- Systemwide comparable sales¹ grew 37.3% year-over-year,

supported by strong sales volume across all divisions

- Total revenues reached $1.1 billion in the quarter, up 22.1%

in US dollars and 42.9% in constant currency, versus the prior year

period

- Digital channel sales (Delivery, Mobile App and Self-order

Kiosks) contributed 50% of systemwide sales, reaching $731.5

million

- Consolidated Adjusted EBITDA¹ was $129.1 million, up 25.8%

in US dollars and 43.9% in constant currency

- Net Income reached $59.7 million, or $0.28 per share, up

from $0.22 per share in the prior year quarter

Arcos Dorados Holdings, Inc. (NYSE: ARCO) (“Arcos Dorados” or

the “Company”), Latin America’s largest restaurant chain and the

world’s largest independent McDonald’s franchisee, today reported

unaudited results for the three and nine months ended September 30,

2023.

Third Quarter 2023 Highlights

- Systemwide comparable sales¹ grew 37.3% versus the prior year

quarter, rising 1.4 times the period’s blended inflation rate.

- Consolidated revenues reached $1.1 billion, rising 22.1% in US

dollars and 42.9% in constant currency versus the prior year

period.

- Disciplined execution of a long-term growth strategy is driving

strong performance across all sales channels and geographies with

an increasingly modernized restaurant portfolio.

- Consolidated Adjusted EBITDA¹ of $129.1 million rose 25.8% in

US dollars versus the prior year result, and 43.9% in constant

currency.

- Consolidated Adjusted EBITDA margin reached 11.5% in the

quarter, expanding by 40 basis points versus the prior year

period.

- Basic net income per share was $0.28 in the quarter, compared

to net income per share of $0.22 in the prior year quarter.

- The Company opened 27 restaurants in the quarter, including 25

free-standing locations.

¹ For definitions, please refer to page 16 of this document.

Message from Marcelo Rabach, Chief Executive Officer

The broad-based momentum we captured in the first half of 2023

continued in the third quarter. McDonald’s Brand strength,

structural competitive advantages and consistent execution

continued driving sales growth and market share gains across the

Arcos Dorados footprint, with the strongest performance in markets

such as Brazil, Chile, Costa Rica and Mexico.

Our strategy is clear: drive sustainable sales growth, supported

by both guest volume and average check growth, to generate

operating leverage and long-term profitability growth. To achieve

this objective, we are leaning on Value, which has always been a

cornerstone of the McDonald’s business. Value includes quality,

service, convenience and optionality, in addition to price. This is

where our Three D’s strategy of Digital, Delivery and Drive-thru

are leveraging Latin America’s largest free-standing restaurant

portfolio and most robust digital platform to offer Value to our

guests and to the communities we serve.

Systemwide comparable sales grew well above inflation again in

the third quarter, with strong guest volume growth in all main

markets. Even as consumption moderated in some countries, sales

growth remained strong and helped generate operating leverage to

improve profitability. This performance, which has been improving

consistently over the last several years, allows us to continuously

reinvest in the expansion, modernization and digitalization of the

business. In turn, these investments bring significant economic

benefit to local economies and create new, long-term career

opportunities for young people.

Importantly, we continue to be recognized by Great Place to

Work® as one of the best, if not the best, employers for young

people, with the latest certifications coming in Brazil, Argentina,

Chile and Uruguay. Youth Opportunity is one of the pillars of our

Recipe for the Future ESG Platform, together with Diversity and

Inclusion, Commitment to Families, Climate Change, Circular Economy

and Sustainable Sourcing. During the quarter we made progress in

and received recognition for our efforts across all these pillars.

This includes the opening of our flagship sustainable restaurant in

Brazil, with multiple ESG (Environmental, Social and Governance)

initiatives, twenty of which have already been implemented in all

of the country’s restaurants. ESG is truly in our DNA!

Arcos Dorados’ results for the third quarter 2023, and so far in

the fourth quarter, demonstrate the importance of a consistent,

long-term, strategic approach to delivering value and convenience

to restaurant customers. This includes the effective management of

our balance sheet, by maintaining a healthy cash balance and

controlling both currency and interest rate risks on our long-term

debt.

