We have also delivered a refit of our Bristol office, with work

also underway in Liverpool. Whilst this strategy remains a work in

progress, our expectation is that we will review all of our office

space globally with the aim that our current and future colleagues

view our office spaces as places they enjoy working from.

In March you announced changes to your global operating

structure. What will these changes allow you to do differently and

how do they support your integrated legal management approach?

The changes we announced in March were a natural evolution in

our strategy as they allow us to go further in how we deliver our

integrated offering to clients. It means our internal operations

are better aligned with the services we provide and the clients and

markets we serve. Many of our largest global clients are insurers

and our integrated legal management approach is of particular

relevance to them. By bringing legal and business services

colleagues together into our two largest divisions, we are

delivering a truly integrated offering to clients, driving greater

internal collaboration and supporting profitable revenue

growth.

What is the outlook for the year ahead?

We continue to be in turbulent times economically, and indeed

the legal sector has seen pressures from both rising costs and

volatility in demand particularly for transactional work. We have

always viewed ourselves as having a defensive model but are not

immune to the environment in which we operate. The margin dilution

from salary and interest rate increases, which brought us in at the

bottom end of Adjusted PBT expectations, will continue to need

mitigating actions on price, productivity and cost control. We

believe we have put the right initiatives in place to protect our

P&L, but are also having to work hard to ensure lock-up stays

within a sensible range as clients are inevitably holding on to

cash for longer. This has implications for our leverage and our

ability to execute our strategy. We remain confident in our

prospects, but cannot be complacent about the headwinds affecting

all businesses. Indeed, absent the Offer from Inflexion, the Board

would need to consider the appropriate level of dividend, if any,

for the period ending Apr-23 and DWF's medium term capital

management framework.

Sir Nigel Knowles

Group Chief Executive Officer

24 August 2023

Financial Review

A Challenging Environment

The Group has delivered profitable growth in a particularly

difficult environment for the sector. The results include reported

revenue growth of 8.6% to GBP452m (PY GBP416m), net revenue growth

of 8.5% to GBP380m (PY GBP350m), a 4.7% increase in adjusted profit

before tax to GBP43.3m (PY GBP41.4m) and a reported profit before

tax reduction of 23% to GBP17.2m (PY GBP22.3m).

In addition to top-line growth rates, the Group is gradually

seeing the stabilisation and reversal of gross margin dilution from

salary inflation over the last 18 months. The gross margin gap to

prior year at FY23 has reduced compared to HY23, reflecting some

improvements in pricing combined with the cost programme announced

in December 2022. Overheads and the cost-to-income ratio are

trending favourably with GBP11m of the previously announced cost

savings secured by the end of FY23. These dynamics help to

underscore confidence in market guidance as management has taken

action to offset some of the adverse economic circumstances not

envisaged when guidance was last issued.

Working capital performance continues to be an area of challenge

in an environment where clients are generally looking to manage

their own working capital cycle by often seeking longer billing or

payment cycles. The Group reported lock-up days of 190 at HY23

which reflected an 11 day increase on FY22. As expected, this

position stabilised in H2 with the like-for-like lock-up day

performance for the full year at 193 days (like-for-like excludes

M&A). Net debt performance follows lock-up days with FY23 net

debt of GBP101.7m.

Revenue

Revenue for the year is GBP452m (FY2021/22 GBP416m) representing

growth of 8.6%. However, the Group focusses revenue measurement on

net revenue as revenue is distorted by the level of irrecoverable

expenses incurred on delivery of client matters where such expenses

do not necessarily reflect the activity levels of the projects or

the business.

Net revenue for the Group is GBP380m (FY2021/22 GBP350m)

representing reported growth of 8.5% and like-for-like growth

(excluding acquisitions of Acumension and Whitelaw Twining) of

5%.

Divisional performance

Highlights of the performance by division are set out below:

Legal Advisory (83% of Group Net Revenue/85% of Group Gross

Profit)

GBPm FY2022/23 FY2021/22 Change

%/ppts

-----------------

+8.5

Revenue 385.3 355.1 %

----------------- ---------- ---------- -----------

+8.4

Net revenue 316.6 292.0 %

----------------- ---------- ---------- -----------

+11.0

Direct costs (154.0) (138.7) %

----------------- ---------- ---------- -----------

+6.1

Gross profit 162.6 153.2 %

----------------- ---------- ---------- -----------

Gross margin

%/ppts 51.4% 52.5% -(1.1)ppts

----------------- ---------- ---------- -----------

Legal Advisory delivered net revenue growth of 8% (LFL growth of

5%) despite facing a number of challenges throughout FY23,

including the impact of the Russia and Ukraine conflict and

significant political uncertainty in the United Kingdom during Q2

and Q3. High single digit percentage growth in a number of our

global teams such as Dispute Resolution and Finance &

Restructuring, with double digit percentage growth in Tax &

Private Capital, has been partly offset by transactional teams

which have been impacted by the broader economic uncertainty and

delays in the regulatory pipeline. Insurance grew by 5% and is

generally less affected by macro factors due to its defensive

nature. As the first financial year following the easing of

Covid-19 restrictions, FY23 chargeable activity was also adversely

impacted by increased absence as many colleagues took their first

substantial holidays since 2019.

