TIDML

RNS Number : 3306D

Sancus Lending Group Limited

19 October 2022

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, THE

REPUBLIC OF SOUTH AFRICA, JAPAN, NEW ZEALAND OR ANY OTHER

JURISDICTION IN WHICH THE PUBLICATION, DISTRIBUTION OR RELEASE OF

THIS ANNOUNCEMENT WOULD BE UNLAWFUL.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014 as amended by The Market Abuse

(Amendment) (EU Exit) Regulations 2019. The person responsible for

making this announcement on behalf of the Company is Rory

Mepham.

19 October 2022

Sancus Lending Group Limited (the "Group" or the "Company")

Proposed ZDP Continuation and Tender Offer, Bond Issue and

Warrant Issue, Exercise of Existing Warrants

and

Notice of Class Meetings and Extraordinary General Meeting and

posting of circular

The Board of the Company is pleased to announce proposals for a

refinancing of and a tender offer in respect of the Group's ZDP

Shares, alongside a proposed extension of the Group's existing

funding facility with Pollen Street and an injection of capital by

the Group's largest existing ordinary shareholder, Somerston.

HIGHLIGHTS

-- Proposed refinancing and extension of the final capital

repayment of the ZDP Shares to 5 December 2027, and a Tender Offer

of up to 15% of the ZDP Shares in issue (excluding those held in

treasury), securing the long-term support of ZDP Shareholders.

-- In principle agreement for an increase in the Company's

existing facility with Pollen Street to GBP125 million and a term

extension for at least three years, expanding the Group's access to

strategic institutional long-term financing.

-- Exercise of existing warrants held by Somerston Fintech (part

of the Somerston Group, the Company's largest Ordinary

Shareholder), and a subscription for additional new Bonds and

Warrants by Somerston Fintech, providing the Group with additional

growth capital at a critical juncture in its turnaround plan.

Rory Mepham, Chief Executive Officer of Sancus Lending Group

Limited, commented:

"The proposed refinancing, tender offer, extension of the

Group's existing facility and capital injection strengthens the

Group's financial position and will enable the Group to continue to

execute its growth plans. The extension of the Pollen Street

facility for three years allows further growth in our loans under

management. I would like to thank our ZDP holders and Somerston

Group for their continued support as we continue to execute our

turnaround and focus on growth."

A circular setting out further details of the Proposals and

including notices of the Meetings will be posted to Shareholders

later today (the " Circular ") and a copy will be available to

download from the Company's website at www.sancus.com . Capitalised

terms used but not otherwise defined in the text of this

announcement are defined in the Circular.

For further information, please contact:

Sancus Lending Group Limited

Rory Mepham

+44 (0)1481 708 280

Liberum Capital (Nominated Adviser and Corporate Broker)

Lauren Kettle

Chris Clarke

William King

+44 (0) 20 3100 2000

Instinctif Partners (PR Adviser)

Tim Linacre

Victoria Hayns

+44 (0)207 457 2020

Sanne Fund Services (Guernsey) Limited (Company Secretary)

Matt Falla

Katrina Rowe

+44 (0)1481 755530

LEI: 213800S2XOO3YSEGCA26

Proposals for the ZDP Continuation and a Tender Offer

1. Introduction

The Board has today posted a Circular to Shareholders setting

out details of Proposals that comprise the extension of the life of

the ZDP Shares to 5 December 2027 (the "ZDP Continuation") and a

Tender Offer for approximately 15 per cent. of the issued ZDP

Shares, excluding ZDP Shares held in treasury, (the "Tender Offer"

and, together with the ZDP Continuation, the "Proposals"). The

Board is also pleased to announce a further investment in the

Company by its largest shareholder, Somerston, by way of the

exercise of Warrants and subscription for New Bonds and further

Warrants, both of which are conditional, amongst other things, on

the ZDP Continuation becoming effective.

The ZDP Continuation requires the approval of Ordinary

Shareholders and ZDP Shareholders at the Meetings and the making of

the Tender Offer requires the approval of Ordinary Shareholders at

the Extraordinary General Meeting.

The Proposals are inter-conditional and include elements that

require the approval of Ordinary Shareholders and ZDP Shareholders

at the Meetings. The purpose of the Circular is to provide Ordinary

Shareholders and ZDP Shareholders with details of the Proposals and

to set out the reasons why the Board recommends that Shareholders

vote in favour of the Proposals. The Circular also contains the

terms and conditions of the Tender Offer, together with details of

how ZDP Shareholders can tender ZDP Shares for purchase, if they

wish to do so.

2. Financial information and trading update

On 26 September 2022 the Company published its interim report

for the period to 30 June 2022 (the "Report").

Earlier this year, the Company launched a range of new strategic

initiatives, with the aim of returning the Group to profitability;

focused on origination, loan management, funding and finance and

operations. The Group's geographical focus remains unchanged, and

the business will look to expand its presence in the UK and Ireland

and grow its loan book in the offshore markets of the Channel

Islands and Gibraltar.

