Management to host a live webcast on August 14,

2023, at 4:30 pm ET

Board of Directors to create a Strategic Review

Committee to explore strategic options

Chicken Soup for the Soul Entertainment Inc. (Nasdaq: CSSE) –

one of the largest providers of premium content to value-conscious

consumers, today announced its financial results for the second

quarter ended June 30, 2023.

“August 11 marked the first anniversary of our Redbox

acquisition. It’s been an incredible year integrating two companies

to create one of the largest providers of premium entertainment to

value-conscious consumers,” said William J. Rouhana, Jr., chairman

and chief executive officer of Chicken Soup for the Soul

Entertainment. “It’s worth noting the massive changes that have

happened in the media space and the broader economy over the past

12 months that are affecting all of us in this space. Despite these

seismic changes, we have been able to streamline our business to

drive cash flow. Additionally, given an increased level of

strategic opportunities, we will be forming a strategic review

committee of our board of directors to consider the various ways to

unlock maximum shareholder value.”

Second Quarter 2023 Financial Summary

- Net revenue of $79.9 million, compared with net revenue of

$37.6 million in the year-ago period

- Net loss of $43.7 million, compared with a net loss of $20.8

million in the year-ago period; $40.5 million net loss before

income taxes and preferred dividends, compared with $18.5 million

net loss in the year-ago period

- Adjusted EBITDA of $0.7 million, compared with Adjusted EBITDA

of $5.6 million in the year-ago period

Recent Business Highlights

- Saw record-breaking performance at kiosks and TVOD driven by

The Super Mario Bros. Movie, including becoming the top movie

rental in 2023, the most rented movie in its first week since Top

Gun: Maverick, and the most first-week rentals for a family film

since The Croods: A New Age. The film also broke week one TVOD

revenue records, and its Premium VOD/EST debut surpassed the

previous record held by Avatar: The Way of Water

- Crackle Connex signed a deal with TikTok to provide content

from its platform to over 3,000 kiosk digital video screens,

allowing brands to leverage Redbox’s digital-out-of-home

network

- Began the rollout of the previously announced 1,500 kiosk

expansion program with key retail partner Dollar General

- Crackle Connex signed a deal with Coinstar’s adPlanet Retail

Media Group and Velocity MSC to bring its reach of

digital-out-of-home video screens to over 10,000

- Signed FAST deals with AMC Networks, Fremantle, Revry, and Love

Stories TV bringing on channels including The Walking Dead,

Portlandia, Supermarket Sweep, and The Jamie Oliver Channel

- Locomotive Global’s Rana Naidu was named a top 10 globally

streamed series on Netflix by Parrot Analytics; Locomotive Global

also recently signed deals with All3Media, Endemol Shine, and

Applause Entertainment

- Premiered At Home with Genevieve on Crackle, presented by

PetSmart through a branded partnership agreement with Crackle

Connex

- Redbox launched its Christmas and Holiday FAST channel on the

Redbox free streaming app, the Roku channel, and LG FAST

- Launched the Chicken Soup for the Soul FAST channel on the

Philo streaming TV service which can be accessed through numerous

devices, including Roku, Samsung TVs, and Amazon Fire TV

For a discussion of the financial measures presented herein

which are not calculated or presented in accordance with U.S.

generally accepted accounting principles (“GAAP”), see “Note

Regarding Use of Non-GAAP Financial Measures" below and the

schedules to this press release for additional information and

reconciliations of non-GAAP financial measures.

The company presents non-GAAP measures such as Adjusted EBITDA

to assist in an analysis of its business. These non-GAAP measures

should not be considered an alternative to GAAP measures as an

indicator of the company's operating performance.

For further information on the matters discussed in this

release, please see our Quarterly Report on Form 10-Q for the three

and six months ended June 30, 2023 to be filed with the Securities

and Exchange Commission on or about August 14, 2023.

Conference Call Information

- Date & Time: Monday, August 14, 2023, 4:30 p.m. ET

- To access a dial-in number, the company encourages participants

to register in advance by visiting the following pre-registration

link here

- Please note that a dial-in option is not available without

registering at the provided link.

