0000874501DEF 14Afalse00008745012022-01-012022-12-31iso4217:USDxbrli:pure00008745012021-01-012021-12-3100008745012020-01-012020-12-310000874501ambc:StockAwardsAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000874501ambc:EquityAwardsReportedValueMemberecd:PeoMember2022-01-012022-12-310000874501ambc:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310000874501ambc:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310000874501ambc:StockAwardsAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000874501ambc:EquityAwardsReportedValueMemberecd:PeoMember2021-01-012021-12-310000874501ambc:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310000874501ambc:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310000874501ambc:StockAwardsAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000874501ambc:EquityAwardsReportedValueMemberecd:PeoMember2020-01-012020-12-310000874501ambc:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310000874501ambc:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000874501ambc:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000874501ambc:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000874501ambc:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000874501ecd:NonPeoNeoMemberambc:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310000874501ambc:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000874501ambc:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000874501ambc:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000874501ecd:NonPeoNeoMemberambc:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310000874501ambc:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000874501ambc:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000874501ambc:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000874501ecd:NonPeoNeoMemberambc:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-31000087450182022-01-012022-12-31000087450112022-01-012022-12-31000087450152022-01-012022-12-31000087450122022-01-012022-12-31000087450162022-01-012022-12-31000087450132022-01-012022-12-31000087450172022-01-012022-12-31000087450142022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | | | | |

| | |

| SCHEDULE 14A INFORMATION | |

| | |

| PROXY STATEMENT PURSUANT TO SECTION 14(A) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

| (AMENDMENT NO. ____) |

| | |

Filed by the Registrant x Filed by a Party other than the Registrant ¨

| | | | | | | | |

Check the appropriate box: |

| | |

¨ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to §240.14a-12 |

| | |

AMBAC FINANCIAL GROUP, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | | | | | | | |

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| | | | |

| x | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

| | | | | |

| 2023 NOTICE OF ANNUAL |

| MEETING OF STOCKHOLDERS & |

| PROXY STATEMENT |

| | | | | |

| Ambac Financial Group, Inc. One World Trade Center New York, NY 10007 Tel: 212.658.7470 |

| | | | | | | | | | | | | | |

| |

| April 28, 2023 |

| | | | |

| To Our Fellow Stockholders: |

| |

| It is our pleasure to invite you to our 2023 Annual Meeting of Stockholders to be held on June 22, 2023 at 11:00 a.m. (Eastern). The meeting will be conducted in a virtual only format. Stockholders can participate from any geographic location with Internet connectivity. We believe this format allows for maximum stockholder participation. Stockholders may view a live webcast of the Annual Meeting and submit questions digitally during the meeting at www.virtualshareholdermeeting.com/AMBC2023. Please refer to the General Information - Participating in the Annual Meeting section of the Proxy Statement for more details. |

| | | | |

| We are taking advantage of the Securities and Exchange Commission (“SEC”) rules that allow companies to furnish proxy materials to stockholders via the internet. This electronic process gives you fast, convenient access to the materials, reduces the impact on the environment and reduces our printing and mailing costs. If you received a Notice Regarding the Availability of Proxy Materials (“Internet Notice”) by mail, you will not receive a printed copy of the proxy materials unless you specifically request them. The Internet Notice instructs you on how to access and review all of the important information contained in this Proxy Statement, as well as how to submit your proxy over the internet. If you want more information, please see the General Information section of this Proxy Statement or visit the Annual Meeting of Stockholders section of our Investor Relations website at http://ir.ambac.com. |

| | | | |

| Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the internet or by phone or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card. Please review the instructions on each of your voting options described in this Proxy Statement, as well as in the Internet Notice you received in the mail. |

| | | | |

| Thank you for your interest in Ambac. |

| | | | |

| Sincerely, | | | |

| | | | |

| Jeffrey S. Stein Chairman | | Claude LeBlanc President and Chief Executive Officer |

AMBAC FINANCIAL GROUP, INC.

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | | | | |

| | | | |

| Time and Date | | 11:00 a.m. (Eastern) on June 22, 2023 | |

|

| Place | | The 2023 Annual Meeting of Stockholders will be conducted in a virtual format at www.virtualshareholdermeeting.com/AMBC2023.* Stockholders of record will be able to vote and ask questions during the meeting through the online platform. | |

|

| Items of Business | | (1) To elect seven members of the Board of Directors to hold office until the next annual meeting of stockholders or until their respective successors have been elected and qualified. | |

| | | (2) To approve, on an advisory basis, the compensation of our named executive officers. | |

| | | (3) To ratify the appointment of KPMG LLP as Ambac’s independent registered public accounting firm for the fiscal year ending December 31, 2023. | |

|

| Adjournments and Postponements | | Any action on the items of business described above will be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. | |

|

| Record Date | | You are entitled to vote only if you were an Ambac stockholder as of the close of business on April 25, 2023 (Record Date). You will need proof of ownership of our common stock to enter the meeting. | |

|

| Voting | | Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice Regarding the Availability of Proxy Materials (“Internet Notice”) you received in the mail, the section titled “General Information - Information About the Annual Meeting and Voting” in this Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy or voting instruction card. | |

|

| | | | |

| | | By order of the Board of Directors, |

| | | |

| | | William J. White |

| | | Corporate Secretary |

* Stockholders can participate from any geographic location with Internet connectivity. We believe this format allows for maximum stockholder participation. Stockholders may view a live audio webcast of the Annual Meeting and submit questions digitally during the meeting at www.virtualshareholdermeeting.com/AMBC2023. Please refer to the General Information - participating in the Annual Meeting section of the Proxy Statement for more details.

This notice of Annual Meeting and Proxy Statement and form of proxy are being distributed and made available on or about April 28, 2023.

| | | | | | | | | | | | | | | | | | | | |

| Table of Contents | |

| PROXY STATEMENT SUMMARY | | | Executive Sessions | | |

| Performance Against Compensation Metrics | | | Outside Advisors | | |

| Response to 2022 Say on Pay Vote and Stockholder Outreach | | | Board Effectiveness | | |

| Key Features of Our Executive Compensation Program | | | Corporate Governance Guidelines | | |

| CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY | | | Code of Business Conduct and Ethics | | |

| Business Model | | | Board Compensation Arrangements for Non-Employee Directors | | |

| Corporate Governance | | | COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| |

| ESG Governance and Oversight | | | EXECUTIVE COMPENSATION | | |

| Environmental | | | Executive Officers | | |

| Climate Change Risk | | | Compensation Discussion and Analysis | | |

| Data Security and Privacy | | | Compensation Committee Report | | |

| Corporate Social Responsibility | | | 2022 Summary Compensation Table | | |

| Diversity and Inclusion | | | Grants of Plan-Based Awards in 2022 | | |

| Training, Development and Well-Being of Employees |

| | Agreement with Claude LeBlanc | | |

| Guiding Principles Concerning Responsible Investing |

| | Agreements with Other Executive Officers | | |

| | | | Outstanding Equity Awards at 2022 Fiscal

Year-End | | |

| GENERAL INFORMATION | | | Stock Vested in 2022 | | |

| INCORPORATION BY REFERENCE | | | Potential Payments Upon Termination or Change-in-Control |

| |

| DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE |

| | Pay Ratio Disclosure | | |

| Board of Directors | | | Pay Versus Performance | | |

| Board Leadership Structure | | | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | |

| Board Committees | | | THE AUDIT COMMITTEE REPORT | | |

| Board’s Role in Risk Oversight | | | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | |

| Director Independence | | | PROPOSAL NUMBER 1 | | |

| Compensation Committee Interlocks and Insider Participation |

| | PROPOSAL NUMBER 2 | | |

| Consideration of Director Nominees | | | PROPOSAL NUMBER 3 | | |

| | | | | | |

| | | | | | |

| | |

Ambac Financial Group, Inc. | i | 2023 Proxy Statement |

PROXY STATEMENT SUMMARY

Below are the highlights of important information you will find in this Proxy Statement for Ambac Financial Group, Inc. ("Ambac" or the "Company") and its subsidiaries. As it is only a summary, please review the complete Proxy Statement before you vote. | | |

