TIDMEOG

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG / Sector: Oil & Gas

12 April 2019

Europa Oil & Gas (Holdings) plc ("Europa" or "the Company")

Interim Results

Europa Oil & Gas (Holdings) plc, the AIM traded Ireland and UK focused oil and

gas exploration, development and production company, announces its interim

results for the six month period ended 31 January 2019.

Operational highlights

* Ongoing negotiations regarding farm-in agreements to three Irish licences

(LO 16/20, FEL 1/17 and FEL 3/13) with a major international oil company:

+ expect Europa to be fully carried on a well on each licence

+ expect Europa to retain a material interest in each licence

+ the Board is confident of concluding the farm-ins in the coming months

however, there can be no guarantee that the current negotiations will

lead to completed agreements

+ final investment decision awaited from the major's head office

* Site surveys for wells at Inishkea, Kiely East and Edgeworth - targeting

summer 2019, are under application subject to regulatory approval

* Successfully executing strategy to manage the decline in production at

onshore UK fields

+ workover of the WF6 well at West Firsby utilising a drain hole jetting

technique - WF6 is currently producing 6 boepd net to Europa having

previously produced zero oil

+ 90 boepd produced in H1 2019 (H1 2018 97 boepd)

* Final phase of discussions with the National Office of Hydrocarbons and

Mines ("ONHYM"), in respect of securing a petroleum agreement in Morocco

Financial performance

* Revenue GBP0.9 million (H1 2018: GBP0.8 million)

* Pre-tax loss of GBP0.4 million, (H1 2018: pre-tax tax loss of GBP0.5 million)

* Net cash used in operating activities GBP0.3 million (H1 2018: cash from

operating activities GBP16k)

* Cash balance at 31 January 2019: GBP4.4 million (31 July 2018: GBP1.8 million)

* Successfully raised GBP4.3 million (before expenses) from existing and new

shareholders including BGF Investment Management Limited, a wholly owned

subsidiary of the Business Growth Fund ("BGF")

+ approximately 33% of the shares in the Company now owned by

institutions,

+ a further 9.5% are held by the Board

Post reporting period events

* Wressle planning appeal submitted to Planning Inspectorate on 5 February

2019 and draft bespoke programme issued by the Inspectorate on 13 February

* Gross un-risked prospective resources at the Inishkea gas prospect in LO 16

/20 confirmed as 1.5 tcf with one in three chance of success (RNS 26

February 2019)

* Transferred operatorship of PEDL143 to UK Oil & Gas PLC as announced on 14

March 2019

Europa's CEO, Hugh Mackay, said: "The last six months have been a highly active

period for Europa, not just in terms of the progress we are making to advance

our industry-leading licence position offshore Ireland, which to date has

estimated gross prospective resources of 6.4 billion barrels of oil and 1.5 tcf

of gas and where negotiations are ongoing for a farm-in for three licences with

a major international oil and gas company. In addition, we completed a GBP4.3

million fund raising, which increased the institutional representation on our

shareholder register to over one third. We also restored production at the WF6

well at West Firsby and moved closer towards landing a high impact new venture

in Morocco.

"The momentum behind the Company has continued post period end with the

completion of a major piece of exploration work at our flagship Inishkea gas

project. I look forward to providing further updates on our progress during the

second half, a period which will see the resumption of drilling activity in the

South Porcupine Basin at CNOOC International's Iolar prospect. Success here

would be a value trigger event for Europa, as it would significantly de-risk

our drill-ready prospects in the basin, specifically, the 280mmboe Kiely East

and 225mmboe Edgeworth targets."

For further information please visit www.europaoil.com or contact:

Hugh Mackay / Phil Greenhalgh Europa +44 (0) 20 7224 3770

Matt Goode finnCap Ltd +44 (0) 20 7220 0500

Simon Hicks finnCap Ltd +44 (0) 20 7220 0500

Camille Gochez finnCap Ltd +44 (0) 20 7220 0500

Frank Buhagiar / Susie St Brides Partners Ltd +44 (0) 20 7236 1177

Geliher

The information communicated in this announcement contains inside information

for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

Chairman's Statement

Our objective is to create a significant liquidity event for our shareholders

through successful drilling of our high impact exploration portfolio in

Atlantic Ireland. I am pleased to report that the six months under review has

seen us take significant steps towards presenting our shareholders with a

series of potential liquidity events. On 20 November 2018, we announced that

we were negotiating farm-in agreements with a major international oil and gas

company in respect of Licensing Option ('LO') 16/20 in the Slyne Basin and

Frontier Exploration Licences ('FEL') 1/17 and 3/13 in the South Porcupine

Basin. We continue to have positive engagement with the potential farminee

and remain confident of the completion of these agreements or similar ones with

other potential farminees who are active in our virtual and physical data

rooms. We believe that the political environment in Ireland, in particular the

Climate Emergency Measures Bill, may be causing potential investors, including

farminees, to slow down their investment decisions.

