Leading Independent Proxy Advisory Firm ISS Supports Saba Capital’s Case for Change at Three BlackRock Closed-End Funds

03 Juillet 2023 - 3:15PM

Business Wire

ISS Recommends ECAT Shareholders Vote

FOR the Election of Saba

Nominee Ilya Gurevich on the GOLD Proxy Card and DO NOT VOTE on All Incumbent Directors

(Cynthia L. Egan, Lorenzo A. Flores, Stayce D. Harris and Catherine

A. Lynch) on BlackRock’s WHITE

Proxy Card

ISS Recommends BIGZ Shareholders Vote

FOR the Election of Saba

Nominee Ilya Gurevich and Vote FOR All of Saba’s Shareholder Proposals on

Corporate Governance on the GOLD Proxy Card and DO NOT VOTE on All Incumbent Directors

(Cynthia L. Egan, Lorenzo A. Flores, Stayce D. Harris and Catherine

A. Lynch) on BlackRock’s WHITE

Proxy Card

ISS Recommends BFZ Shareholders WITHHOLD on Incumbent Director R. Glenn

Hubbard on BlackRock’s WHITE

Proxy Card

Saba Capital Management, L.P. (“Saba” or “we”), a significant

shareholder of the BlackRock ESG Capital Allocation Term Trust

(NYSE: ECAT) (“ECAT”), the BlackRock Innovation and Growth Term

Trust (NYSE: BIGZ) (“BIGZ”) and the BlackRock California Municipal

Income Trust (NYSE: BFZ) (“BFZ”) (collectively, the “Funds”), today

announced that Institutional Shareholder Services Inc. (“ISS”) has

supported its case for change at the aforementioned closed-end

funds advised by BlackRock, Inc. (“BlackRock”). In its reports, ISS

made the following recommendations:

- ISS recommends ECAT shareholders vote FOR the election of Saba nominee Ilya Gurevich

on the GOLD proxy card and

DO NOT VOTE on all incumbent

directors (Cynthia L. Egan, Lorenzo A. Flores, Stayce D. Harris and

Catherine A. Lynch) on BlackRock’s WHITE proxy card at the 2023 Annual Meeting of

Shareholders, which is scheduled to be held on July 10, 2023.

- ISS recommends BIGZ shareholders vote FOR the election of Mr. Gurevich and

FOR all of Saba’s shareholder

proposals on corporate governance on the GOLD proxy card and DO NOT VOTE on all incumbent directors (Ms.

Egan, Mr. Flores, Ms. Harris and Ms. Lynch) on BlackRock’s

WHITE proxy card at the 2023

Annual Meeting of Shareholders, which is scheduled to be held on

July 10, 2023.

- ISS recommends that BFZ shareholders WITHHOLD support for long-time incumbent

director and board chair R. Glenn Hubbard on BlackRock’s

WHITE proxy card – recognizing

his responsibility for BFZ’s corporate governance deficiencies – at

the 2023 Annual Meeting of Shareholders, which is scheduled to be

held on July 10, 2023.

Paul Kazarian, Partner and Portfolio Manager of Saba,

commented:

“ISS agrees that immediate boardroom change is required at ECAT,

BIGZ and BFZ. We are glad that ISS shares our concerns about the

Funds’ corporate governance abuses that violate BlackRock’s own

Investment Stewardship Guidelines. As a self-proclaimed leader in

corporate governance, it is hypocritical for BlackRock to disregard

the ESG standards that it has set as an investor and to which it

purports to hold companies accountable.

Across each of these three funds, BlackRock’s hand-picked

directors have taken extreme steps to stifle the will of

shareholders. They have (1) prohibited bylaw amendments by

shareholders, (2) maintained classified board structures, (3)

required a majority of the outstanding vote in contested elections,

and (4) failed to opt out of the Delaware control share acquisition

statute. BlackRock has also (5) flouted its own views on

individuals who are ‘overboarded’ by keeping in place directors who

also serve as fiduciaries of dozens of other publicly listed

companies.

We believe that the best path to address the Funds’ egregious

and long-term underperformance is through immediate boardroom

change. On behalf of all ECAT, BIGZ and BFZ shareholders, Saba is

committed to improving corporate governance and closing the Funds’

discounts to NAV in order to enhance value for the benefit of all

shareholders. We will do everything in our power to achieve these

goals.”