- A live webcast of the event will also be available in the

“Event Calendar” section under the “News & Events” tab of the

Chicken Soup for the Soul Entertainment investor relations website

at http://ir.cssentertainment.com

Conference Call Replay Information

- A webcast replay will be made available at

http://ir.cssentertainment.com/ in the “Event Calendar” section

under the “News & Events” tab following the completion of the

call

About Chicken Soup for the Soul Entertainment

Chicken Soup for the Soul Entertainment (Nasdaq: CSSE) provides

premium content to value-conscious consumers. The company is one of

the largest advertising-supported video-on-demand (AVOD) companies

in the US, with three flagship AVOD streaming services: Redbox,

Crackle, and Chicken Soup for the Soul. In addition, the company

operates Redbox Free Live TV, a free ad-supported streaming

television service (FAST), with nearly 180 FAST channels as well as

a transaction video on demand (TVOD) service, and a network of

approximately 29,000 kiosks across the US for DVD rentals. To

provide original and exclusive content to its viewers, the company

creates, acquires, and distributes films and TV series through its

Screen Media and Chicken Soup for the Soul TV Group subsidiaries.

Chicken Soup for the Soul Entertainment is a subsidiary of Chicken

Soup for the Soul, LLC, which publishes the famous book series and

produces super-premium pet food under the Chicken Soup for the Soul

brand name.

Note Regarding Use of Non-GAAP Financial Measures

Our consolidated financial statements are prepared in accordance

with generally accepted accounting principles in the United States

(“U.S. GAAP”). We use a non-GAAP financial measure to evaluate our

results of operations and as a supplemental indicator of our

operating performance. The non-GAAP financial measure that we use

is Adjusted EBITDA. Adjusted EBITDA (as defined below) is

considered a non-GAAP financial measure as defined by Regulation G

promulgated by the SEC under the Securities Act of 1933, as

amended. Due to the significance of non-cash and non-recurring

expenses recognized during the years ended December 31, 2022 and

2021, and six months ended June 30, 2023 and 2022, and the

likelihood of material non-cash, non-recurring, and acquisition

related expenses to occur in future periods, we believe that this

non-GAAP financial measure enhances the understanding of our

historical and current financial results as well as provides

investors with measures used by management for the planning and

forecasting of future periods, as well as for measuring performance

for compensation of executives and other members of management.

Further, we believe that Adjusted EBITDA enables our board of

directors and management to analyze and evaluate financial and

strategic planning decisions that will directly affect operating

decisions and investments. We believe this measure is an important

indicator of our operational strength and performance of our

business because it provides a link between operational performance

and operating income. It is also a primary measure used by

management in evaluating companies as potential acquisition

targets. We believe the presentation of this measure is relevant

and useful for investors because it allows investors to view

performance in a manner similar to the method used by management.

We believe it helps improve investors’ ability to understand our

operating performance and makes it easier to compare our results

with other companies that have different capital structures or tax

rates. In addition, we believe this measure is also among the

primary measures used externally by our investors, analysts and

peers in our industry for purposes of valuation and comparing our

operating performance to other companies in our industry.

The presentation of Adjusted EBITDA should not be construed as

an inference that our future results will be unaffected by unusual,

infrequent or non-recurring items or by non-cash items. This

non-GAAP financial measure should be considered in addition to,

rather than as a substitute for, our actual operating results

included in our condensed consolidated financial statements.

We define Adjusted EBITDA as consolidated operating income

(loss) adjusted to exclude interest, taxes, depreciation,

amortization (including tangible and intangible assets), film

library amortization and related costs (film library amortization,

film library revenue shares and participation costs, theatrical

release costs) as well as amortization for certain program rights,

acquisition-related costs, consulting fees related to acquisitions,

dividend payments, non-cash share-based compensation expense, and

adjustments for other unusual and infrequent in nature identified

charges, including transition related expenses. Adjusted EBITDA is

not an earnings measure recognized by U.S. GAAP and does not have a

standardized meaning prescribed by GAAP; accordingly, Adjusted

EBITDA may not be comparable to similar measures presented by other

companies. We believe Adjusted EBITDA to be a meaningful indicator

of our performance that management uses and believes provides

useful information to investors regarding our financial condition

and results of operations. The most comparable GAAP measure is

operating income (loss).

A reconciliation of net loss to Adjusted EBITDA will be provided

in the company’s Quarterly Report on Form 10-Q for the three and

six months ended June 30, 2023 filed on or about August 14, 2023,

under the section thereof entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations –

Reconciliation of Unaudited Historical Results to Adjusted

EBITDA.”

