TIDMFRAN

RNS Number : 3472V

Franchise Brands PLC

04 April 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN ARE

RESTRICTED AND ARE NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES OF AMERICA, CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF

SOUTH AFRICA OR JAPAN OR IN OR INTO ANY OTHER JURISDICTION WHERE TO

DO SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT ("ANNOUNCEMENT") IS FOR INFORMATION PURPOSES

ONLY AND DOES NOT ITSELF CONSTITUTE AN OFFER FOR SALE OR

SUBSCRIPTION OF ANY SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT

(INCLUDING THE APPICES) DOES NOT CONSTITUTE OR CONTAIN ANY

INVITATION, SOLICITATION, RECOMMATION, OFFER OR ADVICE TO ANY

PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY

SECURITIES OF FRANCHISE BRANDS PLC IN ANY JURISDICTION WHERE TO DO

SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

UNLESS OTHERWISE INDICATED, CAPITALISED TERMS IN THIS

ANNOUNCEMENT HAVE THE MEANINGS GIVEN TO THEM IN THE DEFINITIONS

SECTION INCLUDED IN APPIX III OF THE ANNOUNCEMENT ISSUED BY THE

COMPANY AT 5.52 P.M. ON 3 APRIL 2023.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (596/2014/EU) AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("MAR").

4 April 2023

Franchise Brands plc

("Franchise Brands", the "Company" or the "Group")

Acquisition of Pirtek Europe - Result of Placing

Notice of General Meeting and posting of Circular

The Board of Franchise Brands plc, an international multi-brand

franchise business, is pleased to announce that, further to the

announcement made yesterday regarding the acquisition of HAI, the

owner of Pirtek Europe, and associated Fundraising, the Bookbuild

has closed and the Company has conditionally raised approximately

GBP92 million pursuant to the Placing (before expenses).

A total of 51,036,291 Placing Shares have been conditionally

placed in the Placing at an issue price of 180 pence per share for

GBP91,865,323.80, alongside the Subscription to 2,663,889

Subscription Shares by senior management and employees of Pirtek

and the Proposed Director for GBP4,795,000.20. As a result, total

equity of approximately GBP114.3 million at the Issue Price will be

issued by the Company pursuant to the Acquisition and will comprise

(i) 9,772,788 Consideration Shares; (ii) 2,663,889 Subscription

Shares; and (iii) 51,036,291 Placing Shares. Allenby Capital and

Dowgate Capital acted as bookrunners in the UK and Stifel acted as

bookrunner for the US and Europe in respect of the Placing .

The Acquisition, Placing and Subscription are conditional on,

amongst other matters, the passing of the Resolutions at the

General Meeting to be convened for 9.00a.m. on 20 April 2023 and

Admission. Notice of the General Meeting will be sent to

Shareholders today in a Circular setting out details of the

Acquisition, Placing and Subscription. The Circular will be

available by tomorrow on the Company's website,

www.franchisebrands.co.uk .

Stephen Hemsley, Executive Chairman of Franchise Brands,

said:

"We are pleased to have successfully completed the bookbuild for

the fundraise with the support of both new and existing

institutional investors . This will enable us to proceed with the

transformational acquisition of Pirtek Europe, a high quality

provider of mission-critical, emergency response on-site hydraulic

hose replacement and associated services.

"The Acquisition brings an established business of scale with an

attractive financial profile and growth prospects and will

significantly expand the Group's range of B2B services, customer

base and end markets.

" Building on the strong performance of the Group's acquisition

of Filta in March 2022, which brought an international footprint in

North America and Europe, Pirtek Europe will extend the Group's

European presence across a number of key countries, providing a

platform from which to launch the Group's existing brands.

"By expanding the Group's operations to ten countries, the

Acquisition will significantly advance the Board's aim to create a

market leading international B2B multi-brand franchisor that

generates its income equally from the UK, North America and

continental Europe.

