UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February 2025

Commission File Number: 001-14370

COMPANIA DE MINAS BUENAVENTURA S.A.A.

(Exact name of registrant as specified in its charter)

BUENAVENTURA MINING COMPANY INC.

(Translation of registrant’s name into English)

AV. BEGONIAS NO. 415, 19TH FLOOR,

SAN ISIDRO,

LIMA, PERU

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Buenaventura Announces

Fourth Quarter and Full Year 2024 Results

Lima, Peru, February 20, 2025 –

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or “the Company”) (NYSE: BVN; Lima Stock Exchange:

BUE.LM), Peru’s largest publicly-traded precious metals mining company, today announced results for the fourth quarter (4Q24) and

full year (FY24) ended December 31, 2024. All figures have been prepared in accordance with IFRS (International Financial Reporting Standards)

on a non-GAAP basis and are stated in U.S. dollars (US$).

Fourth Quarter and Full Year 2024

Highlights:

| · | 4Q24 EBITDA from direct

operations was US$ 93.4 million, compared to US$ 74.0 million reported in 4Q23 excluding the November 2023 sale of Contacto Corredores

De Seguros S.A. (“Contacto”), the Company’s risk and insurance brokerage. FY24 EBITDA from direct operations excluding

the sale of Chaupiloma Royalty Company reached US$ 431.2 million, compared to US$ 199.2 million reported in FY23 excluding the sale of

Contacto. |

| · | 4Q24 net income reached

US$ 33.6 million, compared to a US$ 9.8 million net loss for the same period in 2023. FY24 net income, including the August 2024 sale

of Chaupiloma Royalty Company, was US$ 402.7 million, compared to US$ 19.9 million in net income for FY23 including the sale of Contacto. |

| · | Buenaventura ended the

year with a cash position of US$ 478.4 million, with total net debt of US$ 148.3 million, resulting in a leverage ratio of 0.34x. |

| · | Buenaventura's 4Q24 consolidated

silver production decreased by 0.4M Oz YoY, zinc production decreased by 60% YoY, and lead production decreased by 33% YoY. This decline

was primarily due to the large volume of lead/zinc concentrate processed from El Brocal's Tajo Norte in 4Q23 which was depleted in 1Q24.

However, this decrease was partially offset by increased production at Uchucchacua and Yumpag during 2024. Gold production decreased by

10% YoY due to decreased output at Orcopampa and Tambomayo. However, copper production increased by 5% YoY. |

| · | 4Q24 CAPEX related to San

Gabriel was US$ 104.8 million, primarily allocated to the processing plant (mechanical and electrical works), the filtered tailings storage

facility, and mine development. |

| · | On December 12, 2024, Buenaventura

received US$78.3 million in dividends related to its stake in Cerro Verde and received a total of US$166.5 million in dividends for the

FY24. |

| · | On February 4, 2025, subsequent

to the quarter’s end, Buenaventura issued senior unsecured notes (the “Notes”) in an aggregate amount of US$650 million.

The Notes mature on February 4, 2032 and bear a 6.800% per year interest rate. Buenaventura intends to use the related net proceeds to

refinance its outstanding 5.500% Senior Notes due 2026, and for general corporate purposes. |

| · | Simultaneous to its issuance

of the above senior unsecured notes, Buenaventura completed a Tender Offer for the purchase of any and all of its bonds maturing in 2026,

successfully repurchasing US$401 million, or 72.98%, of the total outstanding bonds. |

| · | Buenaventura’s Board

of Directors has proposed a dividend payment of US$ 0.2922 per share/ADS, aligned with the Company’s dividend policy. |

Financial Highlights (in millions

of US$, excluding EPS):

| | |

| 4Q24 | | |

| 4Q23 | | |

| Var % | | |

| FY24 | | |

| FY23 | | |

| Var % | |

| Total Revenues | |

| 299.6 | | |

| 253.8 | | |

| 18 | % | |

| 1,154.6 | | |

| 823.8 | | |

| 40 | % |

| Operating Income | |

| 45.8 | | |

| 60.1 | | |

| -24 | % | |

| 445.7 | | |

| 21.1 | | |

| 2,010 | % |

| EBITDA Direct Operations (1) | |

| 93.4 | | |

| 74.0 | | |

| 26 | % | |

| 431.2 | | |

| 199.2 | | |

| 116 | % |

| EBITDA Including Affiliates (1) | |

| 185.9 | | |

| 198.4 | | |

| -6 | % | |

| 850.2 | | |

| 581.5 | | |

| 46 | % |

| Net Income (2) | |

| 33.6 | | |

| -9.8 | | |

| N.A. | | |

| 402.7 | | |

| 19.9 | | |

| 1,928 | % |

| EPS (3) | |

| 0.13 | | |

| -0.04 | | |

| N.A. | | |

| 1.59 | | |

| 0.08 | | |

| 1,928 | % |

| (1) | Does not include US$ 208.9 million from the sale of Chaupiloma Royalty Company