Forward-Looking Statements and Available Information

This press release includes forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements are statements that are not historical facts. These

statements are based on various assumptions, whether or not

identified in this press release, and on the current expectations

of management and are not predictions of actual performance. Such

assumptions involve a number of known and unknown risks and

uncertainties, including but not limited to risks relating to our

core strategy, operating income and margin, seasonality, liquidity,

including cash flows from operations, available funds, and access

to financing sources, free cash flows, revenues, net income,

profitability, stock price volatility, future regulatory changes,

price changes, ability to achieve and sustain market acceptance of

our content streaming services and other content offerings, ability

to recruit and retain officers, key employees, or directors,

ability to protect our intellectual property, ability to complete

and integrate into our existing operations future strategic

acquisitions, ability to manage growth, ability to pay dividends

and our debt obligations, as well as evolving regulatory or other

operational risks, and risks presented by changing general market

conditions impacting demand for our services. For a more complete

description of these and other risks and uncertainties, please

refer to Item 1A (Risk Factors) in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022 filed with the SEC

on March 31, 2023, as amended. If any of these risks materialize or

our assumptions prove incorrect, actual results could differ

materially from the results implied by the forward-looking

statements contained in this press release. Information regarding

the acquisition of Redbox and related transactions is qualified by

reference to the Company’s Current Reports on Form 8-K filed with

the SEC on May 11, 2022 as amended May 12, 2022, June 6, 2022,

August 12, 2022, November 14, 2022 and thereafter from time to

time, and all exhibits filed with respect to such reports. The

forward-looking statements contained in this press release speak

only as of the date hereof and the Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

Tables Follow

Chicken Soup for the Soul Entertainment, Inc.

Condensed Consolidated Balance Sheets June 30,

December 31,

2023

2022

ASSETS Cash, cash equivalents and restricted cash $

6,917,111

$

18,738,395

Accounts receivable, net of allowance for doubtful accounts of

$1,872,302 and $1,277,597, respectively

159,316,288

113,963,425

Prepaid expenses and other current assets

9,044,398

13,196,180

Operating lease right-of-use assets

14,549,978

16,315,342

Content assets, net

109,708,725

126,090,508

Intangible assets, net

290,025,906

305,425,709

Goodwill

261,322,774

260,748,057

Other assets, net

27,714,084

29,401,793

Total assets $

878,599,264

$

883,879,409

LIABILITIES AND EQUITY Accounts payable $

65,156,863

$

50,960,682

Accrued expenses

93,694,320

87,817,015

Due to affiliated companies

4,022,477

3,778,936

Programming obligations

58,228,000

55,883,788

Film library acquisition obligations

30,189,206

39,750,121

Accrued participation costs

46,333,084

28,695,713

Debt, net

511,902,350

479,653,611

Contingent consideration

6,866,449

7,311,949

Put option obligation

4,400,000

11,400,000

Operating lease liabilities

16,127,975

18,079,469

Other liabilities

22,868,837

20,800,186

Total liabilities

859,789,561

804,131,470

Equity Stockholders' Equity: Series A cumulative

redeemable perpetual preferred stock, $.0001 par value, liquidation

preference of $25.00 per share, 10,000,000 shares authorized;

5,556,605 and 4,496,345 shares issued and outstanding,

respectively; redemption value of $138,915,125 and $112,408,625,

respectively

555

450

Class A common stock, $.0001 par value, 140,000,000 shares

authorized; 26,003,391 and 15,621,562 shares issued, 23,581,089 and

13,198,720 shares outstanding, respectively

2,579

1,559

Class B common stock, $.0001 par value, 20,000,000 shares

authorized; 7,654,506 shares issued and outstanding, respectively

766

766

Additional paid-in capital

396,992,240

355,185,280

Deficit

(350,061,978)

(247,752,446)

Accumulated other comprehensive income

(70,969)

47,528

Class A common stock held in treasury, at cost (2,422,842 and

2,422,842 shares, respectively)

(28,165,913)

(28,165,913)

Total stockholders’ equity

18,697,280

79,317,224

Noncontrolling interests

112,423

430,715

Total equity

18,809,703

79,747,939

Total liabilities and equity $

878,599,264

$

883,879,409

Chicken Soup for the Soul Entertainment, Inc.

Condensed Consolidated Statements of Operations (unaudited)

Three Months Ended June 30, Six Months Ended June

30,

2023

2022

2023

2022

Net revenues $

79,910,063

$

37,636,947

$

189,509,356

$

66,843,144

Costs and expenses Operating

65,285,767

31,596,524

161,592,135

54,171,932

Selling, general and administrative

24,556,530

17,373,018

57,320,081

30,189,538

Amortization and depreciation

10,995,085

1,680,443

22,178,802

3,328,701

Management and license fees

4,926,349

3,763,695

12,778,490

6,684,315

Total costs and expenses

105,763,731

54,413,680

253,869,508

94,374,486

Operating loss

(25,853,668)

(16,776,733)