Given these various top line headwinds, fee earner, team and

location performance levels have been closely monitored to identify

potential strategic cost savings and protect margins. Along with

tight controls over recruitment, these activities helped mitigate

the impact of cost pressures that intensified from the FY23 sector

'war on talent' and market demands including cost of living pay

increases for non-qualified grades upwards. Such actions needed to

be balanced sensibly with the longer-term needs of the

division.

Recruitment has been enhanced where the future pipeline warrants

investment, for example in insurance and our new sustainable

business offering and global arbitration teams. There has been a

drive to build presence in London and to recruit high quality

lateral hires into France and other overseas locations, whilst

supporting wider growth in lower cost jurisdictions to facilitate

efficient best-shoring of work.

Consequently direct costs have increased ahead of net revenue

growth, resulting in a degree of gross margin degradation. There

has also been an impact from lengthening matter lifecycles which

have led to slower payments from clients, placing pressure on

working capital and increasing lock-up days. This is consistent

with trends reported across the sector and a broad range of

measures have been introduced to mitigate risks in this regard.

This working capital stretch is considered to be a timing issue

which will ultimately unwind.

The end of the year saw the launch of a number of initiatives,

such as the planned introduction of pricing technology solutions to

help counteract ongoing inflationary cost pressures.

In addition, expansion into new locations (including Saudi

Arabia and Canada) will support the drive for profitable future

growth.

Connected Services (11% of Group Net Revenue/9% of Group Gross

Profit)

GBPm FY2022/23 FY2021/22 Change

%/ppts

-----------------

+21.5

Revenue 41.5 34.2 %

----------------- ---------- ---------- -----------

+20.1

Net revenue 40.7 33.9 %

----------------- ---------- ---------- -----------

+20.8

Direct costs (22.7) (18.8) %

----------------- ---------- ---------- -----------

+19.1

Gross profit 17.9 15.0 %

----------------- ---------- ---------- -----------

Gross margin

%/ppts 44.0% 44.4% -(0.4)ppts

----------------- ---------- ---------- -----------

Connected Services delivered net revenue growth of 20% compared

to FY22 (LFL growth of 14%). This growth was supported by the

acquisition of Acumension in September, a team of 47 legal costs

management specialists in the UK, which has expanded DWF's costs

management capability and enhanced the service for clients in the

insurance and public sectors.

Whilst net revenue has grown by GBP6.8m, gross profit did not

increase by the same proportion, resulting in gross margin decline

for the division. This was due to cost pressures driven primarily

by cost of living linked pay increases across a number of

territories, particularly the UK, US and Canada. This margin

dilution began to ease in Q4 as a result of cost measures and

pricing interventions and is expected to improve along with the

rest of the Group over time, particularly as efficiencies are

secured through the new divisional structure.

The Claims Management and Adjusting business has grown by 12%.

This was driven by both the US and Canadian geographies where the

strength of the North American insurance market led to new client

wins, teams in Chicago and Vancouver were expanded and as the

business benefitted from the pound weakening against the dollar.

The United Kingdom and Ireland business remained flat as new

business replaced Covid-19 Business Interruption claims work.

Combining the Claims Management and Adjusting business with

Insurance Legal Services in FY24 will promote greater client

sharing and collaboration.

The Regulatory business, which largely aligns to the new

Commercial Services Division, has grown by 23% and saw an improving

gross margin. With the exception of Audit, which underwent a

restructure during the year, all businesses showed double-digit net

revenue growth, reflecting a strong pipeline of work due to our

clients increasing demand for regulatory advice.

The wider Group restructure produces synergies with what was the

Legal Advisory division and presents the opportunity to reduce cost

within the division. The full impact of the cost efficiency

programme began to show through in the final quarter and, with the

majority of the identified savings being support roles, should have

limited impact on revenue.

Mindcrest (6% of Group Net Revenue/6% of Group Gross Profit)

GBPm FY2022/23 FY2021/22 Change

%/ppts

-----------------

Revenue 24.8 26.8 -(7.4)%

----------------- ---------- ---------- -----------

Net revenue 22.9 24.4 -(6.3)%

----------------- ---------- ---------- -----------

Direct costs (11.7) (11.8) -(0.7)%

----------------- ---------- ---------- -----------

Gross profit 11.2 12.7 -(11.4)%

----------------- ---------- ---------- -----------

Gross margin

%/ppts 49.0% 51.8% -(2.8)ppts

----------------- ---------- ---------- -----------

Mindcrest had a transitionary year as structural changes were

implemented, including a change in leadership and the recruitment

of new sales resource. The focus for H2 has been on building

pipeline and embedding the new dual go-to-market strategy,

focussing both on sales to the top 450 Group clients as well as

internal work transfer to secure Group margin benefit. As with

other divisions, the cost efficiency programme has driven some cost

removal but has also facilitated investment into sales resource in

the US (the largest alternative legal services provider market

globally).

Divisional net revenue contracted by 6% in the year, owing to

the conclusion of one of the division's flagship engagements which

began winding down in H2 of FY22. Despite net revenue having

contracted year-on-year, H2 of FY23 saw top line growth of 9% as

compared to H2 of FY22 as the division starts to generate momentum.

Certain services within the division have enjoyed particular

success, reflecting improved demand from financial services

clients. This includes eDiscovery services, which grew revenue by

15%, and lender/recovery services, which grew by 10%.

