UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

File No. 812-_______

In the matter of:

First Trust Exchange-Traded Fund

First Trust Exchange-Traded Fund II

First Trust Exchange-Traded Fund III

First Trust Exchange-Traded Fund IV

First Trust Exchange-Traded Fund V

First Trust Exchange-Traded Fund VI

First Trust Exchange-Traded Fund VII

First Trust Exchange-Traded AlphaDEX(R) Fund

First Trust Exchange-Traded AlphaDEX(R) Fund II

First Trust Advisors L.P.

First Trust Portfolios L.P.

Application to amend an Order under Section 6(c) of the Investment Company Act

of 1940, as amended (the "Act"), for an exemption from Sections 2(a)(32),

5(a)(1), 22(d), and 22(e) of the Act and Rule 22c-1 under the Act and under

Sections 6(c) and 17(b) of the Act for an exemption from Section 17(a) of the

Act.

All communications, notices and orders to:

First Trust Exchange-Traded Fund Eric F. Fess

First Trust Exchange-Traded Fund II Felice R. Foundos

First Trust Exchange-Traded Fund III Suzanne M. Russell

First Trust Exchange-Traded Fund IV Chapman and Cutler LLP

First Trust Exchange-Traded Fund V 111 West Monroe

First Trust Exchange-Traded Fund VI Chicago, IL 60603

First Trust Exchange-Traded Fund VII

First Trust Exchange-Traded AlphaDEX(R) Fund

First Trust Exchange-Traded AlphaDEX(R) Fund II

First Trust Advisors L.P.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

Attention: W. Scott Jardine

|

Page 1 of 29 sequentially numbered pages (including exhibits)

I. INTRODUCTION

In this application ("Application"), the undersigned applicants, First

Trust Exchange-Traded Fund (the "Initial Trust"), First Trust Exchange-Traded

Fund II ("Trust II"), First Trust Exchange-Traded Fund III ("Trust III"), First

Trust Exchange-Traded Fund IV ("Trust IV"), First Trust Exchange-Traded Fund V

("Trust V"), First Trust Exchange-Traded Fund VI ("Trust VI"), First Trust

Exchange-Traded Fund VII ("Trust VII"), First Trust Exchange-Traded AlphaDEX(R)

Fund (the "AlphaDEX(R) Trust"), First Trust Exchange-Traded AlphaDEX(R) Fund II

(the "AlphaDEX(R) Trust II" and, together with the Initial Trust, Trust II,

Trust III, Trust IV, Trust V, Trust VI, Trust VII and the AlphaDEX(R) Trust, the

"Existing Trusts" and each, an "Existing Trust"), First Trust Advisors L.P.

("First Trust Advisors"), and First Trust Portfolios L.P. ("First Trust

Portfolios" or the "Distributor" and, together with the Existing Trusts and

First Trust Advisors, the "Applicants"), apply for and request an order

("Order") from the U.S. Securities and Exchange Commission ("Commission") to

amend a prior order (i) under Section 6(c) of the Act, for an exemption from

Sections 2(a)(32), 5(a)(1), 22(d) and 22(e) of the Act and Rule 22c-1 thereunder

and (ii) under Sections 6(c) and 17(b) of the Act, for an exemption from

Sections 17(a)(1) and 17(a)(2) of the Act (referred to herein as the "Prior

Order").(1) As set forth in the Prior Application, the Prior Order applies to

the Existing Trusts, the "Initial Fund" described in the Prior Application and

also to any other open-end management investment company existing or created in

the future (together with the Existing Trusts, the "Trusts" and each, a "Trust")

and any existing or future series of the Trusts advised by First Trust Advisors

or an entity controlling, controlled by, or under common control with First

Trust Advisors (each such entity, an "Adviser"), that operate in accordance with

the terms and conditions stated in the Prior Application (referred to as "Future

Funds"). In both the Prior Application and this Application, the Initial Fund

and the Future Funds together are each referred to as a "Fund" and collectively

as the "Funds." Applicants request that the Order apply to any Funds offered

subsequent to the issuance of the Order that are advised by an Adviser(2) and

operate pursuant to the terms and conditions stated in the Prior Application, as

amended by this Application.(3)

The Prior Order permits, among other things: (a) the Funds to issue shares

("Shares") in large aggregations only; (b) secondary market transactions in

Shares to be effected at negotiated market prices rather than at net asset value

("NAV") per Share on a national securities exchange as defined in Section

(1) Applicants previously submitted an application with the Commission (File

No. 812-14088) on July 11, 2013 (the "Prior Application"), requesting

relief with respect to the offering of certain exchange-traded funds based

on specified indexes. The Prior Application was noticed in Investment

Company Act Release No. 30582 dated June 26, 2013 and the Prior Order

granting the relief requested was set forth in Investment Company Act

Release No. 30610 dated July 23, 2013.

(2) All references herein to "First Trust Advisors" include any successor to

First Trust Advisors. For purposes of the requested Order, a "successor"

is limited to an entity or entities that result from a reorganization into

another jurisdiction or a change in the type of business organization.

(3) As of the date of filing of this Application, no Funds have been offered

in reliance on the Prior Order. All existing entities that currently

intend to rely on the Order have been named as Applicants. Any other

existing or future entity that subsequently relies on the Order will

comply with the terms and conditions of this Application.

2 of 29

2(a)(26) of the Act ("Exchange"); (c) certain affiliated persons of the Funds to

deposit securities into, and receive securities from, the Funds in connection

with the purchase and redemption of aggregations of Shares of such Funds

("Creation Units"); and (d) relief from the seven (7) calendar day redemption

requirement for certain Funds under specified limited circumstances.

As described in the Prior Application, the Funds will seek to provide

investment returns that correspond, before fees and expenses, generally to the

performance of a specified securities index (each an "Underlying Index" and

collectively, "Underlying Indexes"). Certain Underlying Indexes may consist of

sub-indexes. The component securities of an Underlying Index are referred to as

the "Component Securities" and an entity that compiles, creates, sponsors or

maintains an Underlying Index is referred to as an "Index Provider." Each Fund

will hold certain securities and other assets and positions ("Portfolio

Positions") selected to correspond to the performance of its Underlying Index.

Under the Prior Order, Applicants may create and operate Funds that

operate as index-based exchange-traded funds (referred to as "Index-Based

Funds"), for which the Index Provider is not an "affiliated person," as defined

in Section 2(a)(3) of the Act, or an affiliated person of an affiliated person,

of a Trust, the Adviser, any Sub-Adviser (as defined herein), the Distributor or

a promoter of the Fund (an "Unaffiliated Index Provider").(4) In addition, under

the Prior Order, Applicants may create and operate Funds that operate as

index-based exchange-traded funds for which the Adviser or an "affiliated

person," as defined in Section 2(a)(3) of the Act, or an affiliated person of an

affiliated person, of a Trust or a Fund, the Adviser, any Sub-Adviser (as

defined below), the Distributor or a promoter of the Fund (each, other than the

Adviser, an "Affiliated Person") serves as the Index Provider (each such Fund,

an "Affiliated Index Fund").

