Future Capital and Axos Clearing to Enable 401(k) Management for Financial Advisors

04 Février 2025 - 3:03PM

Business Wire

Integration enables advisors to provide

professional management for clients' held-away retirement

assets

Future Capital, a tech-enabled registered investment advisor

(RIA) specializing in personalized retirement solutions, and Axos

Clearing, a subsidiary of Axos Financial Inc. (NYSE: AX), announced

today an integration that will give financial advisors the ability

to manage their clients’ workplace retirement accounts.

This partnership integrates Future Capital's Core and Construct

platforms into the Axos Professional Workstation, a key component

of Axos Complete, allowing firms to seamlessly incorporate

held-away retirement assets into their strategies. Axos Complete is

a fully integrated ecosystem designed to simplify operations,

ignite innovation, and empower firms to stay ahead. It combines

advanced technology, premier financial solutions, and the

full-service expertise of Axos Clearing.

Using Core, advisors can introduce their wealth clients to

Future Capital’s discretionary management service for held-away

retirement assets. Alternatively, they can use Construct to

exercise full discretionary authority over these retirement

accounts, along with the flexibility to build customized portfolios

and set their own fee arrangements. This expanded capability

enables financial advisors with the potential to increase their

assets under administration while providing more comprehensive

wealth management services to their clients.

"For financial advisors, managing held-away retirement assets

has long been a critical gap in their service offering - one that

directly impacts their ability to deliver comprehensive wealth

management," said Mike Row, Chief Revenue Officer of Future

Capital. "Our integration with Axos Complete will address this

challenge head-on, giving advisors the power to actively manage

their clients' retirement assets alongside their other investments.

This enables advisors to provide truly holistic financial guidance

while expanding their practices through new revenue streams."

David Crow, EVP, Head of Axos Clearing, said, “Integrating

Future Capital’s platform into the Axos Complete ecosystem enhances

the value we deliver to wealth management firms by expanding their

ability to manage retirement assets alongside broader financial

strategies. This partnership strengthens Axos Clearing’s role as a

trusted partner, equipping advisors with innovative tools, seamless

integrations, and comprehensive support to better serve their

clients.”

The integration enables Axos Clearing client firms to:

- Manage clients held-away 401(k) assets (Construct)

- Build custom allocations with complete portfolio customization

(Construct)

- Determine their own fee structure (Construct)

- Introduce these accounts to Future Capital for management

(Core)

- Identify rollover opportunities

- Access comprehensive household financial data

For more information about Future Capital’s Core, Construct, or

other services, go to

https://www.futurecapital.com/for-advisors/held-away-401-k-asset-management.

About Axos Clearing

Axos Financial, Inc., with approximately $23.7 billion in

consolidated assets as of December 31, 2024, is the holding company

for Axos Bank, Axos Clearing LLC and Axos Invest, Inc. Axos Bank

provides consumer and business banking products nationwide through

its low-cost distribution channels and affinity partners. Axos

Clearing LLC (including its business division Axos Advisor

Services), with approximately $37.7 billion of assets under custody

and/or administration as of December 31, 2024, and Axos Invest,

Inc., provide comprehensive securities clearing services to

introducing broker-dealers and registered investment advisor

correspondents, and digital investment advisory services to retail

investors, respectively. Axos Financial, Inc.’s common stock is

listed on the NYSE under the symbol “AX,” and is a component of the

Russell 2000® Index, the S&P SmallCap 600® Index, the KBW

Nasdaq Financial Technology Index, and the Travillian Tech-Forward

Bank Index. For more information regarding Axos Clearing, please

visit https://www.axosclearing.com.*

* Bank products and services are offered by Axos Bank®. All

deposit accounts through Axos Bank brands are FDIC insured through

Axos Bank. All deposit accounts of the same ownership and/or

vesting held at Axos Bank are combined and insured under the same

FDIC Certificate 35546. All deposit accounts through Axos Bank

brands are not separately insured by the FDIC from other deposit

accounts held with the same ownership and/or vesting at Axos Bank.

For more information read Axos Bank’s FDIC Notice

https://www.axosbank.com/Legal/FDIC-Notice.

About Future Capital

Future Capital brings two decades of retirement technology

experience to the wealth management industry. The company develops

digital solutions and managed account services to transform advisor

and individual retirement planning approaches. Through its

retirement solutions, Future Capital helps financial professionals

deliver personalized guidance while empowering participants to make

informed decisions. The company serves financial institutions

including broker-dealers, RIAs, recordkeepers, advisors, plan

sponsors, and participants.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204399225/en/

Media Contacts Anthony Sims VP of Marketing 423.999.2712

asims@futurecapital.com Abbie Sheridan Public Relations

516.286.7056 axosclearing@greenrosepr.com Johnny Lai Investor

Relations 858-649-2218 jlai@axosfinancial.com

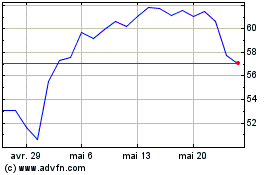

Axos Financial (NYSE:AX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

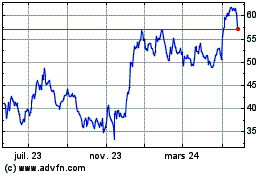

Axos Financial (NYSE:AX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025