Files Restated Fiscal Year 2023 Form 10-K and

Subsequent Forms 10-Q

As Expected, Restatement Had No Impact on

Consolidated Financial Results for 2023 and First and Second

Quarters of 2024

Company to Host Conference Call on December 3,

2024

ADM (NYSE: ADM) today reported financial results for the quarter

ended September 30, 2024 that are consistent with its previously

announced preliminary results, and also filed its third quarter

form 10-Q. The Company also filed its restated financial statements

in its fiscal year 2023 Form 10-K and its forms 10-Q for the first

and second quarters of 2024. The restatement did not impact the

Company’s consolidated financial results for any of the periods

covered by those reports, as noted below.

Third Quarter 2024 Highlights

- Net earnings of $18 million, adjusted net earnings2 of $530

million

- See below for impact of non-cash charge against GAAP earnings

for the third quarter of $461 million related to our Wilmar equity

investment

- Earnings per share2 of $0.04, with adjusted earnings per

share1,2 of $1.09, both down versus the prior year period

- Trailing four-quarter average return on invested capital (ROIC)

of 6.6%, trailing four-quarter average adjusted return on invested

capital (ROIC)1 of 8.8%

Year-to-date cash flows from operating activities were $2,468

million, with cash flows from operations before working capital1,3

of $2,341 million, as compared to cash flows from operating

activities of $1,891 million and cash flows from operations before

working capital1,3 of $3,804 million for the corresponding

prior-year year-to-date period.

“Accuracy and transparency are important to the Company and we

are pleased to have now completed the restatement and be current

with our financial filing. We continue to focus on implementing

enhancements to internal controls to ensure integrity and accuracy

of reporting,” said Chair of the Board and CEO Juan Luciano.

“Looking ahead, while we foresee softer market conditions into

next year, we are taking actions to improve performance and drive

value creation. We are redoubling our focus on productivity and

operational excellence, while maintaining our disciplined approach

to capital allocation.”

1 Non-GAAP financial measures; see pages

7-9 and 14-16 for explanations and reconciliations.

2 All references in this document to

earnings per share (EPS) and adjusted earnings per share reflect

EPS on a diluted basis.

3 Cash from operations before working

capital is cash from operating activities of $2,468 million less

the changes in working capital of $127 million in YTD 2024. Cash

from operations before working capital is cash from operating

activities of $1,891 million excluding the changes in working

capital of ($1,913) million in YTD 2023

Third Quarter and Year-to-Date 2024 Results

3Q 2024 Results Overview

($ in millions except per share

amounts)

Earnings Before Income

Taxes

EPS1 (as reported)

GAAP

$108

$0.04

vs. 3Q 2023

(90)%

(97)%

Total Segment Operating

Profit2

Adjusted EPS1,2

NON-GAAP

$1,037

$1.09

vs 3Q 2023

(28)%

(33)%

YTD 2024 Results Review

($ in millions except per share

amounts)

Earnings Before Taxes

EPS1 (as reported)

GAAP

$1,588

$2.48

vs. YTD 2023

(55)%

(54)%

Total Segment Operating

Profit2

Adjusted EPS2

NON-GAAP

$3,158

$3.61

vs YTD 2023

(32)%

(36)%

1 All references in this document to

earnings per share (EPS) and adjusted earnings per share reflect

EPS on a diluted basis.

2 Non-GAAP financial measures; see pages

7-9 and 14-16 for explanations and reconciliations.

Summary of Third Quarter and

Year-to-Date 2024

For the third quarter ended September 30, 2024, earnings before

income taxes were $108 million, down (90)% versus the prior year

quarter. During the third quarter of 2024, the Company recorded a

non-cash impairment charge against GAAP earnings of $461 million

related to its equity investment in Wilmar. Earnings per share on a

GAAP basis were $0.04, and adjusted earnings per share were $1.09,

both down versus the prior year quarter. Total segment operating

profit was $1,037 million, down (28)% versus the prior year

quarter, and excluded specified items of $504 million, or

approximately $1.03 per share, related to impairments.

Earnings before income taxes were $1,588 million year-to-date in

2024, down (55)% versus the prior year period. Total segment

operating profit was $3,158 million year-to-date in 2024, down

(32)%. Earnings per share on a GAAP basis were $2.48 and adjusted

earnings per share were $3.61, down versus the prior year.

3Q 2024 Segment Overview

($ in millions, except where noted)

3Q 2024

3Q 20232

% Change

Total Segment Operating Profit1

$1,037

$1,446

(28)%

Segment Operating Profit:

Ag Services & Oilseeds

480

848

(43)%

Carbohydrate Solutions

452

468

(3)%

Nutrition

105

130

(19)%

YTD 2024 Segment Overview

($ in millions, except where noted)

YTD 2024

YTD 20232

% Change

Total Segment Operating Profit1

$3,158

$4,616

(32)%

Segment Operating Profit:

Ag Services & Oilseeds

1,803

3,113

(42)%

Carbohydrate Solutions

1,057

1,066

(1)%

Nutrition

298

437

(32)%

1 Non-GAAP financial measure; see pages

7-9 and 14-16 for explanation and reconciliation.

