0001092796falsePRE 14A0001092796swbi:MarkPSmithMember2022-05-012023-04-300001092796swbi:StockAwardsAdjustmentsMember2020-05-012021-04-300001092796ecd:PeoMemberswbi:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearAdjustmentMemberswbi:MarkPSmithMember2021-05-012022-04-300001092796swbi:EquityAwardAdjustmentsMember2022-05-012023-04-300001092796swbi:EquityAwardAdjustmentsMember2020-05-012021-04-300001092796swbi:FairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearAdjustmentMemberecd:NonPeoNeoMember2020-05-012021-04-300001092796ecd:PeoMemberswbi:FairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsAdjustmentMemberswbi:MarkPSmithMember2022-05-012023-04-300001092796ecd:PeoMemberswbi:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearAdjustmentMemberswbi:MarkPSmithMember2020-05-012021-04-300001092796ecd:PeoMemberswbi:EquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearAdjustmentMemberswbi:MarkPSmithMember2021-05-012022-04-300001092796swbi:BrianDMurphyMember2021-05-012022-04-300001092796swbi:StockAwardsAdjustmentsMemberswbi:MarkPSmithMember2022-05-012023-04-300001092796swbi:BrianDMurphyMemberecd:PeoMemberswbi:EquityAwardAdjustmentsMember2020-05-012021-04-300001092796swbi:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearAdjustmentMemberecd:NonPeoNeoMember2020-05-012021-04-3000010927962021-05-012022-04-300001092796swbi:FairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearAdjustmentMemberecd:NonPeoNeoMember2021-05-012022-04-300001092796ecd:PeoMemberswbi:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearAdjustmentMemberswbi:MarkPSmithMember2022-05-012023-04-300001092796swbi:MarkPSmithMemberswbi:EquityAwardAdjustmentsMember2021-05-012022-04-300001092796swbi:BrianDMurphyMemberecd:PeoMemberswbi:FairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsAdjustmentMember2020-05-012021-04-30000109279632022-05-012023-04-300001092796swbi:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-05-012021-04-300001092796ecd:PeoMemberswbi:EquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearAdjustmentMemberswbi:MarkPSmithMember2022-05-012023-04-30000109279622022-05-012023-04-300001092796ecd:PeoMemberswbi:EquityAwardAdjustmentsMemberswbi:MarkPSmithMember2022-05-012023-04-300001092796ecd:PeoMemberswbi:MarkPSmithMemberswbi:EquityAwardAdjustmentsMember2021-05-012022-04-300001092796swbi:FairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearAdjustmentMemberecd:NonPeoNeoMember2021-05-012022-04-300001092796swbi:ValueOfDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseIncludedAdjustmentMemberecd:NonPeoNeoMember2022-05-012023-04-300001092796swbi:FairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearAdjustmentMemberecd:PeoMemberswbi:MarkPSmithMember2021-05-012022-04-3000010927962022-05-012023-04-300001092796swbi:FairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsAdjustmentMemberecd:NonPeoNeoMember2020-05-012021-04-300001092796swbi:BrianDMurphyMemberswbi:FairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearAdjustmentMemberecd:PeoMember2020-05-012021-04-300001092796swbi:BrianDMurphyMemberswbi:ValueOfDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseIncludedAdjustmentMemberecd:PeoMember2020-05-012021-04-300001092796swbi:BrianDMurphyMember2020-05-012021-04-300001092796swbi:FairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearAdjustmentMemberecd:NonPeoNeoMember2020-05-012021-04-300001092796swbi:EquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearAdjustmentMemberecd:NonPeoNeoMember2022-05-012023-04-300001092796swbi:BrianDMurphyMemberecd:PeoMemberswbi:FairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearAdjustmentMember2020-05-012021-04-300001092796swbi:BrianDMurphyMemberecd:PeoMemberswbi:EquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearAdjustmentMember2020-05-012021-04-300001092796swbi:FairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsAdjustmentMemberecd:PeoMemberswbi:MarkPSmithMember2020-05-012021-04-300001092796swbi:ValueOfDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseIncludedAdjustmentMemberecd:NonPeoNeoMember2021-05-012022-04-300001092796ecd:PeoMemberswbi:MarkPSmithMemberswbi:EquityAwardAdjustmentsMember2020-05-012021-04-300001092796ecd:PeoMemberswbi:FairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearAdjustmentMemberswbi:MarkPSmithMember2022-05-012023-04-300001092796swbi:MarkPSmithMemberswbi:EquityAwardAdjustmentsMember2020-05-012021-04-300001092796swbi:MarkPSmithMember2020-05-012021-04-300001092796swbi:FairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearAdjustmentMemberecd:PeoMemberswbi:MarkPSmithMember2020-05-012021-04-300001092796swbi:BrianDMurphyMember2022-05-012023-04-30000109279612022-05-012023-04-300001092796swbi:ValueOfDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseIncludedAdjustmentMemberecd:PeoMemberswbi:MarkPSmithMember2021-05-012022-04-300001092796ecd:PeoMemberswbi:EquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearAdjustmentMemberswbi:MarkPSmithMember2020-05-012021-04-300001092796swbi:FairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearAdjustmentMemberecd:NonPeoNeoMember2022-05-012023-04-300001092796swbi:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearAdjustmentMemberecd:NonPeoNeoMember2021-05-012022-04-300001092796ecd:PeoMemberswbi:FairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearAdjustmentMemberswbi:MarkPSmithMember2020-05-012021-04-300001092796swbi:StockAwardsAdjustmentsMember2022-05-012023-04-300001092796swbi:FairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearAdjustmentMemberecd:PeoMemberswbi:MarkPSmithMember2022-05-012023-04-300001092796swbi:BrianDMurphyMemberswbi:EquityAwardAdjustmentsMember2020-05-012021-04-300001092796ecd:NonPeoNeoMemberswbi:EquityAwardAdjustmentsMember2022-05-012023-04-300001092796swbi:ValueOfDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseIncludedAdjustmentMemberecd:PeoMemberswbi:MarkPSmithMember2022-05-012023-04-300001092796swbi:FairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsAdjustmentMemberecd:NonPeoNeoMember2022-05-012023-04-300001092796swbi:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearAdjustmentMemberecd:NonPeoNeoMember2022-05-012023-04-300001092796swbi:EquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearAdjustmentMemberecd:NonPeoNeoMember2020-05-012021-04-300001092796swbi:EquityAwardAdjustmentsMemberswbi:MarkPSmithMember2022-05-012023-04-300001092796swbi:ValueOfDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseIncludedAdjustmentMemberecd:PeoMemberswbi:MarkPSmithMember2020-05-012021-04-300001092796ecd:NonPeoNeoMemberswbi:EquityAwardAdjustmentsMember2021-05-012022-04-300001092796swbi:StockAwardsAdjustmentsMemberswbi:MarkPSmithMember2021-05-012022-04-300001092796swbi:BrianDMurphyMemberecd:PeoMemberswbi:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearAdjustmentMember2020-05-012021-04-300001092796ecd:PeoMemberswbi:FairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearAdjustmentMemberswbi:MarkPSmithMember2021-05-012022-04-300001092796swbi:FairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsAdjustmentMemberecd:PeoMemberswbi:MarkPSmithMember2021-05-012022-04-300001092796swbi:EquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearAdjustmentMemberecd:NonPeoNeoMember2021-05-012022-04-300001092796swbi:BrianDMurphyMemberswbi:StockAwardsAdjustmentsMember2020-05-012021-04-300001092796swbi:EquityAwardAdjustmentsMember2021-05-012022-04-300001092796swbi:FairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearAdjustmentMemberecd:NonPeoNeoMember2022-05-012023-04-300001092796swbi:ValueOfDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseIncludedAdjustmentMemberecd:NonPeoNeoMember2020-05-012021-04-300001092796swbi:MarkPSmithMember2021-05-012022-04-300001092796swbi:FairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsAdjustmentMemberecd:NonPeoNeoMember2021-05-012022-04-300001092796swbi:StockAwardsAdjustmentsMemberswbi:MarkPSmithMember2020-05-012021-04-3000010927962020-05-012021-04-300001092796swbi:StockAwardsAdjustmentsMember2021-05-012022-04-30iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☒ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

|

Smith & Wesson Brands, Inc. |

(Name of Registrant as Specified in its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