"We would like to thank our investors for their support and we

look forward to driving shareholder value by working with Pirtek

Europe's strong management team to accelerate growth and drive

operational leverage across the combined business."

Director, Proposed Director and management participation in the

Placing

Certain Directors, the Proposed Director (Alex McNutt) and

senior management and employees of Pirtek Europe have agreed to

subscribe for an aggregate of 3,887,061 Fundraise Shares at the

Issue Price, representing an aggregate investment of approximately

GBP7 million. Details of the Directors', Proposed Director's and

Pirtek management's participation and their resultant interests in

Ordinary Shares on Admission are set out below:

No. Fundraise Total

Shares to shareholding Percentage

Current be On held on

Director shareholding acquired Admission Admission

Nigel Wray 22,366,303 555,555 22,921,858 11.83%

Stephen Hemsley 22,179,844 570,156 22,750,000 11.74%

Jason Sayers 13,438,183 - 13,438,183 6.93%

David Poutney 3,696,495 - 3,696,495 1.91%

Julia Choudhury 1,546,701 33,333 1,580,034 0.82%

Tim Harris 1,385,365 8,574 1,393,939 0.72%

Colin Rees 706,039 - 706,039 0.36%

Andrew Mallows 115,957 8,333 124,290 0.06%

Rob Bellhouse 111,260 41,666 152,926 0.08%

Peter Molloy 71,956 - 71,956 0.04%

Andy Brattesani - 5,555 5,555 0.003%

Alex McNutt - 1,182,041 2,074,696 1.07%

Senior management and

employees of Pirtek Europe - 1,481,848 10,361,981 5.35%

Further details of Director participations in the Placing are

set out in the tables at the end of this announcement as required

by MAR (Notification and public disclosure of transactions by

persons discharging managerial responsibilities and persons closely

associated with them).

Admission and Total Voting Rights

Application will be made to the London Stock Exchange for the

63,472,968 New Ordinary Shares to be admitted to trading on AIM.

Subject to, inter alia, the Resolutions being passed, it is

expected that Admission will become effective and that dealings in

the New Ordinary Shares will commence on AIM on 21 April 2023.

Upon Admission the issued share capital of the Company will

comprise 193,784,080 ordinary shares of 0.5 pence each, with one

voting right per share. The Company does not hold any Ordinary

Shares in treasury and therefore the total number of Ordinary

Shares with voting rights in the Company will be 193,784,080. This

figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

The New Ordinary Shares will represent approximately 33 per

cent. of the Enlarged Share Capital.

Definitions

Capitalised terms used in this announcement have the meanings

given to them in the announcement issued by the Company on 3 April

2023, unless the context provides otherwise.

Enquiries:

Franchise Brands plc + 44 (0) 162 550 7910

Stephen Hemsley, Executive Chairman

Andrew Mallows, Interim Chief Financial Officer

Julia Choudhury, Corporate Development Director

Allenby Capital Limited (Nominated Adviser

and Joint Broker) +44 (0) 20 3328 5656

Jeremy Porter / George Payne / Lauren Wright

(Corporate Finance)

Amrit Nahal / Tony Quirke/ Joscelin Pinnington

(Sales & Corporate Broking)

Dowgate Capital Limited (Joint Broker) +44 (0) 20 3903 7715

Russell Cook / Nicholas Chambers (Corporate

Finance)

James Serjeant / Paul Richards / John Monks

/ Colin Climie (Corporate Broking & Sales)

Stifel Nicolaus Europe Limited (Joint Broker) +44 (0)20 7710 7688

Matthew Blawat / Francis North

MHP Group (Financial PR) +44 (0) 20 3128 8100

Katie Hunt / Catherine Chapman +44 (0) 7884 494112

franchisebrands@mhpgroup.com

For further information, visit www.franchisebrands.co.uk

IMPORTANT NOTICES

This Announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by the

Joint Brokers or by any of its affiliates or any person acting on

its or their behalf as to, or in relation to, the accuracy or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed.