In addition to the restructuring and refocussing activities, the

division saw similar inflationary cost of living pressure across

all geographies (more so in United Kingdom following announcement

of Living Wage increases). The margin pressures began to ease in Q4

due to cost savings and the positive pipeline development.

Direct costs

Direct costs, which reflect the salary costs of fee-earning

partners and staff, have increased by GBP19m, or 11%, to GBP188m.

The acquisitions of Acumension and Whitelaw Twining accounted for

GBP6.5m of year-on-year increases, and in addition salary increases

and recruitment of new partners and fee-earners accounted for the

remaining GBP12.5m (7%) increase. A combination of broader

inflationary pressures and the well documented legal sector battle

for talent have driven the salary uplifts.

Gross profit

Gross profit of GBP192m reflects the impact of organic and

inorganic revenue growth and the salary increases from recruitment

and salary uplifts, with gross profit increasing by GBP11m or 6% on

FY2021/22. This reflects a gross margin % of net revenue of 50.4%

(FY2021/22 51.7%). This reduction reflects the investment made in

additional fee earning resources and the impact of salary increases

driven by sector and broader inflationary pressures. Pricing and

productivity are areas of focus which are expected to help mitigate

the gross margin dilution.

Administrative expenses

Administrative expenses (including impairment) have increased to

GBP168m (FY2021/22 GBP153m) which is a GBP14m or 9% increase.

However, on an underlying basis excluding adjusting items,

administrative expenses for FY2022/23 are GBP141m (FY2021/22

GBP134m), an increase of GBP7m or 5%. Approximately two thirds of

the year-on-year increase is attributable to the additional

overheads from the acquisitions of Acumension and Whitelaw Twining.

The balance predominantly represents increases in support staff

salaries, travel, business development and IT costs.

The restriction of underlying overhead growth to 5% has

delivered a cost-to-income ratio of 37.2% (FY2021/22 38.4%).

During the year, the Group announced a cost efficiency programme

with the aim of reducing both direct and indirect costs to help

offset other inflationary pressures. The outturn on administrative

expenses and the resulting reduction in cost-to-income ratio is

partly attributable to the savings delivered by this cost

programme, which began to reflect in the numbers in the final

quarter of the year. In May, the Group announced an increase in the

cost savings target from GBP10-GBP12m to GBP15m in recognition of

the continuing (and in the case of interest rates, increasing)

pressure on the Group's 'Adjusted Profit Before Tax' guidance. Cost

control will continue to be an area of focus with savings in

property (via estate reduction), project spend and other

discretionary overheads helping to mitigate ongoing salary

inflation and interest increases.

Adjusting items (the difference between reported and underlying

administrative expenses) were GBP26m (FY2021/22 GBP19m). The

increase is due to additional share based payment charges,

accelerated depreciation for vacant property, acquisition fees and

restructuring costs. The table below provides more details with

full analysis contained in note 2 to the financial statements:

GBPm FY2022/23 FY2021/22

-----------------------

Office closures

and scale-backs 10.0 (0.2)

----------------------- ---------- ----------

Acquisition related

expenses 6.5 9.6

----------------------- ---------- ----------

Gain on bargain (4.5) -

purchase

----------------------- ---------- ----------

Other share based

payments 10.8 9.6

----------------------- ---------- ----------

Restructuring costs 3.3 -

----------------------- ---------- ----------

Refinancing costs - 0.1

----------------------- ---------- ----------

Total adjusting

items 26.2 19.1

----------------------- ---------- ----------

Adjusting items in FY2022/23 can be summarised as:

1. Historical office closures, impairments and scalebacks where

some final costs were charged to the income statement in the year

in relation to Germany and the Pune lease for the unused 8(th)

floor was impaired;

2. Acquisition related expenses principally relating to

amortisation and impairment of intangibles recognised on

acquisition, acquisition related remuneration for Acumension and

Whitelaw Twining and acquisition related advisory fees;

3. Share based payment expenses reflecting grants from the

Employee Benefit Trust which is a pre-funded trust established on

IPO; and,

4. Non-recurring costs relating to the execution of the cost reduction programme

Net finance expense and interest payable on leases

Net finance expenses relating to bank charges and borrowings

were GBP5.3m (FY2021/22 GBP3.7m). Interest on bank borrowings

increased as a result of a combination of higher interest rates and

an increase in the level of net debt due to acquisition outflows

and higher lock-up.

Interest payable on leases of GBP1.7m (FY2021/22 GBP1.7m)

reflects the notional interest cost relating to lease

borrowings.

Profit before tax

The Group reported a profit before tax of GBP17.2m (FY2021/22

GBP22.3m) which represents a GBP5m or 23% reduction on the prior

year. The reduction is primarily driven by the GBP7m increase in

adjusting items as detailed above in the administrative expenses

section.

Adjusted PBT is GBP43.3m (FY2021/22 GBP41.4m) which represents a

4.7% increase on the prior year. The key factors driving the

slightly lower "drop-through" from revenue growth are the gross

margin dilution due to direct cost increases and significant

interest increases from both base rate rises and sector lock-up

stretch driving higher net debt. These factors are partially, but

not wholly, offset by the initial impacts from the cost programme

which means the adjusted PBT margin of 11.4% represents a 0.4ppts

reduction on prior year (FY2021/22 11.8%).

