As filed with the Securities and Exchange Commission on June 6, 2024

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

AVALO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 45-0705648 (I.R.S. Employer Identification Number) |

540 Gaither Road, Suite 400

Rockville, Maryland 20850

Telephone: (410) 522-8707

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Christopher Sullivan

Chief Financial Officer

Avalo Therapeutics, Inc.

540 Gaither Road, Suite 400

Rockville, Maryland 20850

Telephone: (410) 522-8707

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Andrew J. Gibbons

Alexander M. Donaldson

Wyrick Robbins Yates & Ponton LLP

4101 Lake Boone Trail, Suite 300

Raleigh, North Carolina 27607

Telephone: (919) 781-4000

Fax: (919) 781-4865

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ¨ | | Accelerated filer ¨ |

Non-accelerated filer þ | | Smaller reporting company þ |

| | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

____________________________

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selling stockholders are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated June 6, 2024

PRELIMINARY PROSPECTUS

Up to 22,357,897 Shares of Common Stock Issuable Upon Conversion of Shares of Series C Non-Voting Convertible Preferred Stock Offered by Selling Stockholders

22,357.897 Shares of Series C Non-Voting Convertible Preferred Stock Offered by Selling Stockholders

Up to 11,967,526 Shares of Common Stock Issuable Upon the Exercise of Warrants Offered by Selling Stockholders

Warrants to Purchase up to 11,967,526 Shares of Common Stock (or 11,967.526 Shares of Series C Non-Voting Convertible Preferred Stock) Offered by Selling Stockholders

This prospectus relates to the sale or other disposition from time to time of (i) up to 22,357,897 shares of our common stock, $0.001 par value per share, issuable upon the conversion of shares of our Series C non-voting convertible preferred stock, (ii) 22,357.897 shares of our Series C non-voting convertible preferred stock, (iii) up to 11,967,526 shares of our common stock issuable upon the exercise of warrants,, and (iv) warrants to purchase up to 11,967,526 shares of our common stock (or 11,967.526 shares of Series C non-voting convertible preferred stock), all held by the selling stockholders named in this prospectus, including their transferees, pledgees, donees or successors. We are not selling any shares of common stock, shares of Series C non-voting convertible preferred stock or warrants to purchase common stock (or Series C non-voting convertible preferred stock) under this prospectus and will not receive any of the proceeds from the sale of such securities by the selling stockholders.

The shares of Series C non-voting convertible preferred stock and warrants were issued (i) to the former stockholders of AlmataBio, Inc. in connection with our acquisition of AlmataBio, Inc. on March 27, 2024, and (ii) to institutional investors in a related private placement of Series C non-voting convertible preferred stock and warrants that closed on March 28, 2024. Subject to receiving the requisite stockholder approval and certain beneficial ownership limitations, each share of Series C non-voting convertible preferred stock will automatically convert upon the requisite stockholder approval into shares of common stock in accordance with the terms of the Series C non-voting convertible preferred stock. See “Prospectus Summary – Recent Events” for more details.

The selling stockholders may sell or otherwise dispose of the securities covered by this prospectus in a number of different ways and at varying prices. While there is no established public trading market for our Series C non-voting convertible preferred stock, we believe the actual offering price in sales of our Series C non-voting convertible preferred stock by the selling stockholders will be derived from the prevailing market price of our common stock at the time of any such sale. We provide more information about how the selling stockholders may sell or otherwise dispose of their securities in the section entitled “Plan of Distribution” beginning on page 19. The selling stockholders will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage fees and commissions and similar expenses) relating to the registration of the securities with the Securities and Exchange Commission. No underwriter or other person has been engaged to facilitate the sale of the securities in this offering.

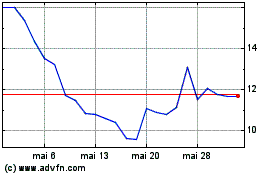

Our common stock is traded on The Nasdaq Capital Market under the symbol “AVTX.” On June 4, 2024, the last reported sale price of our common stock was $11.00 per share. We recommend that you obtain current market quotations for our common stock prior to making an investment decision. The Series C non-voting convertible preferred stock and the warrants are not listed on any exchange, and we do not intend to list the Series C non-voting convertible preferred stock or warrants on any exchange.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus and in the documents incorporated by reference herein, to read about factors you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information that we have provided or incorporated by reference in this prospectus and any prospectus supplement that we may authorize to be provided to you. We have not, and the selling stockholders have not, authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus or any prospectus supplement that we may authorize to be provided to you. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information in this prospectus and any prospectus supplement or incorporated herein or therein is accurate only as of the date on the cover of such document, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

We urge you to carefully read this prospectus and any prospectus supplement, together with the information incorporated herein or therein by reference as described under the heading “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed or are incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in this prospectus include “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Section 27A of the Securities Act of 1933, as amended, or the Securities Act. For these purposes, any statements contained or incorporated by reference herein regarding our strategy, future operations, financial position, product candidates, future revenues, projected costs, prospects, plans and objectives of management, other than statements of historical facts, are forward-looking statements. In some cases, you can identify forward-looking statements by the words “may,” “might,” “can,” “will,” “to be,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “likely,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future, although not all forward-looking statements contain these words. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed or implied in our forward-looking statements. There are a number of important factors that could cause actual results, levels of activity, performance or events to differ materially from those expressed or implied in the forward-looking statements we make.

Examples of risks and uncertainties that could cause actual results to differ materially from historical performance and any forward-looking statements include, but are not limited to, the risks described under the heading “Risk Factors” on page 8 of this prospectus, in our most recent Annual Report on Form 10-K, and subsequent reports filed with the SEC. Given these risks, uncertainties and other factors, many of which are beyond our control, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate, and you should not place undue reliance on these forward-looking statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all.

Any forward-looking statement speaks only as of the date on which it is made. Although we may elect to update forward-looking statements in the future, we specifically disclaim any obligation to do so, except as may be required by law, even if our estimates change, and readers should not rely on our forward-looking statements as representing our views as of any date subsequent to the date the statements were made.

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus and does not contain all of the information that you need to consider in making your investment decision. You should carefully read this entire prospectus and any prospectus supplement, including the risks of investing in our securities discussed under the heading “Risk Factors” contained in this prospectus and any prospectus supplement, and under similar headings in the other documents that are incorporated by reference into this prospectus or any prospectus supplement. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part. Unless the context indicates otherwise, references in this prospectus to “Avalo,” “Company,” “we,” “us” and “our” refer to Avalo Therapeutics, Inc. and its subsidiaries unless the context indicates otherwise.

Company Overview

Avalo Therapeutics, Inc. is a clinical stage biotechnology company focused on the treatment of immune dysregulation. Avalo’s lead asset is AVTX-009, an anti-IL-1β monoclonal antibody (“mAb”), targeting inflammatory diseases. Avalo’s pipeline also includes quisovalimab (anti-LIGHT mAb) and AVTX-008 (BTLA agonist fusion protein).

