false

--12-31

2024

Q1

0001788841

0001788841

2024-01-01

2024-03-31

0001788841

2024-05-20

0001788841

2024-03-31

0001788841

2023-12-31

0001788841

us-gaap:CommonClassAMember

2024-03-31

0001788841

us-gaap:CommonClassAMember

2023-12-31

0001788841

2023-01-01

2023-03-31

0001788841

mcom:ConvertiblePreferredStockSeriesBMember

2023-12-31

0001788841

mcom:ConvertiblePreferredStockSeriesAMember

2023-12-31

0001788841

mcom:ClassACommonStockMember

2023-12-31

0001788841

mcom:ClassBCommonStockMember

2023-12-31

0001788841

us-gaap:RetainedEarningsMember

2023-12-31

0001788841

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001788841

mcom:ConvertiblePreferredStockSeriesBMember

2022-12-31

0001788841

mcom:ConvertiblePreferredStockSeriesAMember

2022-12-31

0001788841

mcom:ClassACommonStockMember

2022-12-31

0001788841

mcom:ClassBCommonStockMember

2022-12-31

0001788841

us-gaap:RetainedEarningsMember

2022-12-31

0001788841

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001788841

2022-12-31

0001788841

mcom:ConvertiblePreferredStockSeriesBMember

2024-01-01

2024-03-31

0001788841

mcom:ConvertiblePreferredStockSeriesAMember

2024-01-01

2024-03-31

0001788841

mcom:ClassACommonStockMember

2024-01-01

2024-03-31

0001788841

mcom:ClassBCommonStockMember

2024-01-01

2024-03-31

0001788841

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001788841

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0001788841

mcom:ConvertiblePreferredStockSeriesBMember

2023-01-01

2023-03-31

0001788841

mcom:ConvertiblePreferredStockSeriesAMember

2023-01-01

2023-03-31

0001788841

mcom:ClassACommonStockMember

2023-01-01

2023-03-31

0001788841

mcom:ClassBCommonStockMember

2023-01-01

2023-03-31

0001788841

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001788841

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001788841

mcom:ConvertiblePreferredStockSeriesBMember

2024-03-31

0001788841

mcom:ConvertiblePreferredStockSeriesAMember

2024-03-31

0001788841

mcom:ClassACommonStockMember

2024-03-31

0001788841

mcom:ClassBCommonStockMember

2024-03-31

0001788841

us-gaap:RetainedEarningsMember

2024-03-31

0001788841

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001788841

mcom:ConvertiblePreferredStockSeriesBMember

2023-03-31

0001788841

mcom:ConvertiblePreferredStockSeriesAMember

2023-03-31

0001788841

mcom:ClassACommonStockMember

2023-03-31

0001788841

mcom:ClassBCommonStockMember

2023-03-31

0001788841

us-gaap:RetainedEarningsMember

2023-03-31

0001788841

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001788841

2023-03-31

0001788841

mcom:MobilityRevenuesMember

2024-01-01

2024-03-31

0001788841

mcom:MobilityRevenuesMember

2023-01-01

2023-03-31

0001788841

mcom:MediaRevenuesMember

2024-01-01

2024-03-31

0001788841

mcom:MediaRevenuesMember

2023-01-01

2023-03-31

0001788841

mcom:OtherRevenuesThirdPartiesMember

2024-01-01

2024-03-31

0001788841

mcom:OtherRevenuesThirdPartiesMember

2023-01-01

2023-03-31

0001788841

mcom:OtherRevenuesRelatedPartyMember

2024-01-01

2024-03-31

0001788841

mcom:OtherRevenuesRelatedPartyMember

2023-01-01

2023-03-31

0001788841

mcom:MobilityMember

2023-12-31

0001788841

mcom:MobilityMember

2024-01-01

2024-03-31

0001788841

mcom:MobilityMember

2024-03-31

0001788841

mcom:MediaRelatedPartyMember

2023-12-31

0001788841

mcom:MediaRelatedPartyMember

2024-01-01

2024-03-31

0001788841

mcom:MediaRelatedPartyMember

2024-03-31

0001788841

mcom:OtherRelatedPartyMember

2023-12-31

0001788841

mcom:OtherRelatedPartyMember

2024-01-01

2024-03-31

0001788841

mcom:OtherRelatedPartyMember

2024-03-31

0001788841

mcom:SharingElectricVehiclesMember

2024-03-31

0001788841

mcom:SharingElectricVehiclesMember

2023-12-31

0001788841

us-gaap:FurnitureAndFixturesMember

2024-03-31

0001788841

us-gaap:FurnitureAndFixturesMember

2023-12-31

0001788841

mcom:ComputerSoftwareMember

2024-03-31

0001788841

mcom:ComputerSoftwareMember

2023-12-31

0001788841

us-gaap:LeaseholdImprovementsMember

2024-03-31

0001788841

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001788841

us-gaap:CostOfSalesMember

2024-01-01

2024-03-31

0001788841

us-gaap:CostOfSalesMember

2023-01-01

2023-03-31

0001788841

us-gaap:ResearchAndDevelopmentExpenseMember

2024-01-01

2024-03-31

0001788841

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-03-31

0001788841

us-gaap:GeneralAndAdministrativeExpenseMember

2024-01-01

2024-03-31

0001788841

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-03-31

0001788841

mcom:SecuredConvertibleLoanNetMember

2024-03-31

0001788841

mcom:SecuredConvertibleLoanNetMember

2024-01-01

2024-03-31

0001788841

mcom:SecuredConvertibleLoanNetMember

2023-12-31

0001788841

us-gaap:ConvertibleDebtMember

2024-03-31

0001788841

us-gaap:ConvertibleDebtMember

2024-01-01

2024-03-31

0001788841

us-gaap:ConvertibleDebtMember

2023-12-31

0001788841

mcom:UnsecuredLoansNetMember

2024-03-31

0001788841

mcom:UnsecuredLoansNetMember

2024-01-01

2024-03-31

0001788841

mcom:UnsecuredLoansNetMember

2023-12-31

0001788841

mcom:RelatedPartyPromissoryNoteMember

2024-03-31

0001788841

mcom:RelatedPartyPromissoryNoteMember

2024-01-01

2024-03-31

0001788841

mcom:RelatedPartyPromissoryNoteMember

2023-12-31

0001788841

mcom:OtherFinancialLiabilitiesMember

2024-01-01

2024-03-31

0001788841

mcom:OtherFinancialLiabilitiesMember

2024-03-31

0001788841

mcom:OtherFinancialLiabilitiesMember

2023-12-31

0001788841

mcom:SecuredConvertibleLoanMember

2023-12-08

0001788841

mcom:SecuredConvertibleLoanMember

2023-12-01

2023-12-08

0001788841

mcom:SecuredConvertibleLoanMember

2024-01-01

2024-03-31

0001788841

mcom:SecuredConvertibleLoanMember

2024-03-31

0001788841

us-gaap:ConvertibleDebtMember

2023-11-13

0001788841

us-gaap:ConvertibleDebtMember

2023-11-01

2023-11-13

0001788841

us-gaap:InvestorMember

2022-07-15

0001788841

us-gaap:InvestorMember

2022-07-01

2022-07-15

0001788841

us-gaap:InvestorMember

2024-01-01

2024-03-31

0001788841

mcom:WheelsUnsecuredDebtsMember

2023-12-01

2023-12-28

0001788841

mcom:WheelsUnsecuredDebtsMember

2024-03-01

2024-03-26

0001788841

mcom:RelatedPartyPromissoryNotesMember

mcom:PalellaHoldingsLLCMember

2024-01-01

2024-03-31

0001788841

mcom:OperatingLeasesMember

2024-01-01

2024-03-31

0001788841

mcom:OperatingLeasesMember

2023-01-01

2023-03-31

0001788841

mcom:OperatingLeaseMember

2024-03-31

0001788841

us-gaap:OtherCurrentLiabilitiesMember

2024-01-01

2024-12-31

0001788841

us-gaap:OtherCurrentLiabilitiesMember

2023-01-01

2023-12-31

0001788841

mcom:WheelsMember

2024-01-01

2024-03-31

0001788841

mcom:MicromobilityMember

2024-01-01

2024-03-31

0001788841

srt:MinimumMember

2024-01-01

2024-03-31

0001788841

srt:MaximumMember

2024-01-01

2024-03-31

0001788841

mcom:EquityIncentivePlanMember

2024-01-01

2024-03-31

0001788841

mcom:EquityIncentivePlanMember

2023-01-01

2023-03-31

0001788841

mcom:EquityIncentivePlanCommonStockPurchaseOptionMember

2024-01-01

2024-03-31

0001788841

mcom:EquityIncentivePlanCommonStockPurchaseOptionMember

2023-01-01

2023-03-31

0001788841

us-gaap:ConvertibleDebtMember

2024-01-01

2024-03-31

0001788841

us-gaap:ConvertibleDebtMember

2023-01-01

2023-03-31

0001788841

mcom:CommonStocksToBeIssuedOutsideEquityIncentivePlansMember

2024-01-01

2024-03-31

0001788841

mcom:CommonStocksToBeIssuedOutsideEquityIncentivePlansMember

2023-01-01

2023-03-31

0001788841

mcom:CommonStockPurchaseWarrantsMember

2024-01-01

2024-03-31

0001788841

mcom:CommonStockPurchaseWarrantsMember

2023-01-01

2023-03-31

0001788841

mcom:MobilityMember

2024-01-01

2024-03-31

0001788841

mcom:MediaMember

2023-01-01