2 2023 Ag Services & Oilseeds,

Carbohydrate Solutions, and Nutrition segment operating profits

have been restated to reflect corrections with no change to total

Segment Operating Profit. See Note 13, Segment Information of the

Company’s consolidated financial statements included in the

Quarterly Report on Form 10-Q for the quarter ended September 30,

2024.

Ag Services and Oilseeds Segment

Summary

AS&O segment operating profit was $480 million during the

third quarter of 2024, down (43)% compared to the prior year

quarter.

The Ag Services subsegment operating profit was (53)% lower

versus the prior year quarter, primarily due to lower results in

South America Origination, as slower farmer selling and higher

logistics costs related to industry take-or-pay contracts led to

lower margins. The prior year quarter also included $48M of

insurance proceeds related to Hurricane Ida.

The Crushing subsegment operating profit was (25)% lower versus

the prior year quarter. Global soybean crush margins were higher,

supported by strong margins in EMEA. However, higher canola seed

prices due to less supply in Europe drove lower canola crush

margins, leading to lower results. During the quarter, there were

approximately zero mark-to-market timing impacts versus

approximately $100 million of positive impacts from the same period

a year ago, totaling approximately $100 million of negative net

impacts versus the prior year. The current quarter also included

$24 million of insurance proceeds for the partial settlement of the

Decatur East and West insurance claims related to incidents in

2023.

The Refined Products & Other (RPO) subsegment operating

profit was (63)% lower versus the prior year quarter, primarily

driven by lower results in North America, as higher imports of used

cooking oil and increased pre-treatment capacity drove

significantly lower refining and global biodiesel margins. During

the quarter, there were negative mark-to-market timing impacts in

RPO of approximately $20 million versus approximately $100 million

of positive timing impacts in the prior year, totaling

approximately $120 million of negative net impacts year over

year.

Equity earnings from the Company’s investment in Wilmar were $62

million during the quarter compared to the prior year quarter of

$35 million.

Year-to-date in 2024, the AS&O segment delivered $1,803

million in segment operating profit, lower versus the elevated

prior year. Ample supplies out of South America created more

balanced supply and demand conditions, leading to a lower margin

environment in the segment. Improved segment volumes and lower

costs partially offset the impact from lower margins. Equity

earnings from the Company’s Wilmar investment were 20% higher

versus the comparable prior year period.

3Q 2024 AS&O Overview

($ in millions, except where noted)

3Q 2024

3Q 2023

% Change

Segment Operating Profit

$480

$848

(43)%

Ag Services

107

226

(53)%

Crushing

187

250

(25)%

Refined Products and Other

124

337

(63)%

Wilmar

62

35

77%

YTD 2024 AS&O Overview

($ in millions, except where noted)

YTD 2024

YTD 2023

% Change

Segment Operating Profit

$1,803

$3,113

(42)%

Ag Services

461

954

(52)%

Crushing

632

901

(30)%

Refined Products and Other

431

1,026

(58)%

Wilmar

279

232

20%

Carbohydrate Solutions Segment

Summary

Carbohydrate Solutions segment operating profit was $452 million

for the third quarter of 2024, down (3)% compared to the prior year

period.

The Starches & Sweeteners subsegment increased 13%, versus

the prior year period, primarily driven by strong starches and

sweeteners volumes and margins, supported by high utilization rates

across the network. The current quarter also included $47 million

of insurance proceeds for the partial settlement of the Decatur

West insurance claims related to an incident that occurred in

2023.

In the Vantage Corn Processing (VCP) subsegment, operating loss

of $(3) million was lower compared to the prior year period, driven

by higher inventories and production, leading to a lower margin

environment.

Year-to-date in 2024, Carbohydrate Solutions segment operating

profit of $1,057 million was (1)% lower than the prior year, as

lower margins in the EMEA region and lower domestic ethanol margins

were partially offset by improved volumes and lower costs.

3Q 2024 Carbohydrate Solutions

Overview

($ in millions, except where noted)

3Q 2024

3Q 2023

% Change

Segment Operating Profit

$452

$468

(3)%

Starches and Sweeteners

455

403

13%

Vantage Corn Processors

(3)

65

(105)%

YTD 2024 Carbohydrate Solutions

Overview

($ in millions, except where noted)

YTD 2024

YTD 2023

% Change

Segment Operating Profit

$1,057

$1,066

(1)%

Starches and Sweeteners

1,039

1,017

2%

Vantage Corn Processors

18

49

(63)%

Nutrition Segment

Summary

Nutrition segment operating profit was $105 million for the

third quarter of 2024, down (19)% compared to the prior year

period.

Human Nutrition subsegment operating profit was $86 million,

approximately (27)% lower versus the prior year period. These

results include solid performance by recent Flavors M&A,

lapping of non-recurring benefits in the prior year period, changes

in inventory adjustments and certain other costs, including costs

associated with the closure of a joint venture. The current quarter

also included $25 million of insurance proceeds for the partial

settlement of the Decatur East insurance claims related to an

incident that occurred in 2023.