The Board considers that growth in lending volumes, supported by

institutional grade credit processes and effective management and

execution, and co-funding secured on improved terms from a

broadened mix of private and institutional funders, will provide

the business with the scale and diversification it needs to deliver

sustainable profit growth. The Company has also focused on

strengthening operational processes, driven by technology

enablement and data integrity, and reinforcing its team, with

significant investment in the sales and credit teams at the end of

2021 and into 2022 to support and drive growth.

As set out in the Report, in the first half of the financial

year the Company made a number of significant positive

achievements, with good progress against these strategic

initiatives. Most notably, the Company saw impressive growth of new

loan facilities, with GBP86 million worth of new loans written,

surpassing the total for the 2021 financial year which was GBP83

million. This momentum is expected to drive revenue growth in the

second half of the 2022 financial year and beyond, reflecting the

lag in fee generation as the loan book grows.

The Group has a funding facility arranged by Pollen Street plc

(the "Facility"), which as at 26 September 2022 was drawn to GBP65

million and currently matures on 28 January 2024.

The Company has signed non-binding heads of terms with Pollen

Street plc which agree in principle, subject to signing definitive

documentation and the usual diligence and approvals for facilities

of this type, amendments including the extension of the term of the

Facility such that it will expire at least three years from the

date of the amendments and the capacity, over time, to increase the

commitment to GBP125 million (the "Facility Renegotiation"). A

further update on the progress of the Facility Renegotiation will

be provided in due course.The focus on returning the Group to

profitability will continue to be the Board's top priority, while

also reporting progress against the strategic key performance

indicators which are set out in the Report. Shareholders may refer

to the Report for the latest financial information on the Company

and the Board's present views on the Company's financial and

trading prospects.

3. The ZDP Continuation

Background to the ZDP Continuation

The Company currently has two classes of Shares in issue;

Ordinary Shares and ZDP Shares. The Ordinary Shares have been

traded on the AIM market of the London Stock Exchange since August

2005. The ZDP Shares were issued in December 2014 and have been

traded on the standard listing segment of the main market of the

London Stock Exchange since October 2015. As at the date of the

Circular, the Company's issued share capital is 489,843,477

Ordinary Shares (of which 11,852,676 Ordinary Shares are held by a

subsidiary of the Company) and 19,101,384 ZDP Shares (of which

12,574,705 ZDP Shares are held by the Company as treasury

shares).

The ZDP Shares are non-participating and non-voting (except in

certain limited circumstances, including at the ZDP Class Meeting

and the Extraordinary General Meeting) but carry the right to the

repayment of a Final Capital Entitlement on the ZDP Maturity Date.

The ZDP Maturity Date is currently 5 December 2022, on which date

the holders of ZDP Shares are entitled to receive from the Company

164.64 pence for each ZDP Share that they hold, which would

represent a return on the issue price of the ZDP Shares equivalent

to 5.5 per cent. per annum up to and including 5 December 2019, and

8 per cent. per annum from 6 December 2019 to the current ZDP

Maturity Date of 5 December 2022. The Final Capital Entitlement is

to be paid by way of the redemption of the ZDP Shares, and under

the Articles and applicable company law the Company may only redeem

such Shares to the extent that the Board is comfortable that, after

such redemption, the Company can satisfy the solvency test

prescribed by Guernsey company law.

The Company has, in the past, utilised available cash funds to

acquire ZDP Shares (through on-market buybacks and tender offers)

with a view to reducing the quantum of the Final Capital

Entitlement. The most recent ZDP buyback exercise took place in

July and August 2022, whereby approximately GBP500,000 was returned

to ZDP Shareholders. Tender offers were completed in March 2020 and

April 2021, returning approximately GBP6.2 million to ZDP

Shareholders in aggregate. ZDP Shares bought back on-market have

previously been held by the Company in treasury whereas those

purchased by the Company in connection with a tender offer have

been cancelled. As at the date of the Circular, 6,526,679 ZDP

Shares remain in issue and are not held by the Company in treasury,

equating to an aggregate 2022 Final Capital Entitlement on 5

December 2022 of approximately GBP10.7 million.

As previously announced, as part of the Group's growth strategy

the Company has been considering options regarding this obligation

to pay the Final Capital Entitlement, including the re-financing,

part repayment and/or extension of the ZDP Shares. Following the

publication of the Report, the Company has consulted with relevant

stakeholders, including certain Ordinary Shareholders and ZDP

Shareholders, in order to agree a long-term plan meeting the needs

of all stakeholders while also enabling the Group to continue to

reinvest for growth. With the support of those key stakeholders,

the Board intends that the ZDP Shares be an integral part of the

Group's long-term finance strategy.

The Board therefore proposes that the life of the ZDP Shares be

extended such that they carry the right to receive the 2027 Final

Capital Entitlement of 253.32 pence per ZDP Share on 5 December

2027 (being the date falling five years after the current ZDP

Maturity Date). This represents an increase to a 9 per cent. per

annum yield on the ZDP Shares in the period from 6 December 2022 to

5 December 2027. The Board believes that the Proposals are in the

best interests of both classes of Shareholder.

The ZDP Continuation will allow ZDP Shareholders to continue

their investment in the Company. As noted at paragraph 1 of Part 5

of the Circular, UK resident ZDP Shareholders should generally not

be treated as making a disposal for the purposes of UK taxation of

chargeable gains as a result of doing so. It is important to note

that the discussion of the tax treatment contained in Part 5 of the

Circular is intended only as a general and non-exhaustive summary

of the expected tax treatment and ZDP Shareholders are advised to

seek independent professional advice as to the tax consequences for

them of the Proposals.

