UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th Floor,

Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F S Form

40-F £

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes £ No

S

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes £ No

S

TABLE OF CONTENTS

Page

| CERTAIN TERMS AND CONVENTIONS |

3 |

| RECENT DEVELOPMENTS |

4 |

| OPERATING AND FINANCIAL REVIEW |

7 |

CERTAIN TERMS AND

CONVENTIONS

In this Report on Form 6-K,

the terms “Azul,” “the Company,” “we,” “us” and “our” refer to Azul S.A.,

a sociedade por ações incorporated under the laws of Brazil, and its subsidiaries on a consolidated basis, unless the context

requires otherwise.

Acronyms used repeatedly,

defined and technical terms, specific market expressions and the full names of our main subsidiaries and other entities referenced in

this current report on Form 6-K are defined, explained or detailed in our Annual Report on Form 20-F for the fiscal year ended December 31,

2022, filed with the SEC on April 20, 2023, as amended by Form 20-F/A filed with the SEC on December 28, 2023 (“2022 Form 20-F”).

This current report on Form

6-K should be read together with (i) our unaudited condensed consolidated interim financial statements as of September 30, 2023 and for

the nine-month periods ended September 30, 2023 and September 30, 2022 and (ii) our 2022 Form 20-F, in particular, “Item 4.

Information on the Company” and “Item 5. Operating and Financial Review and Prospects.”

RECENT DEVELOPMENTS

Completion of Aircraft Lessor and OEM Supplier Restructuring

On September 29, 2023, Azul completed the restructuring

of its obligations with certain aircraft lessors and aircraft and engine original equipment manufacturers (“OEMs”). The terms

of the restructuring included: (i) the elimination of lease payment obligations that had previously been deferred during the COVID-19

pandemic, (ii) a permanent reduction in lease payments from original contractual lease rates to agreed-upon current market rates, (iii)

the deferral of certain payments to lessors and OEMs, as well as certain obligations under supplier agreements, and (iv) other concessions

including improved end-of-lease compensation obligations and aircraft return conditions, the elimination of future maintenance reserves

payments, and the negotiated early termination of certain aircraft leases.

As part of this restructuring, Azul restructured

and reprofiled substantially all of its aggregate payment obligations under its aircraft lease agreements and agreements with OEMs.

Moreover, pursuant to this restructuring, on

September 28, 2023, Azul Investments LLP (“Azul Investments”) issued to certain lessors and OEMs an aggregate of US$370,490,204

principal amount of 7.500% Senior Notes due 2030 (the “Lessor/OEM Notes”), which were issued in satisfaction on a dollar-for-dollar

basis of certain payment and other obligations owed to such lessors and OEMs. The Lessor/OEM Notes are issued by Azul Investments, are

guaranteed by the Parent Guarantor and Azul Linhas and are unsecured.

In addition, pursuant to this restructuring,

certain lessors and OEMs entered into agreements pursuant to which such lessors and OEMs agreed to convert, in 12 equal quarterly consecutive

installments, an aggregate of up to US$570 million of payment and other obligations owed to such lessors and OEMs into preferred shares

of Azul (“preferred shares”). Azul shall commence making quarterly issuances of preferred shares in July 2024 (in respect

of one lessor) or January 2025 (in respect of all other lessors and OEMs), with the issuance of all preferred shares issuable under the

relevant agreements scheduled to be completed by October 2027.

The terms of the relevant agreements provide

that the relevant payment and other obligations shall be satisfied through the issuance of preferred shares at a notional subscription

price of R$36.00 per preferred share. The terms of the relevant agreements provide for upside and downside limitations, whereby if the

trading price of Azul’s preferred shares is lower than R$36.00 on the date that is two business days prior to the relevant meeting

of the board of directors of Azul to be held to ratify the capital increase required for the relevant quarterly issuance of preferred

shares (each, a “measurement date”), Azul is required to compensate the relevant lessors and OEMs for the difference through

the issuance of additional preferred shares. If the trading price of Azul’s preferred shares is higher than R$39.60 on any such

measurement date, the number of preferred shares issuable pursuant to the relevant agreements is capped at a subscription price of R$39.60

per preferred share. Azul shall be entitled to satisfy its obligation to issue preferred shares in respect of any installment by making

a cash payment equal to the amount of the relevant payment and other obligations that would have been converted into preferred shares

in such installment plus the relevant maximum upside amount.

