Compass Minerals (NYSE: CMP), a leading global provider of

essential minerals, today reported fiscal 2025 first-quarter

results.

Unless otherwise noted, it should be assumed that time periods

referenced below are on a fiscal-year basis.

MANAGEMENT COMMENTARY

"This quarter we began to see results from our back-to-basics

strategy and initiatives to reduce inventory volumes, improve our

cost structure, and enhance profitability. Our efforts are expected

to further strengthen our future financial performance, leveraging

our exceptional set of unique assets that are virtually

irreplaceable, enjoy durable competitive advantages and have strong

leadership positions in their respective marketplaces," said Edward

C. Dowling Jr., president and CEO.

"We made good progress on our goals of reducing our North

American salt inventory volumes and improving the cost structure in

our Plant Nutrition business. Despite a slow start to the winter

deicing season, we saw salt inventory volumes decline 10% year over

year through December and we still have a significant portion of

the deicing season in front of us. We're well positioned to

continue to reduce inventory levels in coming months, and our

ability to toggle production at Goderich and Cote Blanche mines

provides the flexibility to adjust production to meet increased

demand next year if we see a stronger winter season. In Plant

Nutrition, the efforts we are making to manage costs are taking

root, which is enabling us to increase adjusted EBITDA guidance for

the segment despite a decline in expected pricing due to softness

in the MOP market. We will continue to focus on systems and

processes where we can improve profitability and financial

performance."

"We have a number of cost reduction initiatives underway to

continue to drive down operating, capital, and general and

administrative costs. Through operational and financial discipline

and a commitment to continuous improvement, I'm confident we will

improve the cash generation capability and unlock the intrinsic

value embedded in our business."

QUARTERLY

FINANCIAL RESULTS

(in millions, except per share

data)

Three Months Ended Dec.

31, 2024

Three Months Ended Dec.

31, 2023

Revenue

$

307.2

$

341.7

Operating earnings (loss)

0.5

(53.6

)

Adjusted operating earnings*

1.4

24.8

Adjusted EBITDA*

32.1

62.2

Net loss

(23.6

)

(75.3

)

Net loss per diluted share

(0.57

)

(1.83

)

Adjusted net (loss) earnings*

(22.9

)

3.1

Adjusted net (loss) earnings* per diluted

share

(0.55

)

0.07

*Non-GAAP financial measure.

Reconciliations to the most directly comparable GAAP financial

measure are provided in tables at the end of this press

release.

SALT BUSINESS COMMENTARY

Reducing North American highway deicing salt inventory volumes

has been a focus for Compass Minerals, which led to the company's

decision to curtail production at Goderich mine and to a lesser

extent Cote Blanche mine in 2024. The company is gaining traction

on this initiative with North American highway deicing inventory

volumes down 10% year over year despite a delayed start to the

winter deicing season. The curtailment of production at Goderich

mine resulted in higher cost production per ton, due to lower fixed

cost absorption, being inventoried throughout 2024. As the company

begins to sell this higher cost 2024 inventory, there is an impact

to cost per ton that is reflected in the results below. Compass

Minerals' view is the benefits to the company from reducing excess

inventory, including harvesting working capital tied up inventory

and contributing to a rebalancing of supply across the market,

outweigh the transient production cost per ton impacts from

curtailing production.

Winter weather was late in arriving in the first quarter, with

minimal snow event activity occurring in the company's served

markets in October and November. With customer inventories full

following last year's exceptionally mild deicing season, the slow

start to winter weather resulted in lower sales volumes during the

first quarter of fiscal 2025 compared to prior year.

The factors above contributed to operating earnings declining

42% year over year to $29.4 million and adjusted EBITDA decreasing

to $47.8 million, down 28% from the prior-year period. Adjusted

EBITDA per ton declined 17% to $19.17.