The Climate Emergency Measures Bill (the "Bill") is a proposal to limit future

oil and gas exploration in Ireland which is progressing through the Irish

legislature. If put into law this Bill would stop the issuance of any new

licences for the exploration of fossil fuels. The Bill is opposed by the Irish

Government. We do not know if it will pass into law and should it do so when

that might be, and in what form. The impact on existing exploration licences is

also not clear.

Europa has honoured its work commitments and obligations to the Irish

Government and naturally we hope that our investment will be recognised and

honoured. Europa is an active member of the Irish Offshore Operators'

Association ("IOOA" www.iooa.ie). IOOA believes that in order to shape a

coherent, realistic, fully-costed and structured national policy and plan to

transition to a low carbon future, that a new and informed energy conversation

needs to begin. IOOA is actively engaged in this matter and further information

can be found at https://www.iooa.ie/

value-of-the-indigenous-oil-and-gas-industry-to-ireland/

Offshore Ireland

Our industry-leading licence position offshore Ireland is comprised of six

licences covering an area of 4,985 km2 and encompassing all the play types and

basins being targeted by the major operators who have already entered the

region, such as Exxon, CNOOC International, Equinor, TOTAL, Woodside and Cairn

Energy. To date, we have identified over 30 prospects across our licences

which, potentially hold combined Gross Mean Un-risked Prospective Resources

("GMUPR") of over 6.4 billion barrels of oil equivalent and 1.5 tcf of gas.

Following completion of technical work programmes, we are now focused on

securing partners with whom we can drill wells to prove up this

'company-making' prospectivity.

The volumetrics involved and the quality of the work we have undertaken have

generated considerable interest among the blue-chip operators as evidenced by

their activity in our data rooms. As mentioned earlier, we are currently

negotiating farm-in agreements with a major international oil and gas company

in respect of LO 16/20, FEL 1/17 and FEL 3/13. A final investment decision is

awaited from the major's head office. Meanwhile, we continue to run data rooms

and market the opportunities to others. We have submitted applications to the

relevant authorities for three site surveys in Atlantic Ireland for our

flagship Inishkea prospect, Kiely East and Edgeworth. Our aim is to be in a

position to drill all three prospects from 2020 onwards, subject to funding and

the regulatory approval process.

Post period end on 26 February 2019, we announced a new prospect inventory for

LO 16/20 including gross mean un-risked prospective dry gas resources of 1.5

tcf and a 1 in 3 chance of success for the Inishkea prospect. Together with a

location in a play that has been proven by the nearby Corrib gas field,

proximity to existing gas infrastructure, comparatively shallow water and lying

in a country that needs more gas, the volumetrics are the final piece in the

jigsaw which confirms Inishkea's status as Europa's flagship project.

Onshore UK

Our UK production assets in the East Midlands continue to generate a valuable

revenue stream for the Company. First half production averaged 90 boepd

generating revenue of GBP0.9 million, 12% higher than H1 2018's GBP0.8 million

thanks to higher oil prices and initiatives we undertook to manage the decline

at the West Firsby oil field. These included the successful workover of the

WF6 well where we, in conjunction with a third party, pioneered the use of a

drain hole jetting technique onshore UK. WF6 is currently producing 6 bopd net

to Europa having previously produced zero oil. Based on the technical success

of the workover we intend to evaluate additional suitable opportunities to use

this technology in other wells leading to higher oil rates than would otherwise

have been possible.

We are keen to grow our production incrementally - via workovers such as WF6,

and by bringing new discoveries on line. Wressle in North Lincolnshire, with an

initial targeted gross rate of 500 bopd, would more than double Europa's

existing net production to over 200 bopd. The planning appeal process formally

commenced post period end on 13 February 2019 and a planning inquiry date will

be announced in due course when a Planning Inspector will consider the

partners' new proposals for the development. Other proposals have previously

been recommended for approval by the Council's Planning Officer and supported

by expert third party review undertaken on behalf of the Council.

New Ventures

A Strategic Review was completed during the review period. This identified

areas and basins where the expertise of our technical team could be applied

to replicate the excellent work carried out in our offshore Ireland licences.

In line with this, over the course of the half year under review we have been

in discussions with the National Office of Hydrocarbons and Mines (ONHYM) to

secure a petroleum agreement in Morocco. These discussions are nearing

completion and we are confident we will soon be in a position to provide

further details on what we believe is an exciting opportunity to acquire

acreage which, in terms of 'company-making' potential, is similar in scale to

our offshore Ireland portfolio. We have also established a new Board Strategy

Committee, to review and approve value-accretive new venture opportunities

within our areas of interest.

Corporate

During the period, we successfully raised GBP4.3million from existing and new

shareholders. Following the fundraise, BGF are the largest shareholder in

Europa, with an equity share close to 15%. One third of the Company's shares

are now held by institutions and the Board holds a further 9.5%. This is a

significant increase in institutional representation in Europa's shareholder

register and we view this as an endorsement of our asset base, strategy to

monetise our assets, and finally the efforts of our excellent team.