By consistently executing our strategy, we are capturing our

opportunities and tackling our challenges from a position of

strength. Brand strength and reputation are at an all-time high and

our structural competitive advantages are widening as we open even

more free-standing restaurants, modernize even more existing

restaurants and develop even more digital capabilities. We are also

working hard to normalize operations among markets to improve

consolidated results. For these reasons, we are confident in our

ability to sustain strong operating results and shareholder value

generation for the foreseeable future.

Thank you for your ongoing support of Arcos Dorados.

Consolidated Results

Figure 1. AD Holdings Inc Consolidated:

Key Financial Results

(In millions of U.S. dollars, except as

noted)

3Q22(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q23(a+b+c) %

AsReported % ConstantCurrency Total Restaurants

(Units)

2,297

2,339

Sales by Company-operated Restaurants

881.6

(186.9)

380.6

1,075.3

22.0%

43.2%

Revenues from franchised restaurants

40.1

(5.1)

14.8

49.8

24.1%

36.9%

Total Revenues

921.7

(192.0)

395.4

1,125.1

22.1%

42.9%

Systemwide Comparable Sales

37.3%

Adjusted EBITDA

102.6

(18.6)

45.1

129.1

25.8%

43.9%

Adjusted EBITDA Margin

11.1%

11.5%

0.4 p.p.

Net income attributable to AD

46.9

(30.4)

43.3

59.7

27.4%

92.4%

No. of shares outstanding (thousands)

210,595

210,655

EPS (US$/Share)

0.22

0.28

Arcos Dorados’ total revenues reached $1.1 billion, up 22.1% in

US dollars and 42.9% in constant currency versus the prior year

quarter. Systemwide comparable sales grew 37.3% in the third

quarter, or about 1.4 times blended inflation, with all three

divisions growing above inflation, including 4.0x blended inflation

in NOLAD and 2.3x inflation in Brazil.

Guest traffic and sales growth continue to benefit from the

strong consumer preference for the McDonald’s Brand, with more than

double the market share of the nearest competitor across all main

markets.

Front counter sales, which include self-order kiosks, grew 41%

in constant currency versus the prior year and generated 58% of

systemwide sales. Third quarter results were also supported by

continued outstanding performance in Delivery, which grew 48% in

constant currency versus the prior year. Drive-thru sales grew 17%

in constant currency, complementing the strong growth of front

counter sales.

Digital channel sales reached $731.5 million and accounted for

50% of systemwide sales in the third quarter. As of the end of

September, the Company’s Mobile App had over 107 million

accumulated downloads, with about 17 million average monthly active

users, and identified sales representing 20% of consolidated sales

in the quarter.

The Company’s Customer Relationship Management (CRM) platform

had almost 75 million unique registered users by the end of

September 2023, which allows it to more efficiently invest its

marketing spend to increase guest frequency and engagement.

Adjusted EBITDA

3Q23 Adjusted EBITDA Bridge

Third quarter consolidated Adjusted EBITDA reached $129.1

million, up 25.8% in US dollars and 43.9% in constant currency over

the prior year quarter, with continued strong US dollar growth

contribution from NOLAD and Brazil. Consolidated Adjusted EBITDA

margin reached 11.5%, expanding 40 basis points versus the prior

year.

Margin performance was highlighted by lower Food and Paper

(F&P) costs as a percentage of revenue in all divisions

compared with the prior year, coupled with an improvement in

G&A and a slight improvement in Payroll expenses as a

percentage of revenue. These more than offset moderately higher

other operating expenses and the impact of the final step up of the

Company’s royalty rate, which became effective as of August 3,

2022.

Notable items in the Adjusted EBITDA reconciliation

Included in Adjusted EBITDA: There

were no notable items included in Adjusted EBITDA in either the

third quarter of 2023 or the third quarter of 2022.

Excluded from Adjusted EBITDA:

There were no notable items excluded from Adjusted EBITDA in either

the third quarter of 2023 or the third quarter of 2022.

Non-operating Results

Arcos Dorados’ non-operating results for the third quarter

included a $2.2 million gain from non-cash foreign exchange and

derivative instruments.

Net interest expense and other financing results totaled $5.0

million in the quarter versus $7.9 million in the same period last

year. The Company recorded an income tax expense of $28.1 million

in the quarter, compared to an income tax expense of $32.6 million

in the prior-year period.

Third quarter net income attributable to the Company totaled

$59.7 million, compared to net income of $46.9 million in the same

period of 2022. Earnings per share were $0.28 in the third quarter

of 2023, compared to $0.22 per share in the corresponding 2022

period.

