false

0001621672

0001621672

2023-11-30

2023-11-30

--12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) of the SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 30, 2023

Super League Enterprise, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-38819

|

47-1990734

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

2912 Colorado Avenue, Suite #203

Santa Monica, California 90404

(Address of principal executive offices)

(213) 421-1920

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

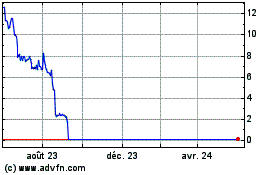

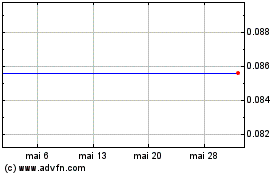

SLE

|

Nasdaq Capital Market

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Subscription Agreements

On November 30, 2023, Super League Enterprise, Inc. (the “Company”) entered into subscription agreements (each, a “Subscription Agreement” and collectively, the “Subscription Agreements”) with accredited investors with respect to the sale of an aggregate of 5,377 shares of newly designated Series AAA Convertible Preferred Stock, par value $0.001 per share (the “Series AAA Preferred”), at a purchase price of $1,000 per share, for aggregate gross proceeds to the Company of approximately $5,377,000 (the “Offering”).

In connection with the Offering, on November 30, 2023 (the “Filing Date”), the Company filed a Certificate of Designation of Preferences, Rights and Limitations of the Series AAA Preferred Stock (the “Series AAA Certificate of Designation”) with the State of Delaware.

Each share of Series AAA Preferred is convertible at the option of the holder, subject to certain beneficial ownership limitations and primary market limitations as set forth in each Series AAA Certificates of Designation, into such number of shares of the Company’s common stock, par value $0.001 (the “Common Stock”), equal to the number of Series AAA Preferred to be converted, multiplied by the stated value of $1,000 (the “Stated Value”), divided by the conversion price in effect at the time of the conversion (the initial conversion price will be $1.674 for the Series AAA Preferred, subject to adjustment in the event of stock splits, stock dividends, certain fundamental transactions and future issuances of equity securities as described below). In addition, subject to beneficial ownership and primary market limitations, on the one year anniversary of the respective filing date, the Company may, in its discretion, convert (y) 50% of the outstanding shares of Series AAA Preferred into the Company’s Common Stock if the volume-weighted average price of such Common Stock over the previous 10 days as reported on the NASDAQ Capital Market (the “VWAP”), equals at least 250% of the Conversion Price, or (z) 100% of the outstanding shares of Series AAA Preferred into the Company’s Common Stock if the VWAP equals at least 300% of the Conversion Price.

The Series AAA Preferred shall vote together with the common stock on an as-converted basis, and not as a separate class, subject to the primary market limitations, except that holders of Series AAA Preferred shall vote as a separate class with respect to (a) amending, altering, or repealing any provision of the Series AAA Certificates of Designation in a manner that adversely affects the powers, preferences or rights of the Series AAA Preferred, (b) increasing the number of authorized shares of Series AAA Preferred, (c) authorizing or issuing an additional class or series of capital stock that ranks senior to or pari passu with the Series AAA Preferred with respect to the distribution of assets on liquidation, (d) authorizing, creating, incurring, assuming, guaranteeing or suffering to exist any indebtedness for borrowed money of any kind outside of certain loans not to exceed $5,000,000 and accounts payable in the ordinary course of business, or (e) entering into any agreement with respect to the foregoing. In addition, no holder of Series AAA Preferred shall be entitled to vote on any matter presented to the Company’s stockholders relating to approving the conversion of such holder’s Series AAA Preferred into an amount in excess of the primary market limitations. Upon any dissolution, liquidation or winding up, whether voluntary or involuntary, holders of Series AAA Preferred (together with any Parity Securities (as defined in the Series AAA Certificate of Designations) will be entitled to first receive distributions out of the Company’s assets in an amount per share equal to the Stated Value plus all accrued and unpaid dividends, whether capital or surplus before any distributions shall be made on any shares of Common Stock (after the payment to any senior security, if any).

Holders of the Series AAA Preferred will be entitled to receive dividends, subject to the beneficial ownership and primary market limitations, payable in the form of that number of shares of Common Stock equal to 20% of the shares of Common Stock underlying the Series AAA Preferred then held by such holder on each of the 12- and 24-month anniversaries of the Filing Date. In addition, subject to the beneficial ownership and primary market limitations, holders of Series AAA Preferred will be entitled to receive dividends equal, on an as-if-converted to shares of Common Stock basis, and in the same form as dividends actually paid on shares of the common stock when, as, and if such dividends are paid on shares of the common stock. Notwithstanding the foregoing, to the extent that a holder’s right to participate in any dividend in shares of common stock to which such holder is entitled would result in such holder exceeding the beneficial ownership and/or primary market limitations, then such holder shall not be entitled to participate in any such dividend to such extent and the portion of such shares that would cause such holder to exceed the beneficial ownership and/or primary market limitations shall be held in abeyance for the benefit of such holder until such time, if ever, as such holder’s beneficial ownership thereof would not result in such holder exceeding the beneficial ownership and primary market limitations.

Subject to the approval by a majority of the voting securities of the Company (the “Stockholder Approval”), pursuant to the Subscription Agreements, purchasers shall have the right to purchase shares of a newly designated series of Preferred Stock of the Company containing comparable terms (except for adjustments to the Conversion Price based on future equity issuances) as the Series AAA Preferred (the “Additional Investment Right”) from the date of each respective closing through the date that is 18 months thereafter for an additional dollar amount equal to its initial investment amount at $1,000 per share (the “Original Issue Price”), with a conversion price equal to the conversion price of the Series AAA Preferred in effect on the Filing Date (i.e., the original conversion price). No further additional investment rights shall be granted to investors that exercise the Additional Investment Rights.

Further subject to the effectiveness of the Stockholder Approval, for twenty-four (24) months after the Filing Date, and subject to certain carveouts as described in the Series AAA Certificates of Designations, if the Company conducts an offering at a price per share less than the then effective conversion price (the “Future Offering Price”) consisting of common stock, convertible or derivative instruments, and undertaken in an arms-length third party transaction, then in such event the conversion price of the Series AAA Preferred shall be adjusted to the Future Offering Price, but not less than the Conversion Price Floor (as defined in the Series AAA Certificate of Designations).

Exchange Agreements

Also on November 30, 2023, the Company entered into certain Series A Exchange Agreements (the “Series A Agreement”) and Series AA Exchange Agreements (the “Series AA Agreement”, and collectively with the Series A Agreement, the “Exchange Agreements”), with certain holders (the “Holders”) of the Company’s Series A Convertible Preferred Stock, par value $0.001 per share (“Series A Preferred”), and Series AA Convertible Preferred Stock, par value $0.001 per share (“Series AA Preferred”), pursuant to which the Holders exchanged an aggregate of 4,011shares of Series A Preferred and/or Series AA Preferred, for an aggregate of 4,011 shares of Series AAA Preferred (the “Exchange”). The Exchange closed concurrently with the closing of the Subscription Agreements.