Furthermore, during the fourth quarter of 2023,

two additional lessors entered into agreements pursuant to which such lessors agreed, among other things, to convert certain payment and

other obligations owed to such lessors into preferred shares and promissory notes payable upon the expiry of the relevant lease, and to

apply certain maintenance reserve amounts to offset payment obligations owed to the relevant lessor on a dollar-for-dollar basis.

Issuance of 2028 Notes

In July 2023, our subsidiary

Azul Secured Finance LLP issued and priced a private offering of US$800,000,000 in aggregate principal amount at a nominal interest rate

of 11.930% p.a., to be paid quarterly, on February, May, August and November of each year, beginning in November 2023 (the “2028

Notes”). The senior notes will mature on August 2028, unless redeemed or repurchased in advance and canceled, in accordance with

the terms of the issuance. In October 2023, Azul Secured Finance LLP issued additional notes in the amount of US$36,778,000 of the 2028

Notes. The additional notes were issued to a professional investor in exchange of the aggregate principal amount of US$37,730,000 of the

5.875% Senior Notes due 2024 issued by Azul Investments LLP (the “2024 Notes”).

Debt Installment Plan

In November 2023, we entered

into a debt installment plan in connection with airport taxes and fees for a period of 60 months, in the amount of R$797,275,000.

OPERATING AND FINANCIAL

REVIEW

Results of Operations

The financial data contained herein as of September

30, 2023 and for the nine-month period ended September 30, 2023 and 2022, respectively, is derived from our unaudited interim condensed

consolidated financial statements. Certain components of our results of operations for the nine-month period ended September 30, 2023

compared to the nine-month period ended September 30, 2022 are as described below, but this financial data does not purport to contain

all of the relevant information about Azul and should be reviewed in conjunction with the financial statements and the related notes included

in our 2022 Form 20-F and our unaudited interim condensed consolidated financial statements as of September 30, 2023:

| |

For the Nine-Month Period

Ended September 30,

|

|

| |

2023 |

2022 |

| |

(Unaudited)

(in thousands of Brazilian Reais) |

|

| Net revenue: |

|

|

|

| Passenger revenue |

12,687,363 |

10,475,009 |

21.1% |

| Other revenues |

961,600 |

1,019,606 |

(5.7)% |

| Total revenue |

13,648,963 |

11,494,615 |

18.7% |

| Operating expenses: |

|

|

|

| Aircraft fuel |

(4,377,466) |

(4,787,823) |

(8.6)% |

| Salaries and benefits |

(1,728,534) |

(1,439,373) |

20.1% |

| Airport fees |

(785,883) |

(660,713) |

18.9% |

| Traffic and customer servicing(1) |

(594,950) |

(453,393) |

31.2% |

| Maintenance and repairs |

(665,839) |

(452,432) |

47.2% |

| Sales and marketing |

(559,121) |

(481,572) |

16.1% |

| Depreciation and amortization(2) |

(1,820,347) |

(1,521,457) |

19.6% |

| Impairment |

— |

346,114 |

— |

| Insurance |

(46,375) |

(59,950) |

(22.6)% |

| Other |

(1,929,362) |

(1,646,165) |

17.2% |

| Total operating expenses |

(12,507,877) |

(11,156,764) |

12.1% |

| Operating profit (loss) |

1,141,086 |

337,851 |

237.7% |

| Financial result: |

|

|

|

| Financial income |

143,883 |

191,230 |

(24.8)% |

| Financial expenses |

(4,339,550) |

(3,481,458) |

24.6% |

| Derivative financial instruments, net |

(44,228) |

532,073 |

(108.3)% |

| Foreign currency exchange, net |

771,190 |

591,884 |

30.3% |

| Financial result |

(3,468,705) |

(2,166,271) |

60.1% |

| Net (loss) profit for the period |

(2,327,619) |

(1,828,420) |

27.3% |

| |

|

|

|

|

| (1) | For the nine-month period ended September 30, 2022, this line item was titled “passenger expenses.” |

| (2) | Net of the Social Integration Program (Programa de Integração Social) and Social Contribution to Social Security

Financing (Contribuição Social para o Financiamento da Seguridade Social) credits in the amount of R$1,278 thousand. |

In the nine-month period ended September 30,

2023, we reported an operating profit of R$1,141.1 million, compared to an operating profit of R$337.9 million in the nine-month period

ended September 30, 2022. Our operating profit for the nine-month period ended September 30, 2023 included non-recurring items, which

include gains and expenses that management considers non-recurring in nature, such as our capital optimization plan in addition to other

restructuring-related expenses.