Total weighted average shares for the third quarter of 2023

amounted to 210,654,969 compared to 210,594,545 in the prior-year

quarter.

For reference:

Figure 2. AD Holdings Inc Consolidated

- Excluding Venezuela: Key Financial Results

(In millions of U.S. dollars, except as

noted)

3Q22(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q23(a+b+c) %

AsReported % ConstantCurrency Total Restaurants

(Units)

2,197

2,251

Sales by Company-operated Restaurants

876.8

(153.9)

343.7

1,066.5

21.6%

39.2%

Revenues from franchised restaurants

39.5

(2.2)

11.7

49.0

23.9%

29.6%

Total Revenues

916.3

(156.2)

355.4

1,115.5

21.7%

38.8%

Systemwide Comparable Sales

32.6%

Adjusted EBITDA

103.0

(18.5)

45.2

129.8

26.0%

43.9%

Adjusted EBITDA Margin

11.2%

11.6%

0.4 p.p.

Net income attributable to AD

47.7

(30.2)

45.1

62.6

31.3%

94.7%

No. of shares outstanding (thousands)

210,595

210,655

EPS (US$/Share)

0.23

0.30

Divisional Results

Brazil Division

Figure 3. Brazil Division: Key

Financial Results

(In millions of U.S. dollars, except as

noted)

3Q22(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q23(a+b+c) %

AsReported % ConstantCurrency Total Restaurants

(Units)

1,077

1,113

Total Revenues

352.8

30.5

55.9

439.2

24.5%

15.9%

Systemwide Comparable Sales

10.8%

Adjusted EBITDA

62.4

5.6

9.9

77.8

24.8%

15.8%

Adjusted EBITDA Margin

17.7%

17.7%

0.0 p.p.

Brazil’s revenues reached $439.2 million, increasing 24.5%

year-over-year. On a constant currency basis, revenues grew 15.9%

and systemwide comparable sales rose 10.8% year-over-year, or 2.3x

inflation in the period. The McDonald’s brand fortified its

leadership in the country with strong market share gains in the

quarter within a consolidating restaurant industry.

Delivery sales increased 32% in constant currency versus the

prior year and strongly contributed to sales and traffic growth in

the quarter, representing 19% of systemwide sales in the period.

Digital channel sales were up 43% versus the prior year and

generated 61% of systemwide sales in Brazil, including 25%

identified sales in the quarter.

Marketing initiatives in the quarter included strong brand

experience campaigns. The highlight was the sponsorship of “The

Town”, the biggest music festival in Brazil this year. In addition

to building the largest McDonald’s restaurant in Latin America on

festival grounds, the Company launched a limited edition of the

“McMelt The Town” sandwich in all restaurants to bring a taste of

the festival to the entire country. Maintaining its strong

connection with sports, the Company also sponsored the FIFA Women’s

World Cup online broadcast on “Cazé TV”, Brazil’s biggest streaming

channel. Finally, the launches of “McFlurry Ovomaltine Mesclado”

and “McFlurry Kit Kat” boosted traffic by bringing innovation to

the dessert category.

As reported Adjusted EBITDA in the division reached $77.8

million in the quarter, rising 24.8% versus the prior year in US

dollars. Adjusted EBITDA margin was 17.7%, in line with the prior

year quarter. Better F&P costs as a percentage of revenue and

operating leverage in both G&A and Payroll were offset by

higher Occupancy & Other Operating expenses and a slightly

higher effective royalty rate.

Following the end of the third quarter, on October 23, 2023, the

Company launched its Loyalty Program “Meu Méqui” nationwide in

Brazil. As part of the Company’s successful Digital strategy, the

program boosts the power of the Mobile App by driving visit

frequency while increasing the percentage of identified sales to

provide a more personalized guest experience.

North Latin American Division (NOLAD)

Figure 4. NOLAD Division: Key Financial

Results

(In millions of U.S. dollars, except as

noted)

3Q22(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q23(a+b+c) %

AsReported % ConstantCurrency Total Restaurants

(Units)

631

638

Total Revenues

232.9

27.7

35.1

295.6

27.0%

15.1%

Systemwide Comparable Sales

11.5%

Adjusted EBITDA

22.7

3.3

6.2

32.3

42.0%

27.4%

Adjusted EBITDA Margin

9.8%

10.9%

1.1 p.p.

