0001673985false00016739852024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

Form 8-K

_____________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2024

ADVANSIX INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware (State or other jurisdiction of incorporation) |

| 1-37774 (Commission File Number) |

| 81-2525089 (I.R.S. Employer Identification No.) |

300 Kimball Drive, Suite 101

Parsippany, New Jersey 07054

(Address of principal executive offices)

Registrant’s telephone number, including area code: (973) 526-1800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | ASIX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 Results of Operations and Financial Condition.

On February 16, 2024, AdvanSix Inc. (the "Company") issued a press release announcing its financial results for the quarter and full year ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1.

ITEM 8.01 Other Events.

Dividend

On February 16, 2024, the Company announced that its Board of Directors declared a cash dividend of $0.16 per share on the Company's common stock. The dividend will be paid on March 18, 2024 to stockholders of record as of the close of business on March 4, 2024.

The Company's announcement of the dividend is included in the press release furnished herewith as Exhibit 99.1.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number |

| Description |

| | |

| 99.1 |

| |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 16, 2024

| | | | | | | | |

| AdvanSix Inc. |

|

|

|

| By: | /s/ Achilles B. Kintiroglou |

| Name: | Achilles B. Kintiroglou |

| Title: | Senior Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

News Release

ADVANSIX ANNOUNCES FOURTH QUARTER AND FULL YEAR 2023 FINANCIAL RESULTS

4Q23 Sales of $382 million, down 5% versus prior year

4Q23 Earnings Per Share of ($0.19); Adjusted Earnings Per Share of ($0.10)

4Q23 Cash Flow from Operations of $60 million

Returned $63 million of cash to shareholders through repurchases and dividends in 2023

Parsippany, N.J., February 16, 2024 - AdvanSix (NYSE: ASIX) today announced its financial results for the fourth quarter and full year ending December 31, 2023. The following results reflect our navigation of a challenging end market environment while maintaining focus on long-term priorities including portfolio simplification in the year and continued investments in support of improved through-cycle profitability.

Full Year 2023 Summary

•Sales down 21% versus prior year driven by 17% unfavorable impact of market-based pricing and 5% lower raw material pass-through pricing, partially offset by 1% contribution from acquisitions and flat volume

•Net Income of $54.6 million, a decrease of $117.3 million versus the prior year

•Adjusted EBITDA of $153.6 million, a decrease of $154.9 million versus the prior year

•Cash Flow from Operations of $117.6 million, a decrease of $156.1 million versus the prior year

•Capital Expenditures of $107.4 million, an increase of $17.9 million versus the prior year

•Free Cash Flow of $10.2 million, a decrease of $174.0 million versus the prior year

•Repurchased 1,317,402 shares for approximately $46.2 million in 2023

Summary full year 2023 financial results for the Company are included below:

| | | | | | | | | | | |

($ in Thousands, Except Earnings Per Share) | FY 2023 | | FY 2022 |

| Sales | $1,533,599 | | $1,945,640 |

| Net Income | 54,623 | | 171,886 |

| Diluted Earnings Per Share | $1.95 | | $5.92 |

Adjusted Diluted Earnings Per Share (1) | $2.14 | | $6.28 |

Adjusted EBITDA (1) | 153,559 | | 308,481 |

Adjusted EBITDA Margin % (1) | 10.0% | | 15.9% |

| Cash Flow from Operations | 117,550 | | 273,601 |

Free Cash Flow (1)(2) | 10,173 | | 184,152 |

(1) See “Non-GAAP Measures” included in this press release for non-GAAP reconciliations

(2) Net cash provided by operating activities less capital expenditures

“I'm proud of the team and our continued commitment to driving improved through-cycle profitability. Our healthy balance sheet helped to support our performance through challenging market conditions, particularly in Nylon Solutions, while maintaining organic investments and return of cash to our shareholders,” said Erin Kane, president and CEO of AdvanSix. “Core to our long-term strategy is accelerating growth in the most profitable areas of our portfolio, continuous improvement to strengthen the underlying earnings power of the business, and sustaining our cost-advantaged business model."

Fourth Quarter 2023 Summary

•Sales down 5% versus prior year driven by 22% unfavorable impact of market-based pricing, partially offset by a 16% increase in volume and 1% higher raw materials pass-through pricing.