In the nine-month period ended September 30,

2023, we reported a net loss of R$2,327.6 million, compared to a net loss of R$1,828.4 million in the nine-month period ended September

30, 2022. This was driven by losses on derivative instruments and higher financial expenses related to the capital optimization plan.

The table below sets forth a breakdown of our

net revenue and expenses on a per-ASK basis (“available seat kilometers,” or “ASKs,” represents aircraft seating

capacity multiplied by the number of kilometers the aircraft is flown) for the periods indicated:

| |

For the Nine-Month

Period ended September 30, |

Percent Change |

| |

2023 |

2022 |

| |

(per ASK in cents of Brazilian Reais) |

|

| Operating revenue per ASK: |

|

|

|

| Passenger revenue |

39.7 |

39.4 |

0.8% |

| Cargo revenue and other |

2.9 |

2.9 |

0.0% |

| Operating revenue (RASK) |

42.6

|

42.3

|

0.7% |

| Operating expenses per ASK: |

|

|

|

| Aircraft fuel |

11.8 |

18.4 |

(35.6)% |

| Salaries and benefits |

5.4 |

5.4 |

0.8% |

| Depreciation and amortization |

5.4 |

5.0 |

7.6% |

| Airport fees |

2.4 |

2.3 |

3.3% |

| Traffic and customer servicing |

1.8 |

1.6 |

10.9% |

| Sales and marketing |

1.8 |

1.9 |

(6.5)% |

| Maintenance and repairs |

2.5 |

1.2 |

106.1% |

| Other operating expenses |

5.7 |

3.1 |

83.1% |

| Total operating expenses (CASK) (1) |

36.8 |

38.9 |

(5.4)% |

| (1) | CASK – cost per available seat kilometer. |

Total Revenue

Total revenue increased 18.7%, or R$2,154.3

million, from R$11,494.6 million in the nine-month period ended September 30, 2022 to R$13,649.0 million in the nine-month period ended

September 30, 2023, as explained below.

The table below sets forth our passenger revenue

and selected operating data for the periods indicated:

| |

For the Nine-Month

Period ended September 30, |

Percent Change |

| |

2023 |

2022 |

| Passenger revenue (in millions of Brazilian reais) |

12,687.4 |

10,475.0 |

21.1% |

| Available seat kilometers (ASKs)(millions) |

32,901 |

29,154 |

12.9% |

| Load factor (%) |

80.60% |

80.30% |

0.3p.p. |

| Passenger revenue per ASK (R$/US$ cents)(PRASK) (1) |

38.6 |

35.9 |

7.3% |

| Operating revenue per ASK (R$/US$ cents)(RASK) (2) |

41.5 |

39.4 |

5.2% |

| Number of departures |

238,773 |

224,894 |

6.2% |

| Block hours |

413,955 |

382,139 |

8.3% |

| (1) | PRASK – passenger revenue per available seat kilometer. |

| (2) | RASK – revenue per available seat kilometer. |

Passenger Revenue

Passenger revenue increased 21.1%, or R$2,212.4

million, from R$10,475.0 million in the nine-month period ended September 30, 2022 to R$12,687.4 million in the nine-month period ended

September 30, 2023, mainly due to our higher capacity compared to the nine-month period ended September 30, 2022, strong demand and disciplined

capacity deployment.

Other Revenues

Other revenues decreased 5.7%, or R$58.0 million,

from R$1,019.6 million in the nine-month period ended September 30, 2022 to R$961.6 million in the nine-month period ended September 30,

2023, as we redeployed widebody aircraft from dedicated cargo operations to passenger service to take advantage of the faster-than-expected

recovery in international travel, which was partially offset by strong domestic demand for our logistics solutions and our exclusive network.

Operating Expenses

Operating expenses increased 12.1%, or R$1,351.1

million, from R$11,156.8 million in the nine-month period ended September 30, 2022, to R$12,507.9 million in the nine-month period ended

September 30, 2023, as explained below.

Aircraft fuel. Aircraft fuel expenses

decreased 8.6%, or R$410.3 million, from R$4,787.8 million in the nine-month period ended September 30, 2022, to R$4,377.5 million in

the nine-month period ended September 30, 2023, mainly due to a reduction in fuel price per liter and a reduction in fuel burn per ASK

as a result of our more efficient next-generation fleet, which was partially offset by an increase in our total capacity.

Salaries and benefits. Salaries and

benefits increased 20.1%, or R$289.1 million, from R$1,439.4 million in the nine-month period ended September 30, 2022, to R$1,728.5 million

in the nine-month period ended September 30, 2023, mostly driven by our capacity increase and an increase in salaries as a result of collective

bargaining agreements with labor unions applicable to all airline employees in Brazil, which was partially offset by our higher employee

productivity.