2023-03-31

0001788841

mcom:MediaMember

2024-01-01

2024-03-31

0001788841

mcom:MobilityMember

2023-01-01

2023-03-31

0001788841

mcom:AllOtherMember

2024-01-01

2024-03-31

0001788841

mcom:AllOtherMember

2023-01-01

2023-03-31

0001788841

country:IT

2024-01-01

2024-03-31

0001788841

country:IT

2023-01-01

2023-03-31

0001788841

country:US

2024-01-01

2024-03-31

0001788841

country:US

2023-01-01

2023-03-31

0001788841

mcom:AllOtherCountriesMember

2024-01-01

2024-03-31

0001788841

mcom:AllOtherCountriesMember

2023-01-01

2023-03-31

0001788841

country:IT

2024-03-31

0001788841

country:IT

2023-12-31

0001788841

country:US

2024-03-31

0001788841

country:US

2023-12-31

0001788841

mcom:AllOtherCountriesMember

2024-03-31

0001788841

mcom:AllOtherCountriesMember

2023-12-31

0001788841

mcom:HelbizMediaMember

2024-01-01

2024-03-31

0001788841

mcom:HelbizSerbiaMember

2024-01-01

2024-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarter ended March 31, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

Commission file number: 001-39136

| micromobility.com, Inc. |

| (Exact Name of Registrant as Specified in Its Charter) |

| Delaware |

|

84-3015108 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

500 Broome St., New York, NY 10013

(Address of principal executive offices)

(917) 675-7157

(Issuer’s telephone number)

(Former name or former address, if changed since last

report.)

Securities registered pursuant to Section 12(b) of

the Act: None.

Check whether the issuer (1) filed all reports required

to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See

definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 20, 2024, 45,185,172 shares of common stock,

par value $0.00001 per share, were issued and outstanding.

MICROMOBILITY.COM, INC.

FORM 10-Q FOR THE QUARTER ENDED MARCH 31, 2024

TABLE OF CONTENTS

i

PART 1 – FINANCIAL INFORMATION

Item 1. Interim Financial Statements.

Micromobility.com,

Inc.

(Formerly

Helbiz, Inc.)

Condensed Consolidated

Balance Sheets

(in thousands, except share

and per share data)

(unaudited)

| | |

| |

|

| | |

March 31, | |

December 31, |

| | |

2024 | |

2023 |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 127 | | |

$ | 128 | |

| Accounts receivables | |

| 485 | | |

| 704 | |

| Accounts receivables - Related Party | |

| 1,344 | | |

| — | |

| VAT receivables | |

| 79 | | |

| 928 | |

| Prepaid and other current assets | |

| 1,070 | | |

| 1,268 | |

| Total current assets | |

| 3,105 | | |

| 3,028 | |

| Property, equipment and deposits, net | |

| 2,009 | | |

| 2,435 | |

| Right of use assets | |

| 905 | | |

| 1,180 | |

| Other assets | |

| 393 | | |

| 389 | |

| TOTAL ASSETS | |

$ | 6,412 | | |

$ | 7,032 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 11,312 | | |

$ | 11,598 | |

| Accounts payable related to media rights | |

| 8,508 | | |

| 11,394 | |

| Accrued expenses and other current liabilities | |

| 11,530 | | |

| 9,549 | |

| Deferred revenues | |

| 4,858 | | |

| 1,558 | |

| Operating lease liabilities | |

| 361 | | |

| 462 | |

| Short term financial liabilities, net | |

| 14,708 | | |

| 13,528 | |

| Total current Liabilities | |

| 51,277 | | |

| 48,089 | |

| Non-current financial liabilities, net | |

| 1,575 | | |

| 1,842 | |

| Operating lease liabilities | |

| 675 | | |

| 861 | |

| Other non-current liabilities | |

| 18 | | |

| 42 | |

| TOTAL LIABILITIES | |

| 53,545 | | |

| 50,834 | |

| Commitments and contingencies | |

| Note 9 | | |

| | |

| | |

| | | |

| | |

| STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Preferred stock, $0.00001 par value; 100,000,000 shares authorized; none issued and outstanding | |

| — | | |

| — | |

| Class A Common stock, $0.00001 par value; 900,000,000 shares authorized and; 45,185,172 and 8,856,230 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively. | |

| 210,950 | | |

| 210,339 | |

| Accumulated other comprehensive loss | |

| (1,567 | ) | |

| (2,144 | ) |

| Accumulated deficit | |

| (256,516 | ) | |

| (251,997 | ) |

| Total Stockholders’ deficit | |

| (47,133 | ) | |

| (43,802 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

$ | 6,412 | | |

| 7,032 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

Micromobility.com,

Inc.

(Formerly

Helbiz, Inc.)

Condensed Consolidated

Statements of Operations and Comprehensive Loss

(in thousands, except share

and per share data)

(unaudited)

| | |

| |

|

| | |

Three Months Ended March 31, |

| | |

2024 | |

2023 |

| Revenue | |

$ | 571 | | |

$ | 3,919 | |

| Operating expenses: | |

| | | |

| | |

| Cost of revenue | |

| 908 | | |

| 11,067 | |

| General and administrative | |

| 3,529 | | |

| 6,232 | |

| Sales and marketing | |

| 275 | | |

| 1,239 | |

| Research and development | |

| 175 | | |

| 843 | |

| Total operating expenses | |

| 4,887 | | |

| 19,381 | |

| | |

| | | |

| | |

| Loss from operations | |

| (4,316 | ) | |

| (15,463 | ) |

| | |

| | | |

| | |

| Non-operating income (expenses), net | |

| | | |

| | |

| Interest expense, net | |

| (864 | ) | |

| (1,701 | ) |

| Gain on extinguishment of financial debts | |

| 728 | | |

| — | |

| SEPA financial expenses, net | |

| (102 | ) | |

| (2,208 | ) |

| Other income (expenses), net | |

| 35 | | |

| (179 | ) |

| Total non-operating income (expenses), net | |

| (203 | ) | |

| (4,088 | ) |

| | |

| | | |

| | |

| Income Taxes | |

| — | | |

| (3 | ) |

| Net loss | |

$ | (4,519 | ) | |

$ | (19,554 | ) |

| | |

| | | |

| | |

| Net loss per share attributable to common stockholders, basic and diluted | |

$ | (0.17 | ) | |

$ | (529.18 | ) |

| | |

| | | |

| | |

| Weighted-average number of shares outstanding used to compute net loss per share, basic and diluted | |

| 26,632,566 | | |

| 36,951 | |

| | |

| | | |

| | |

| Net loss | |

| (4,519 | ) | |

| (19,554 | ) |

| | |

| | | |

| | |

| Other comprehensive (loss) income, net of tax: | |

| | | |

| | |

| Changes in foreign currency translation adjustments | |

| 577 | | |

| (247 | ) |

| | |

| | | |

| | |

| Net loss and comprehensive income | |

$ | (3,942 | ) | |

$ | (19,801 | ) |

The accompanying notes are an integral

part of these condensed consolidated financial statements.

Micromobility.com,

Inc.

(Formerly

Helbiz, Inc.)

Condensed Consolidated Statements of Stockholders’

Deficit for the three months ended March 31, 2024

(in thousands, except share and per share data

which account for two reverse Splits occurred during year ended December 31, 2023)

(unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Class A Common Stock | |

Accumulated | |

Accumulated Other Comprehensive | |

TOTAL STOCKHOLDERS’ |

| | |

Shares | |

Amount | |

Deficit | |

(Loss) Income | |

DEFICIT |

| Balance as of January 1, 2024 | - |

- | 8,856,230 | | |

$ | 210,339 | | - |

$ | (251,997 | ) | |

$ | (2,144 | ) | |

| (43,802 | ) |

| Issuance of common shares – for Advance Notices under SEPA | |

| 35,400,000 | | |

| 564 | | |

| — | | |

| — | | |

| 564 | |

| Issuance of common shares – for Settlement of financial liabilities | |

| 928,942 | | |

| 6 | | |

| — | | |

| — | | |

| 6 | |

| Share based compensation | |

| — | | |

| 42 | | |

| — | | |

| — | | |

| 42 | |

| Changes in currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| 577 | | |

| 577 | |

| Net loss | - |

- | — | | |

| — | | - |

| (4,519 | ) | |

| — | | |

| (4,519 | ) |

| Balance as of March 31, 2024 | - |

- | 45,185,172 | | |

| 210,950 | | - |

$ | (256,516 | ) | |

$ | (1,567 | ) | |

$ | (47,133 | ) |

The accompanying notes are an integral part of these

condensed consolidated financial statements.

