AngloGold Ashanti plc (“AngloGold Ashanti”, “AGA” or the

“Company”) today reported a 2% year-on-year increase in first

quarter gold production1, in line with its plans and despite the

previously reported impact of rains and flooding in Western

Australia on gold production which contributed to a drop of about

15,000oz in production in the first quarter relative to the

previous quarter. The Company reconfirmed its 2024 full-year gold

production guidance and its 2024 annual gold production forecast

for Obuasi in Ghana, which continues its ramp-up.

“This is a good start to the year, with another strong safety

result and a good overall performance from the portfolio,” said

Chief Executive Officer Alberto Calderon. “We’re seeing greater

consistency from most of our operations; in Brazil, both sites have

shown significantly better performance, with greater production

control and stability. Geita and Kibali were strong again, and

Obuasi’s ramp-up remains on track.”

Denver-headquartered AngloGold Ashanti continues to take steps

to close the value gap that exists with its North American peers by

improving safety, relative cost performance and cash conversion,

while increasing the life of its key mines and prioritising

successful development of major projects.

The Company’s Total Recordable Injury Frequency Rate (“TRIFR”)

was 1.08 injuries per million hours worked during the first quarter

of 2024, compared to the most recent average (2022) of 2.66 for

members of the International Council on Metals & Minerals

(“ICMM”). No fatalities were recorded at mines operated by the

Company in the first three months of 2024, for the eleventh

consecutive quarter.

Gold production1 was 2% higher year-on-year at 581,000oz for the

first quarter of 2024, compared to 572,000oz for the first quarter

of 2023, driven mainly by higher recovered grades, and partly

offset by lower tonnes processed. Strong improvements in gold

production versus the first quarter of last year were recorded at

Cuiabá (AGA Mineração) (+55%) and Serra Grande (+40%), where

initiatives have been taken to improve overall performance, as well

as at Kibali (+19%) and at Geita (+16%).

This increase in gold production was partly offset by lower gold

production at Siguiri (-35%), where carbonaceous ore in the Bidini

pit resulted in poor recoveries, and at Tropicana (-17%), where

severe flooding, caused by a tropical cyclone, inundated

underground and open pit mining areas as well as access roads to

the remote site. Both mines have since recovered to normalised gold

production levels. Sunrise Dam (-8%) also suffered from the heavy

rainfall in Western Australia, albeit to a lesser extent than

Tropicana, while gold production at Cerro Vanguardia (-7%) was

lower due to a planned plant stoppage.

At Obuasi, gold production was 54,000oz, in line with the mine

plan, as mining occurred in lower-grade areas. Obuasi’s underground

ore tonnes treated averaged 91,000t/pm for the first three months

of 2024. Underground tonnes treated and grade are expected to

increase in the second half of 2024, supported by additional

development. The mine remains on track to produce an anticipated

275,000oz – 320,000oz of gold in 2024.

As previously reported, gold production at Tropicana was

impacted by heavy rains and flooding during the month of March. The

area in which the Tropicana gold mine is located received 312mm of

rain in a 72-hour period from 9 March, almost 40% higher than its

average annual rainfall. The subsequent flooding interrupted power

supply to the processing plant and required mining operations to be

suspended. Since the flooding, remedial work to recommence

operations was successfully completed and mining and processing has

since restarted. Whilst gold production was impacted in the first

quarter of 2024, and consequently for the first half of 2024, the

Company expects to recover a significant portion of these

production losses in the second half of 2024.

The Company provided gold production guidance for 2024 in

February, which remains unchanged. Gold production is again

expected to be second half weighted, with fourth quarter gold

production expected to be the strongest quarter this year.

1 Excluding the Córrego do Sítio (“CdS”) operation which was

placed on care and maintenance in August 2023.

