Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

08 Septembre 2023 - 11:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2023

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into English)

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: ☒ Form 40-F: ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish

and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as

long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s

security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing

on EDGAR.

Fourth Supplemental Indenture

On

September 8, 2023, Atento Luxco 1 (the “Company”), Wilmington Trust,

National Association and Wilmington Trust (London) Limited entered into a Supplemental Indenture (the “Fourth Supplemental Indenture”)

to supplement the Indenture dated February 10, 2021 (the “Indenture”), governing the Company’s $500 million 8.000% Senior

Secured Notes due 2026 (the “Notes”). Following the execution of the Fourth Supplemental Indenture, (i) the governing law

of the Indenture, the Notes and the Notes Guarantees was changed to the laws of England and Wales, (ii) the jurisdiction for instituting

any suit, action or proceeding against the Company or any Guarantor under the Indenture was changed to England and Wales, and (iii) certain

other changes of conforming nature were made to effect the foregoing and related amendments.

The foregoing summary of the Fourth

Supplemental Indenture does not purport to be complete and is subject to, and qualified in its entirety, by the full text of the Fourth

Supplemental Indenture, which is attached hereto as Exhibit 99.1, and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: September 8, 2023 |

ATENTO S.A.

By: /s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer |

Exhibit 99.1

Fourth Supplemental Indenture dated 8 September 2023

Atento (NYSE:ATTO)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

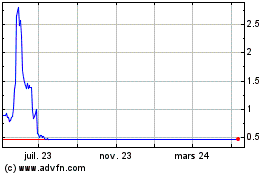

Atento (NYSE:ATTO)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025