Ambac Financial Group Fiscal Year 2022 Highlights |

Performance Highlights:

The following events summarize our performance highlights for fiscal year 2022:

| | | | | |

| |

| l | Reported net income of $522 million for the full year 2022 |

| l | Increased Book Value per Share by 24% to $27.85 and Adjusted Book Value per Share by 50% to $28.29 |

| l | Received $1.98 billion from the settlement of RMBS representation and warranty litigations, recognizing $249 million of gains, partially offset by losses from the extinguishment of secured notes of $53 million. |

| l | Reduced debt and accrued interest by $1.9 billion, primarily from the RMBS representation and warranty litigation proceeds, and recognized a $134 million discount capture on surplus note repurchases. |

| l | Repurchased Auction Market Preferred Shares with a liquidation value of $23 million capturing approximately $15 million of discount capture. |

| l | Increased Specialty Property and Casualty Insurance production by 172% from the fourth quarter of 2021 and $282 million for the full year 2022 up 116% over the prior year. Specialty Property and Casualty Insurance production includes gross premiums written by Ambac's Specialty Property and Casualty Insurance segment and premiums placed by the Insurance Distribution segment, which totaled $90 million in the fourth quarter of 2022, and $282 million for the full year 2022. |

| l | Decreased our insured portfolio net par outstanding at the Legacy Financial Guarantee business by 19% to $22.6 billion from year-end 2021. This includes reduced Watch List and Adversely Classified Credits by 24%, to $7.8 billion from $10.2 billion at year end 2021. The above mentioned declines were primarily the result of active de-risking transactions including the restructuring of all of our remaining Puerto Rico exposures. |

| |

| |

| l | Increased Everspan Gross Written Premium to $146 million in 2022, which was a 10 fold increase from 2021 |

| l | Reduced Gross Operating Run Rate Expense in the fourth quarter of 2022 to $16.3 million |

| l | Acquired All Trans and Capacity Marine, representing approximately $60 million of expected premium placed for Cirrata |

| |

| | |

Ambac Financial Group, Inc. | 1 | 2023 Proxy Statement |

Performance Against Compensation Metrics

Performance Against 2022 Short Term Incentive Plan Metrics. Short Term Incentive Plan ("STIP") awards for 2022 were determined based on a structured approach in which 60% of an executive officer's annual STIP award was based on the Company’s achievement of pre-established financial performance targets at the Company related to (i) reductions in Net Par Outstanding in the legacy financial guarantee insured portfolio; (ii) gross written premiums at Everspan and (iii) reductions in Gross Operating Run Rate Expense; while the remaining 40% of an executive officer's annual STIP award was based on strategic performance goals, a majority of which are based on objective, quantifiable or financial outcomes. For the 2022 fiscal year, we established the following goals for each of our STIP financial performance metrics and assigned weighting factors as follows:

| | | | | | | | | | | | | | |

| Weighting Factor | Threshold ($ in millions) | Target ($ in millions) | Maximum ($ in millions) |

Net Par Outstanding | 60% | $24,900 | $24,200 | $23,200 |

| Gross written premiums at Everspan | 20% | $125 | $160 | $175 |

Gross Operating Run Rate Expenses | 20% | $17.4 | $16.9 | $16.5 |

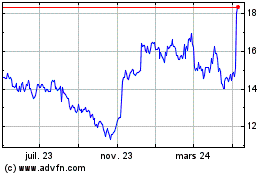

The following graph/charts shows the Company's 2022 actual performance compared to the threshold, target and maximum achievement levels as established for each of the financial performance metrics.

| | | | | | | | |

Net Par Outstanding (1) | Gross Written Premiums at Everspan | Gross Operating Run Rate Expenses (2) |

| ($ in Billions) | ($ in Millions) | ($ in Millions) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Threshold | | Target | | Maximum | ------ | Actual |

(1)Reductions in Net Par Outstanding as of December 31, 2022 under the STIP were measured against Net Par Outstanding as of January 1, 2022.

(2)Gross Operating Run Rate Expenses is measured by comparing actual gross operating run rate expenses for the fourth quarter of a fiscal year to performance goals established against budgeted amounts.

With respect to reductions in Net Par Outstanding, Ambac exceeded the maximum performance goal set for that metric as Net Par Outstanding was reduced to $22.87 billion. With respect to gross written premiums at Everspan, Ambac's performance at year-end was below the target performance goal set for that metric as gross written premiums at Everspan was $146.4 million. With respect to reductions in Gross Operating Run Rate Expenses,

| | |

Ambac Financial Group, Inc. | 2 | 2023 Proxy Statement |

Ambac exceeded the maximum performance goal set for that metric, as Gross Operating Run Rate Expenses for the fourth quarter of 2022 was $16.3 million.

Performance against 2019 LTIP metrics. In 2019, we established the following three year goals for each of our Long Term Incentive Plan ("LTIP") performance metrics. All Ambac LTIP awards are paid in Ambac common stock at the end of a settlement period.

| | | | | | | | | | | | | | |

| At Ambac Assurance and Subsidiaries | | At Ambac | Percentage of Target

Award Earned |

Net Asset Value (1)

($ in millions) | Watch List & Adversely Classified Credits Outstanding (1) ($ in billions) | | Cumulative EBITDA (1)

($ in millions) |

|

| $(180) | $11.5 | | $35 | 200% |

| $(380) | $13.5 | | $20 | 100% |

| $(580) | $15.0 | | $— | —% |

(1) Linear interpolation between levels results in a proportionate amount of the Ambac LTIP Target Award becoming earned and vested.