As reported revenues totaled $295.6 million, up 27.0% in US

dollars and 15.1% in constant currency versus the prior year

quarter. Systemwide comparable sales rose 11.5% year-over-year, or

4.0x the division’s blended inflation in the period, with

comparable sales increasing above inflation in all markets. Sales

growth was supported by higher guest traffic across all markets as

well, with particularly strong volume growth in Mexico, Costa Rica

and the French West Indies markets.

The NOLAD division reached some of its highest ever market share

levels, backed by positive brand attribute trends. Marketing

activities featured menu innovations across the region, including

the launch of “GRANDS” sandwiches, an indulgent and tasty platform.

In Mexico, the #McDonaldsMéxicoMeEncanta brand campaign was

endorsed by Sergio “Checo” Pérez, the popular Mexican Formula 1

driver, and included the “Menú Checo” famous order campaign. In

Puerto Rico, the Company launched the “Saca tu Encanto”

brand-building campaign partnered with Tommy Torres, a popular

local musical artist.

NOLAD’s digital penetration is improving consistently as

investments in both technology and restaurant modernizations bring

the division closer to the Company average. As it closes this gap,

NOLAD is already benefiting from improving digital trends. For

example, the McDonald’s Mobile App is, by far, the leader in

monthly active users among quick service restaurant operators in

Mexico, where the sales growth rate remains one of the strongest in

the Company’s footprint.

As reported Adjusted EBITDA reached $32.3 million in the third

quarter compared with $22.7 million in the prior year quarter,

representing a year-over-year increase of 42.0% versus the prior

year in US dollars. Adjusted EBITDA margin expanded by 110 basis

points versus the prior year period driven by better F&P costs

and Occupancy & Other Operating expenses as a percentage of

revenue that more than offset slightly higher Payroll and G&A

expenses as well as the higher royalty rate.

South Latin American Division (SLAD)

Figure 5. SLAD Division: Key Financial

Results

(In millions of U.S. dollars, except as

noted)

3Q22(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q23(a+b+c) %

AsReported % ConstantCurrency Total Restaurants

(Units)

589

588

Total Revenues

336.1

(250.2)

304.4

390.3

16.1%

90.6%

Systemwide Comparable Sales

93.8%

Adjusted EBITDA

39.7

(39.6)

41.7

41.8

5.3%

105.0%

Adjusted EBITDA Margin

11.8%

10.7%

-1.1 p.p.

Revenues in SLAD reached $390.3 million, rising 16.1% in US

dollars. Systemwide comparable sales rose 93.8%, or 1.3x SLAD’s

blended inflation rate. Chile, Ecuador and Uruguay delivered the

strongest growth, more than double inflation in the quarter.

Systemwide comparable sales growth also reflects the impact of

Argentina and Venezuela’s high inflation rates.

SLAD’s markets captured additional market share in the quarter,

with improved scores in brand attributes, reinforcing McDonald´s

brand preference across the division. To continue strengthening its

leadership in the beef segment, the Company launched the “Bacon

Cheddar McMelt” sandwich and the “Pileta de Cheddar” in Argentina,

Chile, Colombia and Ecuador with strong sales results in all four

countries. The Company also continued the roll out of Best Burger,

extending the platform to Aruba, Curaçao and Trinidad. The dessert

platform produced excellent results with the launch of McFlurry

products with locally relevant brands, including: Sahne-nuss in

Chile, Nucita in Colombia, Chips Ahoy in Perú and Serenata de Amor

in Uruguay.

Digital sales in SLAD continued to grow, supported by increased

penetration of Mobile Order and Pay and Delivery functionalities in

the Mobile App. The Company also continued the development of its

own Delivery platform in SLAD markets.

As reported Adjusted EBITDA in the division totaled $41.8

million in the third quarter. The division generated restaurant

level margin expansion, driven by lower F&P costs as well as

better Payroll and Occupancy & Other Operating expenses as a

percentage of revenue. These were offset by higher other operating

expenses and a moderate increase in G&A as a percentage of

revenue.

For reference:

Figure 6. SLAD Division – Excluding

Venezuela: Key Financial Results

(In millions of U.S. dollars, except as

noted)

3Q22(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q23(a+b+c)

% As Reported

% ConstantCurrency Total Restaurants (Units)

489

500

Total Revenues

330.7

(214.4)

264.4

380.7

15.1%

79.9%

Systemwide Comparable Sales

79.9%

Adjusted EBITDA

40.0

(39.5)

41.8

42.4

6.0%

104.5%

Adjusted EBITDA Margin

12.1%

11.1%

-1.0 p.p.