Applicants are seeking the Order primarily to supercede certain terms and

conditions pertaining to Affiliated Index Funds that are included in the Prior

Application. In addition, Applicants also seek to supercede certain terms and

conditions pertaining to Index-Based Funds to the extent provided herein. The

requested relief is substantially the same as the relief granted by the

Commission to the exchange-traded funds ("ETFs") advised by Transparent Value

Advisors, LLC, Sigma Investment Advisors, LLC and Guggenheim Funds Investment

Advisors, LLC.(5)

(4) As indicated in the Prior Application, Applicants intend to continue to

rely on a previously obtained order for purposes of creating and operating

index-based portfolios that hold equity securities selected to correspond

generally to the price and yield performance of a specified domestic or

international equity securities index for which the Index Provider is an

Unaffiliated Index Provider. In the Matter of First Trust Exchange-Traded

Fund, et al., Investment Company Act Release Nos. 27051 (Aug. 26, 2005)

(notice) and 27068 (Sept. 20, 2005) (order), as amended by In the Matter

of First Trust Exchange-Traded Fund, et al., Investment Company Act

Release Nos. 27772 (Mar. 30, 2007) (notice) and 27784 (Apr. 25, 2007)

(order).

(5) In the Matter of Transparent Value Trust, et al., Investment Company Act

Release Nos. 30558 (June 14, 2013) (notice) and 30596 (July 10, 2013)

(order); In the Matter of Sigma Investment Advisors, LLC, et al.,

Investment Company Act Release Nos. 30559 (June 14, 2013) (notice) and

30597 (July 10, 2013) (order); In the Matter of Guggenheim Funds

Investment Advisors, LLC, et al., Investment Company Act Release Nos.

3 of 29

Except as specifically noted herein, all representations and conditions

contained in the Prior Application relating to the operation of the Funds remain

applicable. All capitalized terms not otherwise defined in this Application have

the meanings ascribed to them in the Prior Application.

Applicants believe that (i) with respect to the relief requested pursuant

to Section 6(c) of the Act, the requested exemption for the proposed

transactions is appropriate in the public interest and consistent with the

protection of investors and the purposes fairly intended by the policy and

provisions of the Act and (ii) with respect to the relief requested pursuant to

Section 17(b) of the Act, the proposed transactions are reasonable and fair and

do not involve overreaching on the part of any person concerned; the proposed

transactions are or will be consistent with the policy of each Fund; and the

proposed transactions are consistent with the general purposes of the Act.

No form having been specifically prescribed for this Application,

Applicants proceed under Rule 0-2 of the General Rules and Regulations of the

Commission.

II. BACKGROUND

A. APPLICANTS

1. The Existing Trusts and the Initial Fund

Each Existing Trust is a Massachusetts business trust and is registered

under the Act with the Commission as an open-end management investment company.

Each Existing Trust offers and sells its Shares pursuant to registration

statements filed with the Commission under the Act and the Securities Act of

1933. The Initial Fund is described in the Prior Application.

2. The Adviser

First Trust Advisors is an Illinois limited partnership, with its

principal office in Wheaton, Illinois. Any Adviser is or will be registered as

an investment adviser under Section 203 of the Investment Advisers Act of 1940,

as amended (the "Advisers Act").

The Adviser, subject to the oversight and authority of the Board of

Trustees of the Trusts ("Board"), will develop the overall investment program

for each Fund.(6) If approved by the Board, the Adviser may enter into

sub-advisory agreements with one or more investment advisers to act as

"sub-advisers" with respect to particular Funds (each, a "Sub-Adviser" and

collectively, the "Sub-Advisers"). The Sub-Advisers, if any, will serve as the

portfolio managers for the Funds. Under the Adviser's supervision, each

Sub-Adviser will manage the investment and reinvestment of each applicable

Fund's assets in accordance with the applicable Fund's investment objective. Any

30560 (June 14, 2013) (notice) and 30598 (July 10, 2013) (order)

(collectively, the "New Self-Indexing Orders").

(6) The term "Board" includes any board of trustees of any Existing Trust or

future Trust.

4 of 29

Sub-Adviser for a Fund either will be registered or not subject to registration

under the Advisers Act.

3. The Distributor

The Distributor, an Illinois limited partnership, is a broker-dealer

registered under the Securities Exchange Act of 1934 (the "Exchange Act"). The

Distributor is an affiliate of First Trust Advisors and will act as distributor

and principal underwriter of the Funds. Applicants request that the Order apply

to the Distributor, any successor to the Distributor, and to any other entity

hired by a Fund as a future distributor (each, a "Future Distributor") that

complies with the terms and conditions of this Application. Neither the

Distributor nor any Future Distributor is or will be affiliated with any

Exchange.

4. Other Service Providers

Each Fund will have an administrator ("Administrator"), custodian

("Custodian"), fund accountant ("Fund Accountant"), transfer agent ("Transfer

Agent"), and dividend disbursing agent ("Dividend Disbursing Agent"), and may

have a securities lending agent ("Securities Lending Agent"). The Trusts and any

Securities Lending Agent will comply with guidelines of the Commission staff

regarding the lending of portfolio securities of an open-end investment company.

As discussed below, subject to the approval of the Board, the Adviser, a

Sub-Adviser or an affiliate of the Adviser and/or any Sub-Adviser may provide

administration, custody, fund accounting, transfer agency, dividend disbursement

and/or securities lending services to the Funds.

B. THE AFFILIATED INDEX FUNDS AND REASONS FOR REQUESTING THE ORDER

Since 2006, the Commission has issued various exemptive orders permitting

applicants to create and operate ETFs that track indexes created and maintained

by their affiliates (referred to as "Self-Indexing Funds").(7) These orders are

subject to certain terms and conditions designed to address potential conflicts

of interest that arise in an affiliated relationship. Until recently,

Self-Indexing Funds were typically required, among other things, to make the

composition of the index available to the public, provide advance notice of

changes to the index methodology, use a third party to calculate the index and

adopt various policies and procedures, including those intended to separate

index and advisory personnel (collectively, the "Prior Approach"). The Prior

Order was issued subject to this long-standing approach to address conflicts of

interest for Self-Indexing Funds and the Prior Application reflects the Prior

Approach. On July 10, 2013, however, the Commission issued the New Self-Indexing

Orders, which reflected an alternative approach to address potential conflicts

of interest (the "Alternative Approach"). Applicants wish to create and operate

Affiliated Index Funds subject to the Alternative Approach and, in that regard,

are seeking the Order to replace the Prior Approach set forth in the Prior

Application with the Alternative Approach set forth in this Application. Except

as described in this Application, the Funds will operate in the manner described

in the Prior Application.

(7) See Division of Investment Management, IM Information Update, August 2013

(IM-INFO-2013-09).

5 of 29

C. SPECIFIC AMENDMENTS TO PRIOR APPLICATION

1. Amendment to Replace Discussion of Underlying Indexes and Licensing

Arrangements.

Applicants seek to amend the Prior Application by deleting Section II.F.

thereof in its entirety and replacing it with the following text:

F. Underlying Indexes and Licensing Arrangements

Except with respect to the Affiliated Index Funds, no Index

Provider(8) is or will be an "affiliated person," as defined in Section

2(a)(3) of the Act, or an affiliated person of an affiliated person, of a

Trust or a Fund, of the Adviser, of any Sub-Adviser to or promoter of a

Fund or of the Distributor. The Adviser, if it is the Affiliated Index

Provider (as defined below), will be the owner of the Affiliated Indexes

(as defined below) and all related intellectual property. Otherwise, the

Adviser will enter into a license agreement with any Affiliated Person

that is an Affiliated Index Provider for the use of the Affiliated Indexes

and related intellectual property in connection with a Trust and its

Affiliated Index Funds. In either case, the Adviser will provide the

Affiliated Indexes and related intellectual property at no cost to the

applicable Trust and Affiliated Index Funds.