Tax

The reported tax charge for the year, excluding prior year

adjustments, is GBP5.7m (FY2021/22 GBP6.1m) on a profit before tax

of GBP17.2m (FY2021/22 GBP22.3m). This represents an effective rate

of tax of 32.9%. The effective tax rate was higher than the UK

statutory tax rate primarily due to current year tax losses that

have not been recognised as deferred tax assets (increasing the tax

charge by GBP2.5m) and the tax effect of non-deductible expenses

(increasing the tax charge by GBP1.7m) offset by the utilisation of

unrecognised losses brought forward (reducing the tax charge by

GBP2.1m).

The Group also booked prior year adjustments of a net credit of

GBP1.0m. Those adjustments principally arise as a result of (a)

finalisation of prior period partnership tax returns and partner

drawings impacting the profits subject to UK corporation tax

(GBP0.5m), and (b) revaluations of the Group's deferred tax assets

relating to tax depreciation timing differences and expected tax

deductions for share based payments as at 30 April 2022

(GBP0.5m).

This gives a net tax charge of GBP4.7m for the year (FY2021/22

GBP2.0m).

There are no open tax audits or investigations across the Group.

In line with Group tax strategy, it is not considered that any

aggressive or materially uncertain tax positions have been adopted

by any of the Group entities. As such, the level of tax risk faced

by the Group is considered to be low.

EPS

Diluted EPS has decreased to 3.8p in FY2022/23 compared to 6.5p

in FY2021/22. The reduction is due to three factors: an increase in

one-off (adjusting items) compared to the prior year, reducing the

reported profit; an increase in tax charge compared to prior year,

which benefitted from deductions from historical closures and

scalebacks; and an increase in the share count from the acquisition

of Whitelaw Twining during the second half of the year.

Adjusted diluted EPS has decreased to 10.2p (FY2021/22 10.7p), a

reduction of 0.5p or 5%. This reduction is due to the

aforementioned one-off benefit in the prior year tax charge which

enhanced the prior year EPS by an estimated 0.9p.

Dividend

The Group's capital allocation policy is to prioritise having

sufficient capital to fund ongoing operating requirements and

strategic investment in the Group's long term growth. Under normal

circumstances, the Board targets a pay-out ratio of up to 70% of

adjusted profit after tax. For FY2022/23, however, no final

dividend has yet been declared given the proposed acquisition of

DWF Group by Inflexion (which will include a special dividend

payment of 3 pence per share if the Offer becomes effective) and

unanimous recommendation that DWF Shareholders vote in favour of

the deal. If the Offer does not become effective, the Board will

need to consider the appropriate level of dividend, if any, for H2

2022/23.

Working capital, cash flow and net debt

The Group measures working capital efficiency using "lock-up

days". Lock-up days are comprised of two elements: Work-in-progress

("WIP days"), representing the amount of time between performing

work and invoicing clients; and Debtor days, representing the

length of time between invoicing and cash collection.

During the year, the Group saw a stretch in lock-up days to 190

days at the half year, after achieving consistent reductions over

the previous four reporting periods. This lock-up increase was in

line with reported lock-up stretch in the legal sector as client

demands have driven either extended billing cycles or longer

payment terms. Whilst the lock-up increase for the Group, at 5% at

half year, outperformed the sector-wide increase of 10% it

nevertheless has driven a higher overall lock-up balance and

resultant net debt outcome. The stated intention at the half-year

was to stabilise the position and this was broadly achieved with

year-end lock-up of 196 days (193 on a like-for-like basis

excluding Whitelaw Twining acquisition). In an inflationary

environment with rising interest rates the upward pressure on

billing and collection terms is potentially an ongoing risk. Whilst

the Group will continue to mitigate this by improving the

efficiency of internal influencing factors, the external

environment is not expected to enable significant near-term

reductions in lock-up.

The Group expects to continue to operate well within its

available facilities and for all covenants to be compliant for the

remaining tenure of the RCF.

Capital expenditure

The main capital expenditure requirements of the Group are for

IT infrastructure, replenishment and project work and office

refurbishments. Overall capex (excluding right-of-use asset

additions under IFRS 16, and intangible assets recognised from

acquisitions) in FY2022/23 was GBP6.3m compared to GBP7.9m in

FY2021/22.

Current trading and future outlook

The performance in FY2022/23 reflects another year of profitable

growth, albeit delivering an Adjusted PBT figure at the lower end

of expectations. Whilst profits increased year-on-year, gross and

net margins were diluted primarily as a result of direct cost

pressures from increased salaries demanded across the sector. The

Group has taken actions to mitigate these cost challenges via the

cost programme which has made good progress and is expected to help

to mitigate the ongoing upward cost pressures.

The balance sheet, specifically lock-up, has proved to be a

continuing challenge with the lock-up stretch seen in H1 sustaining

through H2 and into the new year. This increase in lock-up days has

led to increases in net debt and leverage and reflects sector-wide

pressures on billing frequencies and payment terms. Working capital

efficiency remains a key focus of the Group in order to maximise

cash generation to manage borrowing costs. Inevitably, there are

conflicting pressures between lock-up management, borrowing costs,

leverage, investments in M&A and dividend requirements which

are being carefully managed and considered by management and the

Board.

The Group continues to see growth and profit opportunities but

the various performance levers will require cautious management in

what continues to be a challenging environment.