Salt revenue totaled $242.2 million and was down 12% year over

year, driven by a 13% year-over-year sales volume decline,

partially offset by a 1% increase in average sales price. In the

highway deicing business, the company's disciplined approach to

pricing throughout the 2025 deicing bid season resulted in only a

1% decrease in average highway deicing selling price despite high

inventory levels across the broader market following two mild

winters, including one of the mildest winters in the company's

served markets in nearly a quarter century. Sales volumes declined

12% due to a combination of low pre-fill activity and mild weather

in October and November. Consumer and industrial (C&I) pricing

rose 6% year over year to approximately $206 per ton, while sales

volumes declined by 14%, primarily due to lower retail deicing

demand reflecting the aforementioned mild weather across the

company's served markets.

Distribution costs per ton decreased 2% year over year, while

all-in product costs (defined at the segment level as sales to

external customers less distribution costs less operating earnings)

per ton rose 16% from the comparable prior-year quarter due to the

production cost dynamics for 2024-produced salt described

above.

PLANT NUTRITION BUSINESS

COMMENTARY

In Plant Nutrition, the company has been working predominantly

on improving the cost structure of the segment. In particular, the

ongoing restoration of the pond complex at Ogden is expected to

allow for an improvement in the consistency and grade of sulfate of

potash (SOP) raw materials going to the plant. Recent results from

our pond restoration activities suggest that these initiatives are

having a positive impact on the ponds, which is a critical step in

improving the Plant Nutrition business. Additional opportunities to

improve productivity and increase process efficiencies are also

being evaluated and pursued. Results from these actions are

beginning to take effect, which is reflected in the quarterly

results below.

Plant Nutrition revenue for the quarter totaled $61.4 million,

up 24% year over year on strong sales volume. This was led by

improved sales volumes, which grew by 27 thousand tons, a 36%

improvement year over year. The average segment sales price for the

quarter was down 9% year over year to approximately $603 per ton,

reflecting supply conditions of potassium-based fertilizers

globally. Per-unit distribution costs for the quarter decreased 2%

year over year, largely due to increased sales rates absorbing

fixed rail transport costs. All-in product costs per ton decreased

10% year over year.

Operating loss per ton in the Plant Nutrition business improved

by 1% year over year. This, combined with the increase in sales

volumes between periods, resulted in a slight increase in operating

loss to $3.1 million for the quarter, compared to operating loss of

$2.3 million in the prior-year quarter. Absolute adjusted EBITDA

declined to $4.4 million versus $7.2 million last year due to a

decline in per-unit adjusted EBITDA attributable to a decrease in

DD&A per sales ton.

FORTRESS NORTH AMERICA

COMMENTARY

Compass Minerals continues to evaluate various alternatives

regarding the path forward for Fortress North America (Fortress).

Discussions are ongoing with the U.S. Forest Service (USFS)

regarding the evaluation and testing of the company's conditionally

qualified technical grade orthophosphate-based aerial fire

retardant, Qela.

CASH FLOW AND FINANCIAL

POSITION

Net cash used in operating activities amounted to $4.1 million

for the three months ended Dec. 31, 2024, compared to $52.3 million

in the prior year. Despite a weaker start to the winter deicing

season, reduction to inventory levels contributed to an improvement

in working capital year over year.

Net cash used in investing activities was $22.2 million for the

three months ended Dec. 31, 2024, down $27.1 million year over year

principally driven by lower capital spending. Total capital

spending for the three months ended Dec. 31, 2024 was $21.8

million.

Net cash provided by financing activities was $53.1 million for

the three months ended Dec. 31, 2024, which included net borrowings

of $57.5 million. In the prior year, net cash provided by financing

activities reflected net borrowings of $108.1 million.

The company ended the quarter with $126.3 million of liquidity,

comprised of $45.8 million in cash and cash equivalents and $80.5

million of availability under its $325 million revolving credit

facility.

UPDATED FISCAL 2025

OUTLOOK

Given the quickly evolving dynamics surrounding potential

tariffs on products imported to the United States from the

company's Canadian operations, the company has not included any

potential impacts related to tariffs into the guidance below. For

fiscal 2025, any impact to adjusted EBITDA is expected to be

negligible for the North American highway deicing business as salt

for the 2024/2025 season has already been imported and deployed

across the company's depot network. Compass Minerals is evaluating

the potential impact to the C&I and Plant Nutrition businesses

resulting from any potential tariff actions.