Airport fees. Airport fees increased

18.9%, or R$125.2 million, from R$660.7 million in the nine-month period ended September 30, 2022, to R$785.9 million in the nine-month

period ended September 30, 2023, primarily to due to the increase in our capacity, especially in our international capacity, which drives

higher airport fees.

Traffic and customer servicing. Traffic

and customer servicing increased 31.2%, or R$141.6 million, from R$453.4 million in the nine-month period ended September 30, 2022, to

R$595.0 million in the nine-month period ended September 30, 2023, primarily due to the resumption of our renowned onboard service during

the second quarter of 2022 after a two-year suspension due to the pandemic and an increase in the number of departures, especially international

departures which have higher expenses, as well as inflation in the period.

Maintenance and repairs. Maintenance

and repairs expenses increased 47.2%, or R$213.4 million, from R$452.4 million in the nine-month period ended September 30, 2022, to R$665.8

million in the nine-month period ended September 30, 2023, mostly driven by the increase in block hours and higher number of maintenance

events in the period, partially offset by savings from the insourcing of maintenance events.

Sales and marketing. Sales and marketing

expenses increased 16.1%, or R$77.5 million, from R$481.6 million in the nine-month period ended September 30, 2022, to R$559.1 million

in the nine-month period ended September 30, 2023, mostly due to the growth in passenger revenue, leading to an increase in credit card

fees and commissions, and the increase in international traffic, which has higher distribution costs.

Depreciation and amortization. Depreciation

and amortization increased 19.6%, or R$298.8 million, from R$1,521.5 million in the nine-month period ended September 30, 2022, to R$1,820.3

million in the nine-month period ended September 30, 2023, mostly driven by the increase in the size of our fleet compared to the existing

fleet in the nine-month period ended September 30, 2022.

Insurance. Insurance decreased 22.6%,

or R$13.6 million, from R$60.0 million in the nine-month period ended September 30, 2022, to R$46.4 million in the nine-month period ended

September 30, 2023, mainly due to a lower number of aircraft in our fleet.

Other. Other expenses increased 17.2%,

or R$283.2 million, from R$1,646.2 million in the nine-month period ended September 30, 2022, to R$1,929.4 million in the nine-month period

ended September 30, 2023, primarily due to the increase in passenger capacity as compared to the capacity we had in the nine-month period

ended September 30, 2022 and higher training expenses as we increased our operations, in addition to an increase of revenue-driven IT

expenses, crewmembers accommodations, cargo last mile operations and flight contingencies.

Operating Profit (Loss)

For the nine-month period ended September 30,

2023, our operating profit was R$1,141.1 million, compared to an operating loss of R$337.9 million for the nine-month period ended September

30, 2022, due to the factors described above.

Financial Results

Financial Income. Financial income decreased

24.8%, or R$47.3 million, from R$191.2 million in the nine-month period ended September 30, 2022, to R$143.9 million in the nine-month

period ended September 30, 2023, mainly due to the reduction of the Brazilian risk-free rate in the period.

Financial Expenses. Financial expenses

increased 24.6%, or R$858.1 million, from R$3,481.5 million in the nine-month period ended September 30, 2022, to R$4,339.6 million in

the nine-month period ended September 30, 2023, mainly due to (i) an increase in interest expense on lease liabilities due to a higher

incremental borrowing rate as a result of lease modifications and an increase in expenses incurred in connection with aircraft lease agreements,

and (ii) an increase in gross debt and in the average interest rate of our U.S. dollar-denominated obligations.

Derivative Financial Instruments, net.

Derivative financial instruments, net, amounted to a gain of R$532.1 million for the nine-month period ended September 30, 2022, and a

loss of R$44.2 million for the nine-month period ended September 30, 2023, a variation of R$576.3 million, due to a fuel hedge gain recorded

during the period. As of September 30, 2023, Azul had hedged approximately 14.9% of its expected fuel consumption for the next twelve

months by using forward contracts and options.

Foreign Currency Exchange, Net. The

net currency exchange effect on our monetary assets and liabilities when remeasured into Brazilian reais amounted to a gain of R$591.9

million in the nine-month period ended September 30, 2022, and to a gain of R$771.2 million in the nine-month period ended September 30,

2023, a variation of 30.3%, or R$179.3 million, mainly due to the 6.2% depreciation of the Brazilian real against the US dollar

in the nine-month period ended September 30, 2023, resulting in an increase in lease liabilities and loans denominated in foreign currency.