Recent Events

On March 27, 2024, the Company acquired AVTX-009, through a merger of AlmataBio Inc. (“AlmataBio”) with and into the Company’s wholly owned subsidiary (the “AlmataBio Transaction”). Avalo’s acquisition of AlmataBio was structured as a stock-for-stock transaction whereby all outstanding equity interests in AlmataBio were exchanged in a merger for a combination of Avalo common stock and shares of Avalo Series C non-voting convertible preferred stock, resulting in the issuance of 171,605 shares of Avalo common stock and 2,412 shares of Series C non-voting convertible preferred stock. The Company also made a cash payment of $7.5 million in April 2024 to the former AlmataBio stockholders, which was due upon the initial closing of the private placement investment (described below) on March 28, 2024. A portion of the consideration for the AlmataBio Transaction includes development milestones to the former AlmataBio stockholders, including $5.0 million due upon the first patient dosed in a Phase 2 trial in patients with hidradenitis suppurativa (“HS”) for AVTX-009 and $15.0 million due upon the first patient dosed in a Phase 3 trial for AVTX-009, both of which are payable in cash or common stock of Avalo (or a combination thereof) at the election of the former AlmataBio stockholders. In the absence of timely notice of such election, Avalo may elect to pay the second and third milestones in cash or common stock of Avalo or a combination thereof.

Additionally, on March 28, 2024, the Company closed a private placement investment for up to $185 million in gross proceeds, including an initial upfront gross investment of $115.6 million, whereby Avalo issued (i) 19,945.897 shares of Series C non-voting convertible preferred stock and (ii) warrants to purchase up to an aggregate of 11,967,526 shares of Avalo’s common stock (or up to an aggregate of 11,967.526 shares of Series C non-voting convertible preferred stock), at a per share exercise price of $5.796933 per share of common stock, for an aggregate exercise price of $69.4 million. Net proceeds were approximately $108.1 million after deducting transaction costs.

See the audited financial statements of AlmataBio for the period from April 28, 2023 (date of inception) to December 31, 2023, and the unaudited pro forma financial information of AlmataBio and Avalo for the year ended December 31, 2023, and for the three months ended March 31, 2024, contained in our Current Report on Form 8-K/A, as filed with SEC on June 3, 2024, which are incorporated in this prospectus by reference in their entirety.

The Series C non-voting convertible preferred stock is not convertible into shares of common stock unless and until the Company’s stockholders approve the issuance of the shares of common stock of the Company to be issued upon conversion of the shares of Series C non-voting convertible preferred stock and upon the exercise of the warrants (the “Required Stockholder Approval”). Pursuant to the merger agreement for the AlmataBio Transaction, the Company is obligated to file a proxy statement with the Securities and Exchange Commission (the “SEC”) as soon as practicable after March 27, 2024. Pursuant to the securities purchase agreement for the March 2024 private placement, the Company is obligated to file a proxy statement with SEC for a stockholder meeting to seek the Required Stockholder Approval not later than 75 days after March 28, 2024. If the Required Stockholder Approval is not obtained at that meeting, the Company must hold a stockholder meeting at least once every 90 days until the Required Stockholder Approval is obtained. To that end, the Company plans to file its preliminary proxy materials for the annual meeting prior to or on June 11, 2024 and plans to hold its stockholder meeting promptly thereafter.

Our Strategy

Our strategy for increasing stockholder value includes:

•Advancing our pipeline of compounds through development and to regulatory approval;

•Developing the go-to-market strategy to quickly and effectively market, launch, and distribute each of our compounds that receives regulatory approval;

•Opportunistically out-licensing rights to indications or geographies; and

•Acquiring or licensing rights to targeted, complementary differentiated preclinical and clinical stage compounds.

Pipeline — Overview, Competition, and Intellectual Property

AVTX-009: Anti-IL-1β monoclonal antibody (“mAb”) targeting inflammatory diseases.

Overview: AVTX-009 is a humanized monoclonal antibody (IgG4) that binds to interleukin-1β (“IL-1β”) with high affinity and neutralizes its activity. IL-1β is a central driver in the inflammatory process. Overproduction or dysregulation of IL-1β is implicated in many autoimmune and inflammatory diseases. IL-1β is a major, validated target for therapeutic intervention. There is evidence that inhibition of IL-1β could be effective in HS and a variety of inflammatory diseases in dermatology, gastroenterology, and rheumatology.

Competition: As of the date of this prospectus, and to our knowledge, AVTX-009 is one of three anti-IL-1β antibodies in clinical development worldwide. Currently, worldwide there are two drugs approved for hidradenitis suppurativa (“HS”).

License: AVTX-009 is being developed through a world-wide exclusive license from Eli Lilly and Company (“Lilly”) (the “Lilly License Agreement”). Avalo obtained the rights to AVTX-009, including the world-wide exclusive license from Lilly, pursuant to its acquisition of AlmataBio in the first quarter of 2024. AlmataBio had previously purchased the rights, title and interest in the asset from Leap Therapeutics, Inc. (“Leap”) in 2023.

Avalo is required to pay up to $70 million based on the achievement of specified development and regulatory milestones. Upon commercialization, the Company is required to pay sales-based milestones aggregating up to $720 million. Additionally, Avalo is required to pay royalties during a country-by-country royalty term equal to a mid-single digit-to-low double digit of Avalo or its sublicensees’ annual net sales.

Pursuant to the AlmataBio Transaction, the Company made a cash payment of $7.5 million in April 2024 to the former AlmataBio stockholders which was due upon the initial closing of the private placement investment on March 28, 2024. Further, as noted above, a portion of the consideration for the AlmataBio Transaction includes development milestones to the former AlmataBio stockholders including $5.0 million due upon the first patient dosed in a Phase 2 trial in patients with hidradenitis suppurativa for AVTX-009 and $15.0 million due upon the first patient dosed in a Phase 3 trial for AVTX-009, both of which are payable in cash or stock of Avalo (or a combination thereof) at the election of the former AlmataBio stockholders. In the absence of timely notice of such election, Avalo may elect to pay the second and third milestones in cash or Common Stock of Avalo or a combination thereof.

Avalo is responsible for the development and commercialization of the AVTX-009 program.

Market, Data, and Patent Exclusivity: If we receive marketing approval, we expect to receive biologics data exclusivity in the United States, which would provide twelve years of data exclusivity in the United States from the date of FDA approval.

Quisovalimab (AVTX-002): Anti-LIGHT mAb targeting immune-inflammatory diseases.

Overview: Quisovalimab is a fully human mAb, directed against human LIGHT (Lymphotoxin-like, exhibits Inducible expression, and competes with HSV Glycoprotein D for Herpesvirus Entry Mediator (“HVEM”), a receptor expressed by T lymphocytes; also referred to as TNFSF14). There is increasing evidence that the dysregulation of the LIGHT-signaling network which includes LIGHT, its receptor HVEM and LTβR and the downstream checkpoint BTLA, is a disease-driving mechanism in autoimmune and inflammatory reactions in barrier organs. Therefore, Avalo believes reducing LIGHT levels can moderate immune dysregulation in many acute and chronic inflammatory disorders.