|

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

|

MEETING AND PROXY STATEMENT 2022 NOTICE OF ANNUAL STOCKHOLDER MEETING AND PROXY STATEMENT

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

|

|

|

|

|

|

|

|

Date: Tuesday, September 19, 2023 |

|

|

Time: 10a.m. Eastern Time |

|

|

Location: www.virtualshareholder meeting.com/SWBI2023 |

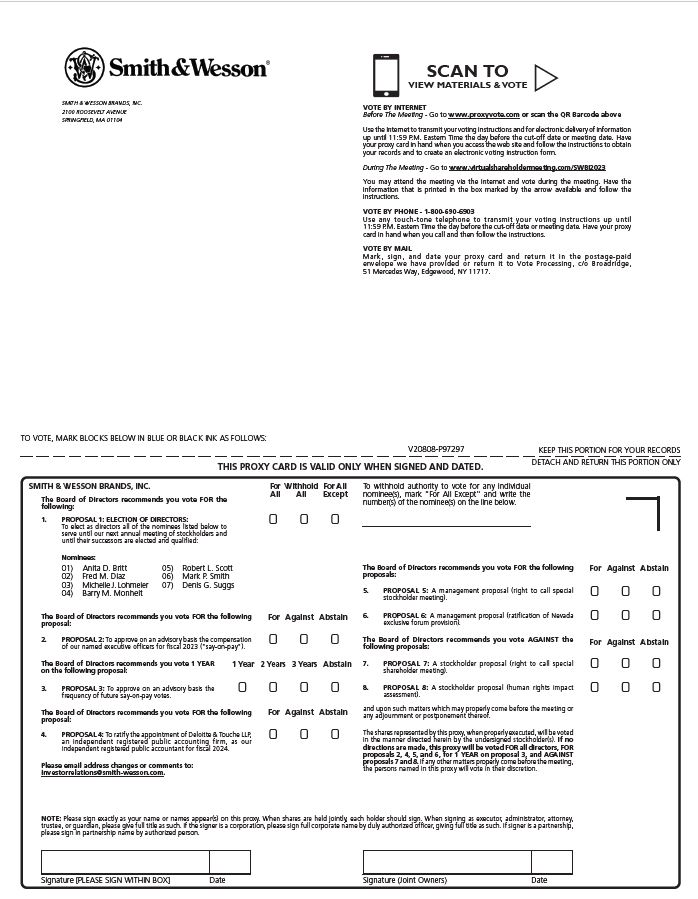

The Annual Meeting of Stockholders of Smith & Wesson Brands, Inc., a Nevada corporation, will be held at 10:00 a.m., Eastern Time, on Tuesday, September 19, 2023 (the “2023 Annual Meeting”). The 2023 Annual Meeting will be a virtual meeting of stockholders. You will be able to attend the 2023 Annual Meeting, vote, and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/SWBI2023 and entering the 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials.

The 2023 Annual Meeting will be held for the following purposes:

|

|

ITEMS OF BUSINESS |

1 |

Election of directors |

2 |

Advisory vote to approve executive compensation ("say-on-pay") |

3 |

Advisory vote on the frequency of future say-on-pay votes |

4 |

Ratification of appointment of independent registered public accounting firm |

5 |

Advisory vote to call special stockholder meeting |

6 |

Ratification of Nevada exclusive forum provision |

7 |

Stockholder proposals, if properly presented |

And such other business as may properly come before the 2023 Annual Meeting or any adjournment or postponement thereof. |

Stockholders of record at the close of business on July 28, 2023 may vote at the 2023 Annual Meeting.

These proxy materials were first made available to our stockholders on the internet on [ ], 2023.

Sincerely,

Kevin A. Maxwell

Senior Vice President,

General Counsel, Chief Compliance Officer, and Secretary

[ ], 2023

Table of Contents

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. You should read this entire Proxy Statement carefully before voting.

|

|

|

|

|

|

|

|

|

|

|

MEETING INFORMATION |

|

|

Time and Date |

|

10:00 a.m., Eastern Time, on Tuesday, September 19, 2023 |

|

|

Location |

|

Online via webcast at www.virtualshareholdermeeting.com/SWBI2023 |

|

|

Record Date |

|

July 28, 2023 |

|

|

|

|

|

MEETING AGENDA |

|

|

|

|

|

|

|

|

|

|

Proposals |

|

Board Recommendation |

|

Page |

|

|

|

|

1. |

Election of Seven Directors |

|

FOR each nominee |

|

3 |

2. |

Advisory Vote to Approve Executive Compensation |

|

FOR |

|

16 |

3. |

Advisory Vote on Frequency of Future Say-on-Pay Votes |

|

ONE YEAR |

|

17 |

4. |

Ratification of Appointment of Deloitte & Touche, LLP |

|

FOR |

|

44 |

5. |

Management Proposal - Advisory Vote to Call Special Stockholder Meeting |

|

FOR |

|

46 |

6. |

Management Proposal - Ratification of Nevada Exclusive Forum Provision |

|

FOR |

|

48 |

7. |

Stockholder Proposal - Right to Call Special Shareholder Meeting |

|

AGAINST |

|

50 |

8. |

Stockholder Proposal - Human Rights Impact Assessment |

|

AGAINST |

|

52 |

|

|

|

|

|

|

Name |

Age |

Director Since |

Experience |

Committee Memberships |

Other Public Company Boards |

Anita D. Britt * |

60 |

2018 |

Former CFO of Perry Ellis International, Inc. |

AC **, CC, ESG |

3 |

Fred M. Diaz * |

57 |

2021 |

Former President and CEO of Mitsubishi Motor North America, Inc. |

CC, ESG** |

3 |

Michelle J. Lohmeier* |

60 |

2023 |

Former Strategic Advisor to CEO of Spirit AeroSystems, Inc. |

CC, ESG |

2 |

Barry M. Monheit * |

76 |

2004 |

Former President of Financial Consulting Division of FTI Consulting |

CC **, NCG |

1 |

Robert L. Scott *§ |

77 |

1999 |

Former President of a predecessor of Smith & Wesson Brands, Inc. |

AC, NCG |

0 |

Mark P. Smith |

47 |

2020 |

President and CEO of Smith & Wesson Brands, Inc. |

|

0 |

Denis G. Suggs * |

57 |

2021 |

CEO of LCP Transportation LLC |

AC, NCG** |

1 |

* = Independent Nominee; ** = Committee Chair; § = Chairman

AC = Audit Committee; CC = Compensation Committee; ESG = Environmental, Social, and Governance Committee; NCG = Nominations and Corporate Governance Committee

|

|

|

2023 Proxy Statement I 1 |

KEY ACCOMPLISHMENTS

Our key accomplishments for the fiscal year ended April 30, 2023 (“fiscal 2023”) include:

|

Continued Investments in Our Business In fiscal 2023, our capital allocation strategy continued to focus on investments in our business associated with the move of our headquarters and significant elements of our operations to Maryville, Tennessee (the “Relocation”). In fiscal 2023, we spent approximately $98 million in aggregate on the Relocation. Once the Relocation is completed, we will be positioned to deliver improved operating and financial performance, in part, due to the realization of certain distribution and manufacturing efficiencies. |

GOVERNANCE HIGHLIGHTS

Board Refreshment

We recognize the importance of board refreshment. Over 70% of our director nominees have joined our board of directors (the "Board") since 2018. This demonstrates the Board’s commitment to refreshment, including with independent nominees who provide perspectives and experience to support our strategy. Of our seven director nominees, two are women, one is a racial minority, and one is an ethnic minority.

Risk Oversight

Given the nature of our business, the Board remains focused on overseeing risk management. In addition to the Audit Committee receiving periodic presentations on enterprise risk management, during fiscal 2023, the Environmental, Social, and Governance Committee (the “ESG Committee”) discussed the campaign against the firearm industry at each of its meetings, and the full Board reviewed an updated report prepared by a third-party media monitoring firm that we have worked with for several years. During fiscal 2023, we also formalized a process whereby our Audit Committee Chair communicates directly with our Chief Compliance Officer at least quarterly in between scheduled Audit Committee meetings.

Stockholder Engagement

We recognize the importance of stockholder engagement. In addition to our regular, year-round stockholder engagement initiatives, prior to our annual meeting of stockholders held on September 12, 2022 (the “2022 Annual Meeting”), we met with certain of our largest stockholders to discuss, among other things, two stockholder proposals. In early 2023, we again met with certain of our largest stockholders. We used these meetings to, among other things, solicit our stockholders’ views on the right of stockholders to call special meetings (see Proposals 5 and 7) and our exclusive forum bylaw provision (see Proposal 6). We also engaged in April 2023 with our social activist stockholders (see Proposal 8).

COMPENSATION HIGHLIGHTS

Pay for Performance

Our executive compensation program emphasizes our pay-for-performance philosophy. For fiscal 2023:

•100% of our named executive officers’ (“NEOs”) annual cash incentive goals were tied to company performance (Net Sales and Adjusted EBITDAS); Adjusted EBITDAS also served as the threshold for which the failure to achieve this performance metric would result in no bonus payments regardless of the achievement of the other performance metric.

•60% of our NEOs’ stock-based award value was tied to our performance, as reflected by relative total shareholder return value.

•Our NEOs received no annual cash incentive payment for fiscal 2023 because we failed to achieve the threshold target for Adjusted EBITDAS.

•Our NEOs who received a stock-based award in 2020 received none of the target shares of common stock for the performance-based restricted stock unit (“PSU”) portion of the award because we failed to meet the minimum performance requirements.

|

|

2 I 2023 Proxy Statement |

|

BOARD AND GOVERNANCE MATTERS

|

|

|

|

|

|

|

|

|

|

|

|

PROPOSAL One – election of directors |

|

|

|

|

What Am I Voting On? Stockholders are being asked to elect each of the seven director nominees named in this Proxy Statement to hold office until the annual meeting of stockholders in 2024 (the “2024 Annual Meeting”) and until his or her successor is elected and qualified. |

|

|

|

|

Voting Recommendation: FOR the election of each of the seven director nominees |

|

|

|

|

Vote Required: A director will be elected if that director nominee receives a majority of the votes cast Broker Discretionary Voting Allowed? No – broker non-votes have no effect Abstentions: No effect |

|

|

GOVERNANCE FRAMEWORK

Our business and affairs are managed under the direction of the Board, subject to limitations and other requirements in our charter documents or in applicable statutes, rules, and regulations, including those of the Securities and Exchange Commission (the "SEC") and the Nasdaq Stock Market (“Nasdaq”).