The Subscription Agreements and Exchange Agreements (collectively, the “Transaction Documents”) contain representations and warranties that the parties made to, and solely for the benefit of, the other signatories to the Transaction Documents in the context of the terms and conditions thereof and in the context of the specific relationship between the parties to the Transaction Documents. The provisions of such Transaction Documents, including the representations and warranties contained therein, are not for the benefit of any party other than the party signatories thereto and are not intended for investors and the public to obtain factual information about the current state of affairs of the parties to such Transaction Documents. Rather, investors and the public should refer to other disclosures contained in the Company’s filings with the U.S. Securities and Exchange Commission with respect to obtaining such factual information.

The Company and the investors in the Offering and the Exchange also executed a registration rights agreement (the “Registration Rights Agreement”), pursuant to which the Company agreed to use its best efforts to file a registration statement covering the resale of the shares of Common Stock issuable upon conversion of the Series AAA Preferred within 45 days, but in no event later than 60 days, following the final closing of the Offering and to use its best efforts to cause such registration statement to become effective within 90 days of the filing date.

The Company sold and/or exchanged the shares of Series AAA Preferred pursuant to a Placement Agency Agreement (the “Placement Agency Agreement”) with a registered broker dealer, which acted as the Company’s exclusive placement agent (the “Placement Agent”) for the Offering and the Exchange. Pursuant to the terms of the Placement Agency Agreement, in connection with the November 30, 2023 closing of the Offering and the Exchange, the Company paid the Placement Agent an aggregate cash fee of $537,700, non-accountable expense allowance of $107,540 and will issue to the Placement Agent or its designees warrants (the “Placement Agent Warrants”) to purchase 465,750 shares of Common Stock at an exercise price of $1.674 per share . The Placement Agent shall also earn fees and be issued additional Placement Agent Warrants with respect to any securities issued pursuant to the Additional Investment Rights. The Company also granted the Placement Agent the right of first refusal, for a period of six (6) months after the final closing of the Offering, to serve as the Company’s lead or co-placement agent for any private placement of the Company’s securities (equity or debt) that is proposed to be consummated with the assistance of a registered broker dealer. In addition, with respect to shares of Series AAA Preferred Stock issued in the Exchange, the Placement Agent exchanged previously issued placement agent warrants to purchase 55,464 shares of Common Stock of the Company that were issued in connection with the Series A and Series AA Preferred Stock financings of the Company, at exercise prices ranging from $7.60 to $13.41 per share, for new Placement Agent Warrants to purchase a total of 347,428 shares of Common Stock at an exercise price of $1.674 per share.

The securities issued in the Offering and Exchange are exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) of the Securities Act and/or Rule 506(b) of Regulation D promulgated thereunder because, among other things, the transaction did not involve a public offering, the investors (including the Holders) are accredited investors, the investors are purchasing and/or exchanging the securities, as applicable, for investment and not for resale and the Company took appropriate measures to restrict the transfer of the securities. The securities have not been registered under the Securities Act and may not be sold in the United States absent registration or an exemption from registration. This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

The forgoing descriptions of the Series AAA Certificate of Designation, Form of Subscription Agreement, Form of Registration Rights Agreement, Form of Series A Exchange Agreement, Form of Series AA Exchange Agreement, and Form of Placement Agent Warrants are qualified in their entirety by reference to the full text of such documents, copies of which are filed as Exhibit 3.1, Exhibit 10.1, Exhibit 10.2, Exhibit 10.3, Exhibit 10.4, and Exhibit 10.5, respectively, to this Current Report on Form 8-K. The foregoing description of the Placement Agency Agreement is qualified by reference to the full text of such document, a copy of which will be filed in the Company’s next periodic report due to be filed under the Exchange Act.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The response to this item is included in Item 1.01, Entry into a Material Definitive Agreement, and is incorporated herein in its entirety.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

The Certificate of Incorporation of the Company authorizes the issuance of up to 10,000,000 shares of preferred stock and further authorizes the Board of the Company to fix and determine the designation, preferences, conversion rights, or other rights, including voting rights, qualifications, limitations, or restrictions of the preferred stock.

On November 30, 2023, the Company filed the Series AAA Certificate of Designation, designating 9,400 shares of Series AAA Preferred in connection with the Offering.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits Index

|

Exhibit No.

|

|

Description

|

| |

|

|

|

3.1

|

|

|

|

10.1*

|

|

|

|

10.2*

|

|

|

|

10.3

|

|

|

|

10.4

|

|

|

|

10.5*

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

* Certain portions of this exhibit (indicated by “[***]”) have been omitted as the Company has determined (i) the omitted information is not material and (ii) the omitted information would likely cause harm to the Company if publicly disclosed.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Super League Enterprise, Inc.

|

| |

|

|

|

Date: December 6, 2023

|

By:

|

/s/ Clayton Haynes

|

| |

|

Clayton Haynes

Chief Financial Officer

|

Exhibit 3.1

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES AAA PREFERRED STOCK

OF

SUPER LEAGUE ENTERPRISE, INC.

It is hereby certified that:

1. The name of the Company (hereinafter called the “Company”) is Super League Enterprise, Inc., a Delaware corporation.

2. The Certificate of Incorporation (the “Certificate of Incorporation”) of the Company authorizes the issuance of Ten Million (10,000,000) shares of preferred stock, $0.001 par value per share, of which Nine Million Nine Hundred Seventy Five Thousand Five Hundred Ninety Seven (9,975,597) shares have not been designated or issued, and expressly vests in the Board of Directors of the Company the authority to issue any or all of said shares in one (1) or more series and by resolution or resolutions to establish the designation and number and to fix the relative rights and preferences of each series to be issued.

3. The Board of Directors of the Company, pursuant to the authority expressly vested in it as aforesaid, has adopted the following resolutions creating a Series AAA issue of Preferred Stock:

RESOLVED, that Nine Thousand Four Hundred (9,400) of the Ten Million (10,000,000) authorized shares of Preferred Stock of the Company shall be designated Series AAA Convertible Preferred Stock, $0.001 par value per share, and shall possess the rights and preferences set forth below:

Section 1. Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Affiliate” means any person that, directly or indirectly through one (1) or more intermediaries, controls or is controlled by or is under common control with a Person, as such terms are used in and construed under Rule 405 of the Securities Act. A Person shall be regarded as in control of the Company if the Company owns or directly or indirectly controls more than fifty percent (50%) of the voting stock or other ownership interest of the other person, or if it possesses, directly or indirectly, the power to direct or cause the direction of the management and policies of such person.

“Alternate Consideration” shall have the meaning set forth in Section 7(d).

“Attribution Parties” shall have the meaning set forth in Section 6(e).

“Base Share Price” shall have the meaning set forth in Section 7(a)(ii).

“Beneficial Ownership Limitation” shall have the meaning set forth in Section 6(e).

“Business Day” means any day except Saturday, Sunday, and any day which shall be a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law or other governmental action to close. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day.

“Buy-In” shall have the meaning set forth in Section 6(d)(iv).

“Certificate of Designations” means this Certificate of Designation of Preferences, Rights and Limitations of Series AAA Preferred Stock.

“Commission” means the United States Securities and Exchange Commission.

“Common Stock” means the Company’s common stock, par value $0.001 per share, and stock of any other class of securities into which such securities may hereafter be reclassified or changed into.