Chris Stefani

Group Chief Financial Officer

24 August 2023

FINANCIAL STATEMENTS

Consolidated income statement

Year ended 30 April 2023

2023 2022

Notes GBP'000 GBP'000

---------------------------------------------- ------ ------------ ------------

Revenue 3 451,641 416,052

---------------------------------------------- ------------ ------------

Recoverable expenses 3 (71,505) (65,810)

---------------------------------------------- ------ ------------ ------------

Net revenue 3 380,136 350,242

---------------------------------------------- ------------ ------------

Direct costs 3 (188,395) (169,332)

---------------------------------------------- ------ ------------ ------------

Gross profit 3 191,741 180,910

---------------------------------------------- ------------ ------------

Administrative expenses (162,220) (146,691)

---------------------------------------------- ------------ ------------

Gain on bargain purchase 9 4,459 -

---------------------------------------------- ------------ ------------

Trade receivables impairment 13 (1,454) (2,973)

---------------------------------------------- ------------ ------------

Accelerated depreciation/amortisation 4 (6,452) -

---------------------------------------------- ------------ ------------

Other impairment 4 (1,856) (3,593)

---------------------------------------------- ------ ------------ ------------

Operating profit 4 24,218 27,653

---------------------------------------------- ------ ------------ ------------

Net finance expense 5 (5,310) (3,664)

---------------------------------------------- ------------ ------------

Net interest expense on leases 5 (1,739) (1,673)

---------------------------------------------- ------ ------------ ------------

Profit before tax 17,169 22,316

---------------------------------------------- ------ ------------ ------------

Total of adjusting items as defined

under the Group's alternative performance

measures 2 (26,158) (19,081)

---------------------------------------------- ------ ------------ ------------

Adjusted profit before tax 2 43,327 41,397

---------------------------------------------- ------ ------------ ------------

Taxation 6 (4,722) (2,029)

---------------------------------------------- ------ ------------ ------------

Profit for the year 12,447 20,287

---------------------------------------------- ------ ------------ ------------

Earnings per share attributable

to the owners of the parent:

---------------------------------------------- ------ ------------ ------------

Basic (p) 8 4.0 6.8

---------------------------------------------- ------ ------------ ------------

Diluted (p) 8 3.8 6.5

---------------------------------------------- ------ ------------ ------------

The results are from continuing operations.

Consolidated statement of comprehensive income

Year ended 30 April 2023

2023 2022

GBP'000 GBP'000

------------------------------------------------------ ---------- ----------

Profit for the year 12,447 20,287

------------------------------------------------------ ---------- ----------

Items that are or may be subsequently reclassified

to the income statement:

------------------------------------------------------ ---------- ----------

Foreign currency translation differences - foreign

operations (1,388) 83

------------------------------------------------------ ---------- ----------

Total other comprehensive (expense)/income for

the year (1,388) 83

------------------------------------------------------ ---------- ----------

Total comprehensive income for the year 11,059 20,370

------------------------------------------------------ ---------- ----------

There is no taxation on items within other comprehensive

income.

Consolidated statement of financial position

As at 30 April 2023

2023 2022

Notes GBP'000 GBP'000

------------------------------------------ ------ ----------- -----------

Non-current assets

------------------------------------------ ------ ----------- -----------

Intangible assets 10 49,890 45,604

------------------------------------------ ------ ----------- -----------

Property, plant and equipment 11 9,300 11,239

------------------------------------------ ------ ----------- -----------

Right-of-use assets 12 57,223 65,234

------------------------------------------ ------ ----------- -----------

Trade and other receivables 13 412 1,464

------------------------------------------ ------ ----------- -----------

Deferred tax assets 20 4,320 3,938

------------------------------------------ ------ ----------- -----------

Total non-current assets 121,145 127,479

------------------------------------------ ------ ----------- -----------

Current assets

------------------------------------------ ------ ----------- -----------

Trade and other receivables 13 243,339 190,174

------------------------------------------ ------ ----------- -----------

Cash and cash equivalents (excluding

bank overdrafts) 14 36,404 28,310

------------------------------------------ ------ ----------- -----------

Total current assets 279,743 218,484

------------------------------------------ ------ ----------- -----------

Total assets 400,888 345,963

------------------------------------------ ------ ----------- -----------

Current liabilities

------------------------------------------ ------ ----------- -----------

Trade and other payables 15 59,855 63,325

------------------------------------------ ------ ----------- -----------

Corporation tax liabilities 9,366 6,190

------------------------------------------ ------ ----------- -----------

Deferred consideration 583 890

------------------------------------------ ------ ----------- -----------

Lease liabilities 16 13,712 14,576

------------------------------------------ ------ ----------- -----------

Interest-bearing loans and borrowings 17 23,512 9,786

------------------------------------------ ------ ----------- -----------

Provisions 18 6,898 6,315

------------------------------------------ ------ ----------- -----------

Amounts due to members of partnerships

in the Group 27 30,700 28,243

------------------------------------------ ------ ----------- -----------

Total current liabilities 144,626 129,325

------------------------------------------ ------ ----------- -----------

Non-current liabilities

------------------------------------------ ------ ----------- -----------

Deferred tax liabilities 20 7,501 5,869

------------------------------------------ ------ ----------- -----------

Lease liabilities 16 58,298 63,163

------------------------------------------ ------ ----------- -----------

Interest-bearing loans and borrowings 17 114,640 90,344

------------------------------------------ ------ ----------- -----------

Provisions 18 3,772 4,147

------------------------------------------ ------ ----------- -----------

Total non-current liabilities 184,211 163,523

------------------------------------------ ------ ----------- -----------

Total liabilities 328,837 292,848

------------------------------------------ ------ ----------- -----------

Net assets 72,051 53,115

------------------------------------------ ------ ----------- -----------

Equity

------------------------------------------ ------ ----------- -----------

Share capital 21 3,420 3,254

------------------------------------------ ------ ----------- -----------

Share premium 21 91,940 89,365

------------------------------------------ ------ ----------- -----------

Treasury shares 21 (129) (129)