Quarter

Quarter

Quarter

Year

ended

ended

ended

ended

Mar

Dec

Mar

Dec

2024

2023

2023

2023

Gold produced (1)

– Subsidiaries (2) (3)

oz (000)

505

632

508

2,250

– Joint ventures

oz (000)

76

93

64

343

– Group (2) (3)

oz (000)

581

725

572

2,593

Tonnes treated

Open-pit

– Subsidiaries

tonnes (000)

5,608

6,741

6,065

25,094

– Joint ventures

tonnes (000)

509

478

538

2,065

– Group

tonnes (000)

6,117

7,219

6,603

27,159

Underground

– Subsidiaries

tonnes (000)

2,216

2,596

2,104

9,511

– Joint ventures

tonnes (000)

416

433

342

1,635

– Group

tonnes (000)

2,632

3,029

2,446

11,146

Other

– Subsidiaries

tonnes (000)

726

859

635

3,007

– Joint ventures

tonnes (000)

—

—

—

—

– Group

tonnes (000)

726

859

635

3,007

Total

– Subsidiaries

tonnes (000)

8,550

10,196

8,804

37,612

– Joint ventures

tonnes (000)

925

911

880

3,700

– Group

tonnes (000)

9,475

11,107

9,684

41,312

Recovered grade

Open-pit

– Subsidiaries

g/tonne

1.03

1.30

1.18

1.23

– Joint ventures

g/tonne

0.97

1.72

1.32

1.58

– Group

g/tonne

1.03

1.33

1.19

1.25

Underground

– Subsidiaries

g/tonne

3.72

3.51

3.63

3.48

– Joint ventures

g/tonne

4.48

4.76

3.71

4.54

– Group

g/tonne

3.84

3.69

3.64

3.63

Other

– Subsidiaries

g/tonne

2.32

2.05

1.58

2.05

– Joint ventures

g/tonne

—

—

—

—

– Group

g/tonne

2.32

2.05

1.58

2.05

Total

– Subsidiaries

g/tonne

1.84

1.93

1.80

1.86

– Joint ventures

g/tonne

2.55

3.17

2.25

2.89

– Group

g/tonne

1.91

2.03

1.84

1.95

(1)

On an attributable basis.

(2)

Adjusted to exclude the Córrego do Sítio

(CdS) operation that was placed on care and maintenance in August

2023. CdS produced nil koz, 2koz and 12koz for the quarters ended

31 March 2024, 31 December 2023 and 31 March 2023, respectively.

CdS produced 42koz for the year ended 31 December 2023.

(3)

Includes gold concentrate from the Cuiabá

mine sold to third parties.

Rounding of figures may result in

computational discrepancies

OPERATING HIGHLIGHTS

In the Africa region – subsidiaries, gold production (on

an attributable basis) was 271,000oz for the quarter ended 31 March

2024, compared to 284,000oz for the quarter ended 31 March 2023. In

the Africa region – joint ventures, gold production (on an

attributable basis) was 76,000oz for the quarter ended 31 March

2024, compared to 64,000oz for the quarter ended 31 March 2023.

In Ghana, at Iduapriem, gold production was 62,000oz for

the quarter ended 31 March 2024, compared to 63,000oz for the same

period last year, mainly due to a marginal decrease in recovered

grade, partly offset by higher tonnes processed.

At Obuasi, gold production was 54,000oz for the quarter ended 31

March 2024, in line with the mine plan, compared to 60,000oz for

the same period last year. Total ore tonnes mined and treated were

18% higher when compared with the first quarter of 2023, while

grade was 24% lower, in line with the mine plan. During the first

quarter of 2024, underground ore tonnes treated averaged 91kt/pm,

supported by additional development. The site is contending with

intermittent power disruptions from the public utility. Obuasi is

forecast to produce between 275,000oz and 320,000oz of gold in 2024

and between 325,000oz and 375,000oz of gold in 2025, as it

continues its ramp-up to steady state production.

In Guinea, at Siguiri, gold production (on an

attributable basis) was 41,000oz for the quarter ended 31 March

2024, compared to 63,000oz for the same period last year. Gold

production was lower year-on-year mainly due to poor equipment

availability, lower feed grades and a significant decline in

metallurgical recoveries in the plant, associated with highly

carbonaceous ore feed from parts of the Bidini pit. The mine has

taken delivery of a new excavator in April 2024 and subsequently

prioritised ore from alternative mining areas, which has assisted a

recovery in gold production rates after the quarter-end.