Micromobility.com,

Inc.

(Formerly

Helbiz, Inc.)

Condensed Consolidated Statements of Convertible

Preferred Stock Stockholders’ Deficit for the three months ended March 31, 2023

(in thousands, except share and per share data

which account for two reverse Splits occurred during year ended December 31, 2023)

(unaudited)

| | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | |

SERIES B –PREFERRED | |

SERIES A – CONVERTIBLE PREFERRED | |

Class A Common Stock | |

Class B Common Stock | |

Accumulated | |

Accumulated Other Comprehensive | |

TOTAL STOCKHOLDERS’ |

| | |

STOCK | |

STOCK | |

Shares | |

Amount | |

Shares | |

Amount | |

Deficit | |

(Loss) Income | |

DEFICIT |

| Balance as of January 1, 2023 | |

$ | — | | |

$ | 945 | | |

| 21,802 | | |

$ | 152,996 | | |

| 1,897 | | |

$ | — | | |

$ | (189,942 | ) | |

$ | (2,904 | ) | |

| (39,850 | ) |

| Issuance of common shares – for Advance Notices under SEPA | |

| — | | |

| — | | |

| 14,003 | | |

| 18,105 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 18,105 | |

| Issuance of common shares – for Conversion of Convertible Notes | |

| — | | |

| — | | |

| 691 | | |

| 1,296 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,296 | |

| Issuance of common stock – for Conversion of Series A Convertible Preferred Stocks | |

| — | | |

| (945 | ) | |

| 904 | | |

| 945 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 945 | |

| Issuance of common shares – for purchasing Intangible Assets | |

| — | | |

| — | | |

| 46 | | |

| 50 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 50 | |

| Issuance of common shares – for settlement of Payroll liabilities | |

| — | | |

| — | | |

| 87 | | |

| 78 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 78 | |

| Share based compensation | |

| — | | |

| — | | |

| — | | |

| 418 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 418 | |

| Issuance of Series B Preferred Stock | |

| 0 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 0 | |

| Redemption of Series B Preferred Stock | |

| (0 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (0 | ) |

| Changes in currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (247 | ) | |

| (247 | ) |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (19,554 | ) | |

| — | | |

| (19,554 | ) |

| Balance as of March 31, 2023 | |

$ | — | | |

$ | — | | |

| 37,533 | | |

| 173,889 | | |

| 1,897 | | |

$ | 0 | | |

$ | (209,496 | ) | |

$ | (3,151 | ) | |

$ | (38,758 | ) |

The accompanying notes are an integral part of these

condensed consolidated financial statements.

Micromobility.com,

Inc.

(Formerly

Helbiz, Inc.)

Condensed Consolidated Statements of Cash

Flows

(in thousands, except share and per share

data)

(unaudited)

| | |

| |

|

| | |

Three months ended March 31, |

| | |

2024 | |

2023 |

| Operating activities | |

| | | |

| | |

| Net loss | |

$ | (4,519 | ) | |

$ | (19,554 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 449 | | |

| 1,784 | |

| Loss on disposal of assets | |

| 73 | | |

| 10 | |

| Non-cash interest expenses and amortization of debt discount | |

| 784 | | |

| 510 | |

| Amortization of Right-of-use assets | |

| 118 | | |

| 462 | |

| Share-based compensation | |

| 42 | | |

| 762 | |

| (Gain) or Loss on extinguishment of debts | |

| (728 | ) | |

| — | |

| Other non-cash activities | |

| 2 | | |

| (33 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivables | |

| (1,125 | ) | |

| 793 | |

| Prepaid and other assets | |

| 1,029 | | |

| 2,706 | |

| Accounts payables | |

| (3,279 | ) | |

| (63 | ) |

| Accrued expenses and other current liabilities | |

| 5,276 | | |

| (309 | ) |

| Other non-current liabilities | |

| (26 | ) | |

| 44 | |

| Net cash used in operating activities | |

| (1,904 | ) | |

| (12,886 | ) |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchase of property, equipment, and vehicle deposits | |

| (60 | ) | |

| (202 | ) |

| Purchase of intangible assets | |

| — | | |

| (154 | ) |

| Net cash used in investing activities | |

| (60 | ) | |

| (356 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Gross proceeds from issuance of financial liabilities | |

| 110 | | |

| 4,190 | |

| Repayment of financial liabilities | |

| (655 | ) | |

| (8,671 | ) |

| Proceeds from issuance of financial liabilities, due to related party - Officer | |

| 1,505 | | |

| — | |

| Payments of offering costs and underwriting discounts and commissions | |

| — | | |

| (15 | ) |

| Gross proceeds from sale of Class A common shares | |

| 564 | | |

| 18,105 | |

| Net cash provided by financing activities | |

| 1,524 | | |

| 13,609 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents, and restricted cash | |

| (440 | ) | |

| 367 | |

| Effect of exchange rate changes | |

| 424 | | |

| (145 | ) |

| Net increase (decrease) in cash and cash equivalents, and restricted cash | |

| (16 | ) | |

| 222 | |

| Cash and cash equivalents, and restricted cash, beginning of year | |

| 143 | | |

| 736 | |

| Cash and cash equivalents, and restricted cash, end of year | |

$ | 127 | | |

$ | 958 | |

| | |

| | | |

| | |

| RECONCILIATION OF CASH, CASH EQUIVALENT AND RESTRICTED CASH TO THE CONSOLIDATED BALANCE SHEET | |

| | | |

| | |

| Cash and cash equivalents | |

| 127 | | |

| 648 | |

| Restricted cash, included in Current assets | |

| — | | |

| 310 | |

| Supplemental disclosure of cash flow information | |

| | | |

| | |

| Cash paid for: | |

| | | |

| | |

| Interest | |

$ | 73 | | |

$ | 1,186 | |

| Income taxes, net of refunds | |

$ | — | | |

$ | 3 | |

| Non-cash investing & financing activities | |

| | | |

| | |

| Issuance of common shares – for Conversion of Convertible Notes | |

| — | | |

| 1,296 | |

| Issuance of common shares – for conversion of Series A Preferred Shares | |

| — | | |

| 945 | |

| Issuance of common shares - for Settlement of Payroll Liabilities | |

| — | | |

| 78 | |

| Issuance of common shares – for purchasing Intangible Assets | |

| — | | |

| 50 | |

| Issuance of common shares – for conversion of financial liabilities | |

| 6 | | |

| — | |

| Lease agreements early termination | |

| 286 | | |

| — | |

| Recognition of new lease agreements | |

| — | | |

| 761 | |

The accompanying notes are an integral

part of these condensed consolidated financial statements.

Micromobility.com,

Inc.

(Formerly

Helbiz, Inc.)

Notes to Condensed Consolidated Financial

Statements

(in thousands, except share and per share

data)

(Unaudited)

1. Description of Business and Basis of Presentation

Description of Business

micromobility.com, Inc.

(formerly known as Helbiz, Inc., and, together with its subsidiaries, “micromobility.com” or the “Company”) was

incorporated in the state of Delaware in October 2015 with its headquarters in New York, New York. The Company is an intra-urban transportation

company that seeks to help urban areas reduce their dependency on individually owned cars by offering affordable, accessible, and sustainable

forms of personal transportation, specifically addressing first and last mile transport.

Founded on proprietary technology

platforms, the Company’s core business is the offering of electric vehicles in the sharing environment. Through its Mobility App,

the Company offers an intra-urban transportation solution that allows users to instantly rent electric vehicles.

The Company currently has

electric vehicles operating in the United States and Europe.

Basis of Presentation

These accompanying unaudited

condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United

States of America (“U.S. GAAP”) and include the accounts of the Company and its wholly-owned subsidiaries. All intercompany

balances and transactions have been eliminated.

The Company uses the U.S.

dollar as the functional currency. For foreign subsidiaries where the U.S. dollar is the functional currency, gains, and losses from remeasurement

of foreign currency balances into U.S. dollars are included in the condensed consolidated statements of operations. For the foreign subsidiary

where the local currency is the functional currency, translation adjustments of foreign currency financial statements into U.S. dollars

are recorded to a separate component of accumulated other comprehensive loss.