------------------------------------------ ------ ----------- -----------

Other reserves 22 17,021 4,929

------------------------------------------ ------ ----------- -----------

Accumulated losses 22 (40,201) (44,304)

------------------------------------------ ------ ----------- -----------

Total equity 72,051 53,115

------------------------------------------ ------ ----------- -----------

Consolidated statement of changes in equity

Year ended 30 April 2023

Other reserves

---------------------------------------

Share-based

Share Share Treasury Merger payments Translation Accumulated Total

capital premium shares reserve reserve reserve losses equity

(note (note (note (note (note (note (note

21) 21) 21) 22) 22) 22) 22)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

At 1 May 2022 3,254 89,365 (129) (2,385) 11,512 (4,198) (44,304) 53,115

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

Profit for

the year - - - - - - 12,447 12,447

---------------- --------- ---------- --------- ------------- ------------- ------------- ----------

Other

comprehensive

income - - - - - (1,388) - (1,388)

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

Total

comprehensive

income - - - - - (1,388) 12,447 11,059

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

Shares issued 166 2,575 - - - 2,741

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

Dividends paid - - - - - - (15,113) (15,113)

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

Share-based

payments

(note

23) - - - - 20,774 - - 20,774

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

Recycling of

share-based

payments

(note

23) - - - - (7,294) - 7,294 -

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

Tax on

share-based

payments - - - - - - (525) (525)

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

At 30 April

2023 3,420 91,940 (129) (2,385) 24,992 (5,586) (40,201) 72,051

---------------- --------- --------- ---------- --------- ------------- ------------- ------------- ----------

Year ended 30 April 2022

Other reserves

-------------------------------

Share-based

Share Share Treasury Merger payments Translation Accumulated Total

capital premium shares reserve reserve reserve losses equity

(note 22) (note 22) (note (note

(note 21) (note 21) (note 21) 22) 22)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

At 1 May 2021 3,246 88,610 (129) (2,385) 12,885 (4,281) (60,566) 37,380

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Profit for the

year - - - - - - 20,287 20,287

---------------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Other

comprehensive

income - - - - - 83 - 83

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Total

comprehensive

income - - - - - 83 20,287 20,370

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Shares issued 8 755 - - - - - 763

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Dividends paid - - - - - - (13,537) (13,537)

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Share-based

payments

(note 23) - - - - 7,701 - - 7,701

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Recycling of

share-based

payments

(note 23) - - - - (9,074) - 9,074 -

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Tax on

share-based

payments - - - - - - 438 438

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

At 30 April

2022 3,254 89,365 (129) (2,385) 11,512 (4,198) (44,304) 53,115

---------------- ----------- ----------- ----------- ----------- ------------- --------------- --------------- ------------

Consolidated statement of cash flows

Year ended 30 April 2023

2023 2022

Note GBP'000 GBP'000

------------------------------------------------ ----- ----------- ------------

Cash flows from operating activities

------------------------------------------------ ----------- ------------

Cash generated from operations before

adjusting items 26 42,929 41,623

------------------------------------------------ ----------- ------------

Cash used to settle non-underlying items (6,756) (8,464)

------------------------------------------------ ----- ----------- ------------

Cash generated from operations 36,173 33,159

------------------------------------------------ ----------- ------------

Interest paid (5,979) (4,596)

------------------------------------------------ ----------- ------------

Interest received 468 -

------------------------------------------------ ----------- ------------

Tax paid (3,713) (2,854)

------------------------------------------------ ----- ----------- ------------

Net cash generated from operating activities 26,949 25,709

------------------------------------------------ ----- ----------- ------------

Cash flows from investing activities

------------------------------------------------ ----------- ------------

Proceeds from sale of investment - 227

------------------------------------------------ ----------- ------------

Acquisition of subsidiary, net of cash

acquired 9 (16,807) (3,540)

------------------------------------------------ ----------- ------------

Purchase of property, plant and equipment (2,874) (3,581)

------------------------------------------------ ----------- ------------

Purchase of other intangible assets (3,452) (4,300)

------------------------------------------------ ----- ----------- ------------

Net cash flows used in investing activities (23,133) (11,194)

------------------------------------------------ ----- ----------- ------------

Cash flows from financing activities

------------------------------------------------ ----------- ------------

Dividends paid 7 (15,113) (13,537)

------------------------------------------------ ----------- ------------

Loan arrangement fee (163) (626)

------------------------------------------------ ----------- ------------

Proceeds from borrowings 37,089 109,727

------------------------------------------------ ----------- ------------

Repayment of borrowings (10,908) (104,861)