The 2019 LTIP awards paid out in early 2022, following the end of a three year performance period at December 31, 2021. The following graph/charts shows the Company's actual performance over the three year performance period running from January 1, 2019 through December 31, 2021, compared to the achievement levels set forth in the chart above.

| | | | | | | | |

AAC

Adjusted Net Asset Value | Watch List & Adversely

Classified Credits Outstanding | Ambac Cumulative EBITDA |

| ($ in Millions) | ($ in Billions) | ($ in Millions) |

For the 2019 LTIP, performance was determined based on (i) increased Net Asset Value at AAC weighted 25%; (ii) reductions in Watchlist & Adversely Classified Credit net par outstanding at AAC weighted at 45%; and (iii) Cumulative EBITDA at Ambac weighted at 30%. In addition, the final 2019 LTIP performance stock unit award payout at the end of a three year settlement period was reduced as a result of the impact of the relative Total Shareholder Return ("rTSR") modifier which serves as an additional metric with respect to performance based LTIP award payouts. The Net Asset Value at the end of the performance period was $42 million. While Net Asset Value was projected to decrease over the performance period, certain favorable achievements by management, such as (i) the COFINA restructuring, (ii) the Ballantyne Re PLC settlement, (iii) the Citibank

For the 2019 LTIP, performance was determined based on (i) increased Net Asset Value at AAC weighted 25%; (ii) reductions in Watchlist & Adversely Classified Credit net par outstanding at AAC weighted at 45%; and (iii) Cumulative EBITDA at Ambac weighted at 30%. In addition, the final 2019 LTIP performance stock unit award payout at the end of a three year settlement period was reduced as a result of the impact of the relative Total Shareholder Return ("rTSR") modifier which serves as an additional metric with respect to performance based LTIP award payouts. The Net Asset Value at the end of the performance period was $42 million. While Net Asset Value was projected to decrease over the performance period, certain favorable achievements by management, such as (i) the COFINA restructuring, (ii) the Ballantyne Re PLC settlement, (iii) the Citibank | | |

Ambac Financial Group, Inc. | 3 | 2023 Proxy Statement |

- SEC settlement, and (iv) debt reduction from surplus note exchanges, along with the resulting lower net interest expense all contributed to the Net Asset Value increasing during the performance period. Watchlist & Adversely Classified Credit net par outstanding at AAC was reduced to $10.3 billion during the performance period and was positively impacted by active de-risking strategies including credit exposure reductions at Ballantyne Re PLC, and COFINA, among other risk reduction transactions. Cumulative EBITDA at Ambac of approximately $13 million was under target during the performance period driven by adverse investment results, partially offset by lower operating expenses during the performance period. Investment results were adversely driven by lower yields on liquid investments, impairments on AAC surplus notes held by Ambac and the use of assets for new business strategies. Ambac's rTSR lagged against our peers and resulted in a total shareholder return of -6.98% and a ranking of 10 out of the 11 peer participants. As a result after applying Ambac's rTSR modifier the LTIP performance multiple was reduced by 10%.

Response to 2022 Say on Pay Vote and Stockholder Outreach

At our 2022 annual meeting, our Say on Pay proposal received support from stockholders representing over 50% of our common stock present, in person or by proxy at the meeting. We greatly appreciate the support of a majority of our stockholders with regard to our executive compensation program and seek to address the concerns of those stockholders whose support we did not receive. We remain committed to a corporate governance approach that aligns the interest of management, the Board of Directors, and our stockholders. Following the 2022 say-on-pay vote, the Chairman of the Board, along with the Chairs of the Compensation Committee and the Governance and Nominating Committee solicited feedback from stockholders representing approximately 46% of our outstanding common stock and from certain proxy advisory firms. These stockholders provided important feedback concerning our executive compensation program.

While the feedback on our executive compensation program was generally favorable, a number of stockholders provided feedback on certain changes they would like the Company to adopt which include the changes listed below. As a result of the feedback received from stockholders, the Compensation Committee made the following changes to the 2023 compensation program:

| | | | | | | | |

| WHAT WE HEARD | WHAT WE DID |

Increase the weighting of the financial performance metrics in the Short Term Incentive Plan. | l | In 2023, we increased the weighting of the Short-Term Incentive Compensation Plan ("STIP") financial performance metrics from 60% to 70%. |

| Place a greater emphasis on total stockholder return as part of the compensation program. | l | We increased the impact of the rTSR modifier from +/- 10% to +/- 20% with respect to our LTIP Awards beginning in 2022 so that any final performance stock unit ("PSU") award payout at the end of the three year performance period may be increased or decreased by 20% if the Company's stock performance compared to a peer group is at or above the 75th percentile or at or below the 25th percentile, respectively. |

| Continued focus should remain on the legacy Financial Guaranty business to drive value. | l | Re-evaluated the key de-risking initiatives for the legacy Financial Guaranty business with a focus on value enhancing initiatives including reductions in Net Par Outstanding and Watch List and Adversely Classified Credits as key metrics in the STIP and LTIP, respectively. |

| The timeline for value creation must be considered and should impact management judgements. | l | Introduced a comprehensive strategic review of AAC, on a time and risk adjusted basis, as a key performance goal connected to the STIP evaluation. |

| | |

Ambac Financial Group, Inc. | 4 | 2023 Proxy Statement |

Key Features of Our Executive Compensation Program

| | | | | | | | |

|

Compensation

Aligned to

Market Levels | l | The Chief Executive Officer’s total compensation is benchmarked to what the Compensation Committee believes is an appropriate level of compensation compared to peers. |

| | |

Rigorous

Performance

Metrics | l | Rigorous performance goals based on multiple metrics for our short-term incentive program. Incentive compensation program for our Chief Executive Officer structured to align with the incentive compensation program for all of our executive officers. |

| l | Sixty percent of our Chief Executive Officer's 2022 annual incentive award was based on the achievement of objective financial performance metrics that have been established by the Compensation Committee pursuant to our Short-Term Incentive Compensation Plan and the remainder of the annual incentive award opportunity is based on strategic performance goals, a majority of which are based on objective, quantifiable or financial outcomes. |

| l | The determination of the portion of the annual incentive award that is based on strategic performance goals considers certain factors, including, but not limited to, evaluation of business unit performance and individual performance. The Compensation Committee believes that it is important to include strategic performance goals in the STIP given the continuing transformation of the Company's business from its legacy financial guarantee insurance business to its specialty property and casualty program and insurance distribution businesses. |

| | |

Included a restricted stock unit

component in the

Long Term

Incentive

Compensation Plan | l | In order to encourage the retention of our most valued employees and to more closely align their interests with that of our stockholders, we included time based restricted stock units ("RSUs") and performance stock units ("PSUs") as a components of our LTIP awards, which for the 2023 grants were denominated 70% in PSUs and 30% in RSUs. |

|

Overall, our current executive compensation program heavily emphasizes performance and equity-based compensation to closely align management's incentives with stockholder interests, and includes other practices that we believe serve stockholder interests such as maintaining an executive stock ownership and retention policy, not providing tax “gross-up” payments, providing limited perquisites, maintaining a recoupment policy for incentive-based compensation and maintaining policies prohibiting the hedging or pledging our Company’s stock.

Corporate Social Responsibility and Sustainability

Ambac is committed to making meaningful progress each year towards communicating our social responsibility efforts. Our Board of Directors, senior management team, and employees understand social responsibility is integral to our business operations and a means by which we can deliver greater value to our stakeholders. To that end, in 2022 Ambac introduced its inaugural Corporate Social Responsibility Report, which highlights our corporate culture and attention to environmental, social and governance (ESG) factors in our everyday decision-making and long-term strategy. See the "Sustainability" section of Ambac's website, at https://ambac.com/sustainability/default.aspx.