“Common Stock Equivalents” means any securities of the Company or the Subsidiaries of the Company, whether or not vested or otherwise convertible or exercisable into shares of Common Stock at the time of such issuance, which would entitle the holder thereof to acquire at any time Common Stock, including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is at any time convertible into or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock, and excluding shares of Common Stock issuable upon conversion of the Series AAA Preferred Stock (including the Parity Securities), and any and all sub-series designated Series AAA-2 Preferred Stock and so on, as well as any and all series or subseries designated Series AAA-1 AIR Preferred and so on, that may be authorized following the date hereof.

“Company Conversion Notice” means a notice delivered by the Company to effect a Mandatory Conversion of all the outstanding Series AAA Preferred Stock (any and all sub-series designated Series AAA-2 Preferred Stock and so on that may be authorized following the date hereof); provided that the effective date of such Mandatory Conversion shall be no less than ten (10) Business Days following the date that such notice is deemed to have been given.

“Conversion Amount” means the Stated Value at issue.

“Conversion Date” shall have the meaning set forth in Section 6(b).

“Conversion Price” means $1.674, subject to adjustment as set forth in Section 7; provided, however, the Conversion Price shall not be less than the Conversion Price Floor.

“Conversion Price Floor” means the amount, in dollars, determined by multiplying (i) the Initial Conversion Price by (ii) thirty percent (30%).

“Conversion Shares” means the shares of Common Stock issuable upon conversion of the shares of Series AAA Preferred Stock in accordance with the terms hereof.

“Deemed Liquidation Event” means any of the following, unless the Majority Holders elect otherwise by written notice sent to the Company at least five (5) business days prior to the effective date of any such event:

| |

(a)

|

a merger or consolidation in which

|

| |

(i)

|

the Company is a constituent party or

|

| |

(ii)

|

a subsidiary of the Company is a constituent party and the Company issues shares of its capital stock pursuant to such merger or consolidation,

|

except any such merger or consolidation involving the Company or a subsidiary in which the shares of capital stock of the Company outstanding immediately prior to such merger or consolidation continue to represent, or are converted into or exchanged for shares of capital stock that represent, immediately following such merger or consolidation, at least a majority of the capital stock of (1) the surviving or resulting corporation; or (2) if the surviving or resulting corporation is a wholly owned subsidiary of another corporation immediately following such merger or consolidation, the parent corporation of such surviving or resulting corporation; or

| |

(b)

|

(1) the sale, lease, transfer, exclusive license or other disposition, in a single transaction or series of related transactions, by the Company or any subsidiary of the Company of all or substantially all the assets of the Company and its subsidiaries taken as a whole or (2) the sale or disposition (whether by merger, consolidation or otherwise, and whether in a single transaction or a series of related transactions) of one (1) or more subsidiaries of the Company if substantially all of the assets of the Company and its subsidiaries taken as a whole are held by such subsidiary or subsidiaries, except where such sale, lease, transfer, exclusive license or other disposition is to a wholly owned subsidiary of the Company.

|

The Company shall not have the power to effect a Deemed Liquidation Event unless the agreement or plan of merger or consolidation for such transaction provides that the consideration payable to the stockholders of the Company in such Deemed Liquidation Event shall be allocated to the holders of capital stock of the Company in accordance with Section 5 hereto.

“Dilutive Issuance Notice” shall have the meaning set forth in Section 7(a)(ii).

“Distribution” shall have the meaning set forth in Section 7(c).

“Dividend Shares” shall have the meaning set forth in Section 3.

“DWAC” shall have the meaning set forth in Section 6(d)(i)

“Effective Date” means the date that this Certificate of Designations is filed with the Secretary of State of Delaware.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Fundamental Transaction” shall have the meaning set forth in Section 7(d).

“Holder” means an owner of shares of Series AAA Preferred Stock.

“Initial Conversion Price” means $1.674, the Conversion Price on the Effective Date.

“Junior Securities” means the Common Stock and any other class or series of capital stock of the Company hereafter created which does not expressly rank senior or pari passu with or senior to the Series AAA Preferred Stock (which for these purposes shall include the Series A Preferred, Series AA Preferred, along with any and all sub-series designated as Series AAA-2 Preferred Stock and so on, as well as any and all series or subseries designated Series AAA-1 AIR Preferred and so on, that may be authorized following the date hereof) with respect to the distribution of assets on Liquidation as well as any other rights, preferences and privileges.

“Liquidation” shall have the meaning set forth in Section 5(a).

“Liquidation Amounts” shall have the meaning set forth in Section 5(b).

“Listing Rules” means the Listing Rules of the Nasdaq Capital Market.

“Majority Holders” means the Holders of 51% or more of the then issued and outstanding shares of all Series AAA Preferred Stock, which for these purposes shall include the shares of Series AAA Preferred Stock, along with any and all sub-series designated Series AAA-2 Preferred Stock and so on that may be authorized following the date hereof.

“Mandatory Conversion” shall have the meaning set forth in Section 6(b).

“Mandatory Conversion Date” shall have the meaning set forth in Section 6(b).

“Mandatory Conversion Determination” shall have the meaning set forth in Section 6(b).

“Minimum Trading Volume” means average trading during the prior twenty (20) Trading Days of shares with a minimum value of $750,000, subject to adjustment in connection with any of the events in Section 7(a)(i).

“New York Courts” shall have the meaning set forth in Section 8(d).

“Notice of Conversion” shall have the meaning set forth in Section 6(a).

“Optional Conversion Date” shall have the meaning set forth in Section 6(a).

“Original Issue Date” means the date of the first issuance of any shares of Series AAA Preferred Stock regardless of the number of transfers of any particular shares of Series AAA Preferred Stock and regardless of the number of certificates which may be issued, if any, to evidence such Series AAA Preferred Stock.

“Parity Securities” means any class or series of capital stock of the Company currently existing or hereinafter created that expressly ranks pari passu with the Series AAA Preferred Stock (including, for these purposes, any and all sub-series designated as Series AAA-2 Preferred Stock and so on, as well as any series or sub-series designated Series AAA-1 AIR Preferred, and so on) that may be authorized following the date hereof) with respect to the distribution of assets on Liquidation as well as any other rights, preferences and privileges. The only Parity Securities existing as of the date hereof are the Series A Preferred and Series AA Preferred.

“Person” means an individual, entity, corporation, partnership, association, limited liability company, limited liability partnership, joint-stock company, trust or unincorporated organization.

“PIK Shares” shall have the meaning set forth in Section 3.

“Preferred Stock” means the Company’s preferred stock, par value $0.0001 per share, and stock of any other class of securities into which such securities may hereafter be reclassified or changed into.

“Primary Market Limitation” shall have the meaning set forth in Section 6(f).

“Purchase Rights” shall have the meaning set forth in Section 7(b).

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Senior Securities” means any class or series of capital stock of the Company hereafter created which expressly ranks senior to the Series AAA Preferred Stock (which for these purposes shall include any and all sub-series designated as Series AAA-2 Preferred Stock and so on, as well as any and all series or subseries designated Series AAA-1 AIR Preferred and so on, that may be authorized following the date hereof) with respect to the distribution of assets on Liquidation, as well as any other rights, preferences and privileges. No Senior Securities exist as of the date hereof.

“Series A Preferred Stock” means, unless otherwise stated herein, Five Thousand Three Hundred and Fifty Nine (5,359) shares of Series A Preferred Stock which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on November 22, 2022.