2. Amendment to Replace Discussion of Special Considerations Applicable to

Affiliated Index Funds.

Applicants seek to amend the Prior Application by deleting Section II.G.

thereof in its entirety and replacing it with the following text:

G. Special Considerations Applicable to Affiliated Index Funds

The Index Provider to an Affiliated Index Fund ("Affiliated Index

Provider")(9) will create a proprietary, rules-based methodology to create

Underlying Indexes (each an "Affiliated Index" and collectively, the

"Affiliated Indexes").(10) For

(8) An Index Provider (or, if the Adviser is the Index Provider, the personnel

with responsibility for the Affiliated Indexes (as defined below)) will

not provide recommendations to a Fund regarding the purchase or sale of

specific securities. In addition, except as described herein, an Index

Provider will not provide any information relating to changes to an

Underlying Index's methodology for the inclusion of Component Securities,

the inclusion or exclusion of specific Component Securities, or the

methodology for the calculation of the return of Component Securities, in

advance of a public announcement of such changes by the Index Provider.

(9) It is currently expected that First Trust Advisors will be the Affiliated

Index Provider. Any future entity that acts as an Affiliated Index

Provider will comply with the terms and conditions of this Application.

(10) The Affiliated Indexes may be made available to registered investment

companies, as well as separately managed accounts of institutional

investors and privately offered funds that are not deemed to be

"investment companies" in reliance on Section 3(c)(1) or 3(c)(7) of the

Act for which the Adviser acts as adviser and/or sub-adviser ("Affiliated

Accounts"), as well as other such registered investment companies,

6 of 29

the reasons discussed herein, the portfolios of the Affiliated Index Funds

will be fully "transparent," meaning that each Affiliated Index Fund will

post on its website ("Website") on each Business Day (as defined below),

before commencement of trading of Shares on the Exchange, the identities

and quantities of the Portfolio Positions held by the Fund that will form

the basis for the Fund's calculation of NAV at the end of the Business

Day.(11)

Applicants recognize that Affiliated Index Funds could raise

concerns regarding the potential ability of an affiliated person to

manipulate the Underlying Index to the benefit or detriment of an

Affiliated Index Fund. Applicants further recognize the potential for

conflicts that may arise with respect to the personal trading activity of

personnel of the affiliated person who may have access to or knowledge of

changes to an Underlying Index's composition methodology or the

constituent securities in an Underlying Index prior to the time that

information is publicly disseminated. In order to address these potential

conflicts of interest, the Prior Self-Indexing ETF Orders have established

a framework that requires: (i) transparency of the Underlying Indexes;

(ii) the adoption of policies and procedures not otherwise required under

the Act or the rules under the Act designed to mitigate such conflicts of

interest; (iii) limitations on the ability to change the rules for index

compilation and the component securities of the index; (iv) that the index

provider enter into an agreement with an unaffiliated third party to act

as "Calculation Agent"; and (v) certain limitations designed to separate

employees of the index provider, adviser and Calculation Agent (clauses

(ii) through (v) are hereinafter referred to as "Policies and

Procedures").

Instead of adopting the same or similar Policies and Procedures,

Applicants propose to fully disclose the Portfolio Positions of each

Affiliated Index Fund to address the potential conflicts of interest noted

above. For the reasons set forth below, Applicants believe that requiring

Affiliated Index Funds to maintain full portfolio transparency will

provide an effective alternative mechanism for addressing any such

potential conflicts of interest.

The framework set forth in the Prior Self-Indexing ETF Orders

discussed above was established before the Commission approved a framework

to allow actively managed ETFs to operate. Subsequently, however, the

Commission began issuing exemptive relief to allow the offering of

actively managed ETFs.(12) Unlike conventional passively managed ETFs,

separately managed accounts and privately offered funds for which it does

not act either as adviser and/or sub-adviser ("Unaffiliated Accounts").

The Affiliated Accounts and the Unaffiliated Accounts (collectively

referred to herein as "Accounts"), like the Funds, would seek to track the

performance of one or more Underlying Index(es) by investing in the

constituents of such index(es) or a representative sample of such

constituents of the index(es). Consistent with the relief requested from

Section 17(a) herein, the Affiliated Accounts will not engage in Creation

Unit transactions with a Fund.

(11) Under accounting procedures followed by each Fund, trades made on the

prior Business Day ("T") will be booked and reflected in NAV on the

current Business Day ("T+1"). Accordingly, the Funds will be able to

disclose at the beginning of the Business Day the portfolio that will form

the basis for the NAV calculation at the end of the Business Day.

(12) See, e.g., In the Matter of Pyxis Capital, L.P., et al., Investment

Company Act Release Nos. 30316 (Dec. 21, 2012) (notice) and 30352 (Jan.

16, 2013) (order) ("Pyxis Order"); In the Matter of Franklin Advisers,

7 of 29

actively managed ETFs do not seek to replicate the performance of a

specified index, but rather seek to achieve their investment objectives by

using an "active" management strategy to invest in portfolio securities.

Notably, the structure of actively managed ETFs presents potential

conflicts of interest that are the same as, or more acute than, those

presented by Affiliated Index Funds: the portfolio managers of an actively

managed ETF by definition have advance knowledge of pending portfolio

changes. However, rather than requiring Policies and Procedures similar to

those required under the Prior Self-Indexing ETF Orders, the Commission

instead determined that for actively managed ETFs, any conflicts of

interest could be addressed appropriately through full portfolio

transparency (i.e., requiring each actively managed ETF to post on its

website on each Business Day, before commencement of trading of shares on

the Exchange, the identities and quantities of the portfolio securities

and other assets held by the actively managed ETF that will form the basis

for such ETF's calculation of NAV at the end of the Business Day).

Accordingly, each such Prior Active ETF Order required full portfolio

transparency as a condition of the relief granted therein.(13)

In addition, Applicants do not believe the potential for conflicts

of interest raised by the Adviser's use of the Underlying Indexes in

connection with the management of the Affiliated Index Funds and the

Affiliated Accounts will be substantially different from the potential

conflicts presented by an adviser managing two or more registered funds.

More specifically, Applicants do not believe the potential for conflicts

presented by the Adviser's use of the Underlying Indexes in connection

with the management of the Funds and the Affiliated Accounts is

substantially different from the potential for conflicts presented by the

side-by-side management of ETFs which track the performance of an index

that also serves as the benchmark for a traditional mutual fund or

unregistered account managed by the same adviser. Both the Act and the

Advisers Act contain various protections to address conflicts of interest

where an adviser is managing two or more registered funds, and these

protections will also help address these conflicts with respect to the

Affiliated Index Funds.(14) Therefore, although the use of portfolio

transparency instead of Policies and Procedures relating to Affiliated

Index Funds in the manner discussed in this Application has not yet been

the subject of many prior orders by the Commission, Applicants do not

Inc., et al., Investment Company Act Release Nos. 30312 (Dec. 19, 2012)

(notice) and 30350 (Jan. 15, 2013) (order); In the Matter of

AllianceBernstein Active ETFs, Inc., et al., Investment Company Act

Release Nos. 30305 (Dec. 13, 2012) (notice) and 30343 (Jan. 8, 2013)

(order); In the Matter of Cambria Investment Management, L.P. and Cambria

ETF Trust, Investment Company Act Release Nos. 30286 (Nov. 30, 2012),

30302 (Dec. 12, 2012) (notices) and 30340 (Jan. 4, 2013) (order); In the

Matter of T. Rowe Price Associates, Inc., et al., Investment Company Act

Release Nos. 30299 (Dec. 7, 2012) (notice) and 30336 (Jan. 2, 2013)

(order); and In the Matter of Salient Advisors, L.P. and MarketShares ETF

Trust, Investment Company Act Release Nos. 30254 (Oct. 31, 2012) (notice)

and 30281 (Nov. 27, 2012) (order) (collectively, the "Prior Active ETF

Orders").