In Tanzania, at Geita, gold production was 114,000oz for

the quarter ended 31 March 2024, compared to 98,000oz for the same

period last year. Gold production was higher year-on-year mainly

due to higher total recovered grade of 2.85g/t, compared to total

recovered grade of 2.70g/t in the same period in 2023. Underground

treated material increased mainly due to a stronger underground

performance, partly offset by a relatively weaker open pit

performance. A strong end to 2023 from the underground mining areas

enabled additions to ore stockpiles, supporting the increased feed

ratio from underground during the first quarter of 2024. In

addition, tonnes treated were higher in the quarter ended 31 March

2024 given the impact of the SAG mill shutdown to replace the girth

gear in the same period last year.

In the DRC, at Kibali, gold production (on an

attributable basis) was 76,000oz for the quarter ended 31 March

2024, compared to 64,000oz for the same period last year. Gold

production was higher year-on-year mainly due to higher recovered

grades resulting from a higher proportion of underground ore tonnes

treated at a higher feed grade as a result of increased underground

efficiency in the quarter ended 31 March 2024 as compared to the

same period in 2023 during which time the mine was converting to

underground multi-lite mining.

In the Americas, gold production (excluding CdS) was

125,000oz of gold (on an attributable basis) for the quarter ended

31 March 2024, compared to 99,000oz for the quarter ended 31 March

2023.

Brazil delivered a significant turnaround following the

operational issues encountered in 2023, with improvements on most

production metrics across both operations. At Cuiabá (AGA

Mineração), gold production was 65,000oz for the quarter ended 31

March 2024, compared to 42,000oz for the same period last year.

Gold production was higher year-on-year mainly due to higher tonnes

processed and higher recovered grades. Cuiabá’s gold production

comprised 21,000oz of gravimetric gold and 44,000oz of

gold-in-concentrate.

At Serra Grande, gold production was 21,000oz for the quarter

ended 31 March 2024, compared to 15,000oz for the same period last

year. Gold production was higher year-on-year mainly due to higher

recovered grades, partly offset by lower tonnes processed.

In Argentina, at Cerro Vanguardia, gold production (on an

attributable basis) was 39,000oz for the quarter ended 31 March

2024, compared to 42,000oz for the same period last year. Gold

production was lower year-on-year mainly due to lower plant

throughput as a result of a planned plant stoppage that was carried

out in March 2024, partly offset by the placement of higher heap

leach tonnes due to operational efficiencies.

In Australia, gold production was 109,000oz of gold (on

an attributable basis) for the quarter ended 31 March 2024,

compared to 125,000oz for the quarter ended 31 March 2023.

At Sunrise Dam, gold production was 56,000oz for the quarter

ended 31 March 2024, compared to 61,000oz for the same period last

year. Gold production was lower year-on-year mainly due to lower

recovered grades, partly offset by higher tonnes processed.

At Tropicana, gold production (on an attributable basis) was

53,000oz for the quarter ended 31 March 2024, compared to 64,000oz

for the same period last year. Gold production was lower

year-on-year mainly due to lower tonnes processed. As noted above,

gold production was impacted by heavy rains and flooding during the

month of March. The area in which the Tropicana gold mine is

located received 312mm of rain in a 72-hour period from 9 March,

almost 40% higher than its average annual rainfall. The subsequent

flooding interrupted power supply to the processing plant and

required mining operations to be temporarily suspended. Since the

flooding, remedial work to recommence operations was successfully

completed and mining and processing has since restarted. The impact

of the rainfall event at Tropicana is expected to continue into the

second quarter of 2024 as water continues to be pumped out of the

Havana 5 pit, which was scheduled to be the main source of open pit

ore in the first half of 2024. The operation expects to process

proportionally more ore from stockpiles whilst ore from Havana 5

has been deferred into the second half of 2024. The impact on gold

production at Tropicana during the first half of 2024 is expected

to be partly offset in the second half of the year, as higher-grade

ore from the Havana 5 pit becomes available and the Havana 4 pit

ramps up production.

GUIDANCE

The Company provided gold production guidance for 2024 in

February, which remains unchanged. Gold production is again

expected to be second half weighted, with fourth quarter gold

production expected to be the strongest quarter this year.