•Quisovalimab has shown a rapid and sustained reduction of LIGHT levels, as well as a favorable safety and tolerability profile, in all indications studied including COVID-19 acute respiratory distress syndrome (“ARDS”), Crohn’s Disease and non-eosinophilic asthma (“NEA”).

•Quisovalimab was statistically significant in reducing respiratory failure and mortality in patients hospitalized with COVID-19 ARDS. Quisovalimab also demonstrated positive trends in an open-label study of Crohn’s Disease.

•A post-hoc analysis of the Company’s Phase 2 randomized, double-blind placebo-controlled trial in patients with poorly controlled NEA showed a sub-population of NEA patients with baseline LIGHT levels of over 125 pg/mL, which represented over 50% of patients, and had an approximate 50% reduction in asthma-related events for patients treated with quisovalimab compared to placebo.

•Avalo is conducting a strategic review of the quisovalimab program.

Competition: As of the date of this prospectus, and to our knowledge, quisovalimab is the only anti-LIGHT mAb in clinical development in the United States.

License: On March 25, 2021, the Company entered into a license agreement with Kyowa Kirin Co., Ltd. (“KKC”) for exclusive worldwide rights to develop, manufacture and commercialize quisovalimab for all indications (the “KKC License Agreement”). The KKC License Agreement replaced the Amended and Restated Clinical Development and Option Agreement between the Company and KKC dated May 28, 2020.

Under the KKC License Agreement, the Company paid KKC an upfront license fee of $10 million. Avalo is also required to pay KKC up to an aggregate of $112.5 million based on the achievement of specified development and regulatory milestones. Upon commercialization, the Company is required to make milestone payments to KKC aggregating up to $75 million tied to the achievement of annual net sales targets.

Additionally, the Company is required to pay KKC royalties during a country-by-country royalty term equal to a mid-teen percentage of annual net sales. The Company is required to pay KKC a double-digit percentage (less than 30%) of the payments that the Company receives from sublicensing its rights under the KKC License Agreement, subject to certain exclusions. Avalo is responsible for the development and commercialization of quisovalimab in all indications worldwide (other than the option in the KKC License Agreement that, upon exercise by KKC, allows KKC to develop, manufacture and commercialize quisovalimab in Japan). In addition to the KKC License Agreement, Avalo is responsible for making additional royalty payments upon commercialization of up to an amount of less than 10% of net sales.

Market, Data, and Patent Exclusivity: If we receive marketing approval, we expect to receive biologics data exclusivity in the United States, which would provide twelve years of data exclusivity in the United States from the date of FDA approval. Additionally, patents exclusively licensed from KKC may provide exclusivity in the United States through 2028 absent any extension, and additional patent applications filed by us covering certain methods of using quisovalimab, if issued and properly maintained, should provide additional exclusivity in certain indications through 2043, absent any extension.

AVTX-008: Fully human B and T Lymphocyte Attenuator agonist fusion protein targeting immune dysregulation disorders.

Overview: AVTX-008 is a fully human B and T Lymphocyte Attenuator (“BTLA”) agonist fusion protein.

•AVTX-008 is uniquely positioned as a fusion protein with high-binding affinity and serum stability. AVTX-008 is differentiated by having specific binding to BTLA, with no binding to LIGHT or CD160.

•Avalo is conducting a strategic review of the AVTX-008 program.

Competition: As of the date of this prospectus, and to our knowledge, worldwide there are a total of five BTLA agonist antibodies in clinical development for the treatment of autoimmune diseases.

License: On June 21, 2021, the Company entered into an Exclusive Patent License Agreement with Sanford Burnham Prebys Medical Discovery Institute (the “Sanford Burnham Prebys License Agreement”) under which Avalo obtained an exclusive license to a portfolio of issued patents and patent applications covering AVTX-008.

Under the Sanford Burnham Prebys License Agreement, Avalo paid a mid-six digit upfront license fee and pays mid-five digit annual maintenance fees. Avalo is also required to pay Sanford Burnham Prebys up to approximately $24 million based on the achievement of specified development and regulatory milestones. Upon commercialization, the Company is required to pay Sanford Burnham Prebys sales-based milestones aggregating up to $50 million tied to the achievement of annual net sales targets. Additionally, the Company is required to pay Sanford Burnham Prebys royalties during a country-by-country royalty term equal to a low-to-mid single digit percentage of annual net sales. Avalo is also required to pay Sanford Burnham Prebys a tiered low-double digit percentage of payments that Avalo receives from sublicensing of its rights under the Sanford Burnham Prebys License Agreement, subject to certain exclusions. Avalo is responsible for the development and commercialization of the program.

Market, Data, and Patent Exclusivity: If we receive marketing approval, we expect to receive biologics data exclusivity in the United States, which would provide twelve years of data exclusivity in the United States from the date of FDA approval. Additionally, patents exclusively licensed from Sanford Burnham Prebys may provide exclusivity in the United States through 2036 absent any extension.

Corporate Information

We were incorporated in Delaware in 2011 and commenced operations in the second quarter of 2011. Our principal executive offices are located at 540 Gaither Road, Suite 400, Rockville, Maryland 20850 and our telephone number is (410) 522‑8707. Our website address is www.avalotx.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

“Avalo”, the Avalo logo and other trademarks or service marks of Avalo Therapeutics, Inc. appearing in this prospectus are the property of Avalo Therapeutics, Inc. Our company is a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act, and we have elected to take advantage of certain of the scaled disclosure available to smaller reporting companies under the Exchange Act.

THE OFFERING

Up to 22,357,897 Shares of Common Stock Issuable Upon Conversion of Shares of Series C Non-Voting Convertible Preferred Stock

22,357.897 Shares of Series C Non-Voting Convertible Preferred Stock

Up to 11,967,526 Shares of Common Stock Issuable Upon the Exercise of Warrants Offered by Selling Stockholders

Warrants to Purchase up to 11,967,526 Shares of Common Stock (or 11,967.526 Shares of Series C Non-Voting Convertible Preferred Stock)

This prospectus relates to the resale or other disposition from time to time of (i) up to 22,357,897 shares of our common stock issuable upon the conversion of shares of our Series C non-voting convertible preferred stock, (ii) 22,357.897 shares of our Series C non-voting convertible preferred stock, (iii) up to 11,967,526 shares of our common stock issuable upon the exercise of warrants, and (iv) warrants to purchase up to 11,967,526 shares of our common stock (or 11,967.526 shares of Series C non-voting convertible preferred stock), all held by the selling stockholders named in this prospectus, including their transferees, pledgees, donees or successors. All of the securities being offered were issued between March 27 and March 28, 2024, (i) to former stockholders of AlmataBio and (ii) to certain investors in our private placement, all of whom are identified as selling stockholders hereunder.

| | | | | | | | |

Common stock offered by the selling stockholders (1) | | 34,325,423 |

Common stock outstanding before the offering (2) | | 1,034,130 |

| Common stock to be outstanding after the offering | | 35,359,553 |

| Common stock Nasdaq Capital Market Symbol | | AVTX |

(1) Consists of shares of common stock issuable upon (i) the conversion of Series C non-voting convertible preferred stock and (ii) the exercise of warrants to purchase shares of our common stock held by the selling stockholders.