Net (Loss) Profit

Net loss was R$2,327.6 million for the nine-month

period ended September 30, 2023, compared to net loss of R$1,828.4 million for the nine-month period ended September 30, 2022, due to

the factors described above.

Liquidity and Capital Resources

General

Our short-term liquidity requirements relate

to the payment of operating costs, including aircraft fuel and salaries, payment obligations under our lease liabilities and loans and

financing (including aircraft debt financing and debentures) and the funding of working capital requirements. Our medium and long-term

liquidity requirements include equity payments for aircraft and debt financing, the working capital required to start up new routes and

new destinations, and payment obligations under our borrowings and financings.

For our short-term liquidity needs, we rely

primarily on cash provided by operations and cash reserves. For our medium and long-term liquidity needs, we rely primarily on cash provided

by operations, cash reserves, working capital loans and bank credit lines including, but not limited to, bank loans, debentures and promissory

notes.

In order to manage our liquidity, we review

our cash and cash equivalents, short-term investments, and trade and other receivables on an ongoing basis. Trade and other receivables

include credit card sales and accounts receivables from travel agencies and cargo transportation. Our accounts receivables are affected

by the timing of our receipt of credit card revenues and travel agency invoicing. One general characteristic of the retail sector in Brazil

and the aviation sector in particular is the payment for goods or services in installments via personal credit cards. Our customers may

pay for their purchases in up to ten installments without interest. This is similar to the payment options offered by other airlines in

Brazil. Once the transaction is approved by the credit card processor, we are no longer exposed to cardholder credit risk, and the payment

is guaranteed by the credit card issuing bank in case of default by the cardholder. Since the risk of non-payment is low, banks are willing

to advance these receivables, which are paid the same day they are requested. As a result, we believe our ability to advance receivables

at any time significantly increases our liquidity position.

As of September 30, 2023, our total cash position

consisting of cash and cash equivalents was R$1,399.4 million, compared to our total cash position consisting of cash and cash equivalents

of R$668.3 million as of December 31, 2022. As of September 30, 2023, we had loans and financing of R$10,423.3 million, compared to R$7,232.7

million as of December 31, 2022, and as of September 30, 2023, our convertible instruments were R$1,150.8 million, compared with R$1,403.7

million as of December 31, 2022.

Since September 30, 2023, we have completed

the restructuring of our obligations with certain aircraft lessors and aircraft and engine OEMs, completed Exchange Offers and the Solicitation,

issued the First Out Notes, completed the 2029 Notes Mandatory Offer to Purchase and completed the Convertible Debentures Mandatory Partial

Early Redemption.

Cash Flows

The table below presents our cash flows from

operating, investing and financing activities for the periods indicated:

| |

For the Nine-Month

Period ended September 30, |

| |

2023 |

2022 |

| |

(Unaudited)

(in Brazilian Reais millions) |

| Cash Flows |

|

|

| Net cash provided by operating activities |

1,540,904 |

1,603,988 |

| Net cash used by investing activities |

(729,776) |

(414,420) |

| Net cash used by financing activities |

(142,764) |

(3,174,811) |

| Exchange rate changes on cash and cash equivalents |

62,680 |

15,192 |

| Net increase (decrease) in cash and cash equivalents |

731,044 |

(1,970,051) |

Net Cash Provided by Operating Activities

Net cash provided by operating activities in

the nine-month period ended September 30, 2023 was R$1,540.9 million, compared to net cash provided by operating activities of R$1,604.0

million in the nine-month period ended September 30, 2022. The decrease in cash flows provided by operating activities was mainly due

to an increase in suppliers and interest payments in the period.

Net Cash Used by Investing Activities

Net cash used by investing activities was R$729.8

million in the nine-month period ended September 30, 2023, compared to the net cash used by investing activities of R$414.4 million in

the nine-month period ended September 30, 2022. The increase in cash used in investing activities is mostly related to restricted cash

of R$256.5 million in the nine-month period ended September 30 2023 and no cash received on sale of property and equipment and in leasebacks

operation in the nine-month period ended September 30 2023, which was offset by a decrease in acquisition of property and equipment and

acquisition of capitalized maintenance.

Net Cash Used by Financing Activities

Net cash used by financing activities was R$142.8

million in the nine-month period ended September 30, 2023, compared to R$3,174.8 million in the nine-month period ended September 30,

2022. The decrease in net cash used in financing activities was mainly due to an increase in proceeds from loans and financing from R$187.7

million in the nine-month period ended September 30, 2022 to R$4,733.3 million in the nine-month period ended September 30, 2023.