New Unit Development

Figure 7. Total Restaurants (eop)*

September

June

March

December

September

2023

2023

2023

2022

2022

Brazil

1,113

1,098

1,091

1,084

1,077

NOLAD

638

639

639

638

631

SLAD

588

580

582

590

589

TOTAL

2,339

2,317

2,312

2,312

2,297

* Considers Company-operated and franchised restaurants at

period-end

Figure 8. Footprint as of September 30,

2023

Store Type* Total Restaurants Ownership

McCafes Dessert Centers FS IS MS

& FC Company Operated Franchised Brazil

564

92

457

1,113

674

439

137

1,993

NOLAD

392

51

195

638

484

154

13

519

SLAD

237

128

223

588

500

88

166

710

TOTAL

1,193

271

875

2,339

1,658

681

316

3,222

* FS: Free-Standing; IS: In-Store; MS: Mall Store; FC: Food Court.

Arcos Dorados opened 27 restaurants during the third quarter of

2023, including 25 free-standing units. In Brazil, the Company

opened 14 free-standing units in the quarter. For the first nine

months of 2023, the Company opened 45 restaurants, 41 of which were

free-standing restaurants. This included 32 restaurant openings in

Brazil, with 29 free-standing units opened in the country in the

period.

More than half the Company’s footprint is made up of

free-standing locations, making it the region’s largest

free-standing restaurant portfolio. As of the end of September,

there were 1,214 Experience of the Future restaurants, composing

52% of the Company’s total restaurant base and offering guests the

most modernized experience in the region’s quick service restaurant

industry.

The restaurant development plan remains on track and the Company

expects to meet its full year guidance of 75 to 80 restaurant

openings.

Balance Sheet & Cash Flow Highlights

Figure 9. Consolidated Debt and

Financial Ratios

(In thousands of U.S. dollars, except

ratios)

September 30,

December 31,

2023

2022

Total Cash & Cash equivalents (i)

251,149

304,396

Total Financial Debt (ii)

709,335

674,401

Net Financial Debt (iii)

458,186

370,005

LTM Adjusted EBITDA

453,735

386,564

Total Financial Debt / LTM Adjusted EBITDA ratio

1.6

1.7

Net Financial Debt / LTM Adjusted EBITDA ratio

1.0

1.0

(i) Total cash & cash equivalents includes short-term

investments. (ii) Total financial debt includes short-term debt,

long-term debt, accrued interest payable and derivative instruments

(including the asset portion of derivatives amounting to $50.3

million and $92.9 million as a reduction of financial debt as of

September 30, 2023 and December 31, 2022, respectively). (iii) Net

financial debt equals total financial debt less total cash &

cash equivalents.

On September 27, 2023, the Company paid off the outstanding

$18.2 million balance of its 2023 Notes. As of September 30, 2023,

total cash and cash equivalents were $251.1 million and total

financial debt (including the net derivative instrument position)

was $709.3 million.

Net debt (total financial debt minus total cash and cash

equivalents) was $458.2 million, up from $370.0 million at the end

of 2022, due to the lower cash balance and lower fair value of the

derivative instruments. The net debt to Adjusted EBITDA leverage

ratio ended the quarter at a healthy 1.0x, unchanged from year-end

2022.

Net cash generated from operating activities for the nine months

ended September 30, totaled $232.3 million, compared with the

$235.4 million cash from operations generated during the same

period last year. Capital expenditures totaled $227.8 million in

the first nine months of 2023. Net cash used in financing

activities was $32.1 million, which included $31.6 million

corresponding to the first three installments of the 2023

dividend.

Supplemental Information

Third Quarter 2023 Earnings Webcast

A webcast to discuss the information contained in this press

release will be held today, November 16, 2023, at 10:00 a.m. ET. In

order to access the webcast, members of the investment community

should follow this link: Arcos Dorados Third Quarter 2023 Results

Webcast.

A replay of the webcast will be available later today in the

investor section of the Company’s website:

www.arcosdorados.com/ir.