(13) See, e.g., Pyxis Order, at Representation 14 and Condition 4.

(14) See, e.g., Rule 17j-1 under the Act and Section 204A under the Advisers

Act; see also Rules 204A-1 and 206(4)-7 under the Advisers Act, the

requirements of which, with respect to the Adviser and any Sub-Adviser,

are discussed below.

8 of 29

believe their request for Relief presents any novel legal issues that are

materially different from those the Commission has already considered.

In light of the foregoing, Applicants believe it is appropriate to

allow the Affiliated Index Funds to be fully transparent in lieu of

adopting Policies and Procedures from the Prior Self-Indexing ETF Orders

discussed above. Applicants assert that each Affiliated Index Fund's

Portfolio Positions will be as transparent as the portfolio holdings of

existing actively managed ETFs (i.e., those relying on the Prior Active

ETF Orders), and that each Affiliated Index Fund will provide the same

level of transparency with respect to its Underlying Index as the

underlying indexes of existing ETFs which track indexes provided by

unaffiliated parties. Applicants also assert that, notwithstanding the

fact that the Affiliated Index Funds' Underlying Indexes will not be

formally required to maintain the full transparency that was required

under the Prior Self-Indexing ETF Orders, such Underlying Indexes will

nonetheless maintain a level of public disclosure regarding components,

weightings, additions and deletions (including prior announcements of any

changes thereto) which will be similar to that of other underlying indexes

used by other ETFs.(15)

Each Adviser and any Sub-Adviser has adopted or will adopt, pursuant

to Rule 206(4)-7 under the Advisers Act, written policies and procedures

designed to prevent violations of the Advisers Act and the rules

thereunder. These include policies and procedures designed to minimize

potential conflicts of interest among the Affiliated Index Funds and the

Affiliated Accounts, such as cross trading policies, as well as those

designed to ensure the equitable allocation of portfolio transactions and

brokerage commissions.(16) In addition, First Trust Advisors has adopted

policies and procedures as required under Section 204A of the Advisers

Act, which are reasonably designed in light of the nature of its business

to prevent the misuse, in violation of the Advisers Act or the Exchange

Act or the rules thereunder, of material non-public information by First

Trust Advisors or an associated person ("Inside Information Policy"). Any

(15) The Affiliated Index Funds' full portfolio transparency will also

typically result in full transparency of an Affiliated Index Fund's

Underlying Index by virtue of an Affiliated Index Fund's replication of

its Underlying Index. While an Affiliated Index Fund which uses a

representative sampling approach to track its Underlying Index may not

thus provide full transparency of its Underlying Index and accordingly,

may give rise to conflicts of interest to the extent that an Adviser or

Sub-Adviser has discretion to designate the securities to be included in

the Portfolio Deposit (defined below), Applicants believe any such

conflicts are appropriately addressed by the existing protections against

conflicts of interest that are provided for in the Prior Active ETF

Orders, the Act and the Advisers Act, as discussed herein. Applicants

further note that even such Affiliated Index Funds that use representative

sampling to track their Underlying Indexes will provide the same amount of

transparency with respect to their Underlying Indexes as is currently

required with respect to Prior Index-Based ETFs in that their Deposit

Instruments and Redemption Instruments (as such terms are defined below)

are required to correspond pro rata to the positions of the Fund's

portfolio, subject to limited exceptions. See Section II.K, infra.

(16) If the requested Order is granted, the Adviser will include under Item

10.C. of Part 2 of its Form ADV a discussion of its relationship to any

Affiliated Index Provider (unless the Affiliated Index Provider is the

Adviser) and any material conflicts of interest resulting therefrom,

regardless of whether the Affiliated Index Provider is a type of affiliate

specified in Item 10.

9 of 29

other Adviser and/or Sub-Adviser will be required to adopt and maintain a

similar Inside Information Policy. In accordance with the Code of Ethics

(discussed below) and Inside Information Policy of the Adviser and any

Sub-Adviser, personnel of those entities with knowledge about the

composition of a Portfolio Deposit (as defined below) will be prohibited

from disclosing such information to any other person, except as authorized

in the course of their employment, until such information is made public.

Each Trust will execute confidentiality agreements with any of its service

providers which are provided information regarding a Portfolio Deposit.

The structure of the Affiliated Index Funds, as well as those of the

Affiliated Accounts, as index funds minimizes the potential for conflicts,

as the investment strategies of each Affiliated Index Fund and the

Affiliated Accounts will be constrained by their objective to track the

performance of their respective Underlying Index (before fees and

expenses).

The portfolio managers responsible for day-to-day portfolio

management of the Affiliated Index Funds and Affiliated Accounts will be

employees of an Adviser or a Sub-Adviser. The personnel responsible for

overseeing the activities of any Sub-Adviser in connection with the

management of the Affiliated Index Funds and Affiliated Accounts will be

employees of the Adviser. First Trust Advisors has also adopted (and any

other Adviser has adopted or will adopt) a Code of Ethics pursuant to Rule

17j-1 under the Act and Rule 204A-1 under the Advisers Act, which contains

provisions reasonably necessary to prevent Access Persons (as defined in

Rule 17j-1) from engaging in any conduct prohibited in Rule 17j-1 ("Code

of Ethics"). Any Sub-Adviser will be required to confirm to the applicable

Adviser and the applicable Trust that it has adopted policies and

procedures to monitor and restrict securities trading by certain of its

employees. Also, any Sub-Adviser will be required to adopt a Code of

Ethics pursuant to Rule 17j-1 under the Act and Rule 204A-1 under the

Advisers Act, and to provide the applicable Trust with the certification

required by Rule 17j-1 under the Act. Neither any Adviser nor any

Sub-Adviser will receive incentive fees for outperforming the Underlying

Index of any Affiliated Index Fund or Affiliated Account. In fact, any

material outperformance or underperformance would be viewed negatively by

investors in such investments.

To the extent the Affiliated Index Funds transact with an affiliated

person of the Adviser or any Sub-Adviser, such transactions will comply

with the Act, the rules thereunder and the terms and conditions of the

Order. Each Affiliated Index Fund's Board will periodically review the

Affiliated Index Fund's use of an Affiliated Index Provider. Subject to

the approval of the Board overseeing any Affiliated Index Fund, the

Adviser, affiliated persons of the Adviser ("Adviser Affiliates") and

those of any Sub-Adviser ("Sub-Adviser Affiliates") may be authorized to

provide administration, custody, fund accounting, transfer agency,

dividend disbursement and/or securities lending services to the Affiliated

Index Funds. Any services provided by an Adviser, Adviser Affiliates,

Sub-Adviser and Sub-Adviser Affiliates will be performed in accordance

with the provisions of the Act, the rules under the Act and any relevant

guidelines from the staff of the Commission.

