XOMA Added to the Russell 2000® and Russell 3000® Indexes

24 Juin 2023 - 12:14AM

XOMA Corporation (NASDAQ: XOMA), the biotech royalty aggregator,

announced it has been added to the Russell 2000® and Russell 3000®

Indexes following its annual reconstitution, which took effect

after the U.S. markets close on June 23, 2023.

FTSE Russell determines membership for its Russell

indexes primarily by objective, market-capitalization rankings, and

style attributes. Each year, the Russell indexes are

reconstituted to capture the 4,000 largest US stocks, ranking them

by total market capitalization. The Russell 2000® Index

measures the performance of the small-cap segment of the U.S.

equity market and is a subset of the Russell 3000® Index.

Inclusion in the Russell 2000® Index results in automatic inclusion

in the appropriate growth and value style indexes. Russell

indexes are widely used by investment managers and institutional

investors for index funds and as benchmarks for active investment

strategies. Approximately $12.1 trillion in assets are

benchmarked against Russell’s US indexes.

About XOMA CorporationXOMA is a

biotechnology royalty aggregator playing a distinctive role in

helping biotech companies achieve their goal of improving human

health. XOMA acquires the potential future economics

associated with pre-commercial therapeutic candidates that have

been licensed to pharmaceutical or biotechnology companies.

When XOMA acquires the future economics, the seller receives

non-dilutive, non-recourse funding they can use to advance their

internal drug candidate(s) or for general corporate purposes.

The Company has an extensive and growing portfolio with more than

70 assets (asset defined as the right to receive potential future

economics associated with the advancement of an underlying

therapeutic candidate). For more information about the

Company and its portfolio, please visit www.xoma.com.

Forward-Looking Statements/Explanatory

NotesCertain statements contained in this press release

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, including statements regarding the timing and

amount of potential commercial and milestone payments to XOMA, the

potential of XOMA’s portfolio of partnered programs and licensed

technologies generating substantial milestone and royalty proceeds

over time, XOMA’s business forecast, the potential expansion and

accelerated growth of XOMA’s portfolio, and the potential for this

portfolio to generate sustained cashflows and positive returns over

time. In some cases, you can identify such forward-looking

statements by terminology such as “anticipate,” “intend,”

“believe,” “estimate,” “plan,” “seek,” “project,” “expect,” “may,”

“will”, “would,” “could” or “should,” the negative of these terms

or similar expressions. These forward-looking statements are

not a guarantee of XOMA’s performance, and you should not

place undue reliance on such statements. These statements are

based on assumptions that may not prove accurate, and actual

results could differ materially from those anticipated due to

certain risks inherent in the biotechnology industry, including

those related to the fact that our product candidates subject to

out-license agreements are still being developed, and our licensees

may require substantial funds to continue development which may not

be available; we do not know whether there will be, or will

continue to be, a viable market for the products in which we have

an ownership or royalty interest; if the therapeutic product

candidates to which we have a royalty interest do not receive

regulatory approval, our third-party licensees will not be able to

market them; and the impact to the global economy as a result of

the COVID-19 pandemic. Other potential risks to XOMA meeting

these expectations are described in more detail in XOMA's most

recent filing on Form 10-K and in other filings with the Securities

and Exchange Commission. Consider such risks carefully when

considering XOMA's prospects. Any forward-looking statement in this

press release represents XOMA's beliefs and assumptions only as of

the date of this press release and should not be relied upon as

representing its views as of any subsequent date. XOMA

disclaims any obligation to update any forward-looking statement,

except as required by applicable law.

EXPLANATORY NOTE: Any references to “portfolio” in

this press release refer strictly to milestone and/or royalty

rights associated with a basket of drug products in

development. Any references to “assets” in this press release

refer strictly to milestone and/or royalty rights associated with

individual drug products in development.

As of the date of this press release, all assets in

XOMA’s milestone and royalty portfolio, except Vabysmo® (faricimab)

and IXINITY® [coagulation factor IX (recombinant)], are

investigational compounds. Efficacy and safety have not been

established. There is no guarantee that any of the

investigational compounds will become commercially available.

|

XOMA Investor Contact |

XOMA Media Contact |

|

Juliane Snowden |

Kathy Vincent |

|

XOMA Corporation |

KV Consulting & Management |

|

+1 646-438-9754 |

+1 310-403-8951 |

|

juliane.snowden@xoma.com |

kathy@kathyvincent.com |

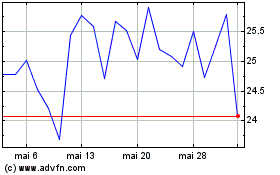

XOMA Royalty (NASDAQ:XOMA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

XOMA Royalty (NASDAQ:XOMA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024