Bakkt Notified by NYSE of Non-Compliance with NYSE Trading Share Price Listing Rule

13 Mars 2024 - 10:40PM

Business Wire

Intends to cure the deficiency and return to

compliance with NYSE standard

Bakkt Holdings, Inc. (NYSE: BKKT) announced today that the New

York Stock Exchange (the “NYSE”) notified the Company (the

“Notice”) that the Company is not in compliance with Section

802.01C of the NYSE Listed Company Manual because, as of March 12,

2024, the average closing price of the Company’s Class A Common

Stock (the “Common Stock”) was less than $1.00 per share over a

consecutive 30-day trading period. The notice does not result in the immediate delisting of the

Common Stock from the NYSE.

On March 13, 2024, the Company notified the NYSE that it intends

to cure the stock price deficiency and to return to compliance with

the NYSE continued listing standard. The Company can regain

compliance at any time within the six-month period following

receipt of the NYSE notice if the Company has a share price of at

least $1.00 on the last trading day of any calendar month within

the six-month cure period and an average share price of at least

$1.00 over the 30 trading-day period ending on the last trading day

of that month.

Under the NYSE’s rules, if the Company determines that it will

cure such average stock price deficiency by taking an action that

will require stockholder approval, it must so inform the NYSE, and

the noncompliance with the price condition will be deemed cured if

the price promptly exceeds $1.00 per share and the price remains

above that level for at least the following 30 trading days. The

Company intends to consider all available alternatives to resolve

this issue, including but not limited to a reverse stock split,

subject to shareholder approval.

The Common Stock will continue to be listed and trade on the

NYSE during this period, subject to the Company’s compliance with

other NYSE continued listing standards.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements include, but are not limited to,

statements regarding the Company’s intention to cure the stock

price deficiency, to return to compliance with the NYSE continued

listing standard and to consider alternatives, including effecting

a reverse stock split, to cure the NYSE continued listing

requirement deficiency, among others. Forward-looking statements

can be identified by words such as “will,” “likely,” “expect,”

“continue,” “anticipate,” “estimate,” “believe,” “intend,” “plan,”

“projection,” “outlook,” “grow,” “progress,” “potential” or words

of similar meaning. Such forward-looking statements are based upon

the current beliefs and expectations of Bakkt’s management and are

inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

difficult to predict and beyond Bakkt’s control. Actual results and

the timing of events may differ materially from the results

anticipated in such forward-looking statements as a result of the

following factors, among others: Bakkt’s ability to continue as a

going concern; Bakkt’s ability to grow and manage growth

profitably; changes in Bakkt’s business strategy; Bakkt’s ability

to integrate its acquisitions and achieve desired synergies;

Bakkt’s future capital requirements and sources and uses of cash,

including funds to satisfy its liquidity needs; changes in the

market in which Bakkt competes, including with respect to its

competitive landscape, technology evolution or changes in

applicable laws or regulations; changes in the markets that Bakkt

targets; disruptions in the crypto market that subject Bakkt to

additional risks, including the risk that banks may not provide

banking services to Bakkt; the possibility that Bakkt may be

adversely affected by other economic, business, and/or competitive

factors; the inability to launch new services and products or to

profitably expand into new markets and services; the inability to

execute Bakkt’s growth strategies, including identifying and

executing acquisitions and Bakkt’s initiatives to add new clients;

Bakkt’s failure to comply with extensive government regulation,

oversight, licensure and appraisals; uncertain regulatory regime

governing blockchain technologies and crypto; the inability to

develop and maintain effective internal controls and procedures;

the exposure to any liability, protracted and costly litigation or

reputational damage relating to Bakkt’s data security; the impact

of any goodwill or other intangible assets impairments on Bakkt’s

operating results; Bakkt’s inability to maintain the listing of its

securities on the NYSE; and other risks and uncertainties indicated

in Bakkt’s filings with the Securities and Exchange Commission. You

are cautioned not to place undue reliance on such forward-looking

statements. Such forward-looking statements relate only to events

as of the date on which such statements are made and are based on

information available to us as of the date of this press release.

Unless otherwise required by law, we undertake no obligation to

update any forward-looking statements made in this press release to

reflect events or circumstances after the date of this press

release or to reflect new information or the occurrence of

unanticipated events.

About Bakkt

Founded in 2018, Bakkt builds solutions that enable our clients

to grow with the crypto economy. Through institutional-grade

custody, trading, and onramp capabilities, our clients leverage

technology that’s built for sustainable, long-term involvement in

crypto.

Bakkt is headquartered in Alpharetta, GA. For more information,

visit: https://www.bakkt.com/ | X (Formerly Twitter) @Bakkt |

LinkedIn https://www.linkedin.com/company/bakkt/.

Bakkt-C

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313401585/en/

Investor Relations Ann DeVries, Head of Investor

Relations Ann.DeVries@bakkt.com Media press@bakkt.com

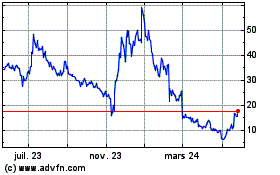

Bakkt (NYSE:BKKT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

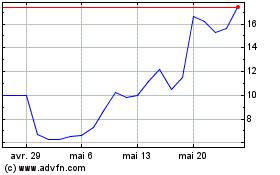

Bakkt (NYSE:BKKT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025