10 of 29

3. Amendment to Replace Discussion of Availability of Information

Regarding Shares and Underlying Indexes.

Applicants seek to amend the Prior Application by deleting Section II.Q.

thereof in its entirety and replacing it with the following text:

Q. Availability of Information Regarding Shares and Underlying

Indexes

On each Business Day, the Deposit Instruments, the Redemption

Instruments, and the Balancing Amount effective as of the previous

Business Day, per individual outstanding Share of each Fund, will be made

available on the Website. As noted above, before commencement of trading

on the Exchange on each Business Day, the identities and quantities of the

portfolio securities and other assets held by the Affiliated Index Fund

that will form the basis for the Affiliated Index Fund's calculation of

NAV at the end of the Business Day will also be made available on the

Website. Similarly, for each Long/Short Fund and 130/30 Fund, the Adviser

will provide full portfolio transparency on the Fund's Website by making

available the identities and quantities of the Portfolio Positions that

will form the basis for the Fund's calculation of NAV at the end of the

Business Day. The information provided on the Website will be formatted to

be reader-friendly.

The Funds' Administrator will provide an estimated Balancing Amount,

adjusted through the close of the trading day, to the relevant Listing

Exchange. Each Listing Exchange or other major market data provider will

disseminate, every fifteen (15) seconds during regular Exchange trading

hours, through the facilities of the Consolidated Tape Association or

other widely disseminated means, an amount for each Fund stated on a per

individual Share basis representing the sum of (i) the estimated Balancing

Amount, and (ii) the current value of the Deposit Instruments (such

intra-day indicative value, the "IIV"). The Listing Exchange will not be

involved in, or be responsible for, the calculation of the estimated

Balancing Amount nor will it guarantee the accuracy or completeness of the

estimated Balancing Amount. No Fund will be involved in, or responsible

for, the calculation or dissemination of the IIV, and no Fund will make

any warranty as to its accuracy.

Applicants expect that the value of the Underlying Indexes will be

disseminated by the relevant Listing Exchange or such other organization

authorized by the Index Provider in accordance with Commission and

Exchange requirements. Applicants expect the same from the Index Providers

of future Underlying Indexes and future primary Listing Exchanges. In

addition, these organizations will disseminate values for each Underlying

Index once each trading day, based on closing prices in the relevant

exchange market. Each Fund will make available on a daily basis the names

and required numbers of each of the Deposit Instruments in a Creation Unit

as well as information regarding the Balancing Amount.

At the end of each Business Day, the Trust will prepare the next

day's Deposit Instruments and Redemption Instruments for the Funds and

send this information to the Transfer Agent, Custodian or index receipt

11 of 29

agent, as applicable. The same evening, that party will add to this

information the Balancing Amount effective as of the close of business on

that Business Day and create a portfolio composition file ("PCF")(17) for

each Fund, which it will transmit to NSCC before the start of the next

Business Day. The PCF will include information on the cash and money

market instruments in the Fund's portfolio and be available to all NSCC

members, as well as through third-party data vendors. Except as discussed

below, the PCF will provide information sufficient to calculate the IIV

for the Funds during the next Business Day and disclose the full portfolio

that will be the basis for the next day's NAV calculation.(18) The

portfolio holdings disclosure on the Website will contain information

sufficient by itself for market participants to calculate a Fund's IIV

during the next Business Day and effectively arbitrage the Fund.

Because bonds typically trade through "over-the-counter" or "OTC"

transactions, information about the intraday prices of such bonds comes

from a variety of sources. With respect to Fixed Income Funds, this

information includes: (i) executed bond transactions as reported on

FINRA's Trace Reporting and Compliance System ("TRACE" or the "TRACE

system"); (ii) intraday prices obtained directly from broker-dealers;

and/or (iii) intraday prices obtained from subscription services, such as

Bloomberg. For these purposes, "intraday prices" may include executed

transaction prices, executable prices or indicative prices, all of which

are available to Authorized Participants and other investors from major

broker-dealers. "Executed transaction prices," as the term suggests, are

the prices at which completed bond transactions actually occurred, such as

those executed transactions reported on TRACE or other transaction

reporting systems. "Executable quotations" are price quotations provided

by broker-dealers that indicate the price at which such broker-dealer

would buy or sell a specified amount of securities. "Indicative

quotations" are price quotations provided by broker-dealers that, while

not necessarily executable, provide an indication of the price at which

such broker-dealer would buy or sell a specified amount of securities.

As previously noted, one source of intraday U.S. bond prices is the

TRACE system. The TRACE system reports executed prices on corporate bonds.

The development of the TRACE system provides evidence that transparency in

the U.S. bond market is increasing. TRACE reported prices are available

without charge on FINRA's website on a "real time" basis (subject to a

fifteen (15)-minute delay as of July 1, 2005) and also are available by

subscription from various information providers (e.g., Bloomberg). In

addition, Authorized Participants and other market participants,

particularly those that regularly deal or trade in bonds, have access to

(17) A PCF consists of the Deposit Instruments and Redemption Instruments that

would be required to effect a creation or redemption on the next trading

day and the Balancing Amount effective as of the close of business on that

Business Day.

(18) The NSCC's system for the receipt and dissemination to its participants of

the PCF was designed for portfolios consisting entirely of equity or fixed

income securities, cash and money market instruments. As a result, it is

not currently capable of processing information with respect to Short

Positions and financial instruments.

12 of 29

intraday bond prices from a variety of sources other than TRACE. One

obvious source of information for Authorized Participants is their own

trading desks. Applicants understand that many Authorized Participants

already make markets in the bonds included in the Underlying Indexes and

that, when acting as such, they have access to intraday bond prices

through their own trading desks and will be able to assess the intraday

value of each Fund's Deposit Instruments using this information. Market

participants, particularly large institutional investors, regularly

receive executable and indicative quotations on bonds from broker-dealers.

Authorized Participants and other market participants also can obtain bond

prices by subscription from third parties through on-line client-based

services.(19)

As discussed herein, the Website, accessible to all investors at no

charge, will publish the current version of the Prospectus and Statement

of Additional Information ("SAI"), the Portfolio Positions and relevant

Underlying Index for each Fund, the prior Business Day's NAV and the

market closing price or the midpoint of the bid/ask spread at the time of

calculation of the relevant Fund's NAV ("Bid/Ask Price"), and a

calculation of the premium or discount of the market closing price or

Bid/Ask Price against such NAV and, each Business Day before the

commencement of trading of Shares on the Exchange, the identities and

quantities of the portfolio securities and other assets held by each

Affiliated Index Fund that will form the basis for the Affiliated Index

Fund's calculation of NAV at the end of the Business Day. The Website will

be publicly available prior to the public offering of Shares. The Exchange

also will disseminate a variety of data such as Total Balancing Amount Per

Creation Unit, Shares Outstanding and NAV with respect to each Fund on a

daily basis by means of CTA and CQ High Speed Lines.