(2) Based on the number of shares outstanding as of May 15, 2024.

Use of Proceeds

The (i) up to 22,357,897 shares of our common stock issuable upon the conversion of shares of our Series C non-voting convertible preferred stock, (ii) 22,357.897 shares of our Series C non-voting convertible preferred stock, (iii) up to 11,967,526 shares of our common stock issuable upon the exercise of warrants, and (iv) warrants to purchase up to 11,967,526 shares of our common stock (or 11,967.526 shares of Series C non-voting convertible preferred stock)that are being offered for resale by the selling stockholders will be sold for the accounts of the selling stockholders named in this prospectus. As a result, all proceeds from the sales of such securities offered for resale hereby will go to the selling stockholders and we will not receive any proceeds from the resale of those securities by the selling stockholders.

We may receive up to a total of $69,374,946 in gross proceeds if all of the warrants to purchase up to 11,967,526 shares of our common stock are exercised for cash for shares of common stock. Of the gross proceeds we may receive, we will owe a commission fee of 2.5% of such proceeds to our placement agent. However, as we are unable to predict the timing or amount of potential exercises of the warrants, we have not allocated any proceeds of such exercises to any particular purpose. Accordingly, all such proceeds are allocated to working capital.

We will incur all costs associated with this registration statement and prospectus.

Dividend Policy

We have never paid dividends on our capital stock and do not anticipate paying any dividends for the foreseeable future.

Risk Factors

Investing in our securities involves a high degree of risk. Please read the information contained under the heading “Risk Factors” on page 8 of this prospectus and in any report incorporated by reference herein.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before purchasing any securities, you should consider carefully the risks and uncertainties described in the section entitled “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with SEC on March 29, 2024, which are incorporated in this prospectus by reference in their entirety, as well as in subsequently filed SEC reports and any prospectus supplement. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our common stock and the value of our Series C non-voting convertible preferred stock and the warrants to purchase shares of our common stock could decline and you might lose all or part of your investment. Please also refer to the section entitled “Special Note Regarding Forward-Looking Statements.”

Risks Related to this Offering

Pursuant to the terms of the securities purchase agreement for the March 2024 private placement, we are required to recommend that our stockholders approve the conversion of all outstanding shares of our Series C non-voting convertible preferred stock into shares of our common stock and the ability to issue shares of common stock upon the exercise of the warrants. We cannot guarantee that our stockholders will approve this matter, and if they fail to do so, it might have an adverse impact on our operations and the value and liquidity of your investment might be impaired.

Under the terms of the securities purchase agreement for the March 2024 private placement, we agreed to use our best efforts to obtain the Required Stockholder Approval to allow (i) the conversion of all outstanding shares of Series C non-voting convertible preferred stock issued in the AlmataBio Transaction and the March 2024 private placement and (ii) the ability of all warrants issued in the March 2024 private placement to be exercised for shares of common stock, as required by the Nasdaq listing rules, at a meeting of our stockholders and, if such approval is not obtained at that meeting, to seek to obtain such approval at a stockholders meeting to be held at least every 90 days thereafter until such approval is obtained. If the Required Stockholder Approval is not obtained at a meeting, the need to hold one or more additional meetings would be time consuming and costly. In addition, the failure to receive the Required Stockholder Approval could impair the public perception of our Company and our securities and could have an adverse impact on the liquidity and value of the Series C non-voting convertible preferred stock and the warrants, as well as on the value of our common stock.

We do not intend to apply for any listing of the Series C non-voting convertible preferred stock or the warrants on any exchange or nationally recognized trading system, and we do not expect a robust trading market to develop for the Series C non-voting convertible preferred stock or the warrants.

We do not intend to apply for any listing of the Series C non-voting convertible preferred stock or the warrants on the Nasdaq Capital Market or any other securities exchange or nationally recognized trading system, and we do not expect a robust trading market to develop for the Series C non-voting convertible preferred stock or the warrants. Without an active market, the liquidity of the Series C non-voting convertible preferred stock and the warrants will be limited. Further, the existence of the Series C non-voting convertible preferred stock and the warrants may act to reduce both the trading volume and the trading price of our common stock.

The Series C non-voting convertible preferred stock and the warrants are not convertible or exercisable for shares of our common stock without the approval of our stockholders and therefore may not have any value.

The Series C non-voting convertible preferred stock is convertible into shares of our common stock and the warrants are exercisable for shares of our common stock only upon the approval of the Stock Issuance Proposal. If we do not obtain approval of the Stock Issuance Proposal, then the Series C Preferred Stock will remain outstanding in accordance with its terms, the Warrants will remain outstanding and exercisable for shares of Series C Preferred Stock, and the Milestone payments would only be payable in cash. If the Series C Preferred Stock cannot convert to shares of Common Stock, there may be less reason for the holders of the Warrants to exercise them as to our knowledge there currently is no market for the Series C Preferred Stock nor do we expect a robust market to develop. This would reduce the ability of the Company to benefit from the receipt of cash proceeds from the exercise of the Warrants.

The warrants are speculative in nature and may not have any value.

The warrants will expire in accordance with their terms (see “Description of Securities to be Registered – Warrants – March 2024 Warrants”), and during that time the holders of the warrants may exercise their right to acquire our common stock and

pay an exercise price of $5.796933 per share. There can be no assurance that the market price of our common stock will exceed the exercise price of the warrants, and consequently, whether it will be profitable for holders of the warrants to exercise the warrants.

Except as provided in the terms of the Series C non-voting convertible preferred stock and the warrants, holders of Series C non-voting convertible preferred stock and warrants purchased in this offering will have no rights as stockholders of common stock until such holders convert their shares of Series C non-voting convertible preferred stock or exercise their warrants and acquire our common stock.

Except as provided therein, the Series C non-voting convertible preferred stock and the warrants offered in this offering do not confer voting rights, but rather represent (i) the right to acquire shares of our common stock at a conversion ratio or exercise price following the Required Stockholder Approval and (ii) the right to receive dividends equal to and in the same form, and in the same manner, based on the then-current conversion ratio as dividends actually paid on shares of Common Stock. Only upon any conversion of the Series C non-voting convertible preferred stock or any exercise of the warrants would the holders thereof be entitled to exercise the voting rights of a holder of common stock and then only as to matters for which the record date occurs after the conversion or exercise date.

A substantial number of shares of our common stock may be sold in this offering, which could cause the price of our common stock to decline.

In this offering, the 34,325,423 shares of Common Stock issuable upon conversion of the Series C Preferred Stock and upon the exercise of the Warrants will represent approximately 97% of the shares of Common Stock outstanding on May 15, 2024 on an as converted-basis. The sale of a substantial number of shares of our securities in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock on the Nasdaq Capital Market. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares of common stock for sale will have on the market price of our common stock.