Allenby, Dowgate and Stifel are authorised and regulated in the

United Kingdom by the FCA and are acting exclusively for the

Company and no one else in connection with the Placing, the

contents of this Announcement or any other matters described in

this Announcement. Allenby, Dowgate and Stifel will not regard any

other person as its client in relation to the Placing, the content

of this Announcement or any other matters described in this

Announcement and will not be responsible to anyone (including any

Placees) other than the Company for providing the protections

afforded to its clients or for providing advice to any other person

in relation to the Placing, the content of this Announcement or any

other matters referred to in this Announcement. Allenby's

responsibilities as Nominated Adviser to the Company are owed

solely to the London Stock Exchange and no-one else.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Stephen Hemsley

------------------------------- -----------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Executive Chairman

------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------- -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name Franchise Brands plc

------------------------------- -----------------------------------------

b) LEI 213800CFRX6CJ8LCKN37

------------------------------- -----------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the financial ordinary shares of 0.5p each in Franchise

instrument, type of instrument Brands plc

Identification code

Identification code (ISIN) for Franchise

Brands plc ordinary shares: GB00BD6P7Y24

------------------------------- -----------------------------------------

b) Nature of the transaction Purchase of ordinary shares

------------------------------- -----------------------------------------

c) Price(s) and volume(s) Price: 180p

Volume: 570,156

------------------------------- -----------------------------------------

d) Aggregated information n/a

- Aggregated volume

- Price

------------------------------- -----------------------------------------

e) Date of the transaction 4 April 2023

------------------------------- -----------------------------------------

f) Place of the transaction London Stock Exchange - AIM

------------------------------- -----------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Nigel Wray

------------------------------- -----------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Non-Executive Director

------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------- -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name Franchise Brands plc

------------------------------- -----------------------------------------

b) LEI 213800CFRX6CJ8LCKN37

------------------------------- -----------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the financial ordinary shares of 0.5p each in Franchise

instrument, type of instrument Brands plc

Identification code

Identification code (ISIN) for Franchise

Brands plc ordinary shares: GB00BD6P7Y24

------------------------------- -----------------------------------------

b) Nature of the transaction Purchase of ordinary shares

------------------------------- -----------------------------------------

c) Price(s) and volume(s) Price: 180p

Volume: 555,555

------------------------------- -----------------------------------------

d) Aggregated information n/a

- Aggregated volume

- Price

------------------------------- -----------------------------------------

e) Date of the transaction 4 April 2023

------------------------------- -----------------------------------------

f) Place of the transaction London Stock Exchange - AIM

------------------------------- -----------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Tim Harris

------------------------------- -----------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Managing Director, B2C division

------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------- -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name Franchise Brands plc

------------------------------- -----------------------------------------

b) LEI 213800CFRX6CJ8LCKN37

------------------------------- -----------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the financial ordinary shares of 0.5p each in Franchise

instrument, type of instrument Brands plc

Identification code

Identification code (ISIN) for Franchise

Brands plc ordinary shares: GB00BD6P7Y24

------------------------------- -----------------------------------------

b) Nature of the transaction Purchase of ordinary shares

------------------------------- -----------------------------------------

c) Price(s) and volume(s) Price: 180p

Volume: 8,574

------------------------------- -----------------------------------------

d) Aggregated information n/a

- Aggregated volume

- Price

------------------------------- -----------------------------------------

e) Date of the transaction 4 April 2023

------------------------------- -----------------------------------------

f) Place of the transaction London Stock Exchange - AIM

------------------------------- -----------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Julia Choudhury*

* Robin Choudhury is a Person closely

associated (PCA) of Julia Choudhury

------------------------------- -----------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Corporate Development Director

------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------- -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name Franchise Brands plc