Ambac's long-term success depends not only on how we execute against our strategic priorities but also how we manage our relationships with our stakeholders, the communities in which we work and our employees. For this reason, we take an integrated approach to sustained value creation and managing risk in and around our business. In 2021, Ambac developed responses to the Global Reporting Initiative ("GRI") voluntary reporting framework and, with respect to certain investments, the "key performance indicators" promulgated by the Sustainability

| | |

Ambac Financial Group, Inc. | 5 | 2023 Proxy Statement |

Accounting Standards Board ("SASB"). See the "Sustainability" section of Ambac's website, at https://ambac.com/sustainability/default.aspx to review our GRI Content Index and SASB Content Index.

Business Model

Ambac Financial Group, Inc. is a financial services holding company. Ambac's business operations include:

•Legacy Financial Guarantee ("FG") Insurance — Ambac's financial guarantee business includes the activities of Ambac Assurance Corporation and its wholly owned subsidiaries ("AAC") , including Ambac Assurance UK Limited (“Ambac UK”) and Ambac Financial Services LLC ("AFS"). Both AAC and Ambac UK (the "Legacy Financial Guarantee Companies") have financial guarantee insurance portfolios that have been in runoff since 2008. AFS uses derivatives to hedge interest rate risk in AAC's insurance and investment portfolios.

•Specialty Property & Casualty Insurance — Ambac's hybrid fronting Specialty Property & Casualty ("P&C") Insurance business currently includes five admitted carriers and an excess and surplus lines insurer (collectively, “Everspan”). Three of the five admitted carriers were acquired in 2022. Everspan carriers have an AM Best rating of 'A-' (Excellent).

•Insurance Distribution —Ambac's Specialty P&C Insurance Distribution business ("Cirrata"), which could include Managing General Agents and Underwriters (collectively "MGAs" or "MGA/Us"), insurance wholesalers, and other distribution businesses, and currently includes Xchange Benefits, LLC (“Xchange”) a P&C MGA specializing in accident and health products, All Trans Risk Solutions, LLC ("All Trans"), an MGA specializing in commercial automobile insurance for specific "for-hire" auto clauses, and Capacity Marine Corporation ("Capacity Marine"), a wholesale and retail brokerage and reinsurance intermediary specializing in marine and international risk. In addition, Cirrata has announced the incubation of two de novo MGAs, one focused on the Health and Human Services sector and the other in the Construction sector.

Our corporate initiatives are governed by our corporate Mission, Vision and Values.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| MISSION | | VISION | | VALUES | |

| | Optimize our business and its components to achieve maximum return for stockholders; | | | Transition to a growth-oriented platform sufficiently capitalized to support businesses that are synergistic with Ambac’s core competencies | | | Culture of respect, inclusion, collaboration and transparency; | |

| | | | | | Attract, retain, and reward top performers who meet standards of excellence, integrity, and collaboration | |

| | Aggressively pursue financially sound strategies to reduce risk and decrease the size of the legacy insured portfolio | | | | |

| | | | | | | | | |

| | |

Ambac Financial Group, Inc. | 6 | 2023 Proxy Statement |

Corporate Governance

Our Board conducts an annual review of its governance practices, committee charters and governance policies to ensure that the Company’s practices are in line with current leading practices. We are committed to a corporate governance approach that aligns the interests of management, the Board of Directors and our stockholders. In furtherance of this approach, over the course of 2022 our investor relations department reached out to stockholders representing approximately 46% of our outstanding common stock to offer a meeting with the Chairman of the Board and the Chairs of the Compensation Committee and the Governance and Nominating Committee. The purpose of the meetings was to solicit feedback from our stockholders on executive compensation and corporate responsibility, including environmental, social, and governance matters. Our Chief Executive Officer provided a brief business update and participated in a discussion regarding the business model, strategies and performance results at the outset of each meeting before excusing himself and turning the meeting over to the independent directors. Stockholders positively acknowledged our efforts and progress on ESG related matters to date.

Consistent with our Board's proactive efforts in soliciting and responding to stockholder feedback and, following the recommendations of the Governance and Nominating Committee and the Compensation Committee, over the past several years we've implemented the following changes relating to our corporate governance practices and compensation program:

| | | | | |

| |

| l | In 2023, we increased the overall weighting of the Short-Term Incentive Compensation Plan ("STIP") financial performance metrics from 60% to 70%; and increased the specific weighting of the STIP financial performance metrics for Everspan and Cirrata to 25%. |

| l | In 2023, we included LTIP performance metrics related to (i) gross written premium and EBITDA at Everspan and (ii) gross written premium and EBITDA at Cirrata. |

| l | In 2022, we increased the proportion of performance stock units ("PSUs") to restricted stock units ("RSUs") granted from 60%/40% to 70%/30%, respectively. |

| l | In 2022, we increased the rTSR modifier with respect to our LTIP awards from +/- 10% to +/- 20%. |

| l | We established an internal ESG committee to focus on enhancement of relevant policies, procedures and disclosures to reflect Ambac’s ESG practices and objectives. |

| l | We eliminated director meeting fees, which previously applied after a director had attended eight meetings of the Board, or eight meetings of a committee that he or she attended as a member. |

| l | We adopted an Executive Stock Ownership and Retention Policy (“Stock Ownership Policy”) applicable to all of our executive officers. |

| l | We adopted a recoupment policy (otherwise known as a "claw-back") providing that in the event of a material financial restatement or the imposition of a material financial penalty, the Company may recoup incentive-based compensation received by our executive officers during a three-year look-back period. |

| |

| | |

Ambac Financial Group, Inc. | 7 | 2023 Proxy Statement |

| | | | | |

| |

| Ambac's corporate governance practices drive accountability to stockholders |

Independent Oversight and Leadership | ü 5 out of 6 current directors (and 6 out of 7 director nominees) independent ü Limited additional current Board obligations (no director sits on more than 3 other public company boards), allowing for focus on the execution of Ambac's strategy ü Separate Chairman and CEO roles ü Average tenure of 6 years for continuing directors (vs. S&P average of 8.4) ü Added two new director nominees this year, and a total of four new independent directors, including three women (one of whom is a new director nominee), in the last six years with a focus on core skills and experience, as well as diversity and inclusion |

| |

Emphasis on

Stockholder

Rights | ü No classified board - all directors elected annually ü No stockholder rights plan |

| |

Stockholder

Engagement | ü Actively engaged with stockholders on corporate governance issues, including Board diversity ü Track record of proactive, ongoing stockholder dialogue |

| |

Our current slate of continuing directors and director nominees is comprised of individuals with diverse skill sets which are necessary in light of the unique nature of Ambac’s business. Four of our director nominees self-identify as men, three self-identify as women, and one director nominee self-identifies as Hispanic. Mr. Herzog is not standing for reelection at the 2023 Annual Meeting of Stockholders.

| | | | | | | | | | | | | | | | | | | | |

| CEO Experience | CFO Experience | Insurance Expertise | Risk Management | Investment Experience | Restructuring Expertise |

| Ian Haft | | ü | | ü | ü | |

| Lisa G. Iglesias | | | ü | ü | ü | |

| Joan Lamm-Tennant | ü | | ü | ü | | |

| Claude LeBlanc | ü | ü | ü | ü | ü | ü |

| Kristi A. Matus | | ü | ü | ü | ü | |

| Michael D. Price | ü | | ü | ü | | |

| Jeffrey S. Stein | | | | ü | ü | ü |

_____________________________________

ESG Governance and Oversight

In 2021, an internal ESG committee was established to focus on enhancement of relevant policies, procedures and disclosures to reflect Ambac’s ESG practices and objectives. To ensure that ESG is appropriately managed and communicated throughout the organization, we have designed the following governance structure:

•Board of Directors: Primary oversight of ESG activities has been assigned to the Governance & Nominating Committee, which will oversee strategy and public reporting.