Outlook

As at 31 January 2019, Europa's cash balances stood at GBP4.4 million (31 July

2018: GBP1.8 million). Our UK production, which averaged 90 boepd over the course

of the half year period, generated GBP0.9 million in revenues. In Ireland, we

have mapped combined gross mean un-risked prospective resources of 6.4 billion

barrels oil equivalent and 1.5 tcf gas across our six licences. We estimate

our Inishkea prospect, which lies close to the producing Corrib gas field, has

a 1 in 3 chance of success.

Compare all the above with our current market capitalisation and the value case

for Europa, in our view, speaks for itself. Our job is to realise the huge

potential of our asset base, while at all times managing risk. Drilling

offshore Ireland alongside heavyweight partners is how we intend to achieve

this. With favourable terms under negotiation with a major operator that could

lead to the funding of up to three high impact wells, we are confident we are

on course to offer our shareholders the series of potential liquidity events.

Simon Oddie

Chairman

11 April 2019

Operational review

Offshore Ireland: Exploration

Europa holds six licences in Atlantic Ireland which, in aggregate, cover an

area of over 4,985 km2, include six play types in three basins and contain over

30 prospects and leads that potentially hold gross mean un-risked prospective

resources of 6.4 billion barrels oil equivalent and 1.5 tcf gas.

To date six prospects have been de-risked to drill-ready status including the

Inishkea gas project in LO 16/20 in the Slyne Basin; Kiely East in FEL 2/13 and

Edgeworth in FEL 1/17 in the South Porcupine Basin. Inishkea is regarded by

Europa as its flagship project due to its location in a play that has been

proven by the Corrib gas field, its potential to be larger than Corrib, its

proximity to existing processing facilities, and Ireland's need for more gas

supplies.

Activity during the half year period has been centred on securing farm-out

partners to fund drilling activity. As announced in November 2018, Europa is

currently negotiating farm-in agreements with a major international oil and gas

company in respect of LO 16/20, FEL 1/17 and FEL 3/13. A final investment

decision from the major's head office is awaited. Subject to a positive

outcome, the terms agreed would see Europa hold material interests in up to

three wells. To ensure wells can be drilled at the earliest opportunity,

Europa has submitted applications for three site surveys in summer 2019 for the

Inishkea, Kiely East and Edgeworth prospects. Subject to successful conclusion

of this work and finalisation of funding, all three prospects could be drilled

from 2020 onwards.

Drilling activity in the region is due to recommence in summer 2019 with a well

targeting the Iolar prospect in FEL 3/18 in the Porcupine basin operated by

CNOOC International, together with its partner ExxonMobil. Exploration success

at Iolar potentially de-risks 1 billion boe in five prospects in Europa's

Porcupine portfolio including Kiely East (280 mmboe) and Edgeworth (225 mmboe).

Slyne Basin: LO 16/20

LO 16/20 is located next to the producing Corrib gas field in the Slyne Basin

and contains the Corrib North gas discovery. LO 16/20 represents low risk

exploration in a proven gas play.

During the half year, technical work was undertaken to further de-risk Inishkea

and calculate prospective resources for Inishkea. This work included Pre-Stack

Depth Migration ("PSDM") reprocessing of 770 km2 of 3D seismic data over

Inishkea and the Corrib gas field. The geophysical interpretation arising from

the PSDM data has been benchmarked and calibrated against newly released Ocean

Bottom Cable 3D seismic data over the Corrib gas field. Post period end in

February 2019, the Company announced prospective resources for Inishkea, the

details of which are provided in the table below:

Licence Prospect Play Gross Un-risked Prospective Resources

(billion cubic feet)

Low Best High Mean

LO 16/20 Inishkea Triassic gas 244 968 3,606 1,528

Inishkea is a large fault bounded Triassic structure that lies 11km to the

northwest of the Corrib gas field. The reservoir is Triassic age sandstone

sourced from the underlying Carboniferous. The trap is provided by a

combination of Triassic Uilleann Halite top seal and fault seal. Engineering

studies demonstrate strong positive economics for a range of porosity outcomes,

including outcomes significantly poorer than Corrib. Europa's view of porosity

at Inishkea is supported by velocity data from new PSDM data. Given the

Company's confidence in trap and reservoir quality and the nearby producing

Corrib gas field, the Company has assigned a one in three chance of success to

Inishkea based on in-house technical work.

A drilling location for a first exploration well on Inishkea (18/20-H) has been

identified. There is a robust, low risk tie on seismic data for the Corrib

Sandstone reservoir back to the Corrib gas field. Europa intends to acquire a

site survey in summer 2019 (subject to regulatory consent), which would enable

a well to be drilled at this location in 2020 (subject to funding and

regulatory consents). Operations planning for both the site survey and

engineering design of the exploration is in progress.