Our governance framework supports independent oversight and accountability.

|

|

|

|

|

|

|

|

|

|

|

Independent Oversight |

|

|

Accountability |

|

• 6 of 7 director nominees are independent • Non-Executive Chairman • All independent committees • Demonstrated commitment to Board refreshment – over 70% of the Board has joined since 2018 |

|

|

• Majority voting in uncontested elections • Annual election of directors • Annual advisory say-on-pay vote • Robust over-boarding policy • Proxy access right |

Our governance framework is based on our Amended and Restated Bylaws (our “Bylaws”), as well as the key governance documents listed below:

•Code of Conduct and Ethics

•Code of Ethics for CEO and Senior Financial Officers

•Corporate Governance Guidelines (the “Guidelines”)

•Charters of the Audit Committee, the Compensation Committee, the Nominations and Corporate Governance Committee (the “NCG Committee”) and the ESG Committee

Copies of these documents are available on our website, www.smith-wesson.com, or upon written request sent to our Corporate Secretary at our principal executive offices located at 2100 Roosevelt Avenue, Springfield, Massachusetts 01104. The information on our website is not part of this Proxy Statement.

|

|

|

2023 Proxy Statement I 3 |

|

|

Board and Governance Matters |

|

|

|

BOARD COMPOSITION

Director Skills and Qualifications

The NCG Committee, using a matrix of director skills and experiences that the Board believes are needed to address existing and emerging business and governance issues relevant to us (the “Skills Matrix”), reviews with the Board annually the desired experiences, mix of skills, and other qualities required for new Board members, as well as Board composition. The Board seeks director candidates who possess the requisite judgment, background, skill, expertise, and time to strengthen and increase the breadth of skills and qualifications of the Board. In particular, the Board may consider, among other things, the fit of the individual’s skills, background, qualifications, experience, and personality with those of other directors in maintaining an effective, collegial, and responsive Board and a mix of diversity in personal and professional experience, background, viewpoints, perspectives, knowledge, and abilities.

|

|

|

Diversity Considerations. The Board does not have a specific diversity policy; however, as noted above, diversity is among the factors the NCG Committee may consider in connection with its annual review of desired experiences, mix of skills, and other qualities required for new Board members. We have posted a board diversity matrix on our website, www.smith-wesson.com, to comply with a Nasdaq rule. The information on our website is not part of this Proxy Statement. |

|

Governance Spotlight Of our seven director nominees, two are women, one is a racial minority, and one is an ethnic minority. |

Skills Matrix. The NCG Committee developed the Skills Matrix in fiscal 2023 in response to requests from certain of our investors for more detailed information concerning our directors’ qualifications. The NCG Committee adopted the Skills Matrix to facilitate the comparison of our directors’ skills and experiences to those that the Board believes are needed to address existing and emerging business and governance issues relevant to us. The table below lists those skills and experiences, along with the total number of director nominees who possess the particular skill or experience.

|

|

|

Skill/Experience |

Description |

# of Director Nominees |

Executive |

Experience serving as a CEO or a senior executive provides a practical understanding of a complex business like ours. |

7 of 7 |

Public Company Board |

Service on other public company boards facilitates an understanding of corporate governance practices and trends, and insights into board management. |

5 of 7 |

Regulated Industry / Government |

Experience with regulated industries and government provides insight and perspective in working constructively and proactively with government agencies. |

4 of 7 |

Sales and Marketing |

Experience in sales, brand management, marketing, and marketing strategy provides a perspective on how to better market our products. |

3 of 7 |

Risk Management |

Given the importance of the Board’s role in risk oversight, we seek directors who can help identify, manage, and mitigate key risks. |

6 of 7 |

Financial |

Understanding financial reporting and accounting processes enables monitoring and assessment of operating and strategic performance and facilitates accurate financial reporting and robust controls. |

4 of 7 |

Manufacturing |

Functional experience in a senior operating position with a manufacturing company can help us drive operating performance. |

6 of 7 |

Environmental, Social, and Governance |

Experience with ESG matters, including sustainability, human capital management and corporate ethics, enables management of ESG risks and opportunities. |

3 of 7 |

|

|

4 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

Director Independence

Under the Guidelines and the Nasdaq listing standards, the Board must consist of a majority of independent directors. The Board annually reviews director independence and has determined that all director nominees, except for Mr. Smith (who is our President and CEO), are independent, as “independence” is defined by the SEC and the Nasdaq listing standards.

Board Refreshment

|

|

|

We recognize the importance of Board refreshment. Directors are elected each year at our annual meeting of stockholders to hold office until the next annual meeting of stockholders and until their successors are elected and qualified. The NCG Committee regularly considers Board composition and how Board composition changes over time. The Board has not established a mandatory retirement age; however, pursuant to the Guidelines, the Board and the NCG Committee review, in connection with the process of selecting nominees for election at annual stockholder meetings, each director’s continuation on the Board. |

|

Governance Spotlight Michelle Lohmeier was appointed to the Board in July 2023, demonstrating the Board's commitment to refreshment. Of our seven director nominees, five have joined the Board since 2018. |

The Board has not established term limits; however, pursuant to the Guidelines, the NCG Committee reviews each director’s continuation on the Board at least every three years, which, among other things, allows the Board, through the NCG Committee, to consider the appropriateness of the director’s continued service.

Director Nomination Process

The NCG Committee is responsible for identifying and evaluating Board nominees. In identifying candidates, the NCG Committee may take into account all factors it considers appropriate, which may include personal qualities and characteristics, individual character and integrity, mature judgment, career specialization, relevant technical skills and accomplishments, and the extent to which the candidate would fill a present need on the Board.

Stockholder-Recommended Candidates. The NCG Committee will consider persons recommended by our stockholders for inclusion as Board nominees if the information required by our Bylaws is submitted in writing in a timely manner addressed and delivered to our Secretary.

Stockholder-Nominated Candidates. We have a “Proxy Access for Director Nominations” bylaw that permits a stockholder, or a group of up to 20 stockholders, owning 3% or more of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials Board nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in our Bylaws.

Majority Voting Standard

Our directors are elected by a majority of the votes cast for them in uncontested elections. If an incumbent director does not receive the requisite majority of votes cast, then the director is expected to submit his or her resignation to the Board. Based on the recommendation of the NCG Committee, the Board would determine whether to accept the resignation and would publicly disclose its decision and its rationale. A director who tenders his or her offer of resignation would abstain from any decision or recommendation regarding the offered resignation.

|

|

5 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

Over-Boarding Policy

Our directors may not serve on more than three other public company boards, unless it is determined, based on the individual facts, that such service will not interfere with service on the Board. In connection with the evaluation of these facts, the Chairman of the Board and Chair of the NCG Committee will consider the time commitment required by the director’s service, if any, in leadership positions (e.g., board chair, committee chair, lead independent director, etc.) on the Board and any other public company board of directors. None of our director nominees serves on more than three other public company boards and our CEO does not serve on any other public company board. The NCG reviews annually the time commitments of our independent directors.

Director Nominees

The Board currently has eight members. Pursuant to the recommendation of the NCG Committee, the Board has nominated each current director for election at the 2023 Annual Meeting, except for Mr. Furman, who, after many years of distinguished service to the Board, is retiring from the Board effective at the 2023 Annual Meeting. Ms. Lohmeier, who was appointed to the Board in July 2023, was first identified as a director candidate by a third-party search firm and will stand for stockholder election for the first time at the 2023 Annual Meeting. If elected, each director nominee will hold office until the 2024 Annual Meeting and until his or her successor is elected and qualified. If any director nominee is unable or declines to serve as a director at the time of the 2023 Annual Meeting, the proxies will be voted for any nominee designated by our current Board to fill the vacancy. We do not expect that any director nominee will be unable or will decline to serve as a director.