“Series A-2 Preferred Stock” means, unless otherwise stated herein, One Thousand Two Hundred Ninety-Seven (1,297) shares of Series A-2 Preferred Stock which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on November 28, 2022.

“Series A-3 Preferred Stock” means, unless otherwise stated herein, One Thousand Seven Hundred Thirty-Three (1,733) shares of Series A-3 Preferred Stock which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on November 30, 2022.

“Series A-4 Preferred Stock” means, unless otherwise stated herein, One Thousand Nine Hundred Thirty-Four (1,934) shares of Series A-4 Preferred Stock which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on December 22, 2022.

“Series A-5 Preferred Stock” means, unless otherwise stated herein, Two Thousand Two Hundred Ninety-Nine (2,299) shares of Series A-5 Preferred Stock which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on January 31, 2023.

“Series A Preferred” means, collectively, the Series A Preferred Stock, Series A-2 Preferred Stock, Series A-3 Preferred Stock, Series A-4 Preferred Stock and Series A-5 Preferred Stock.

“Series AA Preferred Stock” means, unless otherwise stated herein, Seven Thousand Six Hundred Eighty (7,680) shares of Series AA Preferred Stock, which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on April 19, 2023.

“Series AA-2 Preferred Stock” means, unless otherwise stated herein, One Thousand Five Hundred (1,500) shares of Series AA-2 Preferred Stock, which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on April 20, 2023.

“Series AA-3 Preferred Stock” means, unless otherwise stated herein, One Thousand Twenty Five (1,025) shares of Series AA-3 Preferred Stock, which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on April 28, 2023.

“Series AA-4 Preferred Stock” means, unless otherwise stated herein, One Thousand Twenty Six (1,026) shares of Series AA-4 Preferred Stock, which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on May 5, 2023

“Series AA-5 Preferred Stock” means, unless otherwise stated herein, five hundred fifty (550) shares of Series AA-5 Preferred Stock, which were authorized pursuant to a Certificate of Designation of Preferences, Rights and Limitations which was filed with the Delaware Secretary of State on May 26, 2023.

“Series AA Preferred” means, collectively, the Series AA Preferred Stock, Series AA-2 Preferred Stock, Series AA-3 Preferred Stock, Series AA-4 Preferred Stock and Series AA-5 Preferred Stock, and any and all sub-series designated Series AA-6 Preferred Stock, Series AA-7 Preferred Stock and so on, that may be authorized following the date hereof.

“Series AAA Preferred Stock” shall have the meaning set forth in Section 2.

“Series AAA – 1 AIR Preferred” means the preferred stock of the Company, regardless of the specific name used to designate such series of Preferred Stock, that will be issuable pursuant to the exercise of additional investment rights as set forth in Section 6 of those certain Subscription Agreements, dated as of the Effective Date, by and between the Company and the holders of the Series AAA Preferred Stock.

“Share Delivery Date” shall have the meaning set forth in Section 6(d).

“Stated Value” means $1,000.00 per share of Series AAA Preferred Stock.

“Standard Settlement Period” shall have the meaning set forth in Section 6(d)(i).

“Stockholder Approval” means the receipt by the Company of the approval, by vote or action by written consent, of a majority of the issued and outstanding voting securities of the Company, voting on an as-converted basis, together as a single class with respect to (i) adjustments to the Conversion Price pursuant to Section 7.1(a)(ii) hereto, and (ii) the issuance of additional Series AAA-1 AIR Preferred; it being understood that no shares of Series AAA Preferred shall vote in regard to the Stockholder Approval or the approval of any matters which would not be permitted by the Listing Rules.

“Subsidiary” means any subsidiary of the Company existing as of the Effective Date hereof and shall, where applicable, also include any direct or indirect subsidiary of the Company formed or acquired after the Effective Date.

“Trading Day” means a day on which the principal Trading Market is open for business.

“Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, OTCQB or OTCQX (or any successors to any of the foregoing).

“Transfer Agent” means Issuer Direct, the current transfer agent of the Company, with a mailing address of One Glenwood Avenue, Suite 1001, Raleigh, North Carolina 27603, a facsimile number of 919-481-6222 and an email address of info@issuerdirect.com, and any successor transfer agent of the Company.

“VWAP” shall have the meaning set forth in Section 6(b).

Section 2. Designation and Authorized Shares. The series of Preferred Stock designated by this Certificate of Designations shall be designated as the Company’s Series AAA Convertible Preferred Stock (the “Series AAA Preferred Stock”) and the number of shares so designated shall be Nine Thousand Four Hundred (9,400). So long as any of the Series AAA Preferred Stock are issued and outstanding, the Company shall not issue any Senior Securities or Parity Securities without the approval of the Majority Holders. The Series AAA Preferred Stock shall not be redeemed for cash and under no circumstances shall the Company be required to net cash settle the Series AAA Preferred Stock.

Section 3. Dividends. Holders of shares of Series AAA Preferred Stock will be entitled to receive: (a) dividends payable as follows: a number of shares of Common Stock equal to twenty percent (20%) of the number of shares of Common Stock issuable upon conversion of the Series AAA Preferred Stock then held by such Holder on each of the 12 and 24 month anniversaries of the Effective Date (collectively, the “PIK Shares”) and (b) dividends equal, on an as-if-converted to shares of Common Stock basis, to and in the same form as dividends actually paid on shares of the Common Stock when, as, and if such dividends are paid on shares of the Common Stock. The dividends set forth in clause (a) of this Section 3 will be satisfied solely by delivery of shares of Common Stock. The dividends set forth in clause (a) shall be accelerated and paid (to the extent such dividends that are otherwise payable on each of such anniversary dates was not previously paid) upon the consummation of a Fundamental Transaction. The dividends set forth in clause (a) shall be accelerated and paid (to the extent such dividends that are otherwise payable on each of such anniversary dates was not previously paid) upon the Mandatory Conversion Date following any Mandatory Conversion as contemplated in Section 6(b) hereto. Notwithstanding the foregoing, to the extent that a Holder’s right to participate in any dividend of PIK Shares pursuant to clause (a) or any stock dividend declared on the Common Stock to which such Holder is entitled to participate pursuant to clause (b) of this Section 3 (“Dividend Shares”) would result in such Holder exceeding the Beneficial Ownership Limitation or the Primary Market Limitation, then such Holder shall not be entitled to participate in any such dividend to such extent (or in the beneficial ownership of any PIK Shares or Dividend Shares as a result of such dividend to such extent) and the portion of such PIK Shares and/or Dividend Shares that would cause such Holder to exceed the Beneficial Ownership Limitation or the Primary Market Limitation shall be held in abeyance for the benefit of such Holder until such time, if ever, as such Holder’s beneficial ownership thereof would not result in such Holder exceeding the Beneficial Ownership Limitation or the Primary Market Limitation.