In addition, in the future, we may also issue shares of our common stock in connection with investments or acquisitions. The amount of shares of our common stock issued in connection with an investment or acquisition could substantially increase our shares of common stock outstanding, which could adversely affect the price of our common stock on the Nasdaq Capital Market.

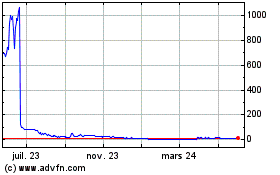

The price of our common stock could be subject to rapid and substantial volatility. Such volatility, including any stock run-ups, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our common stock. Volatility in our common stock price may subject us to securities litigation.

The market for our common stock may have, when compared to seasoned issuers, significant price volatility and we expect that the price of our shares of common stock may continue to be more volatile than that of a seasoned issuer for the indefinite future. As a relatively small-capitalization company with a relatively small public float, we may experience greater share price volatility, extreme price run-ups, lower trading volume, and less liquidity than large-capitalization companies. In particular, our common stock may be subject to rapid and substantial price volatility, low volumes of trades, and large spreads in bid and ask prices. Such volatility, including any stock run-ups, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our common stock.

In addition, if the trading volumes of our common stock are low, persons buying or selling in relatively small quantities may easily influence the price of our common stock. This low volume of trades could also cause the price of our common stock to fluctuate greatly, with large percentage changes in price occurring in any trading day session. Holders of our common stock may also not be able to readily liquidate their investment or may be forced to sell at depressed prices due to low volume trading. Broad market fluctuations and general economic and political conditions may also adversely affect the market price of our common stock. As a result of this volatility, investors may experience losses on their investment in our common stock. A decline in the market price of our common stock also could adversely affect our ability to issue additional common stock or other securities and our ability to obtain additional financing in the future.

To the extent that a secondary market for the Series C non-voting convertible preferred stock or the warrants develops, we believe that the market price of the Series C non-voting convertible preferred stock and the warrants would be significantly affected by the market price of our common stock. No assurance can be given that an active market in our Series C non-voting convertible preferred stock or the warrants will develop or be sustained. If an active market does not develop, holders of our Series C non-voting convertible preferred stock or the warrants may be unable to readily sell the securities they hold or may not be able to sell their securities at all.

In addition, in the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities to the Company and could divert our management’s attention and resources.

Because we do not intend to declare cash dividends on our shares of common stock in the foreseeable future, stockholders must rely on appreciation of the value of our common stock for any return on their investment.

We have never declared or paid cash dividends on our common stock. The continued operation and expansion of our business will require substantial funding. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. Accordingly, we do not anticipate that we will pay any cash dividends on shares of our common stock for the foreseeable future. Consequently, stockholders must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any gains on their investment. Any determination to pay dividends in the future will be at the discretion of our board of directors and will depend upon results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant. Further, the expected lack of a liquid market for the Series C non-voting convertible preferred stock and the warrants might impair their value and their ability to appreciate in value.

If we are not able to comply with the applicable continued listing requirements or standards of The Nasdaq Stock Market, Nasdaq could delist our common stock.

Our common stock is currently listed on The Nasdaq Stock Market. In order to maintain that listing, we must satisfy minimum financial and other continued listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders’ equity, a minimum closing bid price of $1.00 per share, and certain corporate governance requirements. There can be no assurances that we will be able to comply with the applicable listing standards. For example, on August 8, 2023, Nasdaq notified us that we failed the $1.00 minimum bid price requirement and the $35 million minimum Market Value of Listed Securities (“MVLS”) requirement. The Company affected a 1-for-240 reverse stock split on December 28, 2023, which has allowed its common stock to trade above $1.00 since December 29, 2023. On January 30, 2024, the Company received written notification from Nasdaq confirming that the Company had regained compliance with the Bid Price Rule. Nasdaq also notified the Company that it is subject to a mandatory panel monitor for a period of one year from January 30, 2024. If, within the one-year monitoring period, Nasdaq finds the Company again out of compliance with the Bid Price Rule, then notwithstanding Nasdaq Rule 5810(c)(2), the Company will not be permitted to provide Nasdaq with a plan of compliance with respect to that deficiency and Nasdaq will not be permitted to grant additional time for the Company to regain compliance with respect to that deficiency, nor will the Company be afforded an applicable cure or compliance period pursuant to Nasdaq Rule 5810(c)(3). Instead, Nasdaq will issue a Delist Determination Letter and the Company will have an opportunity to request a new hearing with the initial Nasdaq panel assigned to the Company for its recent noncompliance or newly convened hearings panel if the initial panel is unavailable. The Company will have the opportunity to respond to the hearings panel as provided by Nasdaq Rule 5815(d)(4)(C). If the Company fails to satisfy the Nasdaq panel, its securities would be delisted from Nasdaq. There can be no assurance that we will continue to maintain such requirement or remain in compliance with any other Nasdaq listing requirements.

Further, on May 20, 2024, we received a written notice from Nasdaq indicating that the Company no longer complies with the requirement under Nasdaq Listing Rule 5550(b)(1) to maintain a minimum of $2,500,000 in stockholders equity for continued listing on the Nasdaq Capital Market (the “Stockholders’ Equity Requirement) because the Company reported stockholders’ equity of negative $112.6 million in its Form 10-Q for the period ended March 31, 2024, and, as of the date of the written notice, the Company did not meet the alternatives of market value of listed securities or net income from continuing operations (together with the Stockholders’ Equity Requirement, the “Listing Rule”). In accordance with the Nasdaq Listing Rules, the Company has 45 calendar days, until July 5, 2024, to submit a plan to regain compliance, which the Company plans to timely submit for consideration by the Nasdaq Listing Qualification staff (“Staff”). If the plan is accepted, the Staff may grant the Company an extension period of up to 180 calendar days from the date of the notice to evidence compliance. Although this notice from Nasdaq has no immediate effect on the listing of the Company’s common stock, if the Staff does not accept the Company’s plan or if the Company is unable to regain compliance within any extension period granted by the Staff, the Staff would be required to issue a delisting determination.

There can be no assurance that Nasdaq will accept the Company’s plan to regain compliance with the Listing Rule or, if accepted, that the Company will evidence compliance with the Listing Rule during any extension period that Nasdaq may grant.

In the event that our common stock is delisted from The Nasdaq Stock Market and is not eligible for quotation or listing on another market or exchange, trading of our common stock could be conducted only in the over‑the‑counter market or on an

electronic bulletin board established for unlisted securities such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of, or obtain accurate price quotations for, our common stock, and there would likely also be a reduction in our coverage by securities analysts and the news media, which could cause the price of our common stock to decline further. Also, it may be difficult for us to raise additional capital if we are not listed on an exchange.

A delisting would also likely have a negative effect on the price of our common stock and would impair your ability to sell or purchase our common stock when you wish to do so. In the event of a delisting, we may take actions to restore our compliance with The Nasdaq Stock Market’s listing requirements, but we can provide no assurance that any such action taken by us would allow our common stock to become listed again, stabilize the market price or improve the liquidity of our common stock, prevent our common stock from dropping below The Nasdaq Stock Market minimum bid price requirement or prevent non‑compliance with The Nasdaq Stock Market’s listing requirements.