Definitions

Systemwide comparable sales growth: refers to the change,

measured in constant currency, in our Company-operated and

franchised restaurant sales in one period from a comparable period

for restaurants that have been open for thirteen months or longer

(year-over-year basis). While sales by our franchisees are not

recorded as revenues by us, we believe the information is important

in understanding our financial performance because these sales are

the basis on which we calculate and record franchised revenues and

are indicative of the financial health of our franchisee base.

Constant currency basis: refers to amounts calculated

using the same exchange rate over the periods under comparison to

remove the effects of currency fluctuations from this trend

analysis. To better discern underlying business trends, this

release uses non-GAAP financial measures that segregate

year-over-year growth into two categories: (i) currency

translation, (ii) constant currency growth. (i) Currency

translation reflects the impact on growth of the appreciation or

depreciation of the local currencies in which we conduct our

business against the US dollar (the currency in which our financial

statements are prepared). (ii) Constant currency growth reflects

the underlying growth of the business excluding the effect from

currency translation.

Adjusted EBITDA: In addition to financial measures

prepared in accordance with the general accepted accounting

principles (GAAP), within this press release and the accompanying

tables, we use a non-GAAP financial measure titled ‘Adjusted

EBITDA’. We use Adjusted EBITDA to facilitate operating performance

comparisons from period to period.

Adjusted EBITDA is defined as our operating income plus

depreciation and amortization plus/minus the following losses/gains

included within other operating income (expenses), net, and within

general and administrative expenses in our statement of income:

gains from sale, or insurance recovery of property and equipment,

write-offs of property and equipment, and impairment of long-lived

assets.

We believe Adjusted EBITDA facilitates company-to-company

operating performance comparisons by backing out potential

differences caused by variations such as capital structures

(affecting net interest expense and other financing results),

taxation (affecting income tax expense) and the age and book

depreciation of facilities and equipment (affecting relative

depreciation expense), which may vary for different companies for

reasons unrelated to operating performance. Figure 10 of this

earnings release includes a reconciliation for Adjusted EBITDA. For

more information, please see Adjusted EBITDA reconciliation in Note

9 – Segment and geographic information – of our financial

statements (6-K Form) filed today with the S.E.C.

About Arcos Dorados

Arcos Dorados is the world’s largest independent McDonald’s

franchisee, operating the largest quick service restaurant chain in

Latin America and the Caribbean. It has the exclusive right to own,

operate and grant franchises of McDonald’s restaurants in 20 Latin

American and Caribbean countries and territories with more than

2,300 restaurants, operated by the Company or by its

sub-franchisees, that together employ over 95 thousand people (as

of 09/30/2023). The Company is also committed to the development of

the communities in which it operates, to providing young people

their first formal job opportunities and to utilize its Recipe for

the Future to achieve a positive environmental impact. Arcos

Dorados is listed for trading on the New York Stock Exchange (NYSE:

ARCO). To learn more about the Company, please visit the Investors

section of our website: www.arcosdorados.com/ir.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements. The

forward-looking statements contained herein include statements

about the Company’s business prospects, its ability to attract

customers, its affordable platform, its expectation for revenue

generation and its outlook and guidance for growth and investments

in 2023. These statements are subject to the general risks inherent

in Arcos Dorados' business. These expectations may or may not be

realized. Some of these expectations may be based upon assumptions

or judgments that prove to be incorrect. In addition, Arcos

Dorados' business and operations involve numerous risks and

uncertainties, many of which are beyond the control of Arcos

Dorados, which could result in Arcos Dorados' expectations not

being realized or otherwise materially affect the financial

condition, results of operations and cash flows of Arcos Dorados.

Additional information relating to the uncertainties affecting

Arcos Dorados' business is contained in its filings with the

Securities and Exchange Commission. The forward-looking statements

are made only as of the date hereof, and Arcos Dorados does not

undertake any obligation to (and expressly disclaims any obligation

to) update any forward-looking statements to reflect events or

circumstances after the date such statements were made, or to

reflect the occurrence of unanticipated events.