Section 4. Voting Rights. On any matter presented to the stockholders of the Company for their action or consideration at any meeting of stockholders of the Company (or by written consent of stockholders in lieu of meeting), and subject to the limitations set forth in Section 6(e) and 6(f), each Holder of outstanding shares of Series AAA Preferred Stock shall be entitled to cast the number of votes equal to the number of whole shares of Common Stock into which the shares of Series AAA Preferred Stock held by such holder are convertible as of the record date for determining stockholders entitled to vote on such matter. Except as provided by law or by the other provisions of the Certificate of Incorporation, Holders of Series AAA Preferred Stock shall vote together with the holders of Common Stock as a single class. The Holders shall be entitled to the same notice of any regular or special meeting of the stockholders as may or shall be given to holders of Common Stock entitled to vote at such meetings. As long as any shares of Series AAA Preferred Stock are outstanding, the Company may not, without the affirmative vote of the Majority Holders voting as a separate class, (i) amend, alter or repeal any provision of this Certificate of Designations in a manner that adversely affects the powers, preferences or rights of the Series AAA Preferred Stock, (ii) increase the number of authorized shares of Series AAA Preferred Stock, (iii) issue, or obligate itself to issue Parity Securities or Senior Securities, (iv) authorize, create, incur, assume, guarantee or suffer to exist any indebtedness for borrowed money of any kind other than an account receivable factoring facility in an amount not to exceed Five Million and 00/100 Dollars ($5,000,000) and trade accounts payable in the ordinary course of business, or (v) entering into any agreement with respect to the foregoing. Notwithstanding anything contained herein to the contrary, no holder of Series AAA Preferred Stock shall be entitled to vote on any matter presented to the Company’s stockholders relating to approving the conversion of such holder’s Series AAA Preferred Stock into an amount in excess of the Primary Market Limitation. Notwithstanding anything contained herein, for the purposes of this Section 4, the outstanding shares of Series AAA Preferred Stock includes both the Series AAA Preferred Stock, and any and all sub-series designated Series AAA-2 Preferred Stock and so on, that may be authorized following the date hereof and shall take into account the number of whole shares of Common Stock into which the shares of Series AAA Preferred Stock (and any other sub-series designated Series AAA-2 Preferred Stock and so on, that may be authorized following the date hereof) are convertible into as of the record date for determining stockholders entitled to vote on such matter.

Section 5. Liquidation.

(a) The Series AAA Preferred Stock shall, with respect to distributions of assets and rights upon the occurrence of any voluntary or involuntary liquidation, dissolution or winding-up of the Company (“Liquidation”) or Deemed Liquidation Event, rank: (i) junior to the Senior Securities, if any (ii) pari passu with the Parity Securities, if any and (iii) senior to the Junior Securities. For purposes hereof, references to Series AAA Preferred Stock in this Section 5 shall include the Series AAA Preferred and all sub-series designated Series AAA-2 Preferred Stock and so on, as well as any and all series or subseries designated Series AAA-1 AIR Preferred and so on, that may be authorized following the date hereof.

(b) As of the date hereof, there are no outstanding Senior Securities, Parity Securities consist solely of the Series A Preferred and the Series AA Preferred, and the Junior Securities consist solely of shares of Common Stock. That so being, upon any Liquidation, the holders of shares of Series AAA Preferred Stock and other Parity Securities then outstanding shall be entitled to be paid out of the assets of the Company available for distribution to its stockholders, and in the event of a Deemed Liquidation Event, the holders of shares of Series AAA Preferred Stock and other Parity Securities then outstanding shall be entitled to be paid out of the consideration payable to stockholders in such Deemed Liquidation Event, as applicable, before any payment shall be made to the holders of Common Stock by reason of their ownership thereof, an amount per share equal to one (1) times the applicable Original Issue Price, plus any dividends accrued but unpaid thereon (the amount payable pursuant to this sentence is hereinafter referred to as the “Liquidation Amounts”).

(c) After the payment in full of all Liquidation Amounts required to be paid to the holders of shares of Series AAA Preferred Stock and other Parity Securities then outstanding, the remaining assets of the Company available for distribution to its stockholders or, in the case of a Deemed Liquidation Event, the consideration not payable to the holders of shares of Series AAA Preferred Stock and other Parity Securities then outstanding pursuant to Section 5(b), shall be distributed among the holders of shares of Common Stock, pro rata based on the number of shares held by each such holder.

Section 6 Conversion.

(a) Conversions at Option of Holder. Each share of Series AAA Preferred Stock (or fraction thereof) shall be convertible, at any time and from time to time, from and after the Original Issue Date at the option of the Holder thereof into that number of shares of Common Stock (subject to the Beneficial Ownership Limitation set forth in Section 6(e) and the Primary Market Limitation set forth in Section 6(f)) determined by dividing the Stated Value by the Conversion Price then in effect. Holders shall effect conversions by providing the Company and the Transfer Agent, with the form of conversion notice attached hereto as Annex A (a “Notice of Conversion”). Each Notice of Conversion shall specify the number of shares of Series AAA Preferred Stock to be converted, the number of shares of Series AAA Preferred Stock owned prior to such conversion, the number of shares of Series AAA Preferred Stock owned subsequent to such conversion and the date on which such conversion is to be effected, which date may not be prior to the date the applicable Holder delivers such Notice of Conversion to the Company pursuant to Section 6 and in accordance with Section 9 (such date, the “Optional Conversion Date”). Such Holder shall be deemed for all corporate purposes to have become the holder of record of the Conversion Shares with respect to which the shares of Series AAA Preferred Stock have been converted as of the Optional Conversion Date. If no Optional Conversion Date is specified in a Notice of Conversion, the Optional Conversion Date shall be the date that such Notice of Conversion and Cancellation Request are deemed delivered to the Company in accordance with Section 9. The calculations and entries set forth in the Notice of Conversion shall control in the absence of manifest or mathematical error. No ink-original Notice of Conversion shall be required, nor shall any medallion guarantee (or other type of guarantee or notarization) of any Notice of Conversion form be required. To effect conversions of shares of Series AAA Preferred Stock, a Holder shall not be required to surrender any Certificated Series AAA Preferred Stock to the Company unless all of the shares of Series AAA Preferred Stock represented by any such certificate are so converted, in which case such Holder shall deliver the Certificated Series AAA Preferred Stock promptly following the Optional Conversion Date. To the extent that the Beneficial Ownership Limitation contained in Section 6(e) or the Primary Market Limitation contained in Section 6(f) applies to the converting Holder, the determination of whether the Series AAA Preferred Stock is convertible (in relation to other securities owned by such Holder together with any Affiliates and Attribution Parties) and of how many shares of Series AAA Preferred Stock are convertible shall be in the sole discretion of such Holder, and the submission of a Notice of Conversion shall be deemed to be such Holder’s determination of whether the shares of Series AAA Preferred Stock may be converted (in relation to other securities owned by such Holder together with any Affiliates and Attribution Parties) and how many shares of the Series AAA Preferred Stock are convertible, in each case subject to the Beneficial Ownership Limitation or the Primary Market Limitation. To ensure compliance with this restriction, each Holder will be deemed to represent to the Company each time it delivers a Notice of Conversion that such Notice of Conversion has not violated the restrictions set forth in this Section and the Company shall have no obligation to verify or confirm the accuracy of such determination.