USE OF PROCEEDS

The (i) up to 22,357,897 shares of our common stock issuable upon the conversion of shares of our Series C non-voting convertible preferred stock, (ii) 22,357.897 shares of our Series C non-voting convertible preferred stock, (iii) up to 11,967,526 shares of our common stock issuable upon the exercise of warrants, and (iv) warrants to purchase up to 11,967,526 shares of our common stock (or 11,967.526 shares of Series C non-voting convertible preferred stock) are being offered for resale by the selling stockholders and will be sold for the accounts of the selling stockholders named in this prospectus. As a result, all proceeds from the sales of such securities offered for resale hereby will go to the selling stockholders and we will not receive any proceeds from the resale of those securities by the selling stockholders.

We may receive up to a total of $69,374,946 in gross proceeds if all of the warrants to purchase up to 11,967,526 shares of our common stock are exercised for cash for shares of common stock. Of the gross proceeds we may receive, we will owe a commission fee of 2.5% of such proceeds to our placement agent. However, as we are unable to predict the timing or amount of potential exercises of the warrants, we have not allocated any proceeds of such exercises to any particular purpose. Accordingly, all such proceeds are allocated to working capital.

We will incur all costs associated with this registration statement and prospectus.

SELLING STOCKHOLDERS

The following table sets forth certain information regarding the selling stockholders and the shares of common stock beneficially owned by them, which information is available to us as of May 15, 2024. The selling stockholders may offer the shares of common stock, the shares of Series C non-voting convertible preferred stock and the warrants under this prospectus from time to time and may elect to sell under this prospectus some, all or none of the shares and warrants offered for resale by this prospectus. However, for the purposes of the table below, we have assumed that, after completion of the offering, none of the securities covered by this prospectus will be held by the selling stockholders. In addition, a selling stockholder may have sold, transferred or otherwise disposed of all or a portion of that holder’s shares of common stock, Series C non-voting convertible preferred stock or warrants since the date on which the selling stockholder provided information for this table. We have not made independent inquiries about such transfers or dispositions. See the section entitled “Plan of Distribution” beginning on page 19.

Beneficial ownership is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act. The percentage of shares beneficially owned prior to the offering is based on 1,034,130 shares of our common stock outstanding as of May 15, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Warrants | | Shares of Series C Non-Voting Convertible Preferred Stock | | Shares of Common Stock |

| Name | | Warrants with the following number of underlying shares beneficially owned prior to offering | Warrants with the following number of underlying shares registered for sale hereby | Warrants with the following number of underlying shares owned after this offering | | Number of shares of preferred stock beneficially owned prior to offering | Maximum number of shares of preferred stock registered for sale hereby | Number of shares of preferred stock owned after this offering | Percentage of preferred stock beneficially owned after offering(1) | | Number of shares of common stock beneficially owned prior to offering | Maximum Number of shares of common stock registered for sale hereby | Number of shares of common stock beneficially owned after offering | Percentage of common stock beneficially owned after offering(1) |

Justin DiMartino (2) | | — | — | — | | 292 | 292 | — | * | | 312,779 | 292,000 | 20,779 | * |

Patrick J. Crutcher (2) | | — | — | — | | 513 | 513 | — | * | | 549,467 | 513,000 | 36,467 | * |

Mellisa Huhn (2) | | — | — | — | | 9 | 9 | — | * | | 9,641 | 9,000 | 641 | * |

Naveen Daryani (2) | | — | — | — | | 7 | 7 | — | * | | 7,504 | 7,000 | 504 | * |

Navneet Kumar (2) | | — | — | — | | 8 | 8 | — | * | | 8,605 | 8,000 | 605 | * |

Tatyana Touzova (2) | | — | — | — | | 101 | 101 | — | * | | 108,213 | 101,000 | 7,213 | * |

Emily Nixon(2) | | — | — | — | | 5 | 5 | — | * | | 5,403 | 5,000 | 403 | * |

Emerald Bioventures, LLC (2) | | — | — | — | | 821 | 821 | — | * | | 879,345 | 821,000 | 58,345 | * |

Boothbay Absolute Return Strategies, LP (3) | | 138,797 | 138,797 | — | | 313.330 | 313.330 | — | * | | 459,430 | 452,127 | 7,303 | * |

Boothbay Diversified Alpha Master Fund, LP (4) | | 67,613 | 67,613 | — | | 155.689 | 155.689 | — | * | | 227,085 | 223,302 | 3,783 | * |

Ikarian Healthcare Master Fund, LP (5) | | 569,861 | 569,861 | — | | 1,480.770 | 1,480.770 | — | * | | 2,094,274 | 2,050,631 | 43,643 | * |

Commodore Capital Master LP (6) | | 2,264,128 | 2,264,128 | — | | 3,773.547 | 3,773.547 | — | * | | 6,077,675 | 6,037,675 | 40,000 | * |

TCG Crossover Fund II, L.P. (7) | | 2,264,128 | 2,264,128 | — | | 3,773.547 | 3,773.547 | — | * | | 6,037,675 | 6,037,675 | — | * |

Biotechnology Value Fund, L.P. (8) | | 1,027,637 | 1,027,637 | — | | 1,712.730 | 1,712.730 | — | * | | 2,740,367 | 2,740,367 | — | * |

Biotechnology Value Fund II, L.P. (9) | | 809,027 | 809,027 | — | | 1,348.379 | 1,348.379 | — | * | | 2,157,406 | 2,157,406 | — | * |

Biotechnology Value Trading Fund OS LP (10) | | 75,842 | 75,842 | — | | 126.405 | 126.405 | — | * | | 202,247 | 202,247 | — | * |

MSI BVF SPV, LLC (11) | | 28,173 | 28,173 | — | | 46.956 | 46.956 | — | * | | 75,129 | 75,129 | — | * |

OrbiMed Private Investments IX, LP (12) | | 1,035,030 | 1,035,030 | — | | 1,725.050 | 1,725.050 | — | * | | 2,760,080 | 2,760,080 | — | * |

OrbiMed Genesis Master Fund, L.P. (13) | | 517,515 | 517,515 | — | | 862.525 | 862.525 | — | * | | 1,380,040 | 1,380,040 | — | * |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RA Capital Healthcare Fund, L.P. (14) | | 1,293,787 | 1,293,787 | — | | 2,156.313 | 2,156.313 | — | * | | 3,450,100 | 3,450,100 | — | * |

Deep Track Biotechnology Master Fund, Ltd. (15) | | 1,164,408 | 1,164,408 | — | | 1,940.682 | 1,940.682 | — | * | | 3,105,090 | 3,105,090 | — | * |

Petrichor Opportunities Fund I LP (16) | | 224,827 | 224,827 | — | | 374.714 | 374.714 | — | * | | 599,541 | 599,541 | — | * |