Third Quarter 2023 Consolidated Results

Figure 10. Third Quarter 2023

Consolidated Results

(In thousands of U.S. dollars, except per

share data)

For Three-Months ended

For Nine-Months ended

September 30,

September 30,

2023

2022

2023

2022

REVENUES Sales by Company-operated restaurants

1,075,328

881,586

3,016,212

2,485,230

Revenues from franchised restaurants

49,782

40,117

140,211

115,049

Total Revenues

1,125,110

921,703

3,156,423

2,600,279

OPERATING COSTS AND EXPENSES Company-operated restaurant expenses:

Food and paper

(376,023)

(316,368)

(1,061,634)

(880,804)

Payroll and employee benefits

(200,904)

(165,362)

(580,286)

(487,031)

Occupancy and other operating expenses

(300,456)

(243,208)

(843,176)

(708,082)

Royalty fees

(65,058)

(51,076)

(180,317)

(133,753)

Franchised restaurants - occupancy expenses

(21,424)

(17,181)

(60,053)

(50,044)

General and administrative expenses

(67,806)

(58,638)

(202,924)

(169,172)

Other operating (expenses) / income, net

(2,364)

4,044

4,219

11,514

Total operating costs and expenses

(1,034,035)

(847,789)

(2,924,171)

(2,417,372)

Operating income

91,075

73,914

232,252

182,907

Net interest expense and other financing results

(4,973)

(7,920)

(26,960)

(42,740)

Gain / (loss) from derivative instruments

900

7,578

(13,220)

(5,258)

Foreign currency exchange results

1,286

6,016

22,231

16,798

Other non-operating (expenses) / income, net

(106)

59

(100)

(49)

Income before income taxes

88,182

79,647

214,203

151,658

Income tax expense

(28,072)

(32,604)

(87,922)

(65,411)

Net income

60,110

47,043

126,281

86,247

Net income attributable to non-controlling interests

(389)

(176)

(785)

(396)

Net income attributable to Arcos Dorados Holdings Inc.

59,721

46,867

125,496

85,851

Earnings per share information ($ per share): Basic net

income per common share

$ 0.28

$ 0.22

$ 0.60

$ 0.41

Weighted-average number of common shares outstanding-Basic

210,654,969

210,594,545

210,625,346

210,537,894

Adjusted EBITDA Reconciliation Operating income

91,075

73,914

232,252

182,907

Depreciation and amortization

37,286

28,294

105,806

88,934

Operating charges excluded from EBITDA computation

759

441

1,622

668

Adjusted EBITDA

129,120

102,649

339,680

272,509

Adjusted EBITDA Margin as % of total revenues

11.5 %

11.1 %

10.8 %

10.5 %

Third Quarter 2023 Results by Division

Figure 11. Third Quarter Consolidated

Results by Division

(In thousands of U.S. dollars)

For Three-Months ended

as

Constant

For Nine-Months ended

as

Constant

September 30,

reported

Currency

September 30,

reported

Currency

2023

2022

Incr/(Decr)%

Incr/(Decr)%

2023

2022

Incr/(Decr)%

Incr/(Decr)%

Revenues Brazil

439,213

352,798

24.5 %

15.9%

1,218,610

1,022,846

19.1%

16.2%

NOLAD

295,641

232,852

27.0 %

15.1%

832,497

659,430

26.2%

17.1%

SLAD

390,256

336,053

16.1 %

90.6%

1,105,316

918,003

20.4%

85.5%

SLAD - Excl. Venezuela

380,657

330,688

15.1 %

79.9%

1,084,298

905,241

19.8%

76.6%

TOTAL

1,125,110

921,703

22.1 %

42.9%

3,156,423

2,600,279

21.4%

40.9%

TOTAL - Excl. Venezuela

1,115,511

916,338

21.7 %

38.8 %

3,135,405

2,587,517

21.2%

37.6%

Operating Income (loss)

Brazil

59,374

49,498

20.0 %

11.1%

156,376

119,543

30.8%

27.1%

NOLAD

21,779

14,619

49.0 %

32.9%

54,136

42,706

26.8%

16.4%

SLAD

34,187

33,470

2.1 %

125.4%

97,101

84,141

15.4%

112.2%

SLAD - Excl. Venezuela

35,142

34,121

3.0 %

123.3%

101,364

87,543

15.8%

116.4%

Corporate and Other

(24,265)

(23,673)

-2.5%

-55.4%

(75,361)

(63,483)

-18.7%

-63.8%

TOTAL

91,075

73,914

23.2 %

53.0%

232,252

182,907

27.0%

51.0%

TOTAL - Excl. Venezuela

92,030

74,565

23.4 %

52.6%

236,515

186,309

26.9%

54.1%

Adjusted EBITDA Brazil

77,848

62,364

24.8 %

15.8%

206,450

161,108

28.1%

24.6%

NOLAD

32,308

22,748

42.0 %

27.4%

84,218

67,408

24.9%

15.3%

SLAD

41,780

39,683

5.3 %

105.0%

119,370

102,936

16.0%

92.7%

SLAD - Excl. Venezuela

42,428

40,045

6.0 %

104.5%

122,655

105,466

16.3%

97.3%

Corporate and Other

(22,816)

