Preview -- Barron's

06 Janvier 2024 - 4:01AM

Dow Jones News

Thursday 1/11

The Bureau of Labor Statistics releases the consumer price index

for December. Consensus estimate is for the CPI to increase 3.2%

year over year, one-tenth of a percentage point more than in

November. The core CPI, which excludes volatile food and energy

prices, is expected to rise 3.8%, compared with a 4% gain

previously. The annualized change in the CPI is near its lowest

level since March of 2021, which Wall Street thinks will allow the

Federal Open Market Committee to start cutting the federal-funds

rate as soon as March.

Friday 1/12

Fourth-quarter earnings season begins in earnest with the four

largest U.S. banks by assets announcing results. Bank of America,

Citigroup, JPMorgan Chase, and Wells Fargo all report before the

opening bell. Shares of JPMorgan were the best performer of the

group last year, returning 30.6%, the only one of the four to

outpace the S&P 500 index's 26.3% return. Bank of America stock

trailed, partially on concerns over unrealized losses on its large

bond portfolio.

The BLS releases the producer price index for December.

Economists forecast a 1.3% year-over-year rise in the PPI, and a

1.9% increase for the core PPI. This compares with gains of 0.9%

and 2.0%, respectively, in November.

To subscribe to Barron's, visit

http://www.barrons.com/subscribe

(END) Dow Jones Newswires

January 05, 2024 21:46 ET (02:46 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

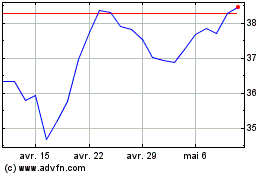

Bank of America (NYSE:BAC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Bank of America (NYSE:BAC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024