Petrichor Opportunities Fund I Intermediate LP (17) | | 98,618 | 98,618 | — | | 164.365 | 164.365 | — | * | | 262,983 | 262,983 | — | * |

Logos Opportunities Fund IV LP (18) | | 323,446 | 323,446 | — | | 539.079 | 539.079 | — | * | | 862,525 | 862,525 | — | * |

Dellora Investments Master Fund LP (19) | | 64,689 | 64,689 | — | | 107.816 | 107.816 | — | * | | 172,505 | 172,505 | — | * |

| | | | | | | | | | | | | | | | | | | | |

| * | | Represents beneficial ownership of less than one percent of the outstanding shares of our common stock. |

| | | | | | |

| (1) | | | The Series C non-voting convertible preferred stock and the warrants held by the certain of the selling stockholder are subject to a beneficial ownership limitation of 4.99% or 9.99% as may be designated in the selling stockholder’s related footnote, which does not permit that portion of the Series C non-voting convertible preferred stock or the warrants that would result in the selling stockholder and its affiliates owning, after conversion or exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The amount of shares beneficially owned by the selling stockholder before the offering does not give effect to the beneficial ownership limitation. |

| | | | | | |

| (2) | | | Consists of shares of (i) shares of common stock issued pursuant to the Almata Merger and (ii) common stock issuable upon the conversion of Series C non-voting convertible preferred stock issued to the selling stockholder on March 27, 2024, which the holder cannot dispose of until September 27, 2024. |

| | | | | | |

| (3) | | | Consists of (i) 82 shares of Series C non-voting convertible preferred stock, which are convertible into 82,000 shares of common stock, issued to the selling stockholder on March 27, 2024, which the holder cannot dispose of until September 27, 2024, (ii) 231.330 shares of Series C non-voting convertible preferred stock, which are convertible into 231,330 shares of common stock, and warrants to purchase 138,797 shares of common stock purchased by the selling stockholder on March 28, 2024, (iii) 5,859 shares of common stock issued pursuant to the Almata Merger, and (iv) 1,445 shares of common stock purchased on the open market. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Boothbay Diversified Alpha Master Fund, LP, and Ikarian Healthcare Master Fund, LP, which are related entities. |

| | | | | | |

| (4) | | | Consists of (i) 43 shares of Series C non-voting convertible preferred stock, which are convertible into 43,000 shares of common stock, issued to the selling stockholder on March 27, 2024, which the holder cannot dispose of until September 27, 2024, (ii) 112.689 shares of Series C non-voting convertible preferred stock, which are convertible into 112,689 shares of common stock, and warrants to purchase 67,613 shares of common stock purchased by the selling stockholder on March 28, 2024, (iii) 3,079 shares of common stock issued pursuant to the Almata Merger, and (iv) 704 shares of common stock purchased on the open market. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Boothbay Absolute Return Strategies, LP and Ikarian Healthcare Master Fund, LP , which are related entities. |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (5) | | | Consists of (i) 531 shares of Series C non-voting convertible preferred stock, which are convertible into 531,000 shares of common stock, issued to the selling stockholder on March 27, 2024, which the holder cannot dispose of until September 27, 2024, (ii) 949.770 shares of Series C non-voting convertible preferred stock, which are convertible into 949,770 shares of common stock, and warrants to purchase 569,861 shares of common stock purchased by the selling stockholder on March 28, 2024, (iii) 37,710 shares of common stock issued pursuant to the Almata Merger, and (iv) 5,933 shares of common stock purchased on the open market. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Boothbay Diversified Alpha Master Fund, LP, and Boothbay Absolute Return Strategies, LP, which are related entities. |

| | | | | | |

| (6) | | | Consists of 3,773.547 shares of Series C non-voting convertible preferred stock, which are convertible into 3,773,547 shares of common stock, warrants to purchase 2,264,128 shares of common stock purchased by the selling stockholder on March 28, 2024, and 40,000 shares of common stock purchased on the open market. Subject to a beneficial ownership limitation of 4.99%. |

| | | | | | |

| (7) | | | Consists of 3,773.547 shares of Series C non-voting convertible preferred stock, which are convertible into 3,773,547 shares of common stock, and warrants to purchase 2,264,128 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 4.99%. |

| | | | | | |

| (8) | | | Consists of 1,712.730 shares of Series C non-voting convertible preferred stock, which are convertible into 1,712,730 shares of common stock, and warrants to purchase 1,027,637 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Biotechnology Value Fund II, L.P., Biotechnology Value Trading Fund OS LP, and MSI BVF SPV, LLC, which are related entities. |

| | | | | | |

| (9) | | | Consists of 1,348.379 shares of Series C non-voting convertible preferred stock, which are convertible into 1,348,379 shares of common stock, and warrants to purchase 809,027 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Biotechnology Value Fund, L.P., Biotechnology Value Trading Fund OS LP, and MSI BVF SPV, LLC, which are related entities. |

| | | | | | |

| (10) | | | Consists of 126.405 shares of Series C non-voting convertible preferred stock, which are convertible into 126,405 shares of common stock, and warrants to purchase 75,842 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Biotechnology Value Fund, L.P., Biotechnology Value Trading Fund II, L.P., and MSI BVF SPV, LLC, which are related entities. |

| | | | | | |

| (11) | | | Consists of 46.956 shares of Series C non-voting convertible preferred stock, which are convertible into 46,956 shares of common stock, and warrants to purchase 28,173 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Biotechnology Value Fund, L.P., Biotechnology Value Fund II, L.P., and Biotechnology Value Trading Fund OS LP, which are related entities. |

| | | | | | |

| (12) | | | Consists of 1,725.050 shares of Series C non-voting convertible preferred stock, which are convertible into 1,725,050 shares of common stock, and warrants to purchase 1,035,030 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with OrbiMed Genesis Master Fund, L.P., which is a related entity. OrbiMed Capital GP IX LLC (“OrbiMed GP”) is the general partner of OrbiMed Private Investments IX, LP (“OPI IX”). OrbiMed Advisors LLC (“OrbiMed Advisors”) is the managing member of OrbiMed GP. By virtue of such relationships, OrbiMed GP and OrbiMed Advisors may be deemed to have voting and investment power with respect to the securities held by OPI IX and as a result, may be deemed to have beneficial ownership over such securities. OrbiMed Advisors exercises voting and investment power through a management committee comprised of Carl L. Gordon, Sven H. Borho, and W. Carter Neild, each of whom disclaims beneficial ownership over the shares held by OPI IX. |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (13) | | | Consists of 862.525 shares of Series C non-voting convertible preferred stock, which are convertible into 862,525 shares of common stock, and warrants to purchase 517,515 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with OrbiMed Private Investments IX, LP, which is a related entity. OrbiMed Genesis GP LLC (“Genesis GP”) is the general partner of OrbiMed Genesis Master Fund, L.P. (“Genesis Master Fund”). OrbiMed Advisors is the managing member of Genesis GP. By virtue of such relationships, Genesis GP and OrbiMed Advisors may be deemed to have voting and investment power with respect to the securities held by Genesis Master Fund and as a result, may be deemed to have beneficial ownership over such securities. OrbiMed Advisors exercises voting and investment power through a management committee comprised of Carl L. Gordon, Sven H. Borho, and W. Carter Neild, each of whom disclaims beneficial ownership over the shares held by Genesis Master Fund. |