Key Features of the amended ZDP Shares

If the Proposals are adopted, the ZDP Shares:

-- will have a repayment date of 5 December 2027;

-- are intended to provide ZDP Shareholders with an increased

level of capital growth at a rate of 9 per cent. per annum

with effect from 6 December 2022 (subject to the performance

of the Company's business and investments);

-- subject to the Company having sufficient assets at the time

to satisfy the solvency test set out under Guernsey company

law, will carry the right to be paid the 2027 Final Capital

Entitlement of 253.32 pence in cash on 5 December 2027; and

-- will continue to benefit from the protection afforded by the

Cover Test.

Save as set out above, the rights of the ZDP Shares following

the implementation of the Proposals will be the same as the rights

of the existing ZDP Shares. The amended rights of the ZDP Shares

are set out in the New Articles and are described in full in Part 2

of the Circular. The New Articles are available for inspection as

set out in Part 6 of the Circular.

The ability of the Company to pay the 2027 Final Capital

Entitlement is dependent on the performance of the Company's

business and investments. ZDP Shares are not a guaranteed,

protected or secured investment and ZDP Shareholders may therefore

not receive their full 2027 Final Capital Entitlement.

Adoption of the New Articles

The ZDP Continuation will be implemented by way of the adoption

of the New Articles.

The New Articles contain the amended rights attaching to the ZDP

Shares as set out in Part 2 of the Circular. The New Articles

contain a right attaching to all ZDP Shares for such ZDP Shares to

be redeemed on 5 December 2027 at a redemption price of 253.32

pence per ZDP Share (being the 2027 Final Capital Entitlement).

The Existing Articles and the New Articles (in the form of a

comparison document showing the changes between the two) are

available for inspection as set out in Part 6 of the Circular.

If the Proposals are approved by Shareholders, the New Articles

will be adopted on the date on which the Resolutions are passed.

Upon the ZDP Continuation, ZDP Shareholders shall continue to hold

ZDP Shares on the amended terms as set out in the New Articles. In

the case of any discrepancy between the Circular and the New

Articles, the terms of the New Articles will prevail.

Dealings in ZDP Shares

No new securities will be issued by the Company in connection

with the ZDP Continuation and the ZDP Shares will continue to be

held by ZDP Shareholders, albeit on the revised terms of the ZDP

Continuation.

Dealings in the ZDP Shares will continue to be effective in

CREST and the existing ISIN number GG00BTDYD136 will continue to

apply.

ZDP Shareholders who hold their ZDP Shares in certificated form

will not receive replacement certificates in respect of their ZDP

Shares.

4. The Tender Offer

Background to the Tender Offer

The Tender Offer is being made for up to 979,001 ZDP Shares,

being 15 per cent. of the issued ZDP Shares as at the date of the

Circular (excluding ZDP Shares held in treasury). Each ZDP

Shareholder (other than Restricted Shareholders and certain

Overseas Shareholders as explained in paragraph 11 of Part 3 of the

Circular) may elect to sell up to 15 per cent. of their ZDP

Shareholding.

The Tender Offer is being made at the Tender Price of 164.64

pence per ZDP Share. This is equal to the accrued capital

entitlement per ZDP Share as at 5 December 2022, the anticipated

date of completion of the Tender Offer and the existing ZDP

Maturity Date, calculated in accordance with the Existing Articles.

The aggregate Tender Price, assuming that the full entitlement of

ZDP Shares is tendered, will be approximately GBP1.6 million.

The Tender Offer is being made for the benefit of both Ordinary

Shareholders, who will benefit from the reduced overall capital

entitlement of the ZDP Shares as a result of repurchasing 15 per

cent. of the ZDP Shares sooner than the 2027 ZDP Maturity Date; and

ZDP Shareholders, who may elect to realise some of their investment

at this time if they wish to do so. ZDP Shareholders are not

obliged to tender any of their ZDP Shares and, if they do not wish

to do so, they should not return a Tender Form or TTE Instruction.

Ordinary Shareholders may not participate in the Tender Offer.

Details of the Tender Offer

The Tender Offer enables those ZDP Shareholders (other than

Restricted Shareholders and certain Overseas Shareholders) who wish

to sell some of their ZDP Shares to elect to do so, subject to the

overall limits of the Tender Offer. ZDP Shareholders who

successfully tender ZDP Shares will receive the Tender Price per

ZDP Share, being equal to the accrued capital entitlement per ZDP

Share as at 5 December 2022, the anticipated date of completion of

the Tender Offer, calculated in accordance with the Existing

Articles.

Under the terms of the Tender Offer, ZDP Shareholders (other

than Restricted Shareholders and certain Overseas Shareholders)

will be entitled to tender up to their Tender Entitlement, being 15

per cent. of the ZDP Shares they hold as at the Record Date.

Tenders in excess of the Tender Entitlement will not be

satisfied.