•Net Loss of ($5.1) million, a decrease of $38.7 million versus the prior year

•Adjusted EBITDA of $15.1 million, a decrease of $51.5 million versus the prior year

•Cash Flow from Operations of $60.2 million, a decrease of $9.4 million versus the prior year

•Capital Expenditures of $38.4 million, an increase of $9.9 million versus the prior year

•Free Cash Flow of $21.8 million, a decrease of $19.4 million versus the prior year

•Repurchased 306,527 shares for approximately $8.5 million in 4Q23

Summary fourth quarter 2023 financial results for the Company are included below: | | | | | | | | | | | |

($ in Thousands, Except Earnings Per Share) | 4Q 2023 | | 4Q 2022 |

| Sales | $382,208 | | $404,062 |

| Net Income (Loss) | (5,082) | | 33,625 |

| Diluted Earnings Per Share | ($0.19) | | $1.18 |

Adjusted Diluted Earnings Per Share (1) | ($0.10) | | $1.27 |

Adjusted EBITDA (1) | 15,099 | | 66,580 |

Adjusted EBITDA Margin % (1) | 4.0% | | 16.5% |

| Cash Flow from Operations | 60,169 | | 69,614 |

Free Cash Flow (1)(2) | 21,817 | | 41,175 |

(1) See “Non-GAAP Measures” included in this press release for non-GAAP reconciliations

(2) Net cash provided by operating activities less capital expenditures

Sales of $382 million in the quarter decreased approximately 5% versus the prior year. Market-based pricing was unfavorable by 22% compared to the prior year primarily reflecting reduced ammonium sulfate pricing amid lower raw material input costs and a more stable global nitrogen supply environment, as well as lower nylon pricing due to unfavorable supply and demand conditions. Sales volume increased approximately 16% primarily driven by higher export shipments in both Ammonium Sulfate and Nylon. Raw material pass-through pricing was favorable by 1% as a result of a net cost increase in benzene and propylene (inputs to cumene which is a key feedstock to our products).

Sales by product line and approximate percentage of total sales are included below:

| | | | | | | | | | | | | | | | | | | | | | | |

| ($ in Thousands) | FY 2023 | | FY 2022 |

| Sales | | % of Total | | Sales | | % of Total |

| Nylon | $ | 356,632 | | | 23% | | $ | 485,241 | | | 25% |

| Caprolactam | 298,375 | | | 19% | | 319,863 | | | 16% |

| Ammonium Sulfate | 440,915 | | | 29% | | 629,021 | | | 33% |

| Chemical Intermediates | 437,677 | | | 29% | | 511,515 | | | 26% |

| $ | 1,533,599 | | | 100% | | $ | 1,945,640 | | | 100% |

| | | | | | | | | | | | | | | | | | | | | | | |

| ($ in Thousands) | 4Q 2023 | | 4Q 2022 |

| Sales | | % of Total | | Sales | | % of Total |

| Nylon | $ | 78,251 | | | 20% | | $ | 93,510 | | | 23% |

| Caprolactam | 82,508 | | | 22% | | 71,871 | | | 18% |

| Ammonium Sulfate | 108,691 | | | 28% | | 136,734 | | | 34% |

| Chemical Intermediates | 112,759 | | | 30% | | 101,947 | | | 25% |

| $ | 382,209 | | | 100% | | $ | 404,062 | | | 100% |

Adjusted EBITDA of $15.1 million in the quarter decreased $51.5 million versus the prior year primarily due to unfavorable market-based pricing, net of raw material costs, partially offset by the net impact of higher sales volume and changes in sales mix including higher export volume.

Adjusted earnings per share of ($0.10) decreased $1.37 versus the prior year driven primarily by the factors discussed above.

Cash flow from operations of $60.2 million in the quarter decreased $9.4 million versus the prior year primarily due to lower net income, partially offset by the favorable impact of changes in working capital. Capital expenditures of $38.4 million in the quarter increased $9.9 million versus the prior year primarily reflecting increased spend on enterprise programs and other maintenance projects.