2024

Gold Production (000oz)

Gold Production

– Subsidiaries

2,270 - 2,430

– Joint ventures

320 - 360

– Group

2,590 - 2,790

Estimates assume neither operational or labour interruptions

(including any further delays in the ramp-up of the Obuasi

redevelopment project), or power disruptions, nor further changes

to asset portfolio and/or operating mines. Other unknown or

unpredictable factors, or factors outside the Company’s control,

could also have material adverse effects on AngloGold Ashanti’s

future gold production and no assurance can be given that any

expectations expressed by AngloGold Ashanti will prove to have been

correct. Measures taken at AngloGold Ashanti’s operations together

with AngloGold Ashanti’s business continuity plans aim to enable

its operations to deliver in line with its gold production targets.

Actual gold production could differ from guidance and any

deviations may be significant. Please refer to the Risk Factors

section in AngloGold Ashanti’s annual report on Form 20-F for the

year ended 31 December 2023 filed with the United States Securities

and Exchange Commission (“SEC”).

SAFETY UPDATE

The Company recorded a fatality-free first quarter of 2024 at

the mines it operates. The TRIFR, the broadest measure of workplace

safety, was 1.08 injuries per million hours worked for the first

quarter of 2024 and 0.85 injuries per million hours worked for the

fourth quarter of 2023. By comparison, the most recent ICMM average

(2022) amounts to 2.66 injuries per million hours worked.

UPDATE ON CAPITAL PROJECTS

Obuasi

UHDF trial update

The underhand drift and fill (“UHDF”) mining method trial in

Block 8 Lower progressed well during the first quarter of 2024. The

UHDF trial aims to test the mining method to ensure it can be used

safely and effectively to mine high-grade ore in areas with poor

ground conditions associated with weak graphitic shears and

increasing mining depth.

Milestones achieved in the first quarter of 2024:

- Developed alongside paste-filled 3,300 level drive to expose

and test paste strength.

- Confirmed in-situ paste strength in this parallel drive, and

installed ground support.

- Trialed slag-based binders to increase backfill strength and

reduce curing times.

- Paste backfill commenced on 24 April 2024 and completed

successfully in single pour.

- Paste curing successfully achieved required strength within 14

days.

Next steps:

- Development beneath paste-fill scheduled to commence on 9 May

2024.

- Annualised production rate of 360,000oz is expected in the

third quarter of 2024.

Phase 3

Phase 3 of the Obuasi redevelopment project relates primarily to

capital expenditure required to refurbish and return to service the

KMS shaft and associated infrastructure. This infrastructure

project, which provides direct access to the high-grade Block 11

and other underground mining areas and augments current underground

materials handling capacity, is expected to be completed by the end

of 2024 after being extended during 2023 when mud, encountered on

5,000 and 5,100 levels, had to be cleared.

Phase 3 achieved the following milestones in the first quarter

of 2024:

- Commissioned the first 100 l/sec pumping system of the three

pumping systems planned.

- Completed reaming of the 945m vent raise marking a significant

achievement for a raise bore.

- Completed the man winder upgrades to a modern thyristor

controlled winder.

- Re-entered 50 level to complete the final works ahead of

starting the installation of the lower shaft loading system.

The next key project milestones include:

- Completion of two new ore passes between upper mine and the

rail transport level.

- Completion of new pump stations and pump columns allowing 300

l/sec shaft pumping.

- Installation and commissioning of the new vent shaft.

- Commissioning the rail system.

- Clearing mud on 5,100 level and shaft bottom.

Tropicana

The Havana underground feasibility study commenced in the third

quarter of 2023 and is expected to continue into the first half of

2024. A final investment decision is expected to be made in 2024.

Development of a link drive began during the first quarter of 2024

to provide access to additional drill areas between Tropicana and

Havana. The link drive is expected to ultimately link up with the

Havana underground.

Tropicana ESG renewables

The Tropicana renewable energy project is on track with the

delivery and installation of the wind turbines and solar plant

expected to commence in the second quarter of 2024. The renewable

energy project is expected to be commissioned in the first quarter

of 2025 and, upon completion, is expected to reduce greenhouse gas

(“GHG”) emissions at Tropicana by 65,000 tonnes per annum on

average over the 10-year life of the power purchase agreement.

North Bullfrog Project (“NBP”)

AngloGold Ashanti’s board of directors approved the feasibility

study for the NBP to proceed into detailed engineering. The NBP

received spend approval from AngloGold Ashanti’s Management

Investment Committee to pursue detailed engineering during 2024.

