Ecclesiastical Insurance Office PLC Annual -8-

24 Mars 2015 - 5:34PM

UK Regulatory

similar over the year.

-------------------------------------- -------------------------------------- --------------------------------------

Strategic execution and business Delivering our business plan is key A number of strategic initiatives

plan delivery to ensuring financial stability and were identified and grouped into

The risk of failing to deliver our the confidence of three waves which are to

business plan and a failure to meet key stakeholders, including the be delivered over the next three

stakeholder expectations regulator and rating agencies. This years. The first wave largely

resulting in negative reaction from is used to prevent the completed during 2014.

the regulator or rating agencies. failure to define appropriate The size of this risk has remained

strategies and execute them to similar over the year.

enable us to deliver on those

expectations.

-------------------------------------- -------------------------------------- --------------------------------------

Group Risks The Group consists of a number of The expectations of the SBUs have

Governance and oversight of SBUs different business divisions which been defined and they have all

The risk of failing to effectively operate across a number confirmed the adoption of

manage the different parts of the of territories and regulatory the required standard. Alongside

Group across different regimes. Failure to effectively this all SBUs have locally adopted

territories and regulatory regimes. manage our operations in line risk appetites, which

with Group expectations could lead have been approved at Group level

to sub-optimal business performance and are regularly monitored with

or damage to our reputation. formal escalation processes

in place for potential breaches.

Annual Risk Reviews and Control Risk

Self-Assessments are undertaken.

Additionally, Group

Internal Audit (GIA) reviews are

carried out.

The size of this risk is largely

unchanged over the year.

-------------------------------------- -------------------------------------- --------------------------------------

Directors' Responsibility Statement

The following statement is extracted from page 75 of the 2014

annual report and accounts, and is repeated here for the purposes

of the Disclosure and Transparency Rules. The statement relates

solely to the Company's 2014 annual report and accounts and is not

connected to the extracted information set out in this

announcement. The names and functions of the Directors making the

responsibility statement are set out on pages 70 and 71 of the full

annual report and accounts.

The Directors confirm to the best of their knowledge:

-- The financial statements, prepared in accordance with IFRS,

give a true and fair view of the assets, liabilities, financial

position and profit or loss of the Company and the undertakings

included in the consolidation taken as a whole;

-- The Strategic Report within the 2014 annual report and

accounts includes a fair review of the development and performance

of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face; and

-- The annual report and financial statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's position and

performance, business model and strategy.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

For the year ended 31 December 2014

2014 2013

GBP000 GBP000

Revenue

Gross written premiums 328,797 399,345

Outward reinsurance premiums (135,132) (131,274)

Net change in provision for unearned premiums 31,178 24,592

---------- ----------

Net earned premiums 224,843 292,663

---------- ----------

Fee and commission income 62,258 58,088

Net investment return 46,197 77,243

---------- ----------

Total revenue 333,298 427,994

---------- ----------

Expenses

Claims and change in insurance liabilities (197,170) (234,789)

Reinsurance recoveries 62,306 36,545

Fees, commissions and other acquisition costs (70,813) (80,285)

Other operating and administrative expenses (79,381) (82,411)

---------- ----------

Total operating expenses (285,058) (360,940)

---------- ----------

Operating profit 48,240 67,054

Finance costs (86) (117)

---------- ----------

Profit before tax 48,154 66,937

Tax expense (7,837) (4,819)

---------- ----------

Profit for the year (attributable to equity holders of the Parent) 40,317 62,118

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2014

2014 2013

GBP000 GBP000

Profit for the year 40,317 62,118

--------- ---------

Other comprehensive income

Items that will not be reclassified to profit or loss:

Fair value gains/(losses) on property 30 (104)

Actuarial losses on retirement benefit plans (13,184) (1,526)

Attributable tax 2,647 484

--------- ---------

(10,507) (1,146)

Items that may be reclassified subsequently to profit or loss:

Losses on currency translation differences (1,697) (10,071)

--------- ---------

Net other comprehensive income (12,204) (11,217)

--------- ---------

Total comprehensive income attributable to equity holders of the Parent 28,113 50,901

--------- ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

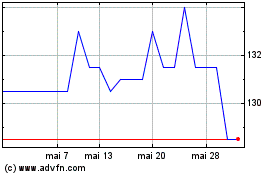

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025