The condensed consolidated

balance sheet as of December 31, 2023, included herein was derived from the audited financial statements as of that date. Certain information

and note disclosures normally included in the financial statements prepared in accordance with U.S. GAAP have been condensed or omitted

pursuant to such rules and regulations. As such, the information included in this Quarterly Report on Form 10-Q should be read in conjunction

with the audited consolidated financial statements and the related notes thereto as of, and for the year ended, December 31, 2023, included

in our Annual Report on Form 10-K.

The accompanying unaudited

condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and,

in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to state fairly the

Company’s financial position, results of operations, comprehensive loss, stockholders’ equity, and cash flows, but are not

necessarily indicative of the results of operations to be anticipated for any future annual or interim period.

2. Going Concern and Management’s Plans

The Company has experienced

recurring operating losses and negative cash flows from operating activities since its inception. To date, these operating losses have

been funded primarily from outside sources of invested capital. The Company had, and expects to continue to have, an ongoing need to raise

additional cash from outside sources to fund its operations. Successful transition to attaining profitable operations depends upon achieving

a level of revenues adequate to support the Company’s cost structure. These conditions raise substantial doubt about the Company’s

ability to continue as a going concern within one year after the date that the financial statements are issued.

The Company plans to continue

to fund its operations through debt and equity financing. Debt or equity financing may not be available on a timely basis on terms acceptable

to the Company, or at all.

The accompanying condensed

consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction

of liabilities in the normal course of business and, as such, the financial statements do not include any adjustments relating to the

recoverability and classification of recorded amounts or amounts and classification of liabilities that might be necessary should the

Company be unable to continue in existence.

3. Summary of Significant Accounting Policies and Use of Estimates

Use of Estimates

The preparation of financial

statements in conformity with U.S. GAAP generally requires management to make estimates and assumptions that affect the reported amount

of certain assets, liabilities, revenues, and expenses, and the related disclosure of contingent assets and liabilities. Specific accounts

that require management estimates include determination of fair values of warrant and financial instruments.

Management bases its estimates

on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which

form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates under different assumptions or conditions.

Recent Accounting Pronouncements Not Yet Adopted

In November 2023, the FASB

issued ASU No. 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures”, which amends and

enhances the disclosure requirements for reportable segments. All disclosure requirements under this standard will also be required for

public entities with a single reportable segment. The new standard will be effective for the Company for fiscal years beginning after

December 15, 2023, including interim periods within fiscal years beginning after December 15, 2024. The Company is currently assessing

the impact of adopting this standard on the consolidated financial statements.

In December 2023, the FASB

issued ASU No. 2023-09, “Improvements to Income Tax Disclosures”, which requires companies to provide disaggregated information

about a reporting entity’s effective tax rate reconciliation as well as information on income taxes paid. The new requirements will

be effective for public business entities for fiscal periods beginning after December 15, 2024. The Company is currently assessing the

impact of adopting this standard on the consolidated financial statements.

4. Revenue Recognition

The table below shows the revenues breakdown for

the three months ended on March 31, 2024, and on March 31, 2023.

| Schedule of revenue recognition | |

| |

|

| | |

Three months ended March 31, |

| | |

2024 | |

2023 |

| Mobility Revenues | |

$ | 432 | | |

$ | 1,578 | |

| Media Revenues | |

| 12 | | |

| 2,086 | |

| Other Revenues – Third Parties | |

| — | | |

| 255 | |

| Other Revenues – Related Party | |

| 127 | | |

| — | |

| Total Revenues | |

$ | 571 | | |

$ | 3,919 | |

| | |

| | | |

| | |

During

the three months ended March 31, 2024, the Company entered into an Agreement on Business

Cooperation with Everli S.p.A. (entity owned by Micrmobility.com CEO) pursuant to which the Company has to provide Everli with software

development services. This agreement has no fixed term and may be terminated by either party with 30 days’ notice. The Company

categorized the revenues generated by this Agreement in Other Revenues

– Related Party.

The table below shows the Deferred revenues roll-forward

from January 1, 2024, to March 31, 2024.

| Schedule of deferred revenue | |

| |

| |

| |

| |

|

| Deferred Income | |

January 1, 2024 | |

FX Rate adj | |

Additions | |

Q1 2024 Revenues | |

March 31, 2024 |

| | |

| |

| |

| |

| |

|

| Mobility | |

$ | 1,558 | | |

| (4 | ) | |

| 354 | | |

| (432 | ) | |

| 1,476 | |

| Media – Related Party | |

| — | | |

| — | | |

| 3,184 | | |

| — | | |

| 3,184 | |

| Other – Related Party | |

| — | | |

| — | | |

| 325 | | |

| (127 | ) | |

| 198 | |

| Total | |

$ | 1,558 | | |

$ | (4 | ) | |

| 3,863 | | |

| (559 | ) | |

| 4,858 | |

Mobility Deferred Income is related to prepaid

customer wallets and it will be recorded as Mobility Revenues when riders take a ride.

Media Deferred Income is related to invoices

issued to a related party Everli S.p.A. (entity owned by Micrmobility.com

CEO) for services to be rendered during 2024, in accordance with a Service Supply Agreement.

Other

Deferred Income is related to invoices issued to a related party Everli S.p.A. (entity

owned by Micrmobility.com CEO) for services to be rendered during 2024, in accordance with the Agreement on Business Cooperation.

5. Property, equipment and vehicle deposits, net

Property, equipment and vehicle deposits, net

consist of the following:

| Schedule of consolidated income statement | |

| |

|

| | |

March 31, | |

December 31, |

| | |

2024 | |

2023 |

| Sharing electric vehicles | |

$ | 13,100 | | |

$ | 14,702 | |

| Furniture, fixtures, and equipment | |

| 1,287 | | |

| 1,379 | |

| Computers and software | |

| 1,063 | | |

| 1,069 | |

| Leasehold improvements | |

| 1,791 | | |

| 1,758 | |

| Total property and equipment, gross | |

| 17,241 | | |

| 18,908 | |

| Less: accumulated depreciation | |

| (15,232 | ) | |

| (16,473 | ) |

| Total property and equipment, net | |

$ | 2,009 | | |

$ | 2,435 | |

The following

table summarizes the loss on disposal and depreciation expenses recorded in the condensed consolidated statement of operations for the

three months ended on March 31, 2024, and 2023.

| Schedule of consolidated income statement | |

|

| | |

Three Months Ended March 31, |

| | |

2024 | |

2023 |

| Cost of revenues | |

$ | 350 | | |

$ | 1,351 | |

| Research & Development | |

| 15 | | |

| 15 | |

| General & administrative | |

| 156 | | |

$ | 108 | |

| Total depreciation and loss on disposal expenses | |

$ | 521 | | |

$ | 1,474 | |

6. Accrued expenses and other current liabilities

Accrued expenses and other current liabilities

consist of the following:

| Schedule of accrued expenses and other current liabilities | |

| |

|

| | |

March 31, | |

December 31, |

| | |

2024 | |

2023 |

| Legal contingencies – refer to Note 9 Commitments and Contingencies | |

$ | 5,969 | | |

$ | 3,978 | |

| Payroll liabilities | |

| 3,207 | | |

| 3,144 | |

| Accrued expenses | |

| 2,354 | | |

| 2,427 | |

| Total accrued expenses and other current liabilities | |

$ | 11,530 | | |

$ | 9,549 | |

7. Current and Non-current financial liabilities, net

The Company's Financial liabilities consisted

of the following:

| Schedule of financial liabilities | |

| |

| |

| |

|

| | |

Weighted Average Interest Rate | |

Maturity Date | |

March 31, 2024 | |

December 31, 2023 |

| Secured Convertible loan, net | |

| 9 | % | |

| 2024 | | |

| 3,226 | | |

| 3,764 | |

| Convertible debts, net | |

| 5 | % | |

| 2024 | | |

| 4,432 | | |

| 3,217 | |

| Unsecured loans, net | |

| 2 | % | |

| Various | | |

| 6,400 | | |

| 7,715 | |

| Related-Party Promissory Note | |

| 0 | % | |

| 2025 | | |

| 1,505 | | |

| — | |

| Other financial liabilities | |

| N/A | | |

| Various | | |

| 720 | | |

| 672 | |

| Total Financial Liabilities, net | |

| | | |

| | | |

| 16,283 | | |

| 15,370 | |

| Of which classified as Current Financial Liabilities, net | |

| | | |

| | | |

| 14,708 | | |

| 13,528 | |

| Of which classified as Non-Current Financial Liabilities, net | |

| | | |

| | | |

| 1,575 | | |

| 1,842 | |

The table below shows the

amounts recorded as Interest expense, net on the statements of operations for the three months ended on March 31, 2024, and March

31, 2023:

| Schedule of interest expense | |

| |

|

| | |

Three months Ended March 31, |

| | |

2024 | |

2023 |

| Secured Convertible loan | |

$ | (668 | ) | |

$ | — | |

| Convertible debt | |

| (130 | ) | |

| (932 | ) |

| Secured loan | |

| — | | |

| (540 | ) |

| Unsecured loans | |

| (59 | ) | |

| (224 | ) |

| Other interest income (expenses) | |

| (7 | ) | |

| (5 | ) |

| Total Interest expenses, net | |

$ | (864 | ) | |

$ | (1,701 | ) |

Secured convertible loan

On December 8, 2023, the

Company entered into a Secured Loan Agreement with YA II PN, Ltd. (the “Note holder”). The secured loan has a principal amount

of $5,750, with 37.5% issuance discount, December 8, 2024 as maturity date, 9.25% as annum interest rate and 13.25% as annum default interest

rate.