(b) Mandatory Conversion. On the one (1) year anniversary of the Original Issue Date, the Company may, in its discretion (subject to the Beneficial Ownership Limitation set forth in Section 6(e) and the Primary Market Limitation set forth in Section 6(f)), convert (A) 50% of the outstanding shares of Series AAA Preferred if the volume-weighted average price of the Company’s common stock over the previous ten (10) days as reported on the NASDAQ Capital Market (the “VWAP”), equals at least 250% of the Conversion Price, or (B) 100% of the outstanding shares of Series AAA Preferred if the VWAP equals at least 300% of the Conversion Price (as applicable, the “Mandatory Conversion Date” and together with an Optional Conversion Date, the “Conversion Date”), into such number of fully paid and non-assessable shares of Common Stock as is determined by dividing the Stated Value by the Conversion Price in effect on the Mandatory Conversion Date (a “Mandatory Conversion”); provided, however, the Company may not effect such Mandatory Conversion unless (I) such shares of Common Stock for which the shares of Series AAA Preferred Stock will be converted are either (i) registered pursuant to an effective registration statement, or (ii) may be resold without restriction pursuant to Rule 144 of the Securities Act, and (II) the Company’s Common Stock has traded above the Minimum Trading Volume for a period of at least five (5) consecutive Trading Days. Within two (2) Trading Days of (x) the Mandatory Conversion Date, if the shares of Series AAA Preferred Stock are held in book entry form, or (y) such Holder’s surrender of Certificated Series AAA Preferred Stock (or, if such registered holder alleges that such certificate has been lost, stolen or destroyed, a lost certificate affidavit and an indemnity or security reasonably acceptable to the Company (which shall not include the posting of any bond) to indemnify the Company against any claim that may be made against the Company on account of the alleged loss, theft or destruction of such certificate), the Company shall deliver: (I) to each Holder, the Conversion Shares issuable upon conversion of such Holder’s Series AAA Preferred Stock via the Certificated Preferred Stock, and (II) the PIK Shares issuable upon Mandatory Conversion under Section 3, to Holders as of the Mandatory Conversion Date; provided that, any failure by the Holder to return Certificated Series AAA Preferred Stock, if any, will have no effect on the Mandatory Conversion pursuant to this Section 6(b), which Mandatory Conversion will be deemed to occur on the Mandatory Conversion Date. To the extent that the Beneficial Ownership Limitation contained in Section 6(e) or the Primary Market Limitation contained in Section 6(f) applies to any Holder, such Holder shall within five Business Days of such Holder’s receipt of the Company Conversion Notice, provide the Company with a written determination (a “Mandatory Conversion Determination”), delivered in accordance with Section 9, of whether such Holder’s Series AAA Preferred Stock is convertible (in relation to other securities owned by such Holder together with any Affiliates and Attribution Parties) and of how many shares of Series AAA Preferred Stock are convertible, and the submission of a Mandatory Conversion Determination shall be deemed to be such Holder’s determination of the maximum number of shares of Series AAA Preferred Stock that may be converted, subject to the Beneficial Ownership Limitation or the Primary Market Limitation and the portion of the shares of Common Stock issuable upon such Mandatory Conversion hereunder that would cause such Holder to exceed the Beneficial Ownership Limitation or the Primary Market Limitation shall be held in abeyance for the benefit of such Holder until such time, if ever, as such Holder’s beneficial ownership thereof would not result in such Holder exceeding the Beneficial Ownership Limitation or the Primary Market Limitation. To ensure compliance with this restriction, each Holder will be deemed to represent to the Company each time it delivers a Mandatory Conversion Determination that such determination has not violated the restrictions set forth in Section 6(e) or Section 6(f) and the Company shall have no obligation to verify or confirm the accuracy of such determination.

(c) Conversion Shares. The aggregate number of Conversion Shares which the Company shall issue upon conversion of the Series AAA Preferred Stock (whether pursuant to Section 6(a) or 6(b)) will be equal to the number of shares of Series AAA Preferred Stock to be converted, multiplied by the Stated Value, divided by the Conversion Price in effect at the time of the conversion.

(d) Mechanics of Conversion.

(i) Delivery of Conversion Shares upon Conversion. Promptly after the applicable Conversion Date, but in any case within the earlier of (i) two (2) Trading Days and (ii) the Standard Settlement Period (as defined below) thereof (the “Share Delivery Date”), the Company shall deliver, or cause to be delivered, to the converting Holder the number of Conversion Shares being acquired upon the conversion of the Series AAA Preferred Stock pursuant to Section 6(a) or 6(b), as applicable, any PIK Shares to which the Holder is entitled pursuant to Section 3 that have not been previously issued, if any, and a wire transfer of immediately available funds in the amount of accrued and unpaid cash dividends, if any. Conversion Shares issuable hereunder shall be transmitted by the Transfer Agent to the Holder by crediting the account of the Holder’s or its designee’s balance account with DTC through its Deposit or Withdrawal at Custodian system (“DWAC”) if the Company is then a participant in such system and otherwise by physical delivery of a certificate, registered in the Company’s share register in the name of the Holder or its designee, for the number of Conversion Shares and PIK Shares, if any, to which the Holder is entitled pursuant to such conversion to the address specified by the Holder in the Notice of Conversion or the Company Conversion Notice, as the case may be. The Company shall (A) deliver (or cause to be delivered) to the converting Holder who has converted less than all of such Holder’s Certificated Series AAA Preferred Stock (1) a certificate or certificates, of like tenor, for the number of shares of Series AAA Preferred Stock evidenced by any surrendered certificate or certificates less the number of shares of Series AAA Preferred Stock converted. The Company agrees to maintain a transfer agent that is a participant in the DTC’s FAST program so long as any shares of Series AAA Preferred Stock remain outstanding. As used herein, “Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Company’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery of the Notice of Conversion.

(ii) Failure to Deliver Conversion Shares upon an Optional Conversion. If, in the case of any Notice of Conversion, such Conversion Shares are not delivered to or as directed by the applicable Holder by the Share Delivery Date, in addition to any other rights herein, the Holder shall be entitled to elect by written notice to the Transfer Agent, on behalf of the Company, at any time on or before its receipt of such Conversion Shares, to rescind such Conversion, in which event the Company shall promptly return to the Holder any Certificated Series AAA Preferred Stock delivered to the Company and the Holder shall promptly return to the Company the Conversion Shares issued to such Holder pursuant to the rescinded Notice of Conversion.

(iii) Obligation Absolute; Partial Liquidated Damages. The Company’s obligation to issue and deliver the Conversion Shares upon conversion of Series AAA Preferred Stock in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by a Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by such Holder or any other Person of any obligation to the Company or any violation or alleged violation of law by such Holder or any other person, and irrespective of any other circumstance which might otherwise limit such obligation of the Company to such Holder in connection with the issuance of such Conversion Shares; provided, however, that such delivery shall not operate as a waiver by the Company of any such action that the Company may have against such Holder. If the Company fails to deliver to a Holder such Conversion Shares pursuant to Section 6(d)(i) by the Share Delivery Date applicable to such conversion, the Company shall pay to such Holder, in cash, as liquidated damages and not as a penalty, for each $1,000 of Stated Value of Series AAA Preferred Stock being converted, $10 per Trading Day (increasing to $20 per Trading Day on the fifth Trading Day after such damages begin to accrue) for each Trading Day after the Share Delivery Date until such Conversion Shares are delivered or Holder rescinds such conversion.