•Executive Leadership Sponsors: Ambac's CEO, General Counsel and Chief Strategy Officer provide direction on ESG strategy and public reporting.

•ESG Committee: Senior leaders from Legal, Human Resources, Investor Relations, and Risk Management meet frequently to drive decision-making, accountability and ownership of ESG reporting and policy initiatives.

| | |

Ambac Financial Group, Inc. | 8 | 2023 Proxy Statement |

•Employees: Ambac’s commitment to ESG is firm-wide and includes input and participation from employees across the organization.

The ESG Committee published Ambac's inaugural Corporate Social Responsibility Report in 2022 and developed a GRI content index, along with certain SASB investment related "key performance indicators." See the "Sustainability" section of Ambac's website.

Environmental

Ambac is committed to protecting the environment through the implementation of policies and procedures that reduce Ambac’s environmental footprint. The Company’s Code of Business Conduct and Ethics commits the Company, as well as its employees, to complying with all applicable environmental laws. We believe that a sustainable approach to our business will benefit our stakeholders by meeting both our strategic business goals and protecting the quality of the environment in which we operate. In the management and monitoring of our environmental impact, the Company has two goals: First, to reduce the impact of the Company’s business operations on the environment in terms of implementing the principles of reducing, reusing, and recycling of materials to mitigate the depletion of natural resources. The Company, for example, encourages recycling, conversion to paperless operations and reuse of materials while increasing employee awareness of the need to reduce the use of utilities as well as other items such as paper and plastic. Second, to focus on improving energy efficiency in the course of business operations, by leveraging energy conservation practices such as continuing to invest in telecommunication technologies (e.g. videoconferencing) to reduce the need for business travel. Given the relatively small size of the Company, energy consumption at our corporate headquarter is not a material initiative. As a tenant Ambac has no control over energy use in the office space it occupies. Our employee count at One World Trade Center is under 110 and emissions is not practical to track.

Climate Change Risk

The Company considers climate risk as it may impact the exposures we insure and the investments we make. As such, the Company’s climate risk is monitored by its Enterprise Risk Management Committee for the primary purposes of both assessing the potential impact of climate change on the Company’s business operations and overseeing the implementation of controls to mitigate this risk to acceptable levels. Currently, climate change risk is not deemed a material risk to Ambac and as the business continues to transform, climate change risk materiality will be monitored through its Enterprise Risk Management process, which takes input from various business units.

| | |

Ambac Financial Group, Inc. | 9 | 2023 Proxy Statement |

Data Security and Privacy

Ambac relies on digital technology to conduct its businesses and interact with internal and external parties. With this reliance on technology comes associated security risks. We maintain an information security program that is designed to protect and preserve the confidentiality, integrity and availability of information located on our systems.

Risk awareness is an important component of Ambac’s cybersecurity program. We require cybersecurity awareness training for all of our employees at the time of onboarding and on an annual basis. The training is designed to educate employees about cyber risk and help them identify and avoid potential threats. We also regularly test employee awareness through simulated phishing exercises. Ambac also engages third-party consultants to conduct penetration tests and periodic risk assessments to identify any potential technical security vulnerabilities.

Given the ongoing proliferation of cyber threats, we continue to mature our defense capabilities with enhanced monitoring of our computer systems for potential new threats. We also leverage the use of multi-factor authentication with the aim to provide an additional layer of defense against unauthorized access to our systems.

Ambac’s business operations also rely on the continuous availability of its computer systems. We maintain and test our business continuity plan and report results to senior management and our Board of Directors. The Board of Directors oversees the risk management process and engages with management on risk management issues, including cybersecurity risks.

We also maintain a cyber incident response plan that outlines the appropriate processes and procedures for incident management (including minimizing impact, investigating, and remediating root cause) and complying with applicable legal requirements (including timely and accurate reporting of any required cybersecurity or privacy incident).

Ambac and its subsidiaries are subject to numerous laws and regulations in a number of jurisdictions regarding its information systems, particularly with regard to certain personal information. We have implemented measures to prevent access to the personal information on our system. Ambac's and its subsidiaries’ privacy policies are available on their respective websites.

_____________________________________

Corporate Social Responsibility

Ambac is a purpose-driven company committed to making meaningful progress each year to integrate our social responsibility efforts with our long-term strategy and business operations. Our Board of Directors, senior management team, and employees understand the importance of social responsibility as a means to deliver greater value as we operate our business each day and support Ambac's long-term strategy.

Diversity and Inclusion

Ambac is committed to fostering, cultivating and preserving a culture of diversity, equity and inclusion. Our human capital is one of the most valuable assets we have. The collective sum of the individual differences, life experiences, knowledge, inventiveness, innovation, self-expression, unique capabilities and talent that our employees invest in their work represents a significant part of not only our culture, but our reputation and the company’s achievements as well. We embrace our employees differences in age, race, color, ethnicity, family or marital status, creed/religion, sex, gender, gender identity or expression, national origin, alienage, citizenship status, medical condition, disability, sexual orientation, military or veteran status and other characteristics that make our employees unique.

| | |

Ambac Financial Group, Inc. | 10 | 2023 Proxy Statement |

Ambac’s diversity initiatives are applicable to – but not limited to – our practices on recruitment and selection; compensation and benefits; professional development and training; promotions; transfers; social and recreational programs; layoffs and terminations; and the ongoing development of a work environment built on the foundation of equity, regardless of gender or other characteristics, that encourages and enforces:

•Respectful communication and cooperation between all employees

•Teamwork and employee participation, encouraging the representation of all groups and employee perspectives

•Flexible work schedules to accommodate employees with varying needs

•Employer and employee contributions to the communities we serve to promote a greater understanding and respect for the diversity of such communities

Zero tolerance for discrimination is a fundamental principle at Ambac and is explicitly detailed in Ambac’s Anti-Harassment and Discrimination policies and referenced in Ambac’s Code of Business Conduct and Ethics, supported by mandatory annual anti-discrimination training for all staff. The principle of zero tolerance for discrimination is embedded at each point of the employee life cycle especially during recruitment, talent management, professional & leadership development, career critical assignments, reward, recognition, and promotion processes.

Training, Development and Well-Being of Employees

Developing employees professionally and personally strengthens the entire organization. Ambac is committed to the professional development and personal health of its employees through established policies and events which we believe have contributed to our low 7.1% voluntary turnover ratio.

•In 2018, a management development program was instituted to identify certain rising employees to be appointed to a senior advisory team, the goal of which is to promote, retain, and incentivize talented individuals within the Company. Selected senior managers provide input and lead initiatives related to improving work environment/culture and corporate efficiencies, fostering better communication and team building.

•Professional development is encouraged for all employees with fee and tuition reimbursement.