Dividend

The Company's Board of Directors declared a quarterly cash dividend of $0.16 per share on the Company's common stock. The dividend is payable on March 18, 2024 to stockholders of record as of the close of business on March 4, 2024.

Outlook

•Expect nylon industry spreads to remain stabilized near current levels amid weak demand; Anticipate higher Nylon Solutions exports in first half of 2024 year-over-year

•Anticipate strong ammonium sulfate seasonal demand supported by continued favorable underlying agriculture industry fundamentals; Expect first half 2024 year-over-year pricing declines amid lower nitrogen pricing environment

•Expect balanced to tight global acetone supply and demand conditions

•Expect Capital Expenditures of $140 to $150 million in 2024, reflecting increased spend to address critical enterprise risk mitigation and growth projects including our SUSTAIN program

•Expect pre-tax income impact of planned plant turnarounds to be $38 to $43 million in 2024 versus approximately $30 million in 2023

•Now expect to incur a total unfavorable impact to pre-tax income in 1Q24 of $23 to $27 million as a result of the process-based operational disruption at our Frankford, PA manufacturing site and a delayed ramp to planned utilization rates

"While the previously disclosed operational disruption at our Frankford, Pennsylvania manufacturing site is impacting our first quarter results, our teams have been focused on stabilization of phenol production, which is enabling us to ramp up our Hopewell and Chesterfield manufacturing facilities to our targeted utilization rates. We thank our customers, partners and AdvanSix teammates for their collaboration and agility to mitigate the value chain impact of this event. Our focus remains on performing in the current set of industry dynamics and executing levers in our control, including remaining disciplined on cost and optimizing working capital. Our outlook reflects a continued investment in our long-term potential through both our SUSTAIN program's planned expansion in granular ammonium sulfate production and increased infrastructure spend in 2024 to mitigate enterprise risk,” concluded Kane.

Conference Call Information

AdvanSix will discuss its results during its investor conference call today starting at 9:00 a.m. ET. To participate on the conference call, dial (844) 855-9494 (domestic) or (412) 858-4602 (international) approximately 10 minutes before the 9:00 a.m. ET start, and tell the operator that you are dialing in for AdvanSix’s fourth quarter 2023 earnings call. The live webcast of the investor call as well as related presentation materials can be accessed at http://investors.advansix.com. Investors can hear a replay of the conference call from 12 noon ET on February 16 until 12 noon ET on February 23 by dialing (877) 344-7529 (domestic) or (412) 317-0088 (international). The access code is 4232990.

About AdvanSix

AdvanSix is a diversified chemistry company that produces essential materials for our customers in a wide variety of end markets

and applications that touch people’s lives. Our integrated value chain of our five U.S.-based manufacturing facilities plays a critical role in global supply chains and enables us to innovate and deliver essential products for our customers across building and construction, fertilizers, agrochemicals, plastics, solvents, packaging, paints, coatings, adhesives, electronics and other end markets. Guided by our core values of Safety, Integrity, Accountability and Respect, AdvanSix strives to deliver best-in-class customer experiences and differentiated products in the industries of nylon solutions, plant nutrients, and chemical intermediates. More information on AdvanSix can be found at http://www.advansix.com.