The Corrib North structure containing the 18/20-7 gas discovery well drilled by

Shell in 2010 may be upgraded to contingent resources pending further

engineering evaluation. Based on the interpretation of historic 3D and 2D

seismic, discovered Gas Initially In Place ("GIIP") is provided in the table

below:

Licence Prospect Play Gross discovered GIIP

(billion cubic feet)

Low Best High

LO 16/20 Corrib North Triassic gas 5 41 208

South Porcupine Basin: FELs 1/17, 2/13 and 3/13

Europa operates three licences in the South Porcupine Basin, FELs 1/17, 2/13

and 3/13. An aggregate of 4.3 billion barrels of oil equivalent (boe) of gross

mean un-risked prospective resources have been estimated across nine priority

prospects on these three licences based on the results of reprocessed PSDM 3D

seismic data originally acquired in 2013. These include firm drilling targets

Edgeworth in FEL 1/17, Wilde in 3/13 and Kiely East in 2/13. The table below

summarises the Gross Un-risked Prospective Resources ("GMUPR") across selected

prospects in FELs 1/17, 2/13 and 3/13 in the South Porcupine Basin:

Licence Prospect Play Gross Un-risked Prospective Resources

mmboe*

Low Best High Mean

FEL 1/17 Ervine Pre-rift 63 159 363 192

FEL 1/17 Edgeworth Pre-rift 49 156 476 225

FEL 1/17 Egerton Syn-rift 59 148 301 167

FEL 3/13 Beckett mid-Cretaceous Fan 111 758 4229 1719

FEL 3/13 Shaw+ mid-Cretaceous Fan 20 196 1726 747

FEL 3/13 Wilde Early Cretaceous Fan 45 241 1082 462

FEL 2/13 Kiely East Pre-rift 52 187 612 280

+

FEL 2/13 Kiely West Pre-rift 23 123 534 225

+

FEL 2/13 Kilroy+ Cret. Slope Apron 37 177 734 312

Total 4,329

*million barrels of oil equivalent. The hydrocarbon system is considered an oil

play and mmboe is used to take account of associated gas. However, due to the

significant uncertainties in the available geological information, there is a

possibility of gas charge.

+ on block

Following the completion of the PSDM programme and release of the new prospect

inventory, Europa opened a virtual data room for prospective farminees for its

three operated South Porcupine licences in July 2018. As mentioned previously,

Europa is negotiating with a major international oil and gas company in respect

of FEL 1/17 and FEL 3/13.

The 2019 CNOOC International well in FEL 3/18 will drill the Iolar prospect,

which the Company understands is a pre-rift play. Europa has five pre-rift

prospects in FEL 2/13 and FEL 1/17 with combined GMUPR of just over 1 billion

boe. If Iolar is successful there may be positive technical and commercial read

across resulting in a de-risking of Europa's prospects.

South Porcupine Basin: LO 16/19

LO 16/19 is located on the west side of the South Porcupine basin. A farm-out

agreement for LO 16/19 was secured with Cairn Energy in April 2017, as a result

of which Cairn was assigned operatorship of and acquired a 70% interest in the

licence in exchange for funding a work programme worth up to US$6 million.

This included the acquisition of 3D seismic in 2017. The final processed

dataset was delivered in Q4 2018 and a prospect inventory based on this is

expected to be published in 2019.

Padraig Basin: LO 16/22

LO16/22 is located in the Padraig Basin on the eastern margin of the Rockall

Trough. Padraig is a remnant Jurassic basin. Based on Europa's restoration of

the conjugate margin prior to the spreading of the Atlantic seafloor, the most

relevant analogue is the conjugate margin play offshore Newfoundland in the

Flemish Pass basin and which hosts the 300 million barrel Bay du Nord oil

discovery.

Structures of significant size have been mapped on 2D seismic acquired in 1998,

along with multiple leads in Triassic gas, pre-rift and syn-rift hydrocarbon

plays. Gross mean un-risked indicative resources are estimated to be

approximately 500 million boe for the syn-rift oil play and potentially 5tcf of

GIIP in the Triassic gas play. Work is underway to mature the leads, which lie

in water depths ranging from 800m to 2,000m, to prospect status.

UK - Onshore Production

East Midlands: West Firsby; Crosby Warren; Whisby-4

Europa produces from three oilfields in the East Midlands: West Firsby (100%

working interest); Crosby Warren (100%); and the Whisby-4 well (65%). During

the six months to 31 January 2019, an aggregate 90 boepd were recovered from

the three fields (H1 2018: 97 boepd) with all the oil transported by road to

the Immingham refinery.

During the period, initiatives were undertaken to manage the decline at the

West Firsby oil field including a workover of the WF6 well utilising a drain

hole jetting technique for the first-time onshore UK. The workover involved

jetting sixteen 90m length drain holes. Having previously produced zero oil,

WF6 is currently producing 6 bopd net to Europa.