| | | | | | |

| (14) | | | Consists of 2,156.313 shares of Series C non-voting convertible preferred stock, which are convertible into 2,156,313 shares of common stock, and warrants to purchase 1,293,787 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99%. RA Capital Management, L.P. is the investment manager for RA Capital Healthcare Fund, L.P. The general partner of RA Capital Management, L.P. is RA Capital Management GP, LLC, of which Peter Kolchinsky and Rajeev Shah are the managing members. Each of Dr. Kolchinsky and Mr. Shah may be deemed to have voting or investment control over the shares. Dr. Kolchinsky and Mr. Shah disclaim beneficial ownership of such shares, except to the extent of any pecuniary interest therein. The principal business address of the selling stockholder is c/o RA Capital Management, L.P., 200 Berkeley Street, 18th Floor, Boston, MA 02116. |

| | | | | | |

| (15) | | | Consists of 1,940.682 shares of Series C non-voting convertible preferred stock, which are convertible into 1,940,682 shares of common stock, and warrants to purchase 1,164,408 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99%. |

| | | | | | |

| (16) | | | Consists of 374.714 shares of Series C non-voting convertible preferred stock, which are convertible into 374,714 shares of common stock, and warrants to purchase 224,827 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Petrichor Opportunities Fund I Intermediate LP, which is a related entity. |

| | | | | | |

| (17) | | | Consists of 164.365 shares of Series C non-voting convertible preferred stock, which are convertible into 164,365 shares of common stock, and warrants to purchase 98,618 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99% on an aggregated basis with Petrichor Opportunities Fund I LP, which is a related entity. |

| | | | | | |

| (18) | | | Consists of 539.079 shares of Series C non-voting convertible preferred stock, which are convertible into 539,079 shares of common stock, and warrants to purchase 323,446 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99%. Logos Opportunities IV GP LLC (“GP IV”) is the general partner of Logos Opportunities Fund IV LP and may be deemed to have beneficial ownership of these shares. Arsani William and Graham Walmsley are the members of GP IV. Mr. William and Mr. Walmsley each disclaim beneficial ownership of these shares, except to the extent of each’s pecuniary interest therein. |

| | | | | | |

| (19) | | | Consists of 107.816 shares of Series C non-voting convertible preferred stock, which are convertible into 107,816 shares of common stock, and warrants to purchase 64,689 shares of common stock purchased by the selling stockholder on March 28, 2024. Subject to a beneficial ownership limitation of 9.99%. |

Information about any other selling stockholders will be included in prospectus supplements or post-effective amendments, if required. Information about the selling stockholders may change from time to time. Any changed information with respect to which we are given notice will be included in a prospectus supplement.

Registration Rights Agreement

In connection with the securities purchase agreement for the March 2024 private placement, on March 28, 2024, the Company entered into a registration rights agreement with the March 2024 investors (the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, the Company has agreed to file a registration statement registering for resale (i) the shares of common stock underlying the Series C non-voting convertible preferred stock issued to the former AlmataBio stockholders in the AlmataBio Transaction and the investors in the March 2024 private placement, (ii) the shares of common stock underlying the warrants issued in the March 2024 private placement, (iii) the shares of Series C non-voting convertible preferred stock issued to the former AlmataBio stockholders in the AlmataBio Transaction and the investors in the March 2024 private placement, and (iv) the warrants issued to the investors in the March 2024 private placement (collectively, the “Registrable Securities”). The Company agreed to file such registration statement within 75 days of March 28, 2024, and have such registration statement declared effective with 135 days of March 28, 2024. The Company also agreed to use its best efforts to keep the registration statement effective under the Securities Act until all Registrable Securities have been publicly sold by the holders thereof. The registration statement of which this prospectus is a part is being filed in order to satisfy our obligations under the Registration Rights Agreement.

We have also agreed, among other things, to indemnify the selling stockholders, and each of their respective officers, directors, agents, partners, members, managers, stockholders, affiliates, investment advisers and employee and any person who controls a selling stockholder and the officers, directors, partners, managers, stockholders, agents, investment advisers and employees of each such controlling person from certain liabilities and pay all fees and expenses (including any reasonable legal fees) incident to our obligations under the Registration Rights Agreement.

PLAN OF DISTRIBUTION

We are registering the shares of Series C non-voting convertible preferred stock, warrants, and shares of common stock of Avalo Therapeutics, Inc., par value of $0.001 per share, or the Common Stock, which we refer to herein as “Shares,” issued to the selling stockholders or issuable upon conversion of our Series C non-voting convertible preferred stock and exercise of the warrants to permit the sale, transfer or other disposition of the Shares, shares of Series C non-voting convertible preferred stock and warrants by the selling stockholders or their donees, pledgees, distributees, transferees or other successors-in-interest from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders of the Shares. We will, however, to the extent the warrants are exercised for cash, receive proceeds from such exercises; to the extent we receive such proceeds, they are expected to be used for general corporate and working capital purposes. We will, or will procure to, bear all fees and expenses incident to our obligation to register the Shares.

The selling stockholders may sell all or a portion of the Shares beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the Shares are sold through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts (it being understood that the selling stockholders shall not be deemed to be underwriters solely as a result of their participation in this offering) or commissions or agent’s commissions. The Shares may be sold on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in one or more transactions at fixed prices, at prices related to prevailing market prices, or at negotiated prices, or, in the case of sales of our common stock, at market prices prevailing at the time of sale. While there is no established public trading market for our Series C non-voting convertible preferred stock, we believe the actual offering price in sales of our Series C non-voting convertible preferred stock by the selling stockholders will be derived from the prevailing market price of our common stock at the time of any such sale. These prices, as well as the timing, manner and size of each sale, will be determined by the selling stockholders or by agreement between such holders and underwriters or dealers who may receive fees or commissions in connection with such sale. These sales may be effected in transactions, which may involve crosses or block transactions. The selling stockholders may use any one or more of the following methods when selling Shares:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the Shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•to or through underwriters or purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•through the distribution of such securities by any selling stockholder to its equity holders;

•privately negotiated transactions;

•settlement of short sales entered into after the effective date the registration statement of which this prospectus is a part;

•broker-dealers may agree with the selling stockholders to sell a specified number of such securities at a stipulated price per Share;

•through the writing or settlement of options or other hedging transactions, whether such options are listed on an options exchange or otherwise;

•a combination of any such methods of sale; and

•any other method permitted pursuant to applicable law.

The selling stockholders also may resell all or a portion of the Shares in open market transactions in reliance upon Rule 144 under the Securities Act, as amended, or the Securities Act, as permitted by that rule, or Section 4(a)(1) under the Securities Act, if available, rather than under this prospectus, provided that they meet the criteria and conform to the requirements of those provisions.