Salt Segment

2025 Range1

Highway deicing sales volumes (thousands

of tons)

7,600 - 8,500

Consumer and industrial sales volumes

(thousands of tons)

1,800 - 1,950

Total salt sales volumes (thousands of

tons)

9,400 - 10,450

Revenue (in millions)

$900 - $1,000

Adj. EBITDA (in millions)

$205 - $230

(1)

Range for fiscal 2025 reflects the

company's committed book of business for the period and assumes an

average historical sales-to-commitment outcomes.

As described above, mild winter weather for the first two months

of the quarter contributed to a softer quarter than had been

assumed in the company's original forecast. January saw strong

winter weather across portions of the company's served markets and

preliminary results for the month suggest the company may be able

to partially offset the weather-driven shortfall from the first

quarter.

Plant Nutrition

Segment

2025 Range

Sales volumes (thousands of tons)

295 - 315

Revenue (in millions)

$180 - $200

Adj. EBITDA (in millions)

$17 - $24

Plant Nutrition guidance is being increased to reflect revised

market and operational conditions and assumptions that could impact

the business, with expected pressure in global potash pricing being

more than offset by higher sales expectations and lower forecasted

production costs for the year.

Corporate

2025 Range

Total1

Adj. EBITDA (in millions)

($70) - ($61)

(1)

Includes $3 to $5 million in cash expenses

related to Fortress.

Projected Corporate segment results in the table above, which

are unchanged from the company's initial guidance provided in

December of 2024, include corporate expenses in support of the

company's core businesses, Fortress financial results, and the

results of DeepStore, the company's records and management services

business in the U.K.

Total Compass Minerals

2025 Adjusted EBITDA

Salt

Plant Nutrition

Corporate1

Total

Adj. EBITDA (in millions)

$205 - $230

$17 - $24

($70) - ($61)

$152 - $193

2025 Capital

Expenditures

Total

Capital expenditures (in millions)

$75 - $85

(1)

Includes financial contribution from

DeepStore and Fortress.

Total planned capital expenditures for the company in fiscal

2025 have been reduced and are now expected to be within a range of

$75 million to $85 million, down from a range of $100 million to

$110 million provided in the company's original guidance. The

company is committed to managing capital expenditures so that they

align with the cash generation performance of the business.

Other Assumptions

($ in millions)

2025 Range

Depreciation, depletion and

amortization

$105 - $115

Interest expense, net

$67 - $72

Effective income tax rate (excl. valuation

allowance)

0% - 5%

Guidance for the 2025 effective income tax rate reflects the

income mix by country with income recognized in foreign

jurisdictions offset by losses recognized in the U.S.

CONFERENCE CALL

Compass Minerals will discuss its results on a conference call

tomorrow morning, Tuesday, Feb. 11, at 9:30 a.m. ET (8:30 a.m. CT).

To access the conference call, please visit the company’s website

at investors.compassminerals.com or dial 800-715-9871. Callers must

provide the conference ID number 7896827. Outside of the U.S. and

Canada, callers may dial 646-307-1963. Replays of the call will be

available on the company’s website.

A supporting corporate presentation with 2025 first-quarter

results is available at investors.compassminerals.com.

About Compass Minerals

Compass Minerals (NYSE: CMP) is a leading global provider of

essential minerals focused on safely delivering where and when it

matters to help solve nature’s challenges for customers and

communities. The company’s salt products help keep roadways safe

during winter weather and are used in numerous other consumer,

industrial, chemical and agricultural applications. Its plant

nutrition products help improve the quality and yield of crops,

while supporting sustainable agriculture. Additionally, it is

working to develop a long-term fire-retardant business. Compass

Minerals operates 12 production and packaging facilities with

nearly 1,900 employees throughout the U.S., Canada and the U.K.

Visit compassminerals.com for more information about the company

and its products.

