As expected, following our exit from the motor business,

non-charity care and schemes not aligned to our niches, GWP

decreased in the year, falling by 20% to GBP234.0m (2013:

GBP291.3m). While we recognise that GWP has fallen significantly we

are satisfied that we have taken the correct decisions, as

demonstrated by the more consistent underwriting profitability in

the UK over the last two years. Moderate sustainable profitable

growth is being targeted as we build on our strengths and continue

to position ourselves as the insurer of choice in our chosen

segments.

Ireland

Our operations in Ireland generated an underwriting profit of

GBP0.6m, a significant improvement on the 2013 loss of GBP9.1m,

which was driven by performance in the liability portfolio. The

team identified and implemented a series of corrective actions,

commencing in late 2013 and continuing throughout 2014.

These actions included lapsing unprofitable business in selected

niches and, while they resulted in a 12% fall in GWP, before

translation, to GBP11.5m (2013: GBP13.6m), the quality of the

portfolio was improved and there were notable new business wins

during the year. Retention was in line with expectations and the

team was strengthened by proactive recruitment across all

areas.

Australia

Australia reported an underwriting loss of GBP1.1m (2013:

GBP4.2m loss). The improvement in the underwriting performance was

mainly due to the impact of new property reinsurance arrangements

and a reduction in operating expenses. The Australian business

delivered an underlying profit before discount rate movements

relating to reductions in market interest rates. The negative

reserve movements were more than offset by corresponding market

gains in Ansvar Australia's investment portfolio which are not

included within the underwriting result.

A new Chief Executive Officer, Warren Hutcheon, was appointed on

1 May 2014. Following a review of the business, a new operating

model was announced on 1 September 2014. The key objective of the

model is to better align the business with our specialist insurer

strategy and the needs of our broker partners.

In 2014, GWP reduced by 12% to GBP40.1m (2013: GBP45.7m),

primarily due to a 12% weakening of the Australian dollar against

sterling during the year. Retention rates improved significantly in

2014 following the completion of the remediation of the business's

property portfolio in mid-2013 and increasing focus on retaining

core business.

Canada

Our Canadian branch reported an underwriting profit of GBP1.7m

(2013: GBP1.1m loss), as the territory did not suffer the same

levels of catastrophe weather events that had driven the losses in

the previous year.

The 12% fall in the value of the Canadian dollar against

sterling meant that the branch's contribution to Group GWP fell to

GBP39.4m (2013: GBP41.2m) but GWP grew by 7% before translation,

with strong retention rates of 94%, continuing a trend that has

seen its premiums more than double since 2008.

Central operations

Profits from internal reinsurance arrangements in this segment

were offset by corporate costs and a further modest strengthening

of reserves in respect of adverse development reinsurance cover

sold to ACS (NZ) Limited in 2012, resulting in an overall loss of

GBP1.7m (2013: GBP3.7m loss).

Investments

The effects of persistent weak global economic activity and

muted inflation were offset by the monetary policy measures

deployed by the world's major central banks which helped to support

positive returns across most asset classes during the year. Over

the course of 2014, the FTSE All Share Index produced a return of

1.2% while the FTSE 100 Index generated a return of 0.7%. Our UK

equity portfolio increased by 2.7%, outperforming both indices,

reflecting its lower weighting in poorly performing sectors such as

oil and mining.

Government bond yields decreased across the developed world over

the course of the final quarter and gilts followed the global

trend. The prospect of the Bank of England raising base rates has

been pushed further into the future as inflation pressures have

diminished, with wage inflation remaining restrained and falling

commodity prices placing downward pressure on prices. Yields on

corporate bonds reached record lows at the end of the year,

although they failed to keep pace with gilts as credit spreads

widened, reflecting both the deteriorating economic picture

globally and the move towards gilts as risk aversion increased.

Longer dated gilts performed strongly while shorter dated gilts

(<5 years) produced total returns of 2.9%. Our UK bond portfolio

produced a total return of 3.6% in 2014, reflecting good

performance of corporate bonds and preference shares which helped

achieve returns above the shorter dated index.

Investment management

EIM's funds under management grew again in 2014, as new business

inflows and positive market movements saw a 5% growth to

GBP2.3bn.

For a second year in succession EIM attracted nearly GBP100m net

new flows from third parties into Ecclesiastical investment funds.