Permitting processes are underway for the NBP. In early April 2024,

the U.S. Bureau of Land Management (“BLM”) published the Notice of

Intent to Prepare an Environmental Impact Statement in the Federal

Register.

Good progress was made during the first quarter of 2024, with

the hiring of the owner’s engineering team largely completed along

with the completion of the front-end engineering and design of the

mill facility, and earthworks for the heavy mobile equipment

assembly yard. The NBP remains on schedule, contingent on receipt

of the requisite permits, to commence anticipated gold production

in 2026.

Merlin

Successful completion of the concept study at the end of 2023

allowed the Merlin project to proceed to the next stage gate of the

pre- feasibility study (“PFS”). The PFS programme is expected to be

performed through the middle of 2025 with a focus on an extensive

drilling programme and further optimisation of development options

considered as part of the framing review in the first half of

2024.

Quebradona

Following the decision of Colombia’s national environmental

agency (“ANLA”) in November 2021 to archive the Company’s

environmental licence application related to the Quebradona

Project, and the confirmation of such decision in April 2022,

AngloGold Ashanti has been working to complete the data acquisition

required by ANLA. AngloGold Ashanti is in the process of preparing

a new Environmental Impact Assessment in connection with its

environmental licence application for the project, which is

currently expected to be submitted to ANLA in 2027. In addition, an

optimised feasibility study is currently underway to implement

improvements in water management, operational flexibility,

maintainability, and constructability.

CORPORATE UPDATE

Proposed Tarkwa / Iduapriem Joint Venture

In March 2023, AngloGold Ashanti announced the proposed joint

venture between the Iduapriem mine and Gold Fields neighbouring

Tarkwa mine in Ghana, that has the potential to create Africa’s

largest gold mine. In addition to leveraging operating efficiencies

to unlock higher grades and enabling an extension of life to at

least 18 years, the proposed joint venture is expected to create

compelling shared value for all stakeholders.

Since the announcement, AngloGold Ashanti and Gold Fields have

been in ongoing engagement with the Government of Ghana with

respect to the proposed transaction. While significant progress has

been made, agreement has not yet been reached. The Company will

continue to keep the market updated on any significant developments

in this regard.

AngloGold Ashanti makes a strategic investment in G2

Goldfields Inc.

On 19 January 2024, AngloGold Ashanti completed its acquisition

of an 11.7% interest in G2 Goldfields Inc., a Canadian gold mining

company with exploration properties in Guyana, South America, for a

consideration of approximately CAD $22.1m.

Appointment of Group Company Secretary

The Company has appointed Ms. Catherine Stead as Group Company

Secretary of AngloGold Ashanti plc with effect from 1 April 2024.

The mandate of Ms. Helen Grantham as Interim Group Company

Secretary expired at the end of March 2024.

Reporting Update

AngloGold Ashanti qualifies as a foreign private issuer (“FPI”)

in the United States for purposes of the US Securities Exchange Act

of 1934, as amended (the “US Exchange Act”), is filing annual

reports on Form 20-F and is furnishing current reports on Form 6-K

with the SEC as the SEC has prescribed for FPIs. AngloGold Ashanti

had previously announced that it was planning to voluntarily file

annual reports on Form 10-K, quarterly reports on Form 10-Q and

current reports on Form 8-K with the SEC, that is, the forms that

the SEC has prescribed for more comprehensive reporting by US

domestic issuers, instead of filing on the reporting forms

available to FPIs, starting with the 10-Q filing for the second

quarter of 2024. AngloGold Ashanti remains committed to voluntarily

transition to reporting on US domestic forms, but now plans to do

so at a later date which will be communicated to the market in

advance of that transition. Until it commences voluntary reporting

on US domestic forms, AngloGold Ashanti will provide full financial

and operational updates, including unaudited condensed consolidated

interim financial statements, on a quarterly basis, which will be

furnished on current reports on Form 6-K with the SEC.