Exchange Rate Changes on Cash and Cash Equivalents

Exchange rate changes on cash and cash equivalents

was R$62.7 million in the nine-month period ended September 30, 2023, compared to exchange rate changes on cash and cash equivalents of

R$15.2 million in the nine-month period ended September 30, 2022, mainly due to the 4.2% end of period appreciation of the Brazilian real

against the U.S. dollar on September 30, 2023, compared to the 3.2% end of period appreciation of the Brazilian real against U.S.

dollar on September 30, 2022.

Loans and Financings

As of September 30, 2023, total loans and

financing and lease liabilities was R$25,424.3 million, compared to R$21,815.5 million as of December 31, 2022, which includes R$15,001.0

million of lease liabilities. As of September 30, 2023, we had pledged collateral under loans and financing, and the outstanding amount

under such loans and financing, including lease liabilities, was R$ 21,988.8 million as of September 30, 2023.

The following table sets forth information

regarding our short-term and long-term loans and financing in the periods indicated, as well as the financial charges and balances of

our aircraft and non-aircraft debt:

| Description |

|

|

|

Consolidated |

|

|

(in thousands

of Brazilian reais, unless otherwise indicated) |

|

|

Average nominal

rate p.a. |

Maturity |

December 31,

2022 |

September 30,

2023 |

|

| |

|

|

|

| In foreign currency (US$) |

|

|

|

|

|

| Senior notes - 2024 |

5.9% |

Oct-24 |

2,097,402 |

541,334 |

|

| Senior notes - 2026 |

7.3% |

Jun-26 |

3,095,665 |

160,527 |

|

| Senior notes - 2028 |

11.9% |

Aug-28 |

— |

3,910,815 |

|

| Senior notes - 2029 |

11.5% |

May-29 |

— |

1,205,582 |

|

| Senior notes - 2030 |

10.9% |

May-30 |

— |

2,872,921 |

|

| |

|

|

|

|

|

| Aircraft, engines and others |

7.3% |

Mar-29 |

731,224 |

493,124 |

|

| |

|

|

5,924,291 |

9,184,303 |

|

| In local currency (R$) |

|

|

|

|

|

| Working capital |

CDI +3.4% |

Feb-24 |

496,997 |

116,225 |

|

| |

|

Sep-25 |

2,675 |

2,201 |

|

| Debentures |

CDI + 5.5% |

Dec-28 |

747,170 |

1,077,687 |

|

| Aircraft and engines |

Selic + 5.5% |

May-25 |

19,284 |

14,614 |

|

| |

6.2% |

Mar-27 |

42,282 |

28,272 |

|

| |

|

|

1,308,408 |

1,238,999 |

|

| Total in R$ |

|

|

7,232,699 |

10,423,302 |

|

| |

|

|

|

|

|

| Current |

|

|

1,112,940 |

1,269,858 |

|

| Non-current |

|

|

6,119,759 |

9,153,444 |

|

| |

|

|

|

|

|

|

Our financing agreements, aircraft finance leases and certain other material agreements contain customary financial and other covenants,

restrictions and events of default, including events of default relating to non-payment, cross-default, cross-acceleration, change of

control, and certain events relating to insolvency, restructuring, readjustment and rescheduling of debt.

Capital Expenditures

Our gross capital expenditures (acquisitions

of property, equipment and intangibles) for the nine-month period ended September 30, 2023 and 2022, totaled R$278.4 million, and R$520.9

million, respectively. Most of these expenditures are related to the capitalization of engine overhaul events and acquisition of spare

parts. Other capital expenditures include IT systems and related facilities. Our gross capital expenditures increased 46.6% in the nine-month

period ended September 30, 2023 compared to the nine-month period ended September 30, 2022, mainly due to the capitalization of our engine

overhaul events and the acquisition of spare parts in the period.

We typically hold our aircraft under leases

or aircraft loans. Although we believe financing should be available for all of our future aircraft deliveries, we cannot assure you that

we will be able to secure them on terms attractive to us, if at all. To the extent we cannot secure these and other financing, we may

be required to modify our aircraft acquisition plans or incur higher than anticipated financing costs. We expect to meet our operating

obligations as they become due through available cash, internally generated funds and credit lines. We believe that our cash provided

by operations and our ability to obtain financing (including through finance leases and aircraft debt-financing), by already approved

lines of credit with financial institutions, as well as our ability to obtain operating leases and issue debentures in the Brazilian capital

market, will enable us to honor our current contractual and financial commitments.