(22,146)

-3.0%

-57.3%

(70,358)

(58,943)

-19.4%

-65.3%

TOTAL

129,120

102,649

25.8 %

43.9%

339,680

272,509

24.6%

39.2%

TOTAL - Excl. Venezuela

129,768

103,011

26.0 %

43.9%

342,965

275,039

24.7%

41.5%

Figure 12. Average Exchange Rate per Quarter*

Brazil Mexico Argentina

3Q23

4.88

17.07

312.54

3Q22

5.24

20.22

135.61

* Local $ per 1 US$

Summarized Consolidated Balance Sheets

Figure 13. Summarized Consolidated

Balance Sheets

(In thousands of U.S. dollars)

September 30, December 31,

2023

2022

ASSETS

Current assets Cash and cash equivalents

166,307

266,937

Short-term investment

84,842

37,459

Accounts and notes receivable, net

136,519

124,273

Other current assets (1)

220,475

196,873

Derivative instruments

—

58,821

Total current assets

608,143

684,363

Non-current assets Property and equipment, net

1,022,274

856,085

Net intangible assets and goodwill

59,106

54,569

Deferred income taxes

83,876

87,972

Derivative instruments

50,267

34,088

Equity method investments

17,709

14,708

Leases right of use assets, net

903,816

820,683

Other non-current assets (2)

101,142

84,162

Total non-current assets

2,238,190

1,952,267

Total assets

2,846,333

2,636,630

LIABILITIES AND EQUITY

Current liabilities Accounts payable

324,453

353,468

Taxes payable (3)

178,355

146,682

Accrued payroll and other liabilities

146,775

115,327

Royalties payable to McDonald’s Corporation

14,453

21,280

Provision for contingencies

2,194

2,272

Interest payable

18,133

7,906

Financial debt (4)

10,697

29,566

Operating lease liabilities

89,737

82,911

Total current liabilities

784,797

759,412

Non-current liabilities Accrued payroll and other

liabilities

23,675

28,781

Provision for contingencies

48,382

42,567

Financial debt (5)

730,772

729,838

Deferred income taxes

5,057

3,931

Operating lease liabilities

810,969

747,674

Total non-current liabilities

1,618,855

1,552,791

Total liabilities

2,403,652

2,312,203

Equity Class A shares of common stock

389,907

389,393

Class B shares of common stock

132,915

132,915

Additional paid-in capital

8,719

9,206

Retained earnings

510,410

424,936

Accumulated other comprehensive losses

(580,821)

(613,460)

Common stock in treasury

(19,367)

(19,367)

Total Arcos Dorados Holdings Inc shareholders’ equity

441,763

323,623

Non-controlling interest in subsidiaries

918

804

Total equity

442,681

324,427

Total liabilities and equity

2,846,333

2,636,630

(1)

Includes "Other receivables",

"Inventories" and "Prepaid expenses and other current assets”.

(2)

Includes "Miscellaneous" and

"Collateral deposits".

(3)

Includes "Income taxes payable"

and "Other taxes payable".

(4)

Includes "Short-term debt”,

“Current portion of long-term debt" and "Derivative

instruments”.

(5)

Includes "Long-term debt,

excluding current portion" and "Derivative instruments".

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231116805274/en/

Investor Relations Contact Dan Schleiniger VP of Investor

Relations Arcos Dorados daniel.schleiniger@mcd.com.uy

Media Contact David Grinberg VP of Corporate

Communications Arcos Dorados david.grinberg@mcd.com.uy

Follow us on: LinkedIn Twitter

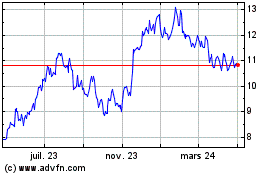

Arcos Dorados (NYSE:ARCO)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

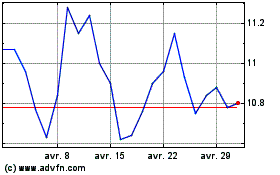

Arcos Dorados (NYSE:ARCO)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025