The closing prices of each Fund's Deposit Instruments and Short

Positions will be readily available from, as applicable, the relevant

Listing Exchange, automated quotation systems, published or other public

sources, such as TRACE, or on-line information services such as Quotron,

Bloomberg or Reuters. Similarly, information regarding market prices and

volume of Shares will be broadly available on a real time basis throughout

the trading day. In addition, given the past history of other Prior ETFs,

Applicants expect that Shares will be followed closely by stock market and

mutual fund professionals as well as investment advisers, who will offer

their analysis of why investors should purchase, hold, sell or avoid

Shares. In conclusion, Exchange listing of Shares should help ensure that

there is a substantial amount of raw data available, and that such data is

packaged, analyzed and widely disseminated to the investing public.

(19) "[M]ost professional market participants, dealers, investors and issuers

have access to reliable bond price data through commercial vendors."

Statement of William H. James of the Bond Market Association before the

House Committee on Commerce Subcommittee on Finance and Hazardous

Materials, September 29, 1998, reported in The Bond Market

Association--Legislative Issues (discussing the increasing availability of

pricing information in all sectors of the bond market).

13 of 29

4. Amendment to Discussion of Sales and Marketing Materials.

Applicants seek to amend the Prior Application by deleting Section II.R.

thereof in its entirety and replacing it with the following text:

R. Public Representations

Applicants will take such steps as may be necessary to avoid

confusion in the public's mind between the Funds and a traditional

"open-end investment company" or "mutual fund." For example, with respect

to disclosure in the Fund's Prospectus concerning the description of a

Fund and the non-redeemability of Shares, the Funds will observe the

following policies: (1) the term "mutual fund" will not be used except to

compare and contrast a Fund with conventional mutual funds; and (2) the

term "open-end management investment company" will be used in the Fund's

Prospectus only to the extent required by Form N-1A or other securities

law requirements, and this phrase will not be included on the Fund's

Prospectus cover page or in the summary.

Although each Trust will be classified and registered under the Act

as an open-end management investment company, neither a Trust nor any of

its individual Funds will be advertised or marketed or otherwise "held

out" as a traditional open-end investment company or a mutual fund.

Instead, each Fund will be marketed as an "ETF." To that end, the

designation of the Funds in all marketing materials will be limited to the

terms "ETF," "investment company," "fund" and "trust" without reference to

an "open-end fund" or a "mutual fund," except to compare and contrast the

Funds with traditional open-end management investment companies (which may

be referred to as "mutual funds"). All marketing materials that describe

the features or method of obtaining, buying or selling Creation Units, or

Shares traded on an Exchange, or refer to redeemability, will prominently

disclose that Shares are not individually redeemable and will disclose

that the owners of Shares may acquire those Shares from the Fund, or

tender such Shares for redemption to the Fund, in Creation Units only. The

same approach will be followed in connection with investor educational

materials issued or circulated in connection with the Shares. After a Fund

has traded for twelve (12) months or more, any advertising or sales

literature will provide supplementary information on market premiums or

discounts relative to the NAV to enable present and prospective

shareholders to evaluate the relative desirability of Shares' intraday

marketability versus a conventional mutual fund's redeemability at NAV at

every trading day's closing NAV.

The primary disclosure document with respect to Shares will be the

Fund's Prospectus. As with all investment company securities, the purchase

of Shares in Creation Units will be accompanied or preceded by a statutory

prospectus or Summary Prospectus.(20)

(20) Pursuant to Rule 498 of the Securities Act, to the extent that a Summary

Prospectus is delivered, the statutory prospectus will be provided online,

and will be sent upon request.

14 of 29

The Funds will provide copies of their annual and semi-annual

shareholder reports to DTC Participants for distribution to shareholders.

The above policies and format will also be followed in all reports to

shareholders.

The Prospectus for each Affiliated Index Fund will prominently

disclose that the Affiliated Indexes are created and sponsored by the

Adviser or an affiliated person of the Adviser.

5. Amendment to Discussion of Relief Requested.

To reflect the amendments above, Applicants seek to amend the Prior

Application by deleting Section III.D. thereof in its entirety and replacing it

with the following text:

D. The Trusts and the Funds Do Not Raise Concerns

1. Structure and Operation of the Trusts and the Funds Compared to

Prior ETFs.

Applicants believe that the structure and operation of the Trusts

and the Funds will be extremely similar to those of the Prior ETFs

discussed in this Application. As discussed below, the liquidity of each

Fund's portfolio securities, the portfolio transparency of each Fund's

Portfolio Positions, the arbitrage mechanism, and the level and detail of

information contained in the Prospectus for each Fund, as well as that

displayed on the Website, will be extremely familiar to investors in Prior

ETFs. Consequently, Applicants have every expectation that the Funds will

operate very similarly to the domestic and international ETFs trading now

in the secondary market.

(a) Portfolio Transparency, "Front Running" and "Free Riding."

As discussed throughout this Application, Applicants believe that

the information about each Fund's Portfolio Positions will be both public

and as extensive as that information now provided by actively managed ETFs

currently listed and traded. In addition, each Fund's IIV will be

disseminated at fifteen (15) second intervals throughout the day and the

current total aggregate market value of each Underlying Index will be

disseminated in accordance with Commission and Exchange requirements.

Further, the identity of Deposit Instruments, and Redemption Instruments,

if different, will be made available to market participants in the same

manner and to the same extent as is provided in connection with current

ETFs.

Applicants believe that the disclosure of Portfolio Positions would

be unlikely to lead to "front running" (where other persons would trade

ahead of the Fund and the investors assembling the Deposit Instruments for

Creation Units) any more than is the case with the ETFs now trading.

Similarly, Applicants assert that the frequent disclosures of Portfolio

Positions would not lead to "free riding" (where other persons mirror the

Fund's investment strategies without paying the Fund's advisory fees) any

15 of 29

more than such disclosures cause this problem in connection with the ETFs

now trading.

(b) Arbitrage Mechanism.

Applicants assert that the arbitrage opportunities offered by the

Trusts and the Funds will be the same as those offered by existing ETFs.

Therefore, Applicants believe that the secondary market prices of Shares

will closely track their respective NAVs or otherwise correspond to the

fair value of their underlying portfolios. The Commission has granted

exemptive relief to existing ETFs in large part because their structures

enable efficient arbitrage, thereby minimizing the premium or discount

relative to such ETFs' NAV. Portfolio transparency has been recognized by

market commentators and analysts, as well as by the Commission itself, to

be a fundamental characteristic of current ETFs. This transparency is

acknowledged to facilitate the arbitrage mechanism described in many of

the applications for relief submitted by existing ETFs.

Although Fund Shares are not yet listed on a Listing Exchange and

therefore do not trade in the secondary market, Applicants have every

reason to believe that the design, structure and transparency of the Funds

will result in an arbitrage mechanism as efficient and robust as that

which now exists for current ETFs. Applicants expect that the spread

between offer and bid prices for Shares will be very similar to such

spreads experienced for shares of existing ETFs. Therefore, in light of

the portfolio transparency and efficient arbitrage mechanism inherent in

each Fund's structure, Applicants submit that the secondary market prices

for Shares of such Funds should be close to NAV and should reflect the

value of each Fund's portfolio.