UK - Development

East Midlands: PEDL180 (Wressle); PEDL182 (Broughton North)

The Wressle conventional oil field on PEDL180 was discovered by the Wressle-1

well in 2014. During production testing in 2015, Wressle-1 flowed oil and gas

at a combined flowrate of 710 boepd from three separate reservoirs: the Ashover

Grit, the Wingfield Flags and the Penistone Flags. In September 2016, a

Competent Person's Report provided independent estimates of Reserves and

Contingent and Prospective oil and gas resources for the Wressle discovery of

2.15 million stock tank barrels classified as discovered (2P+2C). Reservoir

engineering analyses indicate an initial production flow rate of 500 bopd gross

from the Ashover Grit interval at Wressle. At this rate, Europa's existing

production would be over 200 bopd and would generate significant cash flows for

the Company.

Following the Planning Inspectorate's decision to reject an appeal by the

partnership against North Lincolnshire Council Planning Committee's decision to

refuse planning permission for the Wressle oil development in January 2018, the

operator Egdon Resources submitted a new planning application for the

development of Wressle in July 2018. Despite being recommended for approval by

North Lincolnshire Council's planning officers, the application was rejected by

the Council's Planning Committee in November 2018.

In January 2019, an application to extend the existing planning consent for the

Wressle site by a year, was approved by the Planning Inspector on appeal after

the original application for an extension was refused by North Lincolnshire

Council's Planning Committee in August 2018. This was despite having been

recommended for approval by the Council's Planning Officer. The extension to

the existing planning consent to 24 January 2020 is expected to allow

sufficient time for the Planning Inspector to determine an appeal against the

Council's rejection of the Wressle development application. Following this,

post period end, the operator submitted the relevant appeal documentation. A

draft bespoke timetable for the appeal process, which will involve a planning

inquiry, was issued on 13 February by the Planning Inspectorate.

Europa has a 30% working interest in licence PEDL180 in the East Midlands which

holds the Wressle oil discovery, alongside Egdon (operator, 30%), Union Jack

Oil (27.5%), and Humber Oil & Gas Limited (12.5%).

The Broughton North exploration prospect on PEDL182 lies adjacent and north of

PEDL180. In 1984, a well drilled by BP discovered oil at Broughton. In the

CPR, Broughton North was assigned gross mean un-risked prospective resources of

0.6 million boe and a geological chance of success of 50%.

UK - Exploration

Weald Basin: PEDL143 (Holmwood)

In September 2018, the Secretary of State for the Environment, Food and Rural

Affairs, refused an application to extend the site lease. Acting on behalf of

the partnership, Europa withdrew its application to extend planning permission

to drill the Holmwood exploration well from the Bury Hill Wood site, which has

since been re-instated. The remaining prospectivity of PEDL143 is now being

evaluated which, in addition to the established Portland sandstone reservoirs,

includes the Kimmeridge Limestone, an emerging play in the Weald Basin. On 14

March Europa announced that it was in the process of transferring operatorship

to UK Oil & Gas PLC. Regulatory consent has been obtained.

East Midlands: PEDL299 (Hardstoft)

PEDL299 contains the Hardstoft oil field which was discovered in 1919 by the

UK's first ever exploration well. Hardstoft produced 26,000 barrels of oil

from Carboniferous limestone reservoirs in the 1920s. Gross 2C contingent

resources of 3.1 million boe and gross 3C contingent resources of 18.5 million

boe in the Hardstoft structure were identified in a CPR issued by joint venture

partner Upland Resources. The application of modern production testing and

drilling methodologies could lead to commercial oil flowrates being achieved.

Europa's interest in PEDL299, which is restricted to the conventional

prospectivity including Hardstoft, is 25%, alongside Upland 25% and INEOS, the

operator, 50%.

Cleveland Basin: PEDL343 (Cloughton)

PEDL343 contains the Cloughton gas discovery, which was successfully drilled by

Bow Valley in 1986 and flowed a small amount of gas to surface on production

test from conventional Carboniferous sandstone reservoirs. Europa regards

Cloughton as a gas appraisal opportunity with the critical challenge being to

obtain commercial flowrates from future production testing operations. Europa

holds a 35% interest in PEDL343 alongside Arenite 15%, Third Energy 20%

(operator), Egdon Resources 17.5% and Petrichor Energy 12.5%.

East Midlands: PEDL181

PEDL181 is exposed to the hydrocarbon potential of the Humber basin. The

licence has technical synergy with the adjacent PEDL334 which was awarded to an

Egdon Resources-led group in the 14th Round for the purpose of conventional and

unconventional exploration.

New Ventures

As announced in January 2019, Europa is in the final phase of discussions with

The National Office of Hydrocarbons and Mines ('ONHYM') regarding securing a

petroleum agreement in Morocco. The Company continues to evaluate new ventures

within its established areas of interest which include greenfield exploration

and brownfield re-development projects in North Africa, Western Europe, and

Central Europe.