Set forth below is information about each director nominee, including a description of his or her qualifications to serve on the Board and a listing of certain key skills and experiences from the Skills Matrix possessed by each director nominee.

|

|

ANITA D. BRITT |

Age: 60 Director since: 2018 Independent Board committees: • Audit • Compensation • ESG Other public company boards: • Delta Apparel, Inc. • urban-gro, Inc. • VSE Corporation Other public company boards within five years: • None |

Background: Ms. Britt served as CFO of Perry Ellis International, Inc. from 2009 to 2017 and held senior financial leadership positions at Jones Apparel Group, Inc. (1993 to 2006) and Urban Brands, Inc. (2006 to 2009). Ms. Britt is a CPA and a member of the American Institute of Certified Public Accountants. She is also a Board Leadership Fellow, as designated by the National Association of Corporate Directors. Ms. Britt holds a Carnegie Mellon Cybersecurity Oversight Certification and a Harvard Kennedy School Executive Education Certificate in Cybersecurity: The Intersection of Policy and Technology. |

Key Qualifications and Skills Include: Financial. Extensive corporate finance, investor relations, and capital markets experience gained through service as a public company CFO and other senior financial roles; certified public accountant Public Company Board. Service on three other boards (see related caption) Risk Management. Certified public accountant; former public company CFO; holds multiple cybersecurity certifications (see above) |

|

|

6 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

|

|

FRED M. DIAZ |

Age: 57 Director since: 2021 Independent Board committees: • Compensation • ESG Other public company boards: • Archer Aviation Inc. • SiteOne Landscape Supply,

Inc. • Valero Energy Corporation Other public company boards within five years: • None |

Background: Mr. Diaz served as President and CEO of Mitsubishi Motor North America, Inc. from 2018 to 2020 and as General Manager, Performance Optimization Global Marketing and Sales of Mitsubishi Motors Corporation in Tokyo, Japan from 2017 to 2018. He served in various executive level positions with Nissan North America Inc. for four years and Chrysler Corporation LLC for 24 years, including as the President and CEO of the Ram Truck Brand and Chrysler of Mexico. |

Key Qualifications and Skills Include: Executive. Former President and CEO of Mitsubishi Motor North America, the Ram Truck Brand, and Chrysler of Mexico Manufacturing. Extensive operations experience gained through service as executive of multinational manufacturers, including Mitsubishi and Chrysler Public Company Board. Service on three other boards (see related caption) Sales and Marketing. Former SVP, Sales & Marketing and Operations USA for Nissan North America and Head of National Sales of Ram Truck Brand |

MICHELLE J. LOHMEIER |

Age: 60 Director since: 2023 Independent Board committees: • Compensation • ESG Other public company boards: • Kaman Corp. • Mistras Group, Inc. Other public company boards within five years: • None |

Background: Ms. Lohmeier has been a director since July 2023. She is a former senior advisor to the CEO of Spirit AeroSystems Holdings, Inc. having served in that position from 2019 to 2021. Prior to that, she had served as SVP and General Manager of Airbus Programs at Spirit AeroSystems. Before joining Spirit AeroSystems, Ms. Lohmeier held senior positions at Raytheon Company, including VP of the Land Warfare Systems product line at Raytheon Missile Systems. Previously, she was the program director at Raytheon for the design, development, and production implementation of the Standard Missile-6 weapon system for the U.S. Navy. She began her career with Hughes Aircraft Company as a system test engineer in 1985. |

Key Qualifications and Skills Include: Manufacturing. Extensive operations experience gained through roles with Spirit AeroSystems, Raytheon, and Hughes Aircraft Public Company Board. Service on two other boards (see related caption) Regulated Industry/Government. Extensive experience in the highly regulated aerospace and defense industries |

BARRY M. MONHEIT |

Age: 76 Director since: 2004 Independent Board committees: • Compensation • NCG Other public company boards: • American Outdoor Brands, Inc. Other public company boards within five years: • None |

Background: Mr. Monheit served as Chairman of the Board from 2004 until the completion (on August 24, 2020) of the spin-off of our former outdoor products and accessories business (the “Separation”). Since the Separation, he has served as Chairman of American Outdoor Brands, Inc. From 2020 to July 2023, Mr. Monheit served as a Senior Managing Director of J.S. Held, LLC, a consulting company providing services in forensic accounting, fraud investigations, receivership and restructuring, and lost profit exams. He formerly served as President and CEO of Quest Resource Holding Corp., a publicly traded company, as a Senior Managing Director of FTI Palladium Partners, in various capacities with FTI Consulting, Inc., including President of its Financial Consulting Division, and as a partner with Arthur Andersen & Co., where he served as partner-in-charge of its New York Consulting Division and its U.S. Bankruptcy and Reorganization Practice. |

Key Qualifications and Skills Include: Executive. Former CEO of Quest Resource; Division President of FTI Consulting; and partner of Arthur Andersen Financial. Retired certified public accountant; former partner of

Arthur Andersen Public Company Board. Current Chairman of American Outdoor Brands, Inc. |

|

|

7 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

|

|

ROBERT L. SCOTT |

Age: 77 Director since: 1999 Independent Board committees: • Audit • NCG Other public company boards: • None Other public company boards within five years: • None |

Background: Mr. Scott has served as our Chairman since 2020. He also serves as Chairman of the National Shooting Sports Foundation, or NSSF, and served from 2005 to 2008 on the board of directors of the Sporting Arms and Ammunition Manufacturers' Institute, or SAAMI. Mr. Scott served as a consultant to us (2004 to 2006); our President (1999 to 2002); Chairman of our wholly owned subsidiary, Smith & Wesson Corp. (2003); and President of Smith & Wesson Corp. (2001 to 2002). From 1989 to 1999, he served as Vice President of Sales and Marketing and later as Vice President of Business Development of Smith & Wesson Corp. prior to its acquisition by us. Prior to that, Mr. Scott served in senior positions with Berkley & Company and Tasco Sales Inc., two leading companies in the outdoor industry. He previously served as a director of Primos Hunting, a leader in the hunting category, and OPT Holdings, a hunting accessories marketer. |

Key Qualifications and Skills Include: Executive. Our former President, VP of Sales and Marketing, and VP of Business Development Regulated Industry/Government. Extensive leadership experience in firearm and outdoor industries through affiliations with us, NSSF, SAAMI, Primos Hunting, and OPT Holdings Sales and Marketing. Our former VP of Sales and Marketing; previously served in senior sales roles with Berkley and Tasco Sales |

MARK P. SMITH |

Age: 47 Director since: 2020 Not Independent Board committees: • None Other public company boards: • None Other public company boards within five years: • None |

Background: Mr. Smith has served as our President and CEO and as a director since August 2020. Since joining us in 2010, he has served in a number of roles with increasing responsibility, including Vice President of Supply Chain Management (2010 to 2011), Vice President of Manufacturing and Supply Chain Management (2011 to 2016), President, Manufacturing Services (2016 to 2020), and Co-President and Co-Chief Executive Officer (January 2020 to August 2020). Prior to joining us, Mr. Smith served as Director Supply Chain Solutions for Alvarez & Marsal Business Consulting, LLC (2007 to 2010), in various positions with Ecolab, Inc. (2001 to 2007) and as a Production Supervisor for Bell Aromatics (1999 to 2001). |

Key Qualifications and Skills Include: Executive. Our President and CEO Manufacturing. Extensive operations experience gained through roles with us, including as President, Manufacturing Services and VP of Manufacturing and Supply Chain Management, and Alvarez & Marsal Regulated Industry/Government. Extensive leadership experience in firearm industry through affiliation with us |

|

|

8 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

|

|

DENIS G. SUGGS |

Age: 57 Director since: 2021 Independent Board committees: • Audit • NCG Other public company boards: • Patrick Industries Other public company boards within five years: • None |

Background: Mr. Suggs has served as CEO of LCP Transportation LLC, a non-emergency medical transportation provider, since 2020. From 2014 to 2020, he served as President and CEO of Strategic Materials, Inc., a provider of environmental services. Mr. Suggs previously served in executive capacities with Belden, Inc., Danaher Corporation, and Public Storage Inc. |

Key Qualifications and Skills Include: ESG. Experience as President and CEO of Strategic Materials, a leading glass and plastics recycler, as well as through service on board of directors of Glass Packaging Institute, which focuses on sustainability issues Manufacturing. Extensive operations experience gained through service as executive of Belden and Danaher Regulated Industry/Government. Experience as CEO of LCP Transportation, which operates in a heavily regulated industry, as well as leading organizations that serve highly regulated sectors, such as aerospace and defense |

BOARD AND COMMITTEE GOVERNANCE

Risk Oversight

The Board recognizes that risk is inherent in every business. As is the case in virtually all businesses, the Board recognizes that we face a number of risks, including operational, economic, financial, cybersecurity, legal, regulatory, and competitive risks. While our management is responsible for the day-to-day management of the risks we face, the Board, as a whole and through its committees, is responsible for the oversight of risk management.

The Board’s involvement in our business strategy and strategic plans plays a key role in its oversight of risk management, its assessment of management’s risk appetite, and its determination of the appropriate level of enterprise risk. The Board receives updates at least quarterly from senior management and periodically from outside advisors regarding the various risks we face, including operational, economic, financial, cybersecurity, legal, regulatory, and competitive risks. The Board also reviews the various risks we identify in our SEC filings, as well as risks relating to various specific developments, such as new product introductions. In addition, the Board regularly receives reports from senior members of our Internal Audit function and our General Counsel and Chief Compliance Officer.

|

|

|

See Part I, “Item 1A. Risk Factors,” in our annual report on Form 10-K for the fiscal year ended April 30, 2023 (the “Form 10-K”) to learn more about the risks we face. The risks described in the Form 10-K are not the only risks we face. Additional risks and uncertainties not currently known or that may currently be deemed to be immaterial based on the information known to us also may materially and adversely affect our business, operating results, and financial condition. |

|

Governance Spotlight In fiscal 2023, we formalized a process whereby our Audit Committee Chair communicates directly with our Chief Compliance Officer at least quarterly in order to enhance the Board’s oversight of risk and the independence of our compliance function. |

Given the nature of our business, the Board remains focused on overseeing risk management. During fiscal 2023, the ESG Committee discussed the campaign against the firearm industry at each of its meetings and the full Board reviewed an updated report prepared by a third-party media monitoring firm that we have worked with for several years. |

|

|

9 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUDIT COMMITTEE |

|

COMPENSATION COMMITTEE |

|

|

|

|

• Oversees our financial and reporting processes and the audit of our financial statements • Assists the Board with respect to: - the oversight and integrity of our financial statements - our compliance with legal and regulatory matters - our policies and practices related to information security, including cybersecurity - the independent registered public accountant’s qualification and independence - the performance of the independent registered public accountant • Meets separately on a regular basis with representatives of our independent registered public accountant and our internal audit function |

|

• Considers the risk that our compensation policies and practices may have in attracting, retaining, and motivating valued employees • Endeavors to ensure that it is not reasonably likely that our compensation plans and policies would have a material adverse effect on us NCG COMMITTEE • Oversees governance-related risk, such as board independence, conflicts of interest, and management and succession planning ESG COMMITTEE • Reviews emerging risks associated with ESG matters |

|

|

Cybersecurity Risk Oversight. We recognize the importance of cybersecurity risk governance. The Audit Committee receives regular reports from management on, among other things, the emerging cybersecurity threat landscape and our cybersecurity risks and threats. The Audit Committee regularly briefs the full Board on these matters. We maintain a Cyber Incident Response Plan.