Forward-Looking Statements and Other

Disclaimers

This press release may contain forward-looking statements,

including, without limitation, statements about reduction of salt

inventory volumes, improvement in Plant Nutrition costs, cash

generation capability, the future of Fortress, including ongoing

discussions with the USFS, the company's ability to meet or exceed

its plan for January or the remainder of fiscal 2025, SOP prices,

and the company's outlook for 2025, including its expectations

regarding sales volumes, revenue, Adjusted EBITDA, depreciation,

depletion, and amortization, interest expense, tax rates, and

capital expenditures. Forward-looking statements are those that

predict or describe future events or trends and that do not relate

solely to historical matters. The company uses words such as “may,”

“would,” “could,” “should,” “will,” “likely,” “expect,”

“anticipate,” “believe,” “intend,” “plan,” “forecast,” “outlook,”

“project,” “estimate” and similar expressions suggesting future

outcomes or events to identify forward-looking statements or

forward-looking information. These statements are based on the

company’s current expectations and involve risks and uncertainties

that could cause the company’s actual results to differ materially.

The differences could be caused by a number of factors, including

without limitation (i) weather conditions, (ii) inflation, the cost

and availability of transportation for the distribution of the

company’s products and foreign exchange rates, (iii) pressure on

prices and impact from competitive products, (iv) any inability by

the company to successfully implement its strategic priorities or

its cost-saving or enterprise optimization initiatives, and (v) the

risk that the company may not realize the expected financial or

other benefits from its ownership of Fortress North America. For

further information on these and other risks and uncertainties that

may affect the company’s business, see the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of the company’s Amended Annual

Report on Form 10-K for the period ended Sept. 30, 2024, and its

Quarterly Report on Form 10-Q for the quarter ended Dec. 31, 2024,

filed or to be filed with the SEC, as well as the company's other

SEC filings. The company undertakes no obligation to update any

forward-looking statements made in this press release to reflect

future events or developments, except as required by law. Because

it is not possible to predict or identify all such factors, this

list cannot be considered a complete set of all potential risks or

uncertainties.

Non-GAAP Measures

In addition to using U.S. generally accepted accounting

principles (“GAAP”) financial measures, management uses a variety

of non-GAAP financial measures described below to evaluate the

company’s and its operating segments’ performance. While the

consolidated financial statements provide an understanding of the

company’s overall results of operations, financial condition and

cash flows, management analyzes components of the consolidated

financial statements to identify certain trends and evaluate

specific performance areas.

Management uses EBITDA, EBITDA adjusted for items which

management believes are not indicative of the company’s ongoing

operating performance (“Adjusted EBITDA”) and EBITDA margin to

evaluate the operating performance of the company’s core business

operations because its resource allocation, financing methods and

cost of capital, and income tax positions are managed at a

corporate level, apart from the activities of the operating

segments, and the operating facilities are located in different

taxing jurisdictions, which can cause considerable variation in net

earnings. Management also uses adjusted operating earnings,

adjusted operating margin, adjusted net earnings, and adjusted net

earnings per diluted share, which eliminate the impact of certain

items that management does not consider indicative of underlying

operating performance. The presentation of these measures should

not be construed as an inference that future results will be

unaffected by unusual or non-recurring items. Management believes

these non-GAAP financial measures provide management and investors

with additional information that is helpful when evaluating

underlying performance. EBITDA and Adjusted EBITDA exclude interest

expense, income taxes and depreciation, depletion and amortization,

each of which are an essential element of the company’s cost

structure and cannot be eliminated. In addition, Adjusted EBITDA

and Adjusted EBITDA margin exclude certain cash and non-cash items,

including stock-based compensation, impairment charges and certain

restructuring charges. Consequently, any measure that excludes

these elements has material limitations. The non-GAAP financial

measures used by management should not be considered in isolation

or as a substitute for net earnings, operating earnings, cash flows

or other financial data prepared in accordance with GAAP or as a

measure of overall profitability or liquidity. These measures are

not necessarily comparable to similarly titled measures of other

companies due to potential inconsistencies in the method of

calculation. The calculation of non-GAAP financial measures as used

by management is set forth in the following tables. All margin

numbers are defined as the relevant measure divided by sales. The

company does not provide a reconciliation of forward-looking

non-GAAP financial measures to the most directly comparable

financial measures calculated and reported in accordance with GAAP,

as the company is unable to estimate significant non-recurring,

unusual items and/or distinct non-core initiatives without

unreasonable effort. The amounts and timing of these items are

uncertain and could be material to the company’s results.