Subject to the satisfaction of the Conditions relating to the

Tender Offer, the Company will purchase ZDP Shares validly tendered

under the Tender Offer at the Tender Price by way of an on-market

transaction on the main market of the London Stock Exchange. The

ZDP Shares which the Company acquires from tendering ZDP

Shareholders will be cancelled. The repurchase will be made in

accordance with the conditions set out in the Resolution to be

proposed at the EGM, including maintaining compliance with the

Cover Test.

The Tender Offer is subject to the conditions set out in

paragraph 3 of Part 3 of the Circular. The Tender Offer may be

terminated in certain circumstances as set out in paragraph 9 of

Part 3 of the Circular. ZDP Shareholders' attention is drawn to

Part 3 of the Circular, which (and in the case of ZDP Shares held

in certificated form, together with the Tender Form) set out the

terms and conditions of the Tender Offer, and to Part 3 of the

Circular which contains a summary of certain risks associated with

the Tender Offer. Details of how ZDP Shareholders will be able to

tender ZDP Shares can be found in paragraph 5 of Part 3 of the

Circular.

The proposed repurchase of ZDP Shares pursuant to the Tender

Offer would be categorised as a form of distribution under Guernsey

Companies Law. Before the repurchase may be undertaken, the Board

must be satisfied, on reasonable grounds, that the Company will

satisfy the solvency test as defined under the Guernsey Companies

Law immediately after the repurchase has been completed.

The Board will also need to consider if the financial position

of the Company is expected to, or has, changed materially between

the time of the authorisation of the repurchase and the actual time

of the repurchase.

Currently, the Board is satisfied that the Company will satisfy

the solvency test. However, if the Board ceases to be satisfied

prior to completion of the Tender Offer that the Company will

satisfy the above-mentioned solvency test immediately after the

repurchase by the Company of the ZDP Shares from tendering ZDP

Shareholders, then the repurchase will no longer be deemed to be

authorised, and as a result, the Tender Offer will not proceed (or

be capable of becoming unconditional) and the ZDP Shares will not

be repurchased.

ZDP Shareholders should note that, once tendered, ZDP Shares may

not be sold, transferred, charged or otherwise disposed of other

than in accordance with the Tender Offer.

Shareholders who are in any doubt as to the contents of the

Circular or as to the action to be taken should immediately consult

their stockbroker, bank manager, solicitor, accountant or other

independent financial adviser authorised under FSMA.

At the Extraordinary General Meeting, Ordinary Shareholders will

be asked to approve an ordinary resolution that will allow the

implementation of the Tender Offer. The Company's general authority

to repurchase its own ZDP Shares, which was granted at the last

annual general meeting of the Company held on 10 May 2022, in

respect of up to 100 per cent. of the issued ZDP Shares as at the

date of that meeting, will remain in force and be unaffected by the

Tender Offer. However, the Company will not repurchase any ZDP

Shares prior to the date of completion of the Tender Offer.

This is not a recommendation for ZDP Shareholders to tender

their ZDP Shares under the Tender Offer. Whether or not ZDP

Shareholders tender their ZDP Shares will depend on, amongst other

things, their view of the Company's prospects and their own

individual circumstances, including their tax position, on which

they should seek their own independent advice.

Overseas Shareholders and Restricted Shareholders

The making of the Tender Offer to persons outside the United

Kingdom may be prohibited or affected by the laws of the relevant

overseas jurisdictions. ZDP Shareholders with registered or mailing

addresses outside the United Kingdom or who are citizens or

nationals of, or resident in, a jurisdiction other than the United

Kingdom should read carefully paragraph 11 of Part 3 of the

Circular.

The Tender Offer is not being made to ZDP Shareholders who are

resident in, or citizens of, Restricted Jurisdictions. Restricted

Shareholders are being excluded from the Tender Offer in order to

avoid offending applicable local laws relating to the

implementation of the Tender Offer. Accordingly, copies of the

Tender Form are not being and must not be mailed or otherwise

distributed in or into Restricted Jurisdictions.

It is the responsibility of all Overseas Shareholders to satisfy

themselves as to the observance of any legal requirements in their

jurisdiction, including, without limitation, any relevant

requirements in relation to the ability of such holders to

participate in the Tender Offer.

5. The Somerston fundraising

The Conditional Warrant Exercise and Conditional Bond Issue

The Company's major shareholder, Somerston Group, has indicated

its continued support of the Company's relaunched growth strategy

and, accordingly, has indicated its support for the Proposals.

Conditional upon the ZDP Continuation being approved and

implemented and the Facility Renegotiation being completed,

Somerston has agreed to invest further capital into the Company as

described below.

Somerston Fintech has irrevocably committed, conditional upon

the ZDP Continuation becoming effective (which includes

Shareholders approving the Proposals at the Meetings) and the

Facility Renegotiation being completed, to subscribe for 94,294,869

new Ordinary Shares by way of the full exercise of the Warrants

held by Somerston (the "Conditional Warrant Exercise"). The

Warrants are being exercised for an aggregate subscription price of

GBP2,121,634.56 (with an exercise price of 2.25 pence per Ordinary

Share, a premium to the current market value of the Ordinary

Shares). The new Warrants proposed to be issued to Somerston fall

within the Shareholder authority granted in December 2020.