(iv) Compensation for Buy-In on Failure to Timely Deliver Conversion Shares Upon Conversion. In addition to any other rights available to the Holder, if the Company fails for any reason to deliver to a Holder the applicable Conversion Shares by the Share Delivery Date pursuant to Section 6(d)(i), and if after such Share Delivery Date such Holder is required by its brokerage firm to purchase (in an open market transaction or otherwise), or the Holder’s brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by such Holder of the Conversion Shares which such Holder was entitled to receive upon the conversion relating to such Share Delivery Date (a “Buy-In”), then the Company shall (A) pay in cash to such Holder (in addition to any other remedies available to or elected by such Holder) the amount, if any, by which (x) such Holder’s total purchase price (including any brokerage commissions) for the Common Stock so purchased exceeds (y) the product of (1) the aggregate number of shares of Common Stock that such Holder was entitled to receive from the conversion at issue multiplied by (2) the actual sale price at which the sell order giving rise to such purchase obligation was executed (including any brokerage commissions) and (B) at the option of such Holder, either reissue (if surrendered) the shares of Series AAA Preferred Stock equal to the number of shares of Series AAA Preferred Stock submitted for conversion (in which case, such conversion shall be deemed rescinded) or deliver to such Holder the number of shares of Common Stock that would have been issued if the Company had timely complied with its delivery requirements under Section 6(c)(i). For example, if a Holder purchases shares of Common Stock having a total purchase price of $11,000 to cover a Buy-In with respect to an attempted conversion of shares of Series AAA Preferred Stock with respect to which the actual sale price of the Conversion Shares (including any brokerage commissions) giving rise to such purchase obligation was a total of $10,000 under clause (A) of the immediately preceding sentence, the Company shall be required to pay such Holder $1,000. The Holder shall provide the Company written notice indicating the amounts payable to such Holder in respect of the Buy-In and, upon request of the Company, evidence of the amount of such loss. Nothing herein shall limit a Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver the Conversion Shares upon conversion of the shares of Series AAA Preferred Stock as required pursuant to the terms hereof.

(v) Reservation of Shares Issuable Upon Conversion. Subject to receipt of the Stockholder Approval, the Company covenants that it will at all times reserve and keep available out of its authorized and unissued shares of Common Stock, free from preemptive rights or any other actual contingent purchase rights of Persons other than the Holders of the Series AAA Preferred Stock, not less than such aggregate number of shares of the Common Stock as shall be issuable (i) upon the conversion of all outstanding shares of Series AAA Preferred Stock (taking into account the adjustments and restrictions of Section 7) and (ii) in respect of the PIK Shares. The Company covenants that all Conversion Shares and PIK Shares shall, when issued, be duly authorized, validly issued, fully paid and nonassessable. If at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then-outstanding shares of Series AAA Preferred Stock (taking into account the adjustments and restrictions of Section 7), and payment of the PIK Shares, the Company shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes.

(vi) Fractional Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of or as dividends on the Series AAA Preferred Stock. As to any fraction of a share which a Holder would otherwise be entitled to upon such conversion or in respect of any such dividend, the Company shall round up to the next whole share of Common Stock.

(vii) Transfer Taxes and Expenses. The issuance of Conversion Shares on conversion of this Series AAA Preferred Stock shall be made without charge to any Holder for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such Conversion Shares, provided that the Company shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such Conversion Shares upon conversion in a name other than that of the Holders of such shares of Series AAA Preferred Stock and the Company shall not be required to issue or deliver such Conversion Shares unless or until the Person or Persons requesting the issuance thereof shall have paid to the Company the amount of such tax or shall have established to the satisfaction of the Company that such tax has been paid.

(e) Beneficial Ownership Limitation. The Company shall not effect any conversion of the Series AAA Preferred Stock, including, without limitation, a Mandatory Conversion, and a Holder shall not have the right to receive dividends hereunder or convert any portion of the Series AAA Preferred Stock, to the extent that, after giving effect to the receipt of dividends hereunder or conversion set forth on the applicable Notice of Conversion, such Holder (together with such Holder’s Affiliates, and any Persons acting as a group together with such Holder or any of such Holder’s Affiliates (such Persons, “Attribution Parties”)) would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by such Holder and its Affiliates and Attribution Parties shall include the number of shares of Common Stock received as dividends or issuable upon conversion of the Series AAA Preferred Stock with respect to which such determination is being made, but shall exclude the number of shares of Common Stock which are issuable upon (i) conversion of the remaining, unconverted Series AAA Preferred Stock beneficially owned by such Holder or any of its Affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company subject to a limitation on conversion or exercise analogous to the limitation contained herein (including, without limitation, the Series AAA Preferred Stock) beneficially owned by such Holder or any of its Affiliates or Attribution Parties. Except as set forth in the preceding sentence, for purposes of this Section 6(e), beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder, it being acknowledged by the Holder that the Company is not representing to the Holder that such calculation is in compliance with Section 13(d) of the Exchange Act and the Holder is solely responsible for any schedules required to be filed in accordance therewith (other than as it relates to a Holder relying on the number of shares issued and outstanding as provided by the Company pursuant to this Section). In addition, a determination as to any group status as contemplated above shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. For purposes of this Section 6(e), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number of outstanding shares of Common Stock as stated in the most recent of the following: (i) the Company’s most recent periodic or annual report filed with the Commission, as the case may be, (ii) a more recent public announcement by the Company or (iii) a more recent written notice by the Company or the Transfer Agent setting forth the number of shares of Common Stock outstanding. Upon the written or oral request (which may be via email) of a Holder, the Company shall within one (1) Trading Day confirm orally and in writing to such Holder the number of shares of Common Stock then outstanding. The “Beneficial Ownership Limitation” shall be 4.99% (or, at the written election of any Holder delivered to the Company pursuant to the terms of Section 9 prior to the issuance of any shares of Series AAA Preferred Stock, 9.99% but no in event higher than 9.99%) of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon conversion of Series AAA Preferred Stock held by the applicable Holder. Upon delivery of a written notice to the Company, any holder may from time to time increase or waive (with such increase or waiver not effective until the sixty-first (61st) day after delivery of such notice) or decrease (immediately) the Beneficial Ownership Limitation provisions of this Section 6(e); provided, however, that the Holder shall not be entitled to increase or terminate the limitation contained in this Section 6(e) if the Holder has acquired (or if any of the Holder’s Attribution parties has indirectly acquired) the Series AAA Preferred Stock with the purpose or effect of changing or influencing the control of the Company. The limitations contained in this Section 6(e) shall apply to a successor holder of Series AAA Preferred Stock.