ESG Risk Oversight. We recognize the importance to our stakeholders of ESG matters. Since 2021, the ESG Committee has assisted the Board and its committees in fulfilling the Board’s oversight responsibilities with various environmental, social, health, safety, and governance policies and operational control matters relevant to us. In part, the ESG Committee reviews emerging risks and opportunities associated with ESG matters.

Board Leadership Structure

Our Corporate Governance Guidelines support flexibility in the structure of the Board by not requiring the separation of the roles of CEO and Chairman. We maintain separate roles between our CEO and Chairman in recognition of the differences between the responsibilities of these roles. The Board believes this leadership structure is the most effective for us at this time because it allows our CEO to focus on running our business and our Chairman to focus on pursuing sound governance practices that benefit the long-term interests of our stockholders.

Board Committees

The Board has four standing committees, each of which is comprised of independent directors: the Audit Committee, the Compensation Committee, the NCG Committee, and the ESG Committee.

|

|

10 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

|

|

AUDIT COMMITTEE Members: Anita Britt (Chair) John Furman (1) Bob Scott Denis Suggs Meetings in Fiscal 2023: 5 Member Independence: 4 of 4 * All members meet the independence requirements of Nasdaq and Rule 10A-3 of the Exchange Act. The Board has determined that each member is an “audit committee financial expert” within the meaning of SEC regulations. |

Purpose: • Overseeing our financial and reporting processes and the audits of our financial statements. • Providing assistance to the Board with respect to its oversight of: - the integrity of our financial statements - our compliance with legal and regulatory requirements - the independent auditor’s qualifications and independence - the performance of our internal audit function, if any, and independent auditor - our policies and practices related to information security, including cyber security, protection of personally identifiable information, and training of employees around such items • Preparing the report that SEC rules require be included in our annual proxy statement. Principal Responsibilities: • Appointing, retaining, compensating, evaluating, and terminating any accounting firm engaged to prepare or issue an audit report or performing other audit, review, or attest services, and overseeing the work of such firm. • Overseeing our accounting and financial reporting process and audits of our financial statements. |

COMPENSATION COMMITTEE Members: Barry Monheit (Chair) Anita Britt Fred Diaz John Furman (1) Michelle Lohmeier(2) Meetings in Fiscal 2023: 6 Member Independence: 5 of 5 * All members meet the independence requirements of Nasdaq and qualify as “non-employee directors” under Rule 16b-3(b)(3)(i) of the Exchange Act. |

Purpose: • Determining, or recommending to the Board for determination, the compensation of our CEO and other executive officers. • Discharging the Board’s responsibilities relating to our compensation programs and compensation of our executives. • Producing an annual compensation committee report on executive compensation for inclusion in our annual proxy statement. Principal Responsibilities: • Setting compensation for executive officers and directors. • Monitoring incentive- and equity-based compensation plans. • Appointing, compensating, and overseeing the work of any compensation consultant, legal counsel, and other retained advisor. |

|

|

11 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

|

|

NCG COMMITTEE Members: Denis Suggs (Chair) John Furman (1) Barry Monheit Bob Scott Meetings in Fiscal 2023: 6 Member Independence: 4 of 4 * All members meet the independence requirements of Nasdaq. |

Purpose: • Selecting, or recommending to the Board for selection, the individuals to stand for election as directors at each election of directors. • Overseeing the selection and composition of Board committees and, as applicable, overseeing management continuity planning processes. Principal Responsibilities: • Developing and recommending to the Board corporate governance principles applicable to us. • Overseeing the evaluation of the Board and management. • Developing and maintaining the Skills Matrix |

ESG COMMITTEE Members: Fred Diaz (Chair) Anita Britt Michael F. Golden(3) Michelle Lohmeier(2) Meetings in Fiscal 2023: 4 Member Independence: 4 of 4 |

Purpose: • Assisting the Board and its committees in fulfilling the oversight responsibilities of the Board with various environmental, social, health, safety, and governance policies and operational control matters relevant to us. Principal Responsibilities: • Reviewing the status and effectiveness of our ESG performance, metrics, and goals. • Reviewing emerging risks and opportunities associated with ESG. • Assessing whether to adopt ESG goals, metrics, and targets, and adopting such goals, metrics, and targets, if deemed appropriate. |

(1)Mr. Furman is a current director and member of the Audit Committee, the Compensation Committee, and the NCG Committee. He was not nominated for election at the 2023 Annual Meeting due to his anticipated retirement.

(2)Ms. Lohmeier joined the Board in July 2023.

(3)Mr. Golden passed away in June 2023. He served as Chair of the ESG Committee prior to his death.

Meeting Attendance in Fiscal 2023

In fiscal 2023, the Board held seven meetings and its committees held a combined total of 21 meetings. Each director attended 75% or more of the aggregate of all meetings of the Board and the committees on which he or she served. We encourage our directors to attend our annual meetings of stockholders. All directors attended the 2022 Annual Meeting.

Executive Sessions

We regularly schedule executive sessions in which independent directors meet without the presence or participation of management. Our Chairman serves as the presiding director of these executive sessions during Board meetings, and our committee chairs preside at the sessions held during committee meetings.

|

|

12 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

Stockholder Engagement

We meet with investors throughout the year and consider investor feedback on emerging issues, which allows us to better understand their priorities and perspectives. This year-round engagement provides us with useful input and enables us to consider developments proactively. In addition, from time to time, we conduct stockholder outreach programs. Prior to the 2022 Annual Meeting, we requested meetings with the corporate governance teams at stockholders representing approximately 46% of our outstanding shares, as a result of which we engaged with teams at stockholders representing approximately 27% of our outstanding shares. We primarily discussed the stockholder proposals that were included in our proxy materials for the 2022 Annual Meeting. In early 2023, we requested meetings with the corporate governance teams at stockholders representing 44% of our outstanding shares, as a result of which we engaged with teams at stockholders representing 10% of our outstanding shares. We used these meetings to, among other things, discuss progress we had made on topics of importance to our stockholders, including Board refreshment, and solicit our investors’ views on the right of stockholders to call special meetings (see Proposals 5 and 7) and our exclusive forum bylaw provision (see Proposal 6).

Responding to Stockholder Engagement. We value the feedback that we receive from our investors and seek opportunities to respond to their feedback, when appropriate. For example, in response to feedback we received in recent years from many of our largest stockholders, we have expanded our public disclosures both in SEC-filed documents and through the publication of other relevant documents. In 2022, we published our first Firearm Market Factsheet, which was intended to increase transparency around our business practices by, among other things, describing our go-to-market approach to both domestic and international sales and highlighting our commitment to promoting responsible firearm ownership. In 2022, we also published our second Environmental Factsheet, which, among other things, highlighted our commitment to responsible environmental practices, described our approach to environmental management, and listed a number of environmental impact highlights. Copies of the Firearm Market Factsheet and the Environmental Factsheet are available on our website, www.smith-wesson.com. The information on our website is not part of this Proxy Statement.

In response to requests from certain of our stockholders for more detailed information concerning our directors’ qualifications, in fiscal 2023, the NCG Committee developed and adopted the Skills Matrix.

|

|

|

In addition to engaging with our largest stockholders, we have devoted significant resources in recent years engaging with the proponent for Proposal 8. We spoke directly to the proponent on three occasions in 2022 and once in 2023. Each discussion was conducted in a respectful manner, and we came away with a better understanding of the proponent’s positions regarding gun control generally and its stockholder proposal specifically. During fiscal 2023, we also met with a representative of the California State Teachers’ Retirement System. |

|

Governance Spotlight We spoke directly with the proponent for Proposal 8 on four occasions in the last two years in order to better understand the proponent’s views and objectives. |

|

|

13 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

ADDITIONAL GOVERNANCE MATTERS

Certain Relationships

Unless delegated to the Compensation Committee by the Board, the Audit Committee charter requires the Audit Committee to review and approve all related party transactions and to review and make recommendations to the full Board, or approve, any contracts or other transactions with any of our current or former executive officers, including consulting arrangements, employment agreements, change-in-control agreements, termination arrangements, and loans to employees made or guaranteed by us. We have a policy that we will not enter into any such transaction unless the transaction is determined by our disinterested directors to be fair to us or is approved by our disinterested directors or by our stockholders. Any determination by our disinterested directors is based on a review of the particular transaction, applicable laws and regulations, our policies, and the Nasdaq listing standards. As appropriate, the disinterested directors of the applicable committees of the Board will consult with our legal counsel or internal auditor. There was no transaction during fiscal 2023, and there are no currently proposed transactions, in which we were or are to be a participant in which an executive officer, director, director nominee, a beneficial owner of 5% or more of our common stock, or any immediate family members of such persons had or will have a direct material interest.