In addition, Somerston Fintech has irrevocably committed,

conditional upon (i) the ZDP Continuation becoming effective, (ii)

admission to AIM of the ordinary shares issued pursuant to the

Conditional Warrant Exercise becoming effective, and (iii) the

Facility Renegotiation being completed, to subscribe for New Bonds

in an aggregate principal amount of GBP2,425,000 (the "Conditional

Bond Issue"). The New Bonds will be on the same terms as the

existing Bonds issued by the Company, with an interest rate of 7

per cent. per annum (paid quarterly) and a maturity date of 31

December 2025. The New Bonds proposed to be issued to Somerston

form part of the aggregate principal amount of Bond issuance of

GBP15 million described to Shareholders as part of a refinancing

transaction approved in December 2020. As was the case with the

existing Bonds when issued in December 2020, the New Bonds will be

issued alongside a bonus issue of Warrants in respect of 0.25 per

cent. of the Company's issued Ordinary Share capital (calculated as

at admission of the Ordinary Shares that were issued in December

2020, being the same number as are in issue at the date of the

Circular and, for the avoidance of doubt, prior to the Conditional

Warrant Exercise) being issued for every GBP100,000 of principal

amount of New Bonds issued. Accordingly, following the Conditional

Bond Issue, Somerston will hold Warrants in respect of 29,696,761

Ordinary Shares (representing 5.08 per cent. of the Company's

issued Ordinary Share capital following the Conditional Warrant

Exercise).

NO NEW SECURITIES ARE BEING OFFERED TO ANY PERSON PURSUANT TO

THIS ANNOUNCEMENT OR THE CIRCULAR.

Implications under the Takeover Code

The Company is a limited company whose Ordinary Shares are

admitted to trading on AIM and its Shareholders are therefore

entitled to the protections afforded by the Takeover Code.

Under Rule 9 of the Takeover Code, where any person acquires,

whether by a series of transactions over a period of time or by one

specific transaction, an interest in shares which (taken together

with shares in which persons acting in concert with that person are

interested) carry 30 per cent., or more of the voting rights of a

company that is subject to the Takeover Code, that person is

normally required by the Panel to make a Rule 9 Offer to the

remaining shareholders to acquire their shares. Similarly, Rule 9

of the Takeover Code also provides that where any person, together

with persons acting in concert with that person, is interested in

shares which in aggregate carry not less than 30 per cent. of the

voting rights of a company which is subject to the Takeover Code,

but does not hold shares carrying more than 50 per cent. of the

voting rights of that company and such person or any such person

acting in concert with that person acquires an interest in any

other shares which increases the percentage of shares carrying

voting rights in which that person is interested, then such person

or persons acting in concert will normally be required by the Panel

to make a Rule 9 Offer to the remaining shareholders to acquire

their shares.

As at the date of the Circular, Somerston holds 200,349,684

Ordinary Shares (representing 40.90 per cent of the Company's

voting share capital).

In December 2020, independent Shareholders approved the waiver

by the Panel of an obligation that would otherwise arise for

Somerston and certain parties acting in concert with it (the

"Concert Party") to make a mandatory offer under Rule 9 of the

Takeover Code as the result of the exercise of the Warrants to

subscribe for 94,294,869 new Ordinary Shares (the Conditional

Warrant Exercise).

Following the Conditional Warrant Exercise, Somerston will hold

294,644,553 Ordinary Shares (representing 50.44 per cent of the

Company's voting share capital).

Shareholders should be aware that Rule 9 of the Takeover Code

provides that where any person who, together with persons acting in

concert with that person, holds shares carrying more than 50 per

cent. of the voting rights of a company and acquires an interest in

shares which carry additional voting rights, that person will not

normally be required to make a Rule 9 Offer to the other

shareholders to acquire their shares.

Therefore, following implementation of the Proposals and the

Conditional Warrant Exercise, both Somerston and the members of the

Concert Party together will, in aggregate, hold Ordinary Shares

carrying more than 50 per cent. of the Company's voting share

capital. As a result, Somerston and, for as long as they continue

to be treated as acting in concert, the Concert Party will be able

to increase their aggregate holding in the Company (including as a

result of the exercise of the Warrants in respect of the 29,696,761

Ordinary Shares to be issued to Somerston in connection with the

Conditional Bond Issue) without incurring an obligation under Rule

9 to make a mandatory offer to the other Shareholders.

Subject to the implementation of the ZDP Continuation, the

Facility Renegotiation and the admission to AIM of the Ordinary

Shares issued pursuant to the Conditional Warrant Exercise becoming

effective, and following the Conditional Bond Issue, Somerston will

hold Warrants which, if exercised, would result in Somerston

holding 324,341,314 Ordinary Shares in aggregate (representing up

to 52.84 per cent. of the Company's increased voting share

capital).

Related party transaction

Somerston Fintech is a related party to the Company in

accordance with the AIM Rules, by virtue of its shareholding in the

Company. Accordingly, Somerston Fintech's subscription for New

Bonds and Warrants pursuant to the Conditional Bond Issue is a

related party transaction for the purpose of the AIM Rules.

Furthermore, Philip J Milton is a related party to the Company in

accordance with the AIM Rules, by virtue of its Ordinary

Shareholding in the Company. Accordingly, the proposed ZDP

Continuation in respect of the ZDP Shares held by Philip J Milton

is also a related party transaction for the purposes of the AIM

Rules.