On September 29, 2023, Azul completed negotiations

with its aircraft lessors and aircraft and engine OEMs. For more information, see “Recent Developments” above.

Quantitative and Qualitative Disclosures About Market Risk

General

Market risk is the risk that the fair value

of future cash flows of a financial instrument fluctuates due to changes in market prices. Any such changes may adversely affect the value

of our financial assets and liabilities or our future cash flows and results of operations. We have entered into derivative contracts

and other financial instruments for the purpose of hedging against variations in these factors.

We have also implemented policies and procedures

to evaluate such risks and approve and monitor our derivative transactions. Our risk management policy was implemented on April 14, 2011

and was revised on March 9, 2020. It is our policy not to participate in any trading of derivatives for speculative purposes. We measure

our financial derivative instruments at fair value which is determined using quoted market prices, standard option valuation models or

values provided by the counterparty.

Outstanding financial derivative instruments

expose us to credit loss in the event of nonperformance by the counterparties to the agreements. The counterparties to our derivative

transactions are major financial institutions with strong credit ratings, and we do not expect the counterparties to fail to meet their

obligations. We do not have significant exposure to any single counterparty in relation to derivative transactions, and we believe the

credit exposure related to our counterparties is negligible.

Market risk includes three types of risk: interest

rate, foreign currency and commodity price risk. The sensitivity analyses provided below do not consider the effects that such adverse

changes may have on overall economic activity, nor does it consider additional actions we may take to mitigate our exposure to such changes.

Interest Rate Risk

Interest rate risk is the risk that the fair

value of future cash flows of a financial instrument fluctuates due to changes in market interest rates. Our exposure to the risk of changes

in market interest rates refers primarily to long-term obligations (including lease liabilities and other financing) subject to variable

interest rates. To manage this risk, we engage in interest rate swaps, whereby we agree to exchange at specified intervals the difference

between the values of fixed and variable interest rates calculated based on the notional principal amount agreed between the parties.

As of September 30, 2023, we had swap contracts to hedge against the effect of fluctuations in interest rates on part of payments for

leases.

We utilize swap contracts designated as hedges

to protect us from fluctuations on part of the payments of lease liabilities and loans and financing in foreign currency. The swap contracts

are used to hedge the risk of variation in interest rates tied to contractual commitments executed. The essential terms of the swap contracts

were agreed to be coupled with the terms of the hedged loans and financing and lease commitments.

As of September 30, 2023, we had swap contracts

to hedge against the effect of fluctuations in interest rates on part of payments for finance leases. In the nine-month period ended September

30, 2023, we recognized a total loss from interest hedge transactions in the amount of R$34.1 million, compared to a total gain of R$105.5

million in the nine-month period ended September 30, 2022.

Foreign Currency Risk

Foreign currency risk is the risk that the

fair value of future cash flows of a financial instrument fluctuates due to changes in foreign exchange rates. Our exposure to the risk

of changes in exchange rates refers primarily to loans and lease liabilities indexed to the U.S. dollar (net of investments in U.S. dollars),

maintenance reserves and to our TAP bonds denominated in Euros. Also, slightly over half of our operating expenses are either payable

in or affected by the U.S. dollar, such as aviation fuel, aircraft operating lease payments and certain flight hour maintenance contract

payments. Therefore, according to our risk policy, we may enter into currency forward contracts for periods with a currency exposure of

up to 12 months.

Additionally, as part of our international

operations, we maintain offshore bank accounts in U.S. dollars that serve as natural hedges. As of September 30, 2023, we held a U.S.

dollar balance of cash and cash equivalents of R$107.4 million and restricted cash of R$270.7 million.

We constantly monitor the net exposure in foreign

currency and evaluate the possibility of contracting hedge transactions to protect the non-operating cash flow, projecting for a maximum

period of up to 12 months, and a longer term if deemed appropriate, to minimize its exposure. During the nine-month period ended September

30, 2023, we recognized losses on foreign exchange derivative transactions in the amount of R$24.6 million, compared to a loss of R$122.9

million in the nine-month period ended September 30, 2022.

