0001646972False00016469722025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 27, 2025

Albertsons Companies, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39350 | | 47-4376911 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

250 Parkcenter Blvd.

Boise, Idaho 83706

(Address of principal executive office and zip code)

(208) 395-6200

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.01 par value | ACI | New York Stock Exchange |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | | | | |

| Item 5.02 | | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 27, 2025, Vivek Sankaran, Chief Executive Officer of Albertsons Companies, Inc. (the "Company"), notified the Company's Board of Directors (the "Board") of his decision to retire as CEO and member of the Board effective May 1, 2025. Mr. Sankaran's decision to retire from the position of Chief Executive Officer and Board member is not the result of any disagreement with the Company on any matter relating to the Company's operations, policies or practices.

As part of the Company's succession plan, on February 27, 2025, the Board appointed Susan Morris to succeed Mr. Sankaran as Chief Executive Officer, effective at the time of Mr. Sankaran's retirement on May 1, 2025. Ms. Morris, 56, has served as the Company's Executive Vice President and Chief Operations Officer since January 2018. Ms. Morris will also replace Mr. Sankaran as a member of the Board on the effective date. There are no related party transactions between the Company and Ms. Morris other than those described in the "Related Party Transactions" section of the Company's Proxy Statement filed June 21, 2024, which is incorporated herein by reference. Additionally, there are no family relationships between Ms. Morris and any other director or officer of the Company.

A copy of the press release announcing Mr. Sankaran's retirement and Ms. Morris' appointment is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are being filed herewith:

| | | | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Albertsons Companies, Inc. |

| (Registrant) |

| | |

| March 3, 2025 | By: | /s/ Thomas Moriarty |

| Name: | Thomas Moriarty |

| Title: | Executive Vice President, General Counsel and Chief Policy Officer |

| | |

Exhibit 99.1

Albertsons Companies, Inc. Announces CEO Succession Plan

EVP and COO Susan Morris to Succeed Vivek Sankaran as CEO After Transition Period

Albertsons Reaffirms Fiscal 2024 Outlook

BOISE, Idaho – March 3, 2025 – Albertsons Companies, Inc. (NYSE: ACI) (the “Company”) today announced a CEO succession plan under which Susan Morris, Executive Vice President and Chief Operations Officer, will assume the role of CEO following the planned retirement of Vivek Sankaran, effective May 1, 2025. During the transition period, Morris will work closely with Sankaran to continue execution of the Company’s Customers for Life strategy. On the effective date, Morris will join the Albertsons Cos. Board of Directors, replacing Sankaran.

Jim Donald, Chair of the Albertsons Cos. Board of Directors, said, “Over the past several years, the Board has engaged in a thoughtful and comprehensive succession planning process to identify Albertsons Cos.’ next CEO, including evaluating internal and external candidates. The Board is confident that Susan is the ideal person to lead the Company into its next chapter of growth. With a nearly 40-year career at the Company that began at an Albertsons store in the Denver market, Susan brings unmatched expertise and deep knowledge of the business. She is highly respected across the organization and industry, with a strong track record of operational success and passion for serving our customers and communities.”

"At a time of profound change for the grocery industry, I am honored to be appointed as the next CEO of Albertsons Cos.,” said Morris. "I have worked closely with Vivek and the leadership team on our plans to accelerate growth and am confident that we are on the right path with our Customers for Life strategy. I look forward to participating in the fiscal Q4 earnings call where we will discuss our strategy and provide our fiscal 2025 outlook. Albertsons Cos. has an incredibly bright future and the best team in the business – I am energized about the many opportunities that lie ahead.”

Donald added, "On behalf of the Board, we are grateful for Vivek’s exceptional leadership over the past six years, successfully managing Albertsons Cos.’ response to the COVID-19 pandemic and navigating the Company through challenging industry dynamics. During the past two years, he led continued investment in the business and drove our Customers for Life strategy, positioning Albertsons Cos. on strong financial footing for its next chapter of growth. We are grateful for his continued commitment to the Company during this transition period and his mentorship of and collaboration with Susan.”

"It has been a privilege to lead Albertsons Cos. through a critical period of evolution and I couldn’t be more confident in the Company’s future with Susan at the helm,” said Sankaran. “Susan embodies the best of Albertsons Cos.’ culture, with a strong track record of leading and building high performance teams. I have no doubt in her ability to usher in a new phase of

growth and improve our value proposition with customers and the communities where we operate.”

Susan Morris Biography

Morris has served as the Company’s Executive Vice President and Chief Operations Officer since January 2018. In this role, she leads the Company’s retail operations, overseeing more than 2,200 stores across 34 states.

She has nearly 40 years of experience in the retail grocery industry and has held a variety of leadership roles across the Company. Her experience includes serving as Executive Vice President of Regional Operations; Division President in two markets; and various other roles across merchandising and operations. She began her retail career at an Albertsons store in the Denver market.

She serves on the Board of Directors of IDACORP Inc (NYSE: IDA) and the Food Marketing Institute.

Morris is a graduate of Colorado State University. She has been recognized numerous times for her leadership in the grocery industry, including receiving both a Trailblazer Award and Top Women in Grocery from Progressive Grocer.