The Directors consider, having consulted with the Company's

nominated adviser, Liberum, that the terms of Somerston Fintech's

participation in the Conditional Bond Issue and the ZDP

Continuation by Philip J Milton, respectively, are fair and

reasonable insofar as Shareholders are concerned.

6. Importance of voting on the Proposals

The Board believes that the Proposals are in the best interests

of Ordinary Shareholders and ZDP Shareholders, and that there is

strong support for the Proposals.

In the event that Shareholders do not vote in favour of the

Proposals at the Meetings, then the terms of the ZDP Shares will

remain unchanged and the Somerston fundraising will not occur.

Accordingly, the Company would be required to pay the 2022 Final

Capital Entitlement on 5 December 2022 and would not benefit from

the further investment.

If the Resolutions are not passed, the Board believes there is a

material risk that the Company may not have sufficient cash

resources to pay the 2022 Final Capital Entitlement in full in a

manner that would satisfy the solvency test set out under Guernsey

company law, also compromising the Company's ability to continue as

a going concern.

In the event that the Company is required to pay the 2022 Final

Capital Entitlement and has insufficient cash resources to lawfully

do so then, in accordance with the Existing Articles, the Company

shall redeem such number of ZDP Shares (on a pro-rata basis amongst

ZDP Shareholders) as it is lawfully able to redeem on 5 December

2022, and thereafter shall redeem further ZDP Shares in tranches

(on a pro-rata basis amongst ZDP Shareholders) as and when it is

lawfully able to do so. In such circumstances, the Board believes

it would be required to liquidate existing assets on terms which

are likely to be disadvantageous to the Group and therefore

detrimental to the interests of Shareholders. Furthermore, in doing

so, the Board considers that there may be an adverse reaction

amongst the Group's loan funder network, which may disrupt the

Company's operations and prejudice the ability of the Group to

effectively pursue its lending business. The Board considers that

such a situation would pose a material risk to the financial and

trading position of the Group.

THE RESOLUTIONS ARE INTER-CONDITIONAL, SUCH THAT IF ANY OF THE

RESOLUTIONS ARE NOT PASSED, THE PROPOSALS WILL NOT BE

IMPLEMENTED.

7. Taxation

The attention of ZDP Shareholders is drawn to Part 5 of the

Circular which sets out a general guide to certain aspects of

current UK and Guernsey taxation law and HMRC and Revenue Service

published practice. This information is a general guide and is not

exhaustive. Shareholders should seek advice as to their tax

position from an appropriate professional adviser.

8. Costs of the Proposals

The Company estimates that it will incur costs of approximately

GBP140,000 in respect of the development and implementation of the

Proposals.

9. The Meetings

The implementation of the Proposals requires Shareholder

approval as set out below:

-- the passing by ZDP Shareholders of the Resolution to be

proposed at the ZDP Class Meeting;

-- the passing by Ordinary Shareholders of the Resolution to be

proposed at the Ordinary Class Meeting; and

-- the passing by Ordinary Shareholders and ZDP Shareholders of

the Resolutions to be proposed at the Extraordinary General

Meeting.

Notices of the ZDP Class Meeting, the Ordinary Class Meeting and

the Extraordinary General Meeting are set out in Part 8 of the

Circular.

Voting on each of the Resolutions will be held by a poll.

ZDP Class Meeting

The ZDP Class Meeting has been convened for 7 November 2022 at

10.00 a.m. to enable ZDP Shareholders to consider and, if thought

fit, pass a special resolution consenting to the passing of the ZDP

Continuation Resolution to be proposed at the Extraordinary General

Meeting and any variation of their class rights which might arise

under or as a result of the passing and carrying into effect of

such Resolution. In the event that this Meeting is adjourned due to

the absence of a quorum, the adjourned Meeting will be held at the

same venue on the same day at 10.30 a.m.

The majority required for the passing of the Resolution to be

proposed at the ZDP Class Meeting is not less than 75 per cent. of

the votes cast (in person or by proxy) on that Resolution at the

ZDP Class Meeting.

The ZDP Class Meeting will take place at the Company's

registered office, Block C, Hirzel Court, Hirzel Street, St Peter

Port, Guernsey GY1 2NL, Channel Islands. ZDP Shareholders alone are

entitled to attend and vote at the ZDP Class Meeting.

The quorum for the ZDP Class Meeting is two persons present in

person or by proxy and holding at least one third of the issued ZDP

Shares at the date of the Meeting. If the Meeting is not quorate,

it will be adjourned to the time and place indicated above,

whereupon one person holding ZDP Shares and present in person or by

proxy shall form the quorum.

Ordinary Class Meeting

A meeting of Ordinary Shareholders has been convened for 7

November 2022 at 10.05 a.m. (or as soon thereafter as the ZDP Class

Meeting shall have concluded or been adjourned) to enable Ordinary

Shareholders to consider and, if thought fit, pass a special

resolution consenting to the passing of the ZDP Continuation

Resolution to be proposed at the Extraordinary General Meeting and

any variation of their class rights which might arise under or as a

result of the passing and carrying into effect of such Resolution.