Financials

Average daily H1 2019 production was 90 boepd compared to 97 boepd in H1 2018

following:

* Natural decline at three production sites

* Incremental production added from the West Firsby 6 workover starting in

January 2019 which is currently producing 6 bopd net to Europa

There was a 14% increase in average realised oil price to US$67.7 per barrel

(H1 2018: US$59.2). Foreign exchange movements positively impacted revenues by

5% as US Dollar sales converted to Sterling at US$1.29 (H1 2018: US$1.35)

Conclusion and Outlook

Our objective is to drill-up our portfolio of high impact prospects in Atlantic

Ireland at the earliest opportunity. Several workstreams are being advanced

concurrently to ensure we are in a position to achieve this, including securing

partners for our South Porcupine and Slyne Basin licences, and undertaking site

surveys in summer 2019 for our drill-ready prospects Inishkea in the Slyne

Basin, and Kiely East and Edgeworth in the South Porcupine Basin. Much

progress has been made. Notably with an offer received from the NW European

division of a major international oil and gas company to farm-in to three

licences. Subject to final negotiation and an investment decision awaited from

the major's head office, Europa will be funded for up to three high impact

wells including one targeting 1.5 tcf of gas at Inishkea next to the Corrib

field. Furthermore, this is not all high-risk wildcat exploration. We rank

Inishkea as having a one in three chance of success. We also note that other

companies are active in the South Porcupine: CNOOC International intend to

drill the Iolar prospect in summer 2019 and ENI have applied for consent to

acquire a site survey on Dunquin South in summer 2019. These are exciting times

for Atlantic Ireland.

Outside Ireland, we will continue to support the operator's efforts to gain

approval to develop the Wressle oil field. If successful, Wressle will more

than double our existing production to over 200 bopd which, at current oil

prices, would generate a valuable revenue stream for the Company. Elsewhere we

are close to finalising a petroleum agreement in Morocco in line with our

strategy to diversify our portfolio, and where we can deploy the same technical

skillset and expertise..

Hugh Mackay

CEO

11 April 2019

Qualified Person Review

This release has been reviewed by Hugh Mackay, Chief Executive of Europa, who

is a petroleum geologist with over 30 years' experience in petroleum

exploration and a member of the Petroleum Exploration Society of Great Britain,

American Association of Petroleum Geologists and Fellow of the Geological

Society. Mr Mackay has consented to the inclusion of the technical information

in this release in the form and context in which it appears.

Licence Interests Table

Country Area Licence Field/ Operator Equity Status

Prospect

UK East DL003 West Firsby Europa 100% Production

Midlands

DL001 Crosby Warren Europa 100% Production

PL199/215 Whisby-4 BPEL 65% Production

PEDL180 Wressle Egdon 30% Development

PEDL181 Europa 50% Exploration

PEDL182 North Egdon 30% Exploration

Broughton

PEDL299 Hardstoft INEOS 25% Exploration

PEDL343 Cloughton Third 35% Exploration

Energy

Weald PEDL143 Holmwood UKOG 20% Exploration

FEL 2/13 Doyle: Aw/Ac/ Europa 100% Exploration

South Ae/B/C,

Porcupine Kilroy, Keane,

Kiely East,

Ireland Kiely West ,

Lead F

FEL 3/13 Beckett, Wilde Europa 100% Exploration

Shaw

FEL 1/17 Ervine, Europa 100% Exploration

Edgeworth,

Egerton,PR3

LO 16/19 2 leads Cairn 30% Exploration

Slyne LO 16/20 Corrib North Europa 100% Exploration

discovery,

Inishkea

Padraig LO 16/22 6 leads Europa 100% Exploration

Financials

Unaudited consolidated statement of comprehensive income

6 months to 6 months to Year to

31 January 31 January 31 July 2018

2019 2018 (audited)

GBP000 GBP000 GBP000

Revenue 859 778 1,634

Cost of sales (855) (670) (1,365)

Impairment of producing fields - - (142)

Exploration write-off - (46) (1,289)

------ ------ ------

Gross profit 4 62 (1,162)

Administrative expenses (375) (429) (967)

Finance income 27 6 10

Finance expense (93) (136) (171)

------ ------ ------

Loss before taxation (437) (497) (2,290)

Taxation credit/(charge) - 168 (341)

------ ------ ------

Total comprehensive loss for the period (437)

attributed to the equity shareholders of (329) (2,631)

the parent

====== ====== ======

Pence per Pence per Pence per

share share share

Earnings per share (EPS) attributable

to the equity shareholders of the parent

Attributable to the equity shareholders of

the

Basic and diluted EPS (note 4) (0.13)p (0.11)p (0.87)p

Unaudited consolidated statement of financial position

31 January 31 January 31 July

2019 2018 2018

(audited)