In the Animal Nutrition subsegment, operating profit of $19

million was 58% higher compared to prior year quarter, as cost

optimization efforts and lower input costs supported higher

margins.

Year-to-date in 2024, Nutrition segment operating profit of $298

million was (32)% lower than the prior year period, primarily

driven by negative impacts related to unplanned downtime at Decatur

East, lower texturants margins, and higher costs in Human

Nutrition.

3Q 2024 Nutrition Overview

($ in millions, except where noted)

3Q 2024

3Q 2023

% Change

Segment Operating Profit

$105

$130

(19)%

Human Nutrition

86

118

(27)%

Animal Nutrition

19

12

58%

YTD 2024 Nutrition Overview

($ in millions, except where noted)

YTD 2024

YTD 2023

% Change

Segment Operating Profit

$298

$437

(32)%

Human Nutrition

265

441

(40)%

Animal Nutrition

33

(4)

NM

Other and Corporate

Summary

For the third quarter, Other business operating loss was $17

million, down $63 million versus the prior year period, due to

lower Captive insurance results from $112 million in claim

settlements. Included in claim settlements were partial settlements

of $96 million for the Decatur East and West insurance claims. ADM

Investor Services results decreased on lower interest income.

Year-to-date in 2024, Other business operating gain was $200

million, down $29 million versus the prior year period, due to

lower Captive insurance results from $112 million in claim

settlements. Included in claim settlements were partial settlements

of $96 million for the Decatur East and West insurance claims. ADM

Investor Services results decreased on lower interest income.

In Corporate for the third quarter, unallocated corporate costs

increased versus the prior year on $28 million in higher legal fees

and $14 million in higher financing costs, partially offset by

lower incentive compensation.

In Corporate for year-to-date 2024, unallocated corporate costs

increased versus the prior year on higher global technology

investments to support digital transformation efforts, $75 million

in increased legal fees, and $33 million in increased financing

costs, partially offset by lower incentive compensation. Other

Corporate was unfavorable compared to the prior year period due to

investment valuation losses partially offset by foreign currency

gains.

Outlook3

The Company affirmed its previously provided EPS guidance for

the full year. ADM expects adjusted earnings per share1,2 in the

range of $4.50 to $5.00 for the full year 2024 based on trends in

ADM’s performance to date, legislative and regulatory policy

uncertainties, and ongoing headwinds from slower market demand and

internal operational challenges.

Within the reportable segments, for the fourth quarter compared

to the prior year period, the Company anticipates lower

year-over-year segment operating profit in AS&O, as an improved

environment in Ag Services is expected to be more than offset by

lower margins in Crushing and Refined Products & Other. In

Carbohydrate Solutions, solid demand and margins in North American

Starches & Sweeteners and strong fundamentals in ethanol are

expected to be offset by moderating wheat milling margins, leading

to fourth quarter segment operating profit that is roughly in-line

with the prior year period. In Nutrition, the Company anticipates

the fourth quarter operating profit will be higher than the prior

year period, but lower than the third quarter of 2024, due to

softer consumer demand, lower texturants pricing, and ongoing

operational challenges, including prolonged downtime at Decatur

East.

Wilmar

GAAP earnings include a reduction in the carrying value of the

Wilmar equity investment to reflect the Singapore Exchange trading

price as of the balance sheet date. The reduction resulted from a

determination that declines in the valuation amount for our

investment are impaired on an “other than temporary” basis as of

the end of the quarter. This has resulted in a non-cash charge

against GAAP earnings for the third quarter of 2024 of $461

million. The Company is continuing to evaluate trends in the

trading price of our Wilmar equity investment and the potential for

future charges that could result.

1Non-GAAP financial measures; see pages

7-9 and 14-16 for explanations and reconciliations.

2 All references in this document to

earnings per share (EPS) and adjusted earnings per share reflect

EPS on a diluted basis.

3 Forecasted GAAP Earnings Reconciliation:

ADM is not presenting forecasted GAAP earnings per diluted share or

a quantitative reconciliation to forecasted adjusted earnings per

share in reliance on the unreasonable efforts exemption provided

under Item 10(e)(1)(i)(B) of Regulation S-K. ADM is unable to

predict with reasonable certainty and without unreasonable effort

the impact of any impairment and timing of restructuring-related

and other charges, along with acquisition-related expenses and the

outcome of certain regulatory, legal and tax matters. The financial

impact of these items is uncertain and is dependent on various

factors, including timing, and could be material to our

Consolidated Statements of Earnings.

Restated Financial

Statements

As previously disclosed, following ongoing dialogue with the

staff of the United States Securities and Exchange Commission, the

Company concluded that it would amend the Company’s fiscal year

2023 Form 10-K (the “FY2023 Form 10-K”) and Form 10-Q for the first

and second quarters of 2024 (collectively, the “Q1 and Q2 2024 Form

10-Qs”). The Company has now filed the amended FY2023 Form 10-K and

the amended Q1 and Q2 2024 Form 10-Qs, which contain the restated

financial statements for each of the periods included in those

filings, including fiscal years 2021, 2022 and 2023 in the FY2023

Form 10-K and each of the quarterly and year-to-date periods

included in the Q1 and Q2 2024 Form 10-Qs (collectively, the

“Restatements”). Because the transactions affected by the

restatement occurred between the Company’s reporting segments, the

restatement had no impact on ADM’s consolidated balance sheet,

earnings, or cash flows for the periods presented in the restated

filings.