Commodity Price Risk

The volatility of aviation fuel prices is one

of the most significant market risks for airlines. For the nine-month periods ended September 30, 2023 and 2022, aviation fuel accounted

for 35.0% and 42.9%, respectively, of our operating expenses, which are linked or denominated in U.S. dollars. The pricing of aviation

fuel is volatile and cannot be predicted with any degree of certainty, as it is subject to many global and geopolitical factors. For example,

oil prices experienced substantial variances beginning in 2009 and through June 2018. In addition, largely as a result of the war between

Russia and Ukraine, Brent oil prices sharply increased from about US$75 per barrel at the end of 2021 to US$128 per barrel on March 8,

2022. As of September 30, 2023, the Brent oil price was US$95 per barrel. Airlines often use WTI crude or heating oil future contracts

to protect their exposure to jet fuel prices. We attempt to mitigate fuel price volatility primarily through derivative financial instruments

or a fixed price agreement with our suppliers.

Credit Risk

Credit risk is inherent to our operating and

financial activities, mainly disclosed in cash and cash equivalents, long-term investments, accounts receivable, aircraft sublease, security

deposits and maintenance reserves. Financial assets classified as cash and cash equivalents and long-term investments are deposited with

counterparties that have a minimum investment grade rating in the assessment made by agencies S&P Global Ratings, Moody's or Fitch

(between AAA and A+). The TAP Bond is guaranteed by intellectual property rights and credits related to the TAP mileage program.

Credit limits are established for all customers

based on internal classification criteria and the carrying amounts represent the maximum credit risk exposure. We frequently monitor outstanding

receivables from customers and, when necessary, allowances for expected credit losses are recognized.

Derivative financial instruments are contracted

on the over-the-counter market (OTC) from counterparties with a minimum investment grade rating, or on commodities and futures exchanges

(the B3 and the New York Mercantile Exchange), which substantially mitigates the credit risk. Azul assesses the risks of counterparties

in financial instruments and diversifies its exposure periodically.

Liquidity Risk

The maturity schedules of our consolidated financial liabilities as of September 30, 2023 are as follows:

| |

Consolidated |

| Description |

Carrying Amount |

|

Until 1 year |

From 2 to 5 years |

After 5 years |

| |

(in thousands of Brazilian Reais) |

| Loans and financing |

10,423,302 |

16,173,264 |

2,217,417 |

9,182,955 |

4,772,892 |

| Factoring |

104,239 |

104,239 |

104,239 |

— |

— |

| Leases |

15,001,011 |

24,683,413 |

3,909,781 |

14,065,142 |

6,708,490 |

| Convertible Instruments |

1,150,770 |

1,990,714 |

116,231 |

1,874,483 |

— |

| Accounts payable local |

3,328,377 |

3,749,005 |

2,014,434 |

1,234,512 |

500,059 |

| Airport fees |

1,852,228 |

1,873,893 |

1,275,663 |

183,753 |

414,477 |

| Derivative financial instruments |

10,048 |

10,048 |

9,723 |

325 |

— |

| |

31,869,975 |

48,584,576 |

9,647,488 |

26,541,170 |

12,395,918 |

Sensitivity Analysis

Our sensitivity analysis measures the impact

of interest rate risk, foreign currency risk, and commodity price risk on the results of operations considering two different scenarios:

(i) the adverse scenario, which assumes that the relevant interest rate, foreign currency or fuel price will worsen by 25% and (ii) the

remote scenario, which assumes that relevant interest rate, exchange rate or fuel price will worsen by 50%.

| |

As of September

30, 2023 |

| |

|

|

(Unaudited) |

|

Risk Factor |

Financial Instrument |

Risk |

Adverse Scenario |

Remote Scenario |

| |

|

|

(in thousands of Brazilian reais) |

| Financing |

Interest rate |

CDI Rate |

(4,517) |

(9,034) |

| Financing |

Interest rate |

LIBOR |

(1,363) |

(2,726) |

| Financing |

Interest rate |

SOFR |

(5,109) |

(10,219) |

| Assets |

Exchange rate |

Euro rate decrease |

(188,549) |

(377,097) |

| Liabilities and aircraft leases |

Exchange rate |

U.S. dollar rate increase |

(6,427,165) |

(12,854,331) |

| Aircraft fuel |

Cost per liter |

Fuel price |

(1,094,367) |

(2,188,733) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

AZUL S.A. |

| |

|

|

| |

|

|

| |

By: |

/s/ Alexandre Wagner Malfitani |

|

Date: February 5, 2024 |

|

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer |

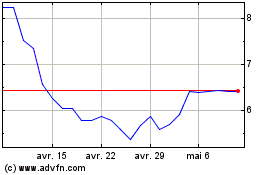

Azul (NYSE:AZUL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Azul (NYSE:AZUL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024