GBP000 GBP000 GBP000

Assets

Non-current assets

Intangible assets 6,759 6,534 5,959

Property, plant and equipment 621 813 668

Deferred tax asset - 508 -

------ ------ ------

Total non-current assets 7,380 7,855 6,627

------ ------ ------

Current assets

Inventories 26 19 20

Trade and other receivables 300 512 471

Cash and cash equivalents 4,435 2,306 1,771

------ ------ ------

4,761 2,837 2,262

------ ------ ------

Total assets 12,141 10,692 8,889

====== ====== ======

Liabilities

Current liabilities

Trade and other payables (918) (883) (1,299)

------ ------ ------

Total current liabilities (918) (883) (1,299)

------ ------ ------

Non-current liabilities

Long-term provisions (2,826) (2,652) (2,735)

------ ------ ------

Total non-current liabilities (2,826) (2,652) (2,735)

------ ------ ------

Total liabilities (3,744) (3,535) (4,034)

------ ------ ------

Net assets 8,397 7,157 4,855

====== ====== ======

Capital and reserves attributable to equity

holders of the parent

Share capital (note 3) 4,447 3,014 3,014

Share premium 21,009 18,481 18,481

Merger reserve 2,868 2,868 2,868

Retained deficit (19,927) (17,206) (19,508)

------ ------ ------

Total equity 8,397 7,157 4,855

====== ====== ======

Unaudited consolidated statement of changes in equity

Share Share Merger Retained Total

capital premium reserve deficit equity

GBP000 GBP000 GBP000 GBP000 GBP000

Unaudited

Balance at 1 August 2017 3,014 18,481 2,868 (16,888) 7,475

Total comprehensive loss - - - (329) (329)

for the period

Share based payments - - - 11 11

------ ------ ------ ------ ------

Balance at 31 January 3,014 18,481 2,868 (17,206) 7,157

2018

====== ====== ====== ====== ======

Audited

Balance at 1 August 2017 3,014 18,481 2,868 (16,888) 7,475

Loss for the year - - - (2,631) (2,631)

attributable to the

equity shareholders of

the parent

Share based payments - - - 11 11

------ ------ ------ ------

------

Balance at 31 July 2018 3,014 18,481 2,868 (19,508) 4,855

====== ====== ====== ====== ======

Unaudited

Balance at 1 August 2018 3,014 18,481 2,868 (19,508) 4,855

Total comprehensive loss - - - (437) (437)

for the period

Issue of share capital 1,433 2,546 - - 3,979

Issue of share options - (18) - 18 -

Share based payments - - - - -

------ ------ ------ ------ ------

Balance at 31 January 4,447 21,009 2,868 (19,927) 8,397

2019

====== ====== ====== ====== ======

Unaudited consolidated statement of cash flows

6 months to 6 months to Year to

31 January 31 January 31 July 2018

2019 2018 (audited)

GBP000 GBP000 GBP000

Cash flows (used in)/from operating activities

Loss after taxation (437) (329) (2,631)

Adjustments for:

Share based payments - 11 11

Depreciation 47 69 72

Impairment of producing field - - 142

Exploration write-off - 46 1,289

Finance income (27) (6) (10)

Finance expense 93 136 171

Taxation charge/(credit) - (168) 341

Decrease in trade and other receivables 22 101 69

Increase in inventories (6) (5) (6)

(Decrease)/increase in trade and other (35) 161 73

payables

------ ------ ------

Net cash (used in)/from operating activities (343) 16 (479)

====== ====== ======

Cash flows used in investing activities

Purchase of intangibles (1,002) (1,081) (1,336)

Buy back of part interest in licence - (160) -

Interest received 5 6 10

------ ------ ------

Net cash used in investing activities (997) (1,235) (1,326)

====== ====== ======

Cash flows from/(used in) financing activities

Proceeds from the issue of share capital 3,961 - -

Increase/(decrease) in payables relating to 14 (16) (16)

share capital issue costs

Option based equity movement on share issue 18 - -

Finance costs (2) (2) (3)

------ ------ ------

Net cash from/(used in) financing activities 3,991 (18) (19)

====== ====== ======

Net increase/(decrease) in cash and cash 2,651 (1,237) (1,824)

equivalents

Exchange gain/ (loss) on cash and cash 13 (48) 4

equivalents

Cash and cash equivalents at beginning of 1,771 3,591 3,591

period

------ ------ ------

Cash and cash equivalents at end of period 4,435 2,306 1,771

====== ====== ======

Notes to the consolidated interim statement

1 Nature of operations and general information

Europa Oil & Gas (Holdings) plc ("Europa Oil & Gas") and subsidiaries' ("the

Group") principal activities consist of investment in oil and gas exploration,

development and production.

Europa Oil & Gas is the Group's ultimate parent Company. It is incorporated and

domiciled in England and Wales. The address of Europa Oil & Gas's registered

office head office is 6 Porter Street, London W1U 6DD. Europa Oil & Gas's

shares are listed on the London Stock Exchange AIM market.