Conference Call

Information

ADM will host a webcast on December 3, 2024 at 8 a.m. Central

Time to discuss financial results and outlook. To listen to the

webcast, go to www.adm.com/webcast. A replay of the webcast will

also be available for an extended period of time at

www.adm.com/webcast.

About ADM

ADM unlocks the power of nature to enrich the quality of life.

We’re an essential global agricultural supply chain manager and

processor, providing food security by connecting local needs with

global capabilities. We’re a premier human and animal nutrition

provider, offering one of the industry’s broadest portfolios of

ingredients and solutions from nature. We’re a trailblazer in

health and well-being, with an industry-leading range of products

for consumers looking for new ways to live healthier lives. We’re a

cutting-edge innovator, guiding the way to a future of new consumer

and industrial solutions. And we're a leader in sustainability,

scaling across entire value chains to help decarbonize the multiple

industries we serve. Around the globe, our innovation and expertise

are meeting critical needs while nourishing quality of life and

supporting a healthier planet. Learn more at www.adm.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995

that involve substantial risks and uncertainties. All statements,

other than statements of historical fact included in this release,

are forward-looking statements. You can identify forward-looking

statements by the fact they do not relate strictly to historical or

current facts. These statements may include words such as

“anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,”

“believe,” “may,” “outlook,” “will,” “should,” “can have,”

“likely,” and other words and terms of similar meaning in

connection with any discussion of the timing or nature of future

operating or financial performance or other events. All

forward-looking statements are subject to significant risks,

uncertainties and changes in circumstances that could cause actual

results and outcomes to differ materially from the forward-looking

statements. These forward-looking statements are not guarantees of

future performance and involve risks, assumptions and

uncertainties, including, without limitation, those described in

the Company’s most recent Annual Report on Form 10-K and in other

documents that the Company files or furnishes with the Securities

and Exchange Commission. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual outcomes may vary materially from those indicated

or anticipated by such forward-looking statements. Accordingly, you

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they are made. Except

to the extent required by law, ADM does not undertake, and

expressly disclaims, any duty or obligation to update publicly any

forward-looking statement after the date of this announcement,

whether as a result of new information, future events, changes in

assumptions or otherwise.

Non-GAAP Financial

Measures

The Company uses certain “Non-GAAP” financial measures as

defined by the Securities and Exchange Commission. These are

measures of performance not defined by accounting principles

generally accepted in the United States, and should be considered

in addition to, not in lieu of, GAAP reported measures.

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in this

press release.

Adjusted net earnings and Adjusted earnings per share (EPS).

Adjusted net earnings reflects ADM’s reported net earnings after

removal of the effect on net earnings of specified items as more

fully described in the reconciliation tables below. Adjusted EPS

reflects ADM’s fully diluted EPS after removal of the effect on EPS

as reported of specified items as more fully described in the

reconciliation tables below. Management believes that Adjusted net

earnings and Adjusted EPS are useful measures of ADM’s performance

because they provide investors additional information about ADM’s

operations allowing better evaluation of underlying business

performance and better period-to-period comparability. These

non-GAAP financial measures are not intended to replace or be

alternatives to net earnings and EPS as reported, the most directly

comparable GAAP financial measures, or any other measures of

operating results under GAAP. Earnings amounts described above have

been divided by the company’s diluted shares outstanding for each

respective period in order to arrive at an adjusted EPS amount for

each specified item.

Total segment operating profit. Total segment operating profit

is ADM’s consolidated earnings before income taxes adjusted for

Other business, Corporate, and specified items as more fully

described in the reconciliation tables below. Management believes

that total segment operating profit is a useful measure of ADM’s

performance because it provides investors information about ADM’s

reportable segment performance excluding other business, corporate

overhead costs as well as specified items. Total segment operating

profit is not a measure of consolidated operating results under

U.S. GAAP and should not be considered an alternative to earnings

before income taxes, the most directly comparable GAAP financial

measure, or any other measure of consolidated operating results

under U.S. GAAP. The Company is revising its reconciliation and

calculation of total segment operating profit. The revised

reconciliation is presented in Note 13. Segment Information of the

Company’s consolidated financial statements included in the

Quarterly Report on Form 10-Q for the quarter ended September 30,

2024, which presents a subtotal for total segment operating profit

that is equal to the sum of the segment operating profit reported

for each of the Ag Services and Oilseeds, Carbohydrate Solutions

and Nutrition segments. Amounts for Other business and specified

items, which previously were reflected in the calculation of total

segment operating profit, are now reflected as reconciling items,

similar to Corporate, between total segment operating profit and

earnings before income taxes

Adjusted Return on Invested Capital (ROIC). Adjusted ROIC is

Adjusted ROIC earnings divided by adjusted invested capital.