2. Investor Uses and Benefits of Products.

Applicants believe that the Trusts and the Funds will offer a

variety of benefits that will appeal to individual and institutional

investors alike. Applicants assert that these will be identical or

substantially similar to the benefits offered by current ETFs. These

benefits include flexibility, tradability, availability, certainty of

purchase price, and tax efficiencies. Equally of interest to investors

will be the relatively low expense ratios of the Funds, as compared to

those of their directly competitive traditional mutual funds, due to their

in-kind efficiencies in portfolio management as well as other reduced

infrastructure costs. Reductions in the cost of trading, clearing, custody

processes, shareholder reporting and accounting experienced by ETFs

currently trading should be similarly experienced by the Trusts and their

Funds. The last, but by no means least important, benefit is that

investors will have access to extensive information regarding the

Portfolio Positions of each Fund, and Deposit/Redemption Instruments.

Applicants believe that this updated information will be used also by fund

analysts, fund evaluation services, financial planners and advisers and

broker-dealers, among others, and will enhance general market knowledge

about each Fund's holdings as well as the performance of its Adviser

and/or Sub-Adviser.

16 of 29

Applicants have made every effort to structure the Funds in a way

that would not favor creators, redeemers and arbitrageurs over retail

investors buying and selling in the secondary market. Given that each Fund

will be managed to replicate or closely track its Underlying Index,

neither the Adviser nor Sub-Adviser will have latitude to change or

specify certain Deposit Instruments or Redemption Instruments to favor an

affiliate.

3. The Commission Should Grant the Exemptive Relief Requested in

This Application.

In summary, Applicants believe that the Trusts and the Funds will

operate in the same manner as existing ETFs, provide necessary safeguards

against shareholder discrimination and potential conflicts of interest,

and create no new regulatory concerns. Applicants submit that the benefits

offered to potential investors are varied and useful, and that the Trusts

and the Funds are appropriate candidates for the requested Relief.

Based on the foregoing, Applicants respectfully request the Relief

as set forth below.

III. IN SUPPORT OF THE APPLICATION

Except as noted herein, the Funds will operate in a manner identical to

that described in the Prior Application. The requested relief would amend the

Prior Order, primarily with respect to the Affiliated Index Funds, to adopt the

Alternative Approach which the Commission has recently approved. The Funds will

comply with the terms and conditions of the Prior Order, except as described in

this Application.

Based on the above, Applicants believe that (i) with respect to the relief

requested pursuant to Section 6(c) of the Act, the requested exemption for the

proposed transactions is appropriate in the public interest and consistent with

the protection of investors and the purposes fairly intended by the policy and

provisions of the Act and (ii) with respect to the relief requested pursuant to

Section 17(b) of the Act, the proposed transactions are reasonable and fair and

do not involve overreaching on the part of any person concerned; the proposed

transactions are or will be consistent with the policy of each Fund; and the

proposed transactions are consistent with the general purposes of the Act.

IV. PRECEDENT

Applicants' requested relief is substantially the same as that granted in

the New Self-Indexing Orders.(21)

(21) See note 5, supra.

17 of 29

V. REQUEST FOR AMENDED ORDER

Applicants respectfully request that the Commission grant an Order

amending the Prior Order.

VI. CONDITIONS TO THE APPLICATION

Applicants agree that the Order will be subject to the conditions set

forth in the Prior Application and, in addition, the following two new

conditions:

1. Each Affiliated Index Fund, Long/Short Fund and 130/30 Fund will post

on the Website on each Business Day, before commencement of trading of

Shares on the Exchange, the Fund's Portfolio Positions.

2. No Adviser or any Sub-Adviser to an Affiliated Index Fund, directly or

indirectly, will cause any Authorized Participant (or any investor on whose

behalf an Authorized Participant may transact with the Affiliated Index

Fund) to acquire any Deposit Instrument for an Affiliated Index Fund

through a transaction in which the Affiliated Index Fund could not engage

directly.

VII. NAMES AND ADDRESSES

Pursuant to Rule 0-2(f) under the Act, the following are the names and

addresses of Applicants:

First Trust Advisors L.P.

First Trust Portfolios L.P.

First Trust Exchange-Traded Fund

First Trust Exchange-Traded Fund II

First Trust Exchange-Traded Fund III

First Trust Exchange-Traded Fund IV

First Trust Exchange-Traded Fund V

First Trust Exchange-Traded Fund VI

First Trust Exchange-Traded Fund VII

First Trust Exchange-Traded AlphaDEX(R) Fund

First Trust Exchange-Traded AlphaDEX(R) Fund II

120 East Liberty Drive

Suite 400

Wheaton, Illinois 60187

18 of 29

All questions concerning this Application should be directed to the

persons listed on the facing page of this Application.

FIRST TRUST EXCHANGE-TRADED FUND

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

FIRST TRUST EXCHANGE-TRADED FUND II

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

FIRST TRUST EXCHANGE-TRADED FUND III

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

FIRST TRUST EXCHANGE-TRADED FUND IV

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

FIRST TRUST EXCHANGE-TRADED FUND V

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

FIRST TRUST EXCHANGE-TRADED FUND VI

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

19 of 29

FIRST TRUST EXCHANGE-TRADED FUND VII

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

FIRST TRUST EXCHANGE-TRADED AlphaDEX(R)

FUND

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

FIRST TRUST EXCHANGE-TRADED AlphaDEX(R)

FUND II

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

|

FIRST TRUST ADVISORS L.P.

By: /s/ James A. Bowen

---------------------------------

Name: James A. Bowen

Title: Chief Executive Officer

|

FIRST TRUST PORTFOLIOS L.P.

By: /s/ James A. Bowen

---------------------------------

Name: James A. Bowen

Title: Chief Executive Officer

Dated: November 13, 2013

|

20 of 29

VIII. AUTHORIZATION AND SIGNATURES

In accordance with Rule 0-2(c) under the Act, the Applicant states that

all actions necessary to authorize the execution and filing of this Application

have been taken, and the persons signing and filing this document are authorized

to do so on behalf of First Trust Advisors L.P. James A. Bowen is authorized to

sign and file this document on behalf of First Trust Advisors L.P., pursuant to

the general authority vested in him as Chief Executive Officer.

FIRST TRUST ADVISORS L.P.

By: /s/ James A. Bowen

---------------------------------

Name: James A. Bowen

Title: Chief Executive Officer

Dated: November 13, 2013

|

21 of 29

IX. AUTHORIZATION AND SIGNATURES

In accordance with Rule 0-2(c) under the Act, the Applicants state that

all actions necessary to authorize the execution and filing of this Application

have been taken, and the persons signing and filing this document are authorized

to do so on behalf of each Existing Trust. Mark R. Bradley is authorized to sign

and file this document on behalf of the Existing Trusts, pursuant to the general

authority vested in him as President and pursuant to resolutions adopted by the

respective Boards of Trustees which are attached as Appendix A-1 Such

resolutions continue to be in force and have not been revoked through the date

hereof.

FIRST TRUST EXCHANGE-TRADED FUND

FIRST TRUST EXCHANGE-TRADED FUND II

FIRST TRUST EXCHANGE-TRADED FUND III

FIRST TRUST EXCHANGE-TRADED FUND IV

FIRST TRUST EXCHANGE-TRADED FUND V

FIRST TRUST EXCHANGE-TRADED FUND VI

FIRST TRUST EXCHANGE-TRADED FUND VII

FIRST TRUST EXCHANGE-TRADED AlphaDEX(R)

FUND

FIRST TRUST EXCHANGE-TRADED AlphaDEX(R)

FUND II

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

Title: President

Dated: November 13, 2013

|

22 of 29

X. AUTHORIZATION AND SIGNATURES

In accordance with Rule 0-2(c) under the Act, the Applicant states that

all actions necessary to authorize the execution and filing of this Application

have been taken, and the persons signing and filing this document are authorized

to do so on behalf of First Trust Portfolios L.P. James A. Bowen is authorized

to sign and file this document on behalf of First Trust Portfolios L.P.,

pursuant to the general authority vested in him as Chief Executive Officer.