•In 2022, Ambac’s commitment to the health and safety of its employees was recognized by the International WELL Building Institute (IWBI) with the award of the WELL Health-Safety Rating following the successful completion of 15 core feature requirements in the following areas: Health Service Resources, Emergency Preparedness Programs, Air and Water Quality Management, Stakeholder Engagement and Communication, and Cleaning and Sanitation Procedures.. The WELL Health-Safety Rating is an evidence based, third-party verified rating, focusing on operational policies, maintenance protocols, stakeholder engagement and emergency plans to address the post-COVID environment now and broader health and safety-related issues in the future.

•Health and wellness training events are held regularly including financial wellness seminars.

Philanthropy

•Ambac supports many charities, both domestic and abroad and beginning in 2019, Ambac instituted a paid time off employee volunteering program, promoting and providing opportunities for employees to volunteer for causes that benefit our communities.

•Since 2017 Ambac has supported, financially and via management board service, Self Help Africa, a leading international development charity, dedicated to ending hunger and poverty in rural Africa. Self Help Africa's work spans several areas across nine African countries including, among other things, agriculture and nutrition, micro finance, gender equality and climate change.

| | |

Ambac Financial Group, Inc. | 11 | 2023 Proxy Statement |

•For over 20 years, Ambac has supported, both financially and through volunteer work, The Children's Village. The Children’s Village was founded in 1851, and today, their mission remains to work in partnership with families to help society’s most vulnerable children so that they become educationally proficient, economically productive, and socially responsible members of their communities.

_____________________________________

Guiding Principles Concerning Responsible Investing

•The principal objective in the management of investment portfolios for Ambac and its subsidiaries is to maximize risk-adjusted returns, subject to regulatory and other constraints. These constraints include maintenance of an appropriate level of liquidity and prudent management of interest rate and credit risk. Ambac also recognizes the importance of ESG considerations when assessing investment returns and risks over time. Operational and reputational risks relating to assets held in the investment portfolios are among these considerations.

•Achieving a competitive investment return is an important determinant of the Company’s ability to satisfy its obligations to policyholders. Ambac seeks to balance that goal with an intent to observe ESG principles. These include commitments to the environment, to diversity and to ethical conduct.

•The majority of the investments held by Ambac and its subsidiaries are managed by third party investment managers. Most are signatories to the U.N. Principles for Responsible Investment (“UNPRI”). Such signatories are required to incorporate ESG factors into their respective investment processes and we encourage all our external investment managers to adhere to their own ESG policies. In this way we can more effectively assess and monitor ESG-related exposures.

•Beginning in 2022, management began to provide regular reports to Ambac's Governance and Nominating Committee regarding ESG investing matters.

_____________________________________

| | |

Ambac Financial Group, Inc. | 12 | 2023 Proxy Statement |

AMBAC FINANCIAL GROUP, INC.

One World Trade Center

New York, New York 10007

PROXY STATEMENT

GENERAL INFORMATION

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Proxy Materials

Why did I receive these Proxy Materials?

The Board of Directors of Ambac Financial Group, Inc. ("Ambac" or the "Company") has made these materials available to you on the internet or, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies for use at Ambac’s 2023 Annual Meeting of Stockholders (the "Annual Meeting"), which will take place on June 22, 2023 at 11:00 a.m. (Eastern). The meeting will be conducted in a virtual format only. Stockholders can participate from any geographic location with Internet connectivity. We believe this format allows for maximum stockholder participation. Stockholders may view a live webcast of the Annual Meeting and submit questions digitally during the meeting at www.virtualshareholdermeeting.com/AMBC2023. Please refer to the Participating in the Annual Meeting section of the Proxy Statement for more details. As a stockholder, you are invited to participate in the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement. This Proxy Statement includes information that we are required to provide to you under SEC rules and that is designed to assist you in voting your shares.

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the SEC, we may furnish proxy materials, including this Proxy Statement and our 2022 Annual Report to Stockholders, to our stockholders by providing access to such documents on the internet instead of mailing printed copies. Stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Internet Notice, which was mailed to our stockholders, will instruct you as to how you may access and review all of the proxy materials on the internet. The Internet Notice also instructs you as to how you may submit your proxy on the internet, by phone or by mail. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Internet Notice.

What is included in the proxy materials?

The proxy materials (collectively, “Proxy Materials”) include:

•Our Proxy Statement for the 2023 Annual Meeting of Stockholders;

•Our 2022 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2022; and

•The proxy card or a voting instruction card for the Annual Meeting.

| | |

Ambac Financial Group, Inc. | 13 | 2023 Proxy Statement |

How can I access the Proxy Materials over the internet?

The Internet Notice, proxy card or voting instruction card will contain instructions on how to:

•View our Proxy Materials for the Annual Meeting on the internet and vote your shares; and

•Instruct us to send our future Proxy Materials to you electronically by email.

Our Proxy Materials are available at www.proxyvote.com.

Choosing to receive your future Proxy Materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact on the environment of printing and mailing these materials. If you choose to receive future Proxy Materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive Proxy Materials by email will remain in effect until you terminate it.

What information is contained in this Proxy Statement?

The information in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting and details regarding the voting process, the compensation of our directors and certain of our executive officers, corporate governance, and certain other required information.

Why did I only receive one set of materials when there is more than one stockholder at my address?

If two or more stockholders share one address, each such stockholder may not receive a separate copy of our Proxy Materials or Internet Notice. Stockholders who do not receive a separate copy of our Proxy Materials or Internet Notice and want to receive a separate copy may request to receive a separate copy of, or additional copies of, our Proxy Materials or Internet Notice via the internet, phone or email, as outlined above. Upon such request we shall furnish such copy, or additional copies, promptly. Stockholders who share an address and receive multiple copies of our Proxy Materials or Internet Notice may also request to receive a single copy by writing to our Investor Relations Department, Ambac Financial Group, Inc., One World Trade Center, New York, New York 10007.

Voting Information

What items of business will be voted on at the Annual Meeting?

The items of business scheduled to be voted on at the Annual Meeting are:

• The election of seven directors to our Board of Directors.

•To approve, on an advisory basis, the compensation of our named executive officers.

• The ratification of the appointment of KPMG LLP as Ambac’s independent registered public accounting firm for the fiscal year ending December 31, 2023.

We will also consider any other business that properly comes before the Annual Meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote your shares:

ü "FOR” each of its nominees to the Board of Directors.

ü "FOR” the approval, on an advisory basis, of the compensation of our named executive officers.

ü "FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 2023 fiscal year.

| | |

Ambac Financial Group, Inc. | 14 | 2023 Proxy Statement |

Other than the three items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Stephen M. Ksenak and William J. White, or either of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

What shares can I vote?

Each share of Ambac common stock issued and outstanding as of the close of business on the Record Date for the 2023 Annual Meeting of Stockholders is entitled to be voted with respect to all items on which stockholders may vote at the Annual Meeting. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record, and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee. On the Record Date, we had 45,321,745 shares of common stock issued and outstanding.

How many votes am I entitled to per share?