The Group's consolidated interim financial information is presented in Pounds

Sterling (GBP), which is also the functional currency of the parent Company.

The consolidated interim financial information has been approved for issue by

the Board of Directors on 11 April 2019.

The consolidated interim financial information for the period 1 August 2018 to

31 January 2019 is unaudited. In the opinion of the Directors the condensed

interim financial information for the period presents fairly the financial

position, and results from operations and cash flows for the period in

conformity with the generally accepted accounting principles consistently

applied. The condensed interim financial information incorporates unaudited

comparative figures for the interim period 1 August 2017 to 31 January 2018 and

the audited financial year to 31 July 2018.

The financial information contained in this interim report does not constitute

statutory accounts as defined by section 435 of the Companies Act 2006. The

report should be read in conjunction with the consolidated financial statements

of the Group for the year ended 31 July 2018.

The comparatives for the full year ended 31 July 2018 are not the Company's

full statutory accounts for that year. A copy of the statutory accounts for

that year has been delivered to the Registrar of Companies. The auditors'

report on those accounts was unqualified and did not contain a statement under

section 498 (2) - (3) of the Companies Act 2006.

Given the current cash balance and cash inflow from the Group's producing

assets, the Directors have concluded, at the time of approving the consolidated

interim financial information, that there is a reasonable expectation, based on

the Group's cash flow forecasts, that the Group can continue in operational

existence for the foreseeable future, which is deemed to be at least 12 months

from the date of signing the consolidated financial information. Accordingly,

they continue to adopt the going concern basis in preparing the consolidated

interim financial information.

2 Summary of significant accounting policies

The condensed interim financial information has been prepared using policies

based on International Financial Reporting Standards (IFRS and IFRIC

interpretations) issued by the International Accounting Standards Board

("IASB") as adopted for use in the EU. The condensed interim financial

information has been prepared using the accounting policies which will be

applied in the Group's statutory financial information for the year ended 31

July 2019.

This results in the adoption of various standards and interpretations, none of

which have had a material impact on the interim report or are expected to have

a material impact on the financial statements for the full year.

3 Share capital

6 months to 31 6 months to Year to

January 2019 31 January 31 July 2018

2018 (audited)

Allotted, called up and fully paid ordinary Shares Shares Shares

shares of 1p

Start of period 301,388,379 301,388,379 301,388,379

Issued in the period 143,303,220 - -

---------------- -------------- --------------

End of period 444,691,599 301,388,379 301,388,379

========== ========= =========

GBP000 GBP000 GBP000

Start of period 3,014 3,014 3,014

Issued in the period 1,433 - -

------ ------ ------

End of period 4,447 3,014 3,014

====== ====== =======

Ordinary shares issued Raised Nominal value

On 10 December 2018 at 6p issue price Number net of costs GBP000

of shares GBP000

Placing 133,333,338 3,684 1,333

Open offer 9,969,882 277 100

------ ------ ------

143,303,220 3,961 1,433

====== ====== ======

4 Earnings per share (EPS)

Basic EPS has been calculated on the loss after taxation divided by the

weighted average number of shares in issue during the period. Diluted EPS uses

an average number of shares adjusted to allow for the issue of shares, on the

assumed conversion of all in-the-money options.

The Company's average share price for the period was 3.51p which was below the

exercise price of all 25,637,898 outstanding share options (H1 2018: 5.74p

which was below the exercise price of all 25,164,440 outstanding share

options).

The calculation of the basic and diluted earnings per share is based on the

following:

6 months to 6 months to Year to

31 January 31 January 31 July 2018

2019 2018 (audited)

GBP000 GBP000 GBP000

Losses

Loss for the period attributable to the (437) (329) (2,631)

equity shareholders of the parent

====== ====== ======

Number of shares

Weighted average number of ordinary shares 342,665,937 301,388,379 301,388,379

for the purposes of basic and diluted EPS

====== ====== ======

5 Taxation

Consistent with the year-end treatment, current and deferred tax assets and

liabilities have been calculated at tax rates which were expected to apply to

their respective period of realisation at the period end.

6 Post reporting date

* Wressle planning appeal submitted to Planning Inspectorate on 5 February

2019 and draft bespoke programme issued by the Inspectorate on 13 February

* Gross un-risked prospective resources at the Inishkea gas prospect in LO 16

/20 confirmed as 1.5 tcf with one in three chance of success (RNS 26

February 2019)

* Transferred operatorship of PEDL143 to UK Oil & Gas PLC as announced on14

March 2019

END

(END) Dow Jones Newswires

April 12, 2019 02:00 ET (06:00 GMT)

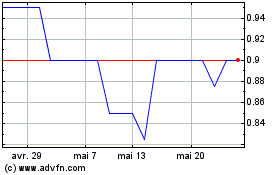

Europa Oil & Gas (holdin... (LSE:EOG)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024