We have entered into indemnification agreements with each of our directors and executive officers that require us to indemnify such individuals, to the fullest extent permitted by Nevada law, for certain liabilities to which they may become subject as a result of their affiliation with us.

Clawback Policy

We maintain a compensation recovery, or clawback, policy. See “Compensation Matters – Compensation Discussion and Analysis – Additional Compensation Matters – Clawback Policy” for more information.

Communicating with the Board

Stockholders may communicate with the Board or specific directors, including our independent directors and the members of our board committees, by submitting a letter addressed to the Board of Directors of Smith & Wesson Brands, Inc., c/o any specified individual director or directors, at our principal executive offices.

Corporate Political Contributions and Expenditures

We have a policy to post on our website each fiscal year an annual report disclosing all political contributions or expenditures in the United States in excess of $50,000 that are not deductible as “ordinary and necessary” business expenses under Section 162(e) of the Internal Revenue Code, as amended (the "Code"). Non-deductible amounts generally include contributions to or expenditures in support of or opposition to political candidates, political parties, or political committees.

Corporate Stewardship Policy

We have a policy, pursuant to which, in order to meet our objective of being a good corporate steward, we consider, among other things, our responsibilities with respect to employee, safety, and governance risks, including the risks caused by the unlawful or improper use of firearms.

Director and Officer Derivative Trading and Hedging

We have a policy prohibiting our directors and officers, including our executive officers, and any family member residing in the same household, from engaging in derivatives trading and hedging involving our securities or pledging or margining our common stock.

Whistleblower Policy

We have a policy covering the policies and procedures for the receipt, retention, and treatment of complaints that we receive regarding accounting, internal controls, or auditing matters, and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

|

|

14 I 2023 Proxy Statement |

|

|

|

Board and Governance Matters |

|

|

|

DIRECTOR COMPENSATION

The Compensation Committee, with advice from its independent compensation consultant, determines, or recommends to the Board for determination, the compensation of our directors. We pay each non-employee director an annual retainer in the amount of $70,000. We also pay additional sums to our Chairman, Vice Chairman, Chairs of our committees, and members of our committees as follows:

|

|

|

|

|

|

Chairman |

|

$ |

62,500 |

|

|

Vice Chairman |

|

$ |

23,000 |

|

(1) |

Chair, Audit Committee |

|

$ |

25,000 |

|

|

Chair, Compensation Committee |

|

$ |

25,000 |

|

|

Chair, NCG Committee |

|

$ |

25,000 |

|

|

Chair, ESG Committee |

|

$ |

25,000 |

|

|

Non-Chair Audit Committee Members |

|

$ |

8,000 |

|

|

Non-Chair Compensation Committee Members |

|

$ |

5,000 |

|

|

Non-Chair NCG Committee Members |

|

$ |

5,000 |

|

|

Non-Chair ESG Committee Members |

|

$ |

5,000 |

|

|

|

|

|

|

|

(1) In June 2023, we eliminated the role of Vice Chairman.

Each committee member receives an additional $1,500 per committee meeting attended in excess of seven meetings per year (for the Audit Committee), in excess of six meetings per year (for the Compensation Committee), in excess of four meetings per year (for the NCG Committee), and in excess of four meetings per year (for the ESG Committee).

We reimburse directors for travel and related expenses incurred in connection with attending Board and committee meetings. Mr. Smith receives no additional compensation for his service as a director.

Each non-employee director receives a stock-based grant to acquire shares of our common stock on the date of his or her first appointment or election to the Board. Each non-employee director also receives a stock-based grant at the meeting of the Board held immediately following our annual meeting of stockholders for that year. Stock-based grants were in the form of restricted stock units (“RSUs”) for 8,071 shares of common stock in fiscal 2023. The RSUs vest one-twelfth each month after the grant.

The following table sets forth the compensation paid by us to each non-employee director for fiscal 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees Earned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Paid in |

|

|

Stock |

|

|

|

All Other |

|

|

|

|

|

Name (1) |

|

Cash |

|

|

Awards (2) |

|

|

|

Compensation |

|

|

|

Total |

|

Anita D. Britt |

|

$ |

105,000 |

|

|

$ |

100,000 |

|

|

|

$ |

2,352 |

|

(4) |

|

$ |

207,352 |

|

Fred M. Diaz |

|

$ |

77,211 |

|

|

$ |

100,000 |

|

|

|

$ |

2,513 |

|

(4) |

|

$ |

179,724 |

|

John B. Furman (3) |

|

$ |

96,333 |

|

|

$ |

100,000 |

|

|

|

$ |

— |

|

|

|

$ |

196,333 |

|

Michael F. Golden (3) |

|

$ |

118,000 |

|

|

$ |

100,000 |

|

|

|

$ |

337 |

|

(5) |

|

$ |

218,337 |

|

Barry M. Monheit |

|

$ |

100,000 |

|

|

$ |

100,000 |

|

|

|

$ |

1,525 |

|

(6) |

|

$ |

201,525 |

|

Robert L. Scott |

|

$ |

145,500 |

|

|

$ |

100,000 |

|

|

|

$ |

29,867 |

|

(6) |

|

$ |

275,367 |

|

Mark P. Smith |

|

$ |

— |

|

|

$ |

— |

|

|

|

$ |

— |

|

|

|

$ |

— |

|

Denis G. Suggs |

|

$ |

94,667 |

|

|

$ |

100,000 |

|

|

|

$ |

— |

|

|

|

$ |

194,667 |

|

(1)As of April 30, 2023, each of the non-employee directors had the following number of stock awards outstanding, which represent undelivered shares underlying vested RSUs: Mr. Monheit 7,708; Mr. Scott 7,708; Ms. Britt 4,708; Mr. Furman 4,708; Mr. Golden 4,708; Mr. Diaz 4,708; and Mr. Suggs 4,708. As of April 30, 2023, there were no stock options outstanding for the directors.

(2)The amounts shown in this column represent the grant date fair value for stock awards granted to the directors calculated in accordance with Accounting Standards Codification (“ASC”) Topic 718. The assumptions used in determining the grant date fair value of these awards are set forth in Note 13 to our consolidated financial statements, which are included in the Form 10-K.

(3)Mr. Furman is retiring effective at the 2023 Annual Meeting. Mr. Golden passed away in June 2023.

(4)Consists of costs for certain products provided without cost.

(5)Consists of spousal travel.

(6)Consists of costs for certain products provided without cost and spousal travel.

(7)Consists of reimbursement of medical coverage costs, costs for certain products provided without cost and spousal travel.

We maintain stock ownership guidelines for our directors and executive officers. See “Compensation Matters — Compensation Discussion and Analysis — Additional Compensation Matters — Stock Ownership and Retention Requirements.”

|

|

15 I 2023 Proxy Statement |

|

compensation matters

|

|

|

|

|

|

|

PROPOSAL TWO – ADVISORY VOTE ON EXECUTIVE COMPENSATION |

|

|

|

|

What Am I Voting On? The Board is asking our stockholders to approve, on an advisory basis, the compensation of our NEOs as disclosed in this Proxy Statement Voting Recommendation: FOR the proposal Vote Required: The affirmative vote of a majority of the votes cast is required to approve the proposal Broker Discretionary Voting Allowed? No – broker non-votes have no effect Abstentions: No effect |

|

|

Pursuant to SEC rules, our stockholders are being asked to approve, on an advisory basis, the compensation of our NEOs as disclosed in this Proxy Statement. We have recently received high levels of support from our stockholders on advisory votes to approve executive compensation.

|

|

Recent Support for Say-on-Pay Proposal |

2021: 97% |

2022: 95% |

As described in the Compensation Discussion and Analysis section, we believe our compensation policies and procedures are competitive, focused on pay-for-performance principles, and aligned with the long-term interests of our stockholders. Our executive compensation philosophy is to pay base salaries to our executive officers at levels that, in the context of unfavorable industry factors beyond the control of management, enable us to attract, motivate, and retain highly qualified executives. Our executive compensation program is designed to link annual performance-based cash incentive compensation to the achievement of pre-established performance objectives, based primarily on our financial results and achievement of other corporate goals.

Consistent with our pay-for-performance philosophy:

•Our NEOs received no annual cash incentive payment for fiscal 2023 because we failed to achieve the threshold target for Adjusted EBITDAS.

•Our NEOs who received a stock-based award in 2020 received none of the target shares of common stock for the PSU portion of the award because we failed to meet the minimum performance requirements.

The advisory vote on this resolution is not intended to address any specific element of compensation; rather, it relates to the overall compensation of our NEOs, as well as the compensation philosophy, policies, and practices described in this Proxy Statement. Our stockholders may vote for or against, or abstain from voting on, the following resolution:

RESOLVED, that the stockholders of the Company approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis, executive compensation tables, and narrative discussion set forth in the Proxy Statement for the 2023 Annual Meeting of Stockholders.