Forward Looking Statements

This release contains certain statements that may be deemed “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, that address activities, events or developments that our management intends, expects, projects, believes or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements may be identified by words such as "expect," "anticipate," "estimate," “outlook,” "project," "strategy," "intend," "plan," "target," "goal," "may," "will," "should" and "believe" and other variations or similar terminology and expressions. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risks, uncertainties and other factors, many of which are beyond our control and difficult to predict, which may cause the actual results or performance of the Company to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: general economic and financial conditions in the U.S. and globally; the potential effects of inflationary pressures, labor market shortages and supply chain issues; instability or volatility in financial markets or other unfavorable economic or business conditions caused by geopolitical concerns, including as a result of the conflict between Russia and Ukraine, the conflict in Israel and Gaza, and the possible expansion of such conflicts; the effect of the foregoing on our customers’ demand for our products and our suppliers’ ability to manufacture and deliver our raw materials, including implications of reduced refinery utilization in the U.S.; our ability to sell and provide our goods and services; the ability of our customers to pay for our products; any closures of our and our customers’ offices and facilities; risks associated with increased phishing, compromised business emails and other cybersecurity attacks, data privacy incidents and disruptions to our technology infrastructure; risks associated with employees working remotely or operating with a reduced workforce; risks associated with our indebtedness including compliance with financial and restrictive covenants, and our ability to access capital on reasonable terms, at a reasonable cost, or at all, due to economic conditions or otherwise; the impact of scheduled turnarounds and significant unplanned downtime and interruptions of production or logistics operations as a result of mechanical issues or other unanticipated events such as fires, severe weather conditions, natural disasters, pandemics and geopolitical conflicts and related events; price fluctuations, cost increases and supply of raw materials; our operations and growth projects requiring substantial capital; growth rates and cyclicality of the industries we serve including global changes in supply and demand; failure to develop and commercialize new products or technologies; loss of significant customer relationships; adverse trade and tax policies; extensive environmental, health and safety laws that apply to our operations; hazards associated with chemical manufacturing, storage and transportation; litigation associated with chemical manufacturing and our business operations generally; inability to acquire and integrate businesses, assets, products or technologies; protection of our intellectual property and proprietary information; prolonged work stoppages as a result of labor difficulties or otherwise; failure to maintain effective internal controls; our ability to declare and pay quarterly cash dividends and the amounts and timing of any future dividends; our ability to repurchase our common stock and the amount and timing of any future repurchases; disruptions in supply chain, transportation and logistics; potential for uncertainty regarding qualification for tax treatment of our spin-off; fluctuations in our stock price; and changes in laws or regulations applicable to our business. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Such forward-looking statements are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by such forward-looking statements. We identify the principal risks and uncertainties that affect our performance in our filings with the Securities and Exchange Commission (SEC), including the risk factors in Part 1, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022, as updated in subsequent reports filed with the SEC.

Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures intended to supplement, not to act as substitutes for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in this press release. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided. Non-GAAP measures in this press release may be calculated in a way that is not comparable to similarly-titled measures reported by other companies.

# # #

| | | | | |

| Contacts: | |

| Media | Investors |

| Janeen Lawlor | Adam Kressel |

| (973) 526-1615 | (973) 526-1700 |

| janeen.lawlor@advansix.com | adam.kressel@advansix.com |

AdvanSix Inc.

Consolidated Balance Sheets

(Unaudited)

(Dollars in thousands, except share and per share amounts) | | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 29,768 | | | $ | 30,985 | |

| Accounts and other receivables – net | 165,393 | | | 175,429 | |

| Inventories – net | 211,831 | | | 215,502 | |

| Taxes receivable | 1,434 | | | 9,771 | |

| Other current assets | 11,378 | | | 9,241 | |

| Total current assets | 419,804 | | | 440,928 | |

| | | |

| Property, plant and equipment – net | 852,642 | | | 811,065 | |

| Operating lease right-of-use assets | 95,805 | | | 114,688 | |

| Goodwill | 56,192 | | | 56,192 | |

| Intangible assets | 46,193 | | | 49,242 | |

| Other assets | 25,384 | | | 23,216 | |

| Total assets | $ | 1,496,020 | | | $ | 1,495,331 | |

| | | |

| LIABILITIES | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 259,068 | | | $ | 272,740 | |

| Accrued liabilities | 44,086 | | | 48,820 | |

| Income taxes payable | 8,033 | | | 30 | |

| Operating lease liabilities – short-term | 32,053 | | | 37,472 | |

| Deferred income and customer advances | 15,678 | | | 34,430 | |

| Total current liabilities | 358,918 | | | 393,492 | |

| | | |

| Deferred income taxes | 151,059 | | | 160,409 | |

| Operating lease liabilities – long-term | 63,961 | | | 77,571 | |

| Line of credit – long-term | 170,000 | | | 115,000 | |

| Postretirement benefit obligations | 3,660 | | | — | |

| Other liabilities | 9,185 | | | 10,679 | |

| Total liabilities | 756,783 | | | 757,151 | |

| | | |

| STOCKHOLDERS' EQUITY | | | |

Common stock, par value $0.01; 200,000,000 shares authorized; 32,598,946 shares issued and 26,750,471 outstanding at December 31, 2023; 31,977,593 shares issued and 27,446,520 outstanding at December 31, 2022 | 326 | | | 320 | |