Adjusted operating earnings, adjusted operating earnings margin,

adjusted net earnings (loss), and adjusted net earnings (loss) per

diluted share are presented as supplemental measures of the

company’s performance. Management believes these measures provide

management and investors with additional information that is

helpful when evaluating underlying performance and comparing

results on a year-over-year normalized basis. These measures

eliminate the impact of certain items that management does not

consider indicative of underlying operating performance. These

adjustments are itemized below. Adjusted net earnings (loss) per

diluted share is adjusted net earnings (loss) divided by weighted

average diluted shares outstanding. You are encouraged to evaluate

the adjustments itemized above and the reasons management considers

them appropriate for supplemental analysis. In evaluating these

measures you should be aware that in the future the company may

incur expenses that are the same as or similar to some of the

adjustments presented below.

Special Items Impacting the

Three Months Ended Dec. 31, 2024

(unaudited, in millions, except

per share data)

Item Description

Segment

Line Item

Amount

Tax Effect(1)

After Tax

EPS Impact

Product recall costs

Salt

Product cost and Other operating

expense

$

0.9

$

(0.2

)

$

0.7

$

0.02

Total

$

0.9

$

(0.2

)

$

0.7

$

0.02

Special Items Impacting the

Three Months Ended Dec. 31, 2023

(unaudited, in millions, except

per share data)

Item Description

Segment

Line Item

Amount

Tax Effect(1)

After Tax

EPS Impact

Restructuring charges(2)

Corporate and Other

Other operating expense

$

2.5

$

—

$

2.5

$

0.06

Restructuring charges(2)

Plant Nutrition

Other operating expense

1.1

—

1.1

0.02

Impairments

Corporate and Other

Loss on impairments

74.8

—

74.8

1.82

Total

$

78.4

$

—

$

78.4

$

1.90

(1)

There were no substantial income tax

benefits related to these items given the U.S. valuation allowances

on deferred tax assets. Applicable product recall costs reflect an

impact from Canadian taxes.

(2)

Restructuring charges do not include

certain reductions in stock-based compensation associated with

forfeitures stemming from the restructuring activities.

Reconciliation for Adjusted

Operating Earnings

(unaudited, in millions)

Three Months Ended Dec.

31,

2024

2023

Operating earnings (loss)

$

0.5

$

(53.6

)

Product recall costs(1)

0.9

—

Restructuring charges(2)

—

3.6

Loss on impairments(2)

—

74.8

Adjusted operating earnings

$

1.4

$

24.8

Sales

307.2

341.7

Operating margin

0.2

%

(15.7

)%

Adjusted operating margin

0.5

%

7.3

%

(1)

The company recognized costs related to a

recall related to food-grade salt produced at its Goderich

Plant.

(2)

In connection with the termination of the

company's lithium development project, the company incurred

severance and related charges for a reduction in workforce and a

loss on impairment of long-lived assets, which were determined to

be no longer probable of recovery.

Reconciliation for Adjusted

Net (Loss) Earnings

(unaudited, in millions)

Three Months Ended Dec.

31,

2024

2023

Net loss

$

(23.6

)

$

(75.3

)

Product recall costs(1)

0.9

—

Restructuring charges(2)

—

3.6

Loss on impairments(2)

—

74.8

Income tax effect

(0.2

)

—

Adjusted net (loss) earnings

$

(22.9

)

$

3.1

Net loss per diluted share

$

(0.57

)

$

(1.83

)

Adjusted net (loss) earnings per diluted

share

$

(0.55

)

$

0.07

Weighted-average common shares outstanding

(in thousands):

Diluted

41,441

41,205

(1)

The company recognized costs related to a

recall related to food-grade salt produced at its Goderich Plant.