Adjusted ROIC earnings is ADM’s net earnings adjusted for the

after-tax effects of interest expense on borrowings and specified

items. Adjusted invested capital is the sum of ADM’s equity

(excluding redeemable and non-redeemable noncontrolling interests)

and interest-bearing liabilities (which totals invested capital),

adjusted for specified items. Management believes Adjusted ROIC is

a useful financial measure because it provides investors

information about ADM’s returns excluding the impacts of specified

items and increases period-to-period comparability of underlying

business performance. Management uses Adjusted ROIC to measure

ADM’s performance by comparing Adjusted ROIC to its weighted

average cost of capital (WACC). Adjusted ROIC, Adjusted ROIC

earnings and Adjusted invested capital are non-GAAP financial

measures and are not intended to replace or be alternatives to GAAP

financial measures.

Cash flow from operations before working capital is defined as

cash flow from operating activities excluding the changes in

operating assets and liabilities as presented in the Company’s

consolidated statement of cash flows. Management believes that cash

flow from operations before working capital is a useful measure of

the Company’s cash generation. Cash flow from operations before

working capital is a non-GAAP financial measure and is not intended

to replace or be an alternative to cash from operating activities,

the most directly comparable GAAP financial measure.

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. Adjusted EBITDA is defined as

earnings before interest on borrowings, taxes, depreciation, and

amortization, adjusted for specified items. The Company calculates

adjusted EBITDA by removing the impact of specified items and

adding back the amounts of income tax expense, interest expense on

borrowings, and depreciation and amortization to net earnings.

Management believes that EBITDA and adjusted EBITDA are useful

measures of the Company’s performance because they provide

investors additional information about the Company’s operations

allowing better evaluation of underlying business performance and

better period-to-period comparability. EBITDA and adjusted EBITDA

are non-GAAP financial measures and are not intended to replace or

be an alternative to net earnings, the most directly comparable

GAAP financial measure.

Financial Tables Follow

Source: Corporate Release

Source: ADM

Total Segment Operating Profit (a

non-GAAP financial measure) and Corporate Results

(unaudited)

Quarter ended

Nine months ended

September 30

September 30

(In millions)

2024

2023

Change

2024

2023

Change

Earnings before income taxes

$

108

$

1,031

$

(923

)

$

1,588

$

3,560

$

(1,972

)

Other Business (earnings) loss

17

(46

)

63

(200

)

(229

)

29

Corporate

409

390

19

1,254

1,105

149

Specified items:

(Gain) loss on sales of assets

(1

)

2

(3

)

(1

)

(10

)

9

Impairment and restructuring charges

504

69

435

517

190

327

Total Segment Operating Profit

$

1,037

$

1,446

$

(409

)

$

3,158

$

4,616

$

(1,458

)

Segment Operating Profit:

Ag Services and Oilseeds

$

480

$

848

$

(368

)

$

1,803

$

3,113

$

(1,310

)

Ag Services

107

226

(119

)

461

954

(493

)

Crushing

187

250

(63

)

632

901

(269

)

Refined Products and Other

124

337

(213

)

431

1,026

(595

)

Wilmar

62

35

27

279

232

47

Carbohydrate Solutions

$

452

$

468

$

(16

)

$

1,057

$

1,066

$

(9

)

Starches and Sweeteners

455

403

52

1,039

1,017

22

Vantage Corn Processors

(3

)

65

(68

)

18

49

(31

)

Nutrition

$

105

$

130

$

(25

)

$

298

$

437

$

(139

)

Human Nutrition

86

118

(32

)

265

441

(176

)

Animal Nutrition

19

12

7

33

(4

)

37

Corporate Results

$

(409

)

$

(390

)

$

(19

)

$

(1,254

)

$

(1,105

)

$

(149

)

Interest expense - net

(113

)

(98

)

(15

)

(351

)

(326

)

(25

)

Unallocated corporate costs

(306

)

(298

)

(8

)

(903

)

(808

)

(95

)

Other

10

11

(1

)

16

34

(18

)

Specified items:

Gain (loss) on debt conversion option

—

—

—

—

6

(6

)

Expenses related to acquisitions

—

(3

)

3

(4

)

(6

)

2

Restructuring and contingency charges

—

(2

)

2

(12

)

(5

)

(7

)

Total segment operating profit is ADM’s

consolidated earnings before income taxes adjusted for Other

business, Corporate, and specified items as more fully described in

the reconciliation tables below. Management believes that total

segment operating profit are useful measures of ADM’s performance

because it provides investors information about ADM’s business unit

performance excluding other business, corporate overhead costs as

well as specified items. Total segment operating profit is not a

measure of consolidated operating results under U.S. GAAP and

should not be considered an alternative to earnings before income

taxes, the most directly comparable GAAP financial measure, or any

other measure of consolidated operating results under U.S.

GAAP.