The secured loan shall be

convertible into shares of the Company’s Class A common stock at the option of the Note Holder, who could convert any portion of

the outstanding and unpaid conversion amount into fully paid and nonassessable shares of Common Stock in accordance with the Conversion

Price defined as $1.25.

As of March 31, 2024, the

Company has $5,916 outstanding as principal and accumulated interests, partially offset by $1,484 of debt discount.

Convertible debt

On November 13, 2023, the

Company entered into a Convertible debt with YA II PN, Ltd. (the “Note holder”). The convertible debt has a principal amount

of $4,000, with 15% issuance discount, 5% as annum interest rate, 15% as annum default interest rate and March 31, 2024 as maturity date.

During 2024, the Company and the Note holder amended the original maturity date from March 31, 2024 to December 31, 2024.

The debt shall be convertible

into shares of the Company’s Class A common stock at the option of the Note Holder, who could convert any portion of the outstanding

and unpaid conversion amount into fully paid and nonassessable shares of Common Stock in accordance with the Conversion Price defined

as $37.50.

During the three months ended March 31, 2024, the Company

partially repaid in cash for a cumulative payment of $122 (of which $116 was principal, and $6 were payment premium).

As a result of the above

repayments, on March 31, 2024, the Company has $3,521 as outstanding principal and accumulated interest, partially offset by $295 of debt

issuance discount.

Unsecured loans

2022 unsecured note

On July 15, 2022, the Company

issued an Unsecured Note to an investor in exchange for 2,000 Euro (approximately $2,210) with 6.75% as interest on an annual basis. In

March 2024, the Company entered into a Settlement agreement with the Note holder pursuant to which the Company’s obligations under

the original agreements, amounting to $2,381 (2,202 Euro), will be satisfied in exchange of a payment of $1,102 (995 Euro), to be paid

within June 30, 2024. As of March 31, 2024, the Company has $2,381 as outstanding principal and accumulated interest recorded as Short-term

financial liabilities.

Wheels unsecured debts

On December 28, 2023, the

Company entered into a second Loan Amendment which restructured the loan with the following terms and conditions:

| |

• |

$1,400 of the amount outstanding to be paid in cash on the earliest of: a) December 15, 2024, b) the date the Company will receive gross cash proceeds of at least $3 million from the offer and sale of any combination of Company’s equity securities or debt securities in a single transaction, or c) the date the Company will receive aggregate gross cash proceeds of at least $6 million from the offer and sale of any combination of Company’s equity securities or debt securities over the course of any series of transactions commencing from December 28, 2023. The interest shall cease to accrue from the amendment date; and |

| |

• |

$734 of the amount outstanding converted into 928,942 shares of Class A Common Stock. |

The Company issued the 928,942

shares of Class A Common Stock on March 26, 2024, recording a gain amounted to $728 for the reduction of the Company’s share price

from the Amendment date to the issuance date.

Related-Party Promissory Notes

During the three months ended March 31, 2024, Palella Holdings LLC,

an entity in which the Company’s CEO is the sole shareholder, provided to the Company $1,505. The Company has to repay Palella Holdings

LLC $1,505 on an interest free basis on January 31, 2025.

8. Leases

Operating leases

The table below presents

the impact on the condensed consolidated statement of operations related to the operating leases for the three months ended March 31,

2024, and March 31, 2023, including expenses related to lease agreements with an initial term of 12 months or less.

| Schedule of operating lease liabilities | |

| |

|

| | |

Three Months Ended March 31, |

| | |

2024 | |

2023 |

| Cost of revenues | |

$ | 160 | | |

$ | 386 | |

| General and administrative | |

| 41 | | |

| 295 | |

| Total Operating lease expenses | |

$ | 201 | | |

$ | 681 | |

Future annual minimum lease

payments as of March 31, 2024, are as follows:

| Schedule of future minimum lease

payments |

|

|

|

|

| Year ending December 31, |

|

Operating Leases |

|

|

| 2024 |

|

$ |

330 |

|

|

| 2025 |

|

|

184 |

|

|

| 2026 |

|

|

191 |

|

|

| Thereafter |

|

|

213 |

|

|

| Total minimum lease payments |

|

$ |

917 |

|

|

9. Commitments and Contingencies

Litigation

The Company is from time

to time involved in legal proceedings, claims, and regulatory matters, indirect tax examinations or government inquiries and investigations

that may arise in the ordinary course of business. Certain of these matters include speculative claims for substantial or indeterminate

amounts of damages.

The Company records a liability

when the Company believes that it is both probable that a loss has been incurred and the amount can be reasonably estimated. If the Company

determines that a loss is reasonably possible and the loss or range of loss can be estimated, the Company discloses the possible loss

in the consolidated financial statements. The Company reviews the developments in contingencies that could affect the amount of the provisions

that have been previously recorded. The Company adjusts provisions and changes to disclosures accordingly to reflect the impact of negotiations,

settlements, rulings, advice of legal counsel, and updated information. Significant judgment is required to determine both the probability

and the estimated amount of any potential losses and many of the legal proceedings are early in the discovery stage and unresolved.

As of December 31, 2024,

and December 31, 2023, the Company concluded that certain losses on litigation were probable and reasonable estimable; as a result, the

Company recorded as Accruals for legal contingencies, included in Other Current liabilities; $5,968 and $3,978, respectively.

The Company recorded

$2,000 and $0 on the Condensed Consolidated statement of operations for the three months ended March 31, 2024 and March 31, 2023, respectively;

included in General & Administrative expenses for additional contingency losses over litigations reasonably estimated and categorized

as probable.

As of March 31, 2024,

legal contingencies related to Wheels amounted to $1,555 while $4,413 are related to micromobility.com. In detail, Wheels has been named

in various lawsuits related to the use of Wheels’s vehicles in US cities and in certain matters involving California Labor Code

violations and the classification of individuals as independent contractors rather than employees. micromobility.com claims are related

to previous investors who claimed financial losses for breaching contractual obligations.

The range of loss for

the Company’s legal contingencies accrued is between $800 to $10,173 which represents the range between the amount already settled

with the counterparts and the amount claimed deducting insurance coverage.

The Company is also

involved in certain claims where the losses are not considered to be reasonably estimable or possible; for these claims the range of potential

loss is between 0 to $3,050.

10. Standby Equity Purchase Agreement

During the year ended December

31, 2023, the Company entered into two Standby Equity Purchase Agreements (“2023 SEPAs”) with an investor. The 2023 SEPAs

terms and conditions represent: i) at inception - a purchased put option on

the Company’s Class A common shares and, ii) upon delivery of an advance notice - a forward contract on the Company’s

Class A common shares. Neither the purchased put option nor the forward contract qualify for equity classification.

As a result of the above

classification the settlement of forward contracts initiated by the Company were recorded as other SEPA financial income (expense),

net.

The table below presents

the impact on the condensed consolidated statement of operations related to the 2023 SEPAs for the three months ended March 31, 2024,

and 2023.

| Schedule of condensed consolidated statement of operations related to 2023 SEPAs | |

| |

|

| | |

Three Months Ended March 31, |

| | |

2024 | |

2023 |

| SEPAs transaction costs | |

$ | — | | |

$ | (1,611 | ) |

| Other SEPA financial income (expenses), net | |

$ | (102 | ) | |

$ | (597 | ) |

| Total SEPA financial income (expenses), net | |

$ | (102 | ) | |

$ | (2,208 | ) |

During the three months

ended March 31, 2024, the Company delivered multiple advance notices for the sale of 35,400,000 Class A Common Shares, resulting in cumulative

gross proceeds of $564.