This advisory vote will not be binding on the Board. The Compensation Committee will, however, take the outcome of the vote into account when considering future executive compensation decisions. We provide our stockholders with this advisory vote on an annual basis and expect that the next such vote will occur at the 2024 Annual Meeting.

|

|

|

2023 Proxy Statement I 16 |

|

|

|

|

|

|

|

PROPOSAL THREE – ADVISORY VOTE ON FREQUENCY OF FUTURE SAY-ON-PAY VOTES |

|

|

|

|

What Am I Voting On? The Board is asking our stockholders to approve, on an advisory basis, the frequency of future advisory votes on executive compensation |

|

|

|

|

Voting Recommendation: FOR the option of every “1 year” |

|

|

|

|

|

|

|

Vote Required: The option of every “1 year,” “2 years,” or “3 years” that receives the highest number of affirmative votes by those shares present in person or represented by proxy and entitled to vote Broker Discretionary Voting Allowed? No – broker non-votes have no effect Abstentions: No effect |

|

|

In accordance with SEC rules, our stockholders may vote, on an advisory basis, on how frequently they would like to cast an advisory vote on the compensation of our NEOs. The Board believes conducting an advisory vote on executive compensation on an annual basis is currently appropriate for us and our stockholders.

Our stockholders may cast a vote on the preferred voting frequency by selecting the option of “1 year,” “2 years,” or “3 years,” or they may abstain from voting in response to the following resolution:

RESOLVED, that the Company’s stockholders wish the Company to include an advisory vote on the compensation of the Company’s named executive officers pursuant to Section 14(a) of the Securities Exchange Act every:

• one year,

• two years, or

• three years.

Because the required vote is advisory, it will not be binding upon the Board. The Board will, however, take into account the outcome of the vote when considering the frequency with which we will provide our stockholders the opportunity to vote, on an advisory basis, to approve the compensation of our NEOs.

|

|

17 I 2023 Proxy Statement |

|

COMPENSATION DISCUSSION AND ANALysis

EXECUTIVE SUMMARY

Named Executive Officers

This section describes our executive compensation program, outlines the core principles behind that program, and reviews the actions taken by the Compensation Committee concerning the fiscal 2023 compensation of the following NEOs:

|

|

Name |

Title |

Mark P. Smith |

President and CEO |

Deana L. McPherson |

Executive Vice President, CFO, Treasurer, and Assistant Secretary |

Kevin A. Maxwell |

Senior Vice President, General Counsel, Chief Compliance Officer, and Secretary |

Susan J. Cupero |

Vice President, Sales |

Program Emphasis

Our executive compensation program emphasizes our pay-for-performance philosophy and is designed to help us attract, motivate, and retain highly qualified executives.

Compensation Governance and Practices

Our executive compensation program demonstrates our ongoing commitment to good corporate governance practices and aligns our executive officers’ interests with those of our stockholders.

|

|

|

|

|

Risk Mitigation |

|

|

Program Features |

|

|

|

|

• Clawback policy • Stock ownership guidelines • Derivatives trading and hedging policy • Annual review of compensation plans and policies includes risk assessment |

|

|

• Annual say-on-pay advisory vote • Independent compensation consultant • "Double trigger" vesting acceleration in the event

of a change-in-control • No tax gross ups in connection with severance or change-in control payments |

|

|

Say-on-Pay Results

At the 2022 Annual Meeting, 95% of the votes cast were in favor of the advisory vote to approve executive compensation. We have recently received high levels of support from our stockholders on advisory votes to approve executive compensation. Based on these high levels of support, the Compensation Committee determined not to make any material changes to our executive compensation program.

|

|

Recent Support for Say-on-Pay Proposal |

2021: 97% |

2022: 95% |

|

|

18 I 2023 Proxy Statement |

|

Summary of Fiscal 2023 Compensation Program

The following highlights aspects of our fiscal 2023 compensation program:

•Base Salary — Consistent with past practice, in April 2022 the Compensation Committee, with advice from its independent compensation consultant, reviewed the base salaries of our executive officers and compared them with peer group and broad market data. The Compensation Committee adjusted base salary levels to more closely align with comparable positions at our peer group, to reflect additional experience, and to take into account cost-of-living factors. In fiscal 2023, base salary increases for our NEOs ranged from 2.9% to 3.0%.