ISS Commentary on ECAT

In its full report on ECAT, ISS affirmed Saba’s case for

boardroom change and agreed with Saba’s concerns regarding the

Fund’s corporate governance abuses and significant underperformance

since its IPO1:

- “Since its 2021 IPO through the advent of the dissident's

campaign, the fund's total shareholder return and discount to NAV

have underperformed peers. In addition, the fund's corporate

governance features several abusive practices. In light of these factors, the dissident has made a case

for significant change.”

- “The fund's corporate governance structure includes

numerous policies and practices that do

not align with the best interests of shareholders. For

example, the board is classified, shareholders do not have the

right to amend the bylaws, and there is a worst-of-all-worlds vote standard for director

elections […] The vote standard

for director elections is particularly

egregious, as it can

function as an entrenchment mechanism.”

- “Ilya Gurevich has over 25 years of experience in financial

services and is currently working in this field […] Gurevich can

credibly claim to understand the perspective of ECAT's retail

shareholder base from his work as a retirement planner. The board

has not offered any substantive criticisms of his background or

experience […] As such, a vote for

Gurevich is warranted on the dissident (GOLD)

card.”

ISS Commentary on BIGZ

In its full report on BIGZ, ISS affirmed Saba’s case for

boardroom change and agreed with Saba’s concerns regarding the

Fund’s corporate governance abuses, operational deficiencies and

discount to NAV:

- “BIGZ completed its IPO in March 2021. Since then, share price

has declined more than 60 percent, erasing billions in market

capitalization. TSR has been disappointing

by any objective measure, and the discount to NAV is

concerning. At the same time, all distributions have

derived from a return of capital, and operational woes have only been compounded by corporate

governance deficiencies.”

- “In mid-2022, BIGZ began regularly trading at a 15-20 percent

discount. Later in the year, valuation deteriorated further, and

BIGZ reached an all-time worst NAV

discount of nearly 25 percent in December.”

- “BIGZ not only has a classified board, but there is an elevated

probability of a failed vote at this meeting due to the majority

standard in contested director elections. These and other provisions disenfranchise shareholders

and entrench leadership.”

- “Ilya Gurevich has over 25 years of ongoing experience with

financial services […] he can credibly claim to understand the

perspective of BIGZ's retail shareholder base, given that he has

been an active retirement planner for over a decade. Moreover, the

board has not offered any substantive criticisms of his background

or experience […] As such, a vote for Ilya

Gurevich is warranted.”

ISS Commentary on BFZ

In its full report on BFZ, ISS affirmed Saba’s case for

boardroom change and agreed with Saba’s concerns regarding BIGZ’s

corporate governance deficiencies, including the Fund’s classified

board structure and restrictive Delaware control share acquisition

statute provision:

- “The corporate governance structure at

BFZ includes numerous policies and practices that do not align with

the best interests of shareholders. For example, the

board is classified, the vote standard for director elections is a

plurality in all cases, and shareholders do not have the right to

amend, repeal, or otherwise change the bylaws […] although the

board has engaged in proactive refreshment over the past several

years, shareholder support in director

elections has remained abnormally low.”

- “As a Delaware statutory trust registered as a CEF, BFZ is

subject to the control beneficial interest acquisition provisions

of the DE Statutory Trust Act, which is among the most restrictive control share acquisition

statutes in the nation.”

- “Among the incumbent directors on ballot, Glenn Hubbard is most responsible for BFZ's corporate

governance deficiencies, as he has been a director for over 15

years, is the board chair, and is a member of the

governance and nominating committee. He is therefore a logical

target for shareholders that are frustrated with the board’s

management of the Delaware control share acquisition statute at

this meeting. […] As such, a WITHHOLD from

Hubbard on the management card is warranted.”

About Saba Capital

Saba Capital Management, L.P. is a global alternative asset

management firm that seeks to deliver superior risk-adjusted

returns for a diverse group of clients. Founded in 2009 by Boaz

Weinstein, Saba is a pioneer of credit relative value strategies

and capital structure arbitrage. Saba is headquartered in New York

City. Learn more at www.sabacapital.com.

______________________________ 1 Permission to quote ISS was

neither sought nor obtained.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230703348209/en/

Longacre Square Partners Greg Marose / Kate Sylvester,

646-386-0091 gmarose@longacresquare.com /

ksylvester@longacresquare.com

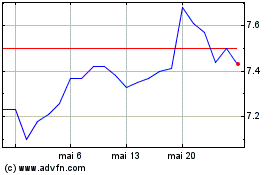

BlackRock Innovation and... (NYSE:BIGZ)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

BlackRock Innovation and... (NYSE:BIGZ)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025