FIRST TRUST PORTFOLIOS L.P.

By: /s/ James A. Bowen

---------------------------------

Name: James A. Bowen

Title: Chief Executive Officer

Dated: November 13, 2013

|

23 of 29

VERIFICATION OF APPLICATION AND STATEMENT OF FACT

In accordance with Rule 0-2(d) under the Act, the undersigned states that

he has duly executed the attached Application for an order, for and on behalf of

FIRST TRUST ADVISORS L.P.; that he is Chief Executive Officer of such company;

and that all actions taken by the stockholders, directors and other bodies

necessary to authorize the undersigned to execute and file such instrument have

been taken. The undersigned further states that he is familiar with such

instrument, and the contents thereof, and that the facts therein set forth are

true to the best of his knowledge, information and belief.

By: /s/ James A. Bowen

---------------------------------

Name: James A. Bowen

|

24 of 29

VERIFICATION OF APPLICATION AND STATEMENT OF FACT

In accordance with Rule 0-2(d) under the Act, the undersigned states that

he has duly executed the attached Application for an order, for and on behalf of

FIRST TRUST EXCHANGE-TRADED FUND, FIRST TRUST EXCHANGE-TRADED FUND II, FIRST

TRUST EXCHANGE-TRADED FUND III, FIRST TRUST EXCHANGE-TRADED FUND IV, FIRST TRUST

EXCHANGE-TRADED FUND V, FIRST TRUST EXCHANGE-TRADED FUND VI, FIRST TRUST

EXCHANGE-TRADED FUND VII, FIRST TRUST EXCHANGE-TRADED AlphaDEX(R) FUND and FIRST

TRUST EXCHANGE-TRADED AlphaDEX(R) FUND II; that he is President of such

companies; and that all actions taken by the stockholders, directors and other

bodies necessary to authorize the undersigned to execute and file such

instrument have been taken. The undersigned further states that he is familiar

with such instrument, and the contents thereof, and that the facts therein set

forth are true to the best of his knowledge, information and belief.

By: /s/ Mark R. Bradley

---------------------------------

Name: Mark R. Bradley

|

25 of 29

VERIFICATION OF APPLICATION AND STATEMENT OF FACT

In accordance with Rule 0-2(d) under the Act, the undersigned states that

he has duly executed the attached Application for an order, for and on behalf of

FIRST TRUST PORTFOLIOS L.P.; that he is Chief Executive Officer of such company;

and that all actions taken by the stockholders, directors and other bodies

necessary to authorize the undersigned to execute and file such instrument have

been taken. The undersigned further states that he is familiar with such

instrument, and the contents thereof, and that the facts therein set forth are

true to the best of his knowledge, information and belief.

By: /s/ James A. Bowen

---------------------------------

Name: James A. Bowen

|

26 of 29

XII. APPENDIX A-1

THE BOARDS OF TRUSTEES OF EACH OF THE FIRST TRUST FUNDS LISTED ON SCHEDULE I

HERETO (COLLECTIVELY, THE "TRUSTS") EACH ADOPTED THE FOLLOWING RESOLUTIONS

WHEREAS, the Trusts, First Trust Advisors L.P. ("First Trust

Advisors") and First Trust Portfolios L.P. ("First Trust

Portfolios") previously received an order (Investment Company Act

Release No. 30610 (July 23, 2013)) (the "Original Order") from the

Securities and Exchange Commission (the "Commission") granting an

exemption from various provisions of the Investment Company Act of

1940 (the "1940 Act") to permit, among other things (a) series of

certain open-end management investment companies (each, a "Fund") to

issue shares ("Fund Shares") redeemable in large aggregations only

("Creation Unit Aggregations"); (b) secondary market transactions in

Fund Shares to occur at negotiated market prices; and (c) certain

affiliated persons of the Funds to deposit securities into, and

receive securities from, the Funds in connection with the purchase

and redemption of Creation Unit Aggregations; and

WHEREAS, subject to various terms and conditions set forth in

the exemptive application submitted to the Commission for the

Original Order (the "Affiliated Index Requirements"), the Original

Order permits, among other things, the Funds to track an underlying

index that is created, compiled, sponsored or maintained by (a)

First Trust Advisors or (b) an "affiliated person," as defined in

the 1940 Act, or an affiliated person of an affiliated person, of a

Trust, a Fund, First Trust Advisors, First Trust Portfolios, or a

sub-advisor or promoter of a Fund (an "Affiliated Index"); and

WHEREAS, the Trusts wish to modify or supercede the Original

Order, among other things, to replace the Affiliated Index

Requirements with alternative terms and conditions that the

Commission has permitted in connection with granting exemptive

relief to permit exchange-traded funds that track Affiliated Indexes

(the "New Affiliated Index Relief");

NOW THEREFORE BE IT

RESOLVED, that Mark R. Bradley, President of each Trust, and

any other appropriate officer of each Trust be, and each hereby is,

authorized to prepare, execute and submit to the Commission, on

behalf of the respective Trust and in its name, an Application or

Applications in such form as such officers, or any one of them,

27 of 29

deems necessary or appropriate to obtain the New Affiliated Index

Relief; and it is further

RESOLVED, that Mark R. Bradley and any other appropriate

officer of the respective Trust be, and each hereby is, authorized

and directed to take such additional actions and to execute and

deliver on behalf of the respective Trust such other documents or

instruments as he or she deems necessary or appropriate in

furtherance of the above resolution, including, without limitation,

the preparation, execution and filing of any necessary or

appropriate amendment(s) or supplement(s) to the above-described

Application or Applications, his or her authority therefor to be

conclusively evidenced by the taking of any such actions or the

execution or delivery of any such document; and it is further

RESOLVED, that upon issuance of an Order of Exemption by the

Commission in accordance with the terms and conditions of any

Application described above, the respective Trust is authorized to

act in accordance with the provisions of such Application and the

related Order of Exemption.

28 of 29

SCHEDULE I

First Trust Exchange-Traded Fund

First Trust Exchange-Traded Fund II

First Trust Exchange-Traded Fund III

First Trust Exchange-Traded Fund IV

First Trust Exchange-Traded Fund V

First Trust Exchange-Traded Fund VI

First Trust Exchange-Traded Fund VII

First Trust Exchange-Traded AlphaDEX(R) Fund

First Trust Exchange-Traded AlphaDEX(R) Fund II

29 of 29

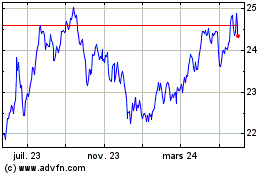

First Trust Global Tacti... (NASDAQ:FTGC)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

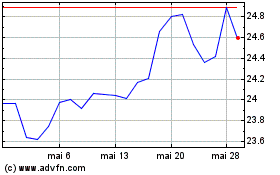

First Trust Global Tacti... (NASDAQ:FTGC)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025