Charges for the three months ended Dec. 31, 2024 were $0.9 million

($0.7 million net of tax).

(2)

In connection with the termination of the

company's lithium development project, the company incurred

severance and related charges for a reduction in workforce and a

loss on impairment of long-lived assets, which were determined to

be no longer probable of recovery.

Reconciliation for EBITDA and

Adjusted EBITDA

(unaudited, in millions)

Three Months Ended

Dec. 31,

2024

2023

Net loss

$

(23.6

)

$

(75.3

)

Interest expense

16.9

15.9

Income tax expense

9.7

3.6

Depreciation, depletion and

amortization

26.8

25.5

EBITDA

29.8

(30.3

)

Adjustments to EBITDA:

Stock-based compensation - non-cash

3.9

11.9

Interest income

(0.4

)

(0.4

)

(Gain) loss on foreign exchange

(5.2

)

1.9

Product recall costs(1)

0.9

—

Restructuring charges(2)

—

3.6

Loss on impairments(2)

—

74.8

Other expense, net

3.1

0.7

Adjusted EBITDA

$

32.1

$

62.2

(1)

The company recognized costs related to a

recall related to food-grade salt produced at its Goderich

Plant.

(2)

In connection with the termination of the

company's lithium development project, the company incurred

severance and related charges for a reduction in workforce and a

loss on impairment of long-lived assets, which were determined to

be no longer probable of recovery.

Salt Segment

Performance

(unaudited, in millions, except

for sales volumes and prices per short ton)

Three Months Ended Dec.

31,

2024

2023

Sales

$

242.2

$

274.3

Operating earnings

$

29.4

$

50.9

Operating margin

12.1

%

18.6

%

Adjusted operating earnings(1)

$

30.3

$

50.9

Adjusted operating margin(1)

12.5

%

18.6

%

EBITDA(1)

$

46.9

$

66.1

EBITDA(1) margin

19.4

%

24.1

%

Adjusted EBITDA(1)

$

47.8

$

66.1

Adjusted EBITDA(1) margin

19.7

%

24.1

%

Sales volumes (in thousands of tons):

Highway deicing

1,987

2,266

Consumer and industrial

506

589

Total Salt.

2,493

2,855

Average prices (per ton):

Highway deicing

$

69.50

$

70.36

Consumer and industrial

$

205.74

$

194.94

Total Salt.

$

97.16

$

96.08

(1)

Non-GAAP financial measure.

Reconciliations follow in these tables.

Reconciliation for Salt

Segment Adjusted Operating Earnings

(unaudited, in millions)

Three Months Ended Dec.

31,

2024

2023

Reported GAAP segment operating

earnings

$

29.4

$

50.9

Product recall costs(1)

0.9

—

Segment adjusted operating earnings

$

30.3

$

50.9

Segment sales

242.2

274.3

Segment operating margin

12.1

%

18.6

%

Segment adjusted operating margin

12.5

%

18.6

%

(1) The company incurred costs related to

a product recall.

Reconciliation for Salt

Segment EBITDA and Adjusted EBITDA

(unaudited, in millions)

Three Months Ended Dec.

31,

2024

2023

Reported GAAP segment operating

earnings

$

29.4

$

50.9

Depreciation, depletion and

amortization

17.5

15.2

Segment EBITDA

$

46.9

$

66.1

Product recall costs(1)

0.9

—

Segment adjusted EBITDA

$

47.8

$

66.1

Segment sales

242.2

274.3

Segment EBITDA margin

19.4

%

24.1

%

Segment adjusted EBITDA margin

19.7

%

24.1

%

(1)

The company incurred costs related to a

product recall.

Plant Nutrition Segment

Performance

(unaudited, dollars in millions,

except for sales volumes and prices per short ton)

Three Months Ended Dec.