------------------------------------------------ ----------- ------------

Repayment of principal of lease liabilities 16 (14,447) (13,396)

------------------------------------------------ ----------- ------------

Interest received - 101

------------------------------------------------ ----------- ------------

Capital contributions by members 27 7,237 2,132

------------------------------------------------ ----------- ------------

Repayments to former members 27 (4,807) (1,072)

------------------------------------------------ ----- ----------- ------------

Net cash flows used in financing activities (1,112) (21,532)

------------------------------------------------ ----- ----------- ------------

Net increase/(decrease) in cash and

cash equivalents 2,704 (7,017)

------------------------------------------------ ----- ----------- ------------

Cash and cash equivalents at the beginning

of year 27,704 34,580

------------------------------------------------ ----- ----------- ------------

Effects of foreign exchange rate changes

on cash and cash equivalents 188 141

------------------------------------------------ ----- ----------- ------------

Cash and cash equivalents at the end

of year 14 30,596 27,704

------------------------------------------------ ----- ----------- ------------

Consolidated notes to the financial statements

Year ended 30 April 2023

1 Accounting policies

1.1 Nature of these financial statements

The following financial information does not amount to full

financial statements within the meaning of Section 434 of Companies

Act 2006. The financial information has been extracted from the

Group's Annual Report and Financial Statements for the year ended

30 April 2023 on which an unqualified report has been made by the

Company's auditors. The 2023 statutory accounts will be delivered

to Companies House in due course.

Copies of the Annual Report and Financial Statements will be

posted to shareholders shortly and will be available from the

Company's registered office at 20 Fenchurch Street, London, EC2M

3AG.

1.2 Statement of accounting policies

The preliminary announcement for the year ended 30 April 2023

has been produced based on the Group's annual financial statements

which are prepared in accordance with UK-adopted International

Financial Reporting Standards. The accounting policies applied in

this preliminary announcement are consistent with those reported in

the Group's annual financial statements for the year ended 30 April

2023 along with new standards and interpretations which became

mandatory for the financial year.

1.3 Going concern

The Directors have assessed the going concern basis adopted by

the Group in the preparation of the consolidated financial

statements, taking into account the current financial position

including its available financing facilities, the business model

and future outlook, as well as the principal risks as listed in the

Strategic Report. The Directors conclude that the Group has

adequate resources to continue as a going concern across the period

of assessment.

Assessment of going concern

The going concern assessment has been considered for the period

to 31 October 2024 and is carried out as follows:

-- The Group's Board-approved budget base case is used to

calculate the net debt position, liquidity, covenant compliance and

available headroom over the going concern period.

-- The going concern assessment has been carried out on two

different base cases, the first of which assumes the recommendation

of an all cash offer for DWF Group plc from Aquila Bidco Limited is

accepted, and the second of which assumes that the business

continues as a Plc.

-- The assessment of going concern is carried out with reference

to available financing facilities under both scenarios, the ability

to pay debts as they fall due and the covenants associated with the

financing facilities.

-- Plausible downside scenarios are modelled to quantify the

impact of a variety of risks materialising over the going concern

period.

-- Mitigating actions which could be taken are identified,

quantified and included in the assessment.

-- The reasonable worst case scenario, along with mitigating

actions, is then used to test that the Group would continue to have

headroom in its available financing facilities, settle liabilities

as they fall due and comply with the associated financial covenants

over the going concern period.

Financing facilities

The Group closed the year with committed banking facilities of

GBP158m (of which GBP139m were drawn). The largest of these is the

GBP120m revolving credit facility ('RCF'), which was increased

through exercising the accordion facility in February 2023. This

RCF matures in December 2025, with one additional 12-month

extension option. The undrawn portion of the RCF is readily

accessible and does not require any further approval for drawdown

by the Group's banking syndicate. The facility agreement also

permits the Group to obtain a further GBP25m of external funding

and GBP15m of leasing facilities, if required. The covenant

thresholds across the assessment period are set out below:

Covenant Oct-23 Jan-24 Apr-24 Jul-24 Oct-24

------- ------- ------- -------

Net Asset Value to Consolidated

Net Borrowings 1.60x 1.60x 1.60x 1.60x 1.60x

Interest Cover 4.00x 4.00x 4.00x 4.00x 4.00x

Leverage 1.75x 1.75x 1.75x 1.75x 1.75x

--------------------------------- ------- ------- ------- ------- -------

Each of the covenants noted above is measured on a pre-IFRS 16

basis in accordance with the banking facility agreement. Interest

cover is defined as the ratio of EBITDA to interest expense, and

leverage is defined as the ratio of net debt to EBITDA.