(64,360,152)

(27,531,342)

Interest expense

17,901,099

2,022,770

34,567,358

3,333,229

Other non-operating income, net

(1,370,495)

(279,405)

(2,065,185)

(481,197)

Loss before income taxes and preferred dividends

(42,384,272)

(18,520,098)

(96,862,325)

(30,383,374)

Income tax provision

(1,898,687)

14,000

(684,536)

34,000

Net loss before noncontrolling interests and preferred

dividends

(40,485,585)

(18,534,098)

(96,177,789)

(30,417,374)

Net loss attributable to noncontrolling interests

(76,942)

(142,350)

(204,604)

(180,735)

Net loss attributable to Chicken Soup for the Soul

Entertainment, Inc.

(40,408,643)

(18,391,748)

(95,973,185)

(30,236,639)

Less: preferred dividends

3,323,756

2,391,442

6,336,347

4,673,511

Net loss available to common stockholders $

(43,732,399)

$

(20,783,190)

$

(102,309,532)

$

(34,910,150)

Net loss per common share: Basic and diluted $

(1.50)

$

(1.39)

$

(4.07)

$

(2.30)

Weighted-average common shares outstanding: Basic and

diluted

29,171,223

14,950,458

25,163,744

15,152,222

Chicken Soup for the Soul Entertainment, Inc.

Adjusted EBITDA (unaudited)

Three Months Ended

June 30, Six Months Ended June 30,

2023

2022

2023

2022

Net loss available to common stockholders $

(43,732,399)

$

(20,783,190)

$

(102,309,532)

$

(34,910,150)

Preferred dividends

3,323,756

2,391,442

6,336,347

4,673,511

Net (loss) income attributable to noncontrolling interests

(76,942)

(142,350)

(204,604)

(103,965)

Income tax (benefit) provision

(1,898,687)

14,000

(684,536)

34,000

Other Taxes

172,859

178,403

425,738

258,775

Interest Expense

17,901,099

2,022,770

34,567,358

3,333,229

Film Library & Program Amortization

10,782,476

14,666,992

51,658,019

24,354,016

Stock-based Compensation

912,841

957,859

1,827,412

1,954,656

Reserve for bad debt and video returns

658,363

692,295

1,816,066

1,274,129

Amortization and depreciation

10,995,085

2,674,893

22,178,802

4,678,966

Other non-operating income, net

(1,370,495)

(279,405)

(2,065,185)

(481,197)

Non-cash settlement of management and licensing fees

1,231,587

255,615

4,681,587

255,615

Transitional expenses and other non-recurring costs

1,759,127

2,919,987

2,506,232

3,909,819

Adjusted EBITDA $

658,670

$

5,569,311

$

20,733,704

$

9,231,404

(a) Includes amortization of deferred

financing costs of $1,188,451 and $217,679 for the three months

ended June 30, 2023 and 2022, respectively, and $2,376,901 and

$366,748 for the six months ended June 30, 2023 and 2022,

respectively.

(b) Includes film library amortization,

film library revenue shares and participation costs, theatrical

release costs as well as amortization for certain program rights

and impairment of content assets. Includes impairment of content

assets of $3,641,602 for the three and six months ended June 30,

2023 and none for the three and six months ended June 30, 2022.

(c) Represents expense related to common

stock equivalents issued to certain employees and officers under

the Long-Term Incentive Plan. In addition to common stock grants

issued to employees, directors, and consultants.

(d) Includes depreciation and amortization

of intangibles, property and equipment and amortization of

technology expenditures included in operating costs.

(e) Other non-operating income is

primarily comprised of interest income earned on cash deposits,

other non-operating income including settlements, debt

extinguishment costs, and changes to fair market value of

warrants.

(f) Represents transitional and

integration costs primarily associated with business combinations .

Costs include non-recurring payroll and redundant or non-recurring

costs including technology, marketing, and certain overhead as well

as legal, consulting, accounting and other non-recurring operating

costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814669903/en/

(INVESTOR RELATIONS) Zaia Lawandow Chicken Soup for the Soul

Entertainment zlawandow@chickensoupforthesoul.com

(PRESS) Peter Binazeski Chicken Soup for the Soul Entertainment

pbinazeski@chickensoupforthesoul.com

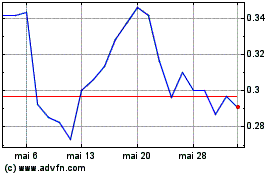

Chicken Soup for the Sou... (NASDAQ:CSSE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Chicken Soup for the Sou... (NASDAQ:CSSE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025