Preferred stock, par value $0.01; 50,000,000 shares authorized; 0 shares issued and outstanding at December 31, 2023 and 2022 | — | | | — | |

Treasury stock at par (5,848,475 shares at December 31, 2023; 4,531,073 shares at December 31, 2022) | (58) | | | (45) | |

| Additional paid-in capital | 138,046 | | | 174,585 | |

| Retained earnings | 605,067 | | | 567,517 | |

| Accumulated other comprehensive loss | (4,144) | | | (4,197) | |

| Total stockholders' equity | 739,237 | | | 738,180 | |

| Total liabilities and stockholders' equity | $ | 1,496,020 | | | $ | 1,495,331 | |

AdvanSix Inc.

Consolidated Statements of Operations

(Unaudited)

(Dollars in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Sales | $ | 382,208 | | | $ | 404,062 | | | $ | 1,533,599 | | | $ | 1,945,640 | |

| | | | | | | |

| Costs, expenses and other: | | | | | | | |

| Costs of goods sold | 363,667 | | | 335,033 | | | 1,368,511 | | | 1,631,161 | |

| Selling, general and administrative expenses | 24,828 | | | 22,628 | | | 95,538 | | | 87,748 | |

| Interest expense, net | 2,189 | | | 763 | | | 7,485 | | | 2,781 | |

| Other non-operating (income) expense, net | (240) | | | (16) | | | (7,158) | | | (1,841) | |

| Total costs, expenses and other | 390,444 | | | 358,408 | | | 1,464,376 | | | 1,719,849 | |

| | | | | | | |

| Income (loss) before taxes | (8,236) | | | 45,654 | | | 69,223 | | | 225,791 | |

| Income tax expense (benefit) | (3,154) | | | 12,029 | | | 14,600 | | | 53,905 | |

| Net Income (loss) | $ | (5,082) | | | $ | 33,625 | | | $ | 54,623 | | | $ | 171,886 | |

| | | | | | | |

| Earnings per common share | | | | | | | |

| Basic | $ | (0.19) | | | $ | 1.22 | | | $ | 2.00 | | | $ | 6.15 | |

| Diluted | $ | (0.19) | | | $ | 1.18 | | | $ | 1.95 | | | $ | 5.92 | |

| | | | | | | |

| Weighted average common shares outstanding | | | | | | | |

| Basic | 26,911,754 | | | 27,572,344 | | | 27,302,254 | | | 27,969,436 | |

| Diluted | 26,911,754 | | | 28,608,181 | | | 28,007,630 | | | 29,031,107 | |

AdvanSix Inc.

Consolidated Statements of Cash Flows

(Unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | |

| Net income (loss) | $ | (5,082) | | | $ | 33,625 | | | $ | 54,623 | | | $ | 171,886 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 18,673 | | | 17,483 | | | 73,010 | | | 69,353 | |

| Loss on disposal of assets | 342 | | | 218 | | | 1,281 | | | 1,521 | |

| Deferred income taxes | (10,416) | | | 7,532 | | | (9,347) | | | 16,228 | |

| Stock-based compensation | 2,473 | | | 2,680 | | | 8,313 | | | 10,279 | |

| Amortization of deferred financing fees | 154 | | | 154 | | | 618 | | | 618 | |

| Operational asset adjustments | — | | | — | | | (4,472) | | | — | |

| Changes in assets and liabilities, net of business acquisitions: | | | | | | | |

| Accounts and other receivables | (20,696) | | | 10,496 | | | 21,489 | | | 17,842 | |

| Inventories | 17,368 | | | (57,070) | | | 3,286 | | | (57,043) | |

| Taxes receivable | 64 | | | 5,159 | | | 8,337 | | | (8,824) | |

| Accounts payable | 27,231 | | | 22,094 | | | (20,756) | | | 55,863 | |

| Income taxes payable | 8,003 | | | (9,693) | | | 8,003 | | | (9,693) | |

| Accrued liabilities | 2,218 | | | 4,544 | | | (5,569) | | | (3,122) | |

| Deferred income and customer advances | 13,263 | | | 31,869 | | | (18,752) | | | 31,681 | |