Company Reaffirms Fiscal 2024 Outlook

Albertsons Cos. also reaffirms its Fiscal 2024 Outlook, as shared in the third quarter earnings announcement on January 8, 2025:

•Identical sales growth in the range of 1.8% to 2.0%

•Adjusted EBITDA in the range of $3.95 billion to $3.99 billion

•Adjusted net income per Class A common share in the range of $2.25 to $2.31 per share

•Effective income tax rate in the range of 15% to 16% (1)

•Capital expenditures in the range of $1.8 billion to $1.9 billion

The Company is unable to provide a full reconciliation of the GAAP and Non-GAAP Measures (as defined below) used in the updated fiscal 2024 outlook without unreasonable effort because it is not possible to predict certain of the adjustment items with a reasonable degree of certainty. This information is dependent upon future events and may be outside of the Company's control and could have a significant impact on its GAAP financial results for fiscal 2024. The expected effective tax rate does not reflect potential future rate adjustments for the resolution of tax audits or potential changes in tax laws, which cannot be predicted with reasonable certainty.

(1)Expected effective tax rate of 15% to 16% reflects the $81.0 million of discrete state income

tax benefits recognized in the third quarter of fiscal 2024.

About Albertsons Companies

Albertsons Companies is a leading food and drug retailer in the United States. As of November 30, 2024, the Company operated 2,273 retail food and drug stores with 1,732 pharmacies, 405 associated fuel centers, 22 dedicated distribution centers and 19 manufacturing facilities. The Company operates stores across 34 states and the District of Columbia under more than 20 well known banners including Albertsons, Safeway, Vons, Jewel-Osco, Shaw's, Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star Market, Haggen, Carrs, Kings Food Markets and Balducci's Food Lovers Market. The Company is committed to helping people across the country live better lives by making a meaningful difference, neighborhood by neighborhood. In 2023, along with the Albertsons Companies Foundation, the Company contributed more than $350 million in food and financial support, including more than $35 million through our Nourishing Neighbors Program to ensure those living in our communities and those impacted by disasters have enough to eat.

Forward-Looking Statements and Factors That Impact Our Operating Results and Trends

This press release includes "forward-looking statements" within the meaning of the federal securities laws. The "forward-looking statements" include our current expectations, assumptions, estimates and projections about our business and our industry. They include statements relating to our future operating or financial performance which the Company believes to be reasonable at this time. You can identify forward-looking statements by the use of words such as "outlook," "may," "should," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future" and "intends" and similar expressions which are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to numerous risks and uncertainties which are beyond our control and difficult to predict and could cause actual results to differ materially from the results expressed or implied by the statements. Risks and uncertainties that could cause actual results to differ materially from such statements and may adversely impact our financial condition and results of operations include:

•the termination of the Merger Agreement and our inability to successfully optimize our value-creating initiatives following the termination of the Merger Agreement;

•litigation in connection with the previously pending Merger and the termination of the Merger Agreement, resulting in:

oongoing costs, including damages that we may be required to pay in connection with the lawsuit against Kroger or our inability to collect the $600 million termination fee from Kroger, all of which could be substantial; and

onegative reactions from the financial markets and our suppliers, customers, and associates;

•significant transaction costs related to the previously pending Merger;

•our inability to execute on our standalone business strategies following the termination of the Merger Agreement due to prolonged uncertainties and restrictions on our business during the pendency of the Merger;

•our ability to recruit and retain qualified associates who are critical to the success of our Customers for Life strategy;

•changes in macroeconomic conditions such as rates of food price inflation or deflation, fuel and commodity prices and expiration of student loan payment deferments;

•changes in price of goods sold in our stores and cost of goods used in our food products due to change in government regulations such as tariffs;

•changes in consumer behavior and spending due to the impact of macroeconomic factors;

•failure to achieve productivity initiatives, unexpected changes in our objectives and plans, inability to implement our strategies, plans, programs and initiatives, or enter into strategic transactions, investments or partnerships in the future on terms acceptable to us, or at all;

•changes in wage rates and ability to negotiate acceptable contracts with labor unions;

•challenges with our supply chain;

•operational and financial effects resulting from cyber incidents at the Company or at a third party, including outages in the cloud environment and the effectiveness of business continuity plans during a ransomware or other cyber incident; and

•changes in tax rates, tax laws, and regulations that directly impact our business or our customers.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements and risk factors. Forward-looking statements contained in this press release reflect our view only as of the date of this press release. We undertake no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

In evaluating our financial results and forward-looking statements, you should carefully consider the risks and uncertainties more fully described in the "Risk Factors" section or other sections in our reports filed with the SEC including the most recent annual report on Form 10-K and any subsequent periodic reports on Form 10-Q and current reports on Form 8-K.

For Investor Relations, contact investor-relations@albertsons.com

For Media Relations, contact media@albertsons.com or Albertsons@fgsglobal.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

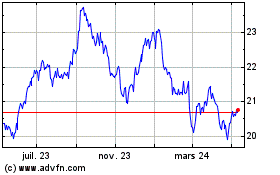

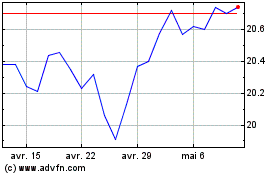

Albertsons Companies (NYSE:ACI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Albertsons Companies (NYSE:ACI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025