If the recommendation of an all cash offer for DWF Group plc

from Aquila Bidco Limited is approved, the current facilities will

be fully repaid on completion, and new committed banking facilities

of GBP330m will become available to the Group. The new facilities

have long-term maturity dates, and include two working capital

facilities, comprising GBP30m initial, with an additional optional

GBP40m to drawdown on. There is also an additional GBP60m facility

available to be utilised for future acquisitions, subject to lender

approval. There are different covenant thresholds across the

facilities, but the minimum covenant ratio has been modelled for

the assessment period and these are as follows:

Covenant Oct-23 Jan-24 Apr-24 Jul-24 Oct-24

-------- -------- -------- -------

Leverage - - - 4.50x 4.50x

---------- -------- -------- -------- ------- -------

Future outlook, risks and uncertainties

The going concern and viability assessments are closely linked

and therefore the conclusions of the going concern assessment are

directly relevant to and should be read in conjunction with the

viability statement. The Board-approved base case combined with the

annual three-year plan, adjusted to include Whitelaw Twining, has

been used to measure the going concern and future viability of the

Group. This assessment has been performed on the same two bases as

going concern. This includes monitoring net debt positions and cash

management activities of the Group and their effect on covenant

testing. The going concern and viability of the Group have been

assessed taking into account the potential impact of certain

downside scenarios arising from the principal risks and

uncertainties.

In particular, the Board has considered the impact of both a

de-listing and business-as-usual scenario, including impacts on

cash flows and covenants. In addition the assessment considers the

potential reduction in demand caused by either macro environmental

factors, commercial pipeline, our ability to retain or attract the

correct level of talent as well as inflationary pressures over and

above each base case.

Mitigating actions

If faced with the reasonable worst-case scenario, the Board also

considers possible mitigating actions available to the Group to

maintain liquidity and covenant compliance. These can be swiftly

implemented should the worst-case scenario arise and include (but

are not limited to):

-- freezing recruitment and a slowdown in investment in recruitment and reward;

-- reducing discretionary operating spend such as marketing and travel;

-- reducing non-committed capital expenditure;

-- revision of the existing dividend policy; and

-- cost cutting measures in non-fee earning areas including an

acceleration of the execution of the Group's real estate reduction

strategy

Reverse stress test

In addition to the modelling of the above scenarios, a reverse

stress test was conducted by the Group to assess the quantum of

increased inflationary pressures and a stretch in working capital

that would materially impact our ability to comply with financial

covenants. Such a material impact is not considered a reasonable

scenario to adversely impact the going concern assessment, under

either scenario.

Conclusion

Based on this assessment, the Directors have a reasonable

expectation that the Group and Company has sufficient resources to

continue its operations for the period of assessment. In particular

the Directors have a reasonable expectation that the Group and

Company will operate under its existing financing facilities, will

comply with all covenants with adequate headroom and settle all

other liabilities as they fall due. The Directors therefore

consider it appropriate for the Group and Company to adopt the

going concern basis in preparing these financial statements.

The directors are satisfied that under the no deal basis there

is sufficient support and knowledge of the cash flows and

operations of the business to adopt a going concern basis for the

Group and Company. The all cash offer for DWF Group plc from Aquila

Bidco Limited outlined above remains subject to shareholder

approval. Assuming such approval is received, the transaction is

expected to complete within 12 months of these Financial

Statements. Aquila Bidco Limited have stated their intentions

surrounding the Group's future outlook and funding plans and these

align to the Group's current business plan and strategy. However,

as the decisions around future strategy and intentions will no

longer be in the exclusive control of the DWF Group PLC Directors,

this creates a material uncertainty that may cast significant doubt

on the Group and Company's ability to continue as a going concern

as at 24th August 2023. The financial statements do not include the

adjustments that would result if the Group or Company were unable

to continue as a going concern.

2 Alternative performance measures

APM's are not intended to supplant IFRS measures but are

included in response to investor feedback or to provide readers of

the financial statements with additional understanding of the

underlying trading performance of the Group.

APMs are fully defined and information as to why they are useful

is provided in the glossary. Adjusted profit before tax reconciles

to profit before tax as follows:

2023 2022

GBP'000 GBP'000

-------------------------------------------------- ---------- ----------

Profit before tax 17,169 22,316

-------------------------------------------------- ---------- ----------

Adjusting items:

-------------------------------------------------- ---------- ----------

Amortisation of intangible assets - acquired 3,929 4,655

-------------------------------------------------- ---------- ----------

Impairment of intangible assets 1,494 2,966

-------------------------------------------------- ---------- ----------

Impairment of tangible and right of use assets 362 627

-------------------------------------------------- ---------- ----------

Accelerated depreciation/amortisation 6,452 -

-------------------------------------------------- ---------- ----------

Non-underlying items 6,248 1,224

-------------------------------------------------- ---------- ----------

Gain on bargain purchase (4,459) -

-------------------------------------------------- ---------- ----------

Share-based payments expense 12,132 9,609

-------------------------------------------------- ---------- ----------

Total of adjusting items 26,158 19,081

-------------------------------------------------- ---------- ----------

Adjusted PBT 43,327 41,397

-------------------------------------------------- ---------- ----------

In FY23, an accelerated depreciation charge of GBP6.5m (FY22:

GBPnil) was recognised in relation to the right of use, and other

fixed assets located within a vacant floor in the Pune office.

There are no future plans to occupy this space given the adoption

of hybrid working, therefore associated assets have been fully

depreciated in the year.

Adjusted profit before tax reconciles to profit before tax with

reconciling items by nature as follows:

2023 2022

GBP'000 GBP'000

----------------------------------- ---------- ----------

Profit before tax 17,169 22,316

----------------------------------- ---------- ----------

Office closures and scale-backs 9,972 (238)

----------------------------------- ---------- ----------

Acquisition-related expenses 6,493 9,564

----------------------------------- ---------- ----------

Gain on bargain purchase (4,459) -

----------------------------------- ---------- ----------