| Other assets and liabilities | 6,574 | | | 523 | | | (2,514) | | | (22,988) | |

| Net cash provided by operating activities | 60,169 | | | 69,614 | | | 117,550 | | | 273,601 | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | | |

| Expenditures for property, plant and equipment | (38,352) | | | (28,439) | | | (107,377) | | | (89,449) | |

| Acquisition of businesses | — | | | — | | | — | | | (97,456) | |

| Other investing activities | (1,116) | | | (781) | | | (3,520) | | | (2,368) | |

| Net cash used for investing activities | (39,468) | | | (29,220) | | | (110,897) | | | (189,273) | |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| Borrowings from line of credit | 66,000 | | | 80,500 | | | 437,000 | | | 434,500 | |

| Payments of line of credit | (66,000) | | | (100,500) | | | (382,000) | | | (454,500) | |

| | | | | | | |

| Principal payments of finance leases | (240) | | | (214) | | | (938) | | | (926) | |

| Dividend payments | (4,303) | | | (3,990) | | | (16,657) | | | (15,073) | |

| Purchase of treasury stock | (8,500) | | | (10,157) | | | (46,151) | | | (33,748) | |

| Issuance of common stock | — | | | 258 | | | 876 | | | 1,304 | |

| Net cash used for financing activities | (13,043) | | | (34,103) | | | (7,870) | | | (68,443) | |

| | | | | | | |

| Net change in cash and cash equivalents | 7,658 | | | 6,291 | | | (1,217) | | | 15,885 | |

| Cash and cash equivalents at beginning of year | 22,110 | | | 24,694 | | | 30,985 | | | 15,100 | |

| Cash and cash equivalents at the end of year | $ | 29,768 | | | $ | 30,985 | | | $ | 29,768 | | | $ | 30,985 | |

| | | | | | | |

| Supplemental non-cash investing activities: | | | | | | | |

| Capital expenditures included in accounts payable | | | | | $ | 22,660 | | | $ | 14,879 | |

AdvanSix Inc.

Non-GAAP Measures

(Dollars in thousands, except share and per share amounts)

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities | $ | 60,169 | | | $ | 69,614 | | | $ | 117,550 | | | $ | 273,601 | |

| Expenditures for property, plant and equipment | (38,352) | | | (28,439) | | | (107,377) | | | (89,449) | |

Free cash flow (1) | $ | 21,817 | | | $ | 41,175 | | | $ | 10,173 | | | $ | 184,152 | |

| | | | | | | |

(1) Free cash flow is a non-GAAP measure defined as Net cash provided by operating activities less Expenditures for property, plant and equipment |

The Company believes that this metric is useful to investors and management as a measure to evaluate our ability to generate cash flow from business operations and the impact that this cash flow has on our liquidity.

Reconciliation of Net Income to Adjusted EBITDA and Earnings Per Share to Adjusted Earnings Per Share

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net Income (loss) | $ | (5,082) | | | $ | 33,625 | | | $ | 54,623 | | | $ | 171,886 | |

| Non-cash stock-based compensation | 2,473 | | | 2,680 | | | 8,313 | | | 10,279 | |

Non-recurring, unusual or extraordinary expenses (income) (2) | — | | | — | | | (4,472) | | | — | |

| Non-cash amortization from acquisitions | 530 | | | 532 | | | 2,126 | | | 1,815 | |

| Non-recurring M&A costs | — | | | — | | | — | | | 277 | |

| Benefit from income taxes relating to reconciling items | (504) | | | (535) | | | (661) | | | (1,996) | |

| Adjusted Net Income (loss) | (2,583) | | | 36,302 | | | 59,929 | | | 182,261 | |

| Interest expense, net | 2,189 | | | 763 | | | 7,485 | | | 2,781 | |

| Income tax expense (benefit) - Adjusted | (2,650) | | | 12,564 | | | 15,261 | | | 55,901 | |

| Depreciation and amortization - Adjusted | 18,143 | | | 16,951 | | | 70,884 | | | 67,538 | |