Operations at a glance

for the quarters ended 31

March 2024, 31 December 2023 and 31 March 2023

Gold production

oz (000)

Open-pit treated

000 tonnes

Underground milled /

treated

000 tonnes

Other milled / treated

000 tonnes

Open-pit recovered

grade

g/tonne

Underground recovered

grade

g/tonne

Other recovered grade

g/tonne

Total recovered grade

g/tonne

Mar-24

Dec-23

Mar-23

Mar-24

Dec-23

Mar-23

Mar-24

Dec-23

Mar-23

Mar-24

Dec-23

Mar-23

Mar-24

Dec-23

Mar-23

Mar-24

Dec-23

Mar-23

Mar-24

Dec-23

Mar-23

Mar-24

Dec-23

Mar-23

AFRICA Joint Ventures

76

93

64

509

478

538

416

433

342

—

—

—

0.97

1.72

1.32

4.48

4.76

3.71

—

—

—

2.55

3.17

2.25

Kibali - Attributable 45% (1)

76

93

64

509

478

538

416

433

342

—

—

—

0.97

1.72

1.32

4.48

4.76

3.71

—

—

—

2.55

3.17

2.25

AFRICA Subsidiaries

271

338

284

3,972

4,924

4,138

902

1,118

784

50

87

38

1.07

1.15

1.24

4.59

4.24

4.68

1.05

1.15

1.05

1.71

1.72

1.78

Iduapriem

62

79

63

1,273

1,516

1,233

—

—

—

—

—

—

1.53

1.61

1.58

—

—

—

—

—

—

1.53

1.61

1.58

Obuasi

54

61

60

—

—

—

273

286

235

50

87

38

—

—

—

5.91

6.30

7.74

1.05

1.15

1.05

5.15

5.10

6.81

Siguiri - Attributable 85%

41

56

63

2,084

2,700

2,324

—

—

—

—

—

—

0.61

0.65

0.86

—

—

—

—

—

—

0.61

0.65

0.86

Geita

114

142

98

615

708

581

629

832

549

—

—

—

1.65

2.10

2.06

4.02

3.53

3.38

—

—

—

2.85

2.87

2.70

AUSTRALIA

109

158

125

1,449

1,616

1,716

892

1,002

890

—

—

—

0.83

1.64

0.93

2.45

2.24

2.59

—

—

—

1.45

1.87

1.50

Sunrise Dam

56

62

61

325

377

349

648

631

603

—

—

—

0.98

1.25

1.27

2.19

2.31

2.44

—

—

—

1.78

1.91

2.01

Tropicana - Attributable 70%

53

96

64

1,124

1,239

1,367

244

371

287

—

—

—

0.79

1.76

0.84

3.14

2.13

2.91

—

—

—

1.21

1.85

1.20

AMERICAS (2)

125

136

99

187

201

211

422

476

430

676

772

597

1.86

2.24

2.10

4.53

4.45

3.87

2.41

2.15

1.61

3.03

2.92

2.48

Cerro Vanguardia - Attributable

92.50%

39

38

42

187

178

205

90

125

85

434

432

406

1.86

2.35

2.13

6.96

5.04

8.03

0.57

0.32

0.46

1.71

1.62

1.87

AngloGold Ashanti Mineração (2)

(3)

65

73

42

—

—

—

117

84

109

242

340

191

—

—

—

5.50

9.00

4.70

5.72

4.47

4.05

5.65

5.37

4.29

Serra Grande

21

25

15

—

23

6

215

267

236

—

—

—

—

1.39

1.07

2.98

2.74

1.99

—

—

—

2.98

2.63

1.97

Subsidiaries (2)

505

632

508

5,608

6,741

6,065

2,216

2,596

2,104

726

859

635

1.03

1.30

1.18

3.72

3.51

3.63

2.32

2.05

1.58

1.84

1.93

1.80

Joint Ventures

76

93

64

509

478

538

416

433

342

—

—

—

0.97

1.72

1.32

4.48

4.76

3.71

—

—

—

2.55

3.17

2.25

Total including equity-accounted joint

ventures (2)

581

725

572

6,117

7,219

6,603

2,632

3,029

2,446

726

859

635

1.03

1.33

1.19

3.84

3.69

3.64

2.32

2.05

1.58

1.91

2.03

1.84

(1)

Equity-accounted joint venture.

(2)

Adjusted to exclude the Córrego do Sítio

(CdS) operation that was placed on care and maintenance in August

2023. CdS produced nil koz, 2koz and 12koz for the quarters ended

31 March 2024, 31 December 2023 and 31 March 2023,

respectively.

(3)

Includes gold concentrate from the Cuiabá

mine sold to third parties. Rounding of figures may result in

computational discrepancies.