Consolidated Statements of

Earnings

(unaudited)

Quarter ended

Nine months ended

September 30

September 30

2024

2023

2024

2023

(in millions, except per share

amounts)

Revenues

$

19,937

$

21,695

$

64,032

$

70,957

Cost of products sold (1)

18,572

19,885

59,612

65,184

Gross profit

1,365

1,810

4,420

5,773

Selling, general, and administrative

expenses (2)

905

815

2,763

2,537

Asset impairment, exit, and restructuring

costs(3)

507

79

532

146

Equity in (earnings) losses of

unconsolidated affiliates

(134

)

(83

)

(498

)

(408

)

Interest and investment income

(137

)

(152

)

(400

)

(428

)

Interest expense (4)

174

155

527

482

Other (income) expense - net (5)

(58

)

(35

)

(92

)

(116

)

Earnings before income taxes

108

1,031

1,588

3,560

Income tax expense (benefit) (6)

90

207

370

636

Net earnings including noncontrolling

interests

18

824

1,218

2,924

Less: Net earnings (losses) attributable

to noncontrolling interests

—

3

(15

)

6

Net earnings attributable to

ADM

$

18

$

821

$

1,233

$

2,918

Diluted earnings per common

share

$

0.04

$

1.52

$

2.48

$

5.35

Average diluted shares outstanding

483

540

497

546

(1) Includes a net reversal of charges related to inventory

writedowns of $5 million and a contingency loss provision of $62

million related to import duties in the prior YTD.

(2) Includes acquisition-related expenses of $3 million and $6

million in the prior quarter and YTD, respectively, and a

contingency loss adjustment of $8 million in the prior quarter and

YTD.

(3) Includes charges related to the impairment of the Company's

investment in Wilmar, impairment of discontinued animal nutrition

trademarks and restructuring costs

(4) Includes (gains) losses related to the mark-to-market

adjustment of the conversion option of the exchangeable bond issued

in August 2020 of $6 million in the prior YTD.

(5) Includes net (gains) losses related to the sale of certain

assets of $(1) million in the current quarter and YTD. Includes net

(gains) losses related to the sale of certain assets of $2 million

and $(10) million in the prior quarter and YTD, respectively.

(6) Includes the tax expense (benefit) impact of above specified

items and tax discrete items totaling $9 million and $23 million in

the current quarter and YTD, respectively, and $(17) million and

$(38) million in the prior year quarter and YTD, respectively.

Summary of Financial Condition

(unaudited)

September 30, 2024

September 30, 2023

(in millions)

Net Investment In

Cash and cash equivalents

$

784

$

1,498

Operating working capital

9,297

11,036

Property, plant, and equipment

10,828

10,218

Investments in affiliates

5,142

5,469

Goodwill and other intangibles

6,999

6,392

Other non-current assets

2,604

2,492

$

35,654

$

37,105

Financed By

Short-term debt

$

1,733

$

116

Long-term debt, including current

maturities

8,303

8,225

Deferred liabilities

3,351

3,183

Temporary equity

283

316

Shareholders’ equity

21,984

25,265

$

35,654

$

37,105

Summary of Cash Flows

(unaudited)

Nine months ended

September 30

2024

2023

(in millions)

Operating Activities

Net earnings

$

1,218

$

2,924

Depreciation and amortization

854

782

Asset impairment charges

517

120

(Gains) losses on sales/revaluation of

assets

9

(33

)

Other - net

(257

)

11

Other changes in operating assets and

liabilities

127

(1,913

)

Net Cash Provided by Operating

Activities

2,468

1,891

Investing Activities

Purchases of property, plant and

equipment

(1,071

)

(1,055

)

Net assets of businesses acquired

(936

)

(11

)

Proceeds from sale of business/assets

31

21

Investments in affiliates

(44

)

(8

)

Other investing activities

18

(8

)

Net Cash (Used) by Investing

Activities

(2,002

)

(1,061

)

Financing Activities

Long-term debt borrowings

—

500

Long-term debt payments

—

(963

)

Net borrowings (payments) under lines of

credit

1,627

(379

)

Share repurchases

(2,327

)

(1,118

)

Cash dividends

(744

)

(738

)

Other

(21

)

(102

)

Net Cash (Used) by Financing

Activities

(1,465

)

(2,800

)

Effect of exchange rate on cash, cash

equivalents, restricted cash, and restricted cash equivalents

6

(22

)

Increase (decrease) in cash, cash

equivalents, restricted cash, and restricted cash

equivalents

(993

)

(1,992

)

Cash, cash equivalents, restricted

cash, and restricted cash equivalents - beginning of period

5,390

7,033

Cash, cash equivalents, restricted

cash, and restricted cash equivalents - end of period

$

4,397

$

5,041

Segment Operating Analysis

(unaudited)

Quarter ended

Nine months ended

September 30

September 30

2024

2023

2024

2023

(in ‘000s metric tons)

Processed volumes (by

commodity)

Oilseeds

8,410

8,648

26,669

26,058

Corn

4,943

4,507

13,833

13,349

Total processed volumes

13,353

13,155

40,502

39,407

Quarter ended

Nine months ended

September 30

September 30

2024

2023

2024

2023

(in millions)