Each holder of shares of common stock is entitled to one vote for each share of common stock held as of the Record Date. The voting rights of certain substantial holders of common stock are restricted. A holder (including any group consisting of such holder and any other person with whom such holder or any affiliate or associate of such holder has any agreement, contract, arrangement or understanding with respect to acquiring, voting, holding or disposing of our common stock) will be entitled to vote only such number of shares that would equal (after giving effect to this restriction) one vote less than 10% of the votes entitled to be cast by all holders of our outstanding common stock. This restriction does not apply if the acquisition or ownership of common stock has been approved, whether before or after such acquisition or first time of ownership, by the Wisconsin Insurance Commissioner. Our certificate of incorporation also restricts the right of certain transferees to vote certain of their shares to the extent that, as a result of a transfer of shares (or any series of transfers of which such transfer is a part), either (i) any person or group of persons shall become a five-percent stockholder or (ii) the percentage stock ownership interest in our shares of any five-percent stockholder (including a group of persons treated as a five-percent stockholder) shall be increased.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most Ambac stockholders hold their shares as a beneficial owner through a broker or other nominee rather than directly in their own name. If your shares are registered directly in your name with our transfer agent, Computershare Inc., you are considered, with respect to those shares, the stockholder of record. If your shares are held in an account at a brokerage firm, bank, broker-dealer, trust, or other similar organization, like the vast majority of our stockholders, you are considered the beneficial owner of shares held in street name.

How can I vote my shares at the Annual Meeting?

Shares held in your name as the stockholder of record or held beneficially in street name may be voted by you in person at the Annual Meeting or by proxy. Even if you plan to participate in the virtual Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to participate in the virtual Annual Meeting. If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated, the shares will be voted as recommended by the Board of Directors.

How can I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without participating in the virtual Annual Meeting. You can vote by proxy over the internet or by phone by following the instructions provided in the Internet Notice, or, if you requested to receive printed Proxy Materials, you can also vote by mail pursuant to instructions provided on the proxy card. If you hold shares through a bank or broker, please refer to your proxy card or other information forwarded by your bank or broker to see which voting options are available to you.

| | |

Ambac Financial Group, Inc. | 15 | 2023 Proxy Statement |

•You may submit your proxy by using the internet. The address of the website for submitting your proxy via the Internet is www.proxyvote.com for both registered holders and beneficial owners of our common stock holding in street name. Internet proxy submission is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on June 21, 2023. Easy-to-follow instructions allow you to submit your proxy and confirm that your instructions have been properly recorded.

•You may submit your proxy by calling. The phone number for submitting your proxy by phone is 1-800-690-6903. Submitting your proxy by phone is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on June 21, 2023.

•You may submit your proxy by mail. As a result of implementing “Notice and Access,” you may request to receive printed copies of Proxy Materials by mail or electronically by email by following the instructions provided in the Internet Notice. You may submit your request in writing to our Corporate Secretary at Ambac Financial Group, Inc., One World Trade Center, New York, New York 10007 (or you can send an email to corporatesecretary@ambac.com). Once you receive your Proxy Materials, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope.

Can I change my vote or revoke my proxy?

You may change your vote at any time prior to the taking of the vote at the Annual Meeting. You may change your vote by (i) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (until the applicable deadline for each method), (ii) providing a written notice of revocation to Ambac’s Corporate Secretary at Ambac Financial Group, Inc., One World Trade Center, New York, New York 10007 (and you can send a copy via email to corporatesecretary@ambac.com), prior to your shares being voted, or (iii) participating in the virtual Annual Meeting and casting a vote. Participation in the meeting will not cause your previously granted proxy to be revoked unless you specifically so request or cast a vote at the virtual Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed to parties other than Ambac, except:

•As necessary to meet applicable legal requirements;

•To allow for the tabulation and certification of votes; or

•To facilitate a proxy solicitation.

How many shares must be present or represented to conduct business at the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the voting power of Ambac’s shares of common stock outstanding as of the Record Date will constitute a quorum. Both abstentions and broker non-votes (described below) are counted for the purpose of determining the presence of a quorum.

How may I vote in the election of directors, and how many votes must the nominees receive to be elected?

With respect to the election of directors, you may:

•vote “FOR" each of the seven nominees for director;

•vote “AGAINST”each of the seven nominees for director; or

•“ABSTAIN” from voting on each of the seven nominees for director.

| | |

Ambac Financial Group, Inc. | 16 | 2023 Proxy Statement |

Our directors are elected by a majority of votes cast unless the election is contested, in which case directors are elected by a plurality of votes cast. A majority of votes cast means that the number of shares voted “FOR” a director exceeds the number of votes cast “AGAINST” a director; abstentions are not counted are not counted as votes cast either “FOR” or “AGAINST." If an incumbent director in an uncontested election does not receive a majority of votes cast FOR such incumbent’s election, the director is required to submit a letter of resignation to the Board of Directors for consideration by the Governance and Nominating Committee. The Governance and Nominating Committee is required to promptly assess the appropriateness of such nominee continuing to serve as a director and recommend to the Board the action to be taken with respect to the tendered resignation. The Board is required to determine whether to accept or reject the resignation, or what other action should be taken, within 90 days of the date of the certification of election results. Each holder of our common stock is entitled to one vote for each share held as of the Record Date. There are no cumulative voting rights associated with any of Ambac's common stock.

How may I vote for the non-binding advisory resolution regarding executive compensation, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

•vote “FOR” the approval of the non-binding resolution regarding executive compensation;

•vote “AGAINST” the approval of the non-binding resolution regarding executive compensation; or

•"ABSTAIN” from voting on the proposal.

In accordance with applicable law, this vote is “advisory,” meaning it will serve as a recommendation to our Board of Directors, but will not be binding. However, our Board of Directors and the Compensation Committee thereof will consider the outcome of the vote when making future compensation decisions for our executive officers.

How may I vote for the proposal to ratify the appointment of our independent registered public accounting firm, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

•vote “FOR” the ratification of the accounting firm;

•vote “AGAINST” the ratification of the accounting firm; or

•“ABSTAIN” from voting on the proposal.

In order to pass, the number of votes cast FOR this proposal must exceed the number votes cast AGAINST this proposal by holders of our common stock who are present in person, or represented by proxy at the Annual Meeting and entitled to vote on this matter. Abstentions are not counted as either votes cast “FOR” or “AGAINST” this proposal.

What are broker non-votes?

If you hold shares beneficially in street name and do not vote your shares as described in this Proxy Statement, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. All of the matters scheduled to be voted on at the Annual Meeting are “non-routine,” except for the proposal to ratify the appointment of KPMG LLP as Ambac’s independent registered public accounting firm for the fiscal year ending December 31, 2023. In tabulating the voting result for any “non-routine” proposal, shares that constitute broker non-votes are not considered voting

| | |

Ambac Financial Group, Inc. | 17 | 2023 Proxy Statement |

power present with respect to that proposal. Thus, broker non-votes will not affect the outcome of any “non-routine” matter being voted on at the Annual Meeting, assuming that a quorum is obtained. Likewise, abstentions are not counted as either votes cast “FOR” or “AGAINST” and will not affect the outcome of any “non-routine” matter being voted on at the Annual Meeting.

Brokers may not vote your shares on the election of directors, certain executive compensation matters, or certain corporate governance matters in the absence of your specific instructions as to how to vote, so we encourage you to provide instructions to your broker regarding the voting of your shares.