Administration and corporate information

AngloGold Ashanti plc Incorporated in England & Wales

Registration No. 14654651 LEI No. 2138005YDSA7A82RNU96

Share codes: ISIN: GB00BRXH2664 CUSIP: G0378L100 NYSE: AU

JSE: ANG A2X: ANG GhSE (Shares): AGA GhSE (GhDS): AAD

JSE Sponsor: The Standard Bank of South Africa

Limited

Auditors: PricewaterhouseCoopers Inc.

Offices Registered and Corporate 4th Floor,

Communications House South Street Staines-upon-Thames Surrey TW18

4PR United Kingdom Telephone: +44 (0) 203 968 3320 Fax: +44 (0) 203

968 3325

Australia Level 10, AMP Building 140 St George’s Terrace

Perth, WA 6000 (PO Box Z5046, Perth WA 6831) Australia Telephone:

+61 8 9425 4602 Fax: +61 8 9425 4662

Ghana Gold House Patrice Lumumba Road (PO Box 2665) Accra

Ghana Telephone: +233 303 773400 Fax: +233 303 778155

Directors Executive A Calderon▲ (Chief Executive

Officer) GA Doran▲ (Chief Financial Officer)

Non-Executive MDC Ramos^ (Chairman) KOF Busia△ AM

Ferguson* AH Garner# R Gasant^ SP Lawson# J Magie§ MC Richter#~ DL

Sands# JE Tilk§

* British § Canadian #American ▲Australian ~Panamanian ^South

African △Ghanaian

Officers C Stead Company Secretary

Company secretarial e-mail

Companysecretary@anglogoldashanti.com

AngloGold Ashanti website www.anglogoldashanti.com

Share Registrars United States Computershare Trust

Company, N.A. 150 Royall Street Suite 101 Canton, MA 02021 United

States of America Telephone US: 866-644-4127 Telephone non-US:

+1-781-575-2000 Shareholder Online Inquiries:

https://www-us.computershare.com/Investor/#Contact Website:

www.computershare.com/investor

South Africa Computershare Investor Services (Pty)

Limited Rosebank Towers, 15 Biermann Avenue Rosebank, 2196 (PO Box

61051, Marshalltown 2107) South Africa Telephone: 0861 100 950 (in

SA) Fax: +27 11 688 5218 E-mail: queries@computershare.co.za

Website: www.computershare.com

Ghana Central Securities Depository (GH) LTD 4th Floor,

Cedi House PMB CT 465, Cantonments Accra, Ghana Telephone: +233 302

689313 Fax: +233 302 689315

Ghana depositary NTHC Limited 18 Gamel Abdul Nasser

Avenue Ringway Estate Accra, Ghana Telephone: +233 302 235814/6

Fax: +233 302 229975

AngloGold Ashanti posts information that may be important to

investors on the main page of its website at

www.anglogoldashanti.com and under the “Investors” tab on the main

page. This information is updated periodically. AngloGold Ashanti

intends to use its website as a means of disclosing material

non-public information to the public in a broad, non-exclusionary

manner and for complying with its disclosure obligations.

Accordingly, investors should visit this website regularly to

obtain important information about AngloGold Ashanti, in addition

to following its press releases, documents it files with, or

furnishes to, the United States Securities and Exchange Commission

(SEC) and public conference calls and webcasts. No material on the

AngloGold Ashanti website forms any part of, or is incorporated by

reference into, this document. References herein to the AngloGold

Ashanti website shall not be deemed to cause such

incorporation.

PUBLISHED BY ANGLOGOLD ASHANTI

Forward-looking statements

Certain statements contained in this document, other than

statements of historical fact, including, without limitation, those

concerning the economic outlook for the gold mining industry,

expectations regarding gold prices, production, total cash costs,

all-in sustaining costs, all-in costs, cost savings and other

operating results, return on equity, productivity improvements,

growth prospects and outlook of AngloGold Ashanti’s operations,

individually or in the aggregate, including the achievement of

project milestones, commencement and completion of commercial

operations of certain of AngloGold Ashanti’s exploration and

production projects and the completion of acquisitions,

dispositions or joint venture transactions, AngloGold Ashanti’s

liquidity and capital resources and capital expenditures, the

consequences of the COVID-19 pandemic and the outcome and

consequences of any potential or pending litigation or regulatory

proceedings or environmental, health and safety issues, are

forward-looking statements regarding AngloGold Ashanti’s financial

reports, operations, economic performance and financial condition.