Revenues

Ag Services and Oilseeds

$

15,089

$

16,479

$

49,642

$

54,902

Carbohydrate Solutions

2,908

3,325

8,484

10,243

Nutrition

1,831

1,784

5,575

5,490

Other Business

109

107

331

322

Total revenues

$

19,937

$

21,695

$

64,032

$

70,957

Adjusted Net Earnings and Adjusted

EPS

Non-GAAP financial measures

(unaudited)

Quarter ended September 30

Nine months ended September

30

2024

2023

2024

2023

In millions

Per share

In millions

Per share

In millions

Per share

In millions

Per share

Net earnings and fully diluted

EPS

$

18

$

0.04

$

821

$

1.52

$

1,233

$

2.48

$

2,918

$

5.35

Adjustments:

Loss (gain) on sales of assets and

businesses (a)

(1

)

—

2

—

(1

)

—

(7

)

(0.02

)

Impairment, restructuring charges and

contingency provisions (b)

500

1.03

54

0.10

523

1.06

152

0.28

Expenses related to acquisitions (c)

—

—

3

0.01

3

0.01

5

0.01

Loss (gain) on debt conversion option

(d)

—

—

—

—

—

—

(6

)

(0.01

)

Certain discrete tax adjustments (e)

13

0.02

—

—

30

0.06

3

0.01

Sub-total adjustments

512

1.05

59

0.11

555

1.13

147

0.27

Adjusted net earnings and adjusted

EPS

$

530

$

1.09

$

880

$

1.63

$

1,788

$

3.61

$

3,065

$

5.62

Current quarter and YTD gain of $1 million and $(1) million

pretax ($(1) million and $(1) million after tax), respectively, was

related to the sale of certain assets, tax effected using the

applicable tax rate. Prior quarter and YTD (gain) loss of $2

million and $(10) million pretax ($2 million and $(7) million after

tax), respectively, was related to the sale of certain assets, tax

effected using the applicable tax rate.

(a)

Current quarter and YTD gain of $1 million

and $(1) million pretax ($(1) million and $(1) million after tax),

respectively, was related to the sale of certain assets, tax

effected using the applicable tax rate. Prior quarter and YTD

(gain) loss of $2 million and $(10) million pretax ($2 million and

$(7) million after tax), respectively, was related to the sale of

certain assets, tax effected using the applicable tax rate.

(b)

Current quarter and YTD charges of $504

million and $529 million pretax ($500 million and $523 million

after tax), respectively were related to the impairment of the

Company's investment in Wilmar, impairment of discontinued animal

nutrition trademarks, and restructuring, tax effected using the

applicable tax rates. Prior quarter and YTD charges of $79 million

and $141 million pretax ($60 million and $111 million after tax),

respectively, were related to the impairment of certain assets and

restructuring. Also included in the prior quarter and YTD is a

contingency loss reversal of $8 million pretax ($6 million after

tax) and a contingency provision related to import duties of $62

million pretax ($47 million after tax) in the prior YTD, tax

effected using the applicable tax rates.

(c)

Current YTD expenses of $4 million ($3

million after tax) were related to certain acquisitions, tax

effected using the Company’s U.S. income tax rate. Prior quarter

and YTD expenses of $3 million and $6 million ($3 million and $5

million after tax), respectively, were related to certain

acquisitions, tax effected using the Company’s U.S. income tax

rate.

(d)

Prior YTD gain on debt conversion option

of $6 million pretax ($6 million after tax).

(e)

Tax adjustments due to certain discrete

items totaling $13 million and $30 million in the current quarter

and YTD, respectively. Tax adjustments due to certain discrete

items totaling $3 million in the prior YTD, respectively.

Adjusted net earnings reflects ADM’s

reported net earnings after removal of the effect on net earnings

of specified items as more fully described above. Adjusted EPS

reflects ADM’s fully diluted EPS after removal of the effect on EPS

as reported of specified items as more fully described above.

Management believes that Adjusted net earnings and Adjusted EPS are

useful measures of ADM’s performance because they provide investors

additional information about ADM’s operations allowing better

evaluation of underlying business performance and better

period-to-period comparability. These non-GAAP financial measures

are not intended to replace or be alternatives to net earnings and

EPS as reported, the most directly comparable GAAP financial

measures, or any other measures of operating results under GAAP.

Earnings amounts described above have been divided by the company’s

diluted shares outstanding for each respective period in order to

arrive at an adjusted EPS amount for each specified item.