------------------------------- -----------------------------------------

b) LEI 213800CFRX6CJ8LCKN37

------------------------------- -----------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the financial ordinary shares of 0.5p each in Franchise

instrument, type of instrument Brands plc

Identification code

Identification code (ISIN) for Franchise

Brands plc ordinary shares: GB00BD6P7Y24

------------------------------- -----------------------------------------

b) Nature of the transaction Purchase of ordinary shares

------------------------------- -----------------------------------------

c) Price(s) and volume(s) Price: 180p

Volume: 33,333

------------------------------- -----------------------------------------

d) Aggregated information n/a

- Aggregated volume

- Price

------------------------------- -----------------------------------------

e) Date of the transaction 4 April 2023

------------------------------- -----------------------------------------

f) Place of the transaction London Stock Exchange - AIM

------------------------------- -----------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Robin Bellhouse

------------------------------- -----------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Independent Non-executive Director

------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------- -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name Franchise Brands plc

------------------------------- -----------------------------------------

b) LEI 213800CFRX6CJ8LCKN37

------------------------------- -----------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the financial ordinary shares of 0.5p each in Franchise

instrument, type of instrument Brands plc

Identification code

Identification code (ISIN) for Franchise

Brands plc ordinary shares: GB00BD6P7Y24

------------------------------- -----------------------------------------

b) Nature of the transaction Purchase of ordinary shares

------------------------------- -----------------------------------------

c) Price(s) and volume(s) Price: 180p

Volume: 41,666

------------------------------- -----------------------------------------

d) Aggregated information n/a

- Aggregated volume

- Price

------------------------------- -----------------------------------------

e) Date of the transaction 4 April 2023

------------------------------- -----------------------------------------

f) Place of the transaction London Stock Exchange - AIM

------------------------------- -----------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Andrew Mallows

------------------------------- -----------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Interim Chief Financial Officer

------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------- -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name Franchise Brands plc

------------------------------- -----------------------------------------

b) LEI 213800CFRX6CJ8LCKN37

------------------------------- -----------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the financial ordinary shares of 0.5p each in Franchise

instrument, type of instrument Brands plc

Identification code

Identification code (ISIN) for Franchise

Brands plc ordinary shares: GB00BD6P7Y24

------------------------------- -----------------------------------------

b) Nature of the transaction Purchase of ordinary shares

------------------------------- -----------------------------------------

c) Price(s) and volume(s) Price: 180p

Volume: 8,333

------------------------------- -----------------------------------------

d) Aggregated information n/a

- Aggregated volume

- Price

------------------------------- -----------------------------------------

e) Date of the transaction 4 April 2023

------------------------------- -----------------------------------------

f) Place of the transaction London Stock Exchange - AIM

------------------------------- -----------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Andrew Brattesani

------------------------------- -----------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Independent Non-executive Director

------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------- -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name Franchise Brands plc

------------------------------- -----------------------------------------

b) LEI 213800CFRX6CJ8LCKN37

------------------------------- -----------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the financial ordinary shares of 0.5p each in Franchise

instrument, type of instrument Brands plc

Identification code

Identification code (ISIN) for Franchise

Brands plc ordinary shares: GB00BD6P7Y24

------------------------------- -----------------------------------------

b) Nature of the transaction Purchase of ordinary shares

------------------------------- -----------------------------------------

c) Price(s) and volume(s) Price: 180p

Volume: 5,555

------------------------------- -----------------------------------------

d) Aggregated information n/a

- Aggregated volume

- Price

------------------------------- -----------------------------------------

e) Date of the transaction 4 April 2023

------------------------------- -----------------------------------------

f) Place of the transaction London Stock Exchange - AIM

------------------------------- -----------------------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFILSSISIIV

(END) Dow Jones Newswires

April 04, 2023 07:08 ET (11:08 GMT)

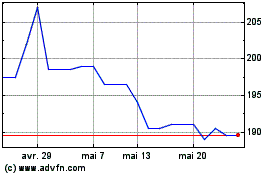

Franchise Brands (LSE:FRAN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Franchise Brands (LSE:FRAN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025