31,

2024

2023

Sales

$

61.4

$

49.7

Operating loss

$

(3.1

)

$

(2.3

)

Operating margin

(5.0

)%

(4.6

)%

Adjusted operating loss(1)

$

(3.1

)

$

(1.2

)

Adjusted operating margin(1)

(5.0

)%

(2.4

)%

EBITDA(1)

$

4.4

$

6.1

EBITDA(1) margin

7.2

%

12.3

%

Adjusted EBITDA(1)

$

4.4

$

7.2

Adjusted EBITDA(1) margin

7.2

%

14.5

%

Sales volumes (in thousands of tons)

102

75

Average price (per ton)

$

602.86

$

660.41

(1)

Non-GAAP financial measure.

Reconciliations follow in these tables.

Reconciliation for Plant

Nutrition Segment Adjusted Operating Loss

(unaudited, in millions)

Three Months Ended Dec.

31,

2024

2023

Reported GAAP segment operating loss

$

(3.1

)

$

(2.3

)

Restructuring charges(1)

—

1.1

Segment adjusted operating loss

$

(3.1

)

$

(1.2

)

Segment sales

61.4

49.7

Segment operating margin

(5.0

)%

(4.6

)%

Segment adjusted operating margin

(5.0

)%

(2.4

)%

(1)

The company incurred severance and related

charges related to a reduction of its workforce.

Reconciliation for Plant

Nutrition Segment EBITDA and Adjusted EBITDA

(unaudited, in millions)

Three Months Ended Dec.

31,

2024

2023

Reported GAAP segment operating loss

$

(3.1

)

$

(2.3

)

Depreciation, depletion and

amortization

7.5

8.4

Segment EBITDA

$

4.4

$

6.1

Restructuring charges(1)

—

1.1

Segment adjusted EBITDA

$

4.4

$

7.2

Segment sales

61.4

49.7

Segment EBITDA margin

7.2

%

12.3

%

Segment adjusted EBITDA margin

7.2

%

14.5

%

(1)

The company incurred severance and related

charges related to a reduction of its workforce.

COMPASS MINERALS

INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited, in millions,

except share and per-share data)

Three Months Ended Dec.

31,

2024

2023

Sales

$

307.2

$

341.7

Shipping and handling cost

80.6

91.3

Product cost

192.3

179.3

Gross profit.

34.3

71.1

Selling, general and administrative

expenses

33.3

45.7

Loss on impairments

—

74.8

Other operating expense

0.5

4.2

Operating earnings (loss)

0.5

(53.6

)

Other (income) expense:

Interest income

(0.4

)

(0.4

)

Interest expense

16.9

15.9

(Gain) loss on foreign exchange

(5.2

)

1.9

Other expense, net

3.1

0.7

Loss before income taxes

(13.9

)

(71.7

)

Income tax expense

9.7

3.6

Net loss

$

(23.6

)

$

(75.3

)

Basic net loss per common share

$

(0.57

)

$

(1.83

)

Diluted net loss per common share

$

(0.57

)

$

(1.83

)

Weighted-average common shares outstanding

(in thousands):(1)

Basic

41,441

41,205

Diluted

41,441

41,205

(1)

Weighted participating securities include

RSUs and PSUs that receive non-forfeitable dividends and consist of

1,116,000 weighted participating securities for the three months

ended Dec. 31, 2024, and 777,000 weighted participating securities

for the three months ended Dec. 31, 2023.

COMPASS MINERALS

INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in

millions)

Dec. 31,

Sept. 30,

2024

2024

ASSETS

Cash and cash equivalents

$

45.8

$

20.2

Receivables, net

261.7

126.1

Inventories, net

367.1

414.1

Other current assets

23.0

26.9

Property, plant and equipment, net

778.6

806.5

Intangible and other noncurrent assets

244.7

246.3

Total assets

$

1,720.9

$

1,640.1

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current portion of long-term debt

$

8.7

$

7.5

Other current liabilities

286.1

209.5

Long-term debt, net of current portion

965.7

910.0

Deferred income taxes and other noncurrent

liabilities

197.4

196.5

Total stockholders' equity

263.0

316.6

Total liabilities and stockholders'

equity

$

1,720.9

$

1,640.1

COMPASS MINERALS

INTERNATIONAL, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited, in

millions)

Three Months Ended Dec.