or US$ 38.6 million from the sale of Contacto. |

| (2) | Net Income attributable to owners of the parent company. |

| (3) | As of December 31, 2024, Buenaventura had a weighted average number of shares outstanding

of 253,986,867. |

For a full version of Compañía de Minas Buenaventura

Fourth Quarter 2024 Earnings Release, please visit: https://buenaventura.com/en/inversionista/reporte-trimestral-2025/

CONFERENCE CALL INFORMATION:

Compañia de Minas Buenaventura will host

a conference call on Friday, February 21, 2025, to discuss these results at 10:00 a.m. Eastern Time / Lima Time.

To participate in the conference call, please dial:

Toll-Free US:

+1 844 481 2914

Toll International:

+1 412 317 0697

Passcode:

Please ask to be joined into the Compañía

de Minas Buenaventura’s call.

Webcast:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=q2aobqy5

If you would prefer to receive a call rather than

dial in, please use the following link 10-15 minutes prior to the conference call start time:

Call Me Link: https://callme.viavid.com/?callme=true&passcode=&info=company&r=true&b=16

Passcode:

7096578

Participants who do not wish to be interrupted to have their information gathered may have Chorus Call dial out to them by clicking on

the above link, filling in the information, and pressing the green phone button at the bottom. The phone number provided will be automatically

called and connected to the conference without any interruption to the participant. (Please note: Participants will be joined directly

to the conference and will hear hold music until the call begins. No confirmation message will be played when joined.)

Company Description

Compañía de Minas Buenaventura S.A.A.

is Peru’s largest, publicly traded precious and base metals Company and a major holder of mining rights in Peru. The Company is

engaged in the exploration, mining development, processing and trade of gold, silver and other base metals via wholly-owned mines and

through its participation in joint venture projects. Buenaventura currently operates several mines in Peru (Orcopampa*, Uchucchacua*,

Julcani*, Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro

Verde, an important Peruvian copper producer (a partnership with Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2023

Form 20-F, please contact the investor relations contacts on page 1 of this report or download the PDF format file from the Company’s

web site at www.buenaventura.com.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release and related conference call

contain, in addition to historical information, forward-looking statements including statements related to the Company’s ability

to manage its business and liquidity during and after the COVID-19 pandemic, the impact of the COVID-19 pandemic on the Company’s

results of operations, including net revenues, earnings and cash flows, the Company’s ability to reduce costs and capital spending

in response to the COVID-19 pandemic if needed, the Company’s balance sheet, liquidity and inventory position throughout and following

the COVID-19 pandemic, the Company’s prospects for financial performance, growth and achievement of its long-term growth algorithm

following the COVID-19 pandemic, future dividends and share repurchases.

This press release may also contain forward-looking

information (as defined in the U.S. Private Securities Litigation Reform Act of 1995) that involve risks and uncertainties, including

those concerning the Company’s, Cerro Verde’s costs and expenses, results of exploration, the continued improving efficiency

of operations, prevailing market prices of gold, silver, copper and other metals mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking statements reflect the Company’s view with respect to the Company’s,

Cerro Verde’s future financial performance. Actual results could differ materially from those projected in the forward-looking statements

as a result of a variety of factors discussed elsewhere in this Press Release.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A. |

| |

|

|

| Date: February 20, 2025 |

By: |

/s/ DANIEL DOMÍNGUEZ VERA |

| |

Name: |

Daniel Domínguez Vera |

| |

Title: |

Market Relations Officer |

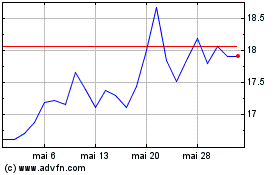

Compania De Minas Buenav... (NYSE:BVN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Compania De Minas Buenav... (NYSE:BVN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025