11. Share based compensation expenses

Stock-based compensation expense is allocated

based on (i) the cost center to which the award holder belongs, for employees, and (ii) the service rendered to the Company, for third-party

consultants. The following table summarizes total stock-based compensation expense by account for the three months ended March 31, 2024

and 2023.

| Schedule of stock-based compensation expenses |

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Cost of revenue |

|

|

1 |

|

|

|

2 |

|

| Research and development |

|

|

12 |

|

|

|

31 |

|

| Sales and marketing |

|

|

8 |

|

|

|

26 |

|

| SEPA financial expenses |

|

|

— |

|

|

|

186 |

|

| General and administrative |

|

|

21 |

|

|

|

518 |

|

| Total Share based compensation expenses, net |

|

|

42 |

|

|

|

762 |

|

| Of which related to shares not issued for services rendered during the period, accrued as Account payables |

|

|

|

|

|

|

344 |

|

12. Net Loss Per Share - Dilutive outstanding

shares

The following potentially

dilutive outstanding shares (considering a retroactive application of the reverse splits occurred during 2023) were excluded from the

computation of diluted net loss per share for the periods presented because including them would have had an anti-dilutive effect, or

issuance of such shares is contingent upon the satisfaction of certain conditions which were not satisfied by the end of the period.

| Schedule of dilutive outstanding shares | |

| |

|

| | |

Three months ended March 31, |

| | |

2024 | |

2023 |

| Equity Incentive Plan - Common Stock Purchase Option | |

| 1,050 | | |

| 1,097 | |

| Convertible Notes | |

| 4,826,315 | | |

| 4,475 | |

| Common Stocks to be issued outside equity incentive Plans | |

| 28,397 | | |

| 714 | |

| Common Stock Purchase Warrants | |

| 2,641 | | |

| 1,578 | |

| Total number of Common Shares not included in the EPS Basic and diluted | |

| 4,858,403 | | |

| 7,864 | |

13. Segment and geographic information

The following table provides

information about our segments and a reconciliation of the total segment Revenue and Cost of revenue to loss from operations.

| Schedule of segment revenue and cost of revenue | |

| |

|

| | |

Three months ended March 31, |

| | |

2024 | |

2023 |

| Revenue | |

| |

|

| Mobility | |

| 432 | | |

| 1,578 | |

| Media | |

| 12 | | |

| 2,086 | |

| All Other | |

| 127 | | |

| 255 | |

| Total Revenue | |

$ | 571 | | |

$ | 3,919 | |

| | |

| | | |

| | |

| Cost of revenue | |

| | | |

| | |

| Mobility | |

| (778 | ) | |

| (4,608 | ) |

| Media | |

| (1 | ) | |

| (5,610 | ) |

| All Other | |

| (129 | ) | |

| (849 | ) |

| Total Cost of revenues | |

$ | (908 | ) | |

$ | (11,067 | ) |

| | |

| | | |

| | |

| Reconciling Items: | |

| | | |

| | |

| Research and development | |

| (175 | ) | |

| (843 | ) |

| Sales and marketing | |

| (275 | ) | |

| (1,239 | ) |

| General and administrative | |

| (3,529 | ) | |

| (6,232 | ) |

| Loss from operations | |

$ | (4,316 | ) | |

$ | (15,463 | ) |

Revenue by geography is based on where the

trip was completed, or media content occurred. The following table set forth revenue by geographic area for the three months ended March

31, 2024, and 2023.

| Schedule of revenue by geography | |

| |

|

| | |

Three months ended March 31, |

| | |

2024 | |

2023 |

| Revenue | |

| |

|

| Italy | |

| 59 | | |

| 3,148 | |

| United States | |

| 385 | | |

| 771 | |

| All other countries | |

| 127 | | |

| — | |

| Total Revenue | |

$ | 571 | | |

$ | 3,919 | |

Long-lived assets, net includes

property and equipment, intangible assets, goodwill and other assets. The following table set forth long-lived assets, net by geographic

area as of March 31, 2024, and December 31, 2023.

| Schedule of intangible assets, goodwill and other assets | |

| |

|

| | |

March 31, | |

December 31, |

| Non-Current Assets | |

2024 | |

2023 |

| Italy | |

$ | 1,058 | | |

$ | 1,273 | |

| United States | |

| 2,173 | | |

| 2,644 | |

| All other countries | |

| 77 | | |

| 87 | |

| Total Non-Current Assets | |

$ | 3,307 | | |

$ | 4,004 | |

14. Related Party Transactions

Agreements

with Everli S.p.A.

In the first quarter

of 2024, the Company entered into two business agreements with Everli S.p.A. which is a related party as the Company’s President

and Chief Executive Officer has a majority equity interest in Everli S.p.A.

Helbiz Media, an Italian

subsidiary of micromobility.com, entered into a Service Supply Agreement with Everli S.p.A. requiring Helbiz Media to provide design,

development, and communication ideas and activities to Everli for one year. Under the terms of the agreement, Everli is to pay the Company

$6,500. Under the mentioned agreement during the three months ended March 31, 2024, the Company issued invoices amounting to $3,184 of

which none have been paid.

Helbiz Serbia, the Serbian

subsidiary of micromobility.com, entered into a Business Cooperation Agreement with Everli S.p.A. requiring Helbiz Serbia to provide software

development services and services for preparing Everli S.p.A. for an initial public offering. During the three months ended March 31,

2024, pursuant to the Agreement, the Company issued invoices amounting to $325 of which $217 have been paid.

Related-Party Promissory Notes

During the three months ended March 31, 2024, Palella Holdings LLC,

an entity in which the Company’s CEO is the sole shareholder, provided to the Company $1,505. The Company has to repay Palella Holdings

LLC $1,505 on an interest free basis on January 31, 2025.

15.

Subsequent Events

None.

Item 2.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following

discussion and analysis of our financial condition and results of operations together with our consolidated financial statements and the

related notes. Some of the information contained in this discussion and analysis or set forth elsewhere, including information with respect

to our plans and strategy for our business and related financing, includes forward-looking statements that involve risks, uncertainties

and assumptions. You should read the “Special Note Regarding Forward-Looking Statements” and “Risk Factors” for

a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the

forward-looking statements contained in the following discussion and analysis.

The following discussion

refers to the financial results of micromobility.com, Inc. for the three months ended March 31, 2024, and 2023. For purposes of this following

discussion the terms “we”, ‘our” or “us” or “the Company” and similar references refer

to micromobility.com, Inc. and our affiliates. Except for per share data and as otherwise indicated, all dollar amounts set out herein

are in thousands.

Overview

micromobility.com, Inc.

(formerly known as Helbiz, Inc., and, together with its subsidiaries, “micromobility.com” or the “Company”) was

incorporated in the state of Delaware in October 2015 with its headquarters in New York, New York. The Company is an intra-urban transportation

company that seeks to help urban areas reduce their dependency on individually owned cars by offering affordable, accessible, and sustainable

forms of personal transportation, specifically addressing first and last mile transport.

Founded on proprietary technology

platforms, the Company’s core business is the offering of electric vehicles in the sharing environment. Through its Mobility App,

the Company offers an intra-urban transportation solution that allows users to instantly rent electric vehicles.

The Company currently has

a strategic footprint with office in New York. The Company currently has electric vehicles operating in the United States and Europe.

Consolidated Results of Operations

The following tables set

forth our results of operations for the periods presented and as a percentage of our net revenue for those periods. Percentages presented

in the following tables may not sum due to rounding.

Comparison of the Three months ended

March 31, 2024, and 2023

The following table

summarizes our consolidated results of operations for the three months ended March 31, 2024, and 2023.

| | |

Three months ended March 31, |

| | |

2024 | |

2023 |

| Revenue | |

$ | 571 | | |

$ | 3,919 | |

| Operating expenses: | |

| | | |

| | |

| Cost of revenue | |

| 908 | | |

| 11,067 | |

| General and administrative | |

| 3,529 | | |

| 6,232 | |

| Sales and marketing | |

| 275 | | |

| 1,239 | |

| Research and development | |

| 175 | | |

| 843 | |

| Total operating expenses | |

| 4,887 | | |

| 19,381 | |

| | |

| | | |

| | |

| Loss from operations | |

| (4,316 | ) | |

| (15,463 | ) |

| Total non-operating income (expenses), net | |

| (203 | ) | |

| (4,088 | ) |

| Income Taxes | |

| 0 | | |

| (3 | ) |

| Net loss | |

$ | (4,519 | ) | |

$ | (19,554 | ) |

| | |

Three months ended March 31, |

| | |

2024 | |

2023 |

| Revenue | |

| 100 | % | |

| 100 | % |

| Operating expenses: | |

| | | |

| | |

| Cost of revenue | |

| 159 | % | |

| 282 | % |

| General and administrative | |

| 618 | % | |

| 159 | % |

| Sales and marketing | |

| 48 | % | |

| 32 | % |

| Research and development | |

| 31 | % | |

| 22 | % |

| Total operating expenses | |

| 856 | % | |

| 495 | % |

| | |

| | | |

| | |

| Loss from operations | |

| (756 | )% | |

| (395 | )% |

| Total non-operating income (expenses), net | |

| (36 | )% | |

| (104 | )% |

| Income Taxes | |

| 0 | % | |

| (0 | )% |

| Net loss | |

| (791 | )% | |

| (499 | )% |

Net Revenue

| | |

Three months ended March 31, | |

|

| | |

2024 | |

2023 | |

% Change |

| Mobility Revenues | |

$ | 432 | | |

$ | 1,578 | | |

| (73 | )% |

| Media Revenues | |

| 12 | | |

| 2,086 | | |

| (99 | )% |

| Other Revenues – Third Parties | |

| — | | |

| 255 | | |

| — | |

| Other Revenues – Related Party | |

| 127 | | |

| — | | |

| — | |

| Total Net Revenues | |

$ | 571 | | |

$ | 3,919 | | |

| (85 | )% |

Total Net revenues decreased

by $3,348, or 85%, from $3,919 for the three months ended March 31, 2023, to $571 for the three months ended March 31, 2024. This decrease

was primarily due to: a) the decrease of Media revenues for the early termination of the LNPB agreements, and b) the decrease of Mobility

revenues driven by the Company’s strategy to exit not profitable markets.