31,

2024

2023

Net cash used in operating activities

$

(4.1

)

$

(52.3

)

Cash flows from investing activities:

Capital expenditures

(21.8

)

(48.6

)

Other, net

(0.4

)

(0.7

)

Net cash used in investing activities

(22.2

)

(49.3

)

Cash flows from financing activities:

Proceeds from revolving credit facility

borrowings

140.3

102.4

Principal payments on revolving credit

facility borrowings

(100.8

)

(31.5

)

Proceeds from issuance of long-term

debt

19.6

38.4

Principal payments on long-term debt

(1.6

)

(1.2

)

Dividends paid

—

(6.4

)

Deferred financing costs

(2.4

)

—

Shares withheld to satisfy employee tax

obligations

(0.4

)

(0.8

)

Other, net

(1.6

)

—

Net cash provided by financing

activities

53.1

100.9

Effect of exchange rate changes on cash

and cash equivalents

(1.2

)

0.3

Net change in cash and cash

equivalents

25.6

(0.4

)

Cash and cash equivalents, beginning of

the year

20.2

38.7

Cash and cash equivalents, end of

period

$

45.8

$

38.3

COMPASS MINERALS

INTERNATIONAL, INC.

SEGMENT INFORMATION

(unaudited, in

millions)

Three Months Ended Dec. 31,

2024

Salt

Plant

Nutrition

Corporate &

Other(1)

Total

Sales to external customers

$

242.2

$

61.4

$

3.6

$

307.2

Intersegment sales

—

3.2

(3.2

)

—

Shipping and handling cost

71.3

9.3

—

80.6

Operating earnings (loss)(2)

29.4

(3.1

)

(25.8

)

0.5

Depreciation, depletion and

amortization

17.5

7.5

1.8

26.8

Total assets (as of end of period)

1,092.4

388.1

240.4

1,720.9

Three Months Ended Dec. 31,

2023

Salt

Plant

Nutrition

Corporate &

Other(1)

Total

Sales to external customers

$

274.3

$

49.7

$

17.7

$

341.7

Intersegment sales

—

3.1

(3.1

)

—

Shipping and handling cost

83.7

7.0

0.6

91.3

Operating earnings (loss)(2)(3)

50.9

(2.3

)

(102.2

)

(53.6

)

Depreciation, depletion and

amortization

15.2

8.4

1.9

25.5

Total assets (as of end of period)

1,056.6

469.7

278.9

1,805.2

(1)

Corporate and other includes corporate

entities, records management operations, the Fortress fire

retardant business, equity method investments and other incidental

operations and eliminations. Operating earnings (loss) for

corporate and other includes indirect corporate overhead, including

costs for general corporate governance and oversight, as well as

costs for the human resources, information technology, legal and

finance functions.

(2)

Corporate operating results include costs

related to a product recall of $0.9 million for the three months

ended Dec. 31, 2024. Corporate operating results were also impacted

by a net loss of $1.6 million related to an increase in the

valuation of the Fortress contingent consideration for the three

months ended Dec. 31, 2023.

(3)

As a result of the company’s decision to

cease the pursuit of the lithium development, the company

recognized an impairment of long-lived assets of $74.8 million. The

company also recognized restructuring costs of $3.6 million, which

impacted operating results for the three months ended Dec. 31,

2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210528573/en/

Investor Contact Brent Collins Vice President, Treasurer

& Investor Relations +1.913.344.9111

InvestorRelations@compassminerals.com

Media Contact Rick Axthelm Chief Public Affairs and

Sustainability Officer +1.913.344.9198

MediaRelations@compassminerals.com

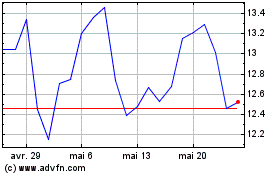

Compass Minerals (NYSE:CMP)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Compass Minerals (NYSE:CMP)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025