Adjusted Return on Invested

Capital

A non-GAAP financial measure

(unaudited)

ROIC Earnings (in millions)

Four Quarters

Quarter Ended

Ended

Dec. 31, 2023

Mar. 31, 2024

Jun. 30, 2024

Sep. 30, 2024

Sep. 30, 2024

Net earnings attributable to ADM

$

565

$

729

$

486

$

18

$

1,798

Adjustments:

Interest expense

109

115

135

124

483

Tax on interest

(26

)

(27

)

(32

)

(30

)

(115

)

Total ROIC Earnings

$

648

$

817

$

589

$

112

$

2,166

Total ROIC Earnings

$

648

$

817

$

589

$

112

$

2,166

Other Adjustments

155

21

22

512

710

Total Adjusted ROIC Earnings

$

803

$

838

$

611

$

624

$

2,876

Invested Capital (in millions)

Quarter Ended

Trailing Four

Dec. 31, 2023

Mar. 31, 2024

Jun. 30, 2024

Sep. 30, 2024

Quarter Average

Equity (1)

$

24,132

$

23,219

$

22,148

$

21,974

$

22,868

+ Interest-bearing liabilities (2)

8,370

9,995

10,576

10,051

9,748

Total Invested Capital

$

32,502

$

33,214

$

32,724

$

32,025

$

32,616

Total Invested Capital

$

32,502

$

33,214

$

32,724

$

32,025

$

32,616

Other Adjustments

155

21

22

512

178

Total Adjusted Invested Capital

$

32,657

$

33,235

$

32,746

$

32,537

$

32,794

Return on Invested Capital

6.6

%

Adjusted Return on Invested

Capital

8.8

%

(1) Excludes noncontrolling interests

(2) Includes short-term debt, current

maturities of long-term debt, finance lease obligations, and

long-term debt

ROIC is ROIC earnings divided by invested

capital. ROIC earnings is ADM’s net earnings adjusted for the

after-tax effects of interest expense on borrowings. Invested

capital is the sum of ADM’s equity (excluding noncontrolling

interests) and interest-bearing liabilities.

Adjusted ROIC is Adjusted ROIC earnings

divided by adjusted invested capital. Adjusted ROIC earnings is

ADM’s net earnings adjusted for the after-tax effects of interest

expense on borrowings, and specified items. Adjusted invested

capital is the sum of ADM’s equity (excluding noncontrolling

interests) and interest-bearing liabilities adjusted for the

after-tax effect of specified items. Adjusted ROIC on a trailing

four quarter average basis is equal to the average trailing four

quarters of adjusted ROIC earnings divided by the average trailing

four quarters of adjusted invested capital. Management believes

Adjusted ROIC is a useful financial measure because it provides

investors information about ADM’s returns excluding the impacts of

specified items and increases period-to-period comparability of

underlying business performance. Management uses Adjusted ROIC to

measure ADM’s performance by comparing Adjusted ROIC to its

weighted average cost of capital (WACC). Adjusted ROIC, Adjusted

ROIC earnings and Adjusted invested capital are non-GAAP financial

measures and are not intended to replace or be alternatives to GAAP

financial measures.

Adjusted Earnings Before Interest,

Taxes, and Depreciation and Amortization (EBITDA)

A non-GAAP financial measure

(unaudited)

The tables below provide a reconciliation

of net earnings to adjusted EBITDA for the trailing four quarters

ended September 30, 2024.

Four Quarters

Quarter Ended

Ended

Dec. 31, 2023

Mar. 31, 2024

Jun. 30, 2024

Sep. 30, 2024

Sep. 30, 2024

(in millions)

Net earnings

$

565

$

729

$

486

$

18

$

1,798

Net earnings (losses) attributable to

noncontrolling interests

(23

)

(10

)

(5

)

—

(38

)

Income tax expense

192

166

115

90

563

Interest expense

109

115

135

124

483

Depreciation and amortization

277

280

286

288

1,131

EBITDA

1,120

1,280

1,017

520

3,937

(Gain) loss on sales of assets and

businesses

(7

)

—

—

(1

)

(8

)

Impairment and restructuring charges and

contingency provisions

172

18

7

504

701

Railroad maintenance expense

39

—

4

28

71

Expenses related to acquisitions

1

—

4

—

5

Adjusted EBITDA

$

1,325

$

1,298

$

1,032

$

1,051

$

4,706

EBITDA is defined as earnings before

interest, taxes, depreciation and amortization. Adjusted EBITDA is

defined as earnings before interest on borrowings, taxes,

depreciation, and amortization, adjusted for specified items. The

Company calculates adjusted EBITDA by removing the impact of

specified items and adding back the amounts of income tax expense,

interest expense on borrowings, and depreciation and amortization

to net earnings. Management believes that EBITDA and adjusted

EBITDA are useful measures of the Company’s performance because

they provide investors additional information about the Company’s

operations allowing better evaluation of underlying business

performance and better period-to-period comparability. EBITDA and

adjusted EBITDA are non-GAAP financial measure and are not intended

to replace or be an alternative to net earnings, the most directly

comparable GAAP financial measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118398169/en/

Media Contact Brett Lutz media@adm.com 312-634-8484

Investor Relations Megan Britt Megan.Britt@adm.com

872-257-8378

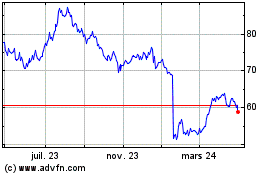

Archer Daniels Midland (NYSE:ADM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

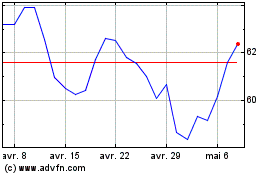

Archer Daniels Midland (NYSE:ADM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024