(f) Primary Market Limitation. Unless the Company obtains the approval of its stockholders as required by the applicable rules of the applicable Trading Market for issuances of Common Stock in excess of such amount, the Company shall not effect any conversion of the Series AAA Preferred Stock, including, without limitation, a Mandatory Conversion, and a Holder shall not have the right to receive dividends hereunder or convert any portion of the Series AAA Preferred Stock, to the extent that, after giving effect to the receipt of dividends hereunder or conversion set forth on the applicable Notice of Conversion, the Holder, together with the Attribution Parties, would beneficially own in excess of the Primary Market Limitation (as defined below). For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by such Holder and its Affiliates and Attribution Parties shall include the number of shares of Common Stock received as dividends or issuable upon conversion of the Series AAA Preferred Stock with respect to which such determination is being made, but shall exclude the number of shares of Common Stock which are issuable upon (i) conversion of the remaining, unconverted Series AAA Preferred Stock beneficially owned by such Holder or any of its Affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company subject to a limitation on conversion or exercise analogous to the limitation contained herein (including, without limitation, the Series AAA Preferred Stock) beneficially owned by such Holder or any of its Affiliates or Attribution Parties. Except as set forth in the preceding sentence, for purposes of this Section 6(f), beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder, it being acknowledged by the Holder that the Company is not representing to the Holder that such calculation is in compliance with Section 13(d) of the Exchange Act and the Holder is solely responsible for any schedules required to be filed in accordance therewith (other than as it relates to a Holder relying on the number of shares issued and outstanding as provided by the Company pursuant to this Section). For purposes of this Section 6(f), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number of outstanding shares of Common Stock as stated in the most recent of the following: (i) the Company’s most recent periodic or annual report filed with the Commission, as the case may be, (ii) a more recent public announcement by the Company or (iii) a more recent written notice by the Company or the Transfer Agent setting forth the number of shares of Common Stock outstanding. Upon the written or oral request (which may be via email) of a Holder, the Company shall within one (1) Trading Day confirm orally and in writing to such Holder the number of shares of Common Stock then outstanding. The “Primary Market Limitation” shall be 19.99% of the number of shares of the Common Stock outstanding as of the Effective Date, immediately prior to the issuance of shares of Series AAA Preferred. The limitations contained in this paragraph shall apply to a successor holder of the Series AAA Preferred Stock.

Section 7. Certain Adjustments.

(a) Adjustments to Conversion Price.

| |

(i)

|

Stock Dividends and Stock Splits. If the Company, at any time while the Series AAA Preferred Stock is outstanding: (A) pays a stock dividend or otherwise makes a distribution or distributions payable in shares of Common Stock on shares of Common Stock or any other Common Stock Equivalents (which, for avoidance of doubt, will not include any shares of Common Stock issued by the Company upon conversion of this Series AAA Preferred Stock (or any other Parity Securities) or payment of a dividend on this Series AAA Preferred Stock (or any other Parity Securities)); (B) subdivides outstanding shares of Common Stock into a larger number of shares; (C) combines (including by way of a reverse stock split) outstanding shares of Common Stock into a smaller number of shares; or (D) issues, in the event of a reclassification of shares of the Common Stock, any shares of capital stock of the Company, then the Conversion Price will be multiplied by a fraction of which the numerator will be the number of shares of Common Stock (excluding any treasury shares of the Company) outstanding immediately before such event and of which the denominator will be the number of shares of Common Stock, or in the event that clause (D) of this Section 7(a) will apply shares of reclassified capital stock, outstanding immediately after such event. Any adjustment made pursuant to this Section 7(a) will become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and will become effective immediately after the effective date in the case of a subdivision, combination or re-classification.

|

| |

(ii)

|

Future Issuances. So long as the Company receives the Stockholder Approval, from and after the date thereof and until the date that is twenty four (24) months from the Effective Date, if the Company shall issue or sell any Equity Securities (as defined below) at an effective price per share less than the then effective Conversion Price (such lower price, the “Base Share Price” and such issuances collectively, a “Dilutive Issuance”), as adjusted hereunder (if the holder of the Equity Securities so issued shall at any time, whether by operation of purchase price adjustments, reset provisions, floating conversion, exercise or exchange prices or otherwise, is entitled to receive shares of Common Stock at an effective price per share which is less than the then effective Conversion Price, such issuance shall be deemed to have occurred for less than the then effective Conversion Price on such date of the Dilutive Issuance), then, the Conversion Price shall be reduced to equal the Base Share Price, subject to the Conversion Price Floor. Notwithstanding the foregoing, no adjustments shall be made, paid or issued under this Section 7(a)(ii) in respect of Exempt Issuances (as defined below). The Company shall notify the Holder in writing as promptly as reasonably possible following the issuance of any Equity Securities subject to this section, indicating therein the applicable issuance price, or of applicable reset price, exchange price, conversion price and other pricing terms (such notice the “Dilutive Issuance Notice”). For purposes of clarification, whether or not the Company provides a Dilutive Issuance Notice pursuant to this Section 7(a)(ii), upon the occurrence of any Dilutive Issuance while the Series AAA Preferred is outstanding, after the date of such Dilutive Issuance the Holder is entitled to the Base Share Price regardless of whether the Holder accurately refers to the Base Share Price in the Conversion Notice.

|

For purposes of this Section 7(a)(ii), the following definitions shall apply:

“Common Stock Equivalents” as defined in Section 1.

“Equity Securities” means (i) Common Stock and (ii) Common Stock Equivalents.

“Exempt Issuance” means (i) Equity Securities issued or issuable upon conversion or exercise of any currently outstanding securities or any Equity Securities issued in accordance with this Certificate (including the Conversion Shares and the Dividend Shares) or issued pursuant to any contractual rights granted to holders of the Series AAA Preferred Stock (which for purposes of this definition shall include any contractual rights granted to holders of all Parity Securities, inclusive of any Equity Securities issued upon the conversion thereof); (ii) Equity Securities granted to officers, directors and employees of, and consultants to, the Company pursuant to stock option or purchase plans or other compensatory agreements approved by the Board of Directors; (iii) Equity Securities issued in connection with any pro rata stock split, stock dividend or recapitalization by the Company; (iv) Equity Securities issued in a Strategic Investment; (v) Equity Securities issued pursuant to the acquisition of another corporation or entity by the Company by consolidation, merger, purchase of all or substantially all of the assets, or other reorganization in which the Company acquires, in a single transaction or series of related transactions, all or substantially all of the assets of such other corporation or entity or fifty percent (50%) or more of the voting power of such other corporation or entity or fifty percent (50%) or more of the equity ownership of such other corporation or entity; and (vi) securities issuable upon conversion or exercise of the securities set forth in paragraphs (i) – (v) above.

“Strategic Investment” any transaction or agreement with one (1) or more persons, firms or entities designated as a “strategic partner” of the Company, as determined in good faith by the Board of Directors of the Company); provided, however, that each such “strategic partner” is itself, or has a subsidiary or affiliate that is, an operating company in a business synergistic with the business of the Company and provided further that the transaction is one in which the Company receives benefits in addition to the investment of funds. In no event shall a transaction in which the Company issues securities primarily for the purpose of raising capital or to one (1) or more persons or entities whose primary business is investing in securities be deemed a Strategic Investment.

| |

(iii)

|

Provisions for Adjustments. Notwithstanding anything in this Section to the contrary: (i) in no event shall an adjustment be made under this clause if such adjustment would result in raising the then-effective Conversion Price; (ii) no adjustment under this Section 7(a) need be made to the Conversion Price unless such adjustment would require a decrease of at least 1.0% of the Conversion Price then in effect, with any lesser adjustment being carried forward and made at the time of and together with the next subsequent adjustment, if any, which, together with any adjustment or adjustments so carried forward, shall result in a decrease of at least 1.0% of such Conversion Price; (iii) no adjustment under this Section 7(a) shall be made if such adjustment will result in a Conversion Price that is less than either the Conversion Price Floor, or the par value of the Common Stock; and (iv) no adjustment shall be made to the Conversion Price upon any Exempt Issuances. The Company will make all calculations under this Certificate of Designation in good faith, which calculations will, absent manifest error, control for purposes this Certificate of Designation.

|