In the event that this Meeting is adjourned due to the absence of a

quorum, the adjourned Meeting will be held at the same venue on the

same day at 10.35 a.m.

The majority required for the passing of the Resolution to be

proposed at the Ordinary Class Meeting is not less than 75 per

cent. of the votes cast (in person or by proxy) on that Resolution

at the Ordinary Class Meeting.

The Ordinary Class Meeting will take place at the Company's

registered office, Block C, Hirzel Court, Hirzel Street, St Peter

Port, Guernsey GY1 2NL, Channel Islands. Ordinary Shareholders

alone are entitled to attend and vote at the Ordinary Class

Meeting.

The quorum for the Ordinary Class Meeting is two persons present

in person or by proxy and holding at least one third of the issued

Ordinary Shares at the date of the Meeting. If the Meeting is not

quorate, it will be adjourned to the time and place indicated

above, whereupon one person holding ZDP Shares and present in

person or by proxy shall form the quorum.

Extraordinary General Meeting

The Extraordinary General Meeting has been convened for 7

November 2022 at 10.10 a.m. (or as soon thereafter as the Ordinary

Class Meeting concludes or is adjourned). In the event that this

Meeting is adjourned due to the absence of a quorum the adjourned

meeting will be held at the same venue on the same day at 10.40

a.m.

At the Extraordinary General Meeting, Shareholders will be asked

to consider and, if thought fit, pass the following

Resolutions.

Resolution 1

Resolution 1 is a special resolution to approve the adoption of

the New Articles in substitution for the Existing Articles, thereby

to implement the ZDP Continuation.

Resolution 2

Resolution 2 is an ordinary resolution to allow the Company to

repurchase from ZDP Shareholders the ZDP Shares successfully

tendered under the Tender Offer

Ordinary Shareholders and ZDP Shareholders are entitled to vote

(together) in respect of Resolution 1 to be proposed at the

Extraordinary General Meeting.

The majority required for the passing of Resolution 1 to be

proposed at the Extraordinary General Meeting is not less than 75

per cent. of the votes cast (in person or by proxy) on that

Resolution at the Extraordinary General Meeting.

The majority required for the passing of Resolution 2 to be

proposed at the Extraordinary General Meeting is a simple majority

of the votes cast (in person or by proxy) on that Resolution at the

Extraordinary General Meeting.

The Extraordinary General Meeting will take place at the

Company's registered office, Block C, Hirzel Court, Hirzel Street,

St Peter Port, Guernsey GY1 2NL, Channel Islands.

The quorum for the Extraordinary General Meeting is two members

present in person or by proxy and holding 5 per cent. or more of

the voting rights available at the Meeting. If the Meeting is not

quorate, it will be adjourned to the time and place indicated

above, whereupon such Shareholders as attend in person or by proxy

shall form the quorum.

Notices of all of the above Meetings are set out in Part 8 of

the Circular.

THE TWO RESOLUTIONS ARE INTER-CONDITIONAL. IF EITHER OF THE

RESOLUTIONS ARE NOT PASSED, NEITHER OF THE PROPOSALS WILL BE

IMPLEMENTED.

10. Action to be taken in respect of the Meetings

Forms of proxy for Shareholders are enclosed as follows:

-- for ZDP Shareholders to vote at the ZDP Class Meeting, a pink form of proxy;

-- for Ordinary Shareholders to vote at the Ordinary Class

Meeting, a blue form of proxy; and

-- for all Shareholders to vote at the Extraordinary General Meeting, a white form of proxy.

Completed Forms of Proxy should be returned by post or by hand

to the Company's Registrar, Link Group, PXS1, 10th Floor, Central

Square, 29 Wellington Street, Leeds LS1 4DL, United Kingdom, as

soon as possible, and in any case so as to be received by the

Registrar by not later than:

-- 10.00 a.m. on 3 November 2022 in relation to the pink form of proxy for the ZDP Class

Meeting;

-- 10.05 a.m. on 3 November 2022 in relation to the blue form of

proxy for the Ordinary Class Meeting; and

-- 10.10 a.m. on 3 November 2022 in relation to the white form

of proxy for the Extraordinary General Meeting.

Action to be taken: ZDP Shareholders

ZDP SHAREHOLDERS WHO WISH TO MAINTAIN THEIR CURRENT SHAREHOLDING

IN THE COMPANY SHOULD NOT COMPLETE OR RETURN A TENDER FORM OR

SUBMIT A TTE INSTRUCTION IN CREST.

Only those ZDP Shareholders (other than Restricted Shareholders

and certain Overseas Shareholders) who wish to tender ZDP Shares

and who hold their ZDP Shares in certificated form should complete

a Tender Form in accordance with the instructions set out therein

and return the completed Tender Form to Link Group, Corporate

Actions, 10th Floor, Central Square, 29 Wellington Street, Leeds

LS1 4DL, United Kingdom, to arrive as soon as possible and, in any

event, by no later than 1.00 p.m. on 1 December 2022.

ZDP Shareholders who participate in the Tender Offer and hold

their Shares in certificated form should also return their ZDP

Share certificate(s) and/or other document(s) of title in respect

of the ZDP Shares tendered with their Tender Form.