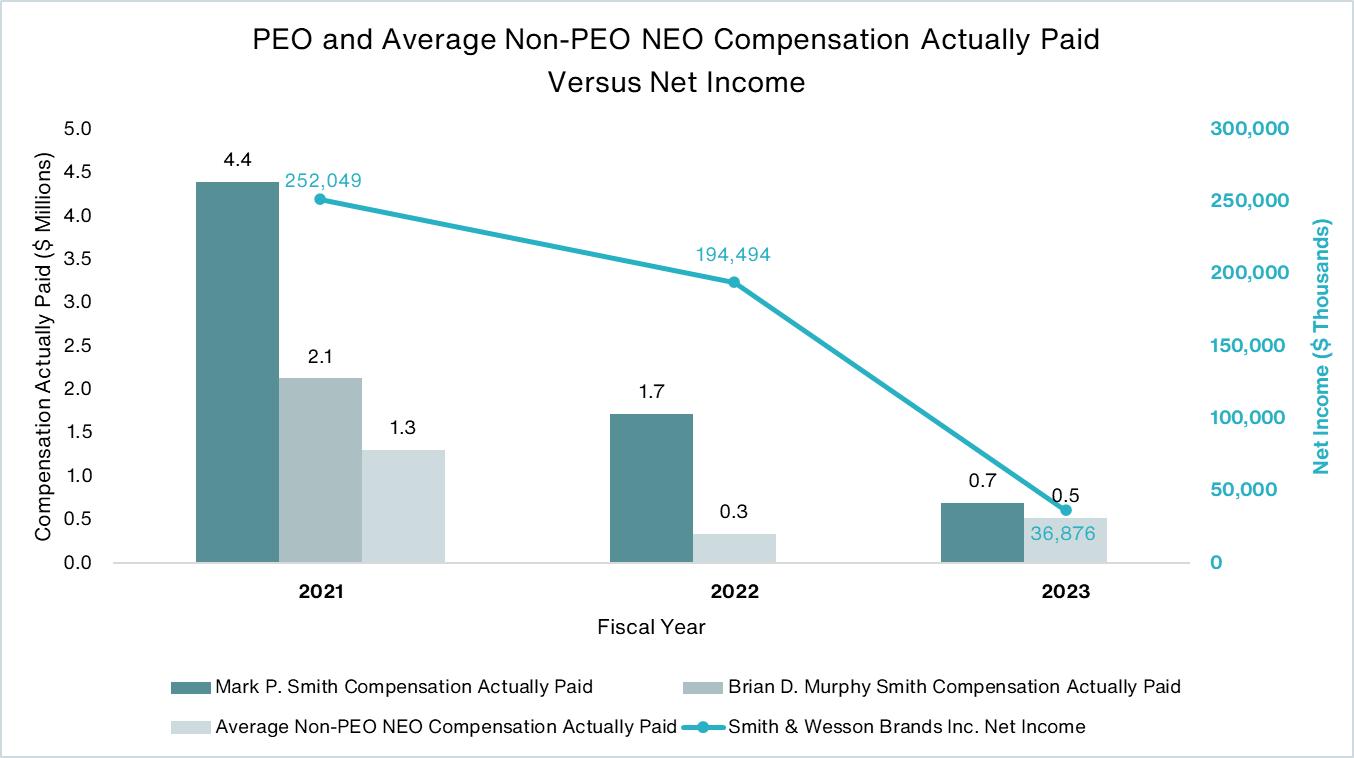

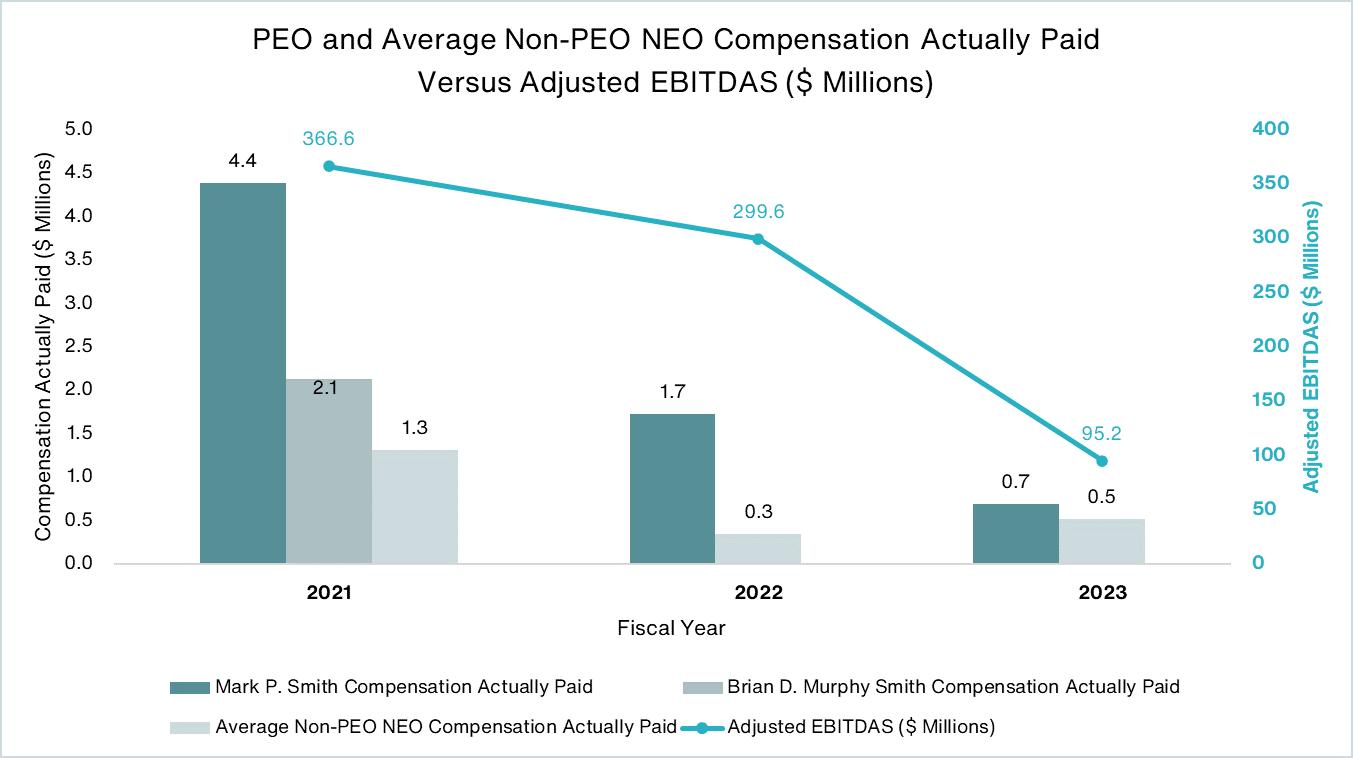

•Annual Cash Incentive Bonuses — Our executive annual cash incentive program for fiscal 2023 continued to focus on the achievement of objective annual financial goals; specifically, Net Sales and Adjusted EBITDAS. NEO annual target cash incentive compensation as a percentage of base salary was 100% in the case of our CEO, 75% in the case of our CFO, and 65% for our other NEOs. When setting the financial performance goals at the beginning of fiscal 2022, the Compensation Committee considered the difficult and unpredictable environment for our business and the relative lack of control that our management has over external, social, political, health, and economic factors that impact us. In accordance with our pay-for-performance philosophy, our NEOs received no bonus payment for fiscal 2023 because we failed to achieve the threshold target for Adjusted EBITDAS.

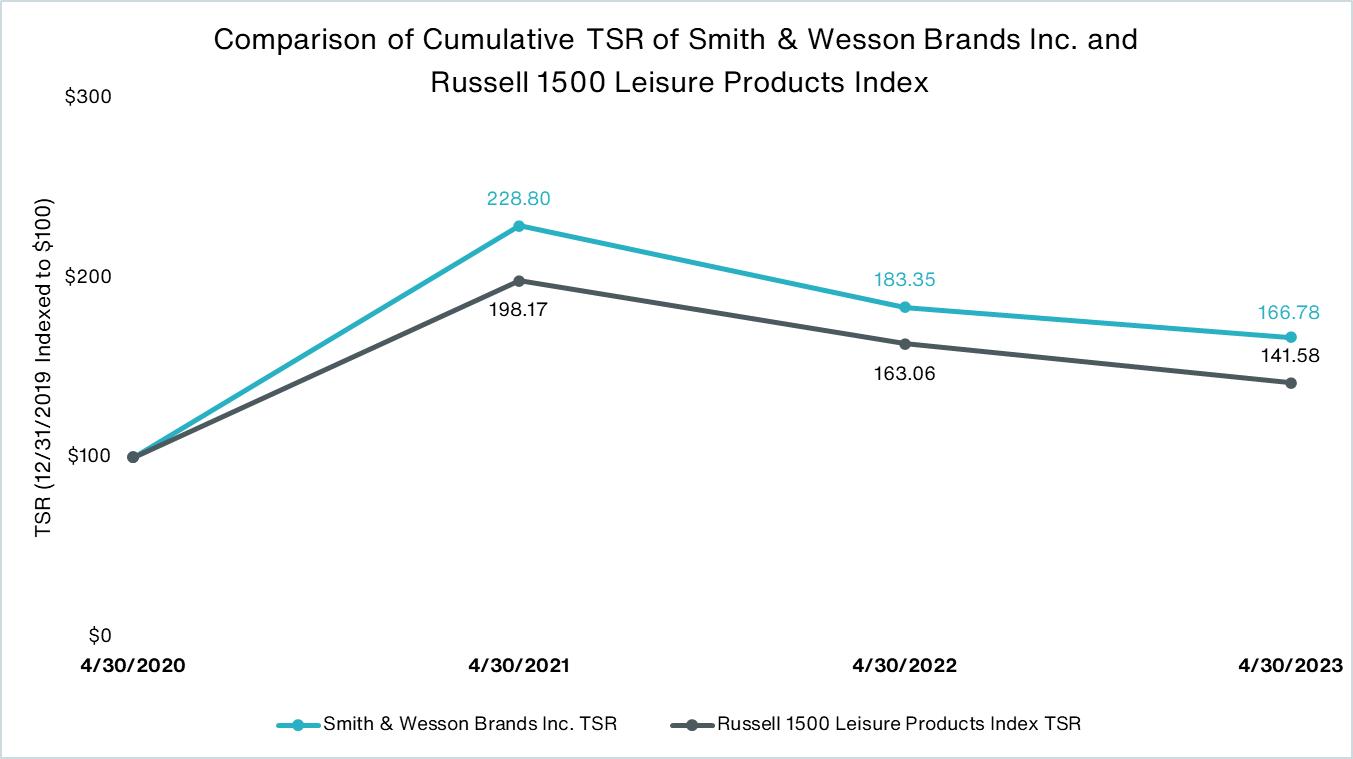

•Long-Term Incentive Compensation — Consistent with past practice, the Compensation Committee granted stock-based awards to our executive officers in fiscal 2023, consisting of a mix of RSUs (40%) and PSUs (60%). The RSUs vest one-fourth following each of the first, second, third, and fourth anniversaries of the grant date. The number of shares of common stock, if any, to be delivered under PSUs depends on the relative performance of our common stock compared with the performance of the Russell 2000 Index (the “RUT”), with a target payout requiring our performance to be higher than the RUT over a three-year period.

Factors Affecting Fiscal 2023 Compensation

Historically, the firearm industry has been very cyclical, with past expansions and contractions driven, in large part, by unpredictable political, economic, social, legislative, and regulatory factors beyond the control of industry participants and their management teams. For example, we experienced historic levels of demand for our products in parts of fiscal 2021 and fiscal 2022, in part, as a result of the impact of COVID-19 and the social unrest experienced in the United States during the summer of 2020. Since then, demand for our products has returned to more normalized levels, which adversely impacted our year-over-year financial and operating results in fiscal 2023.

EXECUTIVE COMPENSATION PROGRAM OVERVIEW

Philosophy and Objectives

Our executive compensation philosophy is to pay base salaries to our executive officers at levels that, in the context of unfavorable industry factors beyond the control of management, enable us to attract, motivate, and retain highly qualified executives. Our executive compensation program is designed to link annual performance-based cash incentive compensation to the achievement of pre-established performance objectives, based primarily on our financial results. Similarly, our executive compensation program is designed so that stock-based compensation focuses our executive officers’ efforts on increasing stockholder value by aligning their economic interests with those of our stockholders.

Total compensation levels for our executive officers reflect corporate positions, responsibilities, and the achievement of performance objectives. Due to our pay-for-performance philosophy, realized compensation levels may vary significantly from year-to-year and among our executive officers.

|

|

19 I 2023 Proxy Statement |

|

Goals

Our executive compensation program’s objectives include:

•Attracting, motivating, and retaining highly qualified executives, especially in the context of challenging business conditions.

•Reflecting our culture and approach to total rewards, which include health and welfare benefits, a safe work environment, and professional development opportunities.

•Reflecting our “pay-for-performance” philosophy.

•Providing a rational and consistent approach to compensation that is understood by senior leadership.

•Aligning compensation with our interests, as well as those of our stockholders.

•Recognizing corporate stewardship and fiscal responsibility.

ADMINISTRATION

The Board has appointed a Compensation Committee, consisting exclusively of independent directors. The charter of the Compensation Committee authorizes the Compensation Committee to determine and approve, or to make recommendations to the Board with respect to, the compensation of our CEO and other executive officers. The Board has authorized the Compensation Committee to make all decisions with respect to executive compensation. Among other things, the Compensation Committee is authorized to determine and approve the base salary of our CEO and other executive officers. Additionally, the Compensation Committee establishes annual cash and stock-based incentive compensation programs for our CEO and other executive officers and provides our executives with variable compensation opportunities, a majority of which is based on the achievement of key operating measures determined at the beginning of the fiscal year. Once the Compensation Committee determines key operating measures for the upcoming fiscal year, the measures generally are not subject to material changes during the fiscal year. The Compensation Committee, with advice from its independent compensation consultant, also determines the compensation of our directors.

Role of the Compensation Committee and our CEO