A further GBP5m was invested into our special charity investment

vehicle. Overall fee income for EIM increased by 11% to GBP14.3m

and pre-tax profits increased to GBP3.2m.

EIM further consolidated its position as a leader in sustainable

and responsible investment, with the company winning the Moneyfacts

Best Ethical Investment Provider Award for a sixth consecutive

year, with it and its funds continuing to win awards, as shown in

the Strategic Report in the full financial statements. EIM was

rated Platinum by Citywire and Andrew Jackson was awarded Fund

Manager of the Year for the UK Growth sector. Across the team our

fund managers continue to be highly rated, with Robin Hepworth, Sue

Round and Chris Hiorns all holding Citywire ratings.

Long-term insurance

As reported last year, Ecclesiastical Life Limited ceased

writing new business from the end of April 2013. The result for

2014 was a small loss of GBP0.2m (2013: GBP0.4m profit) as pressure

on index linked bond yields offset the underlying expected

favourable run-off of the business.

Broking and Advisory

SEIB continued to provide a steady income stream to the Group,

with the acquisition of the business of Lansdown Insurance Brokers

widening its offering to a number of specialist areas and further

building its capacity and expertise. The acquisition and SEIB's

operations in niche markets saw commission and fee income grow by

25% to GBP9.1m (2013: GBP7.3m). Net profit before tax increased to

GBP3.0m (2013: GBP2.5m).

EFAS, our small financial advisory business, has reported a loss

before tax of GBP1.0m. The continuing business improved its

performance following the rationalisation of its independent

financial advisers business, reducing its loss from GBP0.8m to

GBP0.4m. The company agreed to sell its mortgage book as part of

the rationalisation of its operations. This sale completed on 20

January 2015 and a loss on disposal of GBP0.7m was recognised in

2014.

Directors' Report

Principal Activities

The Group operates principally as a provider of general

insurance in addition to offering a range of financial services,

with offices in the UK, Ireland, Canada and Australia.

Ownership

At the date of this report the entire issued Ordinary share

capital of the Company and none of the issued 8.625% Non-Cumulative

Irredeemable Preference shares of GBP1 each ('Preference shares')

were owned by Ecclesiastical Insurance Group plc. In turn, the

entire issued Ordinary share capital of Ecclesiastical Insurance

Group plc was owned by Allchurches Trust Limited (ATL), the

ultimate parent of the Group.

Dividends

Dividends paid on the Preference shares were GBP9,181,000 (2013:

GBP9,181,000).

The Directors do not recommend a final dividend on the Ordinary

shares (2013: GBPnil), and no interim dividends were paid in

respect of either the current or prior year.

Charitable and political donations

Charitable donations paid, and provided for, by the Group in the

year amounted to GBP25.2 million (2013: GBP5.5 million).

During the last 10 years, a total of GBP115.1 million (2013:

GBP95.3 million) has been provided by Group companies for church

and charitable purposes.

It is the Group's policy not to make political donations.

Principal risks and uncertainties

The Directors have carried out a robust assessment of the

principal risks facing the Group including those that threaten its

business model, future performance, solvency and liquidity. The

principal risks and uncertainties, together with the financial risk

management objectives and policies of the Group, are included in

the Risk Management section.

Going concern

The Group has considerable financial resources: financial

investments of GBP892.4m (including current assets classified as

held for sale), 98% of which are liquid (2013: financial

investments of GBP946.5m, 97% liquid); cash and cash equivalents of

GBP107.5m and no borrowings (2013: cash and cash equivalents of

GBP107.2m and no borrowings); and a regulatory enhanced capital

cover of 2.9 (2013: 2.6). As a consequence, the Directors have a

reasonable expectation that the Group is well placed to manage its

business risks successfully and continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the annual report and

accounts.

Risk Management

Introduction

The core business of Ecclesiastical is general insurance. Thus,

risk selection, pricing, reinsurance strategy, portfolio management

and regulatory compliance play an important part in our business

model.

An enterprise-wide risk management framework has been embedded

across the Group, with the purpose of providing the tools,

guidance, policies, standards and defined responsibilities which

will enable us to achieve our strategy and objectives, and ensure

that all individual and aggregated risks to our objectives are

identified and managed on a consistent basis.

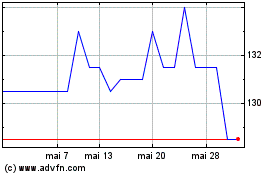

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025