Those ZDP Shareholders who hold their ZDP Shares in

uncertificated form (that is, in CREST) do not need to complete or

return a Tender Form. ZDP Shareholders who wish to participate in

the Tender Offer and hold their ZDP Shares in uncertificated form

should arrange for the relevant ZDP Shares to be transferred to

escrow by means of a TTE Instruction as described in paragraph 5 of

Part 3 of the Circular.

11. Irrevocable undertakings

ZDP Shareholders holding, in aggregate, 4,650,082 ZDP Shares

(representing 71.25 per cent. of the voting rights in respect of

ZDP Shares as at the date of the Circular) have given their

irrevocable undertaking to vote the ZDP Shares held in their name

at the time of the relevant Meetings in favour of the

Proposals.

12. Recommendation

The Board considers that the terms of the Proposals are in the

best interests of both ZDP Shareholders and Ordinary Shareholders

and the Company as a whole.

The Board unanimously recommends that ZDP Shareholders vote in

favour of the Resolution to be proposed at the ZDP Class Meeting

and the Resolution to be proposed at the Extraordinary General

Meeting. The Board unanimously recommends that Ordinary

Shareholders vote in favour of Resolutions to be proposed at the

Ordinary Class Meeting and the Resolutions to be proposed at the

Extraordinary General Meeting, as they intend to do in respect of

their own beneficial shareholdings, totalling 1,518,992 Ordinary

Shares (representing in aggregate approximately 0.31 per cent. of

the issued Ordinary Share capital of the Company).

Shareholders in any doubt as to the action they should take

should consult an appropriately qualified independent adviser,

authorised under the Financial Services and Markets Act 2000,

without delay.

Expected Timetable of Events

2022

Publication of the Circular and Tender 19 October

Offer opens

Latest time for receipt of pink form of 10.00 a.m. on 3 November

proxy for the ZDP Class Meeting

Latest time for receipt of blue form of 10.05 a.m. on 3 November

proxy for the Ordinary Class Meeting

Latest time for receipt of white form 10.10 a.m. on 3 November

of proxy for the Extraordinary General

Meeting

ZDP Class Meeting 10.00 a.m. on 7 November

Ordinary Class Meeting 10.05 a.m. on 7 November

Extraordinary General Meeting 10.10 a.m. on 7 November

Publication of the results of the Meetings 7 November

Effective date of the ZDP Continuation following the EGM on

7 November

Latest time and date for receipt of Tender 1.00 p.m. on 1 December

Forms and submission of TTE Instructions

from Shareholders

Record Date and time for the Tender Offer 6.00 p.m. on 1 December

Completion of the Tender Offer 5 December

CREST settlement date: payments through on or around 14 December

CREST made and CREST accounts settled

Balancing share certificates and cheques on or around 14 December

despatched to certificated ZDP Shareholders

All of the times and dates in the expected timetable may be

extended or brought forward without further notice, at the

discretion of the Company. If any of the above times and/or dates

change materially, the revised time(s) and/or date(s) will be

notified to Shareholders by an announcement through a Regulatory

Information Service provider.

All references to time in the Circular are to UK time.

IMPORTANT NOTICE

If Shareholders are in any doubt about the contents of this

announcement or the action they should take, they are recommended

to seek advice from their stockbroker, solicitor, accountant, bank

manager or other appropriately authorised independent financial

adviser authorised under the Financial Services and Markets Act

2000 (as amended) if they are in the United Kingdom or from another

appropriately authorised independent financial adviser if they are

in a territory outside the United Kingdom.

This announcement does not constitute, or form part of, any

offer for or invitation to sell or purchase any securities, or any

solicitation of any offer for, securities in any jurisdiction. Any

acceptance or other response to the Tender Offer should be made

only on the basis of information contained in or referred to in the

Circular. The Circular will contain important information,

including the full terms and conditions of the Tender Offer, which

Shareholders are urged to read carefully. The Tender Offer is not

being made, directly or indirectly, in or into, or by use of the

mails of, or by any means or instrumentality of interstate or

foreign commerce of, or any facilities of a national securities

exchange of United States, Canada, Australia, New Zealand, South

Africa and Japan and any other jurisdiction where such distribution

of the Circular into or inside or from such jurisdiction would

constitute a violation of the laws of such jurisdiction.

Certain statements in this announcement constitute

forward-looking statements. Any statement in this announcement that

is not a statement of historical fact including, without

limitation, those regarding the Company's future expectations,

operations, financial performance, financial condition and business

is a forward-looking statement. Such forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially. These risks and uncertainties include, among

other factors, changing economic, financial, business or other

market conditions. These and other factors could adversely affect

the outcome and financial effects of the plans and events described

in this presentation. As a result you are cautioned not to place

reliance on such forward-looking statements. Nothing in this

announcement should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMPBMTMTJBTRT

(END) Dow Jones Newswires

October 19, 2022 02:00 ET (06:00 GMT)

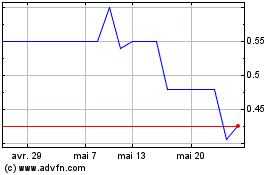

Sancus Lending (LSE:LEND)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Sancus Lending (LSE:LEND)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025