| Adjusted EBITDA | $ | 15,099 | | | $ | 66,580 | | | $ | 153,559 | | | $ | 308,481 | |

| | | | | | | |

| Sales | $ | 382,208 | | | $ | 404,062 | | | $ | 1,533,599 | | | $ | 1,945,640 | |

| | | | | | | |

Adjusted EBITDA Margin (3) | 4.0% | | 16.5% | | 10.0% | | 15.9% |

| | | | | | | |

(2) Includes a pre-tax gain of approximately $11.4 million related to the Company's exit from the Oben alliance, the unfavorable impact to pre-tax income of approximately $4.5 million associated with a licensee of certain legacy ammonium sulfate fertilizer technology assets closing its facility, and the unfavorable impact to pre-tax income of approximately $2.4 million from the exit of certain low-margin oximes products. |

(3) Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Sales |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net Income (loss) | $ | (5,082) | | | $ | 33,625 | | | $ | 54,623 | | | $ | 171,886 | |

| Adjusted Net Income (loss) | (2,583) | | | 36,302 | | | 59,929 | | | 182,261 | |

| | | | | | | |

| Weighted-average number of common shares outstanding - basic | 26,911,754 | | | 27,572,344 | | | 27,302,254 | | | 27,969,436 | |

| Dilutive effect of equity awards and other stock-based holdings | — | | | 1,035,837 | | | 705,376 | | | 1,061,671 | |

| Weighted-average number of common shares outstanding - diluted | 26,911,754 | | | 28,608,181 | | | 28,007,630 | | | 29,031,107 | |

| | | | | | | |

| EPS - Basic | $ | (0.19) | | | $ | 1.22 | | | $ | 2.00 | | | $ | 6.15 | |

| EPS - Diluted | $ | (0.19) | | | $ | 1.18 | | | $ | 1.95 | | | $ | 5.92 | |

| Adjusted EPS - Basic | $ | (0.10) | | | $ | 1.32 | | | $ | 2.20 | | | $ | 6.52 | |

| Adjusted EPS - Diluted | $ | (0.10) | | | $ | 1.27 | | | $ | 2.14 | | | $ | 6.28 | |

| | | | | | | |

The Company believes the non-GAAP financial measures presented in this release provide meaningful supplemental information as they are used by the Company’s management to evaluate the Company’s operating performance, enhance a reader’s understanding of the financial performance of the Company, and facilitate a better comparison among fiscal periods and performance relative to its competitors, as these non-GAAP measures exclude items that are not considered core to the Company’s operations.

AdvanSix Inc.

Appendix

(Pre-tax income impact, Dollars in millions)

Planned Plant Turnaround Schedule (4)

| | | | | | | | | | | | | | | | | | | | |

| 1Q | 2Q | 3Q | 4Q | FY | Primary Unit Operation |

| 2017 | — | ~$10 | ~$4 | ~$20 | ~$34 | Sulfuric Acid |

| 2018 | ~$2 | ~$10 | ~$30 | — | ~$42 | Ammonia |

| 2019 | — | ~$5 | ~$5 | ~$25 | ~$35 | Sulfuric Acid |

| 2020 | ~$2 | ~$7 | ~$20 | ~$2 | ~$31 | Ammonia |

| 2021 | ~$3 | ~$8 | — | ~$18 | ~$29 | Sulfuric Acid |

| 2022 | ~$1 | ~$5 | ~$44 | — | ~$50 | Ammonia |

| 2023 | ~$2 | ~$1 | ~$27 | — | ~$30 | Sulfuric Acid |

| 2024E | ~$6 | — | $28-$33 | ~$4 | $38-$43 | Ammonia |

(4) Primarily reflects the impact of fixed cost absorption, maintenance expense, and the purchase of feedstocks which are normally manufactured by the Company.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

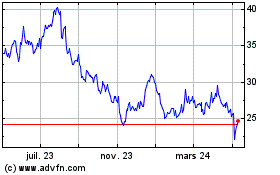

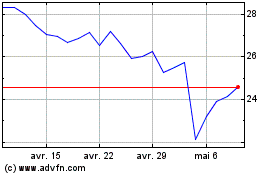

AdvanSix (NYSE:ASIX)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

AdvanSix (NYSE:ASIX)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024