These forward-looking statements or forecasts are not based on

historical facts, but rather reflect our current beliefs and

expectations concerning future events and generally may be

identified by the use of forward-looking words, phrases and

expressions such as “believe”, “expect”, “aim”, “anticipate”,

“intend”, “foresee”, “forecast”, “predict”, “project”, “estimate”,

“likely”, “may”, “might”, “could”, “should”, “would”, “seek”,

“plan”, “scheduled”, “possible”, “continue”, “potential”,

“outlook”, “target” or other similar words, phrases, and

expressions; provided that the absence thereof does not mean that a

statement is not forward-looking. Similarly, statements that

describe our objectives, plans or goals are or may be

forward-looking statements. These forward-looking statements or

forecasts involve known and unknown risks, uncertainties and other

factors that may cause AngloGold Ashanti’s actual results,

performance, actions or achievements to differ materially from the

anticipated results, performance, actions or achievements expressed

or implied in these forward-looking statements. Although AngloGold

Ashanti believes that the expectations reflected in such

forward-looking statements and forecasts are reasonable, no

assurance can be given that such expectations will prove to have

been correct. Accordingly, results, performance, actions or

achievements could differ materially from those set out in the

forward-looking statements as a result of, among other factors,

changes in economic, social, political and market conditions,

including related to inflation or international conflicts, the

success of business and operating initiatives, changes in the

regulatory environment and other government actions, including

environmental approvals, fluctuations in gold prices and exchange

rates, the outcome of pending or future litigation proceedings, any

supply chain disruptions, any public health crises, pandemics or

epidemics (including the COVID-19 pandemic), the failure to

maintain effective internal control over financial reporting or

effective disclosure controls and procedures, the inability to

remediate one or more material weaknesses, or the discovery of

additional material weaknesses, in the Company’s internal control

over financial reporting, and other business and operational risks

and challenges and other factors, including mining accidents. For a

discussion of such risk factors, refer to AngloGold Ashanti’s

annual report on Form 20-F for the year ended 31 December 2023

filed with the United States Securities and Exchange Commission

(SEC). These factors are not necessarily all of the important

factors that could cause AngloGold Ashanti’s actual results,

performance, actions or achievements to differ materially from

those expressed in any forward-looking statements. Other unknown or

unpredictable factors could also have material adverse effects on

AngloGold Ashanti’s future results, performance, actions or

achievements. Consequently, readers are cautioned not to place

undue reliance on forward-looking statements. AngloGold Ashanti

undertakes no obligation to update publicly or release any

revisions to these forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events, except to the extent required by applicable

law. All subsequent written or oral forward-looking statements

attributable to AngloGold Ashanti or any person acting on its

behalf are qualified by the cautionary statements herein.

Non-GAAP financial measures

This communication may contain certain “Non-GAAP” financial

measures. AngloGold Ashanti utilises certain Non-GAAP performance

measures and ratios in managing its business. Non-GAAP financial

measures should be viewed in addition to, and not as an alternative

for, the reported operating results or cash flow from operations or

any other measures of performance prepared in accordance with IFRS.

In addition, the presentation of these measures may not be

comparable to similarly titled measures other companies may

use.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509438167/en/

Investor Relations contacts Yatish Chowthee Telephone:

+27 11 637 6273 Mobile: +27 78 364 2080 E-mail:

yrchowthee@anglogoldashanti.com

Andrea Maxey Telephone: +61 08 9425 4603 Mobile: +61 400

072 199 E-mail: amaxey@anglogoldashanti.com

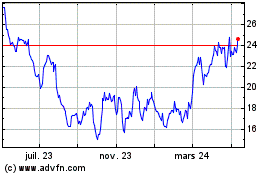

AngloGold Ashanti (NYSE:AU)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

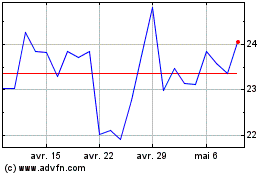

AngloGold Ashanti (NYSE:AU)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025