Who will bear the cost of soliciting votes for the Annual Meeting?

Ambac pays the entire cost of preparing, assembling, printing, mailing, and distributing the Proxy Materials and soliciting votes. If you choose to access the Proxy Materials and/or vote over the internet, you are responsible for internet access charges you may incur. If you choose to vote by phone, you are responsible for any phone charges you may incur. In addition to the mailing of these Proxy Materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities.

What happens if additional matters are presented at the Annual Meeting?

Other than the three items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Stephen M. Ksenak or William J. White, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any reason, any of the nominees for director included in this Proxy Statement is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting and publish final voting results in the Annual Meeting of Stockholders section of our Investor Relations website at http://ir.ambac.com. We will also disclose the final voting results on a Current Report on Form 8-K filed with the SEC within four business days following the date on which the Annual Meeting concludes.

Participating in the Annual Meeting

How can I participate in the Annual Meeting?

We are conducting a virtual Annual Meeting so our stockholders can participate from any geographic location with Internet connectivity. Participation opportunities are reasonably comparable to those provided at the in-person portion of our past meetings.We have structured our virtual meeting to provide stockholders the same rights as if the meeting were held in person, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting.

•To participate in the Annual Meeting, including to vote at the meeting, you must access the meeting website at www.virtualshareholdermeeting.com/AMBC2023 and enter the 16-digit control number found on the Notice of Internet Availability of Proxy Materials or on the proxy card or voting instruction form provided to you with this Proxy Statement.

•Whether or not you plan to participate in the virtual Annual Meeting, it is important that your shares be represented and voted. We encourage you to access www.proxyvote.com or call 1-800-690-6903 and vote in advance of the Annual Meeting.

•Stockholders are able to submit questions for the Annual Meeting’s question and answer session during the meeting through www.virtualshareholdermeeting.com/AMBC2023. We will respond as practical to questions during the meeting. Additional information regarding the rules and procedures for participating in the Annual

| | |

Ambac Financial Group, Inc. | 18 | 2023 Proxy Statement |

Meeting will be set forth in our meeting rules of conduct, which stockholders can view during the meeting at the meeting website or during the ten days prior to the meeting at www.proxyvote.com.

•We encourage you to access the Annual Meeting before it begins. Online check-in will be available at www.virtualshareholdermeeting.com/AMBC2023 approximately 15 minutes before the meeting starts on June 22, 2023. If you have difficulty accessing the meeting, please call the support lines available on the meeting platform. We will have technicians available to assist you.

Do directors attend the Annual Meeting?

It is currently expected that all of our continuing directors will participate in the virtual Annual Meeting of Stockholders. All of our directors who were on the Board last year participated in the virtual 2022 Annual Meeting of Stockholders.

How can I find out if I am a stockholder of record entitled to vote?

A complete list of stockholders of record entitled to vote at the Annual Meeting will be available for inspection by stockholders of record for a period of at least ten days before the Annual Meeting during ordinary business hours at our principal executive offices at One World Trade Center, New York, New York 10007.

Other Questions Related to the Meeting or Ambac

Who will serve as inspector of elections?

The inspectors of election will be representatives from Broadridge Financial Solutions, Inc.

How can I contact Ambac’s transfer agent?

Contact our transfer agent by either writing to Computershare Inc., PO Box 505000, Louisville, KY 40233, or 462 South 4th Street, Suite 1600, Louisville, KY 40202, by telephoning 1-800-662-7232 or via the web at www.computershare.com/investor.

Whom should I call if I have any questions?

If you have any questions about the Annual Meeting or voting, please contact William J. White, Corporate Secretary, at (212) 658-7456 or by email at corporatesecretary@ambac.com. If you have any questions about your investment in Ambac common stock, please contact Ambac's Investor Relations department at (212) 208-3177 or by email at ir@ambac.com.

How can a stockholder communicate directly with our Board?

Stockholders and other interested parties may communicate with Ambac’s Board by writing to Ambac’s Corporate Secretary at Ambac Financial Group, Inc., One World Trade Center, New York, New York 10007 or by sending an email to Ambac’s Corporate Secretary at corporatesecretary@ambac.com. Ambac’s Corporate Secretary will then forward your questions or comments directly to the Board.

Please note that material that is directly or indirectly hostile or threatening, illegal or otherwise unsuitable will not be forwarded to our Board. Any communication that is relevant to Ambac’s business and is not forwarded will be retained for one year and will be made available to our independent directors on request. The independent directors grant the Corporate Secretary discretion to decide what correspondence shall be shared with Ambac management and specifically instruct that any personal employee complaints be forwarded to our Human Resources Department.

What is the deadline to propose actions for consideration at next year’s Annual Meeting of Stockholders or to nominate individuals to serve as directors?

For Stockholder Proposals that are to be included in our Proxy Statement under Rule 14a-8. Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), if a stockholder wants Ambac

| | |

Ambac Financial Group, Inc. | 19 | 2023 Proxy Statement |

to include a proposal in our proxy statement and form of proxy for presentation at our 2024 Annual Meeting of Stockholders (other than a proposal relating to the nomination of a specific individual for election to our Board of Directors), the proposal must be received by us at our principal executive offices at One World Trade Center, New York, New York 10007, not later than December 29, 2023. The proposal must be sent to the attention of our Corporate Secretary, and must comply with the requirements of Regulation 14A under the Exchange Act (including, but not limited to, Rule 14a-8 or its successor provision).

Other Proposals and Nominations. Our by-laws govern the submission of nominations for director or other business proposals that a stockholder wishes to have considered at a meeting of stockholders, but which are not included in our proxy statement for that meeting. Under our by-laws, nominations for director or other business proposals to be addressed at our next annual meeting in 2024 may be made by a stockholder entitled to vote who has delivered a notice to the Corporate Secretary of Ambac Financial Group, Inc. no earlier than the close of business on March 25, 2024, and not later than April 23, 2024, except if the date of our next annual meeting is not within 30 days before or after the anniversary of our 2023 Annual Meeting of Stockholders, such notice must be delivered no earlier than the 90th day before our 2024 Annual Meeting of Stockholders and no later than the later of the 60th day before our 2024 Annual Meeting of Stockholders and the 15th day following the day on which public announcement of the date of our 2024 Annual Meeting of Stockholders is first made by the Company. The notice must set forth and describe the information required by Article II of our by-laws.

These advance notice and information requirements are in addition to, and separate from, the requirements that a stockholder must meet in order to have a proposal included in our proxy statement under the rules of the SEC. A proxy granted by a stockholder will give discretionary authority to the proxies to vote on any matters introduced pursuant to the above-referenced by-law provisions, subject to applicable rules of the SEC.

INCORPORATION BY REFERENCE

To the extent that this Proxy Statement has been or will be specifically incorporated by reference into any other filing of Ambac under the Securities Act of 1933, as amended, or the Exchange Act, the sections of this Proxy Statement entitled “Report of the Audit Committee” (to the extent permitted by the rules of the SEC) shall not be deemed to be so incorporated, unless specifically provided otherwise in such filing.

| | |

Ambac Financial Group, Inc. | 20 | 2023 Proxy Statement |

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Board of Directors