Mobility revenues

Mobility revenues decreased

by $1,146, or 73%, from $1,578 for the three months ended March 31, 2023, to $432 for the three months ended March 31, 2024.

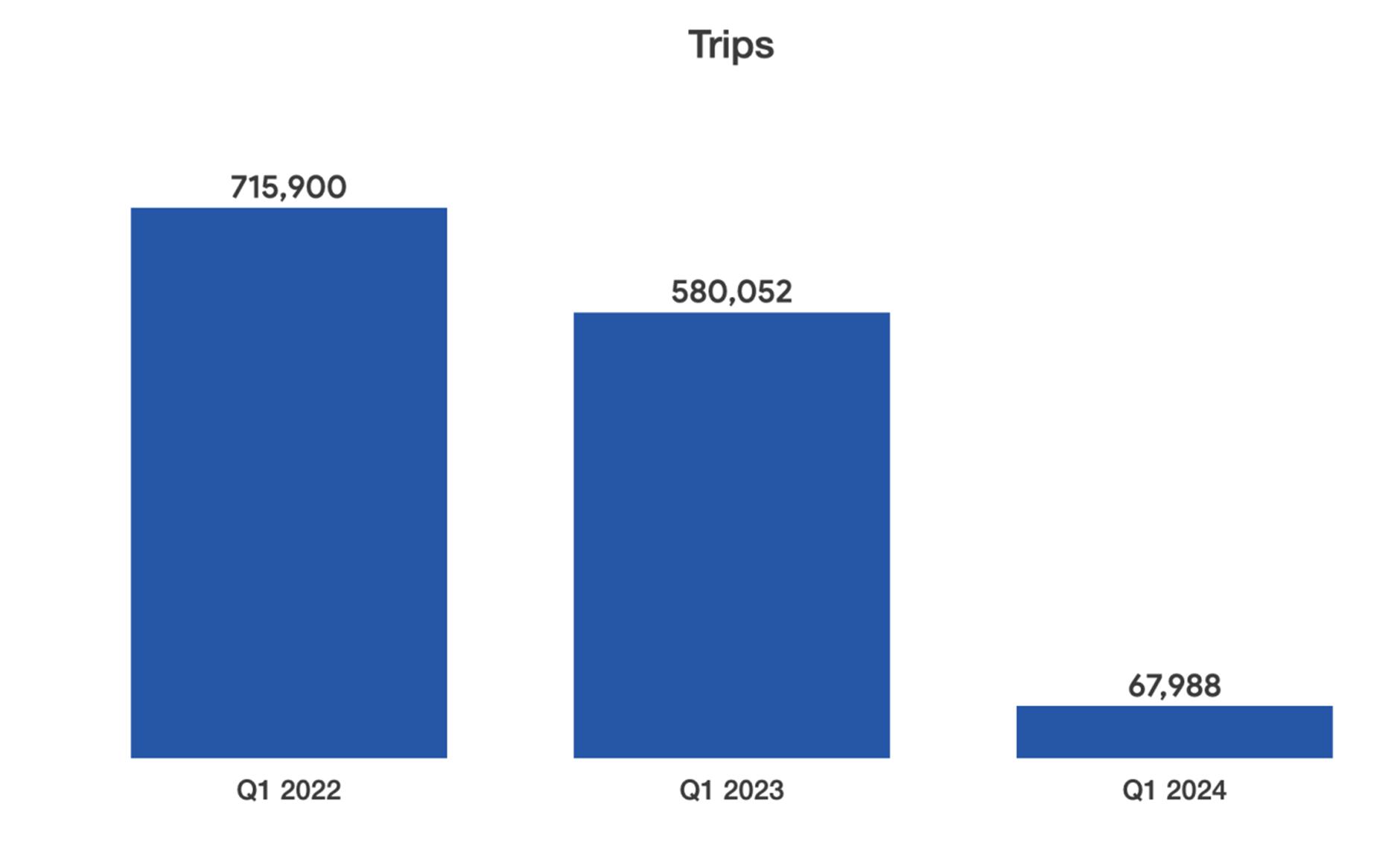

As shown in the paragraph

Mobility - Key Financial Measures and Indicators, Trips and AAPUs decreased in the mobility business in the periods analyzed. The

decreases are explained by the Company’s strategy to decrease the Company’s operating cash which resulted in closing multiple

locations in Italy and United States.

Media

revenues

During 2023, the Company

received communications from the main live content provider, LNPB, notifying the early termination of the agreements related to the commercialize

and broadcast of the Italian Serie B content. The early termination generated a significant decrease in Media revenues.

Media revenues decreased

by $2,074, or 99%, from $2,086 for the three months ended March 31, 2023, to $12 for the three months ended March 31, 2024. The decrease

is mainly explained by the early termination of LNPB agreements. During the next months of 2024, Media revenues are expected to increase

compared to the first three months of 2024 based on a Service Supply Agreement

entered by the Company with a related party: Everli S.p.A. (entity owned by Micrmobility.com CEO). In detail, the mentioned Service

Supply Agreement requires the Company to provide design, development, and communication ideas and activities to Everli.

Other Revenues –

Related Party

Other Revenues generated

with related party is related to an Agreement on Business Cooperation entered by the Company with Everli S.p.A. (entity owned by Micrmobility.com

CEO) for software development services. Additional revenues are expected

to be recorded during the year 2024 based on this Agreement.

Cost of Revenue

| | |

Three months ended March 31, | |

|

| | |

2024 | |

2023 | |

% Change |

| Mobility - Cost of revenues | |

$ | 778 | | |

$ | 4,608 | | |

| (83 | )% |

| Of which Depreciation and write-off | |

| 521 | | |

| 1,580 | | |

| (67 | )% |

| Media - Cost of revenues | |

| 1 | | |

| 5,610 | | |

| (100 | )% |

| Other - Cost of revenues | |

| 129 | | |

| 849 | | |

| (85 | )% |

| Total - Cost of revenues | |

| 908 | | |

| 11,067 | | |

| (92 | )% |

Cost of Revenue decreased

by $10,159 or 92%, from $11,067 for the three months ended March 31, 2023, to $908 for the three months ended March 31, 2024. This decrease

was primarily due to: a) the decrease in Media Cost of revenues for the early termination of the LNPB agreements, and b) the decrease

of Mobility activities driven by the Company’s strategy to exit not profitable markets.

Mobility Cost of revenues

Mobility cost of revenues

shows a decrease of $3,830 or 83% mainly driven by the closing of multiple locations in Italy and United States, in line with the Company’s

strategy to decrease the operating cash used by the micro-mobility business. Removing the depreciation and write-off, for the three months

ended March 31, 2024 shows a Mobility Cost of Revenues lower than Mobility Revenues, this result is in line with the Company strategy

to focus Mobility activities only in profitable markets.

Media Cost of revenues

Cost of Revenues related to

Media decreased by $5,609, or 100% in the three months ended March 31, 2024, compared to the three months ended March 31, 2023. The decrease

is mainly driven by the decrease in media content acquired during the period, including the early termination of LNPB agreements.

General and Administrative

| | |

Three months ended March 31, | |

|

| | |

2024 | |

2023 | |

% Change |

| General and administrative | |

$ | 3,529 | | |

$ | 6,232 | | |

| (43 | )% |

| Of which Litigation accruals | |

| 2,000 | | |

| — | | |

| — | |

General and Administrative

expenses decreased by $2,703 or 43% from $6,232 for the three months ended March 31, 2023, to $3,529 for the three months ended March

31, 2024.

The decrease is mainly driven

by the Company strategy to drastically decrease the cash burn; in detail, several administrative employees in Europe and United States

left the Company and they have not been replaced. Additionally, the Company renegotiated or exited multiple agreements with lawyers and

consultants. The amount recorded for the three months ended March 31, 2024 is also highly impacted by a non-recurring item: Litigation

accruals amounting to $2 million.

Sales and marketing

| | |

Three months ended March 31, | |

|

| | |

2024 | |

2023 | |

% Change |

| Sales and marketing | |

$ | 275 | | |

$ | 1,239 | | |

| (78 | )% |

| | |

| | | |

| | | |

| | |

Sales and marketing expenses

decreased by $964 or 78%, from $1,239 for the three months ended March 31, 2023, to $275 for the three months ended March 31, 2024.

The decrease is explained

by the Company’s strategy to decrease the Company’s operating cash burn. In detail, the Company took the following actions:

a) drastically reduced the marketing campaigns in terms of budget following the exit of multiple operating markets, and b) decrease the

workforce involved in the marketing department.

Research and Development

| | |

Three months ended March 31, | |

|

| | |

2024 | |

2023 | |

% Change |

| Research and development | |

$ | 175 | | |

$ | 843 | | |

| (79 | )% |

| | |

| | | |

| | | |

| | |

Research and Development

expenses decreased by $668 or 79% from $843 for the three months ended March 31, 2023, to $175 for the three months ended March 31, 2023.

The 79% decrease is mainly driven by the exiting of a IT engineering employees, not replaced.

Total non-operating income (expense), net

| | |

Three months ended March 31, | |

|

| | |

2024 | |

2023 | |

% Change |

| | |

| |

| |

|

| Interest expense, net | |

$ | (864 | ) | |

$ | (1,701 | ) | |

| (49 | )% |

| Gain (loss) on extinguishment of financial debts | |

| 728 | | |

| — | | |

| — | |

| SEPA financial income (expenses), net | |

| (102 | ) | |

| (2,208 | ) | |

| (95 | )% |

| Other income (expenses), net | |

| 35 | | |

| (179 | ) | |

| (120 | )% |

| Total non-operating income (expenses), net | |

$ | (203 | ) | |

$ | (4,088 | ) | |

| (95 | )% |

Non-operating expense,

net, decreased by 95% or $3,885 from $4,088 for the three months ended March 31, 2023, to $203 three months ended March 31, 2024.

Interest expenses, net

Interest expenses decreased

by $837, or 49%, from $1,701 for the three months ended March 31, 2023, to $864 for the three months ended March 31, 2024. Such decrease

is mainly driven by the overall decrease of the Company’s financial liabilities.

Gain (loss) on extinguishment

of financial debts

Gain on extinguishment of

debt amounted to $728 for the three months ended March 31, 2024 is related to an Amendment Agreement entered by the Company with the holder

of an unsecured Note previously issued by Wheels Lab Inc (entity acquired in 2022). In detail, the Company settled $734 of the aforementioned

Unsecured Note by issuing 928,942 Class A Common Stock in March 2024, for the reduction of the Company’s share price from the Amendment

date to the issuance date the Company recorded a gain amounted to $728.

SEPA financial income (expenses),

net

SEPA financial expenses,

net decreased by $2,106, or 95%, from $2,208 for the three months ended March 31, 2023, to $102 for the three months ended March 31, 2024.

Such decrease is mainly driven by the overall decrease of the SEPA usage, highly impacted by the Company’s decreases in market volatility

and market price.

Key Financial Measures and Indicators

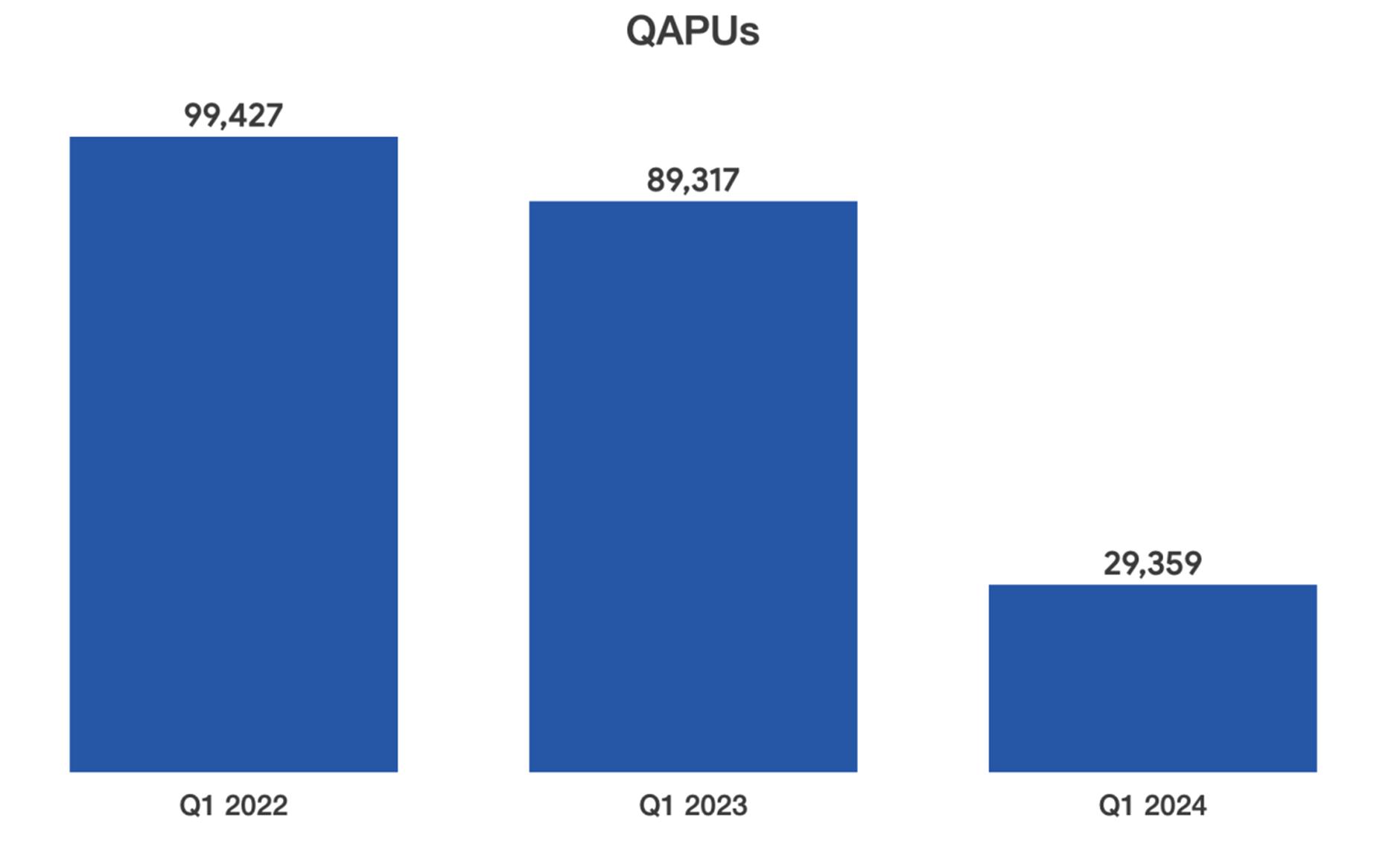

Quarterly Active Platform

Users. We define QAPUs as the number of unique users who completed a ride on our platform at least once in three months. While a unique

user can use multiple product offerings on our platform in a given quarter, that unique user is counted as only one QAPU. We use QAPUs

to assess the adoption of our platform and frequency of transactions, which are key factors in our penetration of the markets in which

we operate.

Trips. We define

Trips as the number of completed rides in a given year. To further clarify, a single-use Helbiz ride is recognized as a unique “Trip”

upon completion of each ride. We believe that Trips is a useful metric to measure the usage of our platform.

Active Markets. We

track the number of active markets (cities).

Italian licenses

We are an operator

in Italy in the micro-mobility environment. During the first three months of 2024, we provided e-mobility services in the following Italian

cities:

• Turin,

Parma, Palermo, Pisa, San Benedetto del Tronto, Modena, and Catania.

United States licenses

During the first three

months of 2024, we provided e-mobility services, either sharing or long-term rental proposal, in the following United States areas:

• Tampa

(Florida), New York (New York), and Santa Monica (California).

Liquidity and Capital Resources

Since our inception, we

have financed our operations primarily with proceeds from outside sources of invested capital. We have had, and expect that we will continue

to have, an ongoing need to raise additional cash from outside sources to fund our operations and expand our business. If we are unable

to raise additional capital when desired, our business, financial condition and results of operations would be harmed. Successful transition

to attaining profitable operations depends upon achieving a level of revenues adequate to support our cost structure.

As of March 31, 2024, our

principal sources of liquidity were cash and cash equivalents of $127.

We plan to continue to fund

our operations and expansion plan, including the new business lines through debt and equity financing, for the next twelve months.

We may be required to seek

additional equity or debt financing. Our future capital requirements will depend on many factors, including our growth and expanded operations,

including the new business lines. In the event that additional financing is required from outside sources, we may not be able to raise

it on terms acceptable to us or at all.

Indebtedness

The following table summarizes our indebtedness

as of March 31, 